Vietnam Public Cloud Market Outlook to 2030

Region:Asia

Author(s):Mukul

Product Code:KROD8054

October 2024

100

About the Report

Vietnam Public Cloud Market Overview

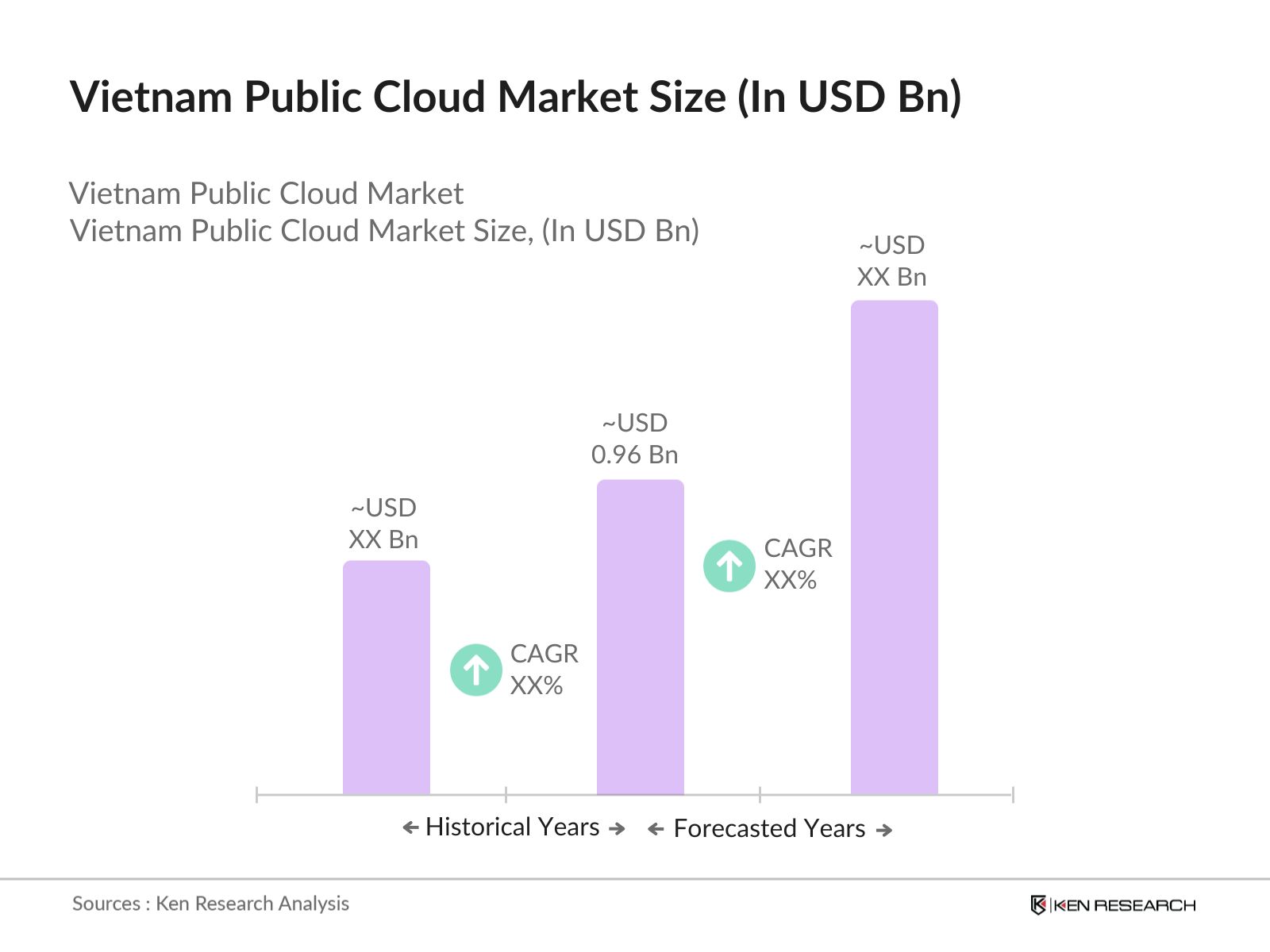

- The Vietnam Public Cloud market is valued at USD 0.96 billion, based on a five-year historical analysis. This growth has been driven by the increasing digital transformation efforts among businesses, alongside the Vietnamese government's strong push towards cloud adoption through initiatives like Make in Vietnam and their national digital transformation strategy. The need for scalable infrastructure and services such as Infrastructure as a Service (IaaS) and Software as a Service (SaaS) has seen significant demand due to the rapid expansion of the country's e-commerce, fintech, and healthcare sectors.

