Vietnam Rental Car Market Outlook to 2030

Region:Asia

Author(s):Mukul

Product Code:KROD8474

October 2024

87

About the Report

Vietnam Rental Car Market Overview

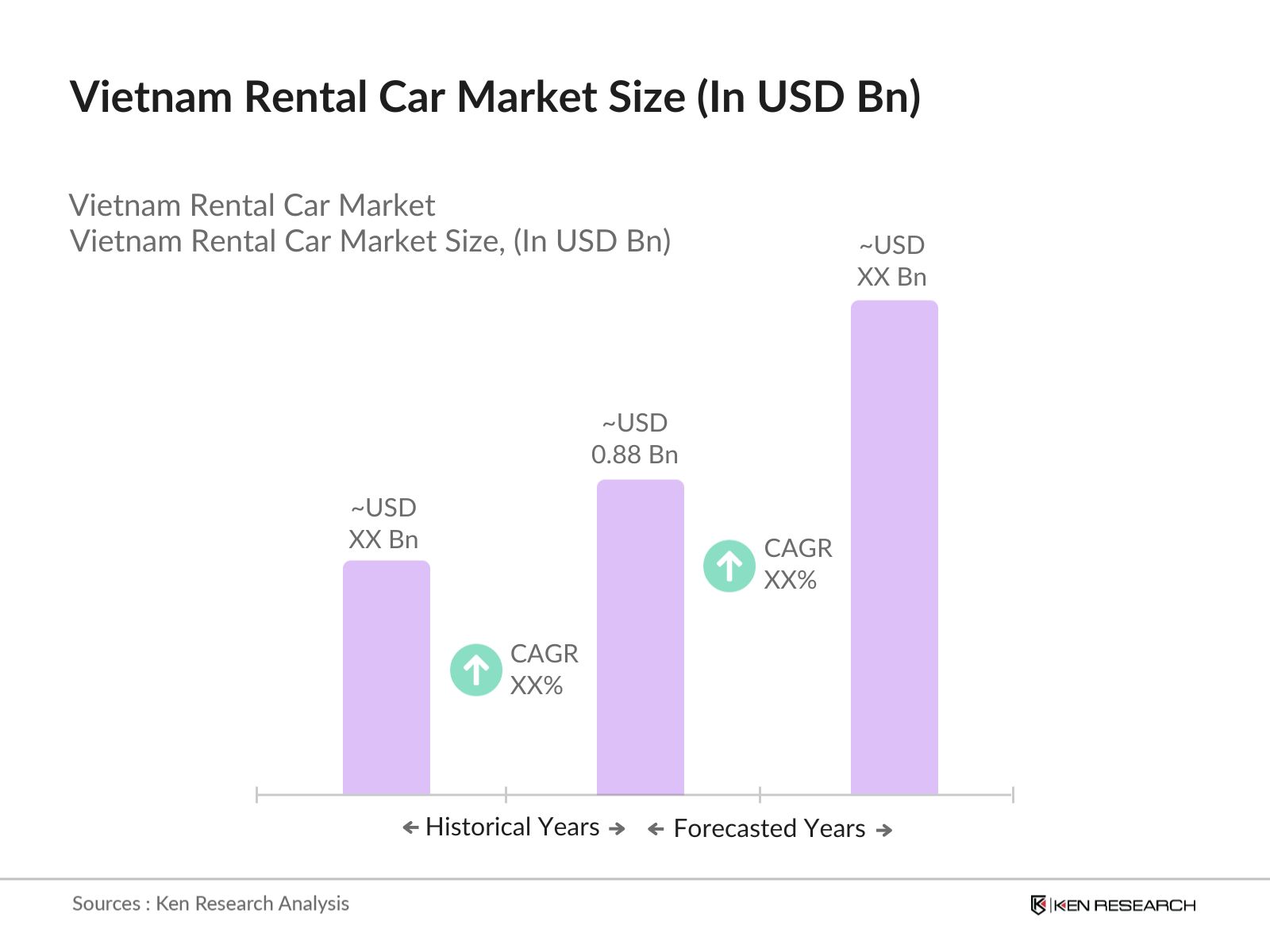

- The Vietnam rental car market is valued at USD 0.88 billion, driven by the growing demand from both leisure travelers and business tourists. Increased tourism, particularly in key tourist hubs like Ho Chi Minh City and Hanoi, plays a crucial role in driving market demand. The market has also benefited from Vietnams rapidly expanding middle class and rising disposable income, which encourages higher spending on transportation services. Furthermore, the adoption of ride-hailing services like Grab, offering car rentals, has further supported the market's growth.

