Vietnam Metal Can Market Outlook to 2030

Region:Asia

Author(s):Shubham

Product Code:KROD5517

November 2024

84

About the Report

Vietnam Metal Can Market Overview

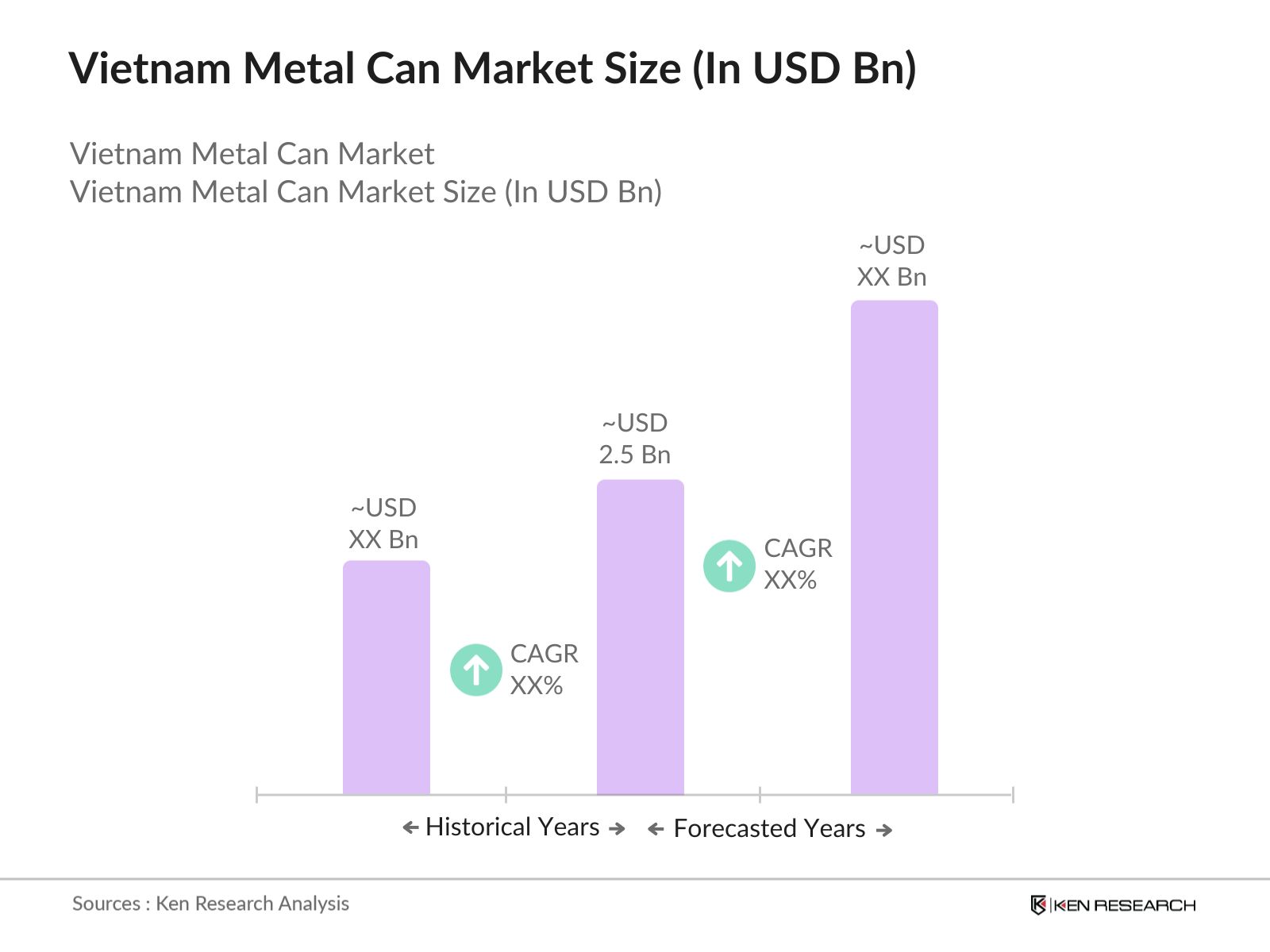

The Vietnam Metal Can Market is valued at USD 2.5 billion, based on a comprehensive five-year historical analysis. This market is primarily driven by the expansion of the food and beverage industry, which increasingly relies on metal cans for packaging due to their sustainability and recyclability. With rising consumer awareness of environmental issues, demand for aluminum cans has surged, especially in urban areas where the preference for eco-friendly packaging solutions is stronger. The governments push for sustainable packaging solutions is also contributing to market growth.

