Vietnam Organic Food Market Outlook to 2030

Region:Asia

Author(s):Naman Rohilla

Product Code:KROD4179

October 2024

86

About the Report

Vietnam Organic Food Market Overview

- The Vietnam organic food market is valued at USD 100 million, driven by increasing health consciousness, sustainability concerns, and government incentives for organic farming. Over the past five years, rising disposable incomes and changing consumer behaviour towards healthy, organic produce have boosted market demand. Consumers are prioritizing products that are free from synthetic chemicals, enhancing the popularity of organic food across the country, with continued market expansion expected as awareness grows.

- Hanoi and Ho Chi Minh City dominate the organic food market due to their higher population density, economic development, and access to premium retail outlets. These cities have better infrastructure, higher consumer purchasing power, and more exposure to international organic standards, making them the primary regions for organic food consumption. Urbanization and modern retail penetration further strengthen their dominance in the market.

- Vietnam has implemented strict organic farming regulations under the TCVN 11041 standards. These standards cover the entire production process, from soil management to post-harvest handling, ensuring that organic products meet stringent quality and safety criteria. In 2023, the Ministry of Agriculture and Rural Development reported that over 1,500 farms had been certified under TCVN 11041. This regulatory framework helps build consumer confidence in organic products and aligns Vietnam's organic sector with global certification standards.