- Vietnam's dominant cities in the Public Cloud market include Ho Chi Minh City and Hanoi. These cities host the largest businesses, tech startups, and enterprises in Vietnam, contributing to the demand for cloud services. Ho Chi Minh City, being the economic hub, leads in cloud adoption, while Hanoi, as the nation's capital, benefits from strong governmental support for digital transformation policies. This concentration of business and administrative activities solidifies their leading positions in the public cloud market.

- Vietnams Personal Data Protection (PDP) regulations, introduced in 2023, impose strict requirements on how personal data is collected, stored, and transferred in cloud environments. The regulations require that personal data of Vietnamese citizens be stored on servers within the country. The Ministry of Public Security reported that compliance costs for cloud service providers rose by 25% in 2024, as firms had to upgrade their infrastructure to meet these mandates.

Vietnam Public Cloud Market Segmentation

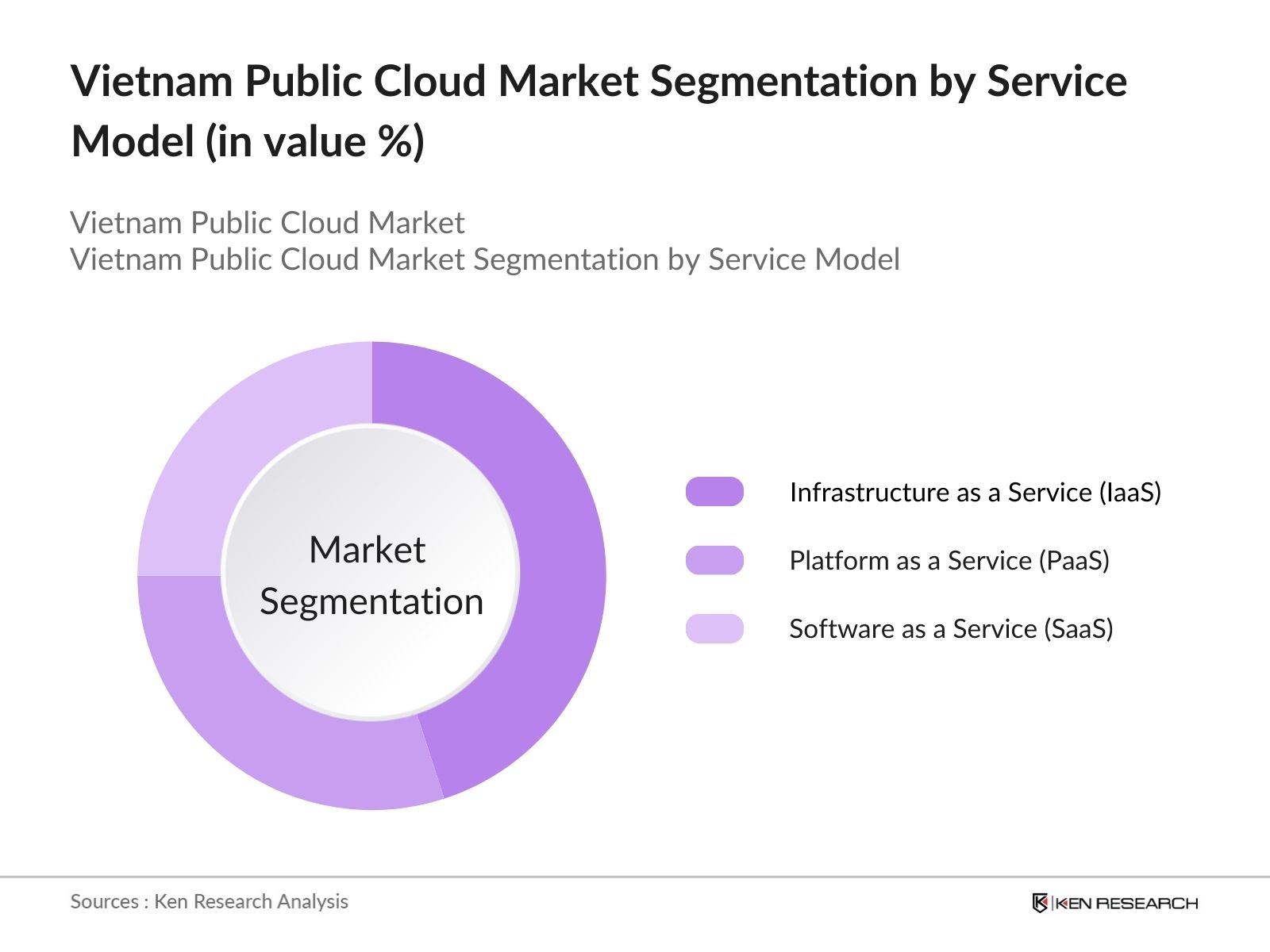

- By Service Model: The Vietnam Public Cloud market is segmented by service model into Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS). Among these, IaaS dominates the market share in 2023 due to the growing demand for scalable infrastructure solutions by enterprises. As businesses look to reduce upfront IT costs and enhance operational efficiency, they increasingly rely on IaaS providers for flexible storage, computing power, and networking solutions. Moreover, the increasing expansion of data centers in Vietnam has enabled wider availability and lower latency for these services, reinforcing IaaSs dominant position.

