Vietnam Milk Alternatives Market Outlook to 2030

Region:Asia

Author(s):Shambhavi Awasthi

Product Code:KROD9839

December 2024

80

About the Report

Vietnam Milk Alternatives Market Overview

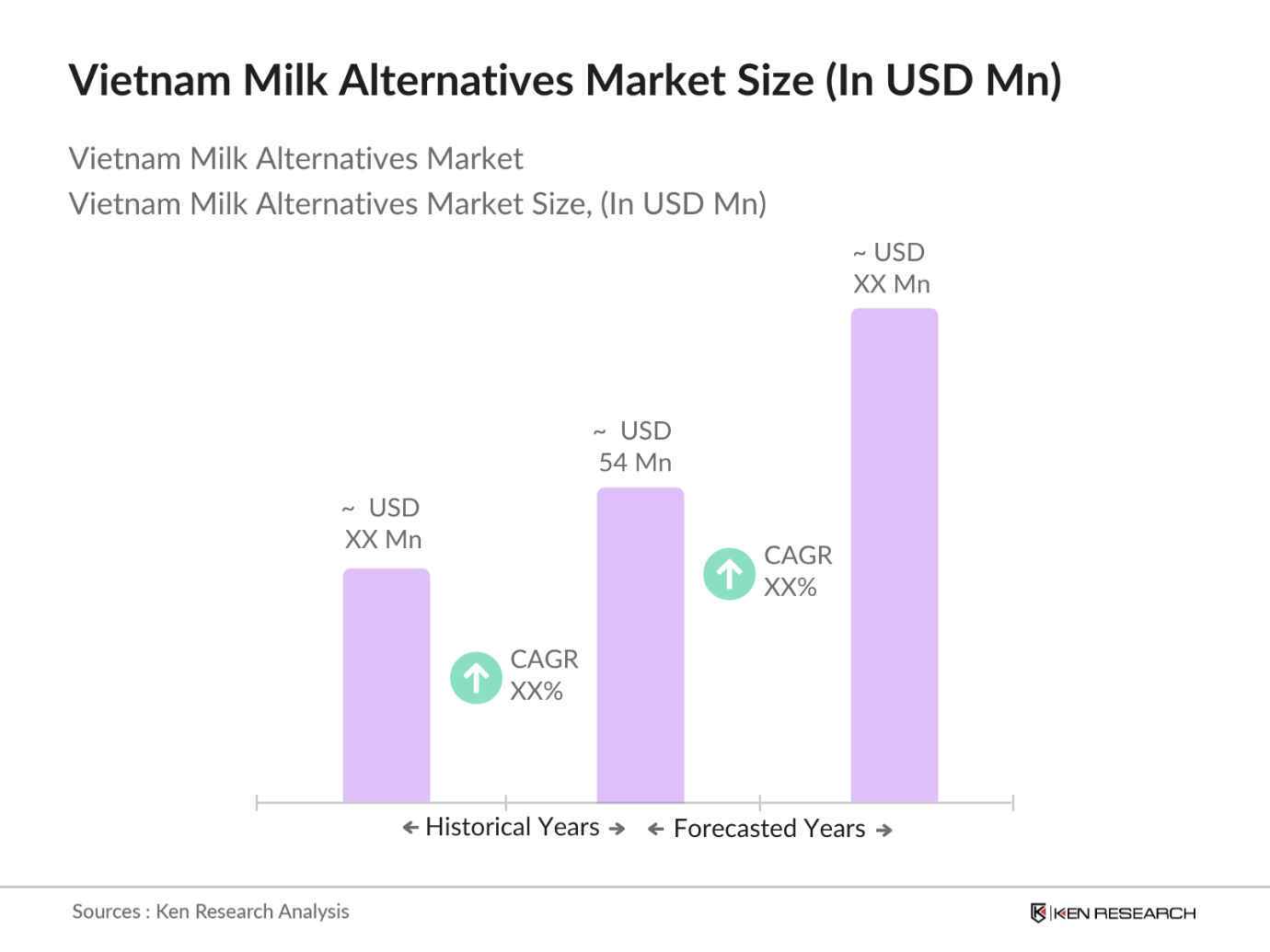

- The Vietnam Milk Alternatives Market has reached a market size USD 54 million in 2023. The market's growth is driven by increasing lactose intolerance awareness among the population, along with a rising trend towards veganism and health-conscious eating. The expanding urban middle class, with its increasing disposable income, has also contributed to the growing demand for plant-based milk products.