Ho Chi Minh City and Hanoi dominate the metal can market due to their well-established industrial infrastructure and high levels of consumption for packaged foods and beverages. These cities have a more developed distribution network, which allows manufacturers to cater to growing demand. Additionally, their high urbanization rates and concentration of manufacturing facilities have made them key players in the growth of the metal can market, especially for beverage cans in the ready-to-drink sector.Vietnams food safety standards require strict packaging and labeling regulations, particularly for the food and beverage sectors. In 2023, the Vietnam Food Administration (VFA) issued new guidelines mandating clearer labeling on metal-packaged food products to ensure consumer safety. These regulations are set to be enforced more rigorously in 2024, compelling companies to comply with updated standards. This is expected to drive the demand for metal cans, which offer durability and compliance with regulatory requirements.

Vietnam Metal Can Market Segmentation

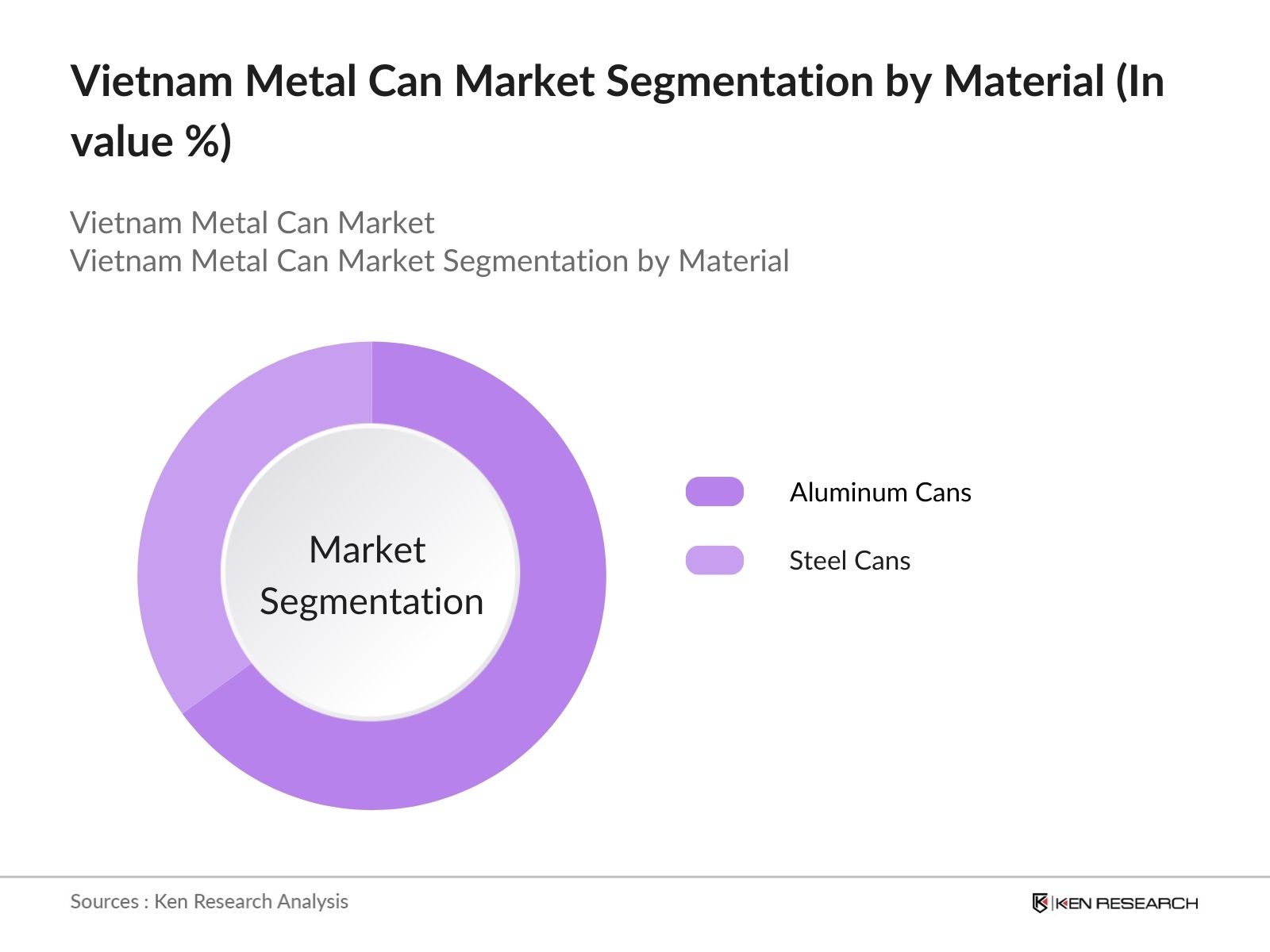

- By Material Type: The Market is segmented by material type into Aluminum Cans and Steel Cans. Aluminum cans dominate the market due to their lightweight properties, ease of recyclability, and growing preference among beverage manufacturers. The trend toward environmentally sustainable packaging has further boosted the demand for aluminum cans in the market. Additionally, leading global brands have adopted aluminum cans, which has bolstered this segments market presence.

