Vietnam Natural Gas Market Outlook to 2030

Region:Asia

Author(s):Vijay Kumar

Product Code:KROD3698

October 2024

87

About the Report

Vietnam Natural Gas Market Overview

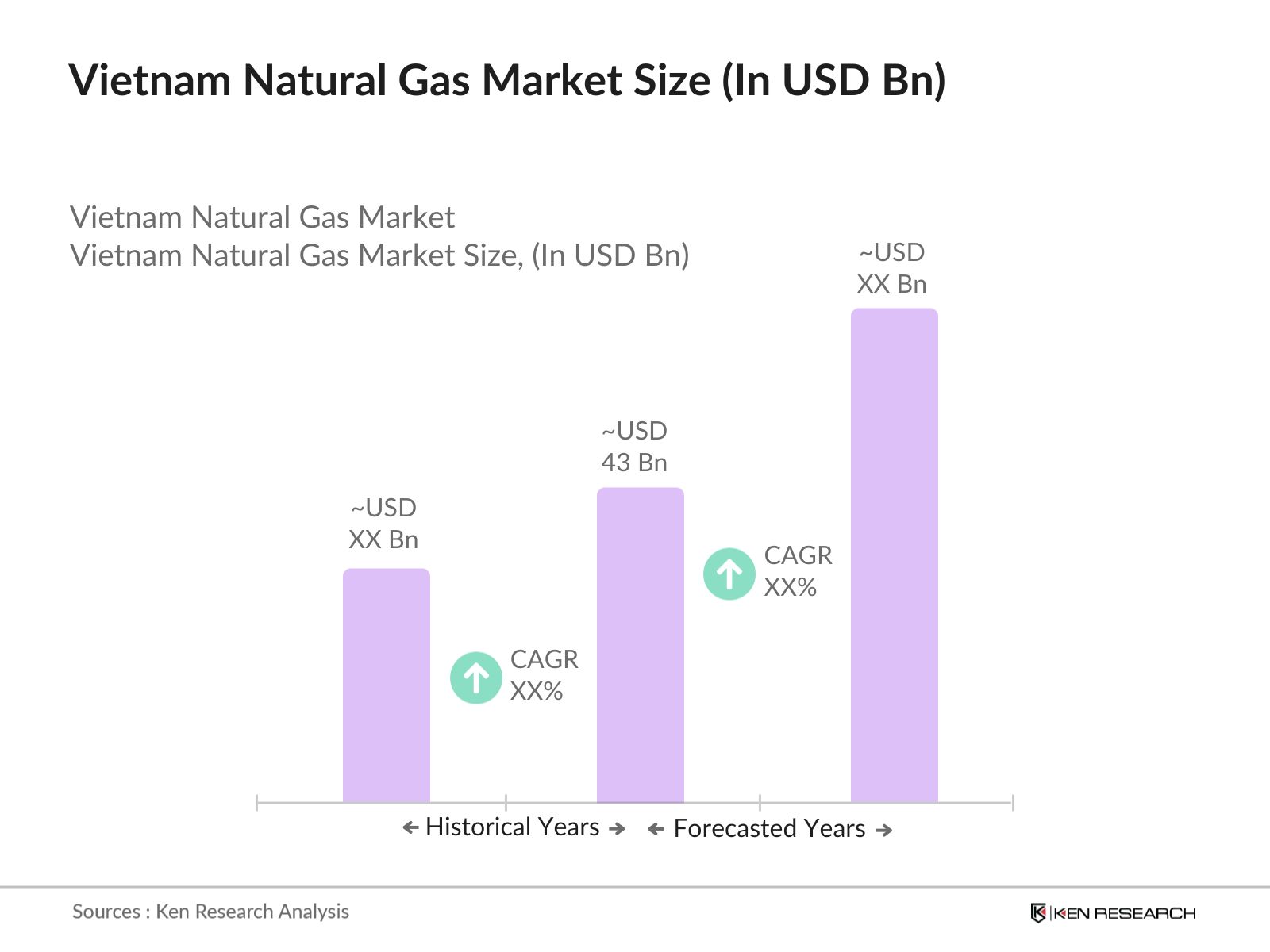

- The Vietnam natural gas market, valued at USD 43 billion based on the latest industry analysis, is driven by a combination of increasing energy demands, government policies encouraging the shift to cleaner energy sources, and significant investments in LNG infrastructure. Vietnams Power Development Plan 8 (PDP8) aims to enhance the role of natural gas in the countrys energy mix, with plans to achieve a substantial increase in gas-fired power generation capacity. The governments focus on reducing dependency on coal and expanding the LNG import capacity has made natural gas a pivotal component in the nations energy strategy.

- The dominant regions for natural gas consumption and distribution in Vietnam include the Southeast, Red River Delta, and Mekong River Delta. These regions lead due to their proximity to major industrial zones and the presence of key LNG infrastructure, such as import terminals and power generation facilities. For example, the Southeast region, home to the Thi Vai LNG Terminal and several power plants, is a hub for natural gas distribution, supporting both domestic and industrial consumption.

- The revised Law on Petroleum, effective from 2024, aims to streamline the approval process for gas projects and provide clearer guidelines on foreign investments. It introduces provisions to attract international investors by offering more favorable terms for joint ventures and technology transfers.

