Vietnam Nutritional Supplements Market Outlook to 2030

Region:Asia

Author(s):Abhinav kumar

Product Code:KROD4722

December 2024

83

About the Report

Vietnam Nutritional Supplements Market Overview

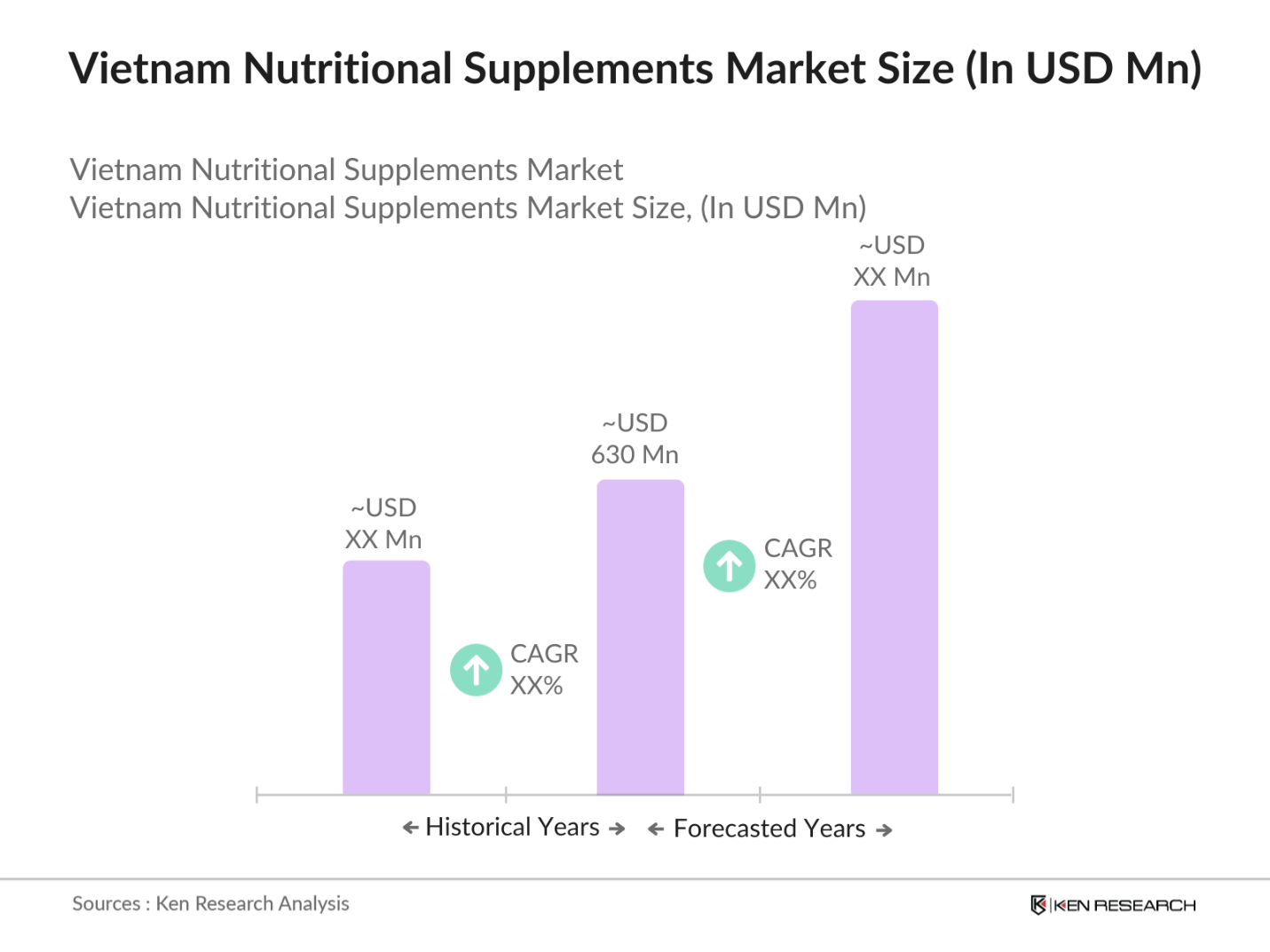

- The Vietnam nutritional supplements market is valued at USD 630 million, driven by growing health consciousness and an aging population seeking abetter quality of life. Increasing disposable income and a rising focus on preventive healthcare among Vietnamese consumers have also contributed to the expansion of the market. Nutritional supplements, especially vitamins and minerals, have become a staple in households across the country, fueling market demand and driving growth.

