Vietnam Meat Market Outlook to 2030

Region:Asia

Author(s):Shivani

Product Code:KROD10667

November 2024

94

About the Report

Vietnam Meat Market Overview

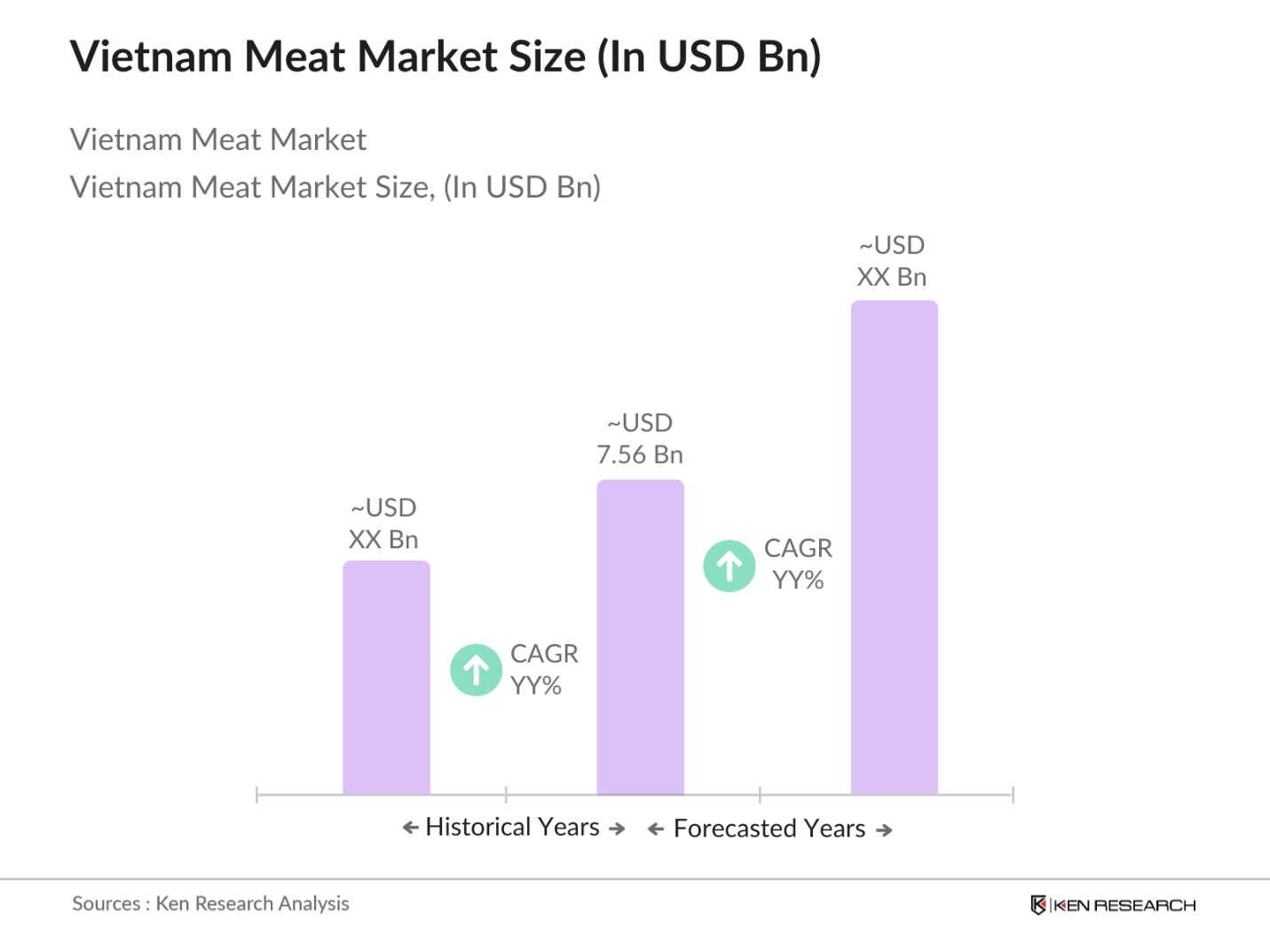

- The Vietnam meat market is valued at USD 7.56 billion, based on a five-year historical analysis, driven primarily by increasing consumer demand for protein-rich diets and the growing foodservice industry. Rising disposable incomes, urbanization, and expanding retail networks have contributed to the steady rise in meat consumption, particularly in pork and poultry segments. Government support for livestock production and disease control initiatives further boost the markets capacity to meet domestic demand.

