Vietnam Retail Market Outlook to 2030

Region:Global

Author(s):Shivani Mehra

Product Code:KROD2357

December 2024

83

About the Report

Vietnam Retail Market Overview

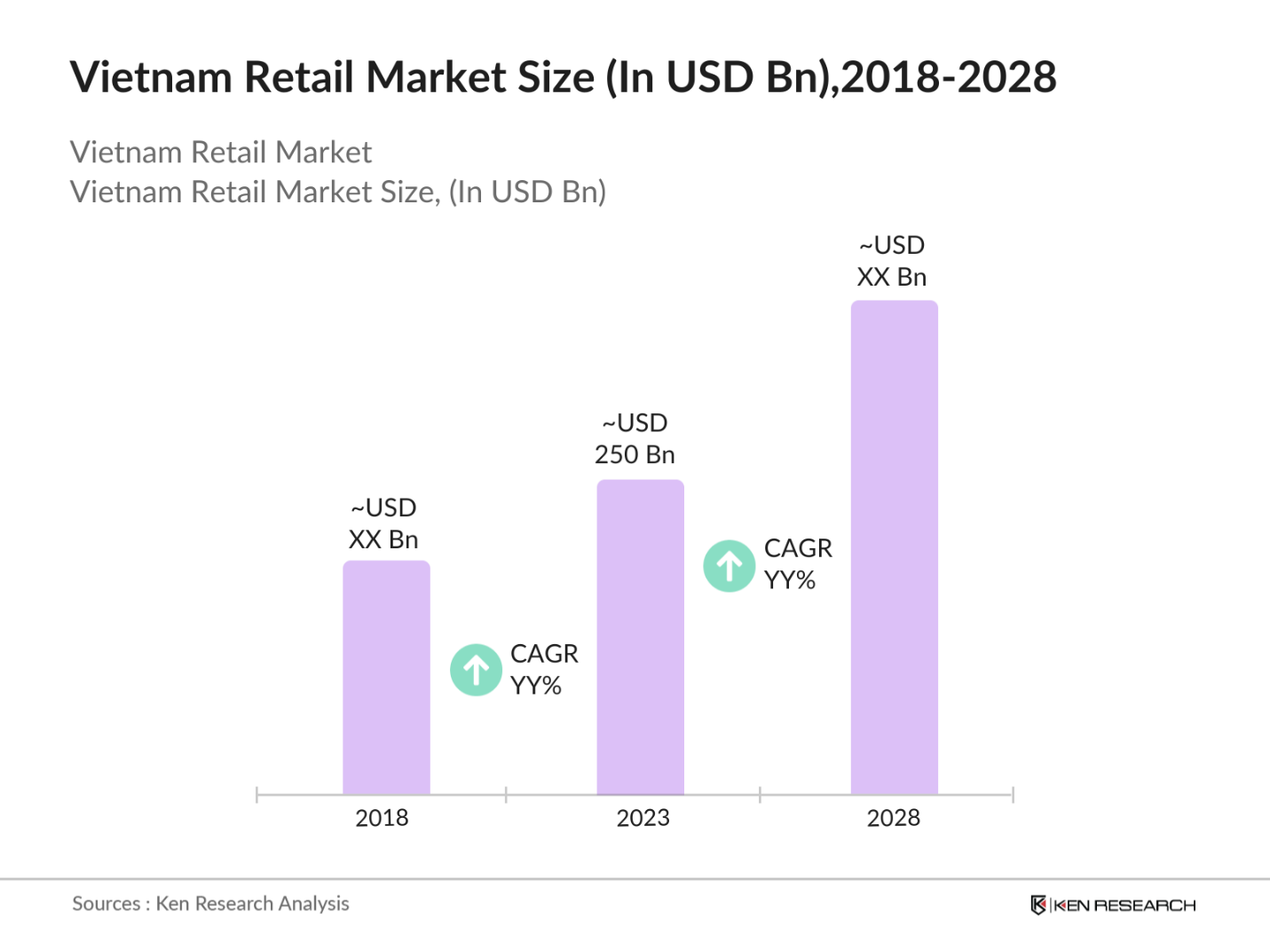

- The Vietnam retail market reached a valuation of USD 250 billion in 2023, driven by strong consumer demand and expanding urbanization. The rapid economic growth in Vietnam has resulted in a burgeoning middle class, which in turn has fueled higher purchasing power. Modern retail formats such as supermarkets, convenience stores, and e-commerce are playing a pivotal role in expanding the market.