- Ho Chi Minh City and Hanoi dominate the market due to their larger populations and higher disposable incomes. These cities house a substantial number of health-conscious consumers and a high concentration of retail outlets, including pharmacies and health stores. The penetration of international brands and modern retail infrastructure further contributes to the dominance of these cities in the Vietnamese market.

- The Ministry of Health in Vietnam enforces strict guidelines roval of nutritional supplements. In 2023, the ministry introduced new regulations requiring detailed clinical trials for any new supplement entering the market. Over 200 products were reviewed under the updated guidelines in 2023, with emphasis on safety and efficacy. These regulations ensure that only scientifically-backed supplements are available in the market, aiming to protect consumers from unverified or harmful products. Compliance with these guidelines is essential for manufacturers looking to introduce new products in the market .

Vietnam Nutritional Supplements Market Segmentation

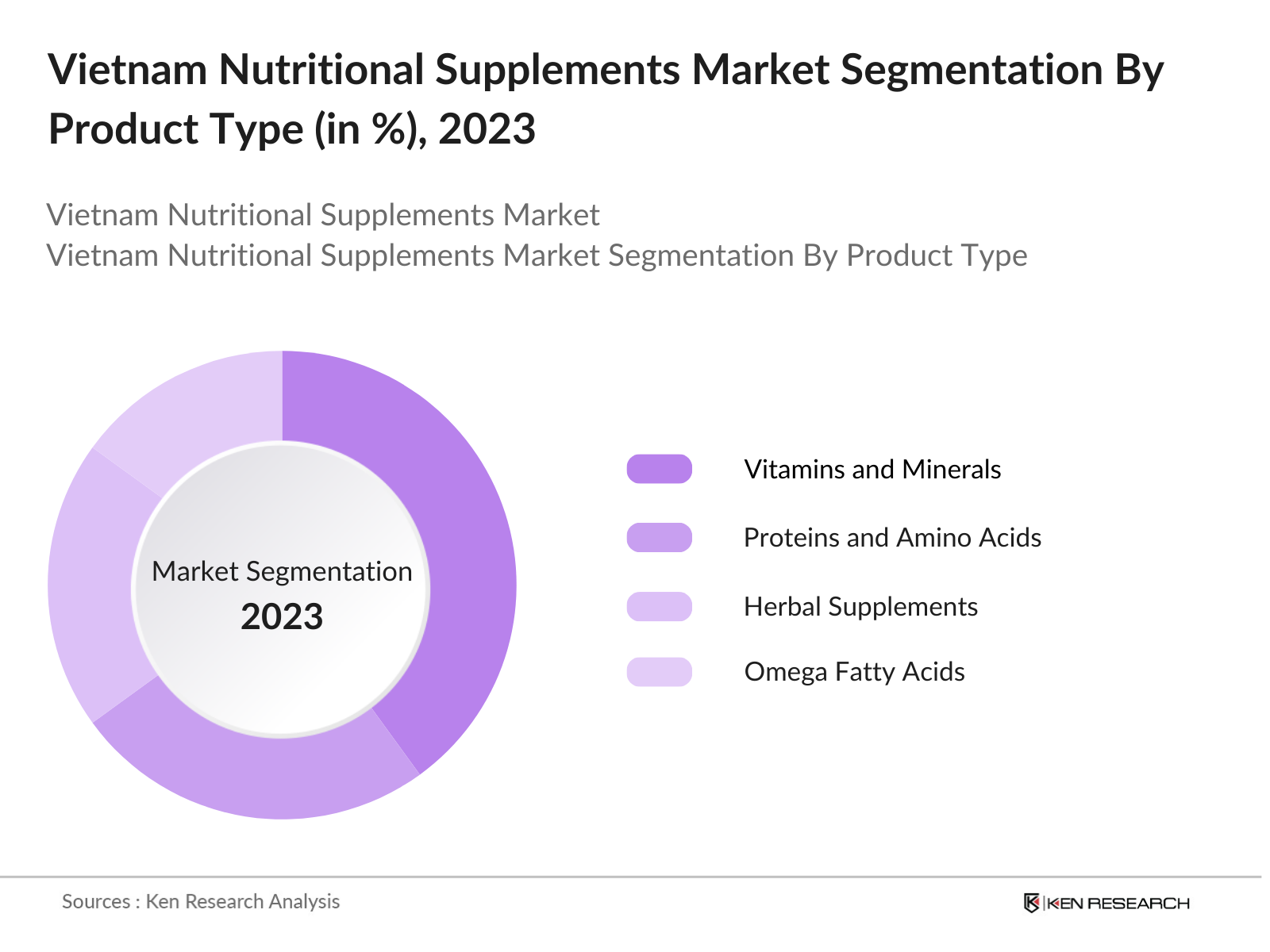

By Product Type: The Vietnam nutritional supplements market is segmented by product type into vitamins and minerals, proteins and amino acids, herbal supplements, omega fatty acids, and probiotics and digestive enzymes. Recently, vitamins and minerals have a dominant market share under this segmentation. This is driven by the increasing consumer focus on preventive healthcare, where these supplements play a pivotal role. Multivitamins and minerals are widely available and affordable, and they cater to a broad demographic range, from children to the elderly. The presence of both local and international brands offering these products at competitive prices has further bolstered their demand.

