Vietnam Metal Can Packaging Market Outlook to 2030

Region:Asia

Author(s):Sanjeev

Product Code:KROD9027

December 2024

87

About the Report

Vietnam Metal Can Packaging Market Overview

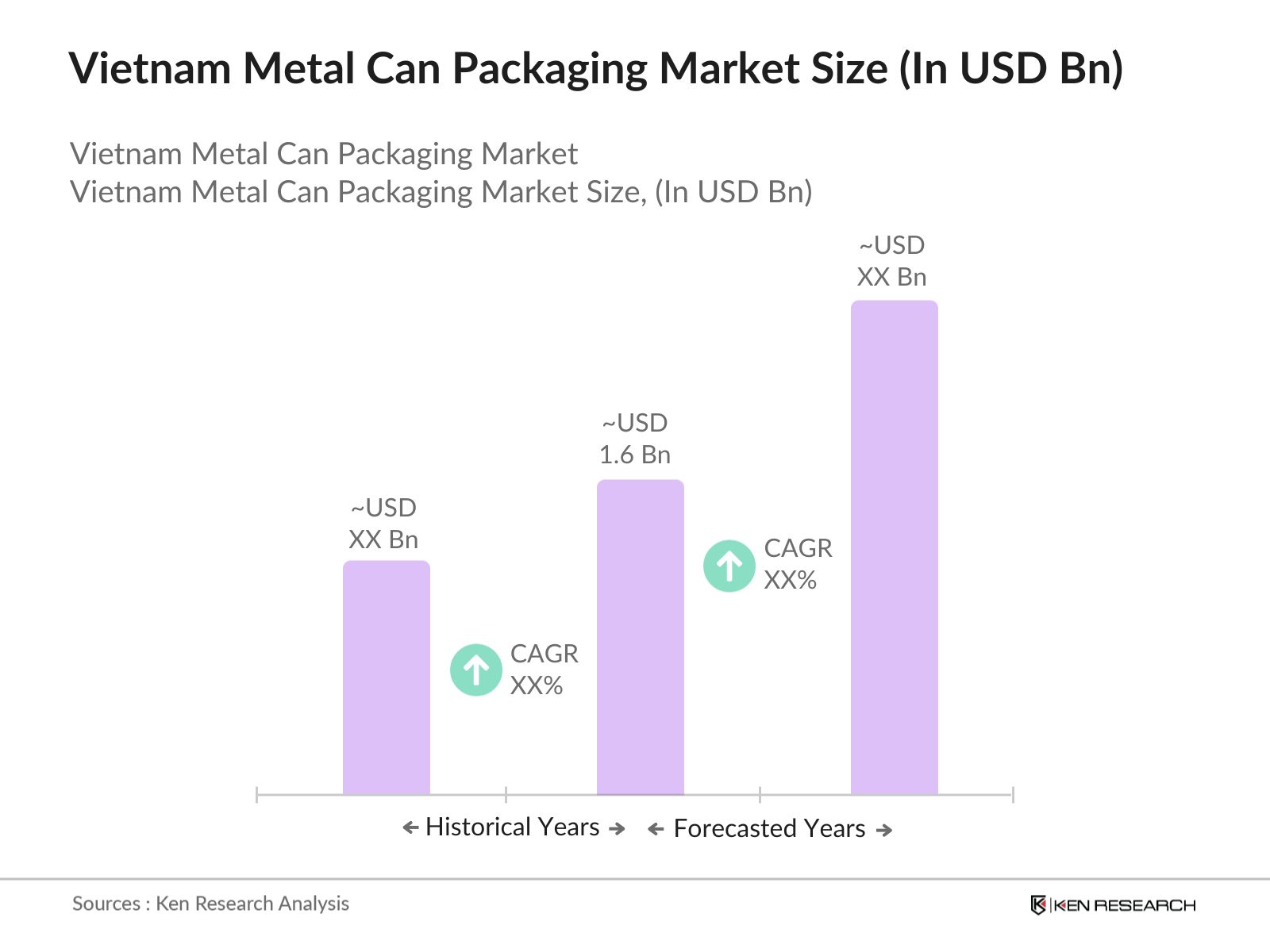

- The Vietnam Metal Can Packaging market is valued at USD 1.6 billion, driven primarily by the increasing demand for sustainable and eco-friendly packaging solutions. The market has experienced significant growth, particularly due to the rise in consumer preference for canned beverages, processed foods, and personal care products. With a strong shift towards reducing plastic use and a rise in recycling initiatives, metal cans are becoming a preferred packaging option across various industries in Vietnam.