Vietnam Natural Gas Market Segmentation

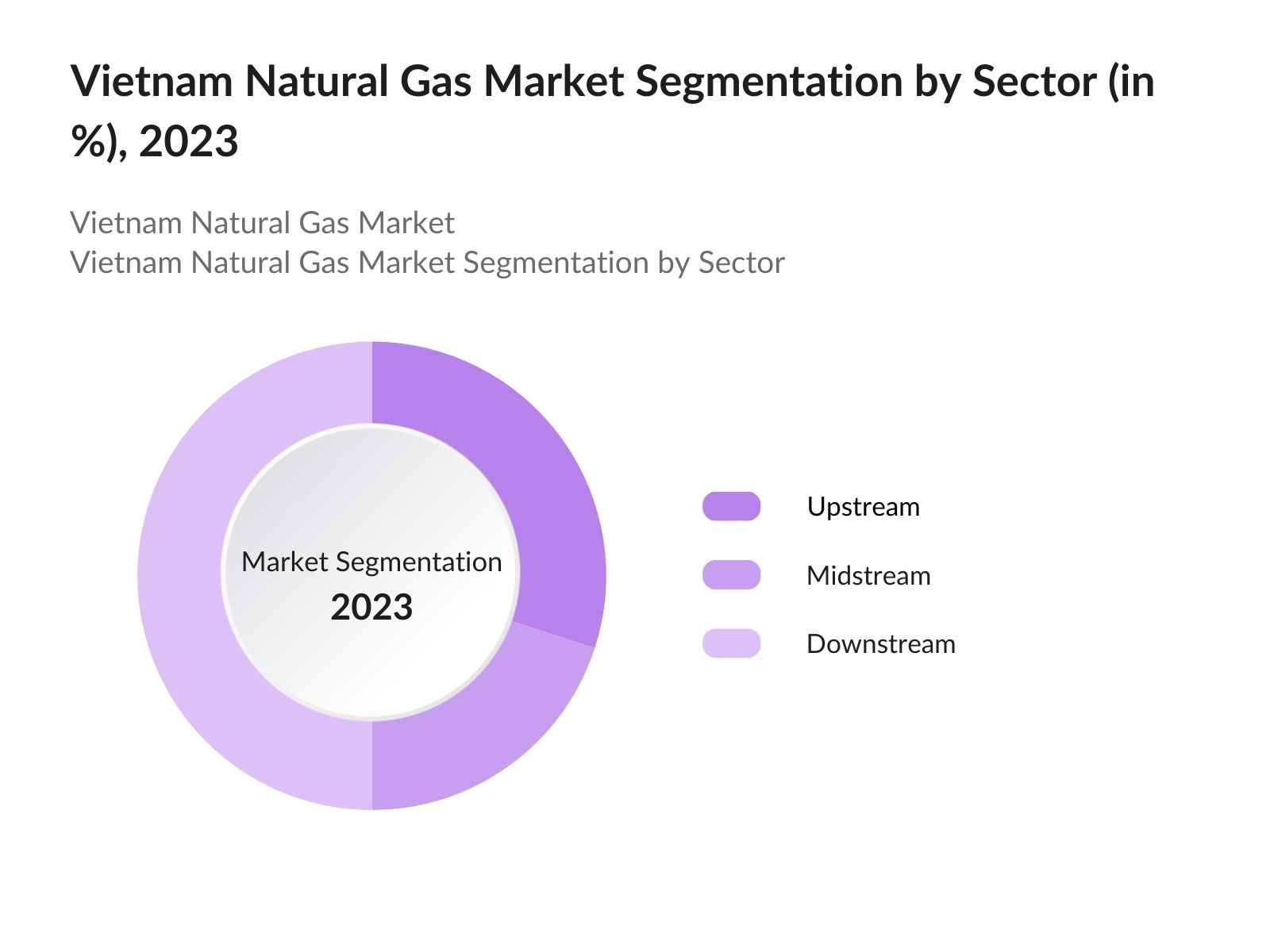

By Sector: The market is segmented by sector into upstream, midstream, and downstream. The upstream sector involves exploration and production activities, primarily focused on gas fields in the Nam Con Son and Cuu Long basins. The midstream sector is concentrated around pipeline transportation and LNG storage, facilitated by infrastructure projects such as the Nam Con Son 2 Pipeline.