Vietnam Organic Food Market Segmentation

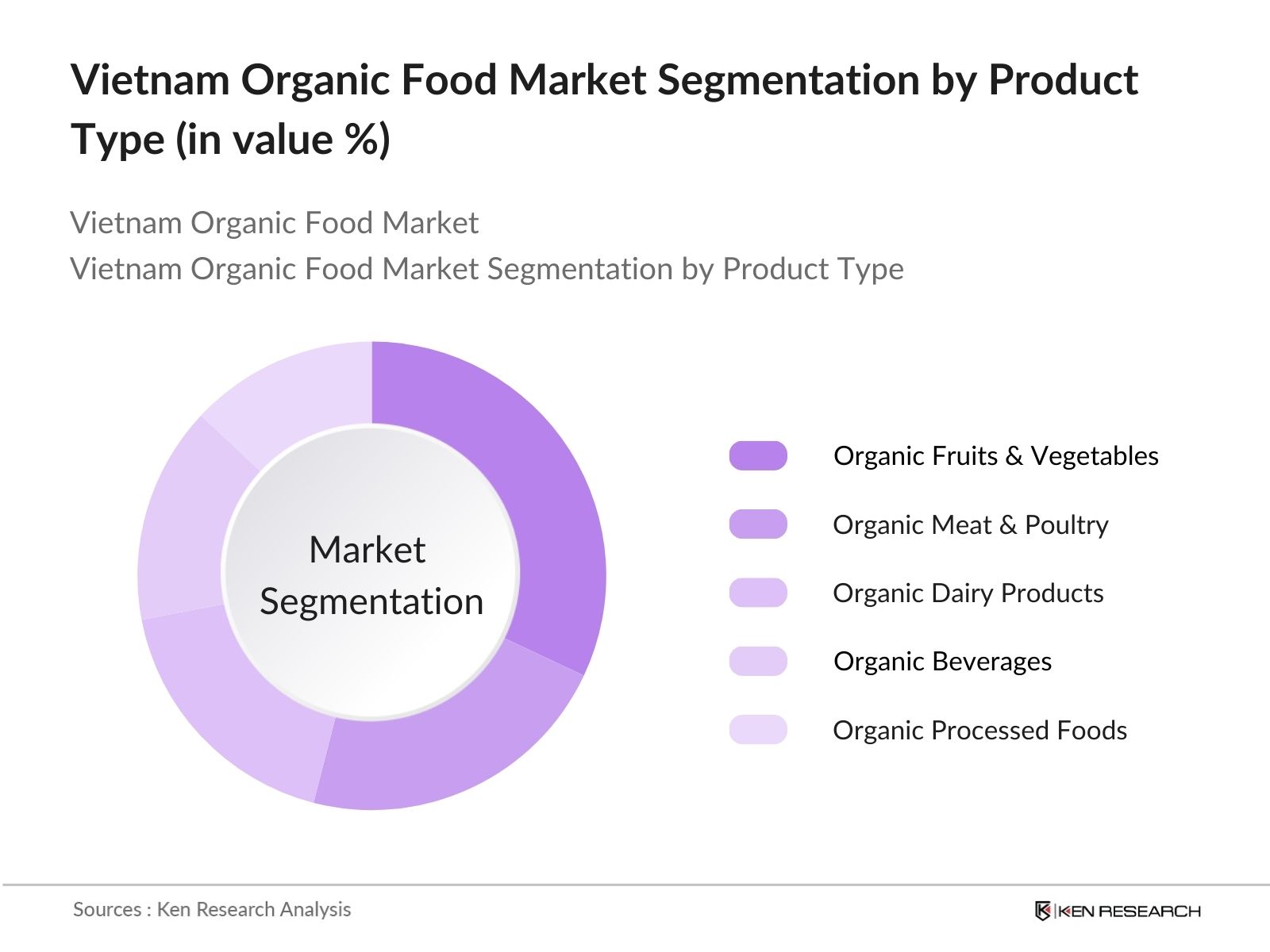

- By Product Type: Vietnam's organic food market is segmented by product type into organic fruits and vegetables, organic meat and poultry, organic dairy products, organic beverages, and organic processed foods. Organic fruits and vegetables hold a dominant market share due to growing awareness about pesticide-free produce and a high preference for fresh, healthy food. Consumers prioritize organic fruits and vegetables as part of a daily healthy diet, driving this segment's growth.