- Major regions such as Ho Chi Minh City and Hanoi dominate the Vietnam Metal Can Packaging market due to their higher population density, urbanization, and industrialization. These cities host numerous food and beverage manufacturing companies, contributing to the large-scale consumption of metal cans. Additionally, these regions have better access to recycling infrastructure, which further supports the adoption of metal can packaging. Furthermore, the presence of large beverage manufacturers and exporters in these cities fuels the demand for metal cans.

- Vietnams government has set stringent metal recycling targets to promote environmental sustainability, with a 90% recycling goal for metals, including aluminum and steel, by 2025. In 2023, over 800,000 tons of metal were recycled, with the government actively supporting recycling initiatives through subsidies and public-private partnerships. These regulations aim to reduce raw material imports and promote a circular economy, benefiting the metal can packaging industry by ensuring a steady supply of recycled materials.

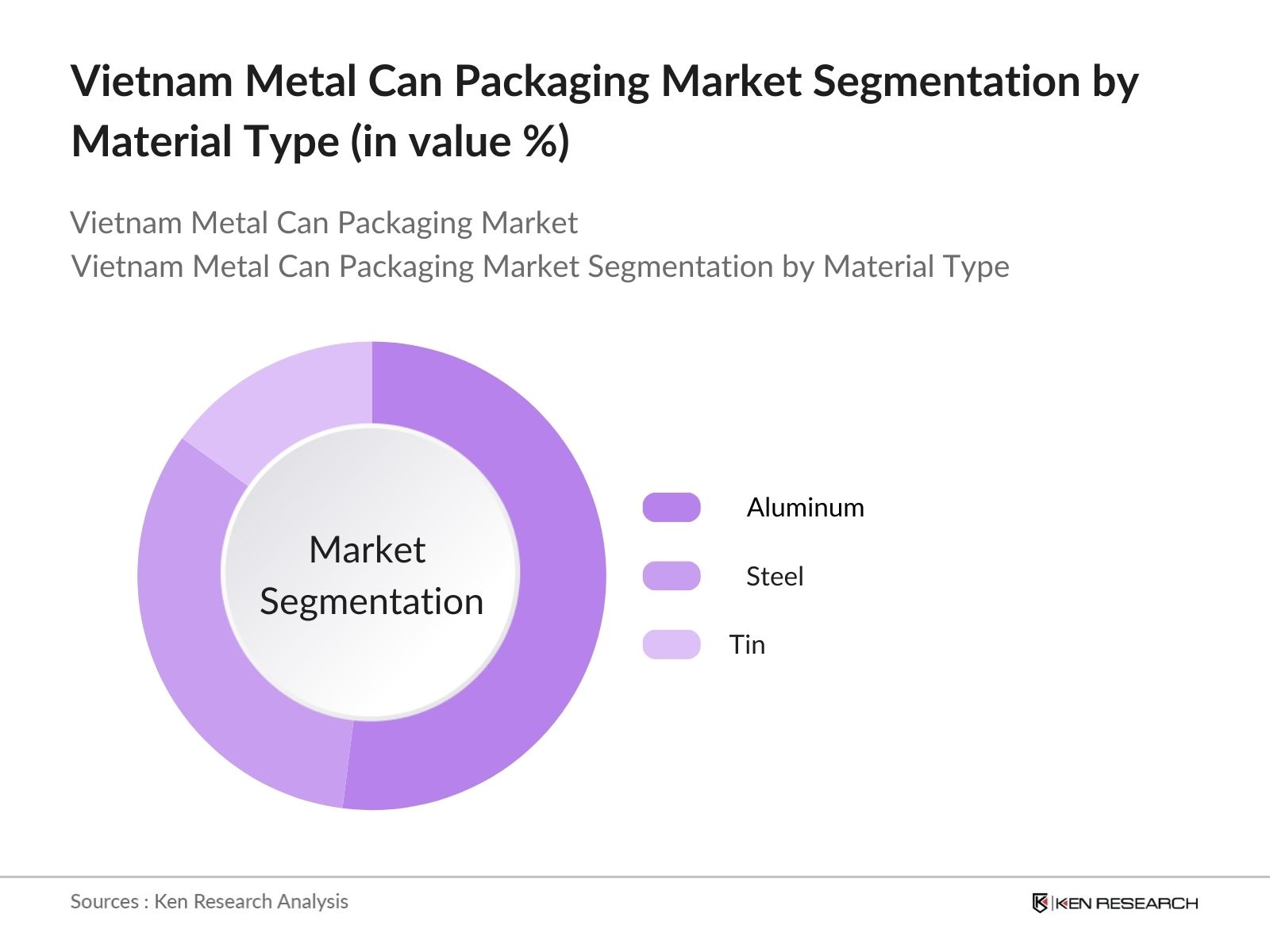

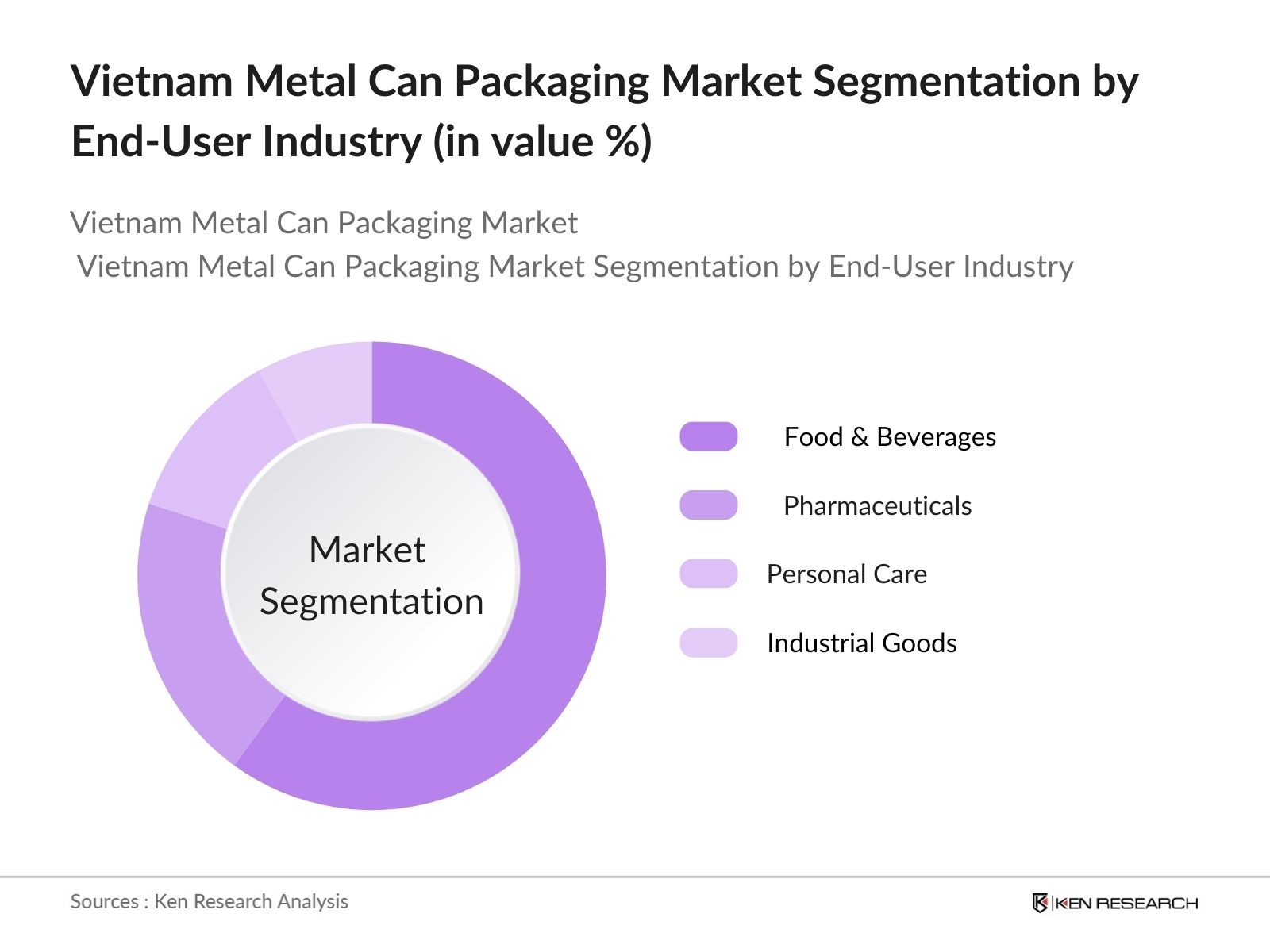

Vietnam Metal Can Packaging Market Segmentation

- By Material Type: The market is segmented by material type into aluminum, steel, and tin. Aluminum cans dominate this segment due to their lightweight properties, recyclability, and cost-effectiveness. Aluminum's sustainability appeal makes it highly sought after in the beverage and food industry, where consumer awareness of eco-friendly packaging is rising. The material's versatility and ease of customization further enhance its market position.