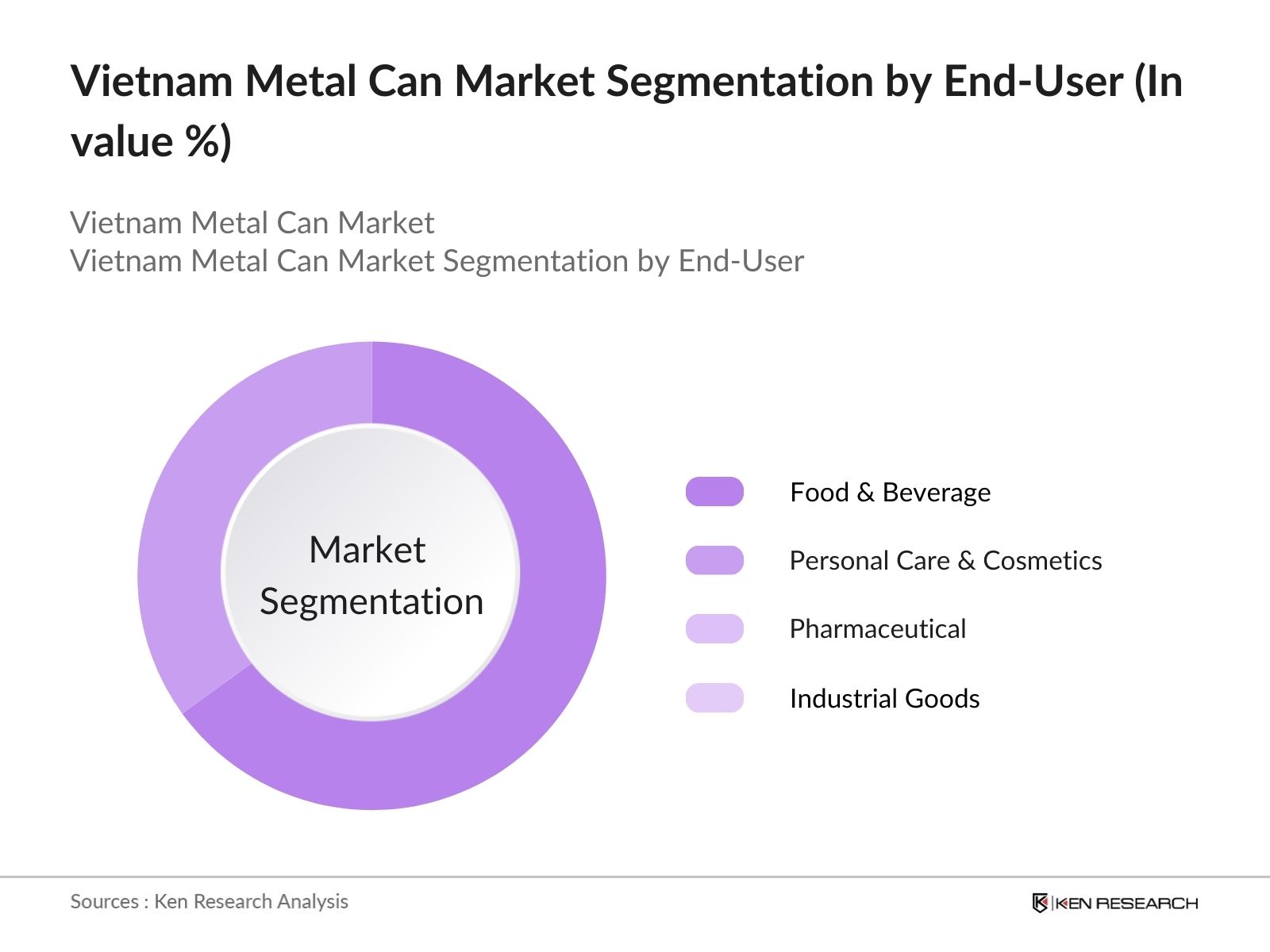

- By End-User: The market is also segmented by end-use industry into Food & Beverage, Personal Care & Cosmetics, Pharmaceutical, and Industrial Goods. The Food & Beverage sector holds the largest share in this market, driven by the increasing demand for canned beverages and processed foods. The beverage industry in particular has seen significant growth, with major companies adopting metal cans as a preferred packaging solution due to their ability to preserve product integrity and extend shelf life.

Vietnam Metal Can Market Competitive Landscape

The Vietnam Metal Can Market is characterized by strong competition from both local and international companies. Local players like Canpac Vietnam cater to the domestic demand for metal cans, particularly in the food and beverage industry, while international giants like Crown Holdings Inc. and Ball Corporation have established a significant presence through their global expertise and extensive manufacturing capabilities. This competitive environment has led to innovation in packaging solutions, particularly in terms of sustainability and product differentiation.

Vietnam Metal Can Market Analysis

Growth Drivers

- Rise in Beverage Consumption: Vietnam's beverage industry has been experiencing rapid growth due to rising consumer demand for ready-to-drink beverages. In 2022, the country saw a significant increase in beverage consumption, driven by a young and urbanized population. According to the Ministry of Industry and Trade (MoIT), Vietnam produced over abillion liters of beverages in 2022. This rise has propelled the demand for metal cans, as they are widely used for packaging beverages like soft drinks and beer. The metal can industry is expected to benefit from these trends, as demand continues to be strong in 2024.

- Shift Towards Sustainable Packaging: Vietnams environmental regulations are pushing industries to adopt more sustainable packaging solutions. With millions of tons of waste generated in 2022, the government has intensified its efforts to reduce plastic waste. The Ministry of Natural Resources and Environment (MoNRE) has introduced regulations promoting the use of recyclable and sustainable materials like metal cans. In 2024, these regulations are expected to further encourage industries to adopt metal cans, which are more recyclable than alternatives like plastic. This shift is driven by growing environmental awareness and regulatory pressure on reducing waste.

