Vietnam Ready-to-Drink Tea Market Outlook to 2030

Region:Asia

Author(s):Sanjna Verma

Product Code:KROD5452

November 2024

85

About the Report

Vietnam Ready-to-Drink Market Overview

- The Vietnam Ready-to-Drink (RTD) Tea market is valued at USD 350 million, based on a five-year historical analysis. The markets growth is primarily driven by rising consumer demand for convenient and healthier beverage alternatives. Additionally, the expansion of modern retail formats and the proliferation of e-commerce platforms have further boosted the availability and accessibility of RTD tea products, contributing to the overall market growth.

- Hanoi and Ho Chi Minh City are the dominant regions in the Vietnam RTD Tea market due to their large urban populations, high consumer purchasing power, and strong distribution networks. These cities are home to a younger demographic that is increasingly shifting towards healthy lifestyles, making them prime markets for RTD tea consumption.

- Vietnams Ministry of Health has stringent food safety standards that directly impact the production and distribution of ready-to-drink tea products. In 2022, the government introduced new regulations under the Food Safety Law, mandating that all beverages meet specific hygiene and labeling requirements. These regulations are aimed at ensuring consumer safety, and non-compliance can lead to penalties, including product recalls and fines. As of 2024, food safety standards are strictly enforced, and manufacturers must ensure adherence to avoid market disruptions

