Vietnam Pineapple Market Outlook to 2030

Region:Asia

Author(s):Samanyu Maan

Product Code:KROD275

June 2024

100

About the Report

Vietnam Pineapple Market Overview

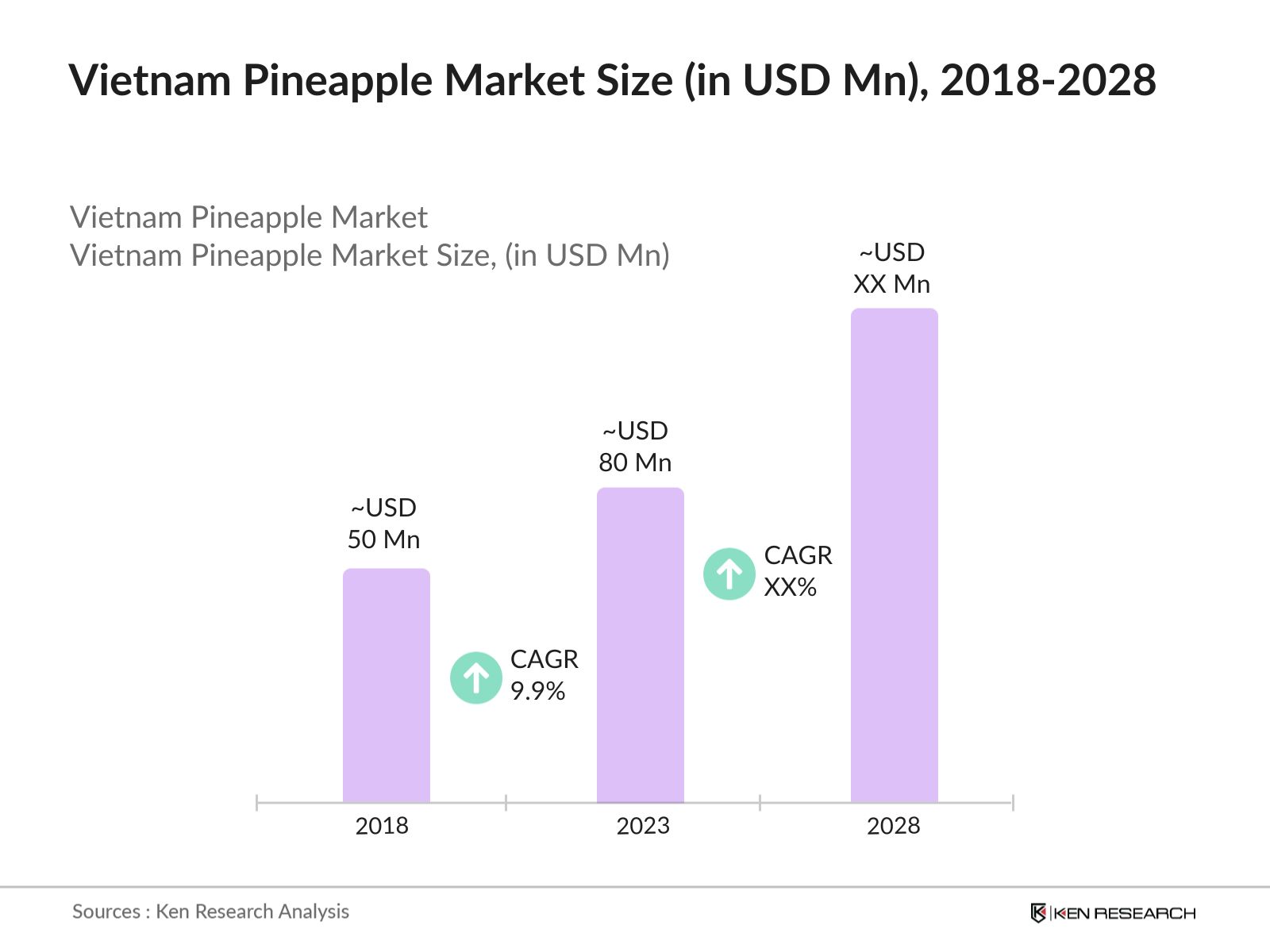

- The Vietnam pineapple market was valued at USD 80 Mn in 2023, driven by increasing domestic consumption and demand for export quality pineapples. In 2018, the market stood at USD 50 Mn, showcasing consistent growth fueled by improved farming techniques and government support.

