Vietnam Smart Glass Market Outlook to 2030

Region:Asia

Author(s):Shambhavi Awasthi

Product Code:KROD8059

December 2024

82

About the Report

Vietnam Smart Glass Market Overview

- The Vietnam Smart Glass Market, currently valued at USD 5.2 Billion, is experiencing significant growth driven by urbanization and the construction of energy-efficient buildings. Smart glass technology is being increasingly adopted in both commercial and residential spaces due to its ability to reduce energy consumption by dynamically adjusting light and heat transmission. This adoption is reinforced by Vietnam's focus on sustainable development, which prioritizes energy-efficient solutions. This trend positions smart glass as a key component in Vietnams green building strategies and aligns with the countrys environmental sustainability goals.

- Major cities like Ho Chi Minh City and Hanoi lead the smart glass market in Vietnam. Ho Chi Minh City, with its advanced urban infrastructure and high-rise buildings, fosters substantial demand for smart glass, primarily in commercial applications. Meanwhile, Hanois strong government support for sustainable construction projects has encouraged smart glass adoption. These urban centers exhibit higher disposable income levels and prioritize energy-saving technologies, making them hotspots for this market.

- Vietnam has implemented strict energy efficiency codes for new construction projects, targeting a national reduction in energy consumption. These codes require the use of energy-efficient materials, especially in high-rise structures, which has led to an increased adoption of smart glass in both residential and commercial projects. This regulatory framework emphasizes sustainable construction practices, making smart glass an ideal material for developers looking to comply with national efficiency standards in urban areas.

