Vietnam Pet Food Market Outlook to 2030

Region:Asia

Author(s):Sanjeev

Product Code:KROD3905

November 2024

93

About the Report

Vietnam Pet Food Market Overview

- The Vietnam Pet Food Market is valued at USD 125 million, driven by the rising number of pet owners and increasing disposable incomes, particularly in urban areas. The market is also influenced by a growing trend towards pet humanization, where pets are treated as family members, prompting a higher spend on premium, nutritious, and specialized pet food products. According to industry sources like the World Bank and local government data, these factors have contributed to steady market growth.

- The Vietnam Pet Food Market is primarily dominated by urban centers such as Ho Chi Minh City and Hanoi. These cities boast a higher concentration of middle-class families with disposable income, fueling the demand for premium pet food products. The rapid urbanization in these areas has led to increased pet ownership, with more consumers looking for convenient, high-quality pet food. Industry sources highlight the modern retail infrastructure in these cities as a significant factor enabling easy access to diverse pet food products.

- Vietnams food safety regulations for pet food are still in development, with the Ministry of Agriculture and Rural Development leading efforts to establish clearer standards. As of 2024, the government has implemented basic quality control measures, but there is no dedicated regulatory framework specific to pet food safety. However, imported pet food products are required to meet certain hygiene and quality standards, particularly those from the European Union and the United States.

