Vietnam Online Education Market Outlook to 2030

Region:Asia

Author(s):Vijay Kumar

Product Code:KROD8034

November 2024

84

About the Report

Vietnam Online Education Market Overview

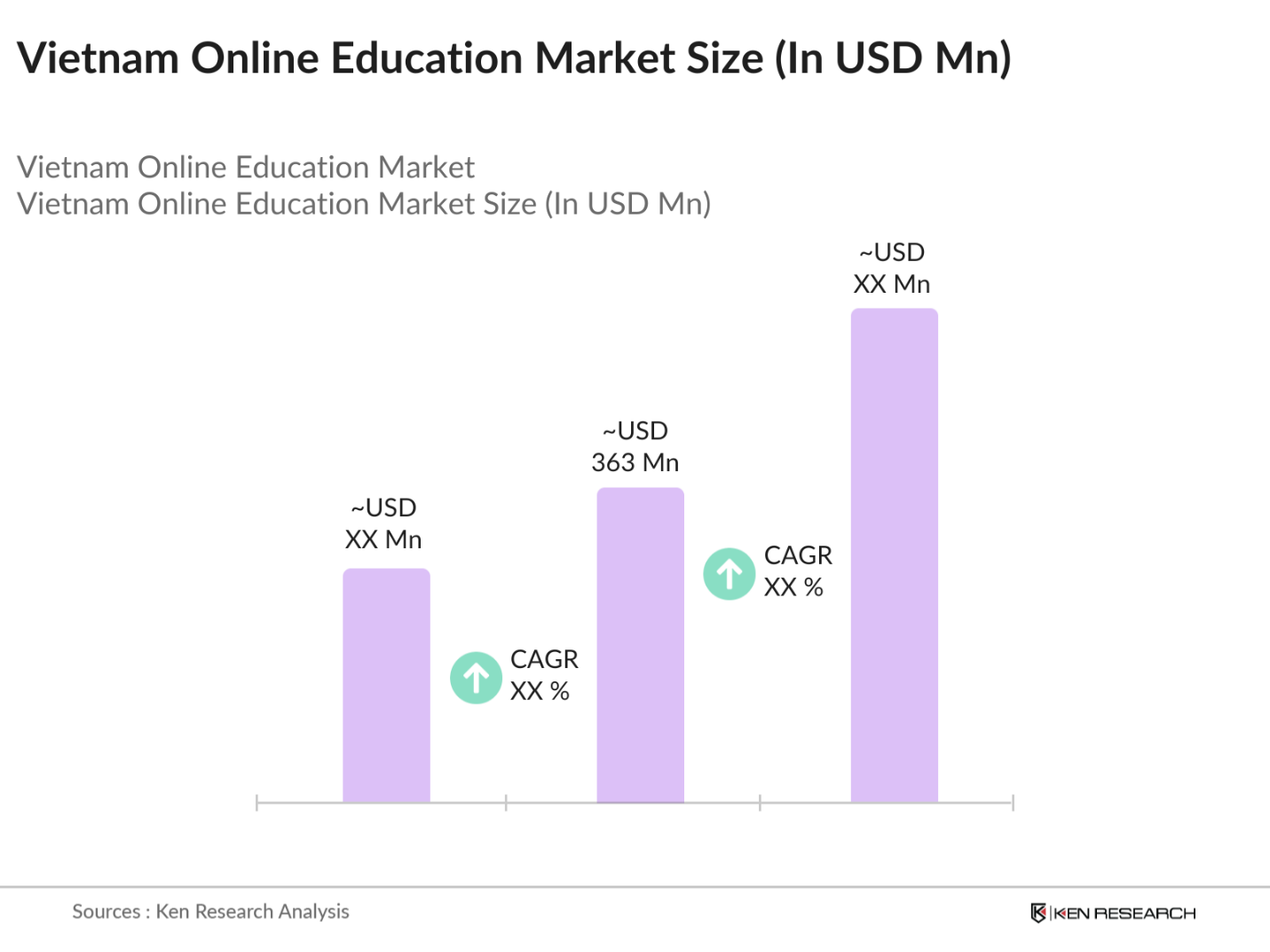

- The Vietnam Online Education Market is valued at USD 363 million, based on a five-year historical analysis. The market's growth is fueled by increased internet penetration, affordable mobile devices, and a strong cultural emphasis on education. These factors, combined with government initiatives supporting digital learning, have accelerated market adoption among both urban and rural populations. The markets expansion is further supported by a youthful demographic seeking accessible education pathways that align with the nations shift toward a knowledge-based economy.

