Vietnam Paper Packaging Market Outlook to 2030

Region:Asia

Author(s):Mukul

Product Code:KROD8124

October 2024

83

About the Report

Vietnam Paper Packaging Market Overview

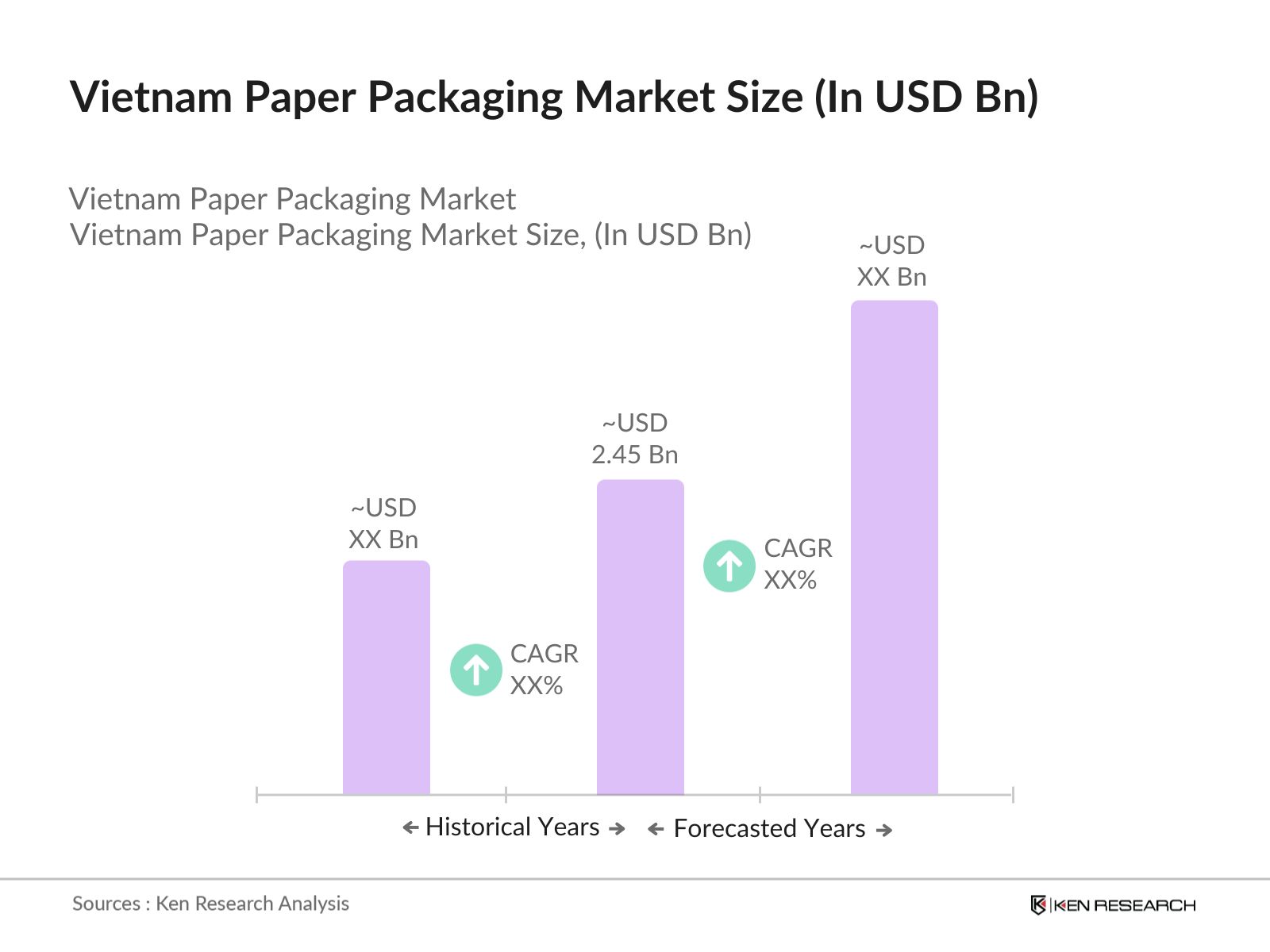

- The Vietnam paper packaging market is valued at USD 2.45 billion, based on a five-year historical analysis. This market is primarily driven by the increasing demand for sustainable packaging solutions, spurred by rising consumer awareness regarding environmental issues. Government regulations on reducing plastic usage have pushed industries like food and beverages, pharmaceuticals, and personal care to shift towards eco-friendly alternatives such as paper packaging. Additionally, the robust e-commerce sector is fueling the need for flexible and durable paper-based packaging, ensuring safe delivery of goods across the country.