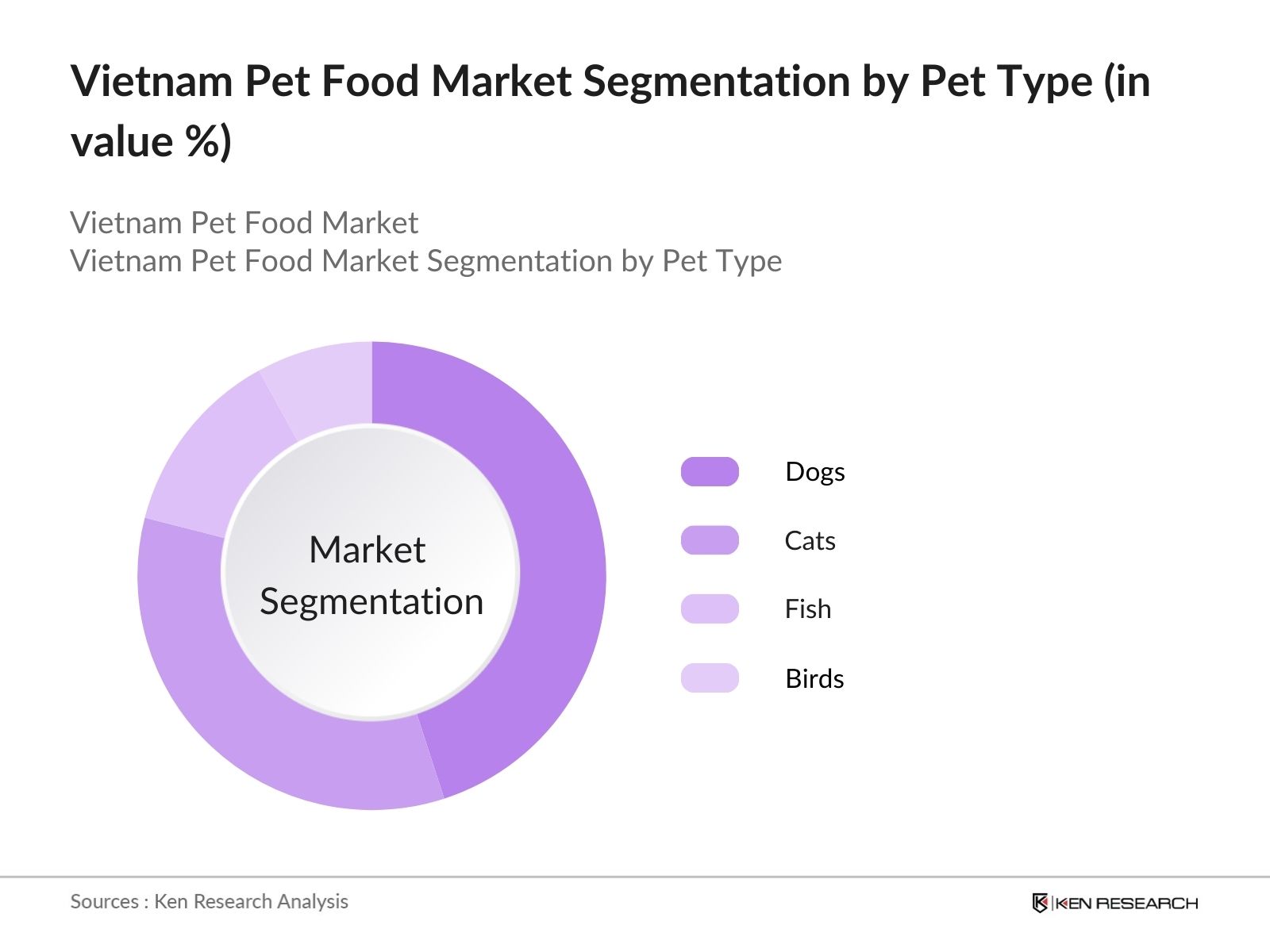

Vietnam Pet Food Market Segmentation

- By Pet Type: The market is segmented by pet type into dogs, cats, fish, and birds. Dog food currently dominates the market. This is attributed to the growing number of households adopting dogs, especially in urban areas, where pet ownership has seen significant growth. Dog owners are increasingly aware of the benefits of specialized and premium dog food, further driving the demand for this segment. The convenience of dry dog food and the variety of options available in the market make this the top choice for dog owners.