- Vietnam's southern cities, particularly Ho Chi Minh City and the Mekong Delta region, dominate the market due to their advanced agricultural infrastructure and proximity to key processing facilities. These regions benefit from favorable climatic conditions for livestock farming and have higher meat consumption levels compared to northern regions. Additionally, the proximity to export markets like China and Thailand makes these areas vital for meat production and trade.

- Vietnams government has implemented stringent national food safety standards to ensure the quality and safety of meat products. The Ministry of Health and the Ministry of Agriculture and Rural Development (MARD) collaborate to enforce strict regulations concerning hygiene and veterinary standards. These standards are applied to both domestically produced and imported meat, ensuring compliance with international trade agreements. The majority of meat producers now meet these national food safety requirements, demonstrating the government's commitment to maintaining high safety standards throughout the meat supply chain.

Vietnam Meat Market Segmentation

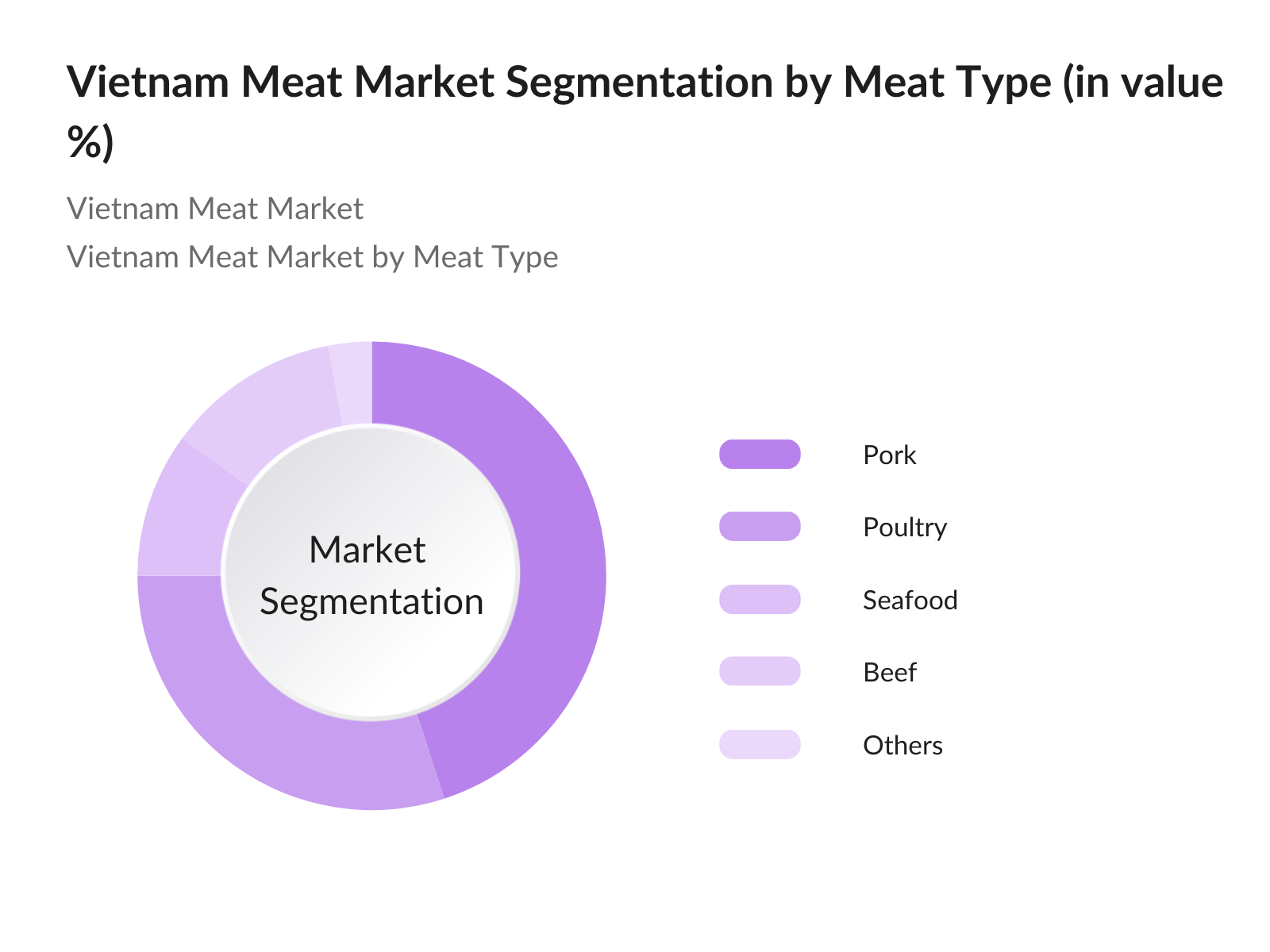

By Meat Type: The Vietnams meat market is segmented by meat type into pork, poultry, beef, seafood, and others (including lamb and duck). Recently, pork has held the dominant market share, driven by its historical and cultural significance in Vietnamese cuisine. Pork is a staple in everyday meals and festivals, contributing to high domestic demand. Despite the challenges posed by African Swine Fever, the government's efforts to replenish pork supplies and support for pig farming have kept this segment at the forefront of the market.