- Ho Chi Minh City and Hanoi are the dominant cities in the Vietnam paper packaging market due to their higher concentration of industrial activity and consumption. These cities have the largest manufacturing hubs and are home to major export-oriented industries, making them key demand centers for packaging materials. Additionally, the rapid growth of e-commerce in these urban areas has accelerated the need for high-quality paper packaging solutions, thus strengthening their dominant position.

- The Ministry of Industry and Trade has established stringent packaging standards to promote sustainable and eco-friendly practices. As of 2023, these standards mandate that packaging must comply with certain environmental criteria, including the use of recyclable and biodegradable materials. These regulations have spurred innovation in paper packaging, with businesses increasingly adopting sustainable materials to meet government requirements and align with international trade standards.

Vietnam Paper Packaging Market Segmentation

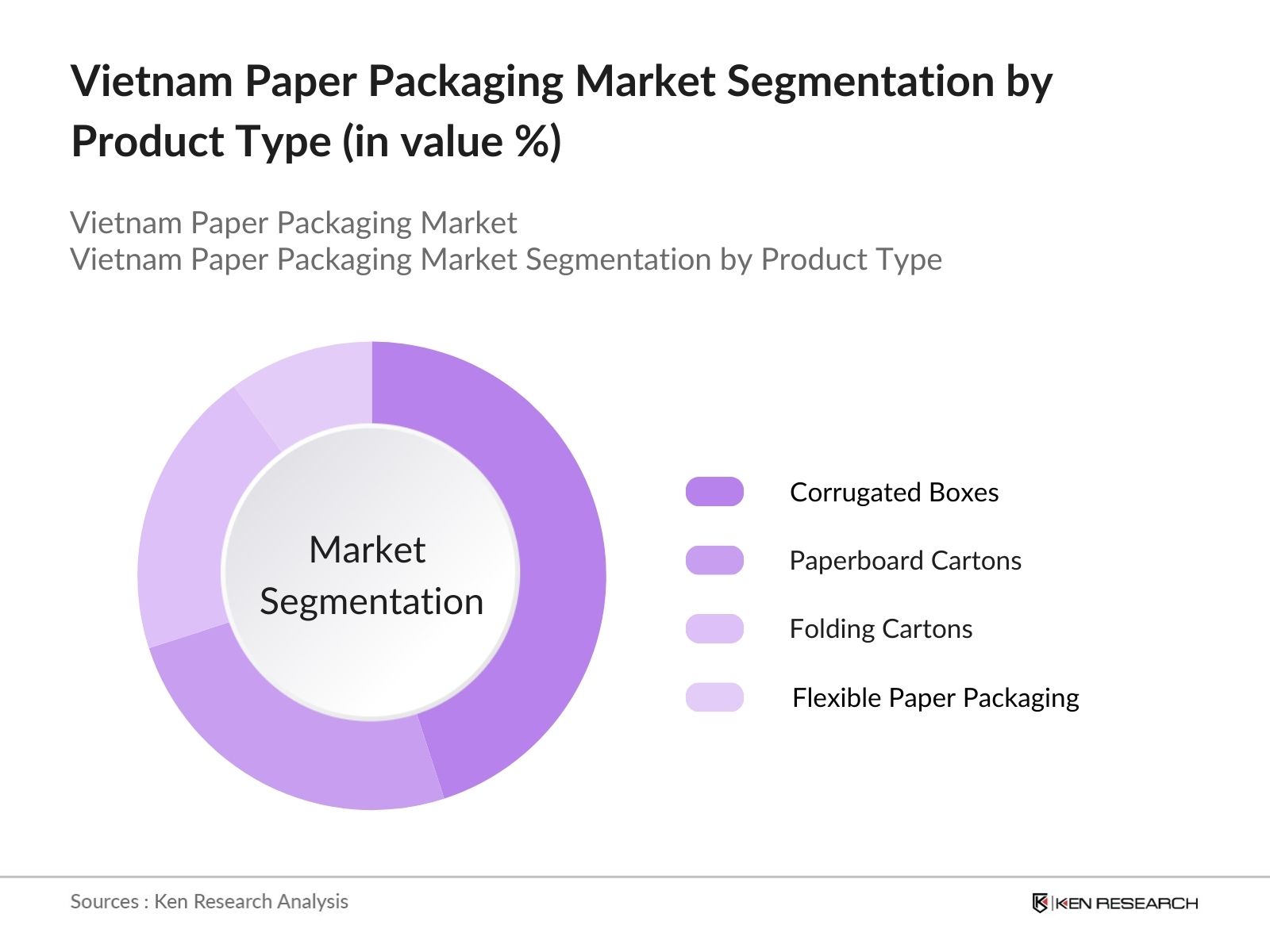

- By Product Type: Vietnam's paper packaging market is segmented by product type into corrugated boxes, paperboard cartons, folding cartons, flexible paper packaging, and liquid packaging cartons. Recently, corrugated boxes have a dominant market share under this segmentation due to their versatility and durability. The increasing demand for online shopping, particularly from e-commerce giants like Shopee and Lazada, has heightened the need for corrugated packaging to safely ship various goods. Additionally, their recyclable nature aligns with the countrys sustainability goals, making them a preferred choice across industries.

