Vietnam Radio Market Outlook to 2030

Region:Asia

Author(s):Shambhavi

Product Code:KROD3039

November 2024

92

About the Report

Vietnam Radio Market Overview

- The Vietnam radio market, valued at USD 60 million based on a five-year historical analysis, is driven by several factors. A growing urban population, paired with increased media consumption habits, has propelled radio to remain a staple medium in both rural and urban areas. Technological advancements in broadcasting, particularly the integration of digital technologies like DAB (Digital Audio Broadcasting), have allowed radio to adapt to modern consumer demands. In addition, radio's affordability, coupled with strong cultural ties, ensures its enduring relevance in Vietnam, particularly among lower-income populations.

- Dominant regions in the Vietnam radio market include Ho Chi Minh City, Hanoi, and Da Nang, driven by their higher population densities, stronger economic development, and higher advertising expenditures. Ho Chi Minh City, in particular, leads in radio advertising due to its status as Vietnam's economic hub. Radio stations in these cities benefit from a well-established infrastructure, broader audience reach, and higher ad revenues. Moreover, these urban centers have access to advanced broadcasting technologies, including satellite and online streaming, which further cement their dominance.

- The Vietnam Ministry of Information and Communications regulates the radio industry through stringent broadcasting license requirements. As of 2024, every station must comply with regulations that include content guidelines, frequency management, and local content quotas. These regulations ensure that the radio content aligns with national values and supports cultural preservation.