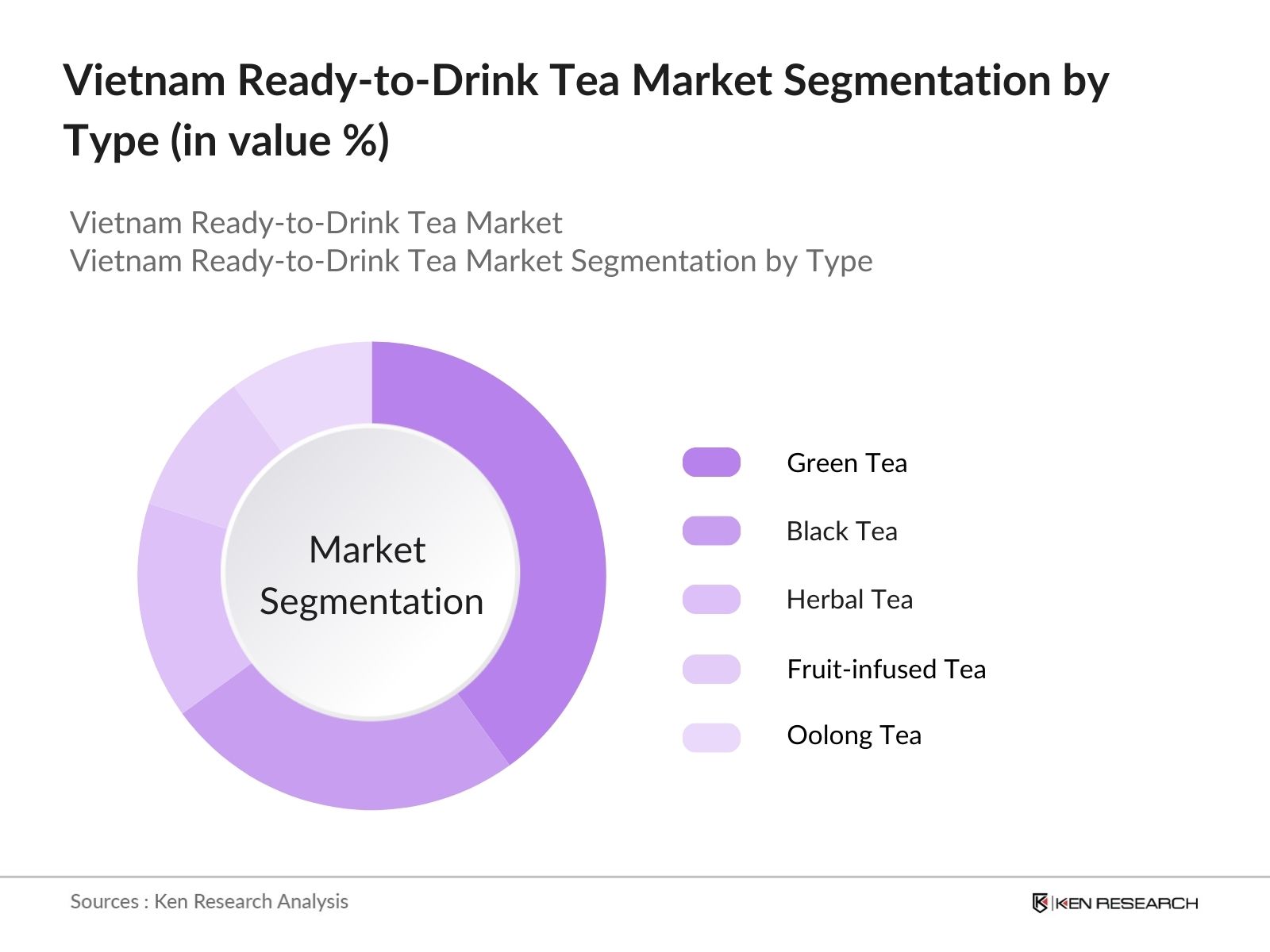

Vietnam Ready-to-Drink Tea Market Segmentation

By Type: Vietnams RTD Tea market is segmented by type into Green Tea, Black Tea, Herbal Tea, Fruit-Infused Tea, and Oolong Tea. Green tea currently dominates the market share due to its well-known health benefits, including antioxidants and weight management properties. Green teas ingrained cultural presence and increasing consumption as a health beverage, coupled with aggressive marketing by both local and international brands, further solidify its leading position in the market.

By Distribution Channel: The RTD Tea market in Vietnam is segmented by distribution channels into Supermarkets/Hypermarkets, Convenience Stores, Online Retail, and Specialty Stores. Supermarkets/Hypermarkets dominate the distribution landscape, accounting for the largest share, as they provide consumers with a wide range of product choices, discounts, and bulk buying opportunities. The rapid growth of modern retail chains and strategic partnerships with tea brands contribute to the strong presence of this channel.

Vietnam Ready-to-Drink Tea Market Competitive Landscape

The Vietnam RTD Tea market is characterized by intense competition, dominated by both local and international players. Major competitors have established a strong presence through product diversification, strategic partnerships, and continuous innovation. These companies have a solid distribution network, leveraging both modern retail and online platforms to maximize market penetration.

|

Company |

Establishment Year |

Headquarters |

Product Innovation |

Distribution Network |

Revenue (USD Mn) |

Key Partnerships |

Sustainability Initiatives |

Marketing Strategy |

|

Suntory PepsiCo Vietnam |

1994 |

Ho Chi Minh City |

- |

- |

- |

- |

- |

- |

|

Tan Hiep Phat Beverage Group |

1994 |

Binh Duong |

- |

- |

- |

- |

- |

- |

|

Nestl Vietnam |

1995 |

Ho Chi Minh City |

- |

- |

- |

- |

- |

- |

|

Kirin Holdings Vietnam |

2011 |

Hanoi |

- |

- |

- |

- |

- |

- |

|

Coca-Cola Vietnam |

1994 |

Ho Chi Minh City |

- |

- |

- |

- |

- |

- |

Vietnam Ready-to-Drink Tea Market Analysis

Growth Drivers

- Consumer Preferences: The increasing shift in consumer preferences towards ready-to-drink tea is driven by the growing demand for convenient and health-oriented beverages in Vietnam. In 2024, the Vietnamese population is expected to reach around 102.9 million, contributing to a larger market base for health-conscious consumers seeking ready-to-consume beverages.

- Convenience Factors: With Vietnams fast-paced lifestyle, the demand for convenient beverage solutions like ready-to-drink tea has surged. According to the General Office of Statistics (GSO) of Vietnam, the country's workforce grew to approximately52.4 million peoplein 2023, which is an increase of about665,500from the previous year. The ready-to-drink tea market benefits from this, offering consumers time-saving options. This trend is supported by the rise of quick-service restaurants and convenience stores.

- Health Benefits: The rising awareness of health benefits associated with tea consumption is a key driver for the ready-to-drink tea market. Vietnams government, through the Ministry of Health, continues to promote healthy dietary choices, including increased consumption of tea due to its antioxidant properties. In 2022, a national survey revealed that over 60% of Vietnamese consumers preferred beverages with functional health benefits, such as immune-boosting and weight management features.