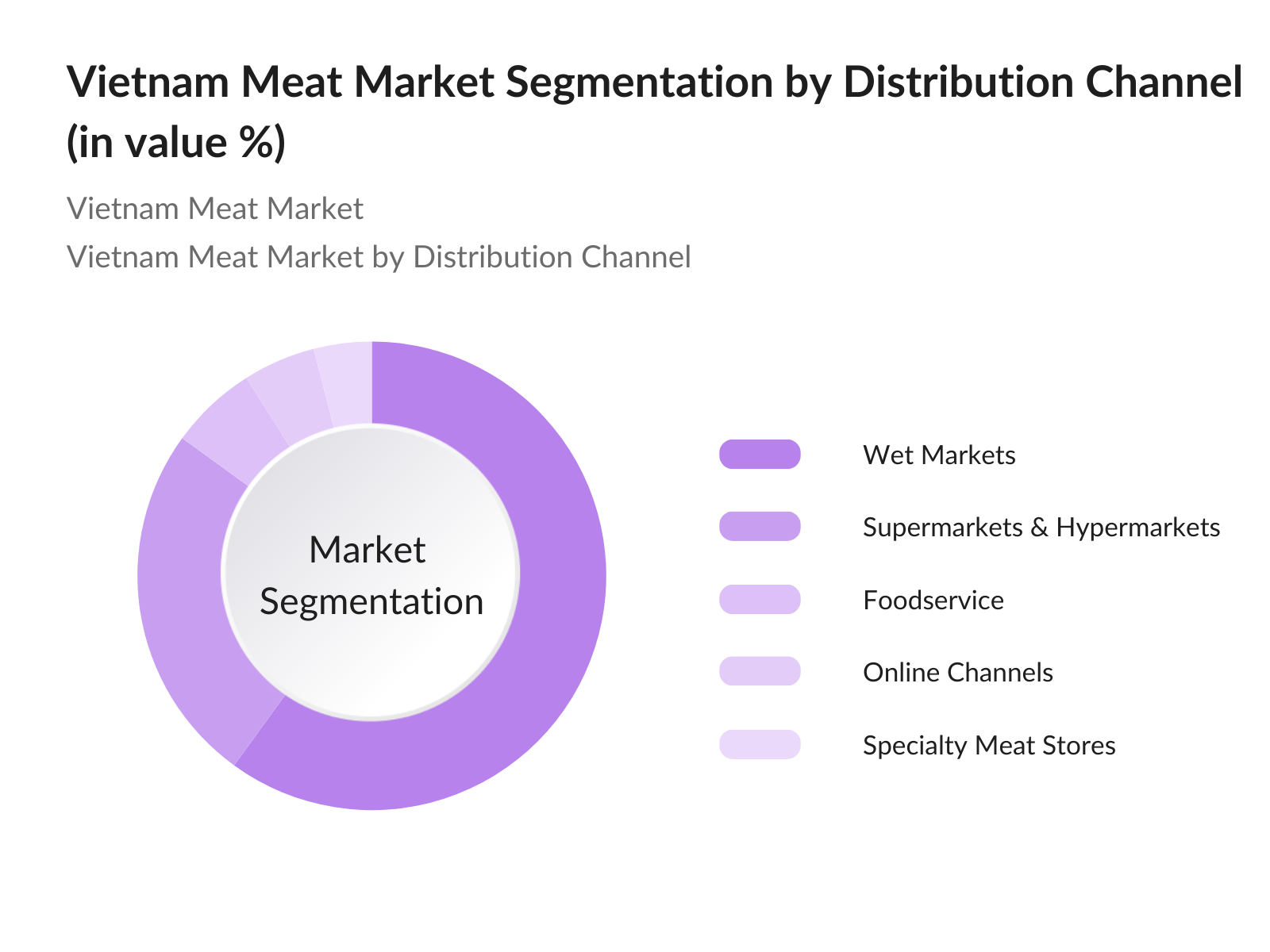

By Distribution Channel: The distribution of meat products in Vietnam is categorized into supermarkets and hypermarkets, wet markets, online channels, specialty meat stores, and foodservice. Wet markets continue to dominate the distribution channels due to their ingrained presence in the Vietnamese shopping habits. These markets offer freshly slaughtered meat daily, catering to the local demand for freshness and affordability. The rise in modern retail formats like supermarkets is growing, but traditional wet markets still hold the majority share in meat distribution.

Vietnam Meat Market Competitive Landscape

The Vietnam meat market is dominated by a few key players who control significant portions of the supply chain, from livestock farming to processing and distribution. Local giants such as Vissan and CP Vietnam Corporation maintain a stronghold in the market, supported by integrated production facilities and a broad distribution network. Their dominance is reinforced by significant investments in cold chain logistics, processing technology, and adherence to food safety regulations. Global companies like Cargill Vietnam also have a substantial presence, benefiting from technological expertise and global partnerships.

|

Company |

Establishment Year |

Headquarters |

Revenue (2023) |

Market Share |

Employees |

Processing Facilities |

Product Range |

Key Partnerships |

Export Market |

|

Vissan |

1970 |

Ho Chi Minh City |

USD 1.5 Bn |

- |

- |

- |

- |

- |

- |

|

CP Vietnam Corporation |

1993 |

Binh Duong |

USD 2 Bn |

- |

- |

- |

- |

- |

- |

|

Masan Group |

2004 |

Ho Chi Minh City |

USD 1.2 Bn |

- |

- |

- |

- |

- |

- |

|

Dabaco Group |

1996 |

Bac Ninh |

USD 700 Mn |

- |

- |

- |

- |

- |

- |

|

Cargill Vietnam |

1995 |

Binh Duong |

USD 900 Mn |

- |

- |

- |

- |

- |

- |

Vietnam Meat Market Analysis

Market Growth Drivers