- Ho Chi Minh City and Hanoi are the dominant cities in Vietnams rental car market due to their status as major business and tourism hubs. Both cities are home to a significant number of expatriates, international businesses, and corporate offices, which increases the demand for business travel. Additionally, these cities witness high tourist footfall, contributing to a robust demand for leisure car rentals. The presence of better infrastructure and accessibility to modern roads also enhances the rental experience in these urban centers.

- Vietnamese authorities impose strict licensing requirements for car rental companies, which are overseen by the Ministry of Transport. To legally operate, companies must obtain a business license and meet the regulations related to vehicle safety, insurance, and emissions. As of 2023, new regulations require periodic inspections of rental vehicles to ensure they meet roadworthiness standards, adding an additional compliance burden for rental companies.

Market Segmentation

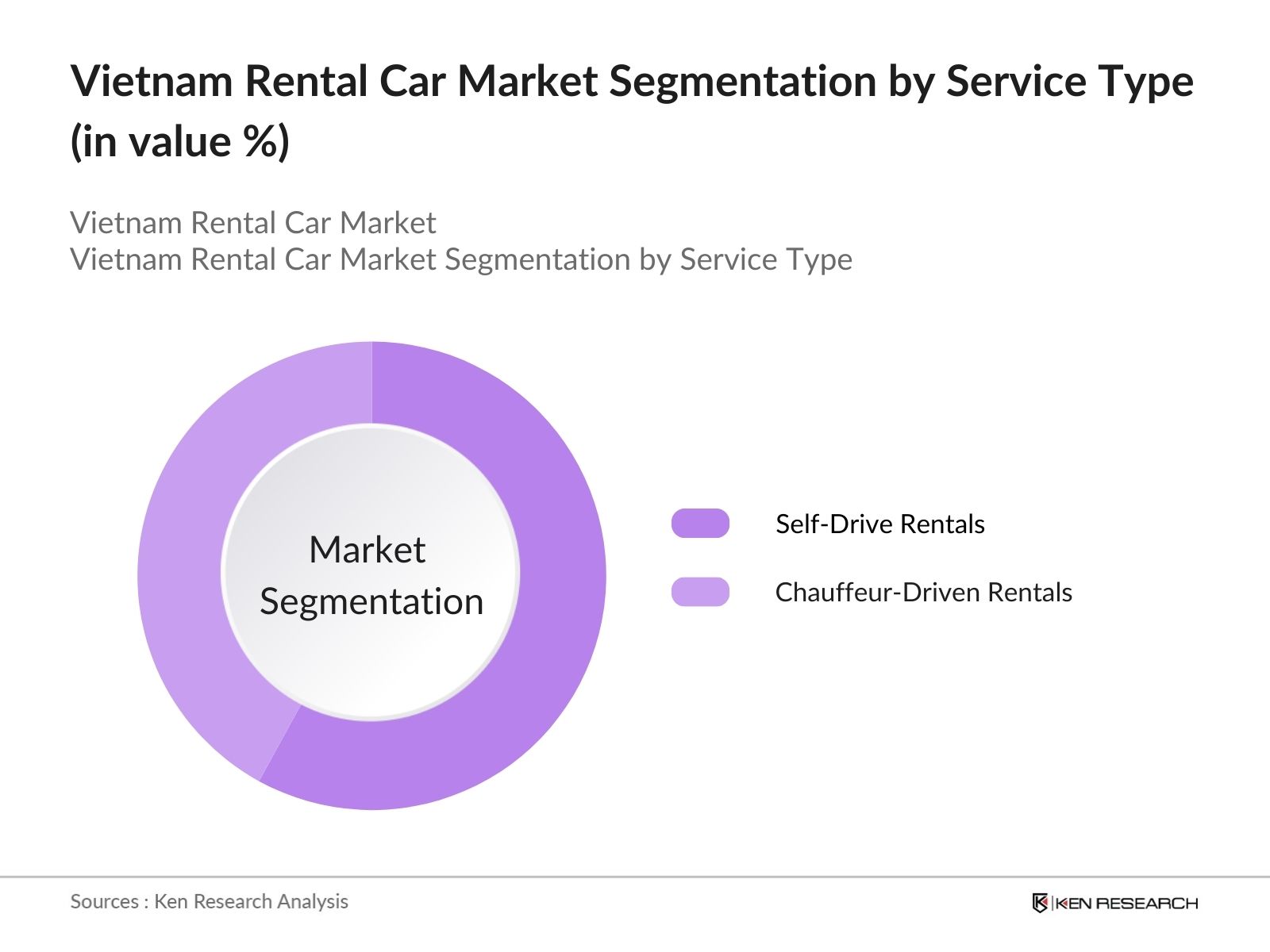

- By Service Type: The Vietnam rental car market is segmented by service type into Self-Drive Rentals and Chauffeur-Driven Rentals. Self-drive rentals dominate the market due to the growing trend of personalized travel experiences. Vietnamese consumers, especially younger demographics, prefer the flexibility of driving their vehicles, which provides convenience for road trips and local exploration. Furthermore, with urban dwellers favoring weekend getaways, self-drive services remain a popular choice. The affordability of renting vehicles without a driver also makes this segment attractive to budget-conscious customers.