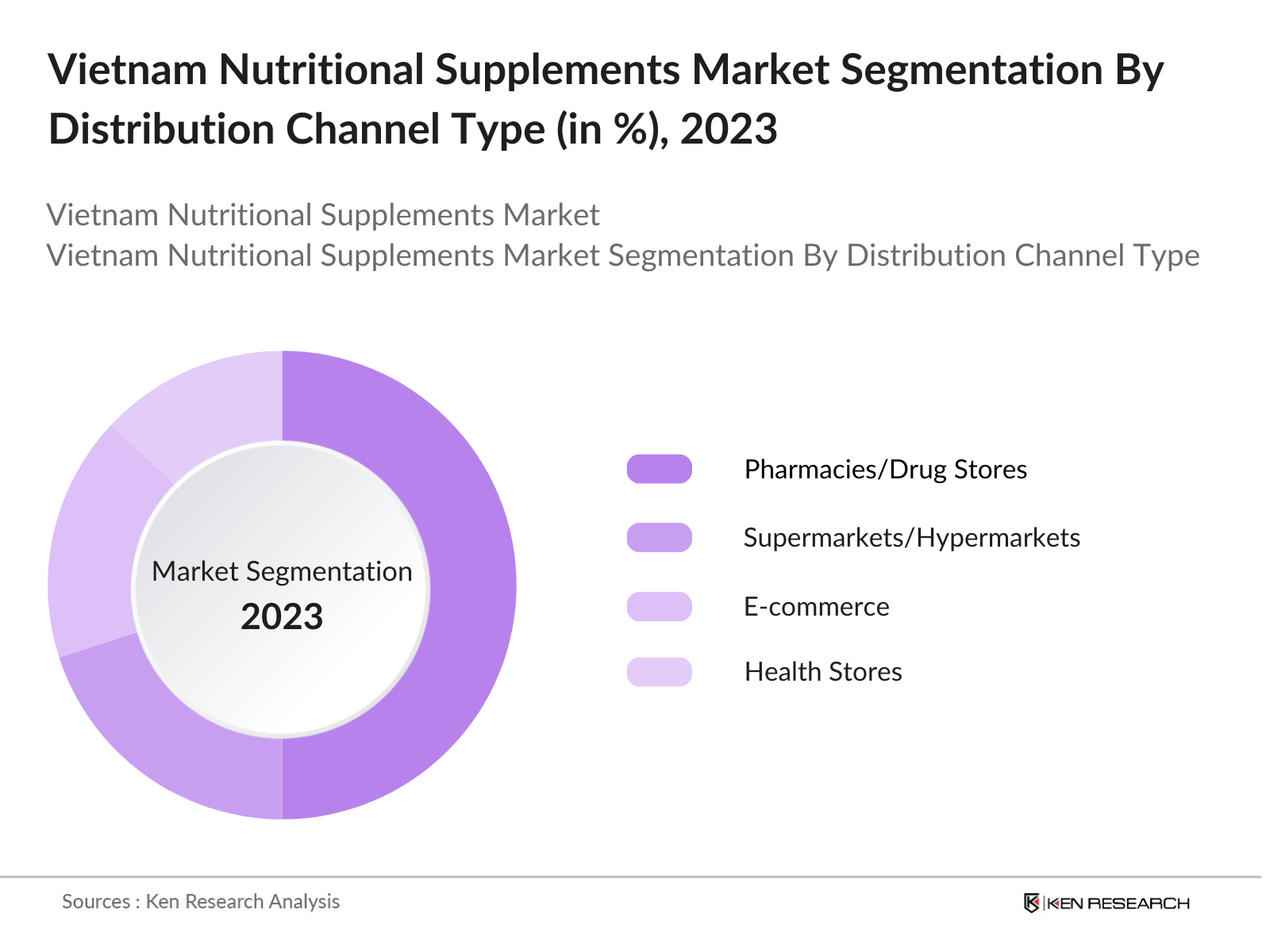

By Distribution Channel: The market is segmented by distribution channel into pharmacies/drug stores, supermarkets/hypermarkets, e-commerce, health stores, and direct sales. Pharmacies and drug stores are the leading distribution channel, holding a substantial share of the market. Their dominance is due to the trust consumers place in pharmacists for product recommendations and advice, particularly when it comes to health-related purchases. Moreover, these outlets offer a wide variety of supplements, making it convenient for consumers to find what they need in one place. The consistent growth of pharmacy chains across urban and rural areas has further supported this segments dominance.

Vietnam Nutritional Supplements Market Competitive Landscape

The Vietnam nutritional supplements market is dominated by both local and international players, with the market being highly fragmented. Local companies such as Nutifood Nutrition Food Joint Stock Company and global brands like Abbott Laboratories and Herbalife are key players, contributing significantly to market growth through aggressive marketing strategies, partnerships with pharmacies, and product innovations.

Vietnam Nutritional Supplements Industry Analysis

Growth Drivers

- Rising Health Consciousness: The demand for nutritional supplements in Vietnam is rising due to increased health consciousness, especially post-pandemic. According to Vietnams Ministry of Health, the country saw a 15% rise in gym memberships and fitness-related activities in 2023, leading to higher consumption of vitamins and supplements. In 2022, an estimated 25% of urban households regularly purchased supplements, driven by a focus on immunity and wellness. Vietnam's growing middle class, projected to reach 56 million by 2025, shows a stronger inclination towards maintaining health, further fueling this demand.

- Aging Population: Vietnam is experiencing a demographic shift, with 11.9 million people aged 60 and above in 2023. As per the World Bank, this number is expected to continue growing, driving demand for age-specific supplements such as calcium, vitamin D, and joint-support supplements. The increasing incidence of age-related diseases, such as osteoporosis and cardiovascular conditions, encourages this demographic to turn to nutritional supplements. Vietnam's life expectancy is around 75 years, highlighting the need for products that support elderly health .

- Increased Disposable Income: Vietnam's per capita income has been steadily increasing, reaching approximately $3,900 in 2023, according to the IMF. This growing disposable income enables consumers to spend more on health-related products, including nutritional supplements. As consumer preferences shift towards premium health products, supplement manufacturers are responding with diverse offerings that cater to various dietary needs. The share of healthcare spending in urban households rose by 12% between 2022 and 2023, signaling robust growth in the health-conscious segment of the population.