- Leading players in the Vietnam Milk Alternatives Market include Vinamilk, Nutifood, TH True Milk, Alpro, and Oatly. These companies have captured significant market share through extensive distribution networks and strong brand positioning. Vinamilk, in particular, has leveraged its established dairy infrastructure to enter the plant-based market, offering a wide range of soy, almond, and oat milk products.

- The Vietnamese government has been promoting healthy eating habits as part of its 2023 National Nutrition Strategy, which includes initiatives encouraging the consumption of plant-based foods. The government has also introduced tax incentives for companies producing or importing plant-based milk, aiming to reduce the country's reliance on dairy imports and promote local production of healthier alternatives.

- Ho Chi Minh City and Hanoi dominate the Vietnam Milk Alternatives Market, collectively accounting for over 60% of the market share in 2023. The high population density, higher disposable income, and greater health consciousness in these cities drive the demand for milk alternatives. Retail outlets and supermarkets in these urban centers also offer a wider variety of plant-based milk products compared to other regions.

Vietnam Milk Alternatives Market Segmentation

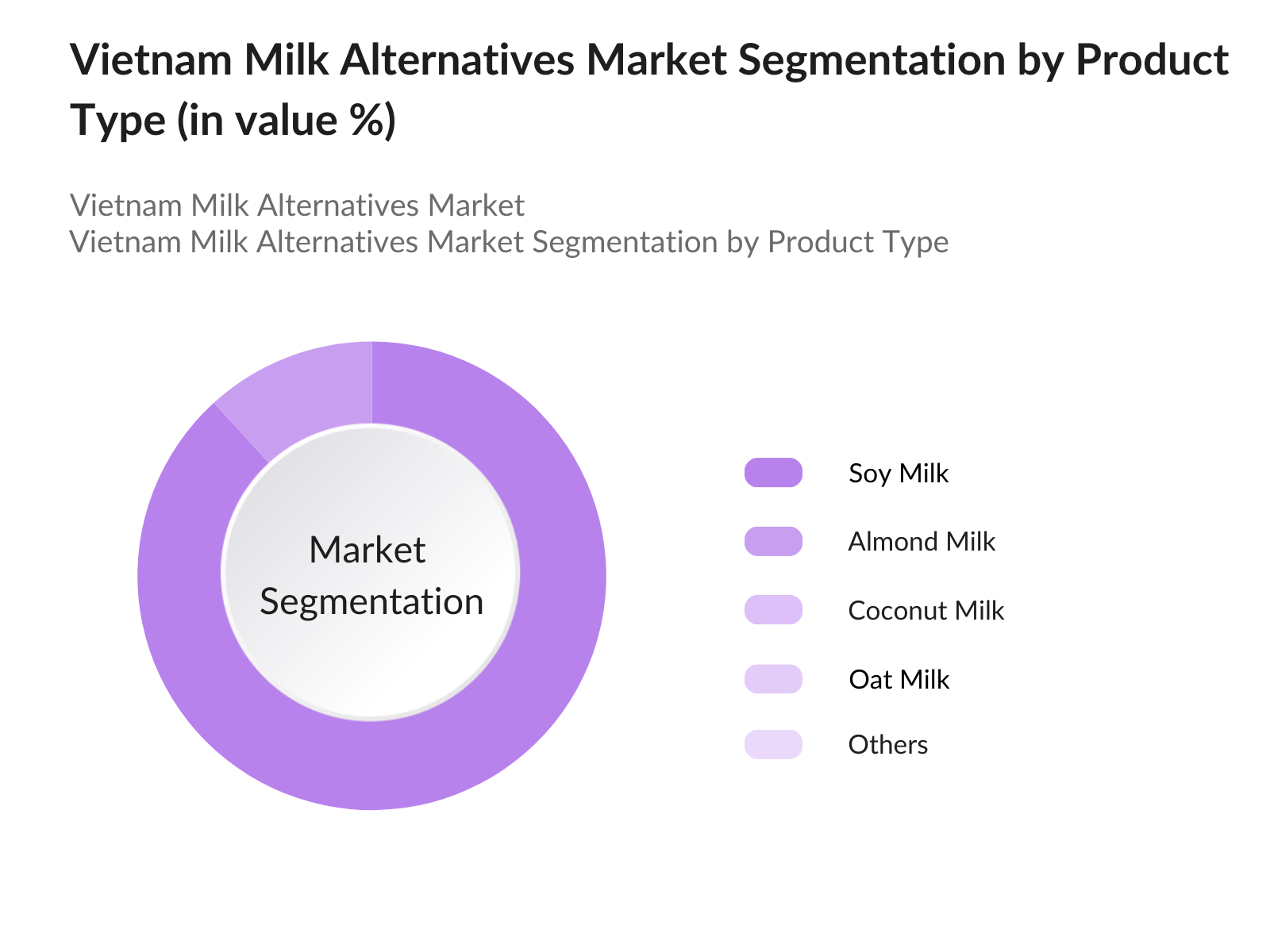

- By Product Type: Vietnam's Milk Alternatives Market is segmented by product type into Soy Milk, Almond Milk, Coconut Milk, Oat Milk, and Others. In 2023, Soy Milk had a dominant market share due to its affordability, nutritional benefits, and strong cultural acceptance in Vietnam. Brands like Vinamilk and Nutifood have capitalized on the long-standing preference for soy products, introducing fortified versions to cater to health-conscious consumers.

- By Distribution Channel: The market is segmented by distribution channels into Supermarkets/Hypermarkets, Convenience Stores, Online Retail, and Specialty Stores. In 2023, Supermarkets/Hypermarkets have a dominant market share. This dominance is due to their extensive reach and the growing trend of consumers purchasing groceries from large retail chains. Additionally, these stores often offer promotions and discounts, making them the preferred choice for budget-conscious buyers.

- By Region: The Vietnam Milk Alternatives Market is segmented by region into North, South, East, and West. The Southern region, led by Ho Chi Minh City, holds the largest market share in 2023. The region's dominance is attributed to its high population density, urbanization, and greater health awareness. The South also has the most developed retail infrastructure, which supports the distribution and availability of milk alternatives.

Vietnam Milk Alternatives Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

Vinamilk |

1976 |

Ho Chi Minh City |

|

Nutifood |

2000 |

Ho Chi Minh City |

|

