Vietnam Mental Health Market Outlook to 2030

Region:Asia

Author(s):Shreya Garg

Product Code:KROD3885

November 2024

90

About the Report

Vietnam Mental Health Market Overview

The Vietnam Mental Health Market is valued at USD 137 million, driven by increasing awareness and gradual destigmatization of mental health issues, alongside government initiatives that promote mental health care accessibility. A historical analysis over the past five years highlights the influence of telemedicine and digital health platforms in expanding mental health services, particularly in underserved areas. The rise in mental health disorders, such as depression, anxiety, and PTSD, further propels the market's growth, as more individuals seek professional help through various channels, including therapy and medication.

Dominant cities such as Ho Chi Minh City and Hanoi lead the mental health market due to their advanced healthcare infrastructure, higher disposable incomes, and more prominent availability of mental health professionals. These urban centers benefit from a stronger healthcare network, public-private collaborations, and concentrated government efforts aimed at reducing the mental health treatment gap. Additionally, these cities are home to major mental health clinics and private practices that offer a broad range of services.

Vietnam has developed a regulatory framework to support the growing telemedicine sector, including mental health e-counseling services. In 2023, the Ministry of Health introduced regulations ensuring the safety and privacy of telemedicine consultations, requiring telemedicine platforms to comply with data protection laws. Over 100 licensed tele-counseling platforms now operate within these regulations, providing services to patients nationwide. These regulations are designed to foster the growth of telemedicine while protecting patient rights, creating a conducive environment for the expansion of digital mental health services.