- Key regions driving the online education market include Ho Chi Minh City and Hanoi. Ho Chi Minh City has positioned itself as a digital hub, attracting investments in EdTech startups and fostering a technologically savvy population. Meanwhile, Hanois prominence as a center for academic excellence has facilitated strong adoption of online educational platforms among students and working professionals. These cities lead the market due to higher internet access, a concentration of educational institutions, and increasing partnerships with international educational providers.

- The National Digital Transformation Program aims to transform Vietnams economy and education sectors through digital means by 2025. This policy supports integrating digital platforms across government agencies and educational institutions, establishing a cohesive digital framework to streamline services and improve education quality. The governments commitment to digital transformation underscores the prioritization of e-learning as a central element of Vietnams future.

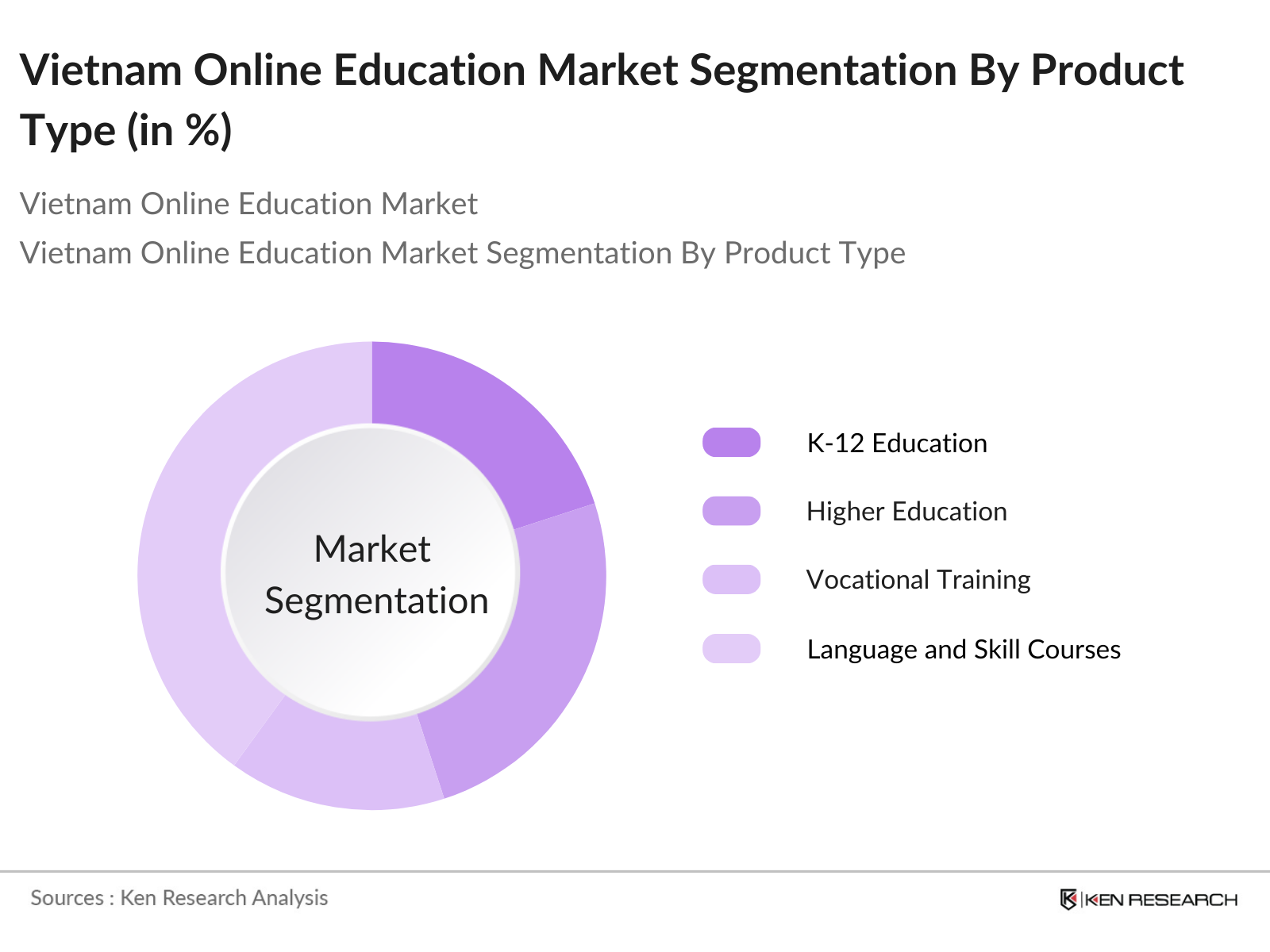

Vietnam Online Education Market Segmentation

By Product Type: The market is segmented by product type into K-12 Education, Higher Education, Vocational Training, and Language and Skill Courses. Recently, Language and Skill Courses have a dominant market share within this segment due to their popularity among working professionals and students aiming to enhance job-specific skills.

