Vietnam Seeds Market Outlook to 2030

Region:Asia

Author(s):Shubham Kashyap

Product Code:KROD5867

November 2024

95

About the Report

Vietnam Seeds Market Overview

- The Vietnam Seeds Market is valued at USD 350 million, based on an in-depth five-year historical analysis. This market's growth is fueled by the need for high-yield crop varieties and the increasing adoption of advanced agricultural techniques to improve crop resilience and productivity. Factors such as government incentives, rising population, and advancements in biotechnology are further driving the demand for quality seeds across various agricultural sectors in Vietnam.

- Regions like the Red River Delta and the Mekong Delta are pivotal in the Vietnam seeds market due to their favorable agro-climatic conditions and large farming areas. The Mekong Delta, being a primary rice-producing region, and the Red River Delta with its intensive crop rotation, contribute significantly to market demand. These regions benefit from established infrastructure, including irrigation and storage facilities, making them key areas for seed consumption and production.

- Vietnam has stringent seed certification standards enforced by the Department of Crop Production, ensuring seed quality and purity. In 2024, majority of certified seeds adhered to updated purity guidelines, vital for maintaining crop yields and supporting export standards. These regulations help combat the challenges of seed adulteration, positioning Vietnam as a reliable source for high-quality seeds in both domestic and international markets.