- Expansion of Processed Food Market: Vietnam's food processing industry has grown by over 9% year-on-year, according to MoITs 2023 data. This industry expansion is contributing to the increased demand for metal cans, especially for processed and canned food products. In 2024, the food processing sector is forecasted to grow further, fueled by urbanization and a growing middle class. Cans provide a durable and cost-effective packaging solution, making them popular in this sector. With over 70% of processed food requiring metal packaging, the can industry is expected to see sustained demand in the near future.

Market Challenges

- Fluctuating Metal Prices: The volatility in metal prices, especially aluminum, presents a significant challenge for the metal can industry in Vietnam. Metal prices have shown instability due to global economic factors, which increases production costs for manufacturers. This unpredictability impacts the profitability of the industry and creates difficulties in long-term planning. Without stable pricing mechanisms or cost-controlling strategies, the fluctuating prices of raw materials are expected to remain a major hurdle for manufacturers in 2024, potentially hindering market growth and increasing the financial risks for businesses in the metal can sector.

- Competition from Alternative Packaging Materials: Despite a global push towards sustainability, metal cans face competition from alternative materials like plastic and glass. These materials remain popular due to their lower production costs and versatility in packaging. Plastic, in particular, continues to be widely used in sectors such as food packaging, where cost-efficiency and convenience are prioritized over recyclability. Although metal cans are more environmentally friendly, the ongoing preference for cheaper materials like plastic and glass poses a significant competitive challenge for the metal can industry in 2024, especially in price-sensitive markets.