Market Challenges

- Regulatory Hurdles: Vietnams regulatory environment for nutritional supplements is stringent, with strict requirements for product registration and labeling set by the Ministry of Health. In 2023, there were over 500 cases of supplement imports being delayed due to non-compliance with registration and safety standards. The registration process can take up to six months, creating significant barriers for new entrants. Additionally, the government has tightened regulations on imported supplements, demanding clearer evidence of efficacy, which further complicates market access.

- Price Sensitivity of Consumers: Despite growing disposable incomes, a large portion of Vietnams population remains price-sensitive, particularly in rural areas. According to the General Statistics Office of Vietnam, about 25% of the population lives on an income below $5.50 per day (World Bank, 2022). This affordability gap limits the purchasing power for premium nutritional supplements, particularly among lower-income households. Manufacturers have had to adapt by offering smaller package sizes or more affordable, local alternatives to meet the demand of this price-sensitive segment.

Vietnam Nutritional Supplements Market Future Outlook

The Vietnam nutritional supplements market is poised for continued growth, driven by the increasing consumer focus on health and wellness, rising disposable incomes, and expanding e-commerce platforms. Over the next five years, the market is expected to witness heightened demand for personalized nutrition and functional foods, as consumers increasingly seek supplements that cater to specific health needs. Furthermore, international brands are expected to expand their presence, benefiting from Vietnams regulatory advancements in supplement approvals and labeling transparency. This will contribute to a more competitive landscape, pushing local brands to innovate and refine their product offerings.

Opportunities

- Growth of Herbal and Organic Supplements: The demand for herbal and organic nutritional supplements is growing in Vietnam due to the populations increasing preference for natural products. In 2023, the Ministry of Health reported a 25% increase in the import and local production of herbal supplements. Vietnamese consumers are increasingly turning to herbal-based solutions, such as ginseng and turmeric, which are traditionally known for their health benefits. This growing trend aligns with global shifts towards clean, organic, and plant-based ingredients in supplements, offering manufacturers new product innovation opportunities.

- Rising Demand for Functional Foods: The demand for functional foodsnutraceutical products that provide health benefits beyond basic nutritionis expanding. According to the Food and Agriculture Organization, the consumption of fortified and functional foods in Vietnam increased by 18% in 2022. The increasing prevalence of chronic diseases, such as diabetes and cardiovascular conditions, is driving this demand, as consumers seek supplements that support long-term health. Nutraceuticals like omega-3 fatty acids and probiotics are particularly popular, offering synergies with traditional supplements and presenting growth opportunities for companies focusing on innovative health solutions.

Scope of the Report

|

Product Type |

Vitamins and Minerals Proteins and Amino Acids Herbal Supplements Omega Fatty Acids Probiotics and Digestive Enzymes |

|

Application |

General Well-being Sports and Fitness Immunity Boosting Weight Management Digestive Health |

|

Form |

Tablets Capsules Powder Liquid Softgels |

|

Distribution Channel |

Pharmacies/Drug Stores Supermarkets/Hypermarket E-commerce Health Stores Direct Sales |

|

Consumer Group |

Adults Elderly Pregnant Women Children |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Pharmacies and Drug Store Industry

Supermarkets/Hypermarkets Industry

E-commerce Platform Companies

Health Stores Industries

Direct Sales Companies

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (Ministry of Health, Vietnam Food Administration)

Nutraceutical Manufacturing Companies

Companies

Players Mentioned in the Report

Abbott Laboratories

Herbalife Nutrition Ltd.

Amway Vietnam

Nutifood Nutrition Food Joint Stock Company

Unilever Vietnam

Mega Lifesciences Public Company Ltd.