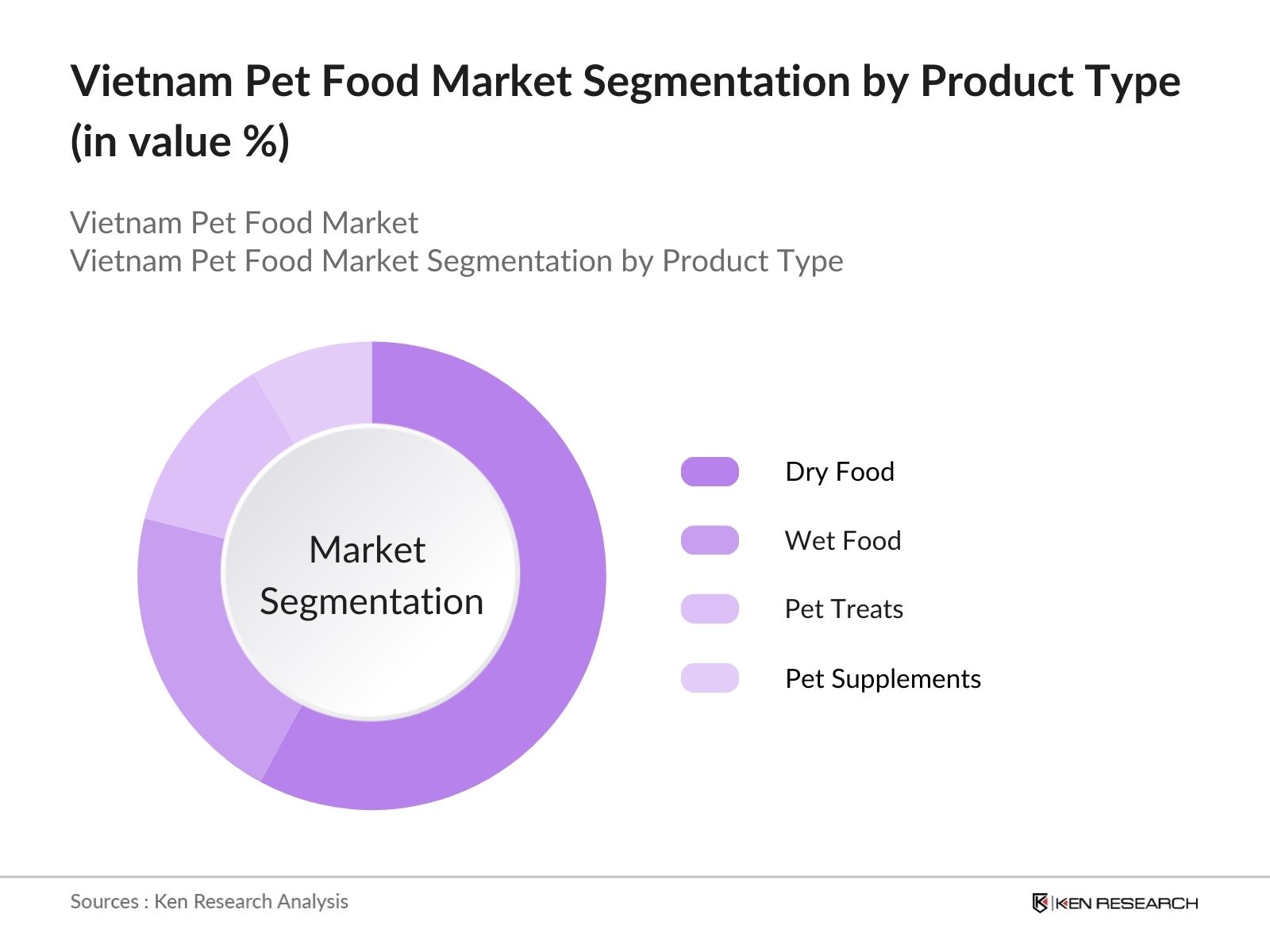

- By Product Type: The market is also segmented by product type into dry food, wet food, pet treats, pet supplements, and raw and frozen food. Dry food holds the largest share due to its cost-effectiveness, long shelf life, and ease of storage. Pet owners prefer dry food as it is more affordable, convenient, and widely available across various retail channels. This segment is particularly popular among working pet owners who seek convenience without compromising on their pets' nutrition.

Vietnam Pet Food Market Competitive Landscape

The Vietnam Pet Food Market is highly competitive, with both multinational corporations and local manufacturers vying for market share. Major players focus on product innovation, expanding distribution networks, and forming strategic partnerships to strengthen their market positions. The market is dominated by global giants such as Mars and Nestl Purina, while local brands also play a critical role in providing affordable options for lower-income consumers.

|

Company Name |

Establishment Year |

Headquarters |

Revenue (2023) |

Number of Employees |

Product Innovation |

|

Mars, Incorporated |

1911 |

McLean, Virginia, USA |

|||

|

Nestl Purina PetCare |

1894 |

St. Louis, Missouri, USA |

|||

|

Royal Canin |

1968 |

Aimargues, France |

|||

|

SmartHeart (Perfect Companion) |

1987 |

Bangkok, Thailand |

|||

|

Cargill Inc. |

1865 |

Minneapolis, Minnesota, USA |

Vietnam Pet Food Industry Analysis

Market Growth Drivers:

- Increasing Pet Ownership (Urban and Rural Areas): The pet ownership rate in Vietnam has steadily increased due to rising living standards and evolving perceptions of pets as companions rather than mere animals. In 2024, Vietnams urban pet ownership was reported at 17 million dogs and cats, particularly driven by young professionals and families in cities like Ho Chi Minh City and Hanoi. Rural areas, traditionally less inclined towards pet ownership, are also seeing growth, with over 9 million households in semi-urban and rural areas now owning pets as of 2024, marking a shift in lifestyle and societal values.

- Urbanization and Nuclear Families: Vietnams rapid urbanization, with 40% of its population now residing in urban areas as of 2024, has led to changes in family structures, with nuclear families becoming the norm. This urban shift, alongside a national GDP per capita of approximately $4,100 in 2024, has contributed to more households seeking pets for companionship. The rise of high-density residential living has further facilitated the demand for smaller pets, particularly cats and small dog breeds, which fit well within urban family dynamics.

- Rising Disposable Income (Per Capita Spend on Pets): As of 2024, Vietnams per capita disposable income is approximately $3,500 annually, reflecting a steady economic improvement. Higher disposable incomes allow households to allocate more funds towards discretionary spending, including pet care. This trend is particularly evident in Vietnams top-tier cities, where average household spending on pets has increased by $100 in the past three years, with a growing portion allocated to premium pet food and health services. Source: International Monetary Fund, 2024.

Market Challenges

- High Price Sensitivity in Middle- and Lower-Income Groups: Despite rising disposable incomes, a significant portion of Vietnam's population, especially in rural and lower-income urban areas, remains highly price-sensitive. Consumers in these income brackets often opt for lower-cost or homemade pet food alternatives, which limits the market penetration of premium pet food brands.

- Distribution Complexities in Rural Areas: Vietnams rural areas face significant distribution challenges for pet food products. The countrys complex geography and underdeveloped infrastructure make it difficult for companies to maintain an efficient supply chain, limiting access to premium pet food and forcing many rural pet owners to rely on local or unbranded products.

- Lack of Standardized Regulations: The pet food market in Vietnam is subject to inconsistent regulations, particularly in terms of safety and quality standards. There is currently no unified national policy governing pet food production and distribution, leading to variability in product quality and making it difficult for international brands to establish trust among local consumers.

