Vietnam Millimeter Market Outlook to 2030

Region:Asia

Author(s):Abhinav kumar

Product Code:KROD361

January 2025

88

About the Report

Vietnam Millimeter Market Overview

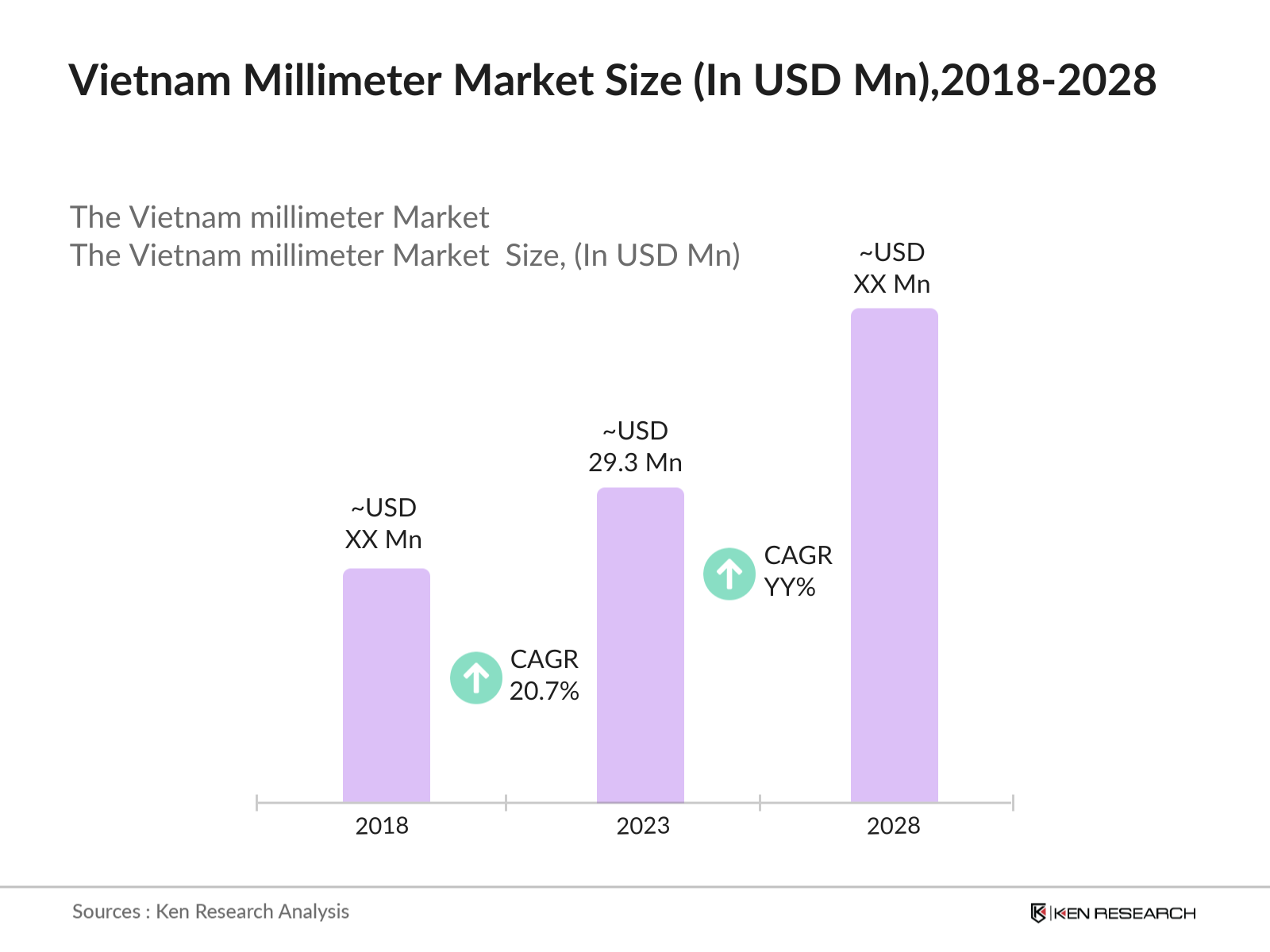

- The Vietnam millimeter market has shown remarkable growth over the years. It is driven by the initial phases of 5G network deployment and increasing demand for high-speed internet services. The market expanded to around USD 29.3 million in 2023, reflecting a CAGR of 20.7% in the past five years.