Sanofi Vietnam

GSK Consumer Healthcare

Pharmacity

Blackmores

Table of Contents

1. Vietnam Nutritional Supplements Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Vietnam Nutritional Supplements Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Vietnam Nutritional Supplements Market Analysis

3.1. Growth Drivers

3.1.1. Rising Health Consciousness

3.1.2. Aging Population

3.1.3. Increased Disposable Income

3.1.4. Expansion of E-commerce Channels

3.2. Market Challenges

3.2.1. Regulatory Hurdles

3.2.2. Price Sensitivity of Consumers

3.2.3. Misinformation and Lack of Consumer Awareness

3.3. Opportunities

3.3.1. Growth of Herbal and Organic Supplements

3.3.2. Rising Demand for Functional Foods

3.3.3. Expansion in Rural Areas

3.4. Trends

3.4.1. Personalized Nutrition

3.4.2. Clean Label and Transparency

3.4.3. Subscription-based Models

3.5. Government Regulation

3.5.1. Health Ministry Guidelines

3.5.2. Import Restrictions and Tariffs

3.5.3. Labeling and Packaging Standards

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Vietnam Nutritional Supplements Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Vitamins and Minerals

4.1.2. Proteins and Amino Acids

4.1.3. Herbal Supplements

4.1.4. Omega Fatty Acids

4.1.5. Probiotics and Digestive Enzymes

4.2. By Application (In Value %)

4.2.1. General Well-being

4.2.2. Sports and Fitness

4.2.3. Immunity Boosting

4.2.4. Weight Management

4.2.5. Digestive Health

4.3. By Form (In Value %)

4.3.1. Tablets

4.3.2. Capsules

4.3.3. Powder

4.3.4. Liquid

4.3.5. Softgels

4.4. By Distribution Channel (In Value %)

4.4.1. Pharmacies/Drug Stores

4.4.2. Supermarkets/Hypermarkets

4.4.3. E-commerce

4.4.4. Health Stores

4.4.5. Direct Sales

4.5. By Consumer Group (In Value %)

4.5.1. Adults

4.5.2. Elderly

4.5.3. Pregnant Women

4.5.4. Children

5. Vietnam Nutritional Supplements Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Abbott Laboratories

5.1.2. Herbalife Nutrition Ltd.

5.1.3. Amway Vietnam

5.1.4. Nutifood Nutrition Food Joint Stock Company

5.1.5. Unilever Vietnam

5.1.6. Mega Lifesciences Public Company Limited

5.1.7. Sanofi Vietnam

5.1.8. GSK Consumer Healthcare

5.1.9. Pharmacity

5.1.10. Blackmores

5.1.11. Dong A Pharma

5.1.12. Otsuka Pharmaceutical Co., Ltd.

5.1.13. Rohto Pharmaceutical Co., Ltd.

5.1.14. Baiyunshan Pharmaceutical

5.1.15. Suntory PepsiCo Vietnam Beverage

5.2. Cross Comparison Parameters

(No. of Employees, Manufacturing Capacity, Product Portfolio, Sales Growth, International Presence, Regional Strength, Pricing Strategies, Retail Partnerships)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Private Equity Investments

6. Vietnam Nutritional Supplements Market Regulatory Framework

6.1. Food Safety and Standards Authority Regulations

6.2. GMP (Good Manufacturing Practices) Compliance

6.3. Import and Export Regulations

6.4. Certification Processes

7. Vietnam Nutritional Supplements Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Vietnam Nutritional Supplements Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By Form (In Value %)

8.4. By Distribution Channel (In Value %)

8.5. By Consumer Group (In Value %)

9. Vietnam Nutritional Supplements Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Vietnam nutritional supplements market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the Vietnam nutritional supplements market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of sales statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through interviews with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple nutritional supplement manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the Vietnam nutritional supplements market.

Frequently Asked Questions

01. How big is the Vietnam Nutritional Supplements Market?

The Vietnam nutritional supplements market is valued at USD630 million, driven by the rising health consciousness of the population and increased disposable income.

02. What are the challenges in the Vietnam Nutritional Supplements Market?

Challenges include regulatory hurdles related to product approvals, price sensitivity among consumers, and the proliferation of counterfeit products, which undermines consumer trust.

03. Who are the major players in the Vietnam Nutritional Supplements Market?

Key players in the market include Abbott Laboratories, Herbalife Nutrition, Nutifood Nutrition, Mega Lifesciences, and Unilever Vietnam.

04. What are the growth drivers of the Vietnam Nutritional Supplements Market?

The market is propelled by rising health awareness, growing disposable incomes, and increased demand for preventive healthcare solutions among the elderly population.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.