- Urbanization and Changing Dietary Patterns: Vietnams urbanization rate in 2023 is substantial, according to the World Bank, and continues to rise steadily. As more people move to urban areas, dietary habits shift from traditional plant-based meals to a more diverse range of foods, with meat becoming a central component. This change is driven by exposure to global dietary trends and changing lifestyles. According to the General Statistics Office (GSO), meat consumption per capita has increased to over 45 kg annually, highlighting the impact of urbanization on food preferences and the growing demand for animal protein in cities.

- Rising Disposable Income: Vietnams GDP per capita reached $4,145 in 2023, according to the IMF. The increase in disposable income has directly influenced higher meat consumption, especially in urban areas where consumers are opting for premium meat products. This rise in purchasing power has driven demand for pork, chicken, and beef, as middle-class households incorporate more protein into their diets. Continued economic growth has been a significant factor in this shift, with Vietnam's economy showing strong momentum, reinforcing the growing preference for protein-rich food choices among its population.

- Shift Toward Protein-Rich Diets: The shift toward protein-rich diets is evident in Vietnams changing food consumption patterns. Meat consumption has grown significantly, with pork accounting for the largest share, followed by chicken and beef. As of 2024, pork production stands at over 3.8 million tons annually, with a growing trend towards protein diversification. This shift is further supported by increased health awareness and the rising influence of Western diets. The trend is also visible in urban areas where meat is becoming an essential part of daily meals.

Market Challenges:

- High Production Costs: Meat production in Vietnam faces high operational costs due to factors such as feed prices, energy consumption, and labor. According to the Vietnam Ministry of Industry and Trade (MOIT), the cost of animal feed increased by 15% between 2022 and 2023, putting pressure on meat producers. Additionally, rising energy prices and labor shortages in rural areas are further inflating costs, making it difficult for small-scale farmers to compete with industrial producers.

