Vietnam Processed Meat Market Outlook to 2030

Region:Asia

Author(s):Yogita Sahu

Product Code:KROD7934

November 2024

85

About the Report

Vietnam Processes Meat Market Overview

- The Vietnam processed meat market is valued at USD 1.2 billion, based on a five-year historical analysis. This market is primarily driven by the growing demand for convenience foods as busy lifestyles in urban areas continue to increase. Additionally, rising health awareness has led to higher consumption of ready-to-cook and pre-packaged meats, contributing significantly to market growth.

- Key cities such as Ho Chi Minh City and Hanoi dominate the market. Their dominance stems from being the most urbanized regions with well-established cold chain infrastructures and higher consumer purchasing power. The concentration of meat processing facilities and robust distribution networks in these cities ensures the steady availability of processed meat products.

- The Vietnamese government has implemented the National Food Safety Plan, which includes specific guidelines for the processed meat industry. In 2024, the government is allocating over VND 2 trillion ($86 million) to strengthen food safety standards, improve inspection protocols, and upgrade meat processing facilities.

Vietnam Processes Meat Market Segmentation

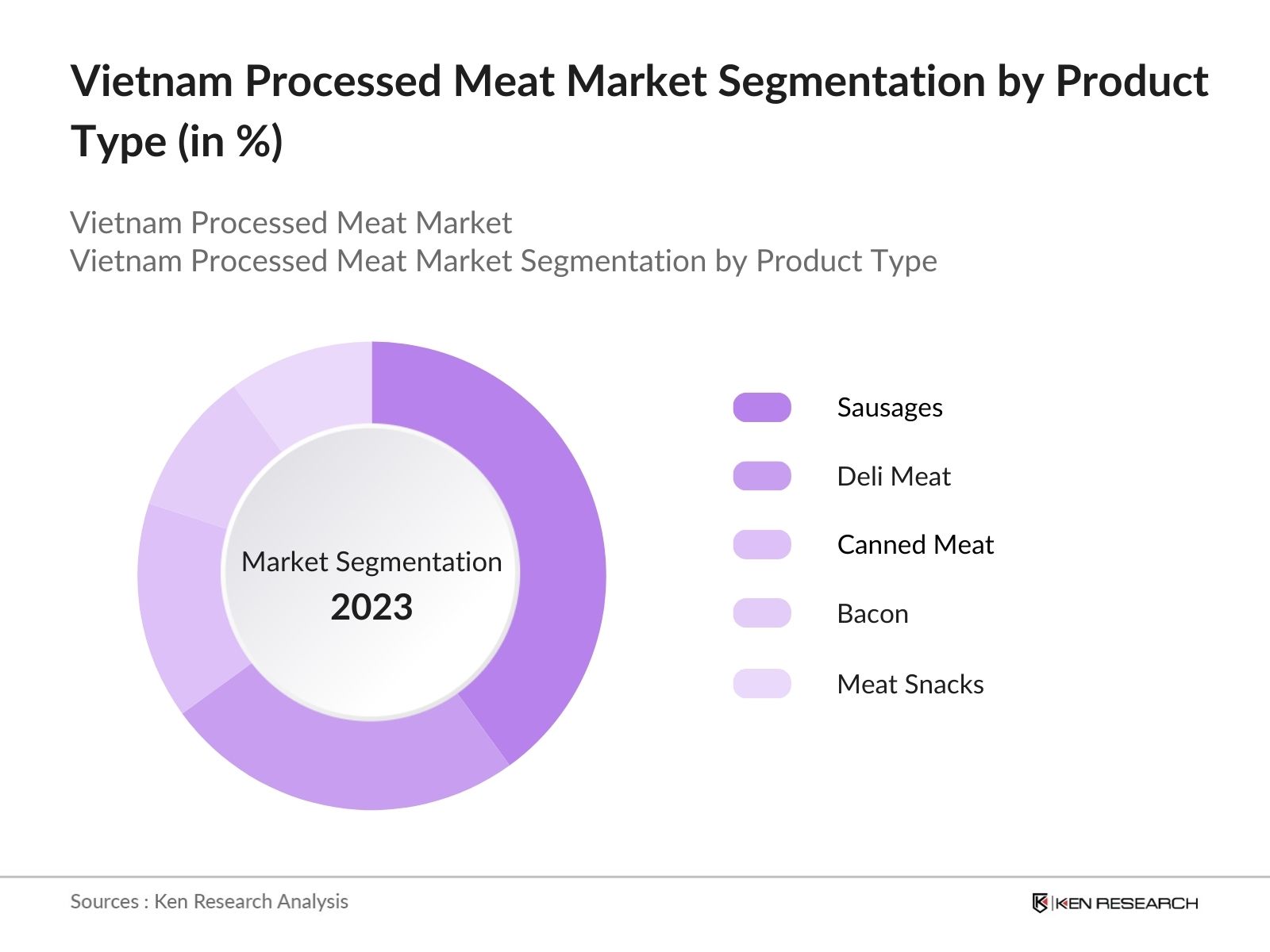

By Product Type: The market is segmented by product type into sausages, deli meat, canned meat, bacon, and meat snacks. Sausages currently hold a dominant market share due to their widespread appeal across various consumer groups. The convenience and versatility of sausages, along with their extensive presence in both household kitchens and foodservice establishments, make them a staple in the Vietnamese diet.