Vietnam Mental Health Market Segmentation

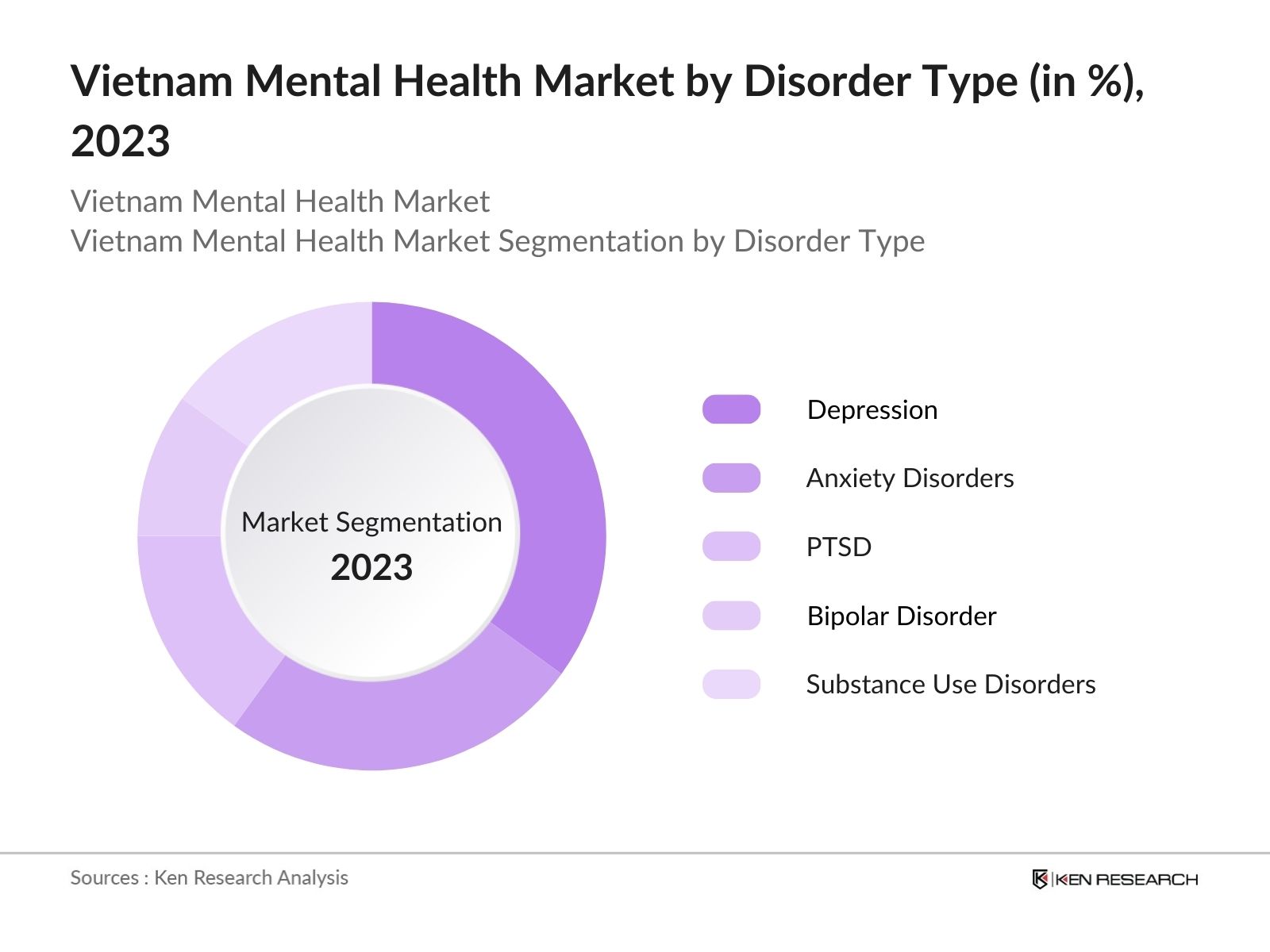

By Disorder Type: The market is segmented by disorder type into depression, anxiety disorders, PTSD, bipolar disorder, and substance use disorders. Depression remains the dominant sub-segment due to its high prevalence and rising public awareness. Efforts from both government and non-governmental organizations have brought attention to the need for treatment, while the growth of teletherapy and online counseling platforms further supports its dominance in market share.