- Disease Outbreaks Impacting Meat Supply (African Swine Fever, Avian Flu): African Swine Fever (ASF) has severely impacted Vietnams pork supply, with the Ministry of Agriculture reporting that a significant portion of pig herds has been affected by outbreaks since 2022. This has led to a noticeable decline in pork production, which has increased reliance on meat imports to meet demand. Similarly, outbreaks of avian influenza have disrupted poultry production, further complicating the meat market. These disease outbreaks not only strain the supply chain but also erode consumer confidence, making effective disease management a critical challenge for the meat industry.

Vietnam Meat Market Future Outlook

Over the next five years, the Vietnam meat market is expected to experience robust growth driven by rising consumer preferences for protein-rich diets and increased investments in meat processing technologies. Continued government support for the livestock industry, especially in disease control and sustainability efforts, will further contribute to market expansion. The shift towards modern retail and online distribution channels is also anticipated to offer new growth avenues, particularly as consumer preferences evolve towards convenience and packaged meat products.

Market Opportunities:

- Growing Demand for Organic and Free-Range Meat: Demand for organic and free-range meat is increasing in Vietnam, driven by health-conscious consumers. According to the Ministry of Agriculture, organic meat production grew by 10% in 2023, with local producers expanding their offerings to meet this demand. Free-range poultry farming has also gained traction, particularly in northern Vietnam, where small-scale farms produce over 200,000 tons of poultry meat annually. This shift presents an opportunity for producers to tap into premium market segments.

- Expansion of Meat Processing Industry: Vietnams meat processing industry is expanding as consumer demand for convenience and processed meat products grows. The number of meat processing facilities has increased by 12% in 2023, with significant investments in automation and food safety technology. The Ministry of Industry and Trade reports that processed meat products, particularly sausages and canned meat, have seen a rise in production to meet urban demand. This presents a significant opportunity for investment in modern processing technologies.

Scope of the Report

|

By Meat Type |

Pork Poultry Beef Seafood Others |

|

By Product Type |

Fresh Meat Processed Meat Frozen Meat |

|

By Distribution Channel |

Supermarkets Wet Markets Online Food Service Specialty Meat Stores |

|

By End User |

Household Commercial Institutional |

|

By Region |

North-East Midwest West Coast Southern States |

Products

Key Target Audience

Livestock Farmers

Meat Processors

Meat Distributors

Foodservice Chains (Restaurants, Hotels)

Government and Regulatory Bodies (Ministry of Agriculture and Rural Development)

Supermarket and Hypermarket Chains

Investments and Venture Capitalist Firms

Cold Chain Logistics Providers

Companies

Major Players

Vissan

CP Vietnam Corporation

Masan Group

Dabaco Group

Greenfeed Vietnam Corporation

Cargill Vietnam

Vinamilk Meat Deli

Saigon Food Company

Anova Corporation

Japfa Comfeed Vietnam

HAGL Agrico

Hung Vuong Corporation

San Miguel Foods Vietnam

Phu Gia Foods

Asia Foods Corporation

Table of Contents

1. Vietnam Meat Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Key Market Indicators (Consumption Volume, Import/Export Data, Pricing Trends)

1.4. Market Segmentation Overview

1.5. Macroeconomic Impact on Meat Consumption (GDP Growth, Inflation, Household Income)

2. Vietnam Meat Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

2.4. Consumption Patterns by Meat Type (Pork, Poultry, Beef, Seafood)

3. Vietnam Meat Market Analysis

3.1. Growth Drivers

3.1.1. Urbanization and Changing Dietary Patterns

3.1.2. Rising Disposable Income

3.1.3. Shift Toward Protein-Rich Diets

3.1.4. Increased Food Service Industry Demand

3.2. Market Challenges

3.2.1. High Production Costs

3.2.2. Disease Outbreaks Impacting Meat Supply (African Swine Fever, Avian Flu)

3.2.3. Environmental Concerns (Emissions, Water Use)

3.2.4. Limited Cold Chain Infrastructure

3.3. Opportunities

3.3.1. Growing Demand for Organic and Free-Range Meat

3.3.2. Expansion of Meat Processing Industry

3.3.3. Investment in Modern Retail Formats

3.3.4. Exports to Emerging Markets

3.4. Trends

3.4.1. Technological Advancements in Meat Processing

3.4.2. Rising Preference for Ready-to-Eat and Processed Meat Products

3.4.3. Shift Toward Plant-Based and Alternative Protein Products

3.4.4. Focus on Food Safety and Traceability

3.5. Government Regulation

3.5.1. National Food Safety Standards

3.5.2. Import Tariffs and Trade Agreements (EVFTA, CPTPP)

3.5.3. Animal Health and Disease Control Regulations

3.5.4. Sustainability Initiatives in Livestock Management

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Producers, Processors, Distributors, Retailers)