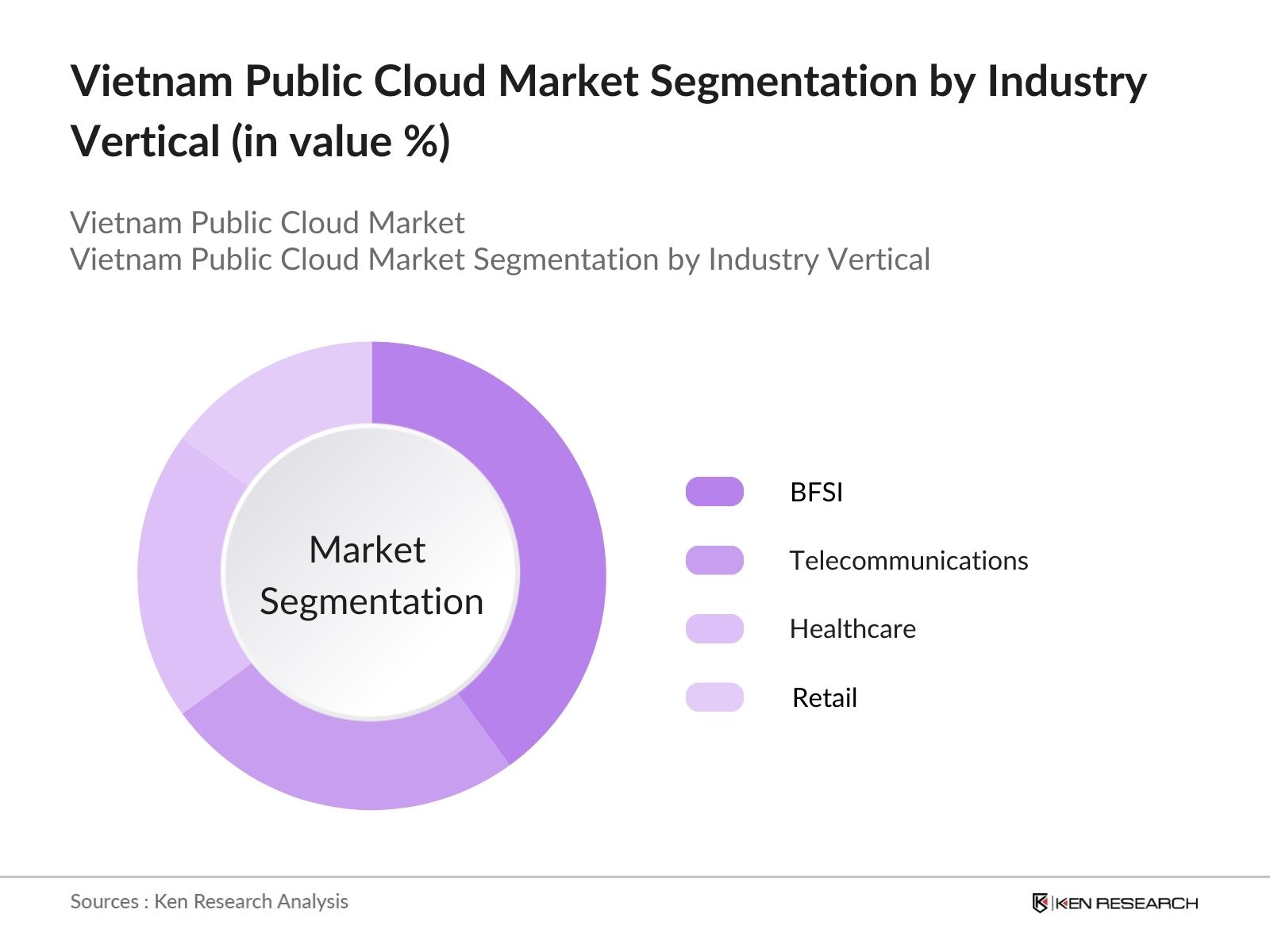

- By Industry Vertical: The Vietnam Public Cloud market is also segmented by industry vertical into Banking, Financial Services, and Insurance (BFSI), Telecommunications, Healthcare, Retail, and Government and Public Sector. The BFSI sector holds the largest market share, driven by the increasing reliance on cloud computing for secure, compliant, and scalable financial services. Cloud adoption in this sector is fueled by the necessity for banks and financial institutions to enhance their digital services, ensuring customer data security and supporting seamless online transactions.

Vietnam Public Cloud Competitive Landscape

The Vietnam Public Cloud market is dominated by a combination of global and local players who are competing to provide scalable, secure, and reliable cloud solutions. Major global players such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud hold a significant position due to their established infrastructures and partnerships with local enterprises. Local providers like FPT Cloud and VNG Cloud are gaining traction by offering tailored solutions that address specific compliance and data localization needs in Vietnam. This competitive environment is intensified by cloud players seeking to secure key clients across verticals such as BFSI, telecommunications, and government sectors.

|

Company Name |

Established |

Headquarters |

Data Center Locations |

Partnerships |

Revenue from Cloud Services |

Number of Employees |

Cloud Certifications |

Compliance with Local Regulations |

|

Amazon Web Services |

2006 |

Seattle, USA |

||||||

|

Microsoft Azure |

2010 |

Redmond, USA |

||||||

|

Google Cloud |

2008 |

Mountain View, USA |

||||||

|

FPT Cloud |

2008 |

Hanoi, Vietnam |

||||||

|

VNG Cloud |

2004 |

Ho Chi Minh City |

Vietnam Public Cloud Industry Analysis

Growth Drivers