Vietnam Radio Market Segmentation

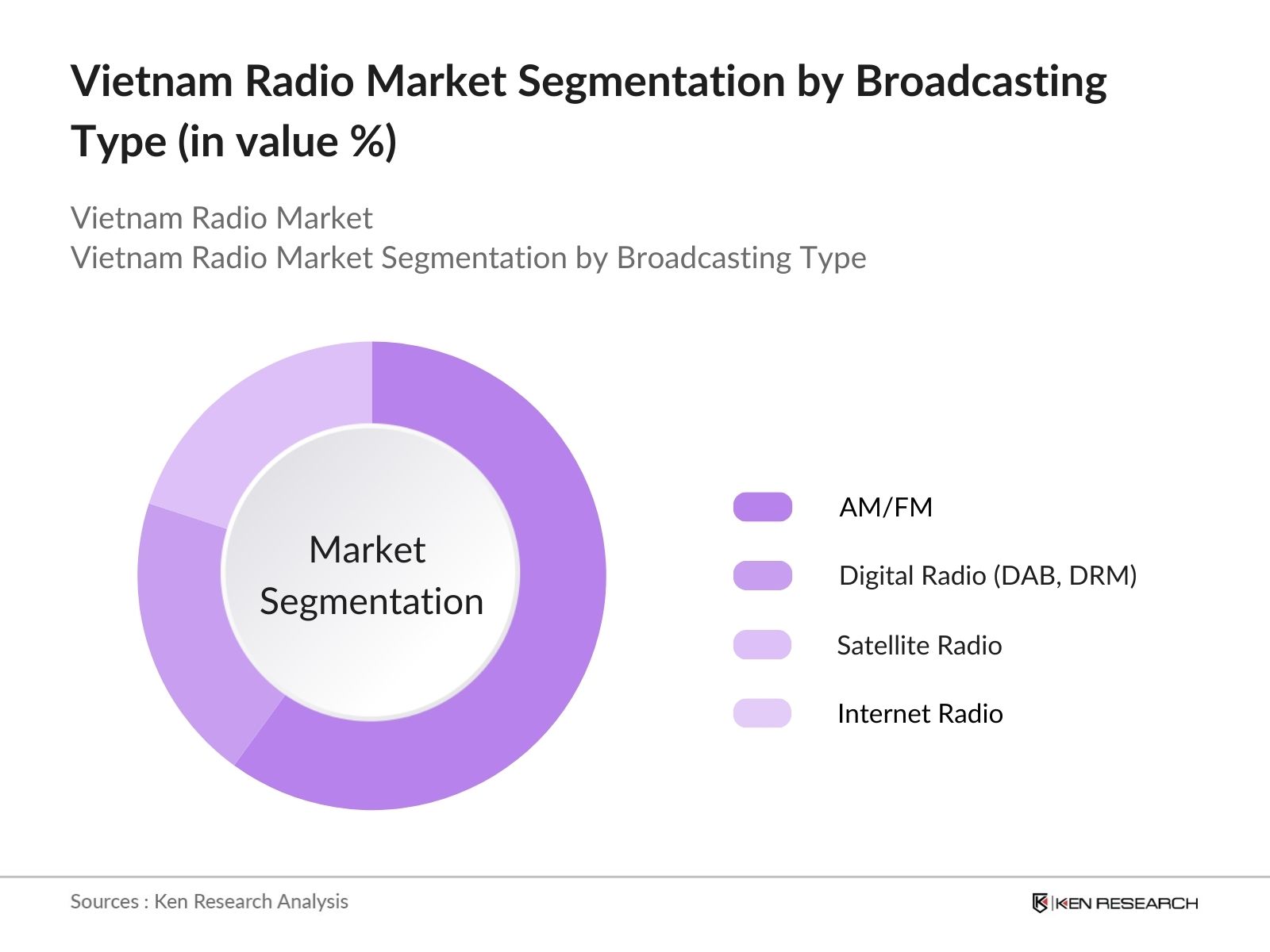

By Broadcasting Type: The Vietnam radio market is segmented by broadcasting type into AM/FM, Digital Radio (DAB, DRM), Satellite Radio, and Internet Radio. Among these, AM/FM holds a dominant market share due to its widespread accessibility and established infrastructure across Vietnam. AM/FM radio continues to thrive, especially in rural and remote areas where internet access is limited. The relatively low cost of AM/FM radios and the familiarity of listeners with this format contribute to its sustained popularity. Additionally, AM/FM broadcasting remains integral to news dissemination, emergency alerts, and local cultural content in Vietnam.