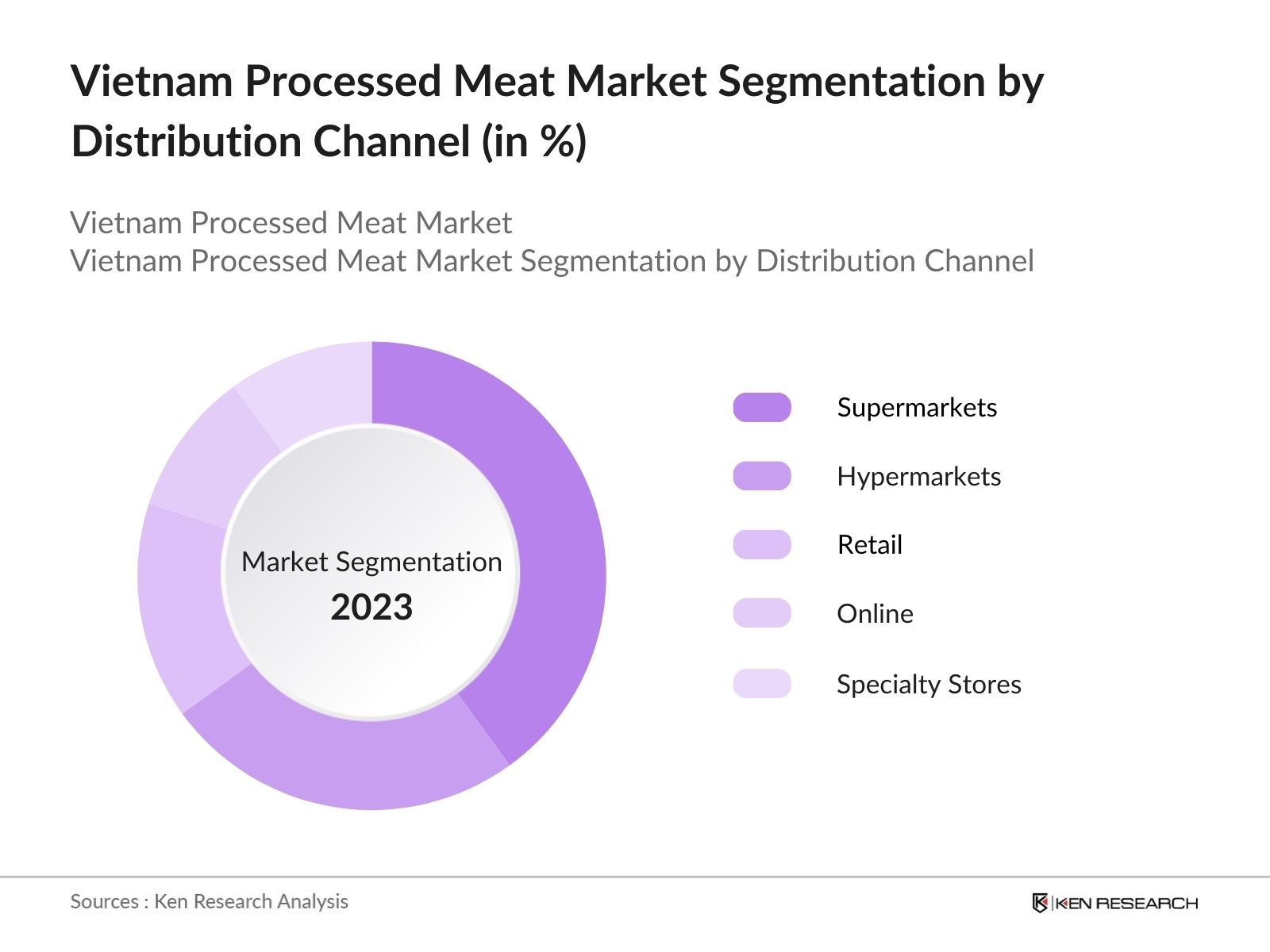

By Distribution Channel: The market is segmented into retail, supermarkets, hypermarkets, online, and specialty stores. Supermarkets and hypermarkets dominate the distribution channel due to their extensive presence and ability to provide a wide variety of processed meat products under one roof. The trust factor associated with quality assurance in large retail chains like Co.opmart and Big C enhances consumer preference for purchasing processed meats from these outlets.