- Digital Transformation Initiatives (Government and Enterprises): Vietnams government has been pushing its digital transformation agenda through programs like "National Digital Transformation Program 2025," aimed at moving 50% of government services to digital platforms by 2025. Enterprises are also driving adoption, with a 2023 report from the Ministry of Information and Communications noting that over 60,000 companies are adopting digital platforms, many migrating to public cloud infrastructure to enhance their operational efficiencies. The government allocated $128 million to digitize public services in 2023, reflecting the strong momentum for cloud services.

- Rising Demand for Cloud Infrastructure in SME Sector: Vietnams 800,000 small and medium-sized enterprises (SMEs) are increasingly migrating to public cloud solutions to meet growing digital demands. In 2024, SMEs accounted for 35% of Vietnam's GDP, according to the Ministry of Planning and Investment. The need for scalable IT infrastructure is driving cloud adoption, with 90% of businesses utilizing cloud services, primarily for data storage and IT operations. A government-backed SME support program allocated $75 million for cloud-based digital transformation initiatives.

- 5G Network Deployment Impact on Cloud Adoption: Vietnam is rolling out 5G networks in 2024, with services already available in major cities like Hanoi and Ho Chi Minh City. The Ministry of Information and Communications has targeted nationwide coverage by 2025, supported by investments exceeding $300 million. This 5G rollout is set to boost the adoption of cloud services, as faster networks allow enterprises to deploy more bandwidth-intensive applications. By enabling real-time processing and data transfer, 5G is poised to enhance the performance of cloud services across industries such as manufacturing, retail, and logistics.

Market Restraints

- Data Sovereignty Concerns: Vietnams strict data sovereignty laws, particularly the Cybersecurity Law (2018), require data generated within the country to be stored locally. This regulation is challenging for global cloud providers who often rely on cross-border data transfers. In 2024, 80% of businesses reported concerns over compliance with these laws, according to the Ministry of Information and Communications. This restriction complicates operations for multinational firms, pushing them to establish local data centers, which increases operational costs and limits the scalability of cloud infrastructure.