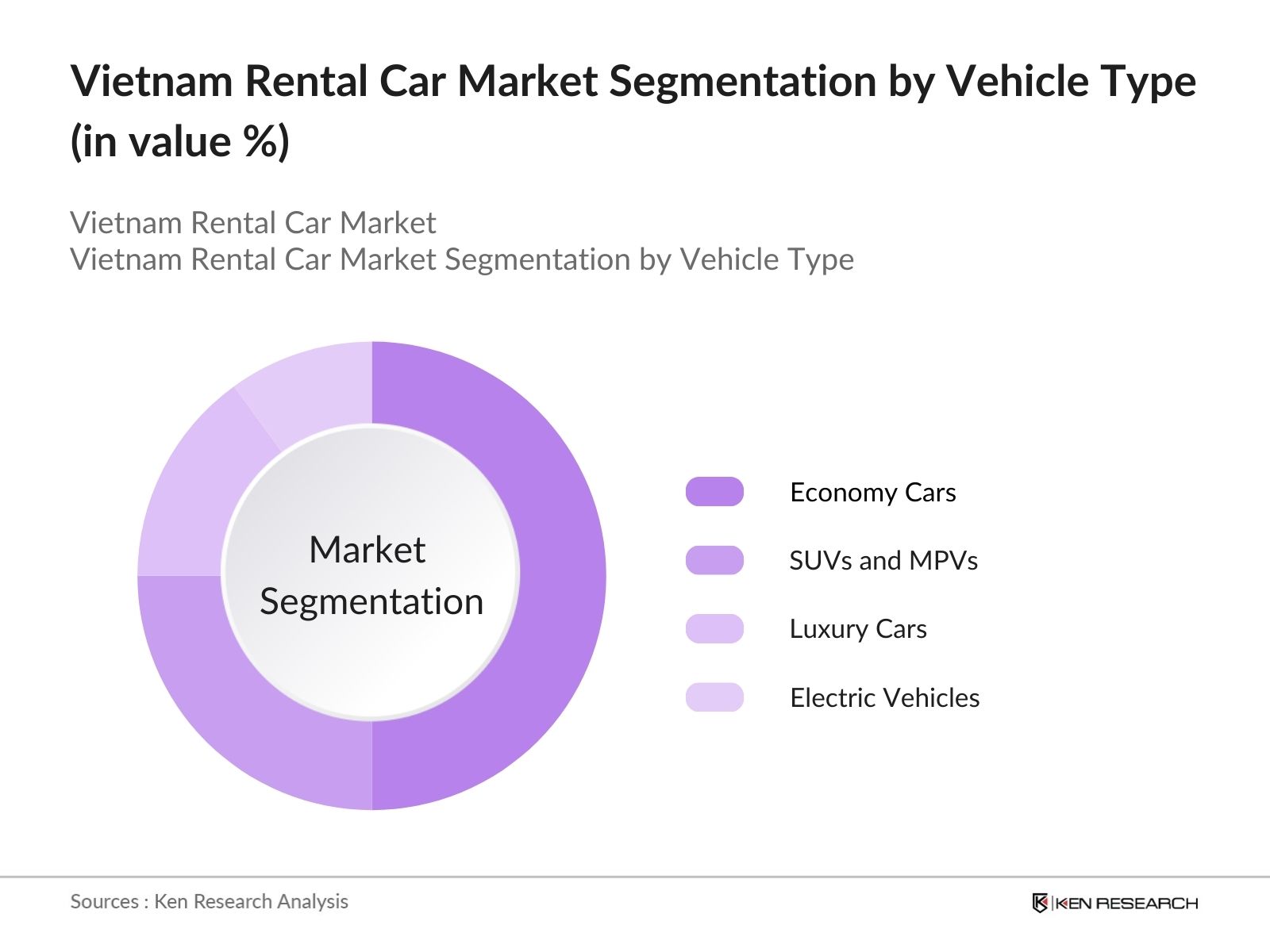

- By Vehicle Type: The Vietnam rental car market is further segmented by vehicle type into Economy Cars, Luxury Cars, SUVs and MPVs, and Electric Vehicles. Economy cars hold the largest market share due to their affordability and fuel efficiency, making them ideal for budget-conscious travelers. Brands such as Toyota and Kia dominate the economy car rental market, supported by their widespread availability and cost-effectiveness. This segment is preferred by both domestic travelers and international tourists looking for value-for-money travel solutions.

Vietnam Rental Car Market Competitive Landscape

The Vietnam rental car market is dominated by both international and local players, with global brands like Avis and Budget competing alongside local providers such as Vinasun. These companies have established a strong foothold in key cities, offering a range of vehicle options and pricing tiers. Global players bring in technological innovations such as online booking platforms, while local companies focus on cost competitiveness and familiarity with local regulations.

|

Company Name |

Establishment Year |

Headquarters |

Fleet Size |

No. of Locations |

Digital Presence |

Customer Base |

Revenue (USD) |

|

Avis Budget Group |

1946 |

USA |

|||||

|

Vinasun Corporation |

2003 |

Vietnam |

|||||

|

Hertz Corporation |

1918 |

USA |

|||||

|

Green Motion Car Rental |

2007 |

UK |

|||||

|

Grab Rentals |

2012 |

Singapore |

Vietnam Rental Car Industry Analysis

Growth Drivers

- Surge in Domestic and International Tourism: Vietnam has experienced significant growth in domestic and international tourism, driven by a recovery in travel demand post-COVID. In 2022, Vietnam welcomed 3.66 million international tourists, a sharp increase from 2021 as per the Vietnam National Administration of Tourism (VNAT). This trend continues in 2024, with the number of international tourists estimated to exceed 10 million. The influx of both domestic and international tourists has increased demand for rental cars, particularly in major tourist destinations like Hanoi, Ho Chi Minh City, and Da Nang.