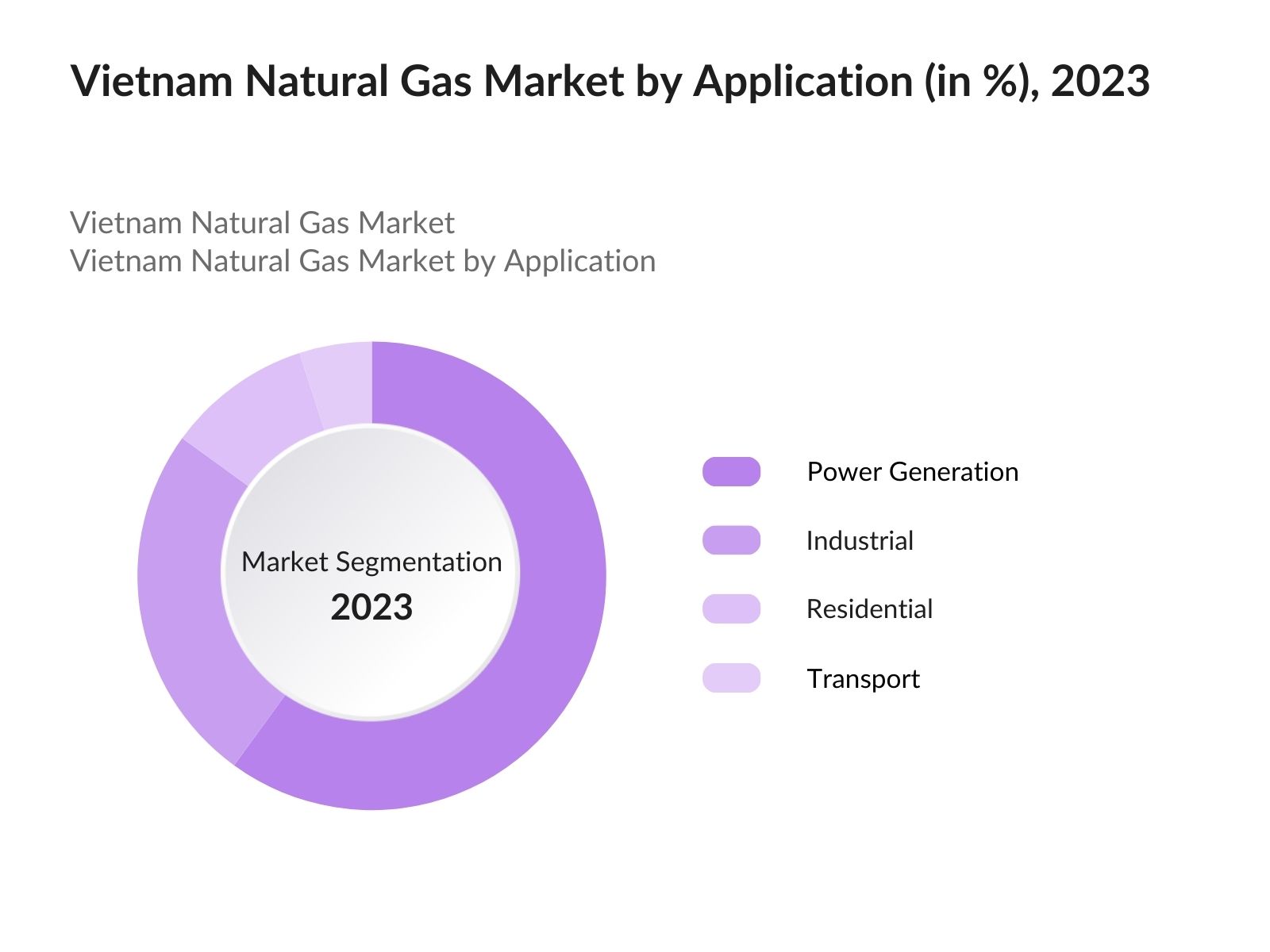

By Application: The market is further segmented by application into power generation, industrial, residential, and transport. Among these, the power generation sub-segment dominates the market, accounting for over 60% of the total natural gas consumption. This dominance is driven by the need for cleaner energy sources and the strategic shift away from coal-fired power plants.

Vietnam Natural Gas Market Competitive Landscape

The Vietnam natural gas market is characterized by the presence of a few dominant players, both domestic and international. Petro Vietnam Gas (PV Gas), a state-owned entity, plays a critical role in the market as the primary producer, distributor, and importer of natural gas. International companies such as ExxonMobil and Shell are also key players, leveraging their expertise and technology to support Vietnams expanding LNG infrastructure the competitive landscape is primarily driven by joint ventures and partnerships, as companies look to expand their footprint and cater to the increasing demand for natural gas in various sectors.

Vietnam Natural Gas Industry Analysis

Growth Drivers

- LNG as a Catalyst for Energy Transition: Vietnams shift towards liquefied natural gas (LNG) is crucial for its energy transition. The government is actively pursuing LNG imports to meet energy demand while reducing reliance on coal. By 2024, LNG will play a pivotal role in the power sector, accounting for over 10% of energy production. The 8th Power Development Plan (PDP8) outlines the addition of 22,400 MW of LNG-fired power capacity by 2030.

- FDI Inflows in Energy Sector: Foreign direct investment (FDI) is pivotal in enhancing Vietnams natural gas infrastructure. In 2023, the country received over $1.5 billion in FDI in its energy sector, with significant allocations for LNG projects. These investments are expected to accelerate LNG terminal construction and facilitate the development of downstream natural gas projects. Vietnams strategic location and favorable policies have attracted international energy giants, making it a key hub for LNG imports and distribution in the ASEAN region

- Rising Demand from Power and Fertilizer Industries: The power sector is a significant consumer of natural gas in Vietnam, with demand projected to rise steadily. Currently, natural gas consumption in the power sector is about 9 billion cubic meters annually. This demand is set to increase as more gas-based power plants come online. Additionally, the fertilizer industry consumes a substantial amount of natural gas, approximately 2 billion cubic meters yearly, for ammonia production.