- By End-User Industry: The market is segmented by end-user industry into food and beverages, pharmaceuticals, personal care, and industrial goods. The food and beverage industry dominates this segment, largely due to the increasing demand for canned beverages and ready-to-eat meals. Brands within this industry have embraced metal cans for their durability, ability to preserve product freshness, and ease of transportation, making them highly popular among consumers.

Vietnam Metal Can Packaging Market Competitive Landscape

The Vietnam Metal Can Packaging market is characterized by the presence of both domestic and international players. These key players hold substantial market influence due to their robust production capacities, distribution networks, and innovative packaging solutions. The Vietnam Metal Can Packaging market is dominated by both local and global manufacturers such as Crown Holdings, Ball Corporation, and Ardagh Group. The dominance of these players can be attributed to their strong production capacities, innovation in packaging materials, and strategic partnerships with beverage and food processing companies. Additionally, their focus on sustainability and recycling initiatives ensures long-term growth and market leadership.

|

Company Name |

Established Year |

Headquarters |

Production Capacity |

Number of Employees |

|

Crown Holdings, Inc. |

1892 |

Philadelphia, USA |

||

|

Ball Corporation |

1880 |

Colorado, USA |

||

|

Ardagh Group |

1932 |

Luxembourg |

||

|

Daiwa Can Company |

1939 |

Tokyo, Japan |

||

|

Thai Beverage Can Limited |

1988 |

Bangkok, Thailand |

Vietnam Metal Can Packaging Industry Analysis

Market Growth Drivers

- Rise in Beverage Consumption: The increasing consumption of beverages, particularly soft drinks and beer, has significantly driven the demand for metal cans in Vietnam. In 2023, Vietnam's beverage industry was valued at approximately $11 billion, with over 4.5 billion liters of beer consumed annually, one of the highest per capita rates in Southeast Asia. The rise in urbanization and the popularity of ready-to-drink beverages have further accelerated this growth. Metal cans, favored for their durability and recyclability, are the packaging of choice for many beverage producers, supported by the Vietnamese governments initiatives to reduce plastic consumption.

- Increased Demand for Sustainable Packaging: With global sustainability trends impacting Vietnam, there is a noticeable shift towards eco-friendly packaging. The Vietnamese government has introduced regulations to minimize plastic waste, leading to an increased preference for recyclable metal cans. In 2022, over 1 million tons of recyclable materials, including metals, were processed, highlighting the rising commitment to sustainability. Metal packaging, especially cans, is recognized for its infinite recyclability, aligning with both consumer demand and regulatory frameworks in Vietnam, pushing the growth of this sector.

- Government Regulations Favoring Metal Recycling: Vietnam has set aggressive recycling targets under the National Action Plan on Sustainable Production and Consumption (2021-2030). In 2023, the government mandated a 90% recycling target for metals by 2025, further supporting the metal can packaging market. Aluminum and steel recycling, crucial in the production of metal cans, is increasingly emphasized, reducing dependency on raw materials and promoting a circular economy. This legislative push significantly benefits metal packaging manufacturers by providing consistent access to recycled materials at lower costs.

Market Challenges

- Fluctuating Raw Material Prices (Aluminum, Steel): The volatility in global prices for raw materials such as aluminum and steel poses a challenge to the metal can packaging industry in Vietnam. In 2022, aluminum prices saw a significant surge, averaging $2,500 per ton, driven by global supply chain disruptions and energy costs. Vietnams metal packaging manufacturers, heavily reliant on imports, are particularly affected, with fluctuating material costs impacting profit margins. This dependency on imported materials raises concerns about the long-term cost competitiveness of the metal can packaging industry.

- High Competition from Plastic Alternatives: Despite metal cans' recyclability, they face stiff competition from plastic packaging, which remains cost-effective and versatile. In 2023, over 2.5 million tons of plastic packaging were produced in Vietnam, with plastic bottles and flexible packaging continuing to dominate in sectors like beverages and personal care. While metal packaging is gaining traction, particularly in premium and sustainable segments, the lower cost of plastic alternatives continues to challenge market penetration, especially in cost-sensitive consumer segments.