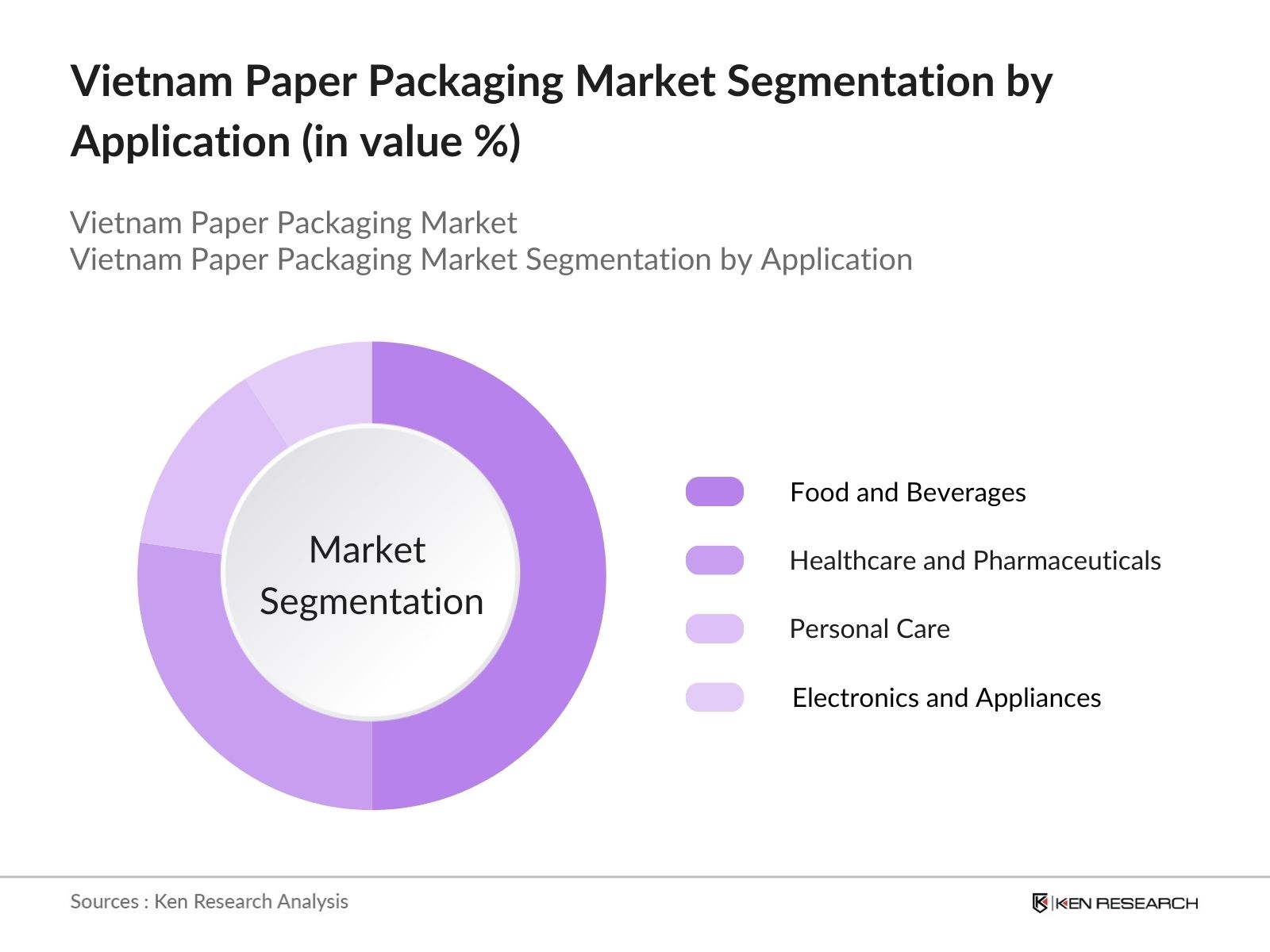

- By Application: The paper packaging market in Vietnam is segmented by application into food and beverages, healthcare and pharmaceuticals, personal care, electronics and appliances, and e-commerce and retail. The food and beverages sector dominates the market share in this segmentation. This is driven by the increasing need for safe, sustainable, and biodegradable packaging in food deliveries and retail products. Vietnam's rapidly growing food delivery services, especially in major cities, have led to heightened demand for durable and eco-friendly packaging solutions.

Vietnam Paper Packaging Market Competitive Landscape

The Vietnam paper packaging market is dominated by several local and global players who are setting industry standards through product innovation and sustainability initiatives. These players are strategically investing in capacity expansion and technology upgrades to enhance their market presence.

|

Company Name |

Establishment Year |

Headquarters |

Production Capacity |

Geographical Reach |

Sustainability Initiatives |

Major Product Lines |

Revenue (USD Mn) |

Employees |

Key Clients |

|

SCG Packaging Public Company |

1913 |

Bangkok, Thailand |

|||||||

|

Tetra Pak Vietnam |

1951 |

Lausanne, Switzerland |

|||||||

|

Dong Hai Ben Tre JSC |

1994 |

Ben Tre, Vietnam |

|||||||

|

Vina Kraft Paper Co., Ltd |

1996 |

Ho Chi Minh City, VN |

|||||||

|

Mondi Group |

1967 |

London, UK |

Vietnam Paper Packaging Industry Analysis

Market Growth Drivers

- Increasing Demand for Sustainable Packaging: The global shift towards sustainable practices has driven demand for paper packaging in Vietnam. As of 2023, Vietnams paper industry has seen a surge in production, reaching over 5.6 million tons of paper, of which a significant portion is dedicated to packaging materials. Paper packaging is increasingly preferred due to its lower environmental impact and alignment with Vietnams efforts to reduce plastic usage. This aligns with Vietnams National Action Plan on Sustainable Production and Consumption (2021-2030), which supports eco-friendly packaging solutions.

