Vietnam Prefabricated Construction Market Outlook 2030

Region:Global

Author(s):Shivani Mehra

Product Code:KROD2839

December 2024

98

About the Report

Vietnam Prefabricated Construction Market Overview

- The Vietnam Prefabricated Construction market is valued at USD 4.70 billion, reflecting a strong growth trajectory driven by increasing urbanization and the need for sustainable building practices. The rising demand for cost-effective and efficient construction methods, alongside government support for infrastructure development, contributes significantly to this market growth. Prefabricated construction offers reduced construction times and labor costs, making it an attractive option for developers and contractors.

- Key cities such as Ho Chi Minh City, Hanoi, and Da Nang dominate the prefabricated construction landscape. Ho Chi Minh City, as the economic hub, sees substantial investment in infrastructure and residential projects. Hanoi's growing population and urban sprawl also create a demand for prefabricated solutions, while Da Nang's focus on tourism and urban development adds to the market's expansion. The convergence of urbanization and government policies promotes a conducive environment for prefabricated construction in these regions.

- Vietnam is revising its building codes to incorporate standards for prefabricated structures, reflecting the construction industrys evolving needs. These updated codes are expected to reduce project approval times by streamlining regulatory requirements for modular and prefabricated buildings, which aligns with the governments goal of increasing affordable housing. These revisions are particularly beneficial in urban areas where housing projects need to meet both speed and compliance requirements.