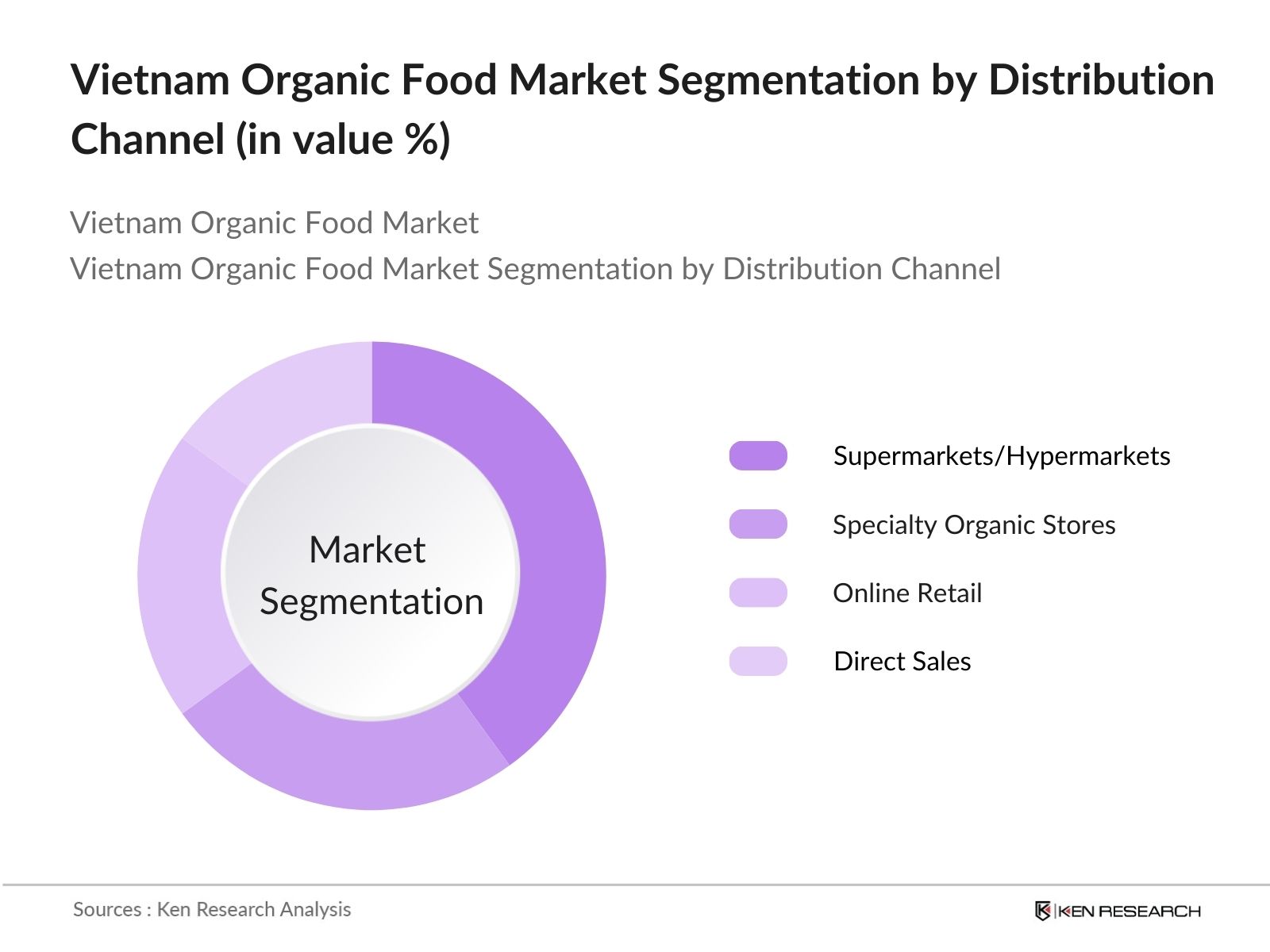

- By Distribution Channel: The market is segmented by distribution channel into supermarkets/hypermarkets, specialty organic stores, online retail, and direct sales. Supermarkets and hypermarkets account for the highest market share due to their expansive reach, convenience, and trust among consumers. These large retail chains have been quick to expand their organic offerings, providing a range of certified organic products and creating a seamless shopping experience for health-conscious consumers.

Vietnam Organic Food Market Competitive Landscape

The Vietnam organic food market is competitive, with a few leading players dominating. Key companies like Vinamilk and TH True Milk have solidified their market position through large-scale production and established supply chains. In addition, companies like Organica and Dabaco Group are expanding their reach by focusing on high-quality certification and organic farming practices. These companies have also invested in consumer education, building trust in the organic certification process.

| Company | Establishment Year | Headquarters | Product Range | Organic Certifications | R&D Investment | Revenue (USD) | Employee Strength | Distribution Network |

|---|---|---|---|---|---|---|---|---|

| Vinamilk | 1976 | Ho Chi Minh City | - | - | - | - | - |

- |

| TH True Milk | 2009 | Nghe An Province | - | - | - | - | - |

- |

| Organica | 2013 | Ho Chi Minh City | - | - | - | - | - |

- |

| Dabaco Group | 1996 | Bac Ninh Province | - | - | - | - | - |

- |

| Quang Thanh Organic | 2010 | Lam Dong Province | - | - | - | - | - |

- |

Vietnam Organic Food Market Analysis

Vietnam Organic Food Market Growth Drivers

- Rising Health Consciousness: The increasing health consciousness among Vietnamese consumers has been a key driver in the growth of the organic food market. According to a World Bank report in 2023, the growing awareness of diet-related illnesses such as diabetes and heart disease has led more people to seek out healthier alternatives. Vietnam saw a 15% increase in cases of non-communicable diseases over the last five years, pushing consumers towards organic products that are perceived to have fewer chemicals and pesticides. This shift is bolstered by government-led public health campaigns advocating for better nutrition.

- Increasing Disposable Income: With Vietnam's GDP per capita increasing from $2,800 in 2018 to $4,200 in 2024 (World Bank), higher disposable incomes have enabled consumers to spend more on premium organic products. The rise in middle-class households, which is expected to reach 35 million by 2025, is further accelerating demand for organic foods. This increasing financial capacity, combined with a preference for healthier and safer food, is driving market expansion. Moreover, as families spend more on groceries, organic products are becoming a staple in urban areas like Ho Chi Minh City and Hanoi.

- Sustainable Farming Practices: Sustainability is becoming a growth factor in Vietnam's organic food market. According to the World Bank, around 30% of Vietnam's land is currently under sustainable agricultural practices, with organic farming playing a crucial role in reducing greenhouse gas emissions. Organic farms, which utilize fewer chemical fertilizers and pesticides, have been shown to reduce emissions by nearly 30% compared to conventional farms. Additionally, the government’s 2023 National Plan on Climate Change prioritizes sustainable agriculture, ensuring further development in this sector.

Vietnam Organic Food Market Challenges

- High Cost of Organic Products: The high cost of organic products in Vietnam remains a major barrier to wider market adoption. According to the Ministry of Industry and Trade, the average price of organic products is nearly 50% higher than conventional food, making it less accessible to a broader audience. This price disparity is driven by more labour-intensive farming methods and lower yield rates. As a result, only 20% of Vietnam’s population can afford to regularly purchase organic products, with most demand coming from affluent urban areas.