- Growing E-commerce Sector and Delivery Services: Vietnams e-commerce market has witnessed exponential growth, with the sector generating more than $23 billion in 2023. This growth is directly linked to the rising need for packaging materials, particularly paper-based options, as e-commerce platforms like Shopee, Tiki, and Lazada rely heavily on sustainable packaging for delivery. The surge in online transactions, supported by the country's internet penetration rate of 72%, is a key driver for the increased demand for paper packaging.

- Government Policies on Reducing Plastic Usage: The Vietnamese government has implemented stringent regulations to curb plastic waste. According to the Prime Ministers Decision No. 1316/QD-TTg in 2021, Vietnam aims to reduce plastic packaging waste by 75% by 2025This has encouraged businesses to transition towards paper packaging solutions. With the national agenda prioritizing environmentally friendly packaging, the demand for paper packaging products is forecasted to grow substantially through 2025.

Market Restraints

- Supply Chain and Logistics Challenges: Vietnams paper packaging market faces logistical challenges due to the fragmented nature of the supply chain. In 2023, Vietnam's Logistics Performance Index (LPI) ranked 39th globally, reflecting inefficiencies in transportation and distribution. These challenges are exacerbated by a lack of advanced infrastructure, increasing lead times, and disruptions in the supply of essential materials such as pulp. Despite improvements in port facilities, supply chain delays remain a critical issue for the growth of the paper packaging sector.

- Fluctuating Raw Material Costs: The volatility of raw material costs, particularly pulp and recycled paper, presents a significant challenge for the Vietnam paper packaging market. The global increase in pulp prices, combined with disruptions in the supply chain, caused fluctuations in raw material availability in 2023. Vietnam, which relies on imports for a substantial portion of its pulp, saw costs rise by approximately 12% compared to 2022. These price fluctuations strain profit margins for manufacturers and complicate pricing strategies for sustainable packaging solutions.