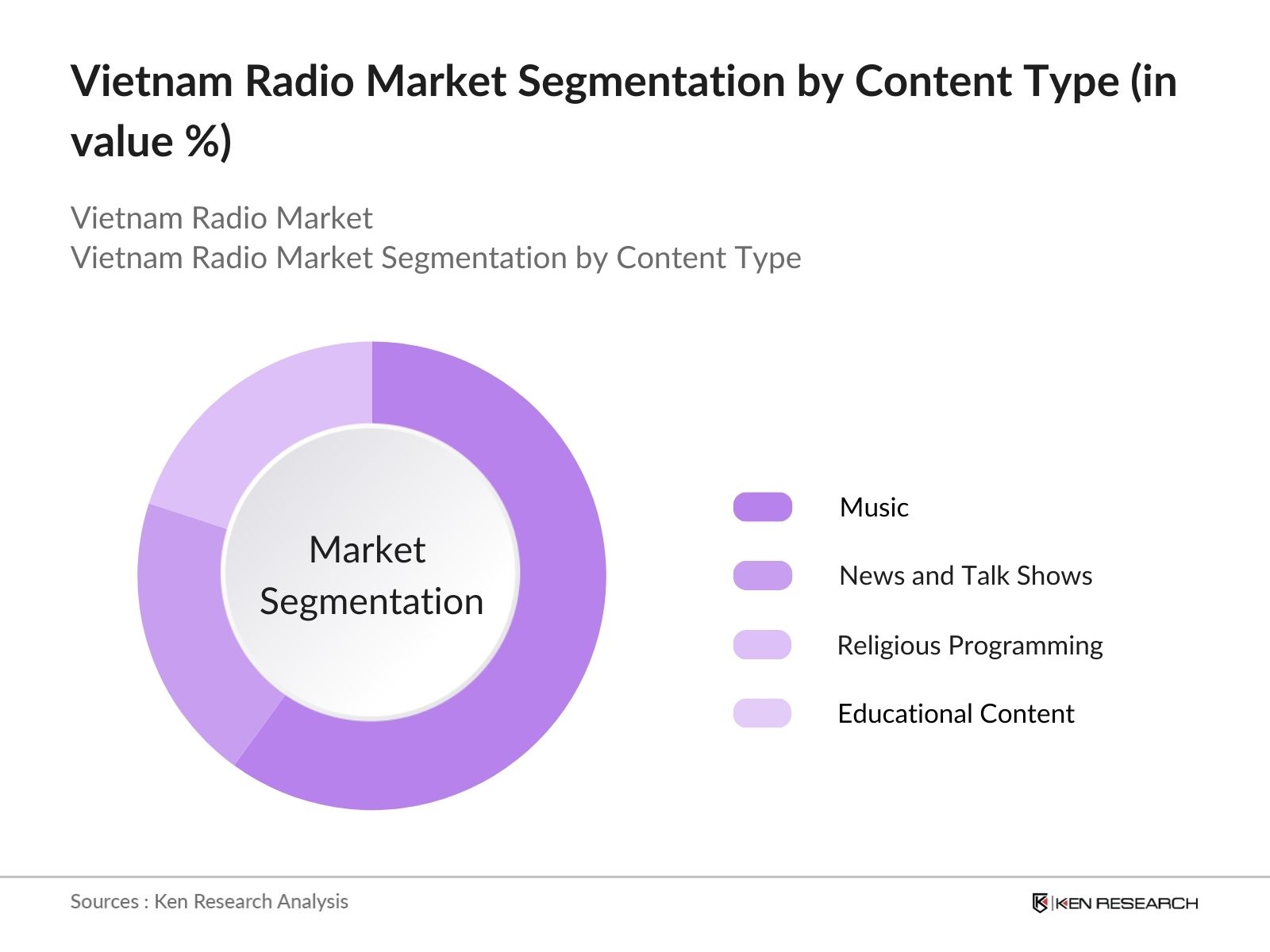

By Content Type:

The market is also segmented by content type into Music, News and Talk Shows, Religious Programming, and Educational Content. Music programming dominates the market, commanding the largest share due to the high demand for entertainment across age groups. Music stations cater to a broad spectrum of tastes, from traditional Vietnamese folk music to modern pop and international hits. Vietnamese consumers strong attachment to local music and culture further reinforces the dominance of this segment. Music-based radio programming benefits from high listenership during commuting times and social gatherings, making it highly attractive for advertisers.

Vietnam Radio Market Competitive Landscape

The Vietnam radio market is characterized by the presence of both local and national players, with a few companies holding substantial market influence. Dominating this market are key entities like Voice of Vietnam (VOV), Vietnam Television Corporation (VTV), and Vietnam Multimedia Corporation (VTC). These companies benefit from their strong foothold in traditional broadcasting and their ability to pivot to digital platforms. VOVs extensive reach across the country, coupled with its diversification into internet radio, makes it a dominant force. Similarly, the integration of satellite and mobile radio by VTC and VTV has further solidified their leadership positions in the market.

|

Company Name |

Year Established |

Headquarters |

Revenue |

No. of Radio Channels |

Technology Used |

Local vs National Reach |

Main Content Focus |

Target Audience |

Ownership |

|

Voice of Vietnam (VOV) |

1945 |

Hanoi |

|||||||

|

Vietnam Television Corp (VTV) |

1970 |

Hanoi |

|||||||

|

Vietnam Multimedia Corp (VTC) |

1993 |

Hanoi |

|||||||

|

Giai Tri FM |

2005 |

Ho Chi Minh City |

|||||||

|

Thanh Nien Radio |

2002 |

Ho Chi Minh City |

Vietnam Radio Market Analysis

Growth Drivers

- Technological Advancements in Broadcasting: Vietnam has been modernizing its broadcasting infrastructure by adopting technologies such as Digital Audio Broadcasting (DAB) and Digital Radio Mondiale (DRM). This modernization improves audio quality and expands reach. As of 2024, Vietnam is actively implementing DAB in major cities, enhancing the radio experience for approximately 45 million users. Technological advancements in radio allow better signal penetration, improving reception in areas with heavy interference and attracting higher ad revenue.

- Increasing Ad Spend on Local and Regional Stations: Advertising expenditures on local radio stations in Vietnam have grown steadily as regional markets expand. In 2023, advertising on radio generated substantial revenue from local businesses targeting region-specific audiences. Radio remains a trusted medium in smaller towns and cities, with over 20% of ad spend allocated to this medium. Businesses, especially SMEs, prefer radio for its low cost and localized reach, increasing demand for airtime on regional stations.

- Cultural Significance and Penetration of Radio: Radio continues to hold cultural importance in Vietnam, especially in rural areas where internet penetration is low. In 2023, more than 65% of rural households reported regular radio use for news, educational content, and entertainment. The Vietnam Ministry of Culture highlights radios role in disseminating public service messages and cultural programs. As of 2024, the radio industry benefits from a culturally ingrained listener base, making it a stable platform for content distribution across diverse regions.

Market Challenges

- Shift to Digital Streaming Platforms: Vietnam's increasing smartphone penetration (98 million mobile connections in 2024) has fueled the shift toward digital streaming platforms. Consumers, especially younger audiences, are moving towards podcasts, online music services, and other digital audio platforms, reducing traditional radio listenership. These platforms offer on-demand content, creating fierce competition for radio stations. According to Vietnam's Ministry of Information and Communications, digital streaming has seen significant growth in urban areas, challenging traditional broadcasters. Source.

- High Infrastructure Costs for Modernization: The costs associated with upgrading Vietnams radio broadcasting infrastructure to digital standards like DAB and DRM are substantial. The government has allocated millions of dollars towards this transformation, but broadcasters face high operational and capital expenses in implementing the new technologies, especially in rural areas. The need for high-quality equipment and infrastructure makes modernization a challenge for smaller stations, which often rely on limited financial resources.