- The Vietnam millimeter market is highly fragmented, with several key players like NEC Corporation, Ericsson, Huawei Technologies, Samsung Electronics, and Qualcomm. These companies have established a strong presence in the market through extensive R&D capabilities, strategic partnerships, and a comprehensive portfolio.

- A notable development in the market is the collaboration between Samsung Electronics and Viettel, Vietnam's largest telecom operator, announced in 2022. This partnership aims to accelerate the deployment of 5G networks across the country, utilizing Samsung's advanced millimeter wave technology to enhance network capacity and performance.

Vietnam Millimeter Market Current Analysis

- According to the Ministry of Information and Communications, the Vietnamese government has launched several initiatives to promote digital infrastructure development. These include subsidies and tax incentives for companies investing in 5G technology.

- The integration of millimeter wave technology with artificial intelligence (AI) and the Internet of Things (IoT) is becoming a trend. According to a report by the International Data Corporation (IDC), the number of IoT devices in Vietnam is expected to reach 50 million by 2025.

- Northern Vietnam leads the millimeter wave market, accounting for 40% of the total market share. According to the Ministry of Information and Communications, Hanoi alone has seen a rapid deployment of 5G base stations, driven by both public and private sector initiatives to enhance digital connectivity.

Vietnam Millimeter Market Segmentation

The Vietnam millimeter market can be segmented into various factors like product, application, and region:

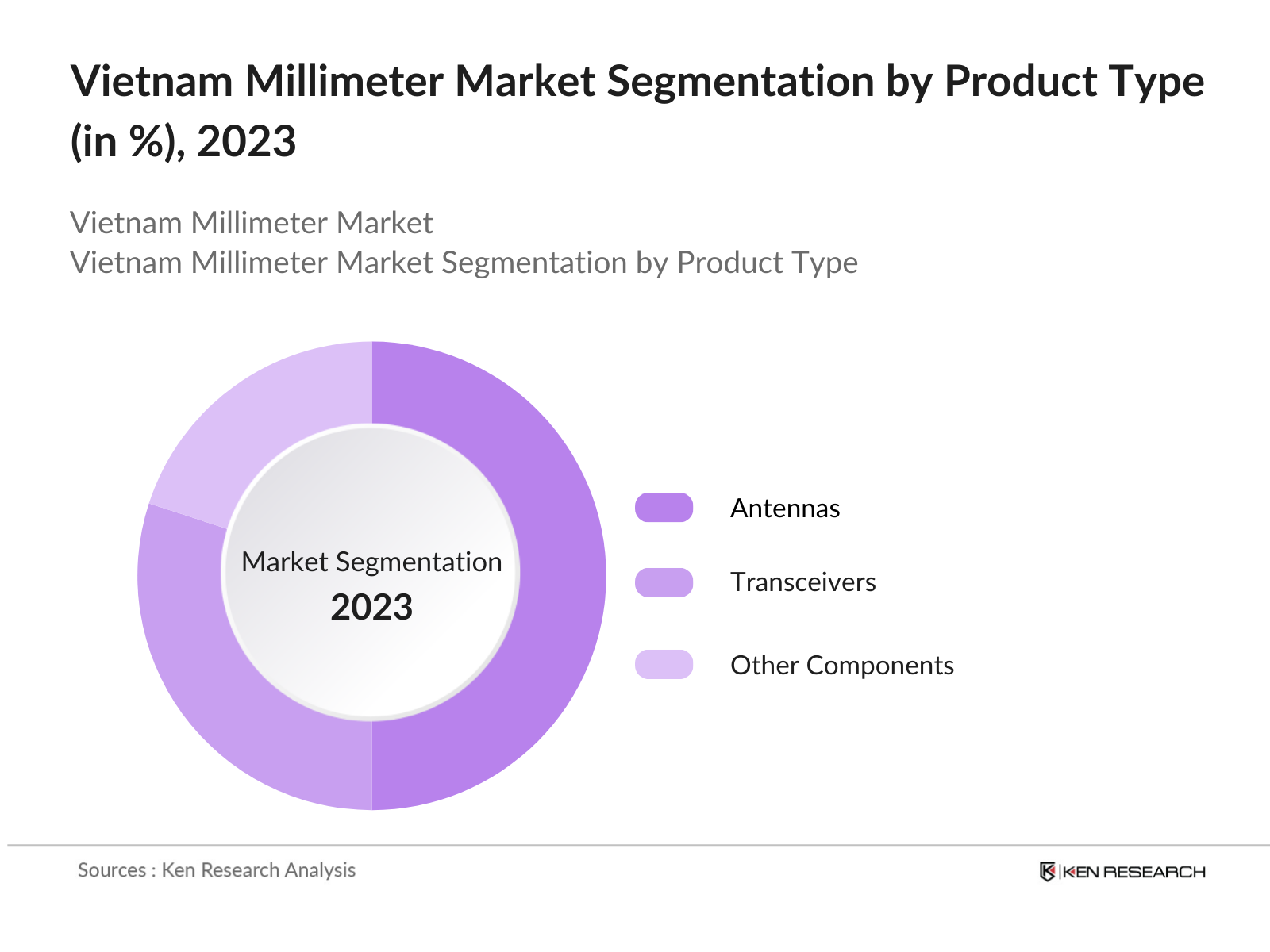

By Product Type: The Vietnam millimeter market is segmented into different products like Antennas, Transceivers, and other components. In 2023, antennas is the dominant segment since it is critical for signal transmission and reception in 5G networks. Their dominance is driven by the need for efficient, high-capacity communication infrastructure.