Vietnam Paper Packaging Market Future Outlook

Over the next five years, the Vietnam paper packaging market is expected to witness substantial growth driven by increased demand for sustainable packaging solutions across industries. This growth will be underpinned by the continued shift from plastic to paper packaging, accelerated by government regulations that restrict the use of single-use plastics. Furthermore, advancements in recycling technologies and the expansion of e-commerce will boost the demand for innovative and flexible paper packaging solutions, ensuring the market's steady rise in the near future.

Market Opportunities

- Advancements in Recycling and Circular Economy Initiatives: Vietnams commitment to a circular economy is evident in its recent recycling initiatives, with the country processing nearly 50% of its waste paper in 2023. The government's support for recycling innovations, such as advanced sorting and reprocessing facilities, presents a significant opportunity for the paper packaging industry to increase the use of recycled materials. This shift not only reduces reliance on virgin pulp but also aligns with Vietnam's sustainability goals under the National Action Plan on Circular Economy.

- Growth in Export Markets for Packaging Products: Vietnams export market for paper packaging is expanding, particularly to regional markets in ASEAN and beyond. In 2023, paper and packaging exports from Vietnam reached $3.4 billion, with a large portion destined for high-demand markets like Japan and South Korea. The favorable trade agreements between Vietnam and these countries, combined with competitive labor costs, make the country an attractive hub for packaging exports. This growing export potential provides a significant boost to the industrys future prospects.

Scope of the Report

|

By Product Type |

Corrugated Boxes, Paperboard Cartons, Folding Cartons, Flexible Paper Packaging, Liquid Packaging Cartons |

|

By Application |

Food and Beverages, Healthcare and Pharmaceuticals, Personal Care, Electronics and Appliances, E-commerce and Retail |

|

By Material Type |

Virgin Pulp Paper, Recycled Paper, Coated Paper, Uncoated Paper |

|

By Packaging Type |

Rigid Packaging, Flexible Packaging, Folding Packaging |

|

By Region |

Northern Vietnam, Central Vietnam, Southern Vietnam |

Products

Key Target Audience

Packaging Manufacturers

Food and Beverage Industry

Healthcare and Pharmaceuticals

E-commerce Companies

Electronics and Appliance Retailers

Government and Regulatory Bodies (Vietnam Ministry of Industry and Trade)

Investors and Venture Capitalist Firms

Retail and Wholesale Distributors

Companies

Players Mentioned in the Report:

SCG Packaging Public Company Limited

Tetra Pak Vietnam

Dong Hai Ben Tre JSC

Vina Kraft Paper Co., Ltd

Mondi Group

Rengo Co., Ltd

Lee & Man Paper Manufacturing Vietnam

Nine Dragons Paper Industries Vietnam Co., Ltd

Saigon Paper Corporation

Thai Paper Company Ltd.

Kraft of Asia Paperboard & Packaging Co., Ltd

WestRock Company

International Paper Co.

Visy Industries

Nippon Paper Group

Table of Contents

1. Vietnam Paper Packaging Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Vietnam Paper Packaging Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Vietnam Paper Packaging Market Analysis

3.1. Growth Drivers (Sustainability, Rise in E-commerce, Government Policies)

3.1.1. Increasing Demand for Sustainable Packaging

3.1.2. Growing E-commerce Sector and Delivery Services

3.1.3. Government Policies on Reducing Plastic Usage

3.2. Market Challenges (Logistics, Raw Material Pricing, Technological Gaps)

3.2.1. Supply Chain and Logistics Challenges

3.2.2. Fluctuating Raw Material Costs (Pulp and Recycled Paper)

3.2.3. Technology Adoption and Automation Gaps

3.3. Opportunities (Recycling Innovations, Export Growth, Renewable Resources)

3.3.1. Advancements in Recycling and Circular Economy Initiatives

3.3.2. Growth in Export Markets for Packaging Products

3.3.3. Integration of Renewable and Bio-based Packaging Materials

3.4. Trends (Eco-friendly Packaging, Smart Packaging)

3.4.1. Increasing Demand for Eco-friendly and Biodegradable Packaging

3.4.2. Emergence of Smart Packaging for Food and Beverage Industry

3.4.3. Digital Printing for Custom Packaging Solutions

3.5. Government Regulation (Packaging Standards, Environmental Policies)

3.5.1. Packaging Standards by the Ministry of Industry and Trade

3.5.2. Circular Economy and Green Growth Initiatives

3.5.3. Regulations on Reducing Plastic Waste and Promoting Paper Packaging

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. Vietnam Paper Packaging Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Corrugated Boxes