Vietnam Smart Glass Market Segmentation

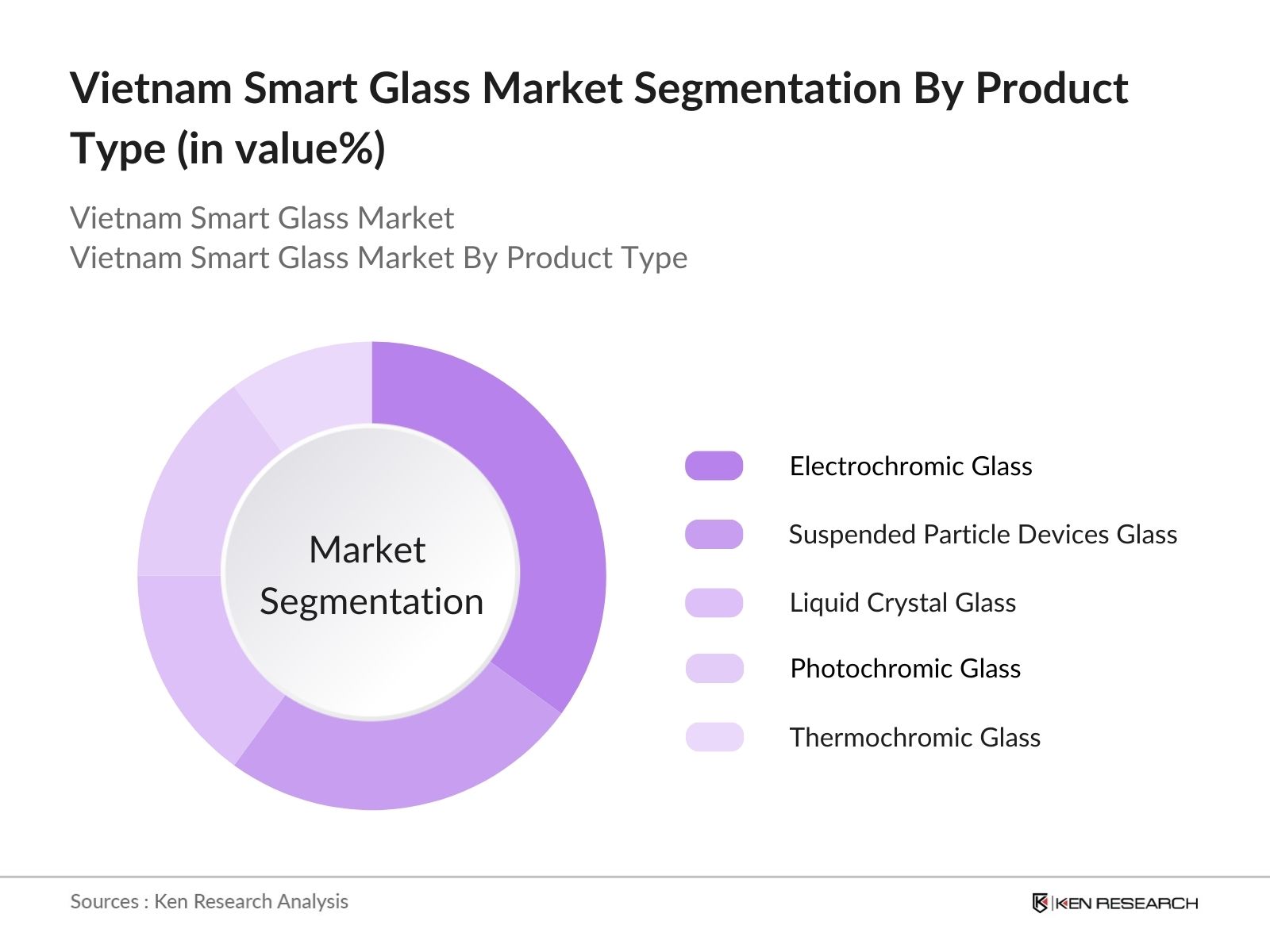

- By Product Type: The Vietnam Smart Glass Market is segmented by product type into Electrochromic Glass, Suspended Particle Devices (SPD) Glass, Liquid Crystal Glass, Photochromic Glass, and Thermochromic Glass. Electrochromic Glass currently holds the dominant market share due to its superior control over glare reduction and light transmission, which makes it ideal for large office buildings and public infrastructure projects. Its ability to offer seamless light control without external mechanical parts enhances durability, contributing to its widespread use in Vietnams commercial sectors.