Vietnam Processes Meat Competitive Landscape

The market is characterized by the presence of both local and global players. Key companies such as Vissan and CP Vietnam have solidified their market positions by leveraging extensive distribution networks and product innovation.

|

Company Name |

Establishment Year |

Headquarters |

Revenue |

Product Portfolio |

Distribution Network |

Market Presence |

Sustainability Initiatives |

Strategic Partnerships |

|

Vissan |

1970 |

Ho Chi Minh City |

||||||

|

CP Vietnam |

1993 |

Hanoi |

||||||

|

Masan Group |

1996 |

Ho Chi Minh City |

||||||

|

Kido Group |

1993 |

Ho Chi Minh City |

||||||

|

Dabaco Group |

1996 |

Bac Ninh |

Vietnam Processed Meat Market Analysis

Market Growth Drivers

- Expansion of Retail Channels: The number of modern retail outlets, including supermarkets and hypermarkets, has been rapidly increasing across urban and suburban areas in Vietnam. In 2024, the number of retail outlets that stock processed meat products is expected to cross 5,000, providing consumers with easy access to these products.

- Shift to Convenience Foods: A growing number of Vietnamese families are transitioning towards convenience foods due to busy lifestyles. By 2024, over 12 million households in Vietnam are expected to adopt processed meat products as part of their daily diet, according to projections based on household consumption data.

- Tourism and Expat Influence: Vietnams booming tourism industry, which is projected to attract more than 18 million international tourists in 2024, is positively impacting the processed meat market. The rise in demand for western-style processed meats, such as sausages and salami, is driven by the preferences of tourists and expatriates.

Market Challenges

- Health Concerns Regarding Processed Meat: Despite the growing demand, the processed meat market faces challenges due to rising health concerns linked to the consumption of processed meats. In 2024, around 30% of Vietnamese consumers have reported being cautious about processed meat consumption due to perceived health risks, such as increased risks of heart disease and cancer.

- Supply Chain Disruptions: Vietnams processed meat market is highly vulnerable to supply chain disruptions, especially in the context of fluctuating raw meat supply. As of 2024, more than 40% of processed meat producers in Vietnam have reported supply chain bottlenecks due to disruptions in pork and beef imports, driven by disease outbreaks such as African Swine Fever.

Vietnam Processed Meat Market Future Outlook

Over the next five years, the Vietnam processed meat industry is expected to grow at a steady pace, driven by the increasing demand for convenient, ready-to-cook meat products. The development of new packaging technologies and an increase in the variety of processed meats are anticipated to propel market growth.

Future Market Opportunities

- Shift Toward Healthier Processed Meat Options: Over the next five years, the Vietnamese processed meat market will witness a growing demand for healthier alternatives, such as low-sodium, organic, and additive-free products. By 2029, more than 5 million health-conscious consumers are expected to shift to these healthier processed meat options, driven by increasing awareness and government-backed health initiatives.

- Rise of Plant-based Processed Meats: The plant-based meat sector is set to experience significant growth in Vietnam, with projections indicating that by 2029, the market for plant-based processed meat could exceed VND 10 trillion ($430 million). This shift is being driven by changing dietary preferences, with more Vietnamese consumers opting for plant-based alternatives to traditional meat products.

Scope of the Report

|

By Product Type |

Sausages Canned Meat Deli Meat Bacon Meat Snacks |

|

By Distribution Channel |

Retail Supermarkets Hypermarkets Online Specialty Stores |

|

By End User |

Households Foodservice Institutions |

|

By Meat Type |

Pork Beef Chicken Fish Mixed Meat |

|

By Region |

North West East South |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Meat Processing Companies

Banks and Financial Institution

Government and Regulatory Bodies (Vietnam Food Administration, Ministry of Health)

Investors and Venture Capitalist Firms

Packaging and Cold Chain Logistics Providers

Private Equity Firms

Foodservice Operators (Restaurants, Hotels, Catering Services)

Companies

Players Mentioned in the Report:

Vissan

CP Vietnam

Masan Group

Kido Group

Dabaco Group

Saigon Food

Ba Huan JSC

Minh An Group

Cau Tre Foods

Anco

Table of Contents

Vietnam Processed Meat Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

Vietnam Processed Meat Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

Vietnam Processed Meat Market Analysis

3.1. Growth Drivers [Increase in Meat Consumption, Rising Demand for Ready-to-Eat Foods, Government Support for Meat Processing Industry, Shifting Consumer Preferences]

3.2. Market Challenges [Stringent Regulations, Supply Chain Disruptions, High Competition, Rising Costs of Raw Materials]