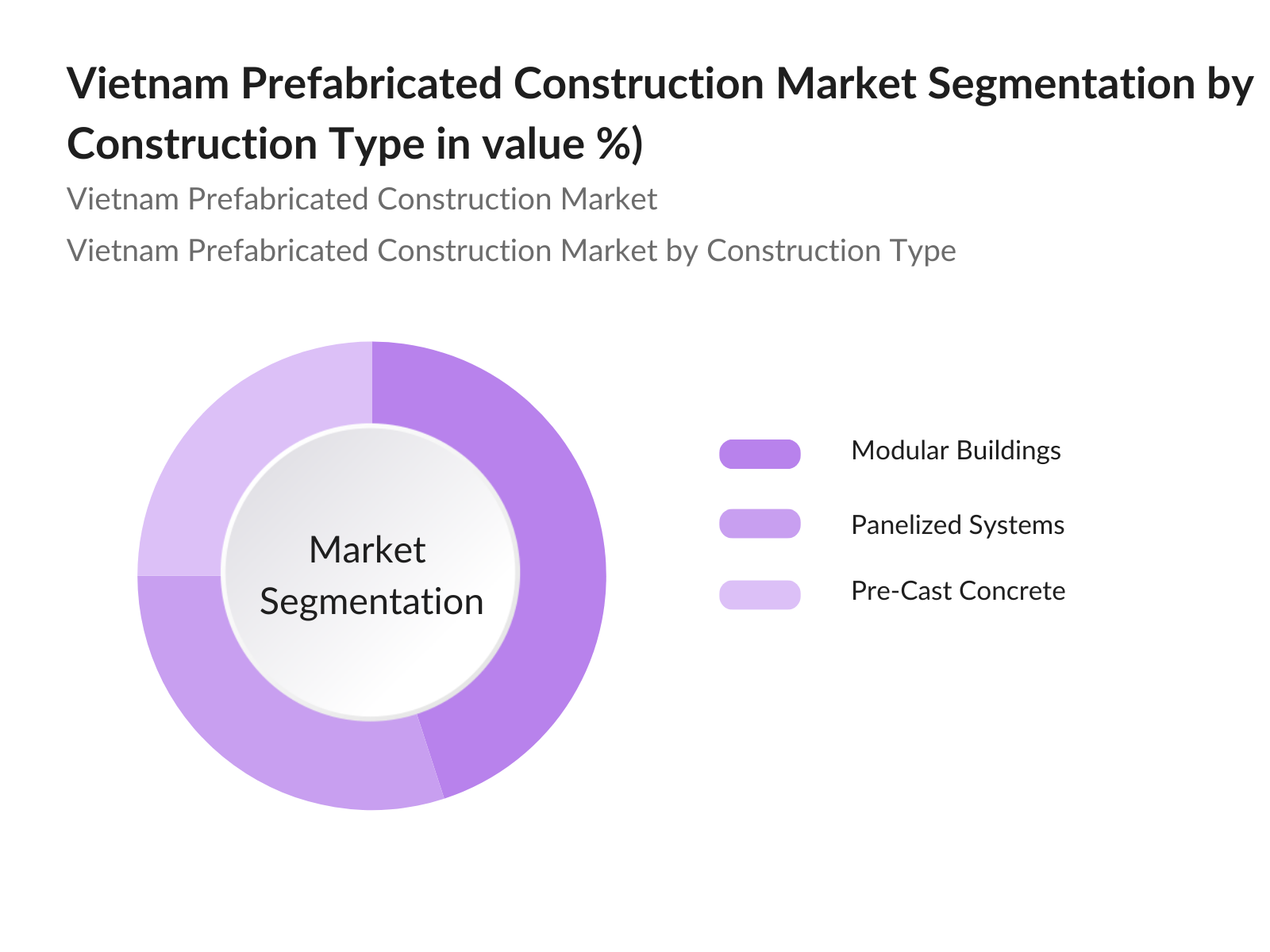

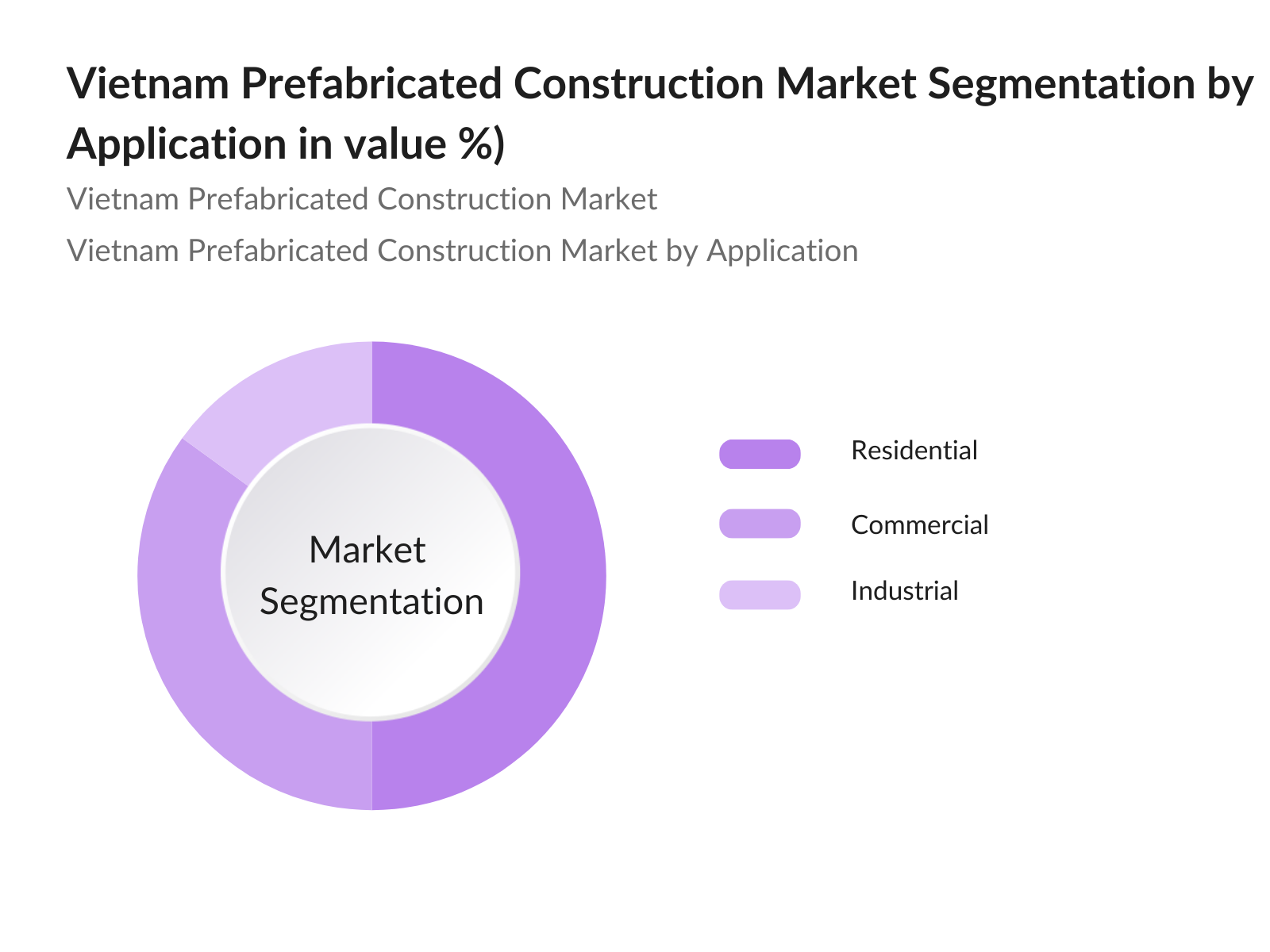

Vietnam Prefabricated Construction Market Segmentation

By Construction Type: The Vietnam Prefabricated Construction market is segmented by construction type into modular buildings, panelized systems, and pre-cast concrete. Modular buildings currently hold a significant market share due to their flexibility and reduced construction time. The ability to design and construct buildings off-site and transport them for quick assembly on-site caters to the urgent demand for housing and commercial spaces, thereby driving growth in this sub-segment.

By Application: The market is also segmented by application, comprising residential, commercial, and industrial uses. The residential segment leads the market, fueled by the need for affordable housing solutions amidst rapid urbanization. The trend toward using prefabricated elements in residential projects minimizes costs and construction timelines, making it increasingly popular among developers and home builders.

Vietnam Prefabricated Construction Market Competitive Landscape

The Vietnam Prefabricated Construction market is characterized by a competitive landscape dominated by several key players, including both local and international companies. Major players in the market include:

|

Company Name |

Establishment Year |

Headquarters |

Key Parameter 1 |

Key Parameter 2 |

Key Parameter 3 |

Key Parameter 4 |

Key Parameter 5 |

Key Parameter 6 |

|

BIM Group |

2012 |

Hanoi |

- |

- |

- |

- |

- |

- |

|

Coteccons Construction |