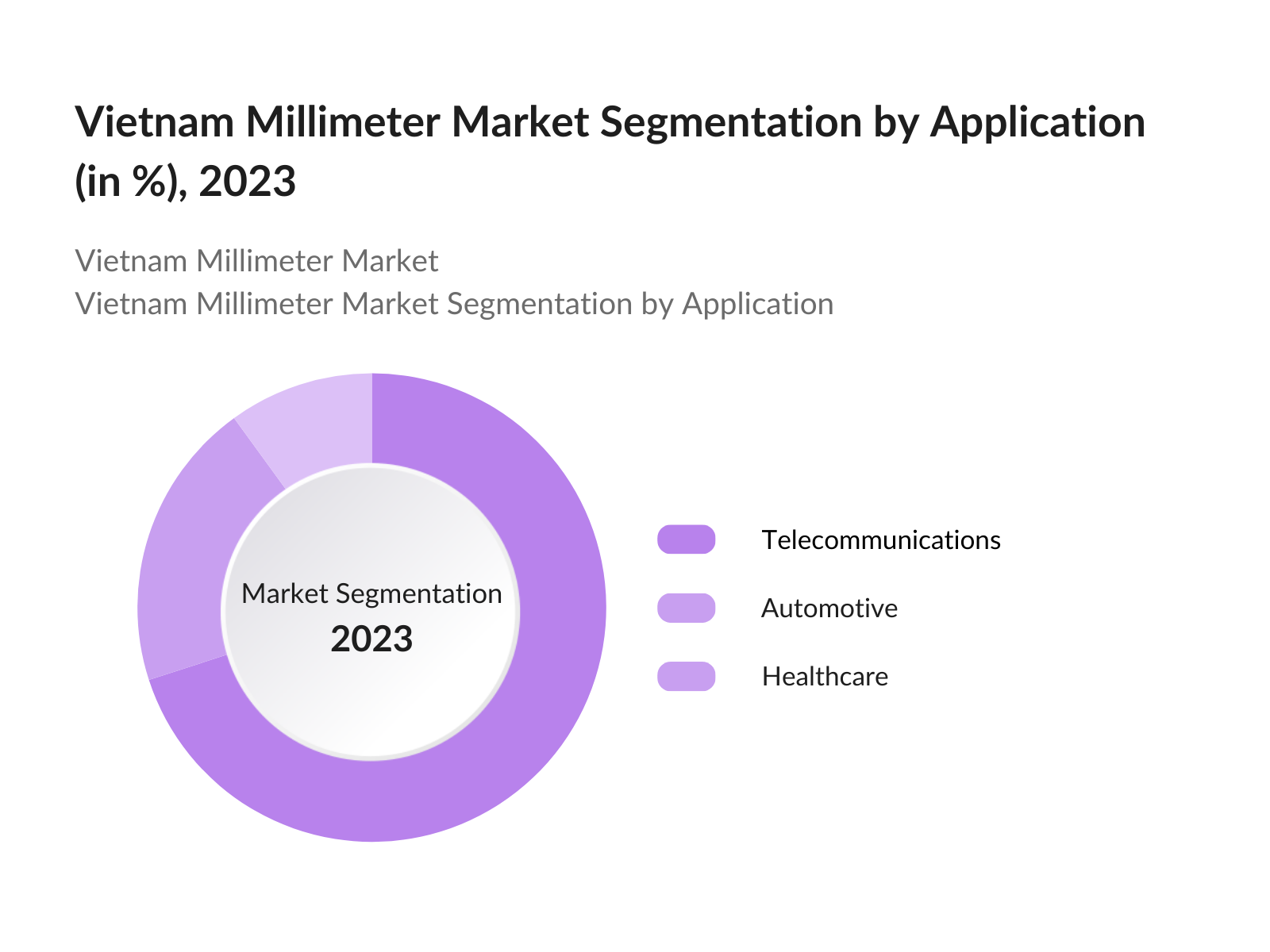

By Application: The Vietnam millimeter market is segmented into applications like telecommunications, automotive, and healthcare. In 2023, telecommunications dominate due to the extensive rollout of 5G networks, requiring millimeter wave technology for high-speed data transfer.

By Region: The Vietnam millimeter market Market is segmented into regions which are North, East, West & South. In 2023, northern region dominates due to higher urbanization and greater investments in 5G infrastructure leading to higher adoption of millimeter wave technology.

Vietnam Millimeter Market Competitive Landscape

|

Company Name |

Establishment Year |

Headquarters |

|

NEC Corporation |

1899 |

Tokyo, Japan |

|

Ericsson |

1876 |

Stockholm, Sweden |

|

Huawei Technologies |

1987 |

Shenzhen, China |

|

Samsung Electronics |

1969 |

Suwon, South Korea |

|

Qualcomm |

1985 |

San Diego, USA |

- NEC Corporation: NEC has been a pioneer in the millimeter wave market, leveraging its strong R&D capabilities to develop cutting-edge solutions. The company's strategic partnerships with telecom operators have significantly boosted market penetration.

- Ericsson: Recognized for its robust portfolio of telecommunications equipment, Ericsson has made significant strides in the millimeter wave market, contributing to the expansion of 5G networks in Vietnam.

- Huawei Technologies: Huawei Technologies is a major player in the Vietnam millimeter wave market, known for its advanced telecommunications solutions. Despite facing geopolitical challenges and restrictions in some markets, Huawei continues to innovate in the field of millimeter wave technology.