3.3. Opportunities [Innovation in Meat Preservation Techniques, Expansion into Export Markets, Investments in Packaging, Growth in Online Distribution Channels]

3.4. Trends [Adoption of Plant-Based Meat Alternatives, Health-Conscious Consumer Shifts, Sustainable Packaging Solutions, Use of Advanced Meat Processing Technology]

3.5. Government Regulations [Food Safety Standards, Import/Export Regulations, Labeling Requirements, Certification Protocols]

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem [Suppliers, Processors, Distributors, Consumers]

3.8. Porters Five Forces [Bargaining Power of Suppliers, Bargaining Power of Buyers, Threat of New Entrants, Threat of Substitutes, Competitive Rivalry]

3.9. Competitive Ecosystem

Vietnam Processed Meat Market Segmentation

4.1. By Product Type (In Value %)

Sausages

Canned Meat

Deli Meat

Bacon

Meat Snacks

4.2. By Distribution Channel (In Value %)

Retail

Supermarkets

Hypermarkets

Online

Specialty Stores

4.3. By End User (In Value %)

Households

Foodservice

Institutions

4.4. By Meat Type (In Value %)

Pork

Beef

Chicken

Fish

Mixed Meat

4.5. By Region (In Value %)

North

West

East

South

Vietnam Processed Meat Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Vissan

5.1.2. CP Vietnam

5.1.3. Masan Group

5.1.4. Kido Group

5.1.5. Dabaco Group

5.1.6. Saigon Food

5.1.7. Ba Huan JSC

5.1.8. Minh An Group

5.1.9. Cau Tre Foods

5.1.10. Anco

5.1.11. Japfa Comfeed Vietnam

5.1.12. Quang Minh Food

5.1.13. Duc Viet Food

5.1.14. Ha Long Canned Food

5.1.15. HAGL Agrico

5.2. Cross Comparison Parameters [Revenue, Number of Employees, Product Portfolio, Distribution Reach, Strategic Partnerships, Sustainability Initiatives, Market Share, Production Capacity]

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

Vietnam Processed Meat Market Regulatory Framework

6.1. Food Safety Standards

6.2. Compliance Requirements

6.3. Certification Processes

6.4. Labeling Guidelines

Vietnam Processed Meat Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

Vietnam Processed Meat Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Distribution Channel (In Value %)

8.3. By End User (In Value %)

8.4. By Meat Type (In Value %)

8.5. By Region (In Value %)

Vietnam Processed Meat Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The first step in our research involved the identification of critical variables influencing the Vietnam processed meat market. We mapped the entire stakeholder ecosystem, which included meat processors, suppliers, distributors, and consumers. This phase involved detailed desk research and consultation with proprietary databases to gather relevant data on market drivers, challenges, and competitive landscape.

Step 2: Market Analysis and Construction

We analyzed historical data and current market trends to construct a comprehensive view of the market. Key indicators such as the growth in retail outlets, foodservice demand, and changes in consumer preferences were examined. This step also included analyzing revenue streams from processed meat sales in both urban and rural areas.

Step 3: Hypothesis Validation and Expert Consultation

Through expert consultations via telephone interviews with industry professionals and company executives, we validated our market hypotheses. These consultations provided insights into real-time market dynamics and operational challenges faced by companies in the processed meat sector.

Step 4: Research Synthesis and Final Output

The final phase of our research involved aggregating insights from various stakeholders, including meat producers and distributors. The data was cross-referenced with a bottom-up market approach to ensure the accuracy and reliability of the final analysis. The report was synthesized to reflect current market conditions and future growth projections.

Frequently Asked Questions

01. How big is the Vietnam Processed Meat Market?

The Vietnam processed meat market is valued at USD 1.2 billion, driven by urbanization, the rise of foodservice establishments, and the growing demand for ready-to-eat and convenience food products.

02. What are the challenges in the Vietnam Processed Meat Market?

Challenges in the Vietnam processed meat market include stringent government regulations on food safety, the rising cost of raw materials, and maintaining the cold chain logistics necessary for the distribution of processed meat products.

03. Who are the major players in the Vietnam Processed Meat Market?

Key players in the Vietnam processed meat market include Vissan, CP Vietnam, Masan Group, and Kido Group, all of whom have extensive distribution networks, strong product portfolios, and continuous product innovation efforts.

04. What are the growth drivers of the Vietnam Processed Meat Market?

Growth drivers in the Vietnam processed meat market include the rising demand for convenience foods, increasing health awareness, and government support for the development of the food processing industry.

05. What trends are shaping the future of the Vietnam Processed Meat Market?

Key trends in the Vietnam processed meat market include the adoption of plant-based meat alternatives, growing health-conscious consumer preferences, and advancements in packaging and preservation technologies.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.