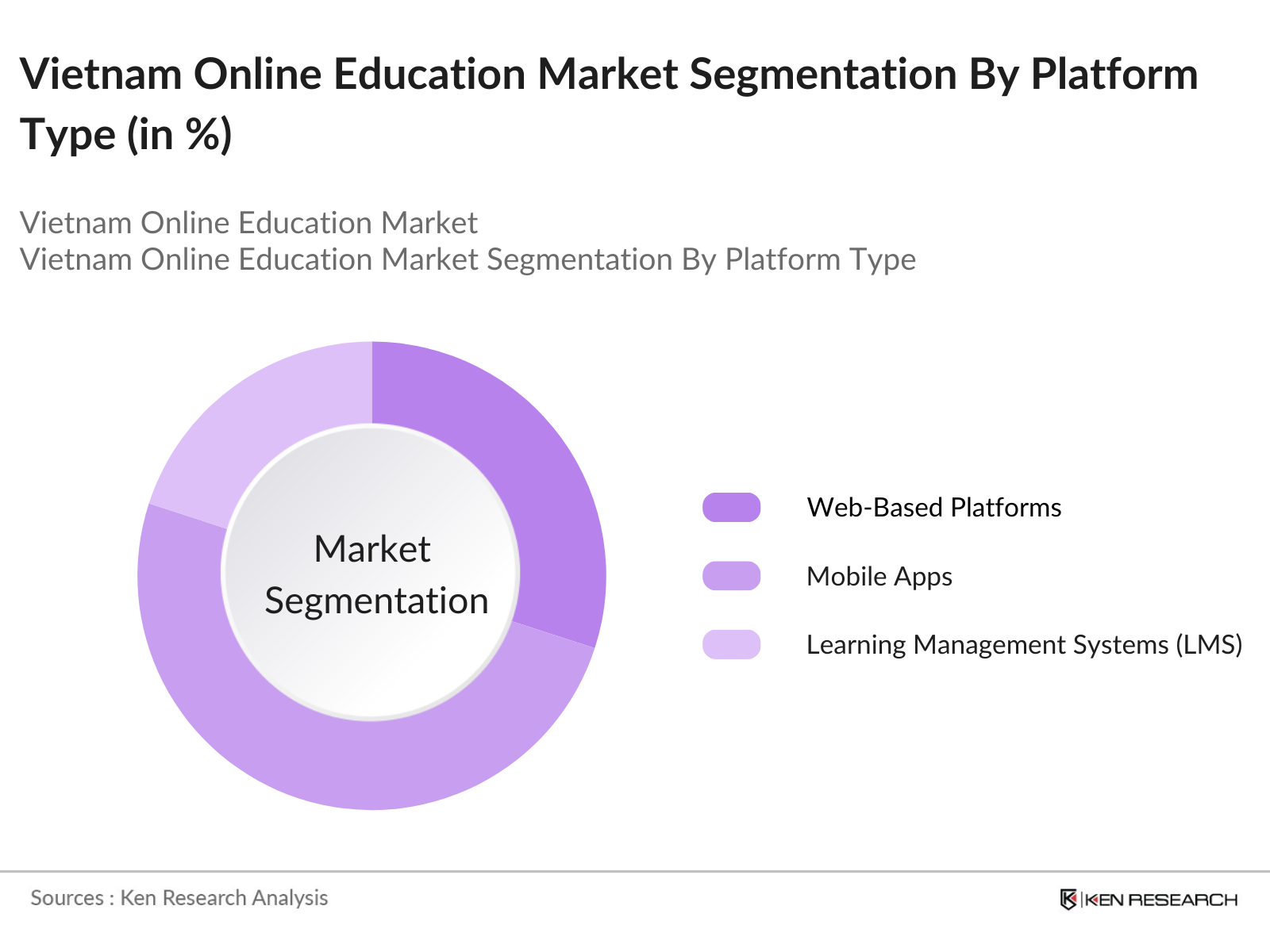

By Platform Type: The market is further segmented by platform type, including Web-Based Platforms, Mobile Apps, and Learning Management Systems (LMS). Mobile Apps currently hold a significant market share within this category, largely due to widespread smartphone usage in Vietnam and a shift toward mobile-based learning.

Vietnam Online Education Market Competitive Landscape

The Vietnam Online Education Market is primarily led by a mixture of local and global EdTech firms, which have capitalized on the growing demand for digital learning. Major companies have reinforced their market presence through partnerships with educational institutions and government bodies, enhancing credibility and user reach.

Vietnam Online Education Industry Analysis

Growth Drivers

- Rising Demand for Flexible Learning Options: Vietnamese students and professionals are increasingly attracted to flexible online learning options as they seek skill enhancement in a digitally evolving workforce. Between 2022 and 2024, the number of Vietnamese students choosing online courses surged, especially in large cities like Hanoi and Ho Chi Minh City, where the demand for flexible education formats has expanded the adoption of online platforms.

- Increasing Internet and Device Penetration: Internet usage in Vietnam has seen substantial growth, with broadband and mobile internet reaching 70% of the population in 2024. The countrys investment in 4G and 5G network infrastructure and recent projects to expand access in rural areas are part of its goal to make Vietnam a digital hub in Southeast Asia. Enhanced internet penetration directly impacts education by enabling broader access to digital learning resources, which is increasingly critical as the country strives to support educational goals in line with its Digital Transformation Program.

- Rising Number of Enrollees in Higher Education: Vietnam has observed an increase in higher education enrollment rates, reaching over 2 million students in 2024, driven by a young population and strong emphasis on academic advancement. The Ministry of Educations initiatives support digital solutions to accommodate this growth, aiming to reduce classroom overcrowding and offer online modules as supplementary resources.

Market Challenges

- Digital Divide (Access and Affordability): Despite progress, digital access remains uneven, with approximately 27% of Vietnams population in remote areas facing connectivity challenges. Many households still lack sufficient digital infrastructure, and this gap affects students in rural areas. The government National Digital Transformation Program aims to reduce this divide by promoting mobile and broadband accessibility, yet barriers remain due to limited affordability and infrastructure in less developed regions, impacting online education availability.

- Quality and Credibility Concerns: The quality of online education varies across Vietnam, with some platforms struggling to gain trust due to inconsistent content standards. In response, Vietnams Ministry of Education has set stringent e-learning quality requirements. These policies aim to establish uniform standards, ensuring that online education can match traditional learning quality. However, concerns about the effectiveness of online education persist, particularly in less regulated platforms, which may hinder widespread adoption.