- The retail landscape in Vietnam is shaped by both international and domestic giants. Notable companies include VinCommerce, which manages VinMart and VinMart+, Saigon Co.op, Big C, Lotte Mart, and AEON. These key players maintain a substantial presence in both urban and rural markets. AEONs ongoing expansion highlights the country's growing appeal to international retailers and the competitive nature of the market.

- In 2020, the Vietnamese government initiated the National Digital Transformation Program, marking a significant step toward digitizing key sectors, including retail, by 2025. This program encourages businesses to implement e-commerce platforms and develop digital supply chains. It also offers financial incentives for small and medium-sized enterprises (SMEs) to adopt digital payment systems, enhancing efficiency and driving growth within the retail sector.

- Ho Chi Minh City is recognized as the leader in modern retail, characterized by a high concentration of shopping centers and international brands. The city attracts significant foreign investment, which enhances its retail infrastructure and increases the availability of global brands. Notably, major international retailers such as Uniqlo and MUJI have expanded their presence in both Ho Chi Minh City and Hanoi, reflecting the cities' appeal to foreign investors and their strategic importance in the retail landscape.

Vietnam Retail Market Segmentation

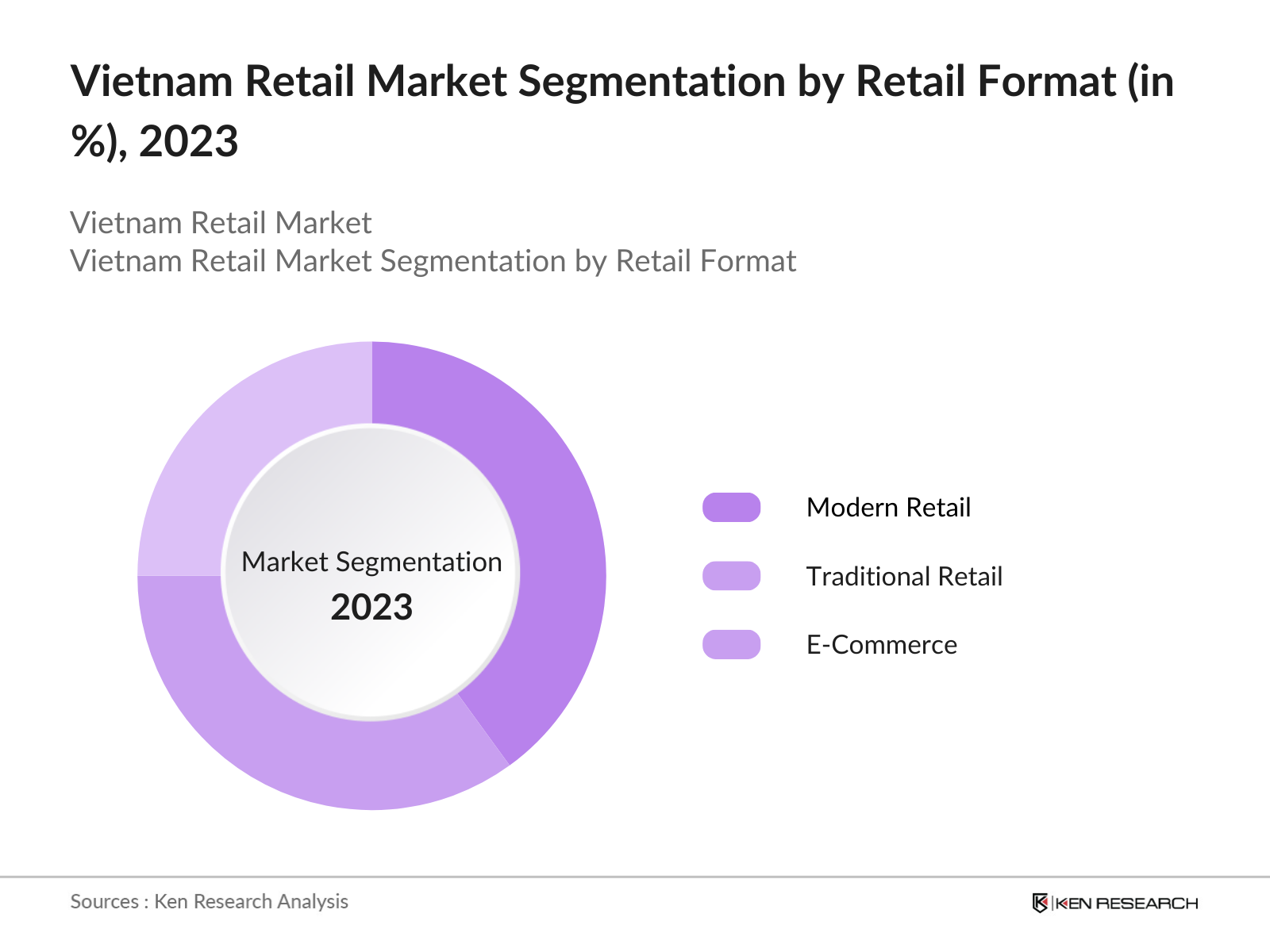

By Retail Format: Vietnams retail market is segmented into traditional retail (wet markets, mom-and-pop shops), modern retail (supermarkets, hypermarkets), and e-commerce. In 2023, modern retail formats dominated the market due to increased urbanization and a growing preference for convenience among middle-class consumers. Retail chains such as VinMart and Big C have gained popularity for their extensive product offerings and standardized pricing, driving the shift towards modern retail solutions across the country.