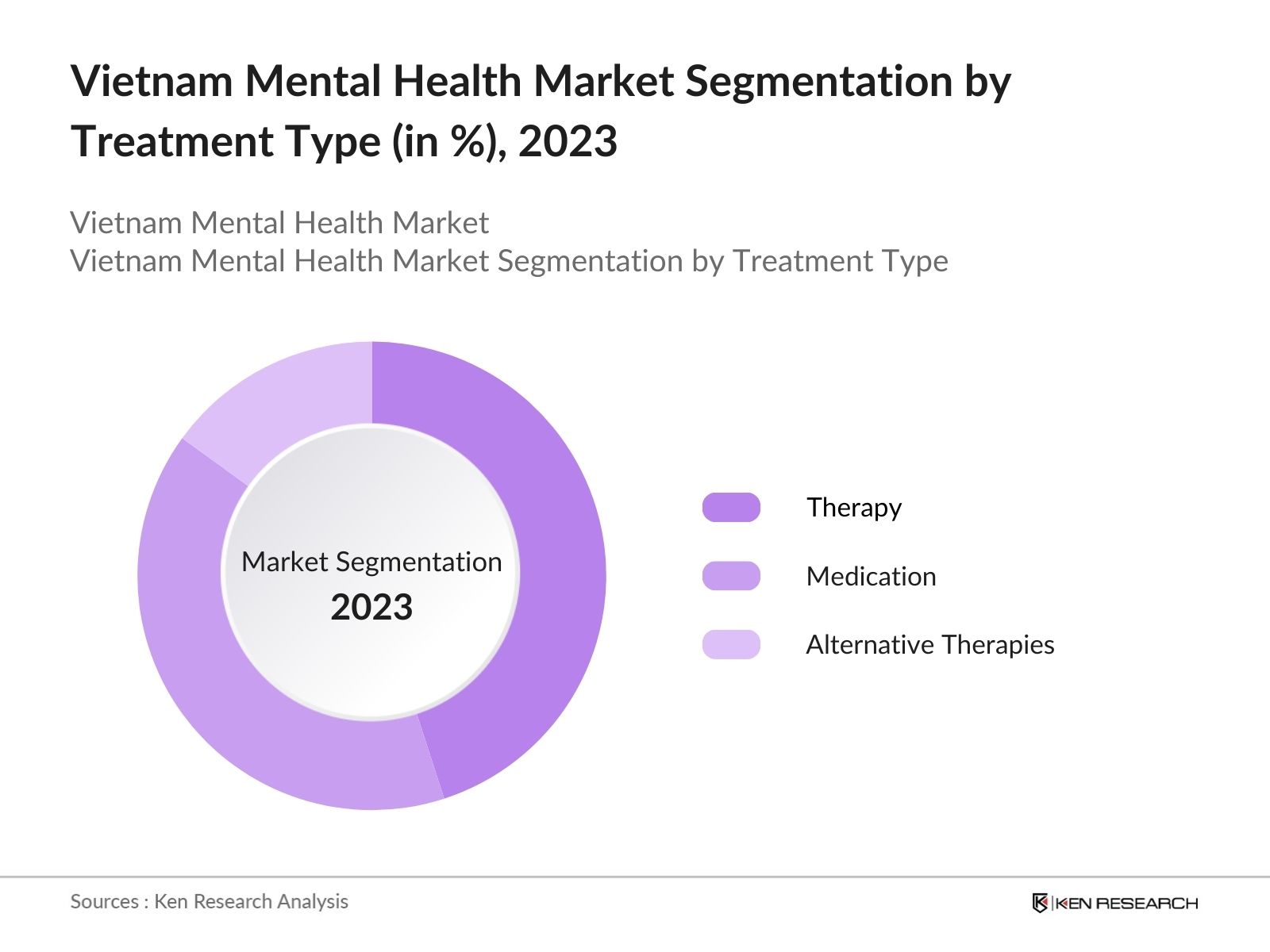

By Treatment Type: The market is segmented by treatment type into therapy, medication, and alternative therapies. Therapy, particularly Cognitive Behavioral Therapy (CBT), dominates this segment, accounting for a substantial market share due to the increasing acceptance of therapeutic approaches as effective interventions for mental health issues. The adoption of teletherapy platforms, combined with growing corporate mental health programs, further boosts the demand for therapy services over other treatment types.

Vietnam Mental Health Market Competitive Landscape

The Vietnam Mental Health Market is dominated by a few key players, ranging from established hospitals to digital health platforms. This consolidation highlights the significant influence of these companies on shaping mental health care delivery, particularly in urban areas where the need for specialized care is more prevalent. Major players have focused on expanding telehealth services, investing in mental health apps, and creating partnerships with local governments to extend mental health access.

|

Company |

Establishment Year |

Headquarters |

Specialty |

Service Coverage |

Telehealth Platform |

Number of Clinics |

Partnerships |

Revenue |

|---|---|---|---|---|---|---|---|---|

|

National Psychiatric Hospital No.1 |

1968 |

Hanoi |

||||||

|

Vinmec International Hospital |

2012 |

Ho Chi Minh City |

||||||

|

BetterHelp Vietnam |

2016 |

Ho Chi Minh City |

||||||

|

MindCare Vietnam |

2018 |

Hanoi |

||||||

|

FV Hospital Mental Health Dept. |

2003 |

Ho Chi Minh City |

Vietnam Mental Health Industry Analysis

Growth Drivers

Government Initiatives: The Vietnamese governments National Mental Health Program, implemented in 2021, aims to strengthen mental health services across the country. According to the Ministry of Health, the program has been instrumental in integrating mental health care into primary health systems, covering 50 provincial health centers by 2023. In 2022, the government invested 150 billion VND to improve psychiatric facilities and train mental health professionals in 25 provinces. This increased access to mental health services, particularly in rural areas, has helped reach over 2 million patients.

Rising Telemedicine Penetration: Telemedicine platforms have gained prominence in Vietnam's mental health care system. In 2023, over 500,000 tele-counseling sessions were conducted across major cities, driven by increased internet penetration (reaching 74% of the population). The Ministry of Health reported that over 100 licensed telemedicine providers were operating by mid-2023, offering virtual therapy to individuals in remote areas. This trend has been further supported by government regulations allowing digital health platforms to operate without stringent licensing laws, facilitating wider adoption.

Growing Urbanization and Its Impact on Mental Health: Vietnams rapid urbanization is impacting mental health, with urban areas seeing a higher incidence of stress, depression, and anxiety disorders. According to the General Statistics Office of Vietnam, 37% of the population lived in urban areas in 2023, with cities like Hanoi and Ho Chi Minh witnessing significant population growth. This growth has exacerbated mental health challenges linked to lifestyle changes, job pressures, and housing instability. A 2022 survey by the Ministry of Health indicated that over 30% of urban residents experienced mental health-related issues.

Market Challenges

Lack of Trained Mental Health Professionals: Vietnam faces a severe shortage of mental health professionals, with only 1 psychiatrist available per 100,000 people as of 2023. The Ministry of Health reported that the country has fewer than 500 psychiatrists nationwide, and most are concentrated in urban areas. The lack of trained professionals in rural regions exacerbates the mental health care gap, as approximately 80% of rural mental health cases remain untreated. The government is addressing this issue by expanding mental health education and offering scholarships for medical students specializing in psychiatry.

Unequal Access to Mental Health Care: Access to mental health care in Vietnam is largely skewed towards urban areas, with rural populations facing significant barriers. The Ministry of Health reported that in 2023, 70% of mental health facilities were concentrated in major cities like Hanoi and Ho Chi Minh. In rural areas, patients must travel an average of 50 kilometers to access basic mental health services. This disparity has resulted in an untreated mental health burden in rural regions, where an estimated 60% of individuals with mental health conditions do not receive proper care.