- Key players like Doveco, Lavifood, and Nafoods Group dominate the market, leveraging extensive production capacities and distribution networks.

- Vietnam signed new export agreements with Japan in 2022, leading to a 15% increase in pineapple exports to the Japanese market by 2024. These agreements have opened new opportunities for Vietnamese pineapples, highlighting the country's growing prominence in the global fruit market.

Vietnam Pineapple Current Market Analysis

- The Vietnam pineapple market sees robust growth, driven by rising domestic demand and increased exports to key markets like the EU, USA, and Japan.

- The increasing demand for Vietnamese pineapples in international markets, especially in Europe and North America, has been a significant growth driver. In 2022, Vietnam exported over 100,000 tons of pineapples, marking a 20% increase from the previous year.

- Consumer preferences shift towards organic and non-GMO pineapples, reflecting health and environmental concerns. Convenience products like canned and pre-cut pineapples witness growing demand.

Vietnam Pineapple Market Segmentation

The Vietnam Pineapple Market can be segmented based on several factors:

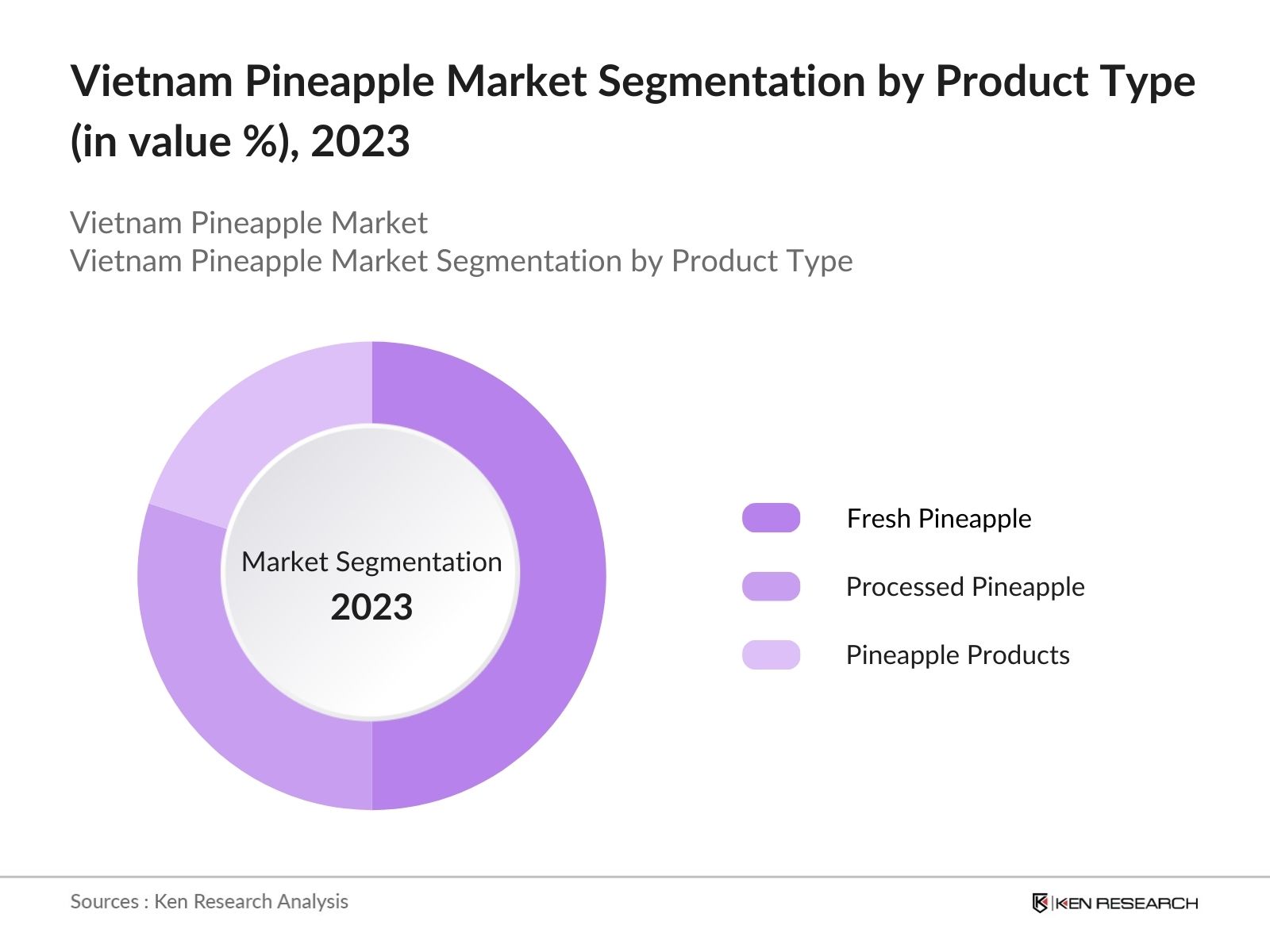

By Product Type: In 2023, the Vietnam Pineapple market is segmented into Fresh Pineapple, Processed Pineapple, Pineapple Products. Fresh pineapple commanded a substantial value percentage in the Vietnam market, driven by its versatility for direct consumption and culinary uses.