Challenges

- Price Sensitivity: The Vietnamese consumer market remains highly price-sensitive, posing a challenge for premium ready-to-drink tea brands. In 2022, household disposable income averaged around VND 4.5 million monthly, limiting the spending potential for higher-priced beverages. As inflation hovered at 3.4% in 2023, consumers leaned towards affordable options, which are predominantly local beverage brands.

- Competition from Local Beverages: Vietnam has a rich heritage of local beverage consumption, including traditional tea, coffee, and herbal drinks, making it a competitive landscape for ready-to-drink tea brands. The availability of cheaper alternatives in local markets and street vendors poses a threat to packaged ready-to-drink teas. Additionally, the preference for freshly brewed tea is still prevalent in many rural areas.

Vietnam Ready-to-Drink Tea Market Future Outlook

Vietnam Ready-to-Drink Tea market is expected to exhibit significant growth, driven by increasing consumer demand for healthier and convenient beverage options. The market will likely benefit from advancements in packaging technology, which will enhance the shelf life and appeal of RTD tea products. Growing interest in organic and low-sugar variants, along with the expansion of e-commerce platforms, will create new opportunities for market players to tap into untapped regions and consumer segments.

Market Opportunities

- Emerging Health-Conscious Consumers: Vietnam is witnessing a rise in health-conscious consumers, offering significant growth opportunities for the ready-to-drink tea market. The 2024 Universal Health Coverage (UHC) Day campaign emphasizes the role of government in promoting health and wellness, aiming to reduce financial barriers to healthcare and enhance access to essential services. This creates an opportunity for manufacturers to introduce low-calorie and functional teas that cater to this demographic.

- Innovation in Flavors: The increasing demand for new and unique flavors presents an opportunity for brands to differentiate themselves in the ready-to-drink tea market. In 2023, flavor innovation accounted for nearly 12% of new beverage launches in Vietnam, reflecting a strong consumer interest in diverse taste profiles. Brands experimenting with local flavors such as pandan, lemongrass, and jasmine are gaining popularity among younger consumers.

Scope of the Report

|

Segments |

Sub-segments |

|

By Type |

Green Tea Black Tea Herbal Tea Fruit-Infused Tea Oolong Tea |

|

By Distribution Channel |

Supermarkets/Hypermarkets Convenience Stores Online Retail Specialty Stores |

|

By Packaging Type |

Bottles Cans Tetra Packs Pouches |

|

By Flavor |

Traditional Fruit Flavors Herbal |

|

By Region |

North Central South |

Major Players

- Suntory PepsiCo Vietnam Beverage

- Tan Hiep Phat Beverage Group

- Nestl Vietnam Ltd.

- Kirin Holdings Vietnam

- Coca-Cola Vietnam

- VinaTea

- Lipton Vietnam

- Fuze Tea

- Bidrico

- Unilever Vietnam

Products

Key Target Audience

Beverage Manufacturers

Retail Chains and Supermarkets

Health and Wellness Brands

Tea Processing Companies

E-commerce Platforms

Investors and Venture Capitalist Firms (IDG Ventures Vietnam, Mekong Capital)

Government and Regulatory Bodies (Vietnam Food Administration, Ministry of Health)

Table of Contents

1. Vietnam Ready-to-Drink Tea Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Vietnam Ready-to-Drink Tea Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Vietnam Ready-to-Drink Tea Market Analysis

3.1. Growth Drivers

3.1.1. Consumer Preferences

3.1.2. Convenience Factors

3.1.3. Health Benefits

3.1.4. Expansion of Organized Retail

3.2. Market Challenges

3.2.1. Price Sensitivity

3.2.2. Competition from Local Beverages

3.2.3. Raw Material Fluctuations

3.3. Opportunities

3.3.1. Emerging Health-Conscious Consumers

3.3.2. Innovation in Flavors

3.3.3. Export Growth Potential

3.4. Trends

3.4.1. Premiumization

3.4.2. Organic and Sugar-Free Products

3.4.3. Sustainable Packaging

3.5. Government Regulation

3.5.1. Food Safety Standards

3.5.2. Import-Export Regulations

3.5.3. Trade Agreements

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Vietnam Ready-to-Drink Tea Market Segmentation