Vietnam Online Education Market Future Outlook

The Vietnam Online Education market is expected to witness substantial growth, driven by continuous advancements in digital learning technologies and rising adoption among underserved regions. Policy support from the Vietnamese government, coupled with the countrys push towards digital transformation, will likely increase the number of EdTech partnerships with international providers, further expanding educational content diversity.

Market Opportunities

- Collaboration with International EdTech Firms: Vietnams online education sector is increasingly collaborating with international EdTech companies, expanding access to global resources and tools. This partnership enables Vietnamese providers to adopt best practices and introduce advanced technologies, such as AI-driven personalized learning. Collaborations with foreign companies also bring potential for curriculum diversification, providing Vietnamese students with access to a broader range of specialized online courses.

- Upsurge in Demand for Skill-Based Courses: There is a notable rise in demand for skill-oriented courses in Vietnam, particularly in IT and digital marketing fields, as the workforce increasingly requires technical expertise. This trend aligns with government support for vocational training digitalization, which encourages skill-based learning and builds a foundation for industry-aligned online courses. Skill-based education in digital formats is particularly appealing to Vietnams younger population entering a rapidly modernizing job market.

Scope of the Report

|

By Product Type |

K-12 Education Higher Education Vocational Training Language and Skill Courses |

|

By Platform Type |

Web-Based Platforms Mobile Apps Learning Management Systems (LMS) |

|

By Technology |

Artificial Intelligence (AI) Virtual Reality (VR) Data Analytics Cloud-Based Solutions |

|

By End User |

Students (K-12 and Higher Ed) Working Professionals Corporates |

|

By Region |

Northern Vietnam Central Vietnam Southern Vietnam |

Products

Key Target Audience

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (Ministry of Education and Training, Ministry of Information and Communications)

EdTech Startups

Digital Content Providers

Telecommunication Providers

Schools and Higher Education Institutions

Corporate Training Departments

Mobile Device Manufacturers

Companies

Players Mentioned in the Report

Topica EdTech Group

Kyna.vn

Hocmai.vn

ELSA Speak

FPT Corporation

ClassIn Vietnam

Monkey Stories

HOC247

Egroup

VUS (Vietnam USA Society English Centers)

Table of Contents

1. Vietnam Online Education Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate and Adoption

1.4. Market Segmentation Overview

2. Vietnam Online Education Market Size (in USD Bn)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Milestones and Investments