Vietnam Mental Health Market Future Outlook

Over the next five years, the Vietnam Mental Health Market is expected to show significant growth driven by continuous government efforts to improve mental health infrastructure, advancements in telehealth technologies, and growing public awareness of mental health issues. Increased collaborations between local governments and international NGOs are likely to play a key role in expanding the reach of mental health services, especially in rural and underserved areas.

Future Market Opportunities

Expansion of Corporate Mental Health Programs: Vietnamese businesses are increasingly recognizing the importance of mental health in the workplace. In 2023, over 300 companies introduced corporate mental health programs, providing employees with access to counseling services and wellness programs. The Ministry of Labor reported that stress-related absenteeism cost businesses over 4 trillion VND in lost productivity in 2022. As awareness grows, more companies are expected to adopt mental health initiatives to improve employee well-being, presenting a major opportunity for service providers.

Partnerships with International Organizations: International organizations such as the World Health Organization (WHO) and UNICEF have partnered with the Vietnamese government to enhance mental health services. In 2022, WHO supported the expansion of Vietnams mental health infrastructure by providing technical assistance and funding to modernize psychiatric facilities in 10 provinces. Additionally, UNICEF launched programs focused on mental health support for children and adolescents, reaching 1.5 million students across 500 schools by mid-2023. Such partnerships present opportunities for further development and expansion of mental health services in Vietnam.

Scope of the Report

|

Disorder Type |

Depression Anxiety PTSD Substance Use |

|

Treatment Type |

Therapy Medication Alternative Therapies |

|

Service Type |

Inpatient Outpatient Telehealth Corporate Programs |

|

Age Group |

Children & Adolescents Adults Geriatric |

|

Region |

North East West South |

Products

Key Target Audience

Hospitals and Healthcare Providers

Mental Health Clinics

Corporate Wellness Programs

Insurance Providers

Government and Regulatory Bodies (Vietnam Ministry of Health, Department of Medical Services Administration)

Non-Governmental Organizations (NGOs)

Investors and Venture Capitalist Firms

Telemedicine Platforms

Banks and Financial Institutions

Companies

Major Players in the Vietnam Mental Health Market

National Psychiatric Hospital No.1

Vinmec International Hospital

BetterHelp Vietnam

MindCare Vietnam

FV Hospital Mental Health Department

Ho Chi Minh City Psychiatric Hospital

ManarCare Mental Health Services

Online Mental Health Vietnam

TherapyGo Vietnam

SOS Vietnam Mental Health Center

Doctors Without Borders Vietnam Chapter

Vietnam Institute of Mental Health

HelloDoctor Vietnam

FPT Telemedicine Services

Vinmec Telehealth Platform

Table of Contents

1. Vietnam Mental Health Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Mental Health Care Structure in Vietnam (Public, Private, NGO)

1.4. Mental Health Disorder Prevalence (Depression, Anxiety, PTSD, etc.)

1.5. Market Growth Rate (Therapy Adoption, Telehealth Expansion)

2. Vietnam Mental Health Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Developments and Milestones in Mental Health Sector (Government Programs, Telehealth Platforms, Mental Health Clinics)

3. Vietnam Mental Health Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Awareness of Mental Health (Mental Health Awareness Campaigns, Media)

3.1.2. Government Initiatives (Government Health Policies, Vietnam National Mental Health Program)

3.1.3. Rising Telemedicine Penetration (Tele-counseling Platforms, Virtual Therapy)

3.1.4. Growing Urbanization and Its Impact on Mental Health

3.2. Market Challenges

3.2.1. Cultural Stigma around Mental Health

3.2.2. Lack of Trained Mental Health Professionals

3.2.3. Unequal Access to Mental Health Care (Urban vs Rural)

3.3. Opportunities

3.3.1. Integration of AI in Mental Health Care (AI-based Diagnostics, Chatbots for Mental Health)

3.3.2. Expansion of Corporate Mental Health Programs

3.3.3. Partnerships with International Organizations

3.4. Trends

3.4.1. Adoption of Digital Therapeutics

3.4.2. Mental Health Apps and Online Platforms

3.4.3. Introduction of Mental Health Insurance

3.5. Government Regulations

3.5.1. National Guidelines for Mental Health Care

3.5.2. Regulations on Telemedicine and E-Counseling

3.5.3. Legal Framework for Patient Data Privacy

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Healthcare Providers, NGOs, Government Bodies)