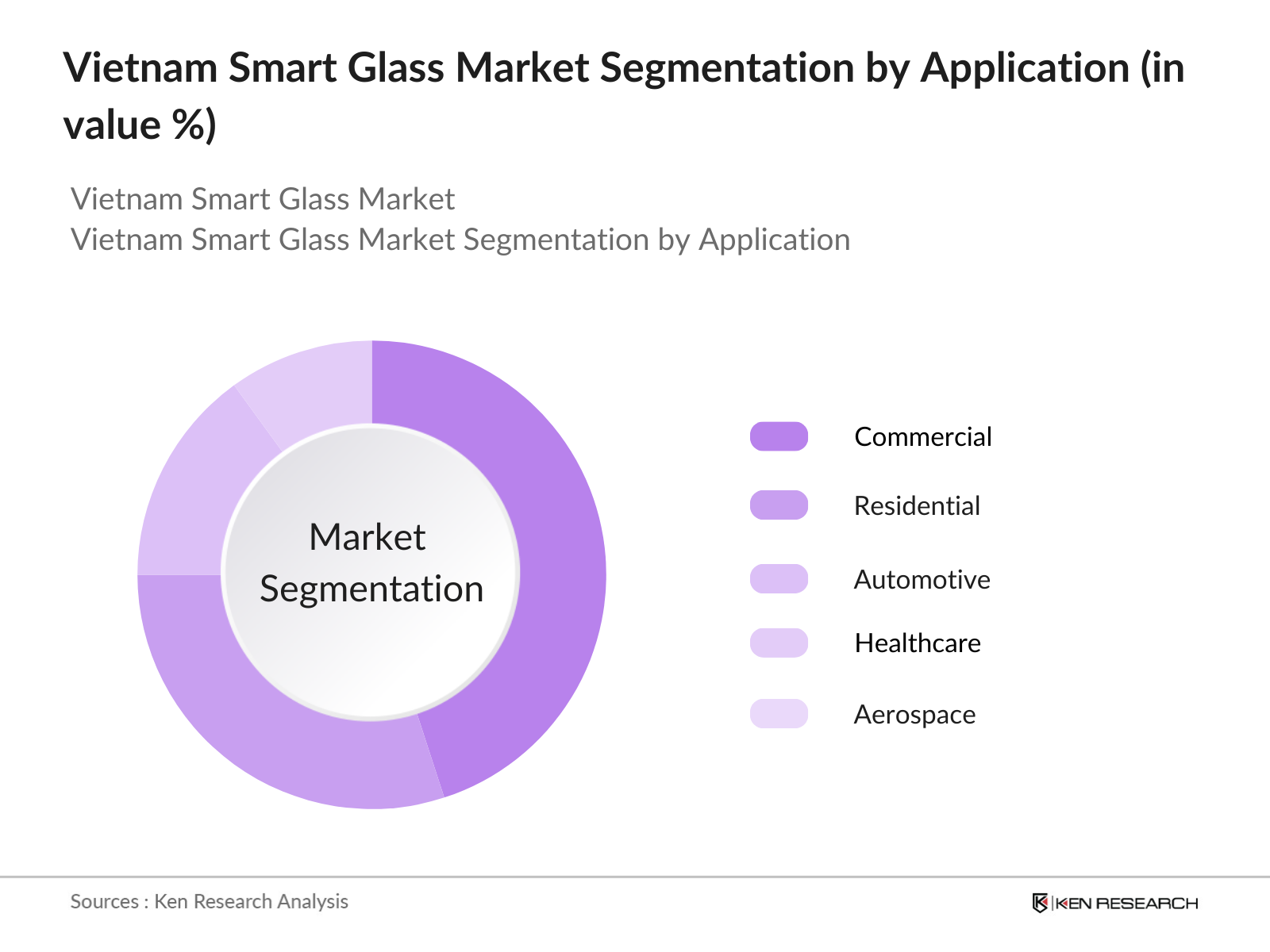

- By Application: The market is further segmented by application into Residential, Commercial, Automotive, Healthcare, and Aerospace. The commercial segment dominates, primarily due to the rapid expansion of office spaces and hotels in major Vietnamese cities. Commercial buildings benefit significantly from smart glasss energy-saving features and the enhanced aesthetic appeal it offers. The commercial real estate boom in cities such as Ho Chi Minh and Hanoi has made this the largest segment in terms of market share within Vietnams smart glass market.

Vietnam Smart Glass Market Competitive Landscape

The Vietnam Smart Glass Market is dominated by several major players, both local and international, with a focus on energy-efficient building technologies and smart home solutions. Key companies like AGC Inc., Saint-Gobain, and Research Frontiers lead the market due to their robust product portfolios and strategic partnerships within Vietnams construction sector. This concentrated market structure highlights the influence of a few major players with strong R&D capabilities and brand recognition.

Vietnam Smart Glass Market Analysis

Growth Drivers

- Urban Infrastructure Development: Vietnam's urban population has grown by approximately 3.5 million people in recent years, spurring significant infrastructure projects in cities like Ho Chi Minh City and Hanoi. This urbanization has led to a substantial demand for sustainable and energy-efficient building materials like smart glass, which aligns with national green building standards aimed at reducing energy use in urban settings by as much as 20%. Government-backed urban projects are anticipated to further drive adoption of smart glass in both residential and commercial buildings across key urban centers.

- Energy Efficiency Initiatives: Vietnam's commitment to reducing its carbon footprint has accelerated the adoption of energy-efficient technologies, particularly in urban developments. National energy conservation targets aim to reduce the country's energy consumption by 5% through the integration of smart technologies. Smart glass, which can cut heating and cooling costs in buildings by up to 30%, has gained traction as part of these initiatives. Its application in government-funded projects, especially in urban centers, highlights its role in helping Vietnam achieve its environmental sustainability targets.

- Increasing Consumer Awareness: Consumer awareness around sustainable, energy-efficient products is rising, with a notable portion of urban residents expressing preference for eco-friendly materials in construction. This shift in consumer behavior has encouraged real estate developers to incorporate smart glass technology into residential and commercial projects. This trend reflects the nations emphasis on green building practices and an increased demand for energy-efficient materials that align with Vietnams long-term environmental objectives.

Market Challenges

- High Initial Costs: Smart glass technology, although beneficial in the long run, requires a high initial investment that poses a barrier for many developers. The upfront costs, which can exceed USD 100 per square meter, are significant for both residential and smaller-scale commercial projects. This expense has deterred widespread adoption, especially in budget-conscious segments. While green technology subsidies are increasing, they currently remain limited, leaving developers and property owners to bear much of the initial financial burden.

- Technical Integration Challenges: Integrating smart glass with existing building systems presents considerable technical challenges, particularly in older buildings. Smart glass needs to connect seamlessly with HVAC and lighting systems, which is often difficult to achieve in retrofitting older properties. Additionally, a shortage of trained technicians familiar with this advanced technology has led to delays and higher costs in the installation process, especially in smaller projects where technical resources are limited. This has slowed adoption in certain segments of the market.