TH True Milk |

2009 |

Hanoi |

|

Alpro |

1980 |

Belgium |

|

Oatly |

1994 |

Sweden |

- Vinamilk's Expansion in Plant-Based Products: In March 2024, Vinamilk launched a new line of almond and oat milk products, marking its third expansion in the plant-based category in two years. The company invested VND 500 billion in R&D to develop these products, focusing on improving taste and nutritional value. The new products have been well-received in urban markets, with sales projected to grow by 15% by the end of 2024.

- TH True Milk's Investment in Organic Plant-Based Milk: TH True Milk, known for its dairy products, ventured into the organic plant-based milk market in 2023 with an investment of VND 600 billion. The company introduced a range of organic soy and coconut milk products, targeting health-conscious consumers. The move is part of TH True Milk's broader strategy to diversify its product portfolio and reduce its environmental footprint.

Vietnam Milk Alternatives Industry Analysis

Vietnam Milk Alternatives Market Growth Drivers

- Rising Health Consciousness and Lactose Intolerance: The increasing awareness of health and wellness among the Vietnamese population is a significant driver of the milk alternatives market. A survey in 2023, by the Ministry of Health revealed that almost half of urban consumers are actively seeking healthier food options, including plant-based milk products. The prevalence of lactose intolerance, in adults in East Asia, has further fueled this demand. Consumers are increasingly opting for soy, almond, and oat milk as they are perceived as healthier and more easily digestible than traditional dairy products.

- Expanding Urban Middle Class with Higher Purchasing Power: Vietnam's expanding urban middle class, which is projected to grow by 15% annually until 2025, is another crucial driver for the milk alternatives market. With rising disposable incomes, this demographic is more willing to spend on premium, health-oriented products. A 2024 report by the General Statistics Office (GSO) noted that consumer spending in urban areas on health-related products, including milk alternatives has increased from 2022. This trend is expected to continue as urbanization progresses and consumer preferences shift towards plant-based diets.

- Increased Availability and Variety of Products: The increased availability and variety of milk alternatives in retail outlets across Vietnam have significantly contributed to market growth. Leading supermarkets and hypermarkets have expanded their product ranges to include more plant-based milk options, catering to diverse consumer preferences. As of 2023, 60% of supermarkets in urban areas stock at least five different types of milk alternatives. This expansion in product variety has made it easier for consumers to access and choose plant-based options, driving market growth further.