- Limited Availability and Supply Chain Issues: Supply chain inefficiencies continue to pose challenges for the organic food market in Vietnam. According to a report by Vietnam’s General Statistics Office (GSO), only 12% of organic food producers have a well-established supply chain. A lack of cold storage facilities and poor logistics infrastructure in rural areas lead to post-harvest losses, making it difficult to maintain consistent supply. In 2023, approximately 30% of organic produce was wasted due to transportation and storage issues, highlighting the need for investment in infrastructure.

Vietnam Organic Food Market Future Outlook

The Vietnam organic food market is expected to witness strong growth over the next five years, driven by increasing consumer demand for healthy and environmentally friendly products, government support for organic farming, and the expansion of distribution networks. Innovations in organic farming technology, such as precision agriculture and vertical farming, will further boost productivity and supply. As Vietnamese consumers become more educated about the benefits of organic products, demand for certified organic foods is anticipated to rise, particularly in urban centers.

Vietnam Organic Food Market Opportunities

- Expansion into E-commerce Channels: The rise of e-commerce platforms presents growth opportunities for Vietnam’s organic food market. According to the Ministry of Industry and Trade, Vietnam's e-commerce market reached $23 billion in 2023, with food and beverage sales accounting for a substantial portion of online transactions. Organic food brands are increasingly leveraging e-commerce to reach a broader audience, with sales on platforms like Tiki and Shopee growing by 18% year-on-year. This shift is helping companies overcome traditional supply chain challenges and directly reach health-conscious consumers.

- Growing Export Potential: Vietnam’s organic food sector is experiencing growing demand from international markets, especially in Europe and North America. In 2023, the country's organic exports reached $335 million, up from $250 million in 2020 (MARD). The rising global demand for organic products has encouraged Vietnamese farmers to adopt organic certification standards like USDA Organic and EU Organic, enhancing their competitiveness abroad. Additionally, trade agreements like the EU-Vietnam Free Trade Agreement (EVFTA) are expected to further boost export potential by reducing tariffs on organic food products.

Scope of the Report

| Product Type |

Organic Fruits and Vegetables Organic Meat and Poultry Organic Dairy Products Organic Processed Foods Organic Beverages |

| Distribution Channel |

Supermarkets/Hypermarkets Specialty Organic Stores Online Retail, Direct Sales |

| End Consumer |

Household Consumers Institutional Buyers |

| Certification Type |

Vietnam National Organic Certification International Certifications |

| Region |

Northern Vietnam Central Vietnam Southern Vietnam |

Products

Key Target Audience

Organic Food Producers

Retail Chains (Supermarkets and Specialty Organic Stores)

Online Retail Platforms

Banks and Financial Institutions

Institutional Buyers (Hotels, Restaurants)

Agricultural Cooperatives

Investment and Venture Capitalist Firms

Government and Regulatory Bodies (Vietnam Ministry of Agriculture and Rural Development)

Organic Certification Agencies

Companies

Major Players

Vinamilk

TH True Milk

Organica

Dabaco Group

Quang Thanh Organic

GreenFarm Vietnam

Phuc Linh Organic

True Organic Vietnam

Greeny Vietnam

Unifarm

Ladophar JSC

EcoFarms

BigGreen Vietnam

Highland Farm

Truong Sa Organic

Table of Contents

1. Vietnam Organic Food Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Organic Certification Landscape

2. Vietnam Organic Food Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Vietnam Organic Food Market Analysis

3.1. Growth Drivers

3.1.1. Rising Health Consciousness

3.1.2. Increasing Disposable Income

3.1.3. Government Support for Organic Farming

3.1.4. Sustainable Farming Practices

3.2. Market Challenges

3.2.1. High Cost of Organic Products

3.2.2. Limited Availability and Supply Chain Issues

3.2.3. Consumer Mistrust in Organic Certification

3.3. Opportunities

3.3.1. Expansion into E-commerce Channels

3.3.2. Growing Export Potential

3.3.3. Innovations in Organic Food Processing

3.4. Trends

3.4.1. Adoption of Technology in Organic Farming

3.4.2. Increasing Vegan and Vegetarian Consumption

3.4.3. Demand for Organic Processed Foods

3.5. Government Regulations

3.5.1. Vietnam Organic Agriculture Standards (TCVN 11041)

3.5.2. Subsidies and Incentives for Organic Farmers

3.5.3. ASEAN Organic Certification Harmonization

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Farmers, Distributors, Retailers, and Certifying Bodies)