Vietnam Smart Glass Market Future Outlook

Over the next five years, the Vietnam Smart Glass Market is set to experience continued growth, fueled by increased investment in smart city projects and government initiatives targeting sustainable building practices. Vietnams urban centers are undergoing rapid expansion, leading to a greater demand for energy-efficient materials. Technological advancements in smart glass applications, such as the integration of IoT and remote-controlled privacy options, are expected to further boost market adoption.

Market Opportunities

- Integration in Smart Building Projects: Vietnams focus on developing smart cities provides a significant growth opportunity for the smart glass market. Major urban initiatives, such as the smart city project in Ho Chi Minh City, have large budgets dedicated to infrastructure improvements that prioritize energy-efficient materials. Smart glass, which contributes to both energy conservation and privacy control, is increasingly being incorporated into these projects. This integration highlights the markets alignment with Vietnams broader goals of urban modernization and environmental sustainability.

- Expansion into Residential Markets: Vietnams residential real estate sector is experiencing rapid growth, with nearly 200,000 new units being constructed annually. As developers respond to consumer demand for sustainable homes, smart glass is gaining traction in high-end residential buildings. This trend is bolstered by government incentives for eco-friendly construction, particularly in urban regions. Sustainable features like smart glass add value to properties, making it an appealing choice in an increasingly competitive housing market.

Scope of the Report

|

Segments |

Sub-Segments |

|

By Product Type |

Electrochromic Glass SPD Glass Liquid Crystal Glass Photochromic Glass Thermochromic Glass |

|

By Technology |

Active Smart Glass Passive Smart Glass |

|

By Application |

Residential Commercial Automotive Healthcare Aerospace |

|

By Functionality |

Switchable Privacy Solar Control Thermal Insulation Acoustic Insulation |

|

By Region |

Northern Vietnam Central Vietnam Southern Vietnam |

Products

Key Target Audience

Investor and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Ministry of Construction, Vietnam Green Building Council)

Smart Building Technology Providers

Automotive Manufacturers

Construction Companies

Real Estate Developers

Environmental Sustainability Organizations

Architectural Design Firms

Companies

Players mentioned in the report

AGC Inc.

Saint-Gobain

Research Frontiers

Asahi Glass Vietnam

Gauzy

View Inc.