2004 |

Ho Chi Minh City |

- |

- |

- |

- |

- |

- |

|

Ha Bnh Construction |

1987 |

Ho Chi Minh City |

- |

- |

- |

- |

- |

- |

|

FLC Group |

2001 |

Hanoi |

- |

- |

- |

- |

- |

- |

|

VinGroup |

1993 |

Hanoi |

- |

- |

- |

- |

- |

- |

Vietnam Prefabricated Construction Market Analysis

Market Growth Drivers

- Urbanization: The rapid urbanization in Vietnam is driving demand for efficient construction methods such as prefabrication to meet housing needs. This urban shift requires quicker, scalable, and cost-effective construction solutions, making prefabricated construction a vital alternative. Increased urbanization places immense pressure on infrastructure development in cities, further emphasizing the need for prefabricated solutions to support housing and infrastructure requirements efficiently. Additionally, this method aligns with the broader infrastructural goals in urban areas, addressing both space and construction efficiency.

- Government Initiatives: Vietnam's government is prioritizing prefabricated construction as part of its housing and urban development policies, with $12 billion allocated to affordable housing projects in 2023 alone. As part of its National Housing Development Strategy, the government aims to build at least 1 million affordable housing units in urban areas, which supports the demand for prefabricated construction methods. These government-backed initiatives make it feasible for companies to leverage prefabricated solutions to meet policy targets while ensuring sustainable growth.