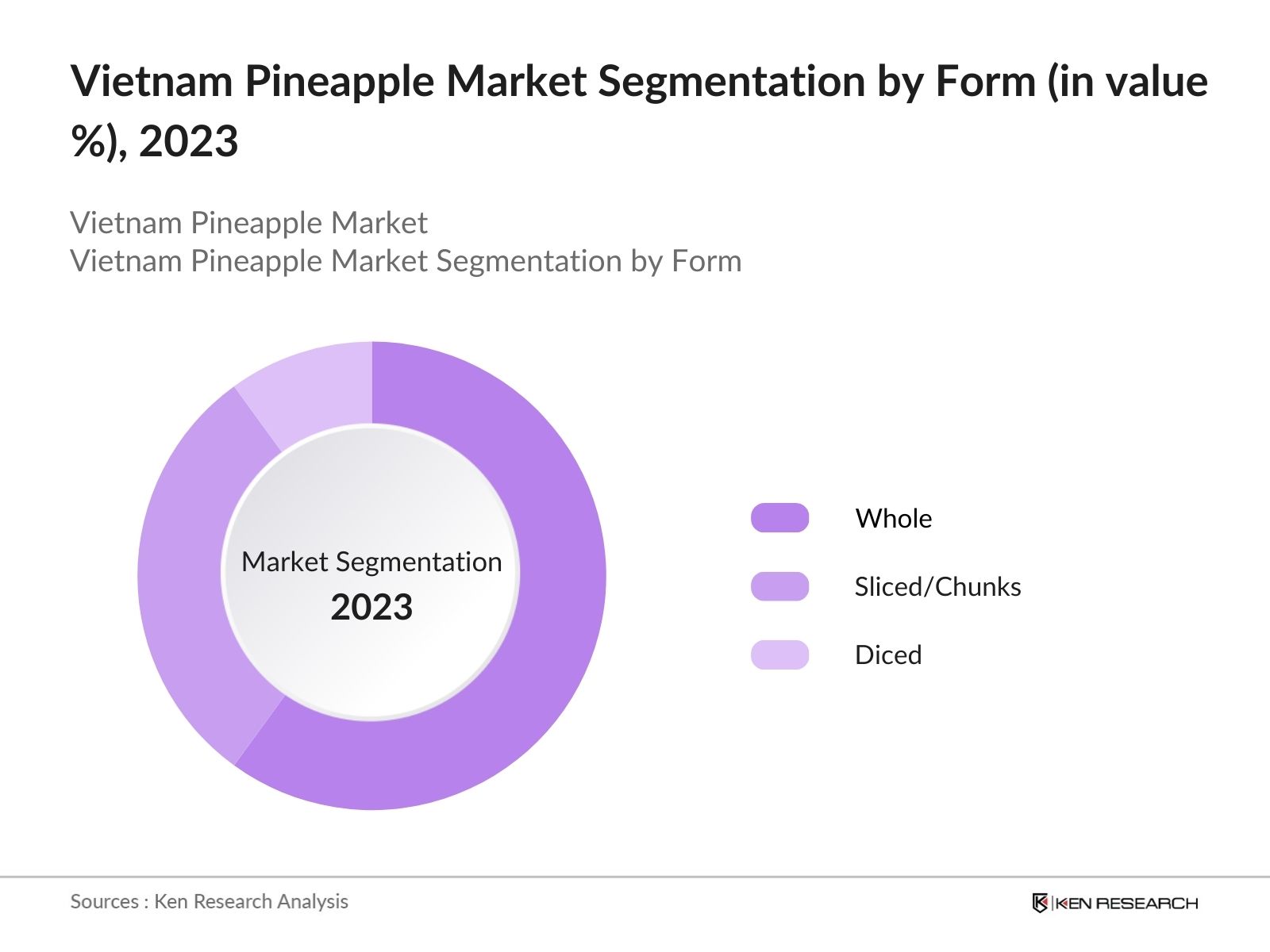

By Form: In 2023, In 2023, the Vietnam Pineapple market is segmented into Whole, Sliced/Chunks, Diced. The segmentation of the Vietnam pineapple market by form indicates that whole pineapples hold a significant value percentage. Preferred by households and the food service industry, whole pineapples offer flexibility in usage.

By Distribution Channel: In 2023, the Vietnam Pineapple market is segmented into Supermarkets/Hypermarkets, Online Retail, Specialty Stores. Supermarkets and hypermarkets dominated the Vietnam pineapple market in value offering a wide range of fresh and processed pineapple products. Online retail platforms also saw significant growth, catering to consumers' increasing preference for convenience.

Vietnam Pineapple Market Competitive Landscape

|

Company Name |

Establishment Year |

Headquarters |

|

Dong Giao Foodstuff Export JSC |

1955 |

Ninh Binh |

|

Vinamit Joint Stock Company |

1988 |

Ho Chi Minh City |

|

Nafoods Group |

1995 |

Nghe An |

|

LAVI Food |

2000 |

Long An |

|

Tien Giang Vegetexco |

1977 |

Tien Giang |

- Lavifood opened a new USD 60 million processing plant in Tay Ninh province in 2022, significantly increasing its capacity for processing pineapples and other fruits. In 2024, the plant processed over 150,000 metric tons of pineapples, enhancing the company's ability to meet export demand and maintain high product quality.

- Doveco, known for its extensive distribution network, plays a crucial role in making Vietnamese pineapples accessible globally. Doveco implemented sustainable farming practices in partnership with local farmers in 2021, resulting in increase in productivity.

- Nafoods Group's focus on organic and sustainable practices has made it a preferred supplier in health-conscious markets. In 2024, the company's organic pineapple exports increased by 20%, driven by the growing consumer preference for organic produce.

Vietnam Pineapple Industry Analysis

Vietnam Pineapple Market Growth Drivers:

- Increasing Export Demand: The demand for Vietnamese pineapples in international markets has surged, driven by favorable trade agreements and high-quality standards. In 2024, exports to Europe increased by 18%, supported by the EU-Vietnam Free Trade Agreement (EVFTA), and exports to the United States grew due to rising consumer demand for exotic fruits and health-conscious eating habits.

- Technological Advancements in Agriculture: The adoption of modern agricultural technologies, such as drip irrigation and precision farming, has improved pineapple yields and quality. In 2024, these advancements led to increase in yield per hectare, enhancing productivity and ensuring a consistent supply to meet growing demand.