Vietnam Pet Food Market Future Outlook

Over the next five years, the Vietnam Pet Food Market is expected to witness steady growth. This expansion will be driven by the rising trend of pet humanization, increasing awareness about pet nutrition, and the growing influence of Western pet care practices. The proliferation of e-commerce platforms offering a wide range of pet food products is also anticipated to contribute to market growth, allowing pet owners greater access to both local and international brands. Additionally, as disposable incomes rise, the demand for premium pet food is expected to increase further.

Market Opportunities

- Growth of E-commerce Platforms for Pet Food Sales: Vietnams booming e-commerce sector, valued at USD 20 billion in 2024, has created significant opportunities for pet food companies to expand their reach. Pet food sales on platforms such as Shopee, Tiki, and Lazada have grown exponentially, with over 5 million online transactions for pet-related products in 2023. This growth is expected to continue, driven by Vietnams high internet penetration (70% of the population) and the convenience of online shopping for consumers, especially in urban areas. Source: Ministry of Industry and Trade, 2024.

- Increasing Demand for Functional and Organic Pet Food: As of 2024, demand for functional and organic pet food has surged, particularly among younger, health-conscious pet owners. Around 20% of pet owners in major cities reported purchasing organic or functional pet food products, which are formulated to address specific health concerns such as joint health or digestive issues. This trend aligns with Vietnams growing organic food market for humans, where consumers prioritize natural ingredients and sustainability, extending similar preferences to their pets diets. Source: Ministry of Health, 2024.

Scope of the Report

|

By Pet Type |

Dogs Cats Fish Birds |

|

By Product Type |

Dry Food Wet Food Pet Treats Pet Supplements Raw and Frozen Food |

|

By Distribution Channel |

Supermarkets and Hypermarkets Specialty Stores E-commerce Veterinary Clinics Pet Shops |

|

By Pricing |

Premium Pet Food Mid-Range Pet Food Economy Pet Food |

|

By Region |

North East West South |

Products

Key Target Audience

Pet Food Manufacturers

Distributors and Retailers of Pet Food

E-commerce Platforms Specializing in Pet Products

Veterinary Clinics

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (Vietnam Ministry of Agriculture and Rural Development, Food Safety Administration)

Banks and Financial Institutes

Pet Specialty Stores

Pet Care Service Providers

Companies

List of Major Players in the Vietnam Pet Food Market

Mars, Incorporated

Nestl Purina PetCare

Royal Canin

SmartHeart (Perfect Companion Group)

Cargill Inc.

AAT Group (Anova)

CP Foods (Charoen Pokphand Group)

Hills Pet Nutrition

Nutreco N.V.

Whiskas Vietnam

Pedigree Vietnam

Diamond Pet Foods

Drools Vietnam

Perfect Fit Pet Food

Me-O (Perfect Companion Group)

Table of Contents

1. Vietnam Pet Food Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Vietnam Pet Food Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Vietnam Pet Food Market Analysis