3.8. Porters Five Forces Analysis

3.9. Competitive Ecosystem (Private Clinics, Telehealth Providers, NGOs)

4. Vietnam Mental Health Market Segmentation

4.1. By Disorder Type (In Value %)

4.1.1. Depression

4.1.2. Anxiety Disorders

4.1.3. Post-Traumatic Stress Disorder (PTSD)

4.1.4. Substance Use Disorders

4.1.5. Bipolar Disorder

4.2. By Treatment Type (In Value %)

4.2.1. Therapy (Cognitive Behavioral Therapy, Psychotherapy, etc.)

4.2.2. Medication (Antidepressants, Antipsychotics, Anxiolytics)

4.2.3. Alternative Therapies (Meditation, Yoga, etc.)

4.3. By Service Type (In Value %)

4.3.1. Inpatient Services

4.3.2. Outpatient Services

4.3.3. Telehealth and E-mental Health Services

4.3.4. Corporate Mental Health Programs

4.4. By Age Group (In Value %)

4.4.1. Children and Adolescents

4.4.2. Adults

4.4.3. Geriatric Population

4.5. By Region (In Value %)

4.5.1. North

4.5.2. East

4.5.3. South

4.5.4. West

5. Vietnam Mental Health Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. National Psychiatric Hospital No. 1

5.1.2. Ho Chi Minh City Psychiatric Hospital

5.1.3. Vinmec International Hospital

5.1.4. ManarCare Mental Health Services

5.1.5. BetterHelp Vietnam

5.1.6. Vietnam Institute of Mental Health

5.1.7. MindCare Vietnam

5.1.8. Online Mental Health Vietnam

5.1.9. FV Hospital Mental Health Department

5.1.10. FPT Telemedicine Services

5.1.11. SOS Vietnam Mental Health Center

5.1.12. Doctors Without Borders Vietnam Chapter

5.1.13. HelloDoctor Vietnam

5.1.14. TherapyGo Vietnam

5.1.15. Vinmec Telehealth Platform

5.2. Cross Comparison Parameters (Revenue, No. of Patients Served, Focus Areas, No. of Employees, Geographical Reach, Digital Services, Collaborations, Certifications)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Partnerships, Expansion Plans, New Service Launches)

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Vietnam Mental Health Market Regulatory Framework

6.1. Mental Health Laws and Policies

6.2. Certification for Mental Health Practitioners

6.3. Mental Health and Patient Data Protection Laws

7. Vietnam Mental Health Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Vietnam Mental Health Future Market Segmentation

8.1. By Disorder Type (In Value %)

8.2. By Treatment Type (In Value %)

8.3. By Service Type (In Value %)

8.4. By Age Group (In Value %)

8.5. By Region (In Value %)

9. Vietnam Mental Health Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The first phase focuses on creating an ecosystem map for the Vietnam Mental Health Market. Comprehensive desk research using primary and secondary databases provides industry-level information to identify key variables such as patient demographics, mental health trends, and service delivery models.

Step 2: Market Analysis and Construction

This step involves gathering historical data on mental health service penetration and disorder prevalence across urban and rural areas. Analyzing the correlation between healthcare accessibility and treatment outcomes helps in assessing market performance.

Step 3: Hypothesis Validation and Expert Consultation

Interviews with industry experts, including mental health practitioners and healthcare administrators, provide insights into market dynamics and operational challenges. These discussions refine the initial hypotheses and ensure the accuracy of market estimates.

Step 4: Research Synthesis and Final Output

Engaging directly with mental health providers and clinics across Vietnam ensures that market data, including service delivery, therapy adoption rates, and digital platform usage, is comprehensive and accurate, ultimately providing a validated analysis of the Vietnam Mental Health Market.

Frequently Asked Questions

01. How big is the Vietnam Mental Health Market?

The Vietnam Mental Health Market is valued at USD 137 million and continues to grow due to increasing awareness of mental health issues, improved healthcare infrastructure, and the rising demand for therapy and telehealth services.

02. What are the challenges in the Vietnam Mental Health Market?

Challenges in the Vietnam Mental Health Market include cultural stigma, unequal access to care in rural areas, and the limited availability of trained mental health professionals, particularly outside of major cities.

03. Who are the major players in the Vietnam Mental Health Market?

Key players in the Vietnam Mental Health market include National Psychiatric Hospital No.1, Vinmec International Hospital, BetterHelp Vietnam, MindCare Vietnam, and FV Hospitals Mental Health Department. These organizations dominate due to their extensive service offerings and growing telehealth platforms.

04. What are the growth drivers of the Vietnam Mental Health Market?

Growth drivers in the Vietnam Mental Health market include increased public awareness of mental health, government initiatives to improve healthcare accessibility, and the expansion of telemedicine services that make mental health care more accessible to rural populations.

05. Which treatment type dominates the Vietnam Mental Health Market?

Therapy dominates the treatment type segmentation in the Vietnam Mental Health Market due to its increasing acceptance as a preferred method of mental health intervention, particularly through digital therapy platforms.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.