- Growing Corporate Demand for Car Rentals: The rise of business and corporate travel in Vietnam is a key growth driver for the rental car market. Vietnam's gross domestic product (GDP) reached $411 billion in 2022, with a significant contribution from sectors such as manufacturing, IT, and finance, which attract corporate travelers. The business travel sector contributes to the increased use of rental cars by corporate clients. This trend is expected to strengthen as corporate travel resumes in full capacity post-pandemic, particularly in cities like Ho Chi Minh and Hanoi.

- Urban Population Expansion and Need for Convenient Mobility Solutions: Vietnams urban population reached 37.5 million in 2023, according to the World Bank, accounting for nearly 38% of the total population. Urbanization is driving the need for flexible and convenient mobility solutions, including car rentals, especially for those who do not own private vehicles. Urban centers like Hanoi and Ho Chi Minh are experiencing significant demand for short-term rentals and self-driving cars as people seek alternatives to traditional public transportation.

Market Restraints

- Stringent Government Regulations for Car Rentals: The Vietnamese government imposes stringent regulations on the car rental market, particularly concerning driver safety and vehicle registration. Car rental companies must meet specific licensing and insurance requirements, which can be cumbersome for new market entrants. In 2023, the Ministry of Transport updated regulations that mandate compliance with vehicle safety and emissions standards, further adding to operational complexities for rental businesses.

- High Costs of Maintaining and Expanding Car Rental Fleets: Car rental companies in Vietnam face high operational costs related to fleet maintenance and expansion. The cost of maintaining a vehicle fleet in line with Vietnams road safety and environmental regulations adds to the financial burden. In 2023, vehicle import tariffs were as high as 70%, according to the Vietnam Ministry of Finance, which makes expanding fleets more costly. This results in rental companies facing difficulties in upgrading or enlarging their car pools to meet growing demand.