Vietnam Metal Can Market Future Outlook

The Vietnam Metal Can Market is projected to continue its steady growth, driven by the expansion of the food and beverage industry, increasing environmental awareness, and government support for sustainable packaging solutions. The market is expected to remain dominated by aluminum cans, as they offer better recyclability and align with the global trend of reducing plastic waste. Furthermore, the ongoing urbanization and the rise of e-commerce will create additional opportunities for growth in the packaging sector.

Future Market Opportunities

- Advancements in Lightweight Cans: Innovations in lightweight metal cans are driving new opportunities in the market. In 2022, Vietnamese companies like TBC-Ball Beverage Can Vietnam introduced aluminum cans that are 10-15% lighter than previous models, reducing both material usage and shipping costs. These advancements are supported by R&D investments aimed at improving efficiency in can production. In 2024, such innovations are expected to expand the use of metal cans in industries like beverages and processed foods, providing a cost-effective and sustainable solution for manufacturers.

- Increasing Export Demand: Vietnams growing trade relationships within the ASEAN region present a significant export opportunity for the metal can market. In 2023, Vietnam exported food and beverages worth billions, many of which are packaged in metal cans. The ASEAN Free Trade Agreement (AFTA) facilitates reduced tariffs on metal-packaged goods, driving demand for metal cans in neighboring countries. In 2024, export growth within ASEAN is expected to continue, providing new opportunities for Vietnams metal can manufacturers to tap into regional markets.

Scope of the Report

|

By Material Type |

Aluminum Cans Steel Cans |

|

By End-User |

Food & Beverage Personal Care & Cosmetics Pharmaceutical Industrial Goods |

|

By Can Type |

Two-piece Cans Three-piece Cans |

|

By Packaging Type |

Aerosol Cans Liquid Cans Dry Goods Cans |

|

By Region |

Northern Central Southern |

Products

Key Target Audience

Beverage Manufacturers

Food Processing Companies

Packaging Industry Associations

Government and Regulatory Bodies (Vietnam Ministry of Natural Resources and Environment)

Investors and Venture Capitalist Firms

Recycling Companies

Banks and Financial Institutions

Industrial Goods Manufacturers

Companies

Players Mentioned in the Report

Crown Holdings Inc.

Ball Corporation

Ardagh Group

Toyo Seikan Group

Canpac Vietnam

Canpack Group

Showa Aluminum Can Corporation

Daiwa Can Company

Anheuser-Busch InBev

Baosteel Packaging

Nampak Limited

Kian Joo Group

Greatview Aseptic Packaging

Silgan Holdings Inc.

Crown Asia Pacific

Table of Contents

1. Vietnam Metal Can Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Vietnam Metal Can Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Vietnam Metal Can Market Analysis

3.1. Growth Drivers

3.1.1. Rise in Beverage Consumption (Beverage Industry Growth)

3.1.2. Shift Towards Sustainable Packaging (Environmental Regulations)

3.1.3. Expansion of Processed Food Market (Food Processing Industry)

3.1.4. Government Support for Recycling Initiatives (Policy Incentives)

3.2. Market Challenges

3.2.1. Fluctuating Metal Prices (Raw Material Costs)

3.2.2. Competition from Alternative Packaging Materials (Plastic, Glass)

3.2.3. High Production Costs (Energy Consumption)

3.2.4. Limited Recycling Infrastructure (Waste Management Challenges)

3.3. Opportunities

3.3.1. Advancements in Lightweight Cans (R&D Innovations)

3.3.2. Increasing Export Demand (ASEAN Market Opportunities)

3.3.3. Growing Preference for Aluminum Cans (Recyclability)

3.3.4. E-commerce Growth Driving Packaging Needs (Online Retail Surge)

3.4. Trends

3.4.1. Adoption of Smart Packaging (IoT Integration)

3.4.2. Customization and Branding through Metal Cans (Marketing Trends)

3.4.3. Expansion of Ready-to-Drink Beverages (Convenience Products)

3.4.4. Focus on Reducing Carbon Footprint (Sustainability)

3.5. Government Regulation

3.5.1. Packaging and Labeling Laws (Vietnam Food Safety Standards)

3.5.2. Circular Economy Promotion (Recycling Regulations)

3.5.3. Import and Export Tariffs on Metal Packaging (Trade Policies)

3.5.4. Subsidies for Metal Recycling (Government Incentives)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Vietnam Metal Can Market Segmentation