Vietnam Millimeter Market Analysis

Vietnam Millimeter Growth Drivers:

- Expansion of 5G Networks: One of the growth driver for the Vietnam millimeter wave market is the deployment of 5G networks. As of 2023, there were approximately 70 million internet users in Vietnam, with a significant portion using mobile devices. The increased adoption of smartphones and mobile internet services necessitates the deployment of high-speed 5G networks

- Increasing Data Traffic: Increasing data traffic is a significant growth driver in Vietnam. With 70 million internet users in 2023 and an internet penetration rate of over 70%, there is a heightened demand for higher bandwidth and faster data transfer rates provided by millimeter wave technology.

- Technological Innovations: Technological advancements in millimeter wave technology are a key growth driver. Innovations such as Qualcomm’s advanced millimeter wave chipsets, which offer improved data transfer speeds and reliability, are making the technology more efficient and cost-effective.

Vietnam Millimeter Market Challenges

- High Deployment Costs: The initial costs associated with deploying millimeter wave infrastructure are substantial, posing a significant challenge for telecom operators and service providers. According to a report by the Ministry of Information and Communications, the cost of setting up a single 5G base station in Vietnam is approximately USD 170,000.

- Regulatory and Spectrum Allocation Issues: Complex regulatory frameworks and spectrum allocation processes can delay the deployment of millimeter wave technology. The World Bank has noted that regulatory delays have impacted the timely rollout of advanced telecommunications infrastructure in Vietnam, creating a bottleneck for market growth.

- Technical Challenges: Millimeter wave technology faces several technical challenges, including signal attenuation and limited range. According to a study by the Institute of Electrical and Electronics Engineers (IEEE), overcoming these technical hurdles is essential for the widespread adoption of millimeter wave technology in urban and rural areas.

Vietnam Millimeter Market Government Initiatives

- Public-Private Partnerships (2022): The government has encouraged public-private partnerships to develop and deploy advanced communication technologies. The collaboration between Viettel and Samsung for 5G deployment is a direct result of such initiatives.

- Digital Transformation Program (2020): Aimed at enhancing digital infrastructure across the country, this program includes significant investments in 5G and millimeter wave technology to support the digital economy. The program has a budget of VND 45 trillion (USD 1.9 billion) and is expected to drive substantial growth in the telecommunications sector.

- National Strategy for Industrial Revolution 4.0 (2020): This strategy focuses on leveraging advanced technologies, including millimeter wave, to drive industrial growth and innovation. The strategy outlines investments in research and development to enhance Vietnam's technological capabilities, supporting the growth of the millimeter wave market.

Vietnam Millimeter Future Market Outlook

The future of the Vietnam millimeter wave market looks promising with increasing demand for high-speed, low-latency internet services, and advancements in millimeter wave technology. The government's supportive policies and investments in digital infrastructure will further fuel this growth, positioning Vietnam as a leading market.

Future Market Trends

- Integration with AI and IoT: The integration of millimeter wave technology with artificial intelligence and the Internet of Things is becoming a trend. This integration facilitates smarter, more efficient networks that can handle large volumes of data and provide enhanced connectivity solutions.

- Healthcare Applications: The use of millimeter wave technology in healthcare, particularly in high-resolution imaging and diagnostics, will see growth, driven by the need for advanced medical solutions. The government is investing in modernizing healthcare infrastructure, which includes the adoption of advanced imaging technologies.

Scope of the Report

|

By Product Type |

Antennas Transceivers Other components |

|

By Application |

Telecommunications Automotive Healthcare |

|

By Region |

North East South  West |

Products

Key Target Audience – Organizations and Entities Who Can Benefit by Subscribing This Report:

Telecommunications Companies

5G Network Operators

Millimeter Wave Technology Manufacturers

Banks and Financial Institutions

Government and regulatory Bodies

Industrial IoT Solution Providers

Time Period Captured in the Report

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-202

Companies

Players Mentioned in the Report:Â

NEC Corporation

Ericsson

Huawei Technologies

Samsung Electronics

Qualcomm

Nokia

ZTE Corporation

Siklu Communication

Keysight Technologies

Sivers IMA

L3Harris Technologies

Smiths Group

Infineon Technologies

Fujitsu

BridgeWave Communications

E-Band Communications

Proxim Wireless

Anokiwave

Millimeter Wave Products Inc.