Vietnam Metal Can Packaging Market Future Outlook

Over the next five years, the Vietnam Metal Can Packaging market is expected to experience steady growth driven by rising consumer demand for sustainable and eco-friendly packaging solutions. With increasing government emphasis on reducing plastic waste and promoting metal recycling, the market is positioned for further expansion. The growth of the beverage and processed food industry, along with advancements in can manufacturing technology, will also play a pivotal role in shaping the future of the market.

Future Market Opportunities

- Expansion into Premium Packaging Solutions: The increasing demand for premium products, especially in the beverage and cosmetic sectors, presents a growth opportunity for the metal can packaging industry in Vietnam. In 2023, Vietnams premium beverage segment grew to $1.2 billion, with premium alcohol and energy drinks increasingly opting for metal cans due to their sleek appearance and superior protection. As consumer preferences shift towards high-quality packaging, metal cans are becoming the go-to solution for brands looking to differentiate themselves in a crowded market.

- Growing Export Potential for Canned Goods: Vietnam's strong agricultural base and increasing production of canned fruits, vegetables, and seafood provide significant export opportunities. In 2023, Vietnam exported over $3 billion worth of canned food products, primarily to Europe and North America, markets where metal cans are preferred for their durability and preservation qualities. The rising global demand for convenient, long-lasting food products places Vietnam in a favorable position to expand its canned goods exports, further driving the demand for metal can packaging solutions.

Scope of the Report

|

Aluminum Steel Tin |

|

|

By Can Type |

Beverage Cans |

|

By End-User Industry |

Food & Beverages |

|

By Application |

Carbonated Soft Drinks |

|

By Region |

North East West South |

Products

Key Target Audience

Metal Can Manufacturers

Food and Beverage Companies

Pharmaceuticals and Healthcare Companies

Personal Care and Cosmetics Manufacturers

Industrial Goods Manufacturers

Investments and Venture Capitalist Firms

Banks and Financial Institutes

Government and Regulatory Bodies (Ministry of Industry and Trade)

Environmental and Recycling Agencies (Vietnam Environment Administration)

Companies

Major Players in the Vietnam Metal Can Packaging Market

Crown Holdings, Inc.

Ball Corporation

Ardagh Group

Can-Pack S.A.

Toyo Seikan Group Holdings, Ltd.

Silgan Holdings Inc.

Daiwa Can Company

Rexam PLC

Thai Beverage Can Limited

Hanacans Joint Stock Company

CCL Industries

Universal Can Corporation

Tin Pak Vietnam Co., Ltd.

Nam Viet Can Co., Ltd.

Pacific Can Vietnam Ltd.

Table of Contents

1. Vietnam Metal Can Packaging Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Vietnam Metal Can Packaging Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Vietnam Metal Can Packaging Market Analysis

3.1. Growth Drivers

3.1.1. Rise in Beverage Consumption

3.1.2. Increased Demand for Sustainable Packaging

3.1.3. Government Regulations Favoring Metal Recycling

3.1.4. Growth in Processed Food Industry

3.2. Market Challenges

3.2.1. Fluctuating Raw Material Prices (Aluminum, Steel)

3.2.2. High Competition from Plastic Alternatives

3.2.3. Limited Technological Innovation in Can Manufacturing

3.3. Opportunities

3.3.1. Expansion into Premium Packaging Solutions

3.3.2. Growing Export Potential for Canned Goods

3.3.3. Increasing Focus on Health Drinks and Energy Beverages

3.4. Trends

3.4.1. Shift Towards Lightweight Cans

3.4.2. Increased Focus on BPA-Free Cans

3.4.3. Digital Printing and Customization in Can Packaging

3.5. Government Regulation

3.5.1. Metal Recycling Targets in Vietnam

3.5.2. Import-Export Tariff Regulations

3.5.3. Food Safety Standards in Packaging

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Raw Material Suppliers, Manufacturers, Distributors, Retailers)