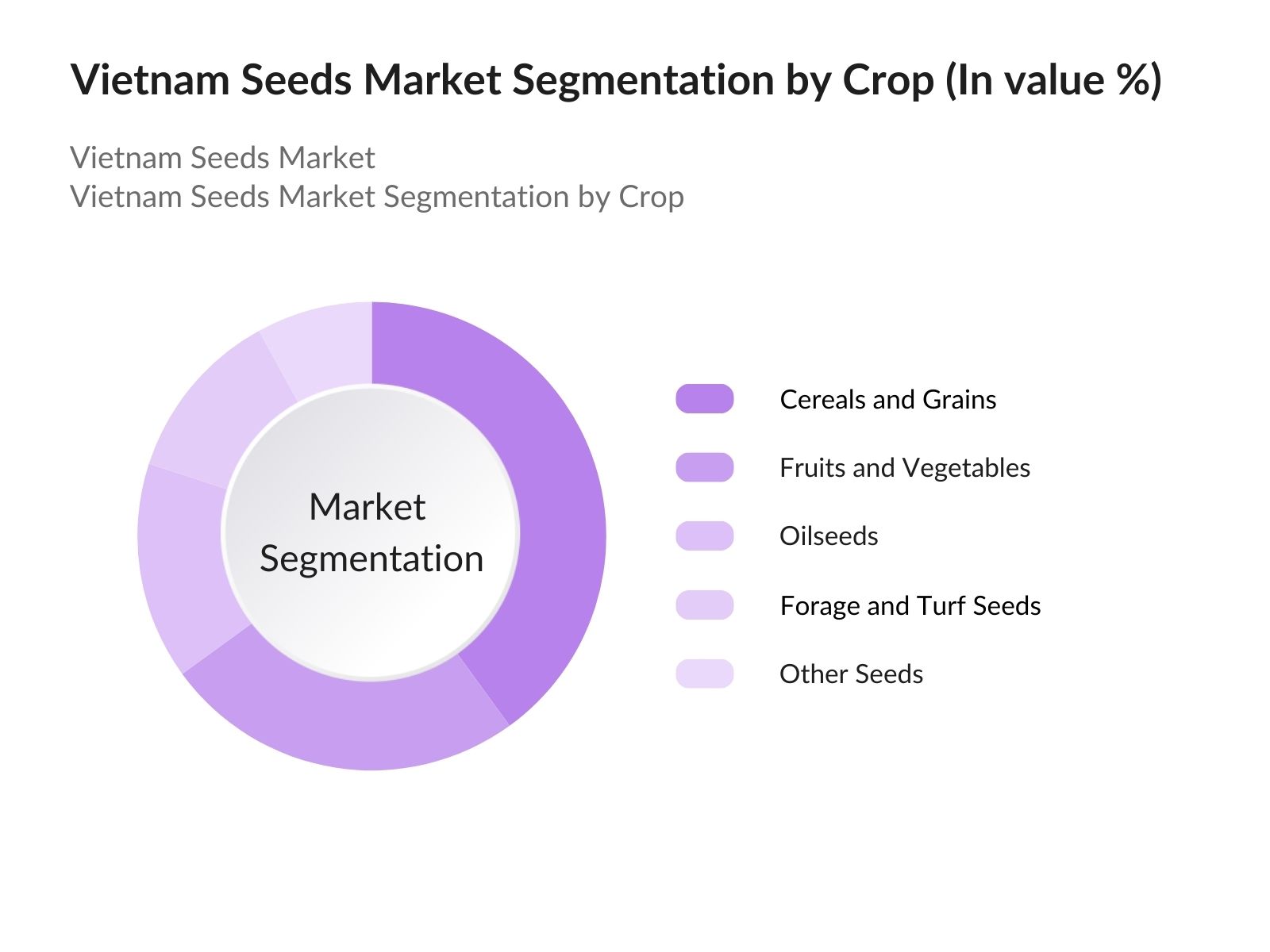

Vietnam Seeds Market Segmentation

- By Crop Type: The Market is segmented by crop type into cereals and grains, fruits and vegetables, oilseeds, forage and turf seeds, and other seeds. Among these, cereals and grains hold a leading market share due to the country's focus on rice production, a staple food and major export product. The strong governmental support for high-yield, pest-resistant varieties in rice production drives this segment. Furthermore, crop diversification programs have strengthened the demand for seeds in this category, especially for rice, maize, and wheat.