Polytronix

Kinestral Technologies

Gentex Corporation

PPG Industries

Schott AG

Nippon Sheet Glass

Taiwan Glass Group

Fuyao Glass Industry

Pleotint

Table of Contents

1. Vietnam Smart Glass Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Industry Lifecycle Positioning

1.4. Market Segmentation Overview

2. Vietnam Smart Glass Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Milestones and Key Developments

3. Vietnam Smart Glass Market Analysis

3.1. Growth Drivers

3.1.1. Urban Infrastructure Development

3.1.2. Energy Efficiency Initiatives

3.1.3. Technological Advancements

3.1.4. Increasing Consumer Awareness

3.2. Market Challenges

3.2.1. High Initial Setup Costs

3.2.2. Technical Integration Issues

3.2.3. Consumer Knowledge Gaps

3.2.4. Regulatory Barriers

3.3. Opportunities

3.3.1. Integration in Smart Building Projects

3.3.2. Expansion into Residential Market

3.3.3. Rising Demand in Commercial Real Estate

3.3.4. Technological Collaborations

3.4. Trends

3.4.1. Adoption of IoT-enabled Smart Glass

3.4.2. Increased Focus on Privacy Glass

3.4.3. Expansion of Solar Control Glass

3.4.4. Investment in Research and Development

3.5. Government Regulation

3.5.1. Building Energy Efficiency Codes

3.5.2. Import and Export Standards

3.5.3. Environmental Compliance Requirements

3.5.4. Industry-Specific Certifications

3.6. Stakeholder Ecosystem

3.7. Porter's Five Forces Analysis

3.8. Competitive Landscape (Top 15 Competitors)

3.9. SWOT Analysis

4. Vietnam Smart Glass Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Electrochromic Glass

4.1.2. Suspended Particle Devices (SPD) Glass

4.1.3. Liquid Crystal Glass

4.1.4. Photochromic Glass

4.1.5. Thermochromic Glass

4.2. By Technology (In Value %)

4.2.1. Active Smart Glass

4.2.2. Passive Smart Glass

4.3. By Application (In Value %)

4.3.1. Residential

4.3.2. Commercial

4.3.3. Automotive

4.3.4. Healthcare

4.3.5. Aerospace

4.4. By Functionality (In Value %)

4.4.1. Switchable Privacy

4.4.2. Solar Control

4.4.3. Thermal Insulation

4.4.4. Acoustic Insulation

4.5. By Region (In Value %)

4.5.1. Northern Vietnam

4.5.2. Central Vietnam

4.5.3. Southern Vietnam

5. Vietnam Smart Glass Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Research Fronts, Partnerships, Innovations

5.1.2. Geographical Presence

5.1.3. Product Differentiation Strategy

5.1.4. Patent Portfolio Strength

5.1.5. Market Penetration Strategy

5.1.6. Key Financial Performance Indicators

5.1.7. Investment Activities

5.2. Cross-Comparison Parameters

5.2.1. R&D Spending

5.2.2. Geographic Reach

5.2.3. Production Capacity

5.2.4. Revenue

5.2.5. Employee Count

5.2.6. Number of Patents

5.2.7. Product Portfolio Diversity

5.2.8. Sustainability Initiatives

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Venture Capital and Private Equity Funding

5.7. Government Incentives and Subsidies

5.8. R&D Investment Trends

6. Vietnam Smart Glass Market Regulatory Framework

6.1. Product Standards and Certifications

6.2. Import and Export Regulations

6.3. Environmental Protection Laws

6.4. Building Codes and Compliance

7. Vietnam Smart Glass Future Market Size (In USD Bn)

7.1. Growth Forecast Factors

7.2. Anticipated Technological Innovations

7.3. Policy and Market Influence

8. Vietnam Smart Glass Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Technology (In Value %)

8.3. By Application (In Value %)

8.4. By Functionality (In Value %)

8.5. By Region (In Value %)

9. Vietnam Smart Glass Market Analysts Recommendations

9.1. Total Addressable Market (TAM), Serviceable Addressable Market (SAM), and Serviceable Obtainable Market (SOM)

9.2. Customer Cohort Analysis

9.3. Marketing and Distribution Initiatives

9.4. Identifying White Space Opportunities

Research Methodology

Step 1: Identification of Key Variables

The first step includes mapping out critical stakeholders and market dynamics within the Vietnam Smart Glass Market. Extensive desk research using proprietary databases helped identify key influencing variables such as regulatory compliance and sustainability trends.

Step 2: Market Analysis and Construction

In this phase, we analyzed historical data focusing on smart glass adoption rates across various sectors in Vietnam. A detailed evaluation of market structure, including product and application segments, was conducted to derive accurate revenue assessments.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were then validated through direct interviews with industry experts and representatives from smart glass manufacturing companies. These interviews provided insights into operational challenges and growth prospects, refining the market data.

Step 4: Research Synthesis and Final Output

The final synthesis involved data triangulation to ensure comprehensive coverage of product demand, consumer preferences, and adoption trends. This validated data was subsequently integrated into a structured report, aligning with industry best practices for Vietnams smart glass sector.

Frequently Asked Questions

01. How big is the Vietnam Smart Glass Market?

The Vietnam Smart Glass Market is valued at USD 5.2 Billion, with demand driven by the construction of sustainable, energy-efficient buildings in key urban areas.

02. What are the main challenges in the Vietnam Smart Glass Market?

Key challenges include high initial costs, technical complexities in installation, and limited awareness among consumers about the benefits of smart glass technology.

03. Who are the major players in the Vietnam Smart Glass Market?

Top companies include AGC Inc., Saint-Gobain, and Research Frontiers, who dominate due to their advanced technologies, extensive product portfolios, and strategic partnerships in Vietnam.

04. What drives growth in the Vietnam Smart Glass Market?

Growth drivers include urbanization, demand for energy-efficient building materials, and the governments commitment to sustainable construction practices, making smart glass a priority for new developments.

05. How is the Vietnam Smart Glass Market segmented?

The market is segmented by product type, including Electrochromic Glass and SPD Glass, as well as by application in residential, commercial, and automotive sectors, each with unique adoption dynamics.

06. Which cities in Vietnam lead the adoption of smart glass?

Cities like Ho Chi Minh City and Hanoi are leaders, driven by high urbanization rates, robust commercial construction, and supportive government policies promoting sustainable development.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.