Vietnam Milk Alternatives Market Challenges

- High Production Costs and Limited Local Supply: One of the significant challenges facing the Vietnam Milk Alternatives Market is the high production cost associated with plant-based milk. The reliance on imported raw materials, particularly almonds and oats, has driven up production costs, making milk alternatives more expensive than traditional dairy products. In 2023, the Ministry of Industry and Trade reported that imported raw materials accounted for 70% of the production cost of almond and oat milk, limiting the affordability and accessibility of these products for the average consumer.

- Regulatory Barriers and Labelling Issues: The milk alternatives market in Vietnam faces regulatory challenges, particularly concerning product labelling and health claims. The Ministry of Health has strict guidelines on labelling plant-based products, which can sometimes lead to consumer confusion. In 2023, several milk alternatives were pulled from shelves due to non-compliance with labelling regulations. These regulatory barriers hinder market growth by creating obstacles for new entrants and limiting product availability.

Vietnam Milk Alternatives Market Government Initiatives

- National Nutrition Strategy (2023-2025): As part of the National Nutrition Strategy, the government has been actively promoting the consumption of plant-based foods, including milk alternatives. The Ministry of Health, in collaboration with the Ministry of Education, launched awareness campaigns in 2023, targeting schools and universities to educate the youth on the benefits of plant-based diets. The strategy also includes partnerships with local producers to increase the availability of plant-based products in schools, aiming to instil healthy eating habits from a young age.

- Investment in Agricultural R&D for Plant-Based Products: The Vietnamese government has invested heavily in agricultural research and development to support the production of plant-based raw materials locally. In 2024, the Ministry of Agriculture allocated investment towards research in sustainable farming practices for almonds, soybeans, and oats. This investment is expected to reduce the dependence on imported raw materials and support the growth of the local plant-based milk industry.

Vietnam Milk Alternatives Market Future Outlook

The Vietnam Milk Alternatives Market is poised for robust growth through 2028, driven by increasing health consciousness, expanding local production, and a strong focus on sustainability. Organic and functional plant-based milk products will dominate, supported by government initiatives and consumer demand for eco-friendly and nutrient-rich options.

Future Trends

- Expansion of Organic and Functional Plant-Based Milk: Over the next five years, the Vietnam Milk Alternatives Market is expected to see significant growth in organic and functional plant-based milk products. The trend towards functional beverages, particularly those fortified with proteins, vitamins, and minerals, will also gain traction as consumers seek products that offer additional health benefits. This expansion will be supported by continued innovation and investment in R&D by major market players.

- Increased Local Production and Reduced Import Dependency: The Vietnamese government's ongoing investments in agricultural R&D and local production of raw materials such as almonds, soybeans, and oats are expected to yield significant results by 2028. Local production of these raw materials is reducing the country's dependency on imports and lowering production costs for milk alternatives. This shift will make plant-based milk more affordable and accessible to a broader consumer base, driving market growth in both urban and rural areas.

Scope of the Report

|

By Distribution Channel |

Supermarkets/Hypermarkets Convenience Stores Online Retail Specialty Stores |

|

By Product Type |

Soy Milk Almond Milk Coconut Milk Oat Milk Others |

|

By Region |

North South West East |

Products

Key Target Audience Organizations:

Supermarkets and Hypermarkets Chains

Health and Wellness Retail Chains

Food and Beverage Manufacturers

Plant-Based Product Distributors

Organic Product Retailers

Urban Health-Conscious Consumers

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Ministry of Industry and Trade)

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

Vinamilk

Nutifood

TH True Milk

Alpro

Oatly

137 Degrees

Soyana

Califia Farms

Silk

Pacific Foods

Kikkoman

Earths Own

Plenish Cleanse

The Bridge Bio

Ecomil

Table of Contents

1. Vietnam Milk Alternatives Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Vietnam Milk Alternatives Market Size (in VND Trillion), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Vietnam Milk Alternatives Market Analysis