Aviat Networks

Table of Contents

1. The Vietnam Millimeter Market Overview

1.1 The Vietnam Millimeter Market Taxonomy

2. The Vietnam Millimeter Market Size (in USD Bn), 2018-2023

3. The Vietnam Millimeter Market Analysis

3.1 The Vietnam Millimeter Market Growth Drivers

3.2 The Vietnam Millimeter Market Challenges and Issues

3.3 The Vietnam Millimeter Market Trends and Development

3.4 The Vietnam Millimeter Market Government Regulation

3.5 The Vietnam Millimeter Market SWOT Analysis

3.6 The Vietnam Millimeter Market Stake Ecosystem

3.7 The Vietnam Millimeter Market Competition Ecosystem

4. The Vietnam Millimeter Market Segmentation, 2023

4.1 The Vietnam Millimeter Market Segmentation by Product Type (in value %), 2023

4.2 The Vietnam Millimeter Market Segmentation by Application (in value %), 2023

4.3 The Vietnam Millimeter Market Segmentation by Region (in value %), 2023

5. The Vietnam Millimeter Market Competition Benchmarking

5.1 The Vietnam Millimeter Market Cross-Comparison (no. of employees, company overview, business strategy, USP, recent development, operational parameters, financial parameters and advanced analytics)

6. The Vietnam Millimeter Future Market Size (in USD Bn), 2023-2028

7. The Vietnam Millimeter Future Market Segmentation, 2028

7.1 The Vietnam Millimeter Market Segmentation by Product Type (in value %), 2028

7.2 The Vietnam Millimeter Market Segmentation by Application (in value %), 2028

7.3 The Vietnam Millimeter Market Segmentation by Region (in value %), 2028

8. The Vietnam Millimeter Market Analysts’ Recommendations

8.1 The Vietnam Millimeter Market TAM/SAM/SOM Analysis

8.2 The Vietnam Millimeter Market Customer Cohort Analysis

8.3 The Vietnam Millimeter Market Marketing Initiatives

8.4 The Vietnam Millimeter Market White Space Opportunity Analysis

Disclaimer

Contact UsResearch Methodology

Step 1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.Â

Step 2 Market Building:

Collating statistics on Vietnam millimeter market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for Vietnam Millimeter market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.Â

Step 3 Validating and Finalizing:

Building market hypotheses and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.Â

Step 4 Research output:

Our team will approach multiple millimeter companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from Vietnam millimeter companies.Â

Frequently Asked Questions

01 How big is the Vietnam Millimeter Market?

The Vietnam millimeter market was valued at USD 29.3 billion in 2023, it had grown with 20.7% CGAR in past 5 years. Majorly driven by the expansion of 5G networks and increasing demand for high-speed internet services​.

02 What are the challenges in the Vietnam Millimeter Market?

The main challenges in the Vietnam millimeter market include high deployment costs, complex regulatory frameworks, and technical issues such as signal attenuation and limited range. These challenges pose significant barriers to market entry and expansion.

03 Who are the major players in the Vietnam Millimeter Market?

Major players in the Vietnam millimeter market include NEC Corporation, Ericsson, Huawei Technologies, Samsung Electronics, Qualcomm, Nokia, ZTE Corporation, Siklu Communication, Keysight Technologies, and Sivers IMA​.

04 What are the factors driving the Vietnam Millimeter Market?

Key factors driving the Vietnam millimeter market include the expansion of 5G networks, increasing data traffic, technological advancements, and strong government support through initiatives and policies aimed at promoting digital infrastructure​.

Â

Â

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.