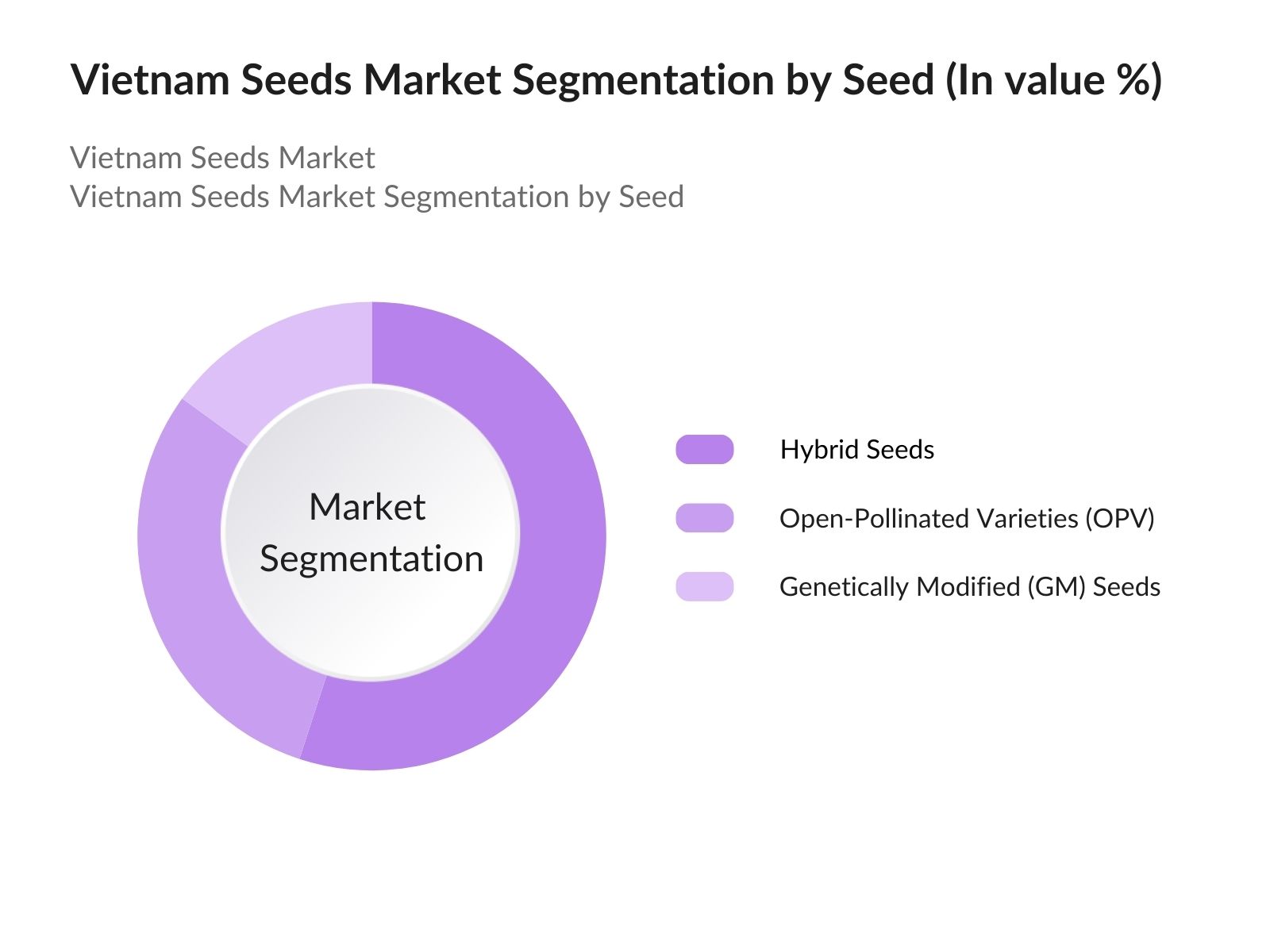

- By Seed Type: The Market is segmented by seed type into hybrid seeds, open-pollinated varieties (OPV), and genetically modified (GM) seeds. Hybrid seeds dominate the market due to their resistance to diseases and pests, which ensures higher yields. The preference for hybrid seeds is supported by governmental initiatives and extension programs encouraging their adoption. OPV seeds are also popular due to their affordability and adaptability to local agricultural practices, though GM seeds are gaining traction as they cater to specific crop resilience requirements.

Vietnam Seeds Market Competitive Landscape

The Vietnam Seeds Market is competitive, with a mix of domestic and international players. These companies utilize extensive R&D, distribution networks, and partnerships to enhance their presence and offerings in the market. The competitive landscape includes well-established players who dominate through innovation, a wide product portfolio, and collaborations with government bodies and agricultural institutions.

Vietnam Seeds Market Analysis

Growth Drivers

- Increasing Demand for High-Yield Crop Varieties: Vietnam's agricultural sector has shown a clear demand for high-yield crop varieties, driven by the need to feed a growing population, which reached 100 million in 2024. Government programs have actively promoted high-yield seed varieties to boost food security and crop productivity, aligning with Vietnam's goal to increase rice production by over 7 million tons annually. This initiative is backed by FAO and other agricultural studies, emphasizing enhanced yield seeds as essential for food self-sufficiency and export stability.

- Expansion of Agricultural Land and Mechanization: Vietnams agricultural land continues to expand as government initiatives prioritize new farming areas, with 11.5 million hectares designated for crop cultivation in 2024. The Ministry of Agriculture has allocated an additional thousands of hectares, focusing on underutilized regions to increase food production and reduce dependency on imported crops. This strategic expansion helps accommodate the demand for high-quality seeds, fueling productivity across Vietnams central and southern agricultural zones.

- Government Support and Subsidies: The Vietnamese government has initiated subsidies to lower the costs of certified seeds, particularly in rice and maize sectors, where 60-70% of crop producers rely on government-supported seeds. In 2024, funding for seed subsidies rose substantially compared to the previous year, with allocations geared toward high-demand areas such as the Mekong Delta. These subsidies aim to mitigate costs for farmers and ensure a stable supply chain of quality seeds

Market Challenges

- Limited Availability of Quality Seeds: Vietnam faces a significant gap in the availability of quality seeds, particularly for staple crops like rice and maize, where a limited portion of farmers use certified seeds. This gap is primarily due to logistical and infrastructural limitations in rural areas, affecting distribution and accessibility. The scarcity of high-grade seeds impacts overall productivity, underscoring the need for collaboration between government and the private sector to establish improved distribution networks and support systems for quality seed supply.

- Climate Variability Impacting the market: Vietnams agricultural sector is highly vulnerable to climate extremes, which affect seed quality and crop yields. Extreme weather events, including severe flooding, have consistently impacted vast tracts of farmland, creating unpredictable conditions that pose risks to seed viability and crop stability. Addressing these challenges calls for the development of resilient seed varieties capable of sustaining yields under fluctuating weather patterns, a goal actively pursued by research initiatives in the region.