- Regulatory Compliance for Cloud Services: Compliance with Vietnams data protection and cybersecurity laws adds complexity for cloud providers. The Cybersecurity Law and the Personal Data Protection Decree mandate strict guidelines for handling sensitive data. The Ministry of Public Security reported in 2024 that 70% of cloud service providers had to revise their operational frameworks to meet these requirements, leading to delays in service deployment. This regulatory landscape is viewed as a key challenge for global providers seeking to expand in Vietnams cloud market.

Vietnam Public Cloud Market Future Outlook

Over the next five years, the Vietnam Public Cloud market is expected to show significant growth, driven by continuous government support, advancements in cloud technology, and the growing demand for scalable IT infrastructure across various sectors. Vietnams robust digital transformation strategy is anticipated to play a pivotal role, along with the increased adoption of multi-cloud and hybrid cloud models as businesses seek more flexible solutions to optimize their IT environments. The expansion of local data centers and the regulatory push for data sovereignty will further stimulate the demand for cloud services.

Marke Opportunities

- Expansion of Cloud Services into Rural and Remote Areas: Despite cloud adoption being concentrated in urban areas, Vietnams rural regions are an untapped market. Government programs like the "National Rural Digital Infrastructure Project" have allocated $200 million to extend internet coverage to remote areas by 2025, laying the groundwork for cloud service providers to expand. Currently, only 35% of rural enterprises have adopted cloud services, compared to 85% in urban centers, highlighting the opportunity for growth.

- Increased Adoption of AI and Big Data Analytics in Cloud: The Vietnamese governments focus on becoming a regional leader in AI and data analytics presents a key opportunity for cloud providers. In 2024, the Ministry of Science and Technology earmarked $50 million for AI research and development. Companies across sectors such as manufacturing, finance, and healthcare are leveraging cloud-based AI platforms to enhance decision-making, customer interactions, and operational efficiency. Cloud providers offering integrated AI solutions are well-positioned to capitalize on this trend.

Scope of the Report

|

Segment |

Sub-Segments |

|

Service Model |

Infrastructure as a Service (IaaS), Platform as a Service (PaaS), Software as a Service (SaaS) |

|

Deployment Model |

Public Cloud, Hybrid Cloud, Multi-Cloud |

|

Industry Vertical |

BFSI, Telecommunications, Healthcare, Retail, Government and Public Sector |

|

Enterprise Size |

Small and Medium Enterprises (SMEs), Large Enterprises |

|

Region |

Hanoi, Ho Chi Minh City, Da Nang, Other Regions |

Products

Key Target Audience for Vietnam Public Cloud Market

Cloud Service Providers

Government and Regulatory Bodies (Vietnam Ministry of Information and Communications, Authority of Information Security)

IT Infrastructure Companies

Telecommunications Providers

Banking, Financial Services, and Insurance Companies

E-commerce Platforms

Investor and Venture Capitalist Firms

Healthcare Providers and Hospitals

Companies

Players Mentioned in the Report:

Amazon Web Services (AWS)