Vietnam Radio Market Future Outlook

Over the next five years, the Vietnam radio market is expected to experience steady growth, driven by increased digital penetration, the expansion of regional radio stations, and the diversification of content offerings. As consumer preferences shift towards mobile and internet-based radio, the market is likely to see the rise of hybrid models that combine both traditional and digital formats. Furthermore, government support in frequency allocation and technology upgradation for radio broadcasting will play a crucial role in shaping the market's future trajectory. Factors such as increasing mobile phone penetration, urbanization, and the continued cultural relevance of radio in rural areas will ensure that radio remains a key communication medium. Meanwhile, the growth of online radio and podcasts, particularly among younger audiences, will provide new avenues for revenue generation and market expansion.

Market Opportunities

- Integration of Digital and Analog Broadcasts: Hybrid radio technology that integrates digital and analog broadcasts presents a significant opportunity for Vietnams radio industry. In 2024, several stations began trialing hybrid models, allowing listeners to enjoy better sound quality while maintaining access to analog services in areas without digital coverage. This integration improves coverage and listener experience, ensuring that radio remains relevant in both urban and rural areas. The Ministry of Information and Communications is spearheading efforts to roll out this technology nationwide.

- Partnerships with Online Platforms: Radio stations in Vietnam are increasingly collaborating with online platforms to expand their audience reach. In 2024, several broadcasters partnered with popular streaming services, allowing their content to be accessible via mobile apps and online channels. These partnerships help radio stations tap into the growing demand for digital content while retaining their traditional listener base. This strategy is supported by Vietnams 80 million internet users, creating a seamless blend of online and offline content delivery.

Scope of the Report

|

Segment |

Sub-Segment |

|

By Type of Broadcasting |

AM/FM, Digital Radio (DAB, DRM), Satellite Radio, Internet Radio |

|

By Content Type |

Music, News, Talk Shows, Religious Programming, Educational |

|

By Geography |

Northern Vietnam, Central Vietnam, Southern Vietnam |

|

By Distribution Channel |

Direct Broadcast, Online Streaming, Mobile Apps |

|

By End User |

Residential, Commercial, Public Sector |

Products

Key Target Audience

Media Agencies

Advertising Agencies

Content Creators and Producers

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (Vietnam Ministry of Information and Communications)

Telecommunication Service Providers

Radio Broadcasters

Audio Equipment Manufacturers

Companies

Major 15 Players

Voice of Vietnam (VOV)

Vietnam Television Corporation (VTV)

Vietnam Multimedia Corporation (VTC)

Giai Tri FM

Thanh Nien Radio

Hanoi Radio and Television

Ho Chi Minh City Television (HTV)

Zing MP3 Radio

Radio Saigon

VN Express Radio

FPT Play Radio

Yeu Am Nhac Radio

VTC Now

Tuoi Tre Online Radio

SBS Radio Vietnam

Table of Contents

1. Vietnam Radio Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Vietnam Radio Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Vietnam Radio Market Analysis