Vietnam Seeds Market Future Outlook

The Vietnam Seeds Market is expected to see consistent growth through 2028, driven by the increasing need for sustainable agricultural practices, government incentives, and expanding export opportunities. As the demand for high-quality and disease-resistant seeds continues to rise, companies are likely to invest in research and development to cater to both domestic and international markets. Additionally, advancements in biotechnology and a stronger focus on organic farming practices are anticipated to create new avenues for seed producers.

Future Market Opportunities

- Growing Export Potential: Vietnams seed industry shows promise in the export market, particularly within ASEAN, where Vietnam exported around 8.3 Mn metric tons of rice seeds in 2023. These exports are supported by trade agreements, fostering partnerships and new market entries for Vietnamese seed producers. This opportunity is underscored by ASEANs seed demand, particularly in rice, as countries look to Vietnams agricultural advances for affordable and high-quality seed options.

- Expansion into Hybrid Seed Market: Hybrid seed adoption has gained momentum, with Vietnams Ministry of Agriculture reporting a 30% hybrid seed adoption rate among maize farmers in 2023. Hybrid seeds offer advantages in yield and resilience, and expanding into this market supports sustainable productivity, particularly for key crops like rice, maize, and vegetables. The focus on hybrids aligns with Vietnams commitment to addressing agricultural efficiency and sustainability, opening significant growth potential within the hybrid seed segment

Scope of the Report

|

By Crop Type |

Cereals and Grains Fruits and Vegetables Oilseeds Forage and Turf Seeds Other Seeds |

|

By Seed Type |

Hybrid Seeds Open Pollinated Varieties (OPV) Genetically Modified (GM) Seeds |

|

By Distribution Channel |

Governmental Bodies Agricultural Cooperatives Private Dealers Online Platforms |

|

By Trait |

Herbicide Tolerance Insect Resistance Disease Resistance Drought Tolerance |

|

By Region |

Red River Delta Central Highlands Mekong Delta Northern Midlands and Mountain Areas South-East Region |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Banks and Financial Institutions

Government and Regulatory Bodies (Ministry of Agriculture and Rural Development)

Seed Distributors and Wholesalers

Agricultural Equipment Manufacturers

Agrochemical Companies

Exporters of Agricultural Products

Agricultural Research Institutes

Companies

Players Mentioned in the Report

Bayer CropScience

Syngenta AG

Corteva Agriscience

East-West Seed

CP Group

Bejo Zaden B.V.

Sakata Seed Corporation

Limagrain

Rijk Zwaan

DuPont Pioneer

KWS Saat SE

Takii & Co., Ltd.

Advanta Seeds

Enza Zaden

Mahyco

Table of Contents

1. Vietnam Seeds Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Vietnam Seeds Market Size (in USD Million)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Vietnam Seeds Market Dynamics