- Labor Shortages in Construction Sector: Vietnam's construction sector faces labor shortages, with the workforce declining by around 100,000 workers in 2023 due to urban migration and the aging population. Prefabricated construction addresses this issue by significantly reducing on-site labor needs, offering a practical solution for labor constraints. Additionally, prefabrication can substantially decrease project timelines, helping companies complete projects efficiently amid limited labor resources. The controlled environment of prefabrication also reduces dependency on skilled labor, making it an ideal solution for Vietnams current workforce challenges.

Market Challenges:

- High Initial Costs: Prefabricated construction involves high initial setup costs for factories and equipment, which can range between $3 million and $5 million for a medium-scale facility. This investment creates a financial barrier, especially for smaller construction firms. Moreover, these costs are difficult to offset quickly, impacting profitability, as the return on investment typically spans several years. The upfront cost remains a primary challenge, particularly in a price-sensitive market like Vietnam, where developers are cautious about capital-intensive methods.

- Regulatory Hurdles: Vietnam's construction regulations still favor conventional building methods, presenting hurdles for prefabrication. Stringent approval processes delay the adoption of prefabricated construction techniques, with permit approvals taking an average of 18 months for such projects. The existing regulatory framework lacks specific provisions for modular construction, slowing the adoption rate and impacting project timelines. Government bodies are working towards updating these standards, but the slow pace of reform remains a notable challenge.

Vietnam Prefabricated Construction Market Future Outlook

Over the next five years, the Vietnam Prefabricated Construction market is expected to experience significant growth, driven by continuous government support, advancements in construction technology, and increasing consumer demand for sustainable building practices. As urban areas expand and infrastructure projects accelerate, prefabricated construction will play a critical role in meeting the housing and commercial needs of the population. Innovations in materials and construction techniques will further enhance the efficiency and appeal of prefabricated solutions.

Market Opportunities:

- Rising Investments in Infrastructure: Vietnams public and private sectors have invested over $28 billion in infrastructure projects, with a significant portion allocated to urban housing and commercial facilities, which can benefit from prefabrication. The governments plan to continually increase annual infrastructure spending provides an opportunity for prefabricated solutions to support rapid project rollouts. The focus on public infrastructure also encourages foreign investments, further bolstering the demand for prefabricated construction in Vietnam.

- Increased Adoption of Modular Construction: Modular construction is gaining popularity in Vietnam, with over 500 new modular buildings constructed across the country in the past year. This trend is particularly strong in urban areas, where space constraints demand efficient building solutions. Modular construction supports Vietnams rapid urbanization by offering high-density, space-efficient buildings, especially for commercial and residential projects in cities like Ho Chi Minh and Hanoi.

Scope of the Report

|

By Construction Type |

Modular Buildings Panelized Systems Pre-Cast Concrete |

|

By Application |

Residential Commercial Industrial |

|

By Material Type |

Steel Concrete Wood |

|

By End-User |

Public Sector Private Sector |

|

By Region |

North America Europe Asia Pacific Latin America Middle East & Africa |

Products

Key Target Audience

Real Estate Developers

Construction Companies

Government and Regulatory Bodies (Ministry of Construction, Ministry of Planning and Investment)