3. Vietnam Online Education Market Dynamics

3.1. Growth Drivers

3.1.1. Government Initiatives in Digital Learning

3.1.2. Rising Demand for Flexible Learning Options

3.1.3. Increasing Internet and Device Penetration

3.1.4. Rising Number of Enrollees in Higher Education

3.2. Market Challenges

3.2.1. Digital Divide (Access and Affordability)

3.2.2. Quality and Credibility Concerns

3.2.3. Cultural Barriers to Online Learning

3.3. Opportunities

3.3.1. Collaboration with International EdTech Firms

3.3.2. Upsurge in Demand for Skill-Based Courses

3.3.3. Government Partnerships for Rural Education Access

3.4. Trends

3.4.1. Personalized Learning Paths with AI and Data Analytics

3.4.2. Gamification in Learning Modules

3.4.3. Emergence of Hybrid Learning Models

3.5. Regulatory Overview

3.5.1. Vietnams Digital Transformation Policies

3.5.2. Government Standards for e-Learning Quality

3.5.3. Policies on Foreign Investment in Education

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Ecosystem

4. Vietnam Online Education Market Segmentation

4.1. By Product Type (in Value %)

4.1.1. K-12 Education

4.1.2. Higher Education

4.1.3. Vocational Training

4.1.4. Language and Skill Courses

4.2. By Platform Type (in Value %)

4.2.1. Web-Based Platforms

4.2.2. Mobile Apps

4.2.3. Learning Management Systems (LMS)

4.3. By Technology (in Value %)

4.3.1. Artificial Intelligence (AI)

4.3.2. Virtual Reality (VR)

4.3.3. Data Analytics

4.3.4. Cloud-Based Solutions

4.4. By End User (in Value %)

4.4.1. Students (K-12 and Higher Ed)

4.4.2. Working Professionals

4.4.3. Corporates

4.5. By Region (in Value %)

4.5.1. Northern Vietnam

4.5.2. Central Vietnam

4.5.3. Southern Vietnam

5. Vietnam Online Education Market Competitive Landscape

5.1. Key Company Profiles (15 Competitors)

5.1.1. Topica EdTech Group

5.1.2. Kyna.vn

5.1.3. Hocmai.vn

5.1.4. ELSA Speak

5.1.5. ClassIn Vietnam

5.1.6. Monkey Stories

5.1.7. HOC247

5.1.8. FPT Corporation

5.1.9. Egroup

5.1.10. VUS (Vietnam USA Society English Centers)

5.1.11. Edumall

5.1.12. ILA Vietnam

5.1.13. Antoree

5.1.14. Language Link

5.1.15. GreenEdu

5.2. Cross Comparison Parameters

Number of Employees, Revenue, Headquarter Location, Year Established, Funding Rounds, Customer Base, Service Reach, Partnerships

5.3. Market Share Analysis

5.4. Strategic Initiatives (Partnerships and Alliances)

5.5. Mergers and Acquisitions

5.6. Investment Analysis

Government Grants, Private Equity, Venture Capital, Public Funding

6. Vietnam Online Education Market Regulatory Framework

6.1. Licensing and Compliance Requirements

6.2. Data Privacy and Security Regulations

6.3. Accreditation and Quality Standards

7. Vietnam Online Education Future Market Size (in USD Bn)

7.1. Projected Market Size and Expansion

7.2. Key Growth Enablers and Strategic Forecasts

8. Vietnam Online Education Future Market Segmentation

8.1. By Product Type (in Value %)

8.2. By Platform Type (in Value %)

8.3. By Technology (in Value %)

8.4. By End User (in Value %)

8.5. By Region (in Value %)

9. Vietnam Online Education Market Analysts Recommendations

9.1. Total Addressable Market (TAM), Serviceable Available Market (SAM), and Serviceable Obtainable Market (SOM) Analysis

9.2. Customer Behavior and Usage Trends

9.3. Marketing Strategies and Positioning

9.4. Innovation and Differentiation Opportunities

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involved constructing an ecosystem map encompassing all key stakeholders within the Vietnam Online Education Market. This process utilized secondary research from trusted sources and primary research via expert interviews to define critical market dynamics.

Step 2: Market Analysis and Data Collection

This phase involved gathering and analyzing historical data, focusing on growth drivers, user demographics, and market adoption rates. Additional research into competitive positioning, user engagement, and content localization was conducted to enrich data accuracy.

Step 3: Hypothesis Validation and Expert Consultation

The market hypotheses were validated through telephonic consultations with industry professionals, ensuring accuracy and relevance. Insights from major EdTech firms were incorporated to understand consumer behavior trends and product-specific performance.

Step 4: Research Synthesis and Final Output

The final report incorporated data from extensive sources, including government reports and expert insights, to construct a complete and validated picture of the Vietnam Online Education Market. Quality checks ensured consistency across all report sections.

Frequently Asked Questions

1. How big is the Vietnam Online Education Market?

The Vietnam Online Education Market is valued at USD 363 million, based on a five-year historical analysis. The market's growth is fueled by increased internet penetration, affordable mobile devices, and a strong cultural emphasis on education.

2. What are the challenges in the Vietnam Online Education Market?

Major challenges include disparities in digital access, quality control concerns, and resistance to non-traditional education formats, which can limit market expansion.

3. Who are the major players in the Vietnam Online Education Market?

Key players include Topica EdTech Group, Kyna.vn, Hocmai.vn, ELSA Speak, and FPT Corporation, with their competitive edge rooted in extensive content offerings and partnerships.

4. What are the growth drivers for the Vietnam Online Education Market?

The market is fueled by increased smartphone usage, supportive government policies, and a rising demand for skill-based learning modules, particularly for the English language.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.