- Health and Wellness Trends: Growing awareness of the health benefits associated with pineapple consumption has driven demand. In 2024 increase in preference for pineapples as a healthy snack, supported by public health campaigns emphasizing the nutritional benefits of fruits.

Vietnam Pineapple Market Challenge

- Climate Change and Weather Extremes: Vietnam's pineapple production is vulnerable to climate change, with extreme weather events impacting yields. In 2024, severe flooding in the Mekong Delta region led to a 10% decrease in production, posing a risk to supply stability and market stability.

- Pest and Disease Outbreaks: Pests and diseases, such as the pineapple mealybug, challenge cultivation. In 2024, mealybug outbreaks led to crop loss in key producing areas, highlighting the need for effective pest management strategies, which increase production costs.

- Infrastructure Deficiencies: Despite improvements, inadequate infrastructure remains a challenge, particularly in cold storage and transportation. In 2024, post-harvest losses due to inadequate cold storage facilities were estimated, affecting supply and quality.

Vietnam Pineapple Market Government Initiatives:

- National Agricultural Restructuring Plan (2017): This plan aims to enhance the efficiency and competitiveness of Vietnam's agricultural sector. By 2024, subsidies for farmers and investment in irrigation systems improved yields, supporting sustainable practices and boosting the pineapple industry.

- Green Agriculture Policy (2021): Introduced to promote sustainable farming, this policy provides incentives for organic farming. In 2024, the policy led to increase in organic pineapple production areas, including financial support for organic certification and eco-friendly farming inputs.

- Export Market Expansion Programs (2022): These programs aim to expand export markets for agricultural products. In 2024, new export agreements with Japan and South Korea led to a 12% increase in pineapple exports, supported by trade promotion activities and international quality standards.

Vietnam Pineapple Future Market Outlook

The Vietnam pineapple market is expected to show significant growth, driven by increasing demand for fresh and processed pineapples.

Future Market Trends

- Organic Pineapple Production: The trend towards organic farming will continue to grow, driven by demand for chemical-free produce. The area dedicated to organic pineapple farming is expected to increase by 25%, supported by higher market prices and sustainable agriculture practices

- Product Diversification: Companies will diversify their offerings to include pineapple-based snacks, beverages, and health supplements. New pineapple snack products, such as dried pineapple and pineapple chips, are projected to see increase in sales, meeting changing consumer preferences and enhancing profitability.

- Sustainable Packaging Solutions: The focus on sustainable packaging will increase to reduce environmental impact. Leading exporters are expected to adopt more biodegradable packaging materials, resulting in reduction in plastic use and appealing to environmentally conscious consumers.

Scope of the Report

|

By Product Type |

Fresh Pineapple Processed Pineapple Pineapple Products |

|

By Form |

Whole Sliced/Chunks Diced |

|

By Distribution Channel |

Supermarkets/Hypermarkets Online Retail Specialty Stores |

Products

Key Target Audience – Organizations and Entities Who Can Benefit by Subscribing this Report:

Pineapple Exporters and Importers

Food Processing Companies

Investor and Financial Institutions

Major Pineapple Retailers and Distributors

Agricultural Organizations

Government & Regulatory Bodies

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:Â

Doveco

Lavifood

Nafoods Group

Vinamit

Camau Agricultural Products

Phu Gia Food

Quang Minh Agriculture and Forestry

An Thinh

Minh Long Agricultural Products

Duyen Hai Trading & Investment

Vina T&T Group

Binh Minh Agriculture

P. Vietnam Corporation

An Phat Agricultural Products

South Can Tho Food Import Export Company

Table of Contents

Vietnam Pineapple Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

Vietnam Pineapple Market Size (In USD Billion)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

Vietnam Pineapple Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Domestic Consumption