3.1. Growth Drivers (Pet Ownership Rates, Urbanization, Changing Pet Care Trends, Premiumization)

3.1.1. Increasing Pet Ownership (Urban and Rural Areas)

3.1.2. Urbanization and Nuclear Families

3.1.3. Rising Disposable Income (Per Capita Spend on Pets)

3.1.4. Premiumization of Pet Food Products

3.2. Market Challenges (High Price Sensitivity, Distribution Complexity, Regulatory Barriers)

3.2.1. High Price Sensitivity in Middle- and Lower-Income Groups

3.2.2. Distribution Complexities in Rural Areas

3.2.3. Lack of Standardized Regulations

3.3. Opportunities (E-commerce Growth, Functional and Organic Pet Food Demand, Product Diversification)

3.3.1. Growth of E-commerce Platforms for Pet Food Sales

3.3.2. Increasing Demand for Functional and Organic Pet Food

3.3.3. Product Diversification in Pet Treats and Supplements

3.4. Trends (Humanization of Pets, Eco-friendly Packaging, Pet Supplements Growth)

3.4.1. Humanization of Pets Influencing Premium Food Choices

3.4.2. Adoption of Eco-friendly and Sustainable Packaging

3.4.3. Rising Popularity of Pet Supplements and Functional Nutrition

3.5. Government Regulations (Food Safety Standards, Import Tariffs, Labeling Requirements)

3.5.1. Food Safety and Quality Control Regulations

3.5.2. Import Tariffs and Trade Restrictions

3.5.3. Labeling and Advertising Guidelines for Pet Food

3.6. SWOT Analysis (Strengths, Weaknesses, Opportunities, Threats)

3.7. Stakeholder Ecosystem (Producers, Retailers, Distributors, Veterinarians)

3.8. Porters Five Forces (Competitive Landscape, Supplier and Buyer Power, Threats of New Entrants)

3.9. Competitive Ecosystem (Market Share, Key Players Market Positioning)

4. Vietnam Pet Food Market Segmentation

4.1. By Pet Type (In Value %)

4.1.1. Dogs

4.1.2. Cats

4.1.3. Fish

4.1.4. Birds

4.1.5. Other Small Pets

4.2. By Product Type (In Value %)

4.2.1. Dry Food

4.2.2. Wet Food

4.2.3. Pet Treats

4.2.4. Pet Supplements

4.2.5. Raw and Frozen Food

4.3. By Distribution Channel (In Value %)

4.3.1. Supermarkets and Hypermarkets

4.3.2. Specialty Stores

4.3.3. E-commerce

4.3.4. Veterinary Clinics

4.3.5. Pet Shops

4.4. By Pricing (In Value %)

4.4.1. Premium Pet Food

4.4.2. Mid-Range Pet Food

4.4.3. Economy Pet Food

4.5. By Region (In Value %)

4.5.1. North

4.5.2. West

4.5.3. South

4.5.4. East

5. Vietnam Pet Food Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Mars, Incorporated

5.1.2. Nestl Purina PetCare

5.1.3. Royal Canin

5.1.4. Pedigree Vietnam

5.1.5. SmartHeart (Perfect Companion Group)

5.1.6. Me-O (Perfect Companion Group)

5.1.7. AAT Group (Anova)

5.1.8. Cargill Inc.

5.1.9. CP Foods (Charoen Pokphand Group)

5.1.10. Diamond Pet Foods

5.1.11. Hills Pet Nutrition

5.1.12. Nutreco N.V.

5.1.13. Whiskas Vietnam

5.1.14. Pedigree Vietnam

5.1.15. Drools Vietnam

5.2. Cross Comparison Parameters (Market Presence, Product Portfolio, Revenue, Distribution Network, Product Innovation, Market Share, Regional Penetration, Pricing Strategy)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Vietnam Pet Food Market Regulatory Framework

6.1. Pet Food Safety Standards

6.2. Import and Export Regulations

6.3. Labeling and Packaging Requirements

7. Vietnam Pet Food Market Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Vietnam Pet Food Market Future Segmentation

8.1. By Pet Type (In Value %)

8.2. By Product Type (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By Pricing (In Value %)

8.5. By Region (In Value %)

9. Vietnam Pet Food Market Analysts' Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

This phase involves mapping key stakeholders within the Vietnam Pet Food Market. Extensive desk research is conducted to identify the critical factors affecting market dynamics, such as pet ownership trends and the rise of premium pet products.

Step 2: Market Analysis and Construction

In this step, historical data is collected and analyzed to construct a comprehensive view of the market. Data from credible sources such as government reports and industry associations is used to evaluate market size and growth.

Step 3: Hypothesis Validation and Expert Consultation

Interviews are conducted with industry experts, including manufacturers and distributors, to validate market hypotheses. These consultations provide real-time insights into market trends and operational challenges.

Step 4: Research Synthesis and Final Output

The final step involves synthesizing data from both desk research and expert interviews to produce a complete market report. The focus is on delivering accurate, actionable insights for industry players.

Frequently Asked Questions

01. How big is the Vietnam Pet Food Market?

The Vietnam Pet Food Market is valued at USD 125 million, driven by the increasing number of pet owners and the growing demand for premium pet food products, particularly in urban areas.

02. What are the challenges in the Vietnam Pet Food Market?

Key challenges include in Vietnam Pet Food market price sensitivity among lower-income consumers and the logistical difficulties of distributing pet food across Vietnams rural areas, which limits market penetration.

03. Who are the major players in the Vietnam Pet Food Market?

Major players in the Vietnam Pet Food market include Mars, Nestl Purina PetCare, Royal Canin, SmartHeart, and Cargill Inc. These companies dominate due to their strong product portfolios and extensive distribution networks.

04. What are the growth drivers of the Vietnam Pet Food Market?

The market is driven by increasing urbanization, rising disposable incomes, and the growing trend of pet humanization, which encourages owners to invest in high-quality pet food products.

05. Which product type dominates the Vietnam Pet Food Market?

Dry food dominates the Vietnam Pet Food market due to its affordability, long shelf life, and ease of storage, making it the preferred choice for many pet owners in Vietnam.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.