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Vietnam Meat Market Segmentation

4.1. By Meat Type (In Value %)

4.1.1. Pork

4.1.2. Poultry

4.1.3. Beef

4.1.4. Seafood

4.1.5. Others (Lamb, Duck)

4.2. By Product Type (In Value %)

4.2.1. Fresh Meat

4.2.2. Processed Meat

4.2.3. Frozen Meat

4.3. By Distribution Channel (In Value %)

4.3.1. Supermarkets & Hypermarkets

4.3.2. Wet Markets

4.3.3. Online Channels

4.3.4. Specialty Meat Stores

4.3.5. Food Service

4.4. By End User (In Value %)

4.4.1. Household

4.4.2. Commercial (Restaurants, Hotels)

4.4.3. Institutional (Schools, Hospitals)

4.5. By Region (In Value %)

4.5.1. Northern Vietnam

4.5.2. Central Vietnam

4.5.3. Southern Vietnam

5. Vietnam Meat Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Vissan

5.1.2. CP Vietnam Corporation

5.1.3. Masan Group

5.1.4. Dabaco Group

5.1.5. Greenfeed Vietnam Corporation

5.1.6. Vinamilk Meat Deli

5.1.7. Saigon Food Company

5.1.8. Cargill Vietnam

5.1.9. Anova Corporation

5.1.10. Japfa Comfeed Vietnam

5.1.11. HAGL Agrico

5.1.12. Hung Vuong Corporation

5.1.13. San Miguel Foods Vietnam

5.1.14. Phu Gia Foods

5.1.15. Asia Foods Corporation

5.2. Cross Comparison Parameters (Production Capacity, Market Share, Revenue, Product Portfolio, Market Presence, Number of Employees, Supply Chain Integration, Key Partnerships)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Joint Ventures & Partnerships

5.8. Private Equity Investments

6. Vietnam Meat Market Regulatory Framework

6.1. Government Support for Livestock Sector

6.2. Animal Health and Welfare Standards

6.3. Import and Export Regulations

6.4. Food Safety Certification Processes

7. Vietnam Meat Market Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Vietnam Meat Market Future Segmentation

8.1. By Meat Type (In Value %)

8.2. By Product Type (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By End User (In Value %)

8.5. By Region (In Value %)

9. Vietnam Meat Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Expansion Strategies for Local Producers

9.3. Investment Opportunities in Cold Chain Infrastructure

9.4. White Space Opportunity Analysis in Processed Meat

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves identifying critical factors such as consumer preferences, meat production trends, and import/export data relevant to the Vietnam meat market. This is achieved through extensive desk research, leveraging proprietary and secondary data sources.

Step 2: Market Analysis and Construction

In this phase, historical data related to meat consumption, production, and distribution is compiled. The collected data is analyzed to identify key trends, market growth rates, and revenue generation across various market segments.

Step 3: Hypothesis Validation and Expert Consultation

To validate market assumptions, consultations are conducted with industry experts, including meat producers and distributors. This process helps refine market estimates and assess operational challenges faced by key players.

Step 4: Research Synthesis and Final Output

The final step involves synthesizing the data collected from stakeholders to produce a detailed report that provides a comprehensive analysis of the Vietnam meat market. This synthesis ensures that the research output is accurate and actionable for market participants.

Frequently Asked Questions

01. How big is the Vietnam Meat Market?

The Vietnam meat market is valued at USD 7.56 billion, supported by increasing domestic demand for pork and poultry and the expanding foodservice industry. The market continues to grow as consumers shift towards protein-rich diets.

02. What are the key growth drivers in the Vietnam Meat Market?

Key drivers include rising disposable incomes, urbanization, and government support for livestock farming. Additionally, a growing preference for processed and ready-to-eat meat products is propelling the market forward.

03. Which regions dominate the Vietnam Meat Market?

Southern Vietnam, particularly Ho Chi Minh City and the Mekong Delta, dominates the market due to advanced livestock farming infrastructure and high meat consumption levels.

04. What challenges does the Vietnam Meat Market face?

Challenges include high production costs, disease outbreaks like African Swine Fever, and inadequate cold chain infrastructure. These factors hinder market growth despite increasing demand.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.