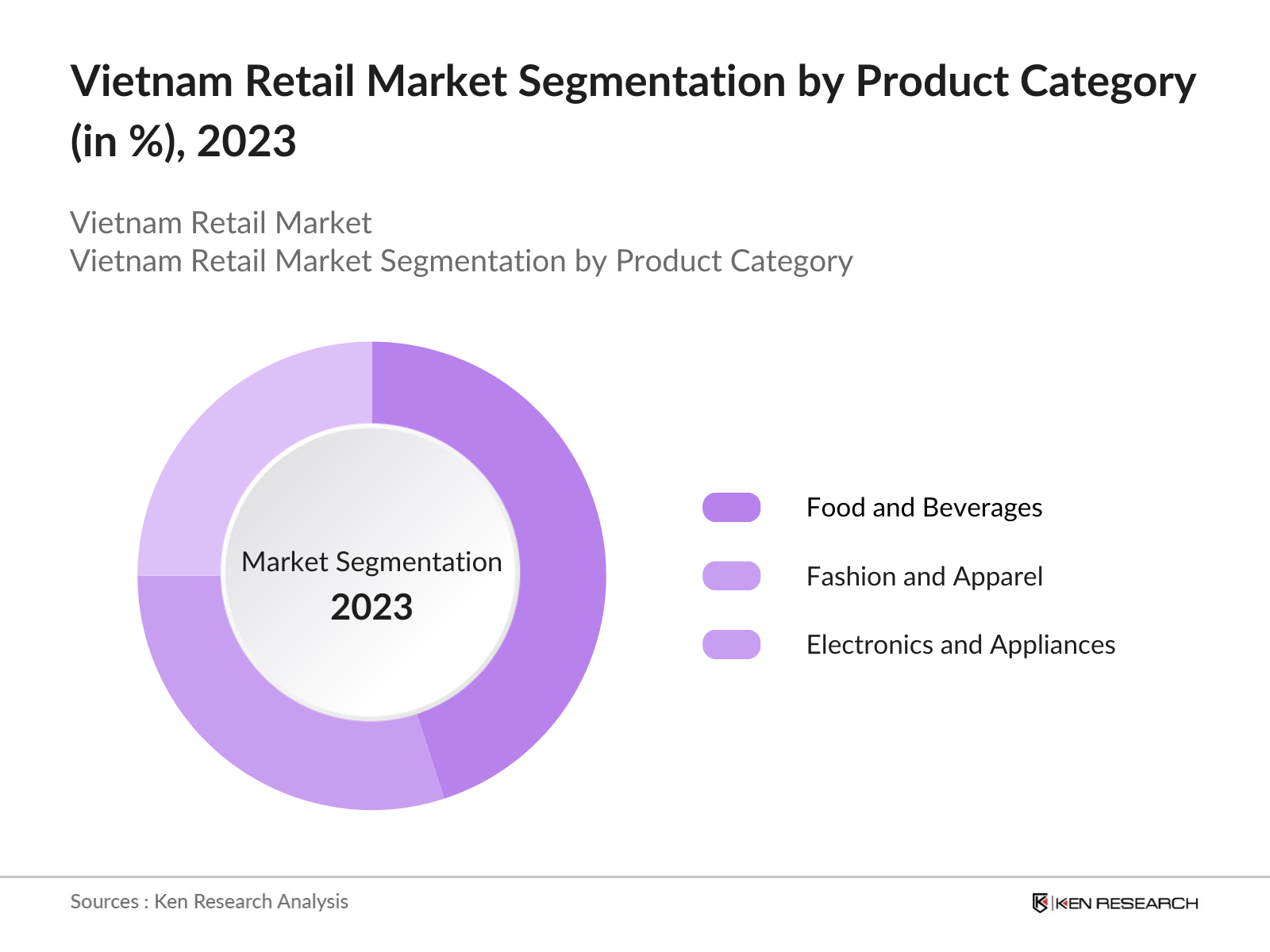

By Product Category: The Vietnam retail market is segmented into food and beverages, fashion and apparel, and electronics and home appliances. In 2023, the food and beverages category led the market, driven by frequent consumer purchases and the growing number of supermarkets offering fresh produce, packaged goods, and ready-to-eat meals. Major retail chains like Saigon Co.op and VinMart have significantly expanded in this segment, with private-label food products contributing to their growth.

By Region: The retail market in Vietnam is segmented into North, South, East, and West regions. In 2023, the Southern region, led by Ho Chi Minh City, held the largest market share, driven by substantial foreign investment and modern retail infrastructure. The South benefits from higher disposable income levels and a strong concentration of international brands and large shopping malls, making it the dominant region in Vietnam's retail landscape.

Vietnam Retail Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

VinCommerce |

2010 |

Hanoi, Vietnam |

|

Saigon Co.op |

1989 |

Ho Chi Minh City, Vietnam |

|

AEON Vietnam |

2013 |

Ho Chi Minh City, Vietnam |

|

Lotte Mart |

2008 |

Seoul, South Korea |

|

Big C |

1998 |

Bangkok, Thailand |

- Saigon Co.op: Saigon Co.op, the operator of Co.opmart and Co.opXtra, opened its 150th store in 2023, reinforcing its presence in both urban and rural areas. In the same year, it launched a series of new private-label products in the food and beverage segment, targeting health-conscious consumers.

- AEON Vietnam: AEON Vietnam has indeed expanded its presence by opening its 7th shopping mall in Ho Chi Minh City. The new mall, AEON MALL Hue, is set to officially launch in early 2024, with a total investment of $200 million. This development aligns with AEON's strategy to enhance its footprint in Vietnam's retail market.

Vietnam Retail Market Analysis

Vietnam Retail Market Growth Drivers

- Rise of E-commerce in Urban and Rural Areas: E-commerce is a key driver of Vietnam's retail market, valued at $24 billion in 2023. With over 70 million internet users and 65 million smartphone users, digital infrastructure supports rapid growth, especially among younger consumers. Government initiatives promoting e-commerce in rural areas further boost this expansion, with more regions expected to adopt online shopping as internet coverage increases.