4.1.2. Paperboard Cartons

4.1.3. Folding Cartons

4.1.4. Flexible Paper Packaging

4.1.5. Liquid Packaging Cartons

4.2. By Application (In Value %)

4.2.1. Food and Beverages

4.2.2. Healthcare and Pharmaceuticals

4.2.3. Personal Care

4.2.4. Electronics and Appliances

4.2.5. E-commerce and Retail

4.3. By Material Type (In Value %)

4.3.1. Virgin Pulp Paper

4.3.2. Recycled Paper

4.3.3. Coated Paper

4.3.4. Uncoated Paper

4.4. By Packaging Type (In Value %)

4.4.1. Rigid Packaging

4.4.2. Flexible Packaging

4.4.3. Folding Packaging

4.5. By Region (In Value %)

4.5.1. Northern Vietnam

4.5.2. Central Vietnam

4.5.3. Southern Vietnam

5. Vietnam Paper Packaging Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. SCG Packaging Public Company Limited

5.1.2. Dong Hai Ben Tre JSC

5.1.3. Kraft of Asia Paperboard & Packaging Co., Ltd

5.1.4. Tetra Pak Vietnam

5.1.5. Saigon Paper Corporation

5.1.6. Nine Dragons Paper Industries Vietnam Co., Ltd

5.1.7. Rengo Co., Ltd

5.1.8. Thai Paper Company Ltd.

5.1.9. Lee & Man Paper Manufacturing Vietnam

5.1.10. Vina Kraft Paper Co., Ltd

5.1.11. Mondi Group

5.1.12. Nippon Paper Group

5.1.13. International Paper Co.

5.1.14. Visy Industries

5.1.15. WestRock Company

5.2. Cross Comparison Parameters (Production Capacity, Geographical Reach, Sustainability Initiatives, Inception Year, Revenue, Employees, Headquarters, Product Portfolio)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Joint Ventures, Collaborations, Expansion Plans)

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital and Private Equity Funding

5.8. Government Grants and Support

6. Vietnam Paper Packaging Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements for Packaging Materials

6.3. Certification Processes for Sustainable Packaging

7. Vietnam Paper Packaging Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Vietnam Paper Packaging Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By Material Type (In Value %)

8.4. By Packaging Type (In Value %)

8.5. By Region (In Value %)

9. Vietnam Paper Packaging Market Analysts' Recommendations 9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The first step involves mapping the stakeholder ecosystem of the Vietnam Paper Packaging Market, including manufacturers, suppliers, and consumers. Secondary data from trusted sources like industry reports and government databases is utilized to define key market variables such as product type, application, and market size.

Step 2: Market Analysis and Construction

In this phase, historical data on paper packaging production, demand, and application sectors is gathered and analyzed. This includes assessing the volume of products sold in key application sectors like food and beverages, e-commerce, and pharmaceuticals. A thorough analysis of production capacity and consumption patterns helps to generate accurate market estimates.

Step 3: Hypothesis Validation and Expert Consultation

To validate market estimates and hypotheses, consultations with industry experts are conducted. These consultations are carried out via interviews with professionals from the leading paper packaging companies operating in Vietnam. Their insights help verify the trends and data accuracy observed during secondary research.

Step 4: Research Synthesis and Final Output

Finally, direct interaction with key stakeholders such as manufacturers and suppliers provides a deeper understanding of market performance, trends, and projections. These insights are synthesized into a final, accurate market report.

Frequently Asked Questions

01. How big is the Vietnam Paper Packaging Market?

The Vietnam paper packaging market is valued at USD 2.45 billion, driven by the rising demand for sustainable packaging solutions, especially in the food, beverage, and e-commerce sectors.

02. What are the challenges in the Vietnam Paper Packaging Market?

Key challenges include fluctuating raw material costs, logistics and supply chain disruptions, and technological gaps in manufacturing. Additionally, high initial investments in technology can hinder small-scale manufacturers.

03. Who are the major players in the Vietnam Paper Packaging Market?

Major players in the market include SCG Packaging Public Company Limited, Tetra Pak Vietnam, Dong Hai Ben Tre JSC, Vina Kraft Paper Co., Ltd, and Mondi Group. These companies dominate due to their advanced production capabilities and focus on sustainability.

04. What are the growth drivers of the Vietnam Paper Packaging Market?

The growth of this market is driven by increased demand for eco-friendly packaging, rising e-commerce activity, and governmental regulations aimed at reducing plastic usage in packaging solutions.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.