Microsoft Azure

Google Cloud

Alibaba Cloud

IBM Cloud

Oracle Cloud

FPT Cloud

VNG Cloud

SAP Cloud

T-Systems

Cloud4C

Tencent Cloud

VMWare

Viettel Cloud

OVHcloud

Table of Contents

1. Vietnam Public Cloud Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (CAGR, YoY Growth)

1.4. Market Segmentation Overview

1.5. Cloud Service Model Overview (IaaS, PaaS, SaaS)

1.6. Deployment Model Overview (Public Cloud, Hybrid Cloud, Multi-Cloud)

2. Vietnam Public Cloud Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Vietnam Public Cloud Market Analysis

3.1. Growth Drivers

3.1.1. Digital Transformation Initiatives (Government and Enterprises)

3.1.2. Rising Demand for Cloud Infrastructure in SME Sector

3.1.3. 5G Network Deployment Impact on Cloud Adoption

3.1.4. Growing E-commerce and FinTech Ecosystem

3.2. Market Challenges

3.2.1. Data Sovereignty Concerns

3.2.2. Regulatory Compliance for Cloud Services

3.2.3. High Competition Among Global Cloud Providers

3.3. Opportunities

3.3.1. Expansion of Cloud Services into Rural and Remote Areas

3.3.2. Increased Adoption of AI and Big Data Analytics in Cloud

3.3.3. Government Incentives for Cloud Infrastructure Investments

3.4. Trends

3.4.1. Adoption of Edge Computing in Public Cloud

3.4.2. Growth of Multi-Cloud and Hybrid Cloud Solutions

3.4.3. Increasing Demand for Cloud Security Solutions

3.5. Government Regulations

3.5.1. Vietnams Personal Data Protection Regulations (PDP)

3.5.2. Compliance with Cybersecurity Law for Cloud Service Providers

3.5.3. Data Localization Mandates

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.7.1. Cloud Service Providers

3.7.2. System Integrators

3.7.3. End-User Industries

3.8. Porters Five Forces

3.9. Competitive Ecosystem

4. Vietnam Public Cloud Market Segmentation

4.1. By Service Model (In Value %)

4.1.1. Infrastructure as a Service (IaaS)

4.1.2. Platform as a Service (PaaS)

4.1.3. Software as a Service (SaaS)

4.2. By Deployment Model (In Value %)

4.2.1. Public Cloud

4.2.2. Hybrid Cloud

4.2.3. Multi-Cloud

4.3. By Industry Vertical (In Value %)

4.3.1. Banking, Financial Services, and Insurance (BFSI)

4.3.2. Telecommunications

4.3.3. Healthcare

4.3.4. Retail

4.3.5. Government and Public Sector

4.4. By Enterprise Size (In Value %)

4.4.1. Small and Medium Enterprises (SMEs)

4.4.2. Large Enterprises

4.5. By Region (In Value %)

4.5.1. Hanoi

4.5.2. Ho Chi Minh City

4.5.3. Da Nang

4.5.4. Other Regions

5. Vietnam Public Cloud Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Amazon Web Services (AWS)

5.1.2. Microsoft Azure

5.1.3. Google Cloud Platform (GCP)

5.1.4. Alibaba Cloud

5.1.5. IBM Cloud

5.1.6. Oracle Cloud

5.1.7. FPT Cloud

5.1.8. VNG Cloud

5.1.9. SAP Cloud

5.1.10. T-Systems

5.1.11. Cloud4C

5.1.12. Tencent Cloud

5.1.13. VMWare

5.1.14. Viettel Cloud

5.1.15. OVHcloud

5.2. Cross Comparison Parameters (Number of Data Centers, Market Share, Cloud Infrastructure Investment, Partnership with Local ISPs, Data Sovereignty Policies, Cloud Certification, Compliance Standards, Service Pricing Models)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Vietnam Public Cloud Market Regulatory Framework

6.1. Personal Data Protection Requirements

6.2. Cybersecurity Law Compliance

6.3. Data Localization Laws

6.4. Public Cloud Certification Processes

6.5. Cloud Service Provider Licensing Regulations

7. Vietnam Public Cloud Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Vietnam Public Cloud Future Market Segmentation

8.1. By Service Model (In Value %)

8.2. By Deployment Model (In Value %)

8.3. By Industry Vertical (In Value %)

8.4. By Enterprise Size (In Value %)

8.5. By Region (In Value %)

9. Vietnam Public Cloud Market Analysts' Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Vietnam Public Cloud market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the Vietnam Public Cloud market. This includes assessing market penetration, the ratio of cloud service providers to end users, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATI) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple cloud service providers to acquire detailed insights into service models, client preferences, and cloud adoption trends. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the Vietnam Public Cloud market.

Frequently Asked Questions

1. How big is the Vietnam Public Cloud Market?

The Vietnam Public Cloud market, valued at USD 0.96 billion, is driven by strong demand for scalable infrastructure from enterprises and continuous digital transformation efforts.

2. What are the challenges in the Vietnam Public Cloud Market?

Challenges include data sovereignty concerns, stringent regulatory compliance requirements, and high competition among global and local cloud service providers.

3. Who are the major players in the Vietnam Public Cloud Market?

Key players in the market include Amazon Web Services, Microsoft Azure, Google Cloud, FPT Cloud, and VNG Cloud, driven by their infrastructure, partnerships, and data center expansions.

4. What are the growth drivers of the Vietnam Public Cloud Market?

Growth is propelled by increased demand for cloud services across BFSI, e-commerce, and healthcare, alongside the government's focus on digital transformation and 5G network deployment.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.