Vietnam Rental Car Market Future Outlook

Over the next five years, the Vietnam rental car market is expected to experience steady growth, driven by increasing tourism, rising disposable incomes, and the expanding demand for business travel. The countrys growing middle class is likely to further stimulate demand for affordable transportation solutions, while the rise in business tourism will enhance the need for chauffeur-driven rentals. Additionally, as the adoption of electric vehicles (EVs) gains momentum, rental agencies are expected to incorporate more EV options into their fleets, responding to global trends in sustainability and green transportation.

Market Opportunities

- Adoption of Digital Platforms and Mobile Apps for Car Rentals: With digital transformation accelerating across Vietnam, the adoption of online platforms and mobile apps for car rentals is increasing. In 2023, Vietnam recorded over 93 million smartphone users, according to data from Statista. Car rental companies are leveraging digital solutions, offering online booking, real-time vehicle availability, and mobile payment options. These technological advancements help companies streamline operations and cater to the digitally savvy population.

- Increasing International Tourists Driving Rental Demand: Vietnam continues to attract international tourists due to its cultural heritage, affordable travel options, and easing of entry restrictions. In 2023, nearly 7.5 million international tourists visited Vietnam, according to VNAT. With the government targeting tourism as a key growth sector, this influx of international travelers is projected to sustain high demand for rental cars, especially in popular tourist regions. This presents a lucrative opportunity for the rental car market to capitalize on.

Scope of the Report

|

By Service Type |

- Self-Drive Rentals |

|

- Chauffeur-Driven Rentals |

|

|

By Rental Duration |

- Short-Term Rentals |

|

- Long-Term Rentals |

|

|

By Customer Type |

- Leisure Travelers |

|

- Business Travelers |

|

|

- Local Residents |

|

|

By Vehicle Type |

- Economy Cars |

|

- Luxury Cars |

|

|

- SUVs and MPVs |

|

|

- Electric Vehicles |

|

|

By Region |

- Ho Chi Minh City |

|

- Hanoi |

|

|

- Da Nang |

|

|

- Other Provinces |

Products

Key Target Audience

Corporate Travel Agencies

Tourism Operators

Car Rental Agencies

Automotive Manufacturers

Local and International Tourists

Government and Regulatory Bodies (Ministry of Transport, Ministry of Tourism)

Investor and Venture Capitalist Firms

Fleet Management Companies

Companies

Players Mentioned in the Report:

Avis Budget Group

Hertz Corporation

Sixt SE

Vinasun Corporation

Green Motion Car Rental

Thrifty Car Rental

Grab Rentals

Savico Rent-a-Car

Toyota Rent a Car

Vietnam Drive

Europcar Mobility Group

Budget Rent a Car

Enterprise Holdings

Localiza Rent A Car

Carzonrent

Table of Contents

1. Vietnam Rental Car Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Vietnam Rental Car Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Vietnam Rental Car Market Analysis

3.1. Growth Drivers (Increasing Tourism, Rise in Corporate Travel, Urbanization, Rising Disposable Income)

3.1.1. Surge in Domestic and International Tourism

3.1.2. Growing Corporate Demand for Car Rentals

3.1.3. Urban Population Expansion and Need for Convenient Mobility Solutions

3.1.4. Increase in Household Disposable Income

3.2. Market Challenges (Regulatory Barriers, High Fleet Maintenance Costs, Market Fragmentation)

3.2.1. Stringent Government Regulations for Car Rentals

3.2.2. High Costs of Maintaining and Expanding Car Rental Fleets

3.2.3. Intense Market Competition Leading to Price Pressures

3.3. Opportunities (Technology Integration, Tourism Growth, Business Travel Expansion)

3.3.1. Adoption of Digital Platforms and Mobile Apps for Car Rentals

3.3.2. Increasing International Tourists Driving Rental Demand

3.3.3. Rising Corporate Partnerships and Fleet Leasing

3.4. Trends (Digital Transformation, Shift to Electric Vehicles, Subscription Models)

3.4.1. Growing Use of Online Rental Services

3.4.2. Introduction of Electric Vehicles into Rental Fleets

3.4.3. Subscription-Based Car Rental Models

3.5. Government Regulation (Licensing, Taxation, Vehicle Safety Standards)

3.5.1. Rental Company Licensing Requirements

3.5.2. Taxation and Regulatory Fees for Car Rental Services

3.5.3. Compliance with Vehicle Safety and Environmental Standards

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Car Manufacturers, Rental Agencies, Tour Operators)