4.1. By Material Type (In Value %)

4.1.1. Aluminum Cans

4.1.2. Steel Cans

4.2. By End-Use Industry (In Value %)

4.2.1. Food & Beverage

4.2.2. Personal Care & Cosmetics

4.2.3. Pharmaceutical

4.2.4. Industrial Goods

4.3. By Can Type (In Value %)

4.3.1. Two-piece Cans

4.3.2. Three-piece Cans

4.4. By Packaging Type (In Value %)

4.4.1. Aerosol Cans

4.4.2. Liquid Cans

4.4.3. Dry Goods Cans

4.5. By Region (In Value %)

4.5.1. Northern

4.5.2. Central

4.5.3. Southern

5. Vietnam Metal Can Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Crown Holdings Inc.

5.1.2. Ball Corporation

5.1.3. Ardagh Group

5.1.4. Toyo Seikan Group

5.1.5. Canpac Vietnam

5.1.6. Canpack Group

5.1.7. Showa Aluminum Can Corporation

5.1.8. Daiwa Can Company

5.1.9. Anheuser-Busch InBev

5.1.10. Baosteel Packaging

5.1.11. Nampak Limited

5.1.12. Kian Joo Group

5.1.13. Greatview Aseptic Packaging

5.1.14. Silgan Holdings Inc.

5.1.15. Crown Asia Pacific

5.2 Cross Comparison Parameters (Manufacturing Capacity, No. of Plants, Revenue, Market Presence, Sustainability Initiatives, Product Diversification, R&D Investments, Partnership/Collaboration)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Government Grants

5.8. Private Equity Investments

6. Vietnam Metal Can Market Regulatory Framework

6.1. Environmental Standards (Vietnam Ministry of Natural Resources and Environment)

6.2. Compliance Requirements (Vietnam Packaging Standards)

6.3. Certification Processes (Food Grade Certification, ISO Standards)

7. Vietnam Metal Can Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Vietnam Metal Can Future Market Segmentation

8.1. By Material Type (In Value %)

8.2. By End-Use Industry (In Value %)

8.3. By Can Type (In Value %)

8.4. By Packaging Type (In Value %)

8.5. By Region (In Value %)

9. Vietnam Metal Can Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

In the initial stage, we conducted comprehensive desk research to map out the key stakeholders within the Vietnam Metal Can Market, including manufacturers, regulatory bodies, and end-users. We utilized proprietary databases and secondary sources to gather relevant industry-level data.

Step 2: Market Analysis and Construction

Historical data on the Vietnam Metal Can Market was compiled, focusing on market penetration rates and production volumes. These data points helped in constructing revenue estimates and analyzing the share of key players in the market.

Step 3: Hypothesis Validation and Expert Consultation

Market assumptions were validated through interviews with industry experts, including manufacturers and distributors. These consultations provided operational insights that contributed to the refinement of our market analysis.

Step 4: Research Synthesis and Final Output

The final stage involved synthesizing data from both primary and secondary sources to generate an accurate and validated overview of the Vietnam Metal Can Market. This approach ensured that our findings reflected real market dynamics and provided actionable insights.

Frequently Asked Questions

01. How big is the Vietnam Metal Can Market?

The Vietnam Metal Can Market is valued at USD 2.5 billion, driven by growing demand in the food and beverage sector.

02. What are the challenges in the Vietnam Metal Can Market?

Challenges in the Vietnam Metal Can Market include fluctuating raw material prices and competition from alternative packaging materials such as plastic and glass.

03. Who are the major players in the Vietnam Metal Can Market?

Key players in the Vietnam Metal Can Market include Crown Holdings Inc., Ball Corporation, Ardagh Group, Canpac Vietnam, and Crown Asia Pacific, among others.

04. What are the growth drivers of the Vietnam Metal Can Market?

Growth drivers in the Vietnam Metal Can Market include the rising demand for sustainable packaging solutions, expansion of the food and beverage industry, and government support for recycling initiatives.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.