3.1.2. Expansion of Export Markets

3.1.3. Government Support and Policies

3.1.4. Technological Advancements in Cultivation

3.2. Market Challenges

3.2.1. Fluctuating Global Prices

3.2.2. Climate Change and Environmental Factors

3.2.3. Supply Chain Inefficiencies

3.3. Opportunities

3.3.1. Value-Added Product Development

3.3.2. Organic and Sustainable Farming Practices

3.3.3. Penetration into Emerging Markets

3.4. Trends

3.4.1. Adoption of High-Yield Varieties

3.4.2. Integration of Digital Farming Techniques

3.4.3. Rise in Processed Pineapple Products

3.5. Government Regulations

3.5.1. Export Incentives

3.5.2. Quality Standards and Certifications

3.5.3. Subsidies for Farmers

3.5.4. Trade Agreements Impact

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porter’s Five Forces Analysis

3.9. Competitive Landscape

Vietnam Pineapple Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Fresh Pineapple

4.1.2. Canned Pineapple

4.1.3. Pineapple Juice

4.1.4. Dried Pineapple

4.1.5. Other Processed Products

4.2. By Form (In Value %)

4.2.1. Whole

4.2.2. Sliced/Chunks

4.2.3. Diced

4.3. By Distribution Channel (In Value %)

4.3.1. Supermarkets and Hypermarkets

4.3.2. Convenience Stores

4.3.3. Online Retail

4.3.4. Specialty Stores

4.3.5. Direct Sales

4.4. By Region (In Value %)

4.4.1. Northern

4.4.2. Central

4.4.3. Southern

4.4.4. Export Markets

Vietnam Pineapple Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Doveco

5.1.2. Nafoods Group

5.1.3. Lavifood

5.1.4. An Giang Fruit-Vegetables & Foodstuff JSC (Antesco)

5.1.5. Vinamit JSC

5.1.6. Hoang Anh Gia Lai Agricultural JSC

5.1.7. Dong Giao Foodstuff Export JSC

5.1.8. Vina T&T Group

5.1.9. Quang Ngai Sugar JSC

5.1.10. Hiep Thanh Seafood JSC

5.1.11. Ben Tre Import Export JSC

5.1.12. Long An Food Processing Export JSC

5.1.13. Sai Gon Food JSC

5.1.14. Tan Binh Import Export JSC

5.1.15. Thuan Phong Co., Ltd.

5.2. Cross Comparison Parameters (Revenue, Production Capacity, Market Share, Export Destinations, Product Portfolio, Certifications, Technological Adoption, Sustainability Initiatives)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.6.1. Venture Capital Funding

5.6.2. Government Grants

5.6.3. Private Equity Investments

Vietnam Pineapple Market Regulatory Framework

6.1. Agricultural Policies

6.2. Export Regulations

6.3. Quality Control Standards

6.4. Certification Processes

Vietnam Pineapple Market Future Outlook

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

Vietnam Pineapple Market Future Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By Region (In Value %)

8.5. By Cultivation Method (In Value %)

Vietnam Pineapple Market Analyst Recommendations

9.1. Total Addressable Market (TAM), Serviceable Available Market (SAM), and Serviceable Obtainable Market (SOM) Analysis

9.2. Customer Segmentation Analysis

9.3. Marketing and Distribution Strategies

9.4. Identification of Untapped Opportunities

Disclaimer Contact UsResearch Methodology

Step: 1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.Â

Step: 2 Market Building:

Collating statistics on Vietnam pineapple market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for Vietnam Pineapple Market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.Â

Step: 3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.Â

Step: 3 Research Output:

Our team will approach multiple pineapple supplier and distributors companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from pineapple supplier and distributors companies.

Frequently Asked Questions

1. How big is the Vietnam Pineapple Market?

The Vietnam Pineapple Market was valued at USD 80 Bn in 2023 driven by increasing domestic consumption and demand for export quality pineapples.

2. What are the key challenges faced in Vietnam Pineapple Market?

The key challenges faced in Vietnam Pineapple Market are weather dependence, infrastructure limitations and price volatility.

3. Who are some of the major players in the Vietnam Pineapple Market?

Some of the major players in the Vietnam Pineapple Market include Doveco, Lavifood, and Nafoods Group.

4. What are the factors driving Vietnam Pineapple market?

Market growth is driven by favorable climatic conditions, government incentives for exports, and increasing popularity of pineapple-based products.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.