3.8. Porter’s Five Forces Analysis

3.9. Competition Ecosystem

4. Vietnam Organic Food Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Organic Fruits and Vegetables

4.1.2. Organic Meat and Poultry

4.1.3. Organic Dairy Products

4.1.4. Organic Processed Foods

4.1.5. Organic Beverages

4.2. By Distribution Channel (In Value %)

4.2.1. Supermarkets/Hypermarkets

4.2.2. Specialty Organic Stores

4.2.3. Online Retail

4.2.4. Direct Sales

4.3. By End Consumer (In Value %)

4.3.1. Household Consumers

4.3.2. Institutional Buyers (Restaurants, Hotels, Catering)

4.4. By Certification Type (In Value %)

4.4.1. Vietnam National Organic Certification

4.4.2. International Certifications (USDA, EU Organic, JAS)

4.5. By Region (In Value %)

4.5.1. Northern Vietnam

4.5.2. Central Vietnam

4.5.3. Southern Vietnam

5. Vietnam Organic Food Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Vinamilk

5.1.2. TH True Milk

5.1.3. Organica

5.1.4. Vietnam Organic Food Co. Ltd.

5.1.5. Dabaco Group

5.1.6. Quang Thanh Organic Farm

5.1.7. GreenFarm Vietnam

5.1.8. Phuc Linh Organic

5.1.9. True Organic Vietnam

5.1.10. Greeny Vietnam

5.1.11. Unifarm

5.1.12. Ladophar JSC

5.1.13. EcoFarms

5.1.14. BigGreen Vietnam

5.1.15. Highland Farm

5.2. Cross Comparison Parameters

(Number of Employees, Headquarters, Revenue, Inception Year, Product Offerings, Market Share, Export Share, R&D Investment)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Product Launches, Certifications)

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Government Grants for Organic Farming

5.8. Private Equity and Venture Capital Funding

6. Vietnam Organic Food Market Regulatory Framework

6.1. Organic Certification Process

6.2. Compliance with International Standards

6.3. Import/Export Regulations

6.4. Labelling and Packaging Standards

7. Vietnam Organic Food Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Growth

8. Vietnam Organic Food Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Distribution Channel (In Value %)

8.3. By End Consumer (In Value %)

8.4. By Certification Type (In Value %)

8.5. By Region (In Value %)

9. Vietnam Organic Food Market Analyst’s Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Segmentation and Marketing Initiatives

9.3. White Space Opportunities in the Market

Research Methodology

Step 1: Identification of Key Variables

The initial step involved identifying key stakeholders in the Vietnam organic food market through comprehensive desk research. Various primary and secondary sources, including industry databases, government reports, and proprietary sources, were used to map the market's ecosystem and define key variables impacting market growth.

Step 2: Market Analysis and Construction

Data on the historical growth of the organic food market was collected and analyzed. Key metrics, such as consumer preferences, sales channels, and product trends, were evaluated to determine the revenue generated and the expansion of the market across various segments.

Step 3: Hypothesis Validation and Expert Consultation

Market assumptions were validated by consulting organic food producers, distributors, and retailers through structured interviews. These consultations provided first-hand insights into market dynamics and consumer behaviour, helping to refine the market projections.

Step 4: Research Synthesis and Final Output

After validating the data, a detailed synthesis was conducted to produce final insights. Cross-referencing information from primary interviews and secondary sources ensured accuracy in the market projections and segment-level analysis.

Frequently Asked Questions

01. How big is the Vietnam Organic Food Market?

The Vietnam organic food market is valued at USD 100 million, driven by increasing consumer demand for healthy and environmentally friendly products.

02. What are the challenges in the Vietnam Organic Food Market?

Challenges in the Vietnam organic food market include the high cost of organic products, limited availability in rural areas, and consumer mistrust in organic certification processes.

03. Who are the major players in the Vietnam Organic Food Market?

Major players in the Vietnam organic food market include Vinamilk, TH True Milk, Organica, Dabaco Group, and Quang Thanh Organic, known for their strong supply chains and certified organic products.

04. What are the growth drivers of the Vietnam Organic Food Market?

Vietnam's organic food market growth is propelled by rising health consciousness, government support for organic farming, and the expansion of modern retail outlets.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.