Market Challenges

- Regulatory Barriers and Complex Approval Processes: The approval process for LNG projects in Vietnam remains complex and time-consuming, involving multiple government agencies. Project developers face delays that can extend up to 24 months, impacting the timeline of critical infrastructure projects. This bureaucratic complexity has been a significant barrier to timely investment and project execution, hindering the countrys ability to meet its growing energy demands.

- Volatile LNG Pricing and Supply Chain Disruptions: Vietnams heavy reliance on LNG imports makes it susceptible to global price fluctuations and supply chain disruptions. In 2022, the cost of LNG imports spiked by nearly 30% due to geopolitical tensions and fluctuating global demand. Such volatility poses a risk to energy affordability and the financial sustainability of LNG projects in Vietnam.

Vietnam Natural Gas Market Future Outlook

Over the next five years, the Vietnam natural gas market is expected to experience steady growth, primarily driven by continuous government support, expansion of LNG import capacity, and the ongoing development of gas-to-power projects. The government's focus on reducing carbon emissions and enhancing energy security will bolster the market, with natural gas playing a key role in the transition to cleaner energy sources. As the demand for electricity grows, especially in industrial zones, the need for reliable and sustainable energy solutions will further propel the market.

Market Opportunities

- Technological Innovations in LNG Storage and Transportation: Technological advancements in LNG storage and transportation present an opportunity for Vietnam to overcome logistical constraints. The deployment of Floating Storage Regasification Units (FSRUs) can enhance storage capacity and reduce dependence on fixed infrastructure. Adoption of advanced cryogenic technologies in LNG storage has the potential to improve efficiency and reduce operational costs.

- Investments in Domestic Gas Production (Block B & Ca Voi Xanh): Domestic natural gas fields like Block B and Ca Voi Xanh have the potential to reduce Vietnams dependency on imported LNG. With estimated reserves of over 150 billion cubic meters, these fields can support domestic production for the next two decades. Ongoing investments in these projects are expected to begin yielding output by 2025, contributing significantly to the national energy supply.

Scope of the Report

|

Sector |

Upstream Midstream Downstream |

|

Application |

Power Generation Industrial Residential Transport |

|

Source |

Domestic Production Imports |

|

Product Type |

Liquefied Natural Gas Compressed Natural Gas |

|

Region |

Southeast Red River Delta Mekong River Delta South Central Coast |

Products

Key Target Audience

Energy Companies

Oil and Gas Exploration Companies

Government Agencies (Vietnam Ministry of Industry and Trade)

LNG Importers and Exporters

Power Generation Companies

Investors and Venture Capitalist Firms

Technology Providers (Pipeline and Storage Technologies)

Government and Regulatory Bodies (Petroleum Authority of Vietnam)

Companies

Players Mentioned in the Report

PetroVietnam Gas (PV Gas)

ExxonMobil Corp.

Shell Plc

TotalEnergies SE

Idemitsu Kosan Co., Ltd.

Eni S.p.A

Mitsui Chemicals Inc.