3.1 Growth Drivers

3.1.1 Increasing Demand for High-Yield Crop Varieties

3.1.2 Government Support and Subsidies (Subsidy Rate %)

3.1.3 Expansion of Agricultural Land (Hectares)

3.1.4 Technological Advancements in Seed Production

3.2 Market Challenges

3.2.1 Limited Availability of Quality Seeds

3.2.2 Climate Variability (Impact Analysis)

3.2.3 High Production Costs (Cost per Acre)

3.3 Opportunities

3.3.1 Growing Export Potential

3.3.2 Expansion into Hybrid Seed Market (Market Share %)

3.3.3 Partnerships with International Seed Producers

3.4 Trends

3.4.1 Organic and Non-GMO Seed Demand

3.4.2 Smart Agriculture Integration

3.4.3 Seed Treatments for Pest Resistance

3.5 Regulatory Environment

3.5.1 Seed Certification Standards

3.5.2 Import and Export Regulations

3.5.3 National Seed Policy

4. Vietnam Seeds Market Segmentation

4.1 By Crop Type (in Value %)

4.1.1 Cereals and Grains

4.1.2 Fruits and Vegetables

4.1.3 Oilseeds

4.1.4 Forage and Turf Seeds

4.1.5 Other Seeds

4.2 By Seed Type (in Value %)

4.2.1 Hybrid Seeds

4.2.2 Open Pollinated Varieties (OPV)

4.2.3 Genetically Modified (GM) Seeds

4.3 By Distribution Channel (in Value %)

4.3.1 Governmental Bodies

4.3.2 Agricultural Cooperatives

4.3.3 Private Dealers

4.3.4 Online Platforms

4.4 By Trait (in Value %)

4.4.1 Herbicide Tolerance

4.4.2 Insect Resistance

4.4.3 Disease Resistance

4.4.4 Drought Tolerance

4.5 By Region (in Value %)

4.5.1 Red River Delta

4.5.2 Central Highlands

4.5.3 Mekong Delta

4.5.4 Northern Midlands and Mountain Areas

4.5.5 South-East Region

5. Vietnam Seeds Market Competitive Landscape

5.1 Key Competitors

5.1.1 Bayer CropScience

5.1.2 Syngenta AG

5.1.3 Corteva Agriscience

5.1.4 East-West Seed

5.1.5 CP Group

5.1.6 Bejo Zaden B.V.

5.1.7 Sakata Seed Corporation

5.1.8 Limagrain

5.1.9 Rijk Zwaan

5.1.10 DuPont Pioneer

5.1.11 KWS Saat SE

5.1.12 Takii & Co., Ltd.

5.1.13 Advanta Seeds

5.1.14 Enza Zaden

5.1.15 Mahyco

5.2 Cross Comparison Parameters (No. of Employees, Revenue, Market Share, Product Portfolio, Regional Presence, R&D Expenditure, Customer Base, Manufacturing Capacity)

5.3 Market Share Analysis

5.4 Strategic Initiatives and Partnerships

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital and Funding Analysis

6. Vietnam Seeds Market Regulatory Framework

6.1 Certification and Quality Standards

6.2 Intellectual Property Rights (IPR) for Seeds

6.3 Seed Testing and Quality Assurance

6.4 Import and Export Policies

6.5 Government Subsidies and Grants

7. Vietnam Seeds Future Market Size (in USD Million)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Growth

8. Vietnam Seeds Market Analysts' Recommendations

8.1 TAM/SAM/SOM Analysis

8.2 Target Customer Segmentation Analysis

8.3 Key Marketing Initiatives

8.4 White Space Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The research process begins by identifying essential stakeholders and variables within the Vietnam Seeds Market. This phase involves gathering extensive data from reliable sources, including government databases and industry publications, to understand market dynamics comprehensively.

Step 2: Market Analysis and Construction

In this stage, we analyze historical data on seed sales and consumption across Vietnam's key agricultural regions. The data is used to establish correlations between seed types, crop output, and regional demand to estimate current and projected market size.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses regarding market trends and growth drivers are validated through discussions with industry professionals and stakeholders. Insights from local farmers, seed distributors, and government officials are integrated to refine data accuracy.

Step 4: Research Synthesis and Final Output

The final phase synthesizes data from primary research with validated insights, resulting in a report that offers a precise, validated analysis of the Vietnam Seeds Market. This comprehensive approach ensures the report accurately reflects current market trends and future growth projections.

Frequently Asked Questions

01. How big is the Vietnam Seeds Market?

The Vietnam Seeds Market is valued at USD 350 million, driven by a combination of government support for agricultural productivity and the increasing adoption of high-yield, disease-resistant seed varieties across the country.

02. What are the challenges in the Vietnam Seeds Market?

Challenges in the Vietnam Seeds Market include the high cost of quality seeds, limited availability of advanced seed varieties, and unpredictable weather patterns that impact crop yields. Addressing these challenges is crucial for sustaining market growth.

03. Who are the major players in the Vietnam Seeds Market?

Key players in the Vietnam Seeds Market include Bayer CropScience, Syngenta AG, Corteva Agriscience, East-West Seed, and CP Group. These companies dominate due to their extensive distribution networks, R&D investments, and strong market presence.

04. What are the growth drivers of the Vietnam Seeds Market?

Growth in the Vietnam Seeds Market is driven by factors such as the increasing demand for high-yield crop varieties, technological advancements in seed production, and government initiatives to boost agricultural productivity and food security.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.