- Favorable Trade Agreements Expanding Product Availability: Vietnams free trade agreements with key global economies have reduced tariffs, making the importation of goods more affordable. In 2023, these agreements boosted retail product diversity, allowing retailers to offer a wider variety of goods, particularly in categories like luxury goods, electronics, and fashion. The flow of high-quality imported products continues to enhance the retail sector's offerings.

- Rapid Expansion of Retail Infrastructure: Vietnam is seeing significant investments in retail infrastructure, with new shopping malls and expanded retail spaces in cities like Ho Chi Minh City and Hanoi. In 2023, $3.5 billion was allocated for retail space development, with major players like AEON and Lotte Mart driving the growth of modern retail formats, creating opportunities for both local and international brands.

Vietnam Retail Market Challenges

- Supply Chain Disruptions and Logistical Inefficiencies: Vietnams retail sector faced ongoing challenges due to supply chain disruptions caused by global issues like fluctuating commodity prices and shipping delays. These disruptions impacted the import of consumer goods, while high transportation costs and infrastructure gaps in rural areas slowed the distribution process, affecting retailer profitability.

- Consumer Price Sensitivity Amid Inflationary Pressures: Inflation in Vietnam has posed challenges for the retail sector as rising costs of goods have reduced consumers' purchasing power. Retailers are balancing increasing operating costs, particularly for imported goods, while maintaining competitive pricing. This has impacted discretionary spending and made it difficult for retailers to preserve profit margins while addressing price-conscious consumer behavior.

Vietnam Retail Market Government Initiatives

- National Digital Transformation Program: Launched in 2023, Vietnams National Digital Transformation Program aims to modernize sectors like retail through digital technologies. With $500 million allocated, the program focuses on enhancing e-commerce, promoting digital payments, and helping rural retail businesses go online, benefiting SMEs by improving market access and operational efficiency.

- Preferential Tax Policies for Retail Investors: To encourage investments in the retail sector, the Vietnamese government introduced preferential tax policies. Companies investing in rural retail development or establishing supply chains in underdeveloped regions are offered tax exemptions and reductions. These policies aim to incentivize both local and foreign companies to expand into less developed areas, fostering regional growth and boosting employment in the retail sector.

Vietnam Retail Market Outlook

The Vietnam retail market is poised for significant transformation by 2028, driven by rapid advancements in technology, increasing foreign investment, and evolving consumer preferences. Over the next five years, several key trends will reshape the market landscape, particularly in e-commerce and retail technologies.

Future Trends:

- Growing Dominance of E-commerce: By 2028, e-commerce is set to dominate the Vietnam retail market, driven by improvements in digital infrastructure and increasing consumer preference for online shopping. As more retailers adopt digital platforms and enhance delivery capabilities, e-commerce will continue to grow rapidly, becoming the primary retail channel.

- Shift Towards Automated Retail Technologies: The adoption of automated retail technologies will revolutionize the sector by 2028. Retailers are increasingly investing in technologies like cashier-less stores and AI-powered inventory management. Automation will improve operational efficiency, reduce labor costs, and provide a more personalized shopping experience for consumers, enhancing profitability and customer satisfaction.

Scope of the Report

|

By Retail Format |

Modern Retail Traditional Retail E-Commerce |

|

By Product Category |

Food and Beverages Fashion and Apparel Electronics and Appliances |

|

By Region |

South Vietnam North Vietnam East Vietnam West Vietnam |

Products

Key Target Audience

Retail Chains and Supermarket Operators

E-commerce Platforms

Distribution and Logistics Companies

Manufacturers and Suppliers

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (MoIT)

Payment Solution Providers

Private Label Manufacturers

FMCG Companies

Digital Marketing Agencies

Companies

Players Mentioned in the Report:

VinCommerce

Saigon Co.op

Big C

Lotte Mart

AEON Vietnam

Tiki

The Gioi Di Dong

FPT Shop

Guardian Vietnam

Circle K

Bach Hoa Xanh

Pharmacity

Mobile World

Lazada Vietnam

Shopee Vietnam

Table of Contents

01. Vietnam Retail Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

02. Vietnam Retail Market Size (in USD Bn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

03. Vietnam Retail Market Analysis

3.1. Growth Drivers

3.1.1. Rise of E-commerce

3.1.2. Trade Agreements and Product Availability

3.1.3. Retail Infrastructure Expansion

3.2. Challenges

3.2.1. Supply Chain Disruptions

3.2.2. Rising Competition from Foreign Retailers

3.2.3. Price Sensitivity Amid Inflation

3.3. Government Initiatives

3.3.1. National Digital Transformation Program

3.3.2. Tax Incentives for Retail Investment

3.3.3. Consumer Protection Act Revision

3.4. Recent Trends

3.4.1. Omni-channel Retailing

3.4.2. Growth of Private Label Brands

3.4.3. Sustainability and Green Practices

04. Vietnam Retail Market Segmentation, 2023

4.1. By Retail Format (in Value %)

4.1.1. Modern Retail

4.1.2. Traditional Retail

4.1.3. E-commerce

4.2. By Product Category (in Value %)

4.2.1. Food and Beverages

4.2.2. Fashion and Apparel

4.2.3. Electronics and Appliances

4.3. By Region (in Value %)

4.3.1. North Vietnam

4.3.2. South Vietnam

4.3.3. East Vietnam

4.3.4. West Vietnam

05. Vietnam Retail Market Competitive Landscape

5.1. Major Players Overview

5.1.1. VinCommerc

5.1.2. Saigon Co.op

5.1.3. AEON Vietnam

5.1.4. Lotte Mart

5.1.5. Big C

5.1.6. Tiki

5.1.7. The Gioi Di Dong

5.1.8. FPT Shop

5.1.9. Circle K

5.1.10. Pharmacity

5.2. Recent Developments by Key Players

5.2.1. VinCommerce Expansion

5.2.2. Saigon Co.op Store Launches

5.2.3. AEON E-commerce Investments

06. Vietnam Retail Market Growth Drivers and Challenges

6.1. Macroeconomic Indicators Impacting Retail

6.2. Consumer Spending Patterns

6.3. Challenges Related to Foreign Competition

07. Vietnam Retail Market Future Outlook (2028)

7.1. E-commerce Dominance by 2028

7.2. Increased Foreign Retailer Presence

7.3. Shift Towards Automated Retail Technologies

08. Vietnam Retail Market Target Audience

8.1. Retail Chains and Supermarkets

8.2. E-commerce Platforms

8.3. Manufacturers and Suppliers

8.4. Government and Regulatory Bodies

09. Vietnam Retail Market Future Trends (2028)

9.1. E-commerce Growth and Expansion

9.2. Rise of Automation in Retail

9.3. Further Foreign Investments

10. Vietnam Retail Market Analysts Recommendations

10.1. Expansion Strategies for Local Retailers

10.2. Adoption of Omni-channel and E-commerce Models

10.3. Strategic Partnerships with International Retailers

Disclaimer

Contact Us

Research Methodology

Step: 1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step: 2 Market Building:

Collating statistics on Vietnam Retail Market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for Vietnam Retail Market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step: 3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step: 4 Research Output:

Our team will approach multiple Retail and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from Retail.

Frequently Asked Questions

01. How big is the Vietnam retail market?

The Vietnam retail market was valued at USD 250 billion in 2023, driven by strong consumer demand, rapid urbanization, and the expansion of modern retail formats such as supermarkets and e-commerce platforms.

02. What are the challenges in the Vietnam retail market?

Challenges in the Vietnam retail market include supply chain disruptions, increasing competition from foreign retailers, and inflationary pressures, which affect consumer purchasing power and retail profitability.

03. Who are the major players in the Vietnam retail market?

Key players in the Vietnam retail market include VinCommerce, Saigon Co.op, AEON, Lotte Mart, and Big C. These companies dominate the market through extensive distribution networks and strong presence across modern retail formats.

04. What are the growth drivers of the Vietnam retail market?

The Vietnam retail market is propelled by factors such as the rapid rise of e-commerce, increased foreign investment in retail infrastructure, and favorable government trade agreements, which have improved product availability.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.