4.1. By Type (In Value %)

4.1.1. Green Tea

4.1.2. Black Tea

4.1.3. Herbal Tea

4.1.4. Fruit-Infused Tea

4.1.5. Oolong Tea

4.2. By Distribution Channel (In Value %)

4.2.1. Supermarkets/Hypermarkets

4.2.2. Convenience Stores

4.2.3. Online Retail

4.2.4. Specialty Stores

4.3. By Packaging Type (In Value %)

4.3.1. Bottles

4.3.2. Cans

4.3.3. Tetra Packs

4.3.4. Pouches

4.4. By Flavor (In Value %)

4.4.1. Traditional

4.4.2. Fruit Flavors

4.4.3. Herbal

4.5. By Region (In Value %)

4.5.1. North

4.5.2. Central

4.5.3. South

5. Vietnam Ready-to-Drink Tea Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Suntory PepsiCo Vietnam Beverage

5.1.2. Tan Hiep Phat Beverage Group

5.1.3. Nestl Vietnam Ltd.

5.1.4. Kirin Holdings Vietnam

5.1.5. Unilever Vietnam

5.1.6. Coca-Cola Vietnam

5.1.7. VinaTea

5.1.8. Fuze Tea

5.1.9. Bidrico

5.1.10. Lipton Vietnam

5.2. Cross Comparison Parameters (Market Share, Product Portfolio, Distribution Network, Innovation Capabilities, Strategic Alliances, Revenue Growth, Sustainability Initiatives, Manufacturing Capacity)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Vietnam Ready-to-Drink Tea Market Regulatory Framework

6.1. Compliance Requirements (Food Labeling Regulations, Quality Standards)

6.2. Certification Processes (ISO, HACCP, Organic Certifications)

7. Vietnam Ready-to-Drink Tea Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Vietnam Ready-to-Drink Tea Future Market Segmentation

8.1. By Type (In Value %)

8.2. By Distribution Channel (In Value %)

8.3. By Packaging Type (In Value %)

8.4. By Flavor (In Value %)

8.5. By Region (In Value %)

9. Vietnam Ready-to-Drink Tea Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

In the initial phase, an ecosystem map is developed to include all major stakeholders within the Vietnam Ready-to-Drink Tea market. Extensive desk research and proprietary databases are utilized to gather industry-level insights. The key objective here is to define critical variables such as consumer preferences, distribution channels, and regulatory policies affecting market dynamics.

Step 2: Market Analysis and Construction

This phase involves collecting and analyzing historical data on the Vietnam RTD Tea market. Penetration of tea products across urban and rural areas, sales volumes, and revenue generation will be assessed. This stage also involves the calculation of market share distribution for various sub-segments to ensure accuracy in market estimation.

Step 3: Hypothesis Validation and Expert Consultation

A series of expert consultations and interviews will be conducted using computer-assisted telephone interviews (CATIs). These experts, who come from key companies operating within the RTD tea market, provide insights into operational challenges, consumer preferences, and key growth drivers. These interviews help refine and validate initial market hypotheses.

Step 4: Research Synthesis and Final Output

Finally, data from various stakeholders will be synthesized to form a comprehensive report. This step ensures that all market forecasts and growth predictions are cross-verified with actual sales data and expert opinions, offering a holistic analysis of the Vietnam RTD Tea market.

Frequently Asked Questions

01 How big is the Vietnam Ready-to-Drink Tea Market?

The Vietnam Ready-to-Drink Tea market, valued at USD 350 million, has been growing steadily due to increasing consumer demand for healthier alternatives and convenience products.

02 What are the challenges in the Vietnam Ready-to-Drink Tea Market?

Challenges of Vietnam Ready-to-Drink Tea market include the high competition from local and international beverage brands, fluctuating raw material costs, and price sensitivity among consumers.

03 Who are the major players in the Vietnam Ready-to-Drink Tea Market?

Key players of Vietnam Ready-to-Drink Tea market include Suntory PepsiCo Vietnam Beverage, Tan Hiep Phat Beverage Group, Nestl Vietnam, Kirin Holdings Vietnam, and Coca-Cola Vietnam.

04 What are the growth drivers of the Vietnam Ready-to-Drink Tea Market?

Vietnam Ready-to-Drink Tea market is driven by health-conscious consumers, the rise in e-commerce platforms, and innovation in flavors and packaging. There is also a growing demand for organic and low-sugar tea products.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.