3.1. Growth Drivers

3.1.1. Health Consciousness and Lactose Intolerance

3.1.2. Expanding Urban Middle Class

3.1.3. Increased Availability and Variety of Products

3.2. Challenges

3.2.1. High Production Costs

3.2.2. Cultural Preferences for Dairy

3.2.3. Regulatory Barriers and Labeling Issues

3.3. Opportunities

3.3.1. Expansion of Local Production

3.3.2. Technological Innovations in Production

3.3.3. Strategic Partnerships and Collaborations

3.4. Trends

3.4.1. Shift Towards Organic and Fortified Milk Alternatives

3.4.2. Growth in E-commerce Distribution

3.4.3. Collaboration Between Local and International Brands

3.5. Government Initiatives

3.5.1. Tax Incentives for Plant-Based Manufacturers

3.5.2. National Nutrition Strategy (2023-2025)

3.5.3. Investment in Agricultural R&D for Plant-Based Products

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Competition Ecosystem

4. Vietnam Milk Alternatives Market Segmentation, 2023

4.1. By Product Type (in Value %)

4.1.1. Soy Milk

4.1.2. Almond Milk

4.1.3. Coconut Milk

4.1.4. Oat Milk

4.1.5. Others

4.2. By Distribution Channel (in Value %)

4.2.1. Supermarkets/Hypermarkets

4.2.2. Convenience Stores

4.2.3. Online Retail

4.2.4. Specialty Stores

4.3. By Region (in Value %)

4.3.1. North

4.3.2. South

4.3.3. East

4.3.4. West

5. Vietnam Milk Alternatives Market Cross Comparison

5.1. Detailed Profiles of Major Companies

5.1.1. Vinamilk

5.1.2. Nutifood

5.1.3. TH True Milk

5.1.4. Alpro

5.1.5. Oatly

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. Vietnam Milk Alternatives Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

7. Vietnam Milk Alternatives Market Regulatory Framework

7.1. Labeling and Health Claim Regulations

7.2. Compliance Requirements

7.3. Certification Processes

8. Vietnam Milk Alternatives Future Market Size (in VND Trillion), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9. Vietnam Milk Alternatives Future Market Segmentation, 2028

9.1. By Product Type (in Value %)

9.2. By Distribution Channel (in Value %)

9.3. By Region (in Value %)

10. Vietnam Milk Alternatives Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identifying Key Variables:

Ecosystem creation for all the major entities involved in the Vietnam Milk Alternatives Market, including manufacturers, suppliers, distributors, and regulatory bodies. This step involves referring to multiple secondary and proprietary databases to perform desk research, aiming to collate industry-level information. Key variables such as market size, growth drivers, product types (e.g., soy milk, almond milk, oat milk), consumer demographics, and regional segmentation are identified to form the basis of further research.

Step 2: Market Building:

Collating statistics on the Vietnam Milk Alternatives Market over the years, analyzing the penetration of different product types and their regional distribution to compute the revenue generated. This process involves reviewing data on production capacities, import-export trends, retail distribution channels, and consumer behavior regarding plant-based diets. It also includes an in-depth analysis of market shares, brand preferences, and technological innovations in production to ensure data accuracy.

Step 3: Validating and Finalizing:

Building market hypotheses and conducting CATIs (Computer Assisted Telephone Interviews) with industry experts from milk alternative producers, nutritionists, food researchers, and retail partners. This step aims to validate the statistics and insights gathered, seeking operational and market information from key stakeholders. The feedback received is used to refine the market estimates and identify emerging trends.

Step 4: Research Output:

Our team will approach multiple key players in the Vietnam Milk Alternatives Market to understand the dynamics of product segments, sales channels, consumer preferences, and regional demand. This step will support the validation of statistics derived through a bottom-to-top approach, ensuring that the market data reflects current industry realities. The final research output will provide a comprehensive analysis, including market forecasts, growth opportunities, and strategic insights to assist stakeholders in decision-making.

Frequently Asked Questions

01. How big is the Vietnam Milk Alternatives Market?

The Vietnam Milk Alternatives Market was valued at USD 54 million in 2023, driven by rising health consciousness, increased prevalence of lactose intolerance, and a growing urban middle class with higher purchasing power.

02. What are the challenges in the Vietnam Milk Alternatives Market?

Challenges in the Vietnam Milk Alternatives Market include high production costs due to reliance on imported raw materials, cultural preferences for traditional dairy products, and regulatory barriers related to product labeling and health claims.

03. Who are the major players in the Vietnam Milk Alternatives Market?

Key players in the Vietnam Milk Alternatives Market include Vinamilk, Nutifood, TH True Milk, Alpro, and Oatly. These companies dominate the market through strong distribution networks, innovative product offerings, and strategic partnerships.

04. What are the growth drivers of the Vietnam Milk Alternatives Market?

The Vietnam Milk Alternatives Market is driven by factors such as increasing health awareness, the rising prevalence of lactose intolerance, and the growing availability of plant-based milk products in retail outlets across the country.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.