3.1. Growth Drivers

3.1.1. Urbanization and Media Consumption Trends (Radio audience demographics)

3.1.2. Technological Advancements in Broadcasting (DAB, DRM technologies)

3.1.3. Increasing Ad Spend on Local and Regional Stations

3.1.4. Cultural Significance and Penetration of Radio

3.2. Market Challenges

3.2.1. Shift to Digital Streaming Platforms (Competition from podcasts, online music services)

3.2.2. High Infrastructure Costs for Modernization

3.2.3. Limited Reach in Remote Areas (Infrastructure challenges)

3.3. Opportunities

3.3.1. Integration of Digital and Analog Broadcasts (Hybrid radio technology)

3.3.2. Partnerships with Online Platforms (Cross-platform collaborations)

3.3.3. Local Content Production and Localization (Vietnamese language and cultural programming)

3.4. Trends

3.4.1. Growth of Talk Radio and Educational Content

3.4.2. Expansion of Community and Regional Radio Stations

3.4.3. Adoption of Mobile Radio Apps

3.4.4. Increasing Demand for Real-Time News and Traffic Updates

3.5. Government Regulation

3.5.1. Broadcasting License Requirements (Vietnam Ministry of Information and Communication regulations)

3.5.2. Advertising Restrictions and Policies

3.5.3. Frequency Allocation and Spectrum Management

3.5.4. Public Broadcasting Mandates

3.6. SWOT Analysis

3.7. Stake Ecosystem (Advertisers, content creators, broadcasters, regulators)

3.8. Porters Five Forces Analysis (Supplier power, buyer power, barriers to entry, competition, and substitutes)

3.9. Competition Ecosystem

4. Vietnam Radio Market Segmentation

4.1. By Type of Broadcasting

4.1.1. AM/FM

4.1.2. Digital Radio (DAB, DRM)

4.1.3. Satellite Radio

4.1.4. Internet Radio

4.2. By Content Type

4.2.1. Music (Classical, Pop, Folk, etc.)

4.2.2. News and Talk Shows

4.2.3. Religious Programming

4.2.4. Educational Content

4.3. By Geography

4.3.1. Northern Vietnam

4.3.2. Central Vietnam

4.3.3. Southern Vietnam

4.4. By Distribution Channel

4.4.1. Direct Broadcast (Over-the-Air)

4.4.2. Online Streaming

4.4.3. Mobile Apps

4.5. By End User

4.5.1. Residential

4.5.2. Commercial

4.5.3. Public Sector (Education, government communication)

5. Vietnam Radio Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Vietnam Television Corporation (VTV)

5.1.2. Voice of Vietnam (VOV)

5.1.3. Vietnam Multimedia Corporation (VTC)

5.1.4. Hanoi Radio and Television

5.1.5. Ho Chi Minh City Television (HTV)

5.1.6. Giai Tri FM Radio

5.1.7. Tuoi Tre Online Radio

5.1.8. SBS Radio Vietnam

5.1.9. Thanh Nien Radio

5.1.10. Zing MP3 Radio

5.1.11. VTC Now

5.1.12. FPT Play Radio

5.1.13. Yeu Am Nhac Radio

5.1.14. Radio Saigon

5.1.15. VN Express Radio

5.2 Cross Comparison Parameters (Audience reach, Headquarters, Inception Year, Revenue, Content type, No. of radio channels, Language, Distribution)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. Vietnam Radio Market Regulatory Framework

6.1 Broadcasting Standards (Audio quality, language, programming rules)

6.2 Compliance Requirements (Government approval, licensing)

6.3 Certification Processes (Approval from the Ministry of Information and Communication)

7. Vietnam Radio Market Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth (Digital adoption, rural penetration)

8. Vietnam Radio Market Future Market Segmentation

8.1 By Type of Broadcasting

8.2 By Content Type

8.3 By Distribution Channel

8.4 By Geography

8.5 By End User

9. Vietnam Radio Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis (Demographics, listener loyalty)

9.3 Marketing Initiatives (Localized advertising strategies)

9.4 White Space Opportunity Analysis (Untapped rural markets, niche content)

Research Methodology

Step 1: Identification of Key Variables

The first stage of research involves constructing an ecosystem map of the Vietnam radio market, identifying major stakeholders such as broadcasters, advertisers, and government regulators. This step relies on extensive desk research using industry databases to determine key market dynamics, such as technology adoption and content trends.

Step 2: Market Analysis and Construction

In this phase, historical data on radio broadcasting is compiled, including revenue generation, advertising spend, and consumer preferences. Additionally, analysis of market penetration and the competitive landscape is conducted to provide a comprehensive overview of the Vietnam radio market.

Step 3: Hypothesis Validation and Expert Consultation

Interviews with industry experts, including radio station managers and content creators, are conducted to validate market hypotheses. This step provides firsthand insights into operational challenges, listener demographics, and revenue generation trends, enhancing the accuracy of market data.

Step 4: Research Synthesis and Final Output

The final stage involves synthesizing the research findings, combining insights from both qualitative and quantitative data sources. The result is a detailed analysis of the Vietnam radio market, validated by market experts, providing a reliable foundation for strategic decision-making.

Frequently Asked Questions

01. How big is the Vietnam Radio Market?

The Vietnam radio market is valued at USD 60 million, driven by urbanization, media consumption growth, and the integration of new broadcasting technologies such as digital radio.

02. What are the challenges in the Vietnam Radio Market?

The key challenges include competition from digital streaming platforms, high infrastructure costs for modernization, and limited reach in remote areas due to insufficient infrastructure investment.

03. Who are the major players in the Vietnam Radio Market?

Key players include Voice of Vietnam (VOV), Vietnam Television Corporation (VTV), Vietnam Multimedia Corporation (VTC), Giai Tri FM, and Thanh Nien Radio. These companies dominate due to their established presence and technological advancements.

04. What are the growth drivers of the Vietnam Radio Market?

Growth drivers include the increasing use of mobile and digital platforms, government support for radio broadcasting, and strong cultural attachment to radio content, particularly in rural areas.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.