Investors and Venture Capitalist Firms

Architects and Design Firms

Project Management Firms

Housing Authorities

Urban Development Agencies

Companies

Players Mention in the Report

BIM Group

Coteccons Construction

Ha Bnh Construction

FLC Group

VinGroup

Delta Group

Ricons Construction

Unicons Construction

Nam Long Investment Corporation

Viettel Construction

Phuc Khang Corporation

Cienco 4

Anh Duong Construction

Hoang Anh Gia Lai

PVI Holdings

Table of Contents

01. Vietnam Prefabricated Construction Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

02. Vietnam Prefabricated Construction Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

03. Vietnam Prefabricated Construction Market Analysis

3.1. Growth Drivers

3.1.1. Urbanization

3.1.2. Government Initiatives

3.1.3. Demand for Sustainable Building Solutions

3.1.4. Labor Shortages in Construction Sector

3.2. Market Challenges

3.2.1. High Initial Costs

3.2.2. Regulatory Hurdles

3.2.3. Quality Control Issues

3.3. Opportunities

3.3.1. Technological Advancements

3.3.2. Rising Investments in Infrastructure

3.3.3. Expansion of the Housing Sector

3.4. Trends

3.4.1. Increased Adoption of Modular Construction

3.4.2. Integration of Smart Technologies

3.4.3. Use of Advanced Materials

3.5. Government Regulation

3.5.1. Building Codes and Standards

3.5.2. Environmental Regulations

3.5.3. Investment Incentives

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

04. Vietnam Prefabricated Construction Market Segmentation

4.1. By Construction Type (In Value %)

4.1.1. Modular Buildings

4.1.2. Panelized Systems

4.1.3. Pre-Cast Concrete

4.2. By Application (In Value %)

4.2.1. Residential

4.2.2. Commercial

4.2.3. Industrial

4.3. By Material Type (In Value %)

4.3.1. Steel

4.3.2. Concrete

4.3.3. Wood

4.4. By End-User (In Value %)

4.4.1. Public Sector

4.4.2. Private Sector

4.5. By Region (In Value %)

4.5.1. Northern Vietnam

4.5.2. Southern Vietnam

4.5.3. Central Vietnam

05. Vietnam Prefabricated Construction Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. BIM Group

5.1.2. Coteccons Construction

5.1.3. Ha Bnh Construction Group

5.1.4. FLC Group

5.1.5. VinGroup

5.1.6. Delta Group

5.1.7. Ricons Construction

5.1.8. Unicons Construction

5.1.9. Nam Long Investment Corporation

5.1.10. Viettel Construction

5.1.11. Phuc Khang Corporation

5.1.12. Cienco 4

5.1.13. Anh Duong Construction

5.1.14. Hoang Anh Gia Lai

5.1.15. PVI Holdings

5.2. Cross Comparison Parameters (Revenue, Market Share, Geographic Reach, Construction Type, Application Focus, Material Utilization, Sustainability Practices, Innovation Index)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

06. Vietnam Prefabricated Construction Market Regulatory Framework

6.1. Building Codes and Standards

6.2. Compliance Requirements

6.3. Certification Processes

07. Vietnam Prefabricated Construction Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

08. Vietnam Prefabricated Construction Future Market Segmentation

8.1. By Construction Type (In Value %)

8.2. By Application (In Value %)

8.3. By Material Type (In Value %)

8.4. By End-User (In Value %)

8.5. By Region (In Value %)

09. Vietnam Prefabricated Construction Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Vietnam Prefabricated Construction Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the Vietnam Prefabricated Construction Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple construction firms to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction serves to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the Vietnam Prefabricated Construction market.

Frequently Asked Questions

01. How big is the Vietnam Prefabricated Construction market?

The Vietnam Prefabricated Construction market is valued at USD 4.70 billion, driven by urbanization and the need for sustainable building practices. Increased government support for infrastructure development further propels market growth.

02. What are the challenges in the Vietnam Prefabricated Construction market?

Challenges include regulatory hurdles, quality control issues, and high initial costs associated with prefabricated systems. The industry must address these challenges to capitalize on growth opportunities.

03. Who are the major players in the Vietnam Prefabricated Construction market?

Key players include BIM Group, Coteccons Construction, Ha Bnh Construction, and VinGroup. These companies dominate the market through their innovative solutions and strong operational capabilities.

04. What are the growth drivers of the Vietnam Prefabricated Construction market?

The market is propelled by factors such as rising urbanization, government support for infrastructure projects, and the demand for cost-effective and efficient construction methods.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.