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. Vietnam Rental Car Market Segmentation

4.1. By Service Type (In Value %)

4.1.1. Self-Drive Rentals

4.1.2. Chauffeur-Driven Rentals

4.2. By Rental Duration (In Value %)

4.2.1. Short-Term Rentals

4.2.2. Long-Term Rentals

4.3. By Customer Type (In Value %)

4.3.1. Leisure Travelers

4.3.2. Business Travelers

4.3.3. Local Residents

4.4. By Vehicle Type (In Value %)

4.4.1. Economy Cars

4.4.2. Luxury Cars

4.4.3. SUVs and MPVs

4.4.4. Electric Vehicles

4.5. By Region (In Value %)

4.5.1. Ho Chi Minh City

4.5.2. Hanoi

4.5.3. Da Nang

4.5.4. Other Provinces

5. Vietnam Rental Car Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Avis Budget Group

5.1.2. Hertz Corporation

5.1.3. Sixt SE

5.1.4. Thrifty Car Rental

5.1.5. Enterprise Holdings

5.1.6. Localiza Rent A Car

5.1.7. Green Motion Car Rental

5.1.8. Vinasun Corporation

5.1.9. Vietnam Drive

5.1.10. Europcar Mobility Group

5.1.11. Grab Rentals

5.1.12. Savico Rent-a-Car

5.1.13. Toyota Rent a Car

5.1.14. Carzonrent

5.1.15. Budget Rent a Car

5.2 Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue, Fleet Size, Customer Base, Market Reach, Digital Integration)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Partnerships, Expansions, Diversifications)

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7 Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Vietnam Rental Car Market Regulatory Framework

6.1. Licensing and Permits for Rental Companies

6.2. Compliance with Local Vehicle Safety Standards

6.3. Taxation Laws for Rental Services

6.4. Regulations on Fleet Expansion and Import Duties

7. Vietnam Rental Car Market Future Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Vietnam Rental Car Future Market Segmentation

8.1. By Service Type (In Value %)

8.2. By Rental Duration (In Value %)

8.3. By Customer Type (In Value %)

8.4. By Vehicle Type (In Value %)

8.5. By Region (In Value %)

9. Vietnam Rental Car Market Analysts' Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The first phase involves identifying critical variables within the Vietnam rental car market, including demand drivers like tourism growth, urbanization rates, and vehicle ownership patterns. This phase uses secondary research and proprietary databases to collect relevant data.

Step 2: Market Analysis and Construction

Next, we analyze historical data to evaluate rental market trends, fleet sizes, and customer preferences. This stage ensures accurate revenue estimates by evaluating fleet utilization and market penetration in both urban and rural areas.

Step 3: Hypothesis Validation and Expert Consultation

Industry experts from leading car rental companies are consulted to validate market assumptions. These experts provide insights into operational challenges, financial performance, and customer behavior, ensuring that our findings are reliable.

Step 4: Research Synthesis and Final Output

In the final stage, comprehensive research is synthesized to generate an accurate market analysis. The data is verified through consultations with rental car agencies, ensuring it aligns with market realities and consumer preferences.

Frequently Asked Questions

01. How big is the Vietnam Rental Car Market?

The Vietnam rental car market is valued at USD 0.88 billion, driven by increased tourism and business travel. The market benefits from rising disposable incomes and the growing preference for self-drive and chauffeur-driven rentals.

02. What are the challenges in the Vietnam Rental Car Market?

Key challenges include high fleet maintenance costs, regulatory barriers, and intense competition from both international and local players. Additionally, the market faces difficulties in scaling services across rural areas due to infrastructure limitations.

03. Who are the major players in the Vietnam Rental Car Market?

Major players include Avis Budget Group, Hertz Corporation, Vinasun Corporation, Green Motion Car Rental, and Grab Rentals. These companies dominate due to their extensive service networks, strong brand presence, and technological innovations.

04. What are the growth drivers of the Vietnam Rental Car Market?

The market is propelled by increasing tourism, rising disposable incomes, and the growing demand for business travel. The adoption of online booking platforms and mobile apps further boosts the ease of renting vehicles.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.