Perenco SA

Rosneft PJSC

Vietsovpetro

Table of Contents

1. Vietnam Natural Gas Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

1.5. Role of Natural Gas in Vietnams Energy Mix

2. Vietnam Natural Gas Market Size (USD Billion)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

2.4. LNG Import and Export Analysis

2.5. Share of Natural Gas in Power Generation Capacity

3. Vietnam Natural Gas Market Analysis

3.1. Growth Drivers

3.1.1. LNG as a Catalyst for Energy Transition

3.1.2. Government Policies (Power Development Plan 8)

3.1.3. Rising Demand from Power and Fertilizer Industries

3.1.4. FDI Inflows in Energy Sector

3.2. Market Challenges

3.2.1. Regulatory Barriers and Complex Approval Processes

3.2.2. Volatile LNG Pricing and Supply Chain Disruptions

3.2.3. Infrastructure and Logistic Constraints

3.3. Opportunities

3.3.1. Technological Innovations in LNG Storage and Transportation

3.3.2. Investments in Domestic Gas Production (Block B & Ca Voi Xanh)

3.3.3. Expanding LNG Import Terminals

3.4. Trends

3.4.1. Transition from Coal to Gas-Based Power Generation

3.4.2. Growing Importance of Energy Security

3.4.3. Partnerships with International Energy Companies

3.5. Regulatory Framework

3.5.1. Revised Law on Petroleum

3.5.2. Environmental Impact Regulations

3.5.3. Incentives for LNG and Gas Projects

3.5.4. Role of PetroVietnam in Gas Market Regulation

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Landscape

4. Vietnam Natural Gas Market Segmentation

4.1. By Sector (Upstream, Midstream, Downstream)

4.2. By Application (Power Generation, Industrial, Residential, Transport)

4.3. By Source (Domestic Production, Imports)

4.4. By Product Type (Liquefied Natural Gas, Compressed Natural Gas)

4.5. By Region (Southeast, Red River Delta, Mekong River Delta, South Central Coast)

5. Vietnam Natural Gas Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. PetroVietnam Gas

5.1.2. ExxonMobil Corp.

5.1.3. Shell Plc

5.1.4. TotalEnergies SE

5.1.5. Idemitsu Kosan Co., Ltd.

5.1.6. Mitsui Chemicals Inc.

5.1.7. Eni S.p.A

5.1.8. Perenco SA

5.1.9. Rosneft PJSC

5.1.10. Vietsovpetro

5.1.11. AP SAIGON PETRO

5.1.12. Essar Oil and Gas Exploration and Production Ltd.

5.1.13. Pharos Energy

5.1.14. Japan Vietnam Petroleum Company

5.1.15. Delta Offshore Energy

5.2. Cross Comparison Parameters (Market Share, Revenue, LNG Handling Capacity, Projects in Pipeline, Import-Export Ratio, Market Penetration, Technological Advancements, Strategic Partnerships)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Private Equity and Government Funding

6. Vietnam Natural Gas Market Regulatory Framework

6.1. Energy Transition Policies and Impact on Gas Market

6.2. Compliance and Certification Requirements for Gas Projects

6.3. LNG Import and Export Regulations

6.4. Investment Law and Taxation for Foreign Energy Companies

7. Vietnam Natural Gas Market Future Projections

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Vietnam Natural Gas Market Future Segmentation

8.1. By Sector (In Value %)

8.2. By Application (In Value %)

8.3. By Region (In Value %)

8.4. By Source (In Value %)

8.5. By Product Type (In Value %)

9. Vietnam Natural Gas Market Analysts Recommendations

9.1. Total Addressable Market (TAM) Analysis

9.2. Serviceable Available Market (SAM) Analysis

9.3. Serviceable Obtainable Market (SOM) Analysis

9.4. Strategic Recommendations for Market Entry and Expansion

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Vietnam Natural Gas Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the Vietnam Natural Gas Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIS) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple natural gas suppliers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the Vietnam Natural Gas Market.

Frequently Asked Questions

01. How big is the Vietnam Natural Gas Market?

The Vietnam natural gas market, valued at USD 43 billion based on the latest industry analysis, is driven by a combination of increasing energy demands, government policies encouraging the shift to cleaner energy sources, and significant investments in LNG infrastructure.

02. What are the challenges in the Vietnam Natural Gas Market?

The Vietnam natural gas market challenges include regulatory barriers, inconsistent investment laws, and volatile LNG prices, which complicate project implementation and investment planning

03. Who are the major players in the Vietnam Natural Gas Market?

Key players in the Vietnam natural gas market include PetroVietnam Gas, ExxonMobil Corp., Shell Plc, and TotalEnergies SE, which dominate due to their strong market presence and extensive infrastructure.

04. What are the growth drivers of the Vietnam Natural Gas Market?

The Vietnam natural gas market is propelled by factors such as government policies favoring cleaner energy sources, increasing LNG imports, and growing electricity demand in industrial regions.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.