3.8. Porters Five Forces (Metal Can Packaging Industry)

3.9. Competition Ecosystem

4. Vietnam Metal Can Packaging Market Segmentation

4.1. By Material Type (In Value %)

4.1.1. Aluminum

4.1.2. Steel

4.1.3. Tin

4.2. By Can Type (In Value %)

4.2.1. Beverage Cans

4.2.2. Food Cans

4.2.3. Aerosol Cans

4.2.4. Paint Cans

4.3. By End-User Industry (In Value %)

4.3.1. Food & Beverages

4.3.2. Pharmaceuticals

4.3.3. Personal Care & Cosmetics

4.3.4. Chemicals & Paints

4.4. By Application (In Value %)

4.4.1. Carbonated Soft Drinks

4.4.2. Alcoholic Beverages

4.4.3. Canned Foods

4.4.4. Industrial Goods

4.5. By Region (In Value %)

4.5.1. North

4.5.2. East

4.5.3. South

4.5.4. West

5. Vietnam Metal Can Packaging Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Crown Holdings, Inc.

5.1.2. Ball Corporation

5.1.3. Ardagh Group

5.1.4. Can-Pack S.A.

5.1.5. Toyo Seikan Group Holdings, Ltd.

5.1.6. Silgan Holdings Inc.

5.1.7. Daiwa Can Company

5.1.8. Rexam PLC

5.1.9. Thai Beverage Can Limited

5.1.10. Hanacans Joint Stock Company

5.1.11. CCL Industries

5.1.12. Universal Can Corporation

5.1.13. Tin Pak Vietnam Co., Ltd.

5.1.14. Nam Viet Can Co., Ltd.

5.1.15. Pacific Can Vietnam Ltd.

5.2. Cross Comparison Parameters (Number of Employees, Headquarters, Inception Year, Revenue, Production Capacity, Manufacturing Units, Key Clients, Market Share)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Vietnam Metal Can Packaging Market Regulatory Framework

6.1. Packaging Material Standards (Aluminum, Steel)

6.2. Recycling Compliance

6.3. Food Safety and Hygiene Regulations

6.4. Environmental Impact and Sustainability Standards

7. Vietnam Metal Can Packaging Market Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Vietnam Metal Can Packaging Future Market Segmentation

8.1. By Material Type (In Value %)

8.2. By Can Type (In Value %)

8.3. By End-User Industry (In Value %)

8.4. By Application (In Value %)

8.5. By Region (In Value %)

9. Vietnam Metal Can Packaging Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The research process begins with identifying key stakeholders in the Vietnam Metal Can Packaging market. Using comprehensive desk research and industry reports, critical variables such as material type, production capacity, and sustainability initiatives are defined. These variables are pivotal in understanding market trends and dynamics.

Step 2: Market Analysis and Construction

Historical data related to the Vietnam Metal Can Packaging market is gathered and analyzed. This phase involves assessing production volumes, market penetration by material type, and revenue generation within key segments. This analysis ensures a robust foundation for future market projections.

Step 3: Hypothesis Validation and Expert Consultation

The market hypotheses are tested through consultations with industry experts and stakeholders, including packaging manufacturers and distributors. These interviews provide valuable insights and help validate the findings with real-time operational data from the industry.

Step 4: Research Synthesis and Final Output

In the final stage, the research findings are synthesized, and comprehensive insights into the Vietnam Metal Can Packaging market are compiled. This includes detailed analyses of production trends, material preferences, and the competitive landscape. The research outputs undergo thorough validation to ensure data accuracy.

Frequently Asked Questions

01. How big is the Vietnam Metal Can Packaging Market?

The Vietnam Metal Can Packaging market is valued at USD 1.6 billion, driven by the increasing demand for sustainable packaging solutions in the food and beverage industry.

02. What are the challenges in the Vietnam Metal Can Packaging Market?

Key challenges in Vietnam Metal Can Packaging market include fluctuating raw material prices, particularly for aluminum and steel, and competition from alternative packaging materials like plastic. Additionally, the need for technological advancements in can manufacturing poses a challenge.

03. Who are the major players in the Vietnam Metal Can Packaging Market?

The major players in the Vietnam Metal Can Packaging market include Crown Holdings, Ball Corporation, Ardagh Group, Daiwa Can Company, and Thai Beverage Can Limited. These companies lead due to their extensive production capacities and strong relationships with food and beverage manufacturers.

04. What are the growth drivers of the Vietnam Metal Can Packaging Market?

The Vietnam Metal Can Packaging market growth is driven by the rising demand for sustainable packaging options, especially in the food and beverage sector. Increased government regulations on plastic waste reduction and the promotion of recycling also support market growth.

05. Which segment dominates the Vietnam Metal Can Packaging Market?

The aluminum can segment dominates the Vietnam Metal Can Packaging market, largely due to its lightweight nature, recyclability, and widespread usage in the beverage industry.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.