Vietnam Smart Home Market Outlook to 2030

Region:Asia

Author(s):Shubham Kashyap

Product Code:KROD3483

November 2024

92

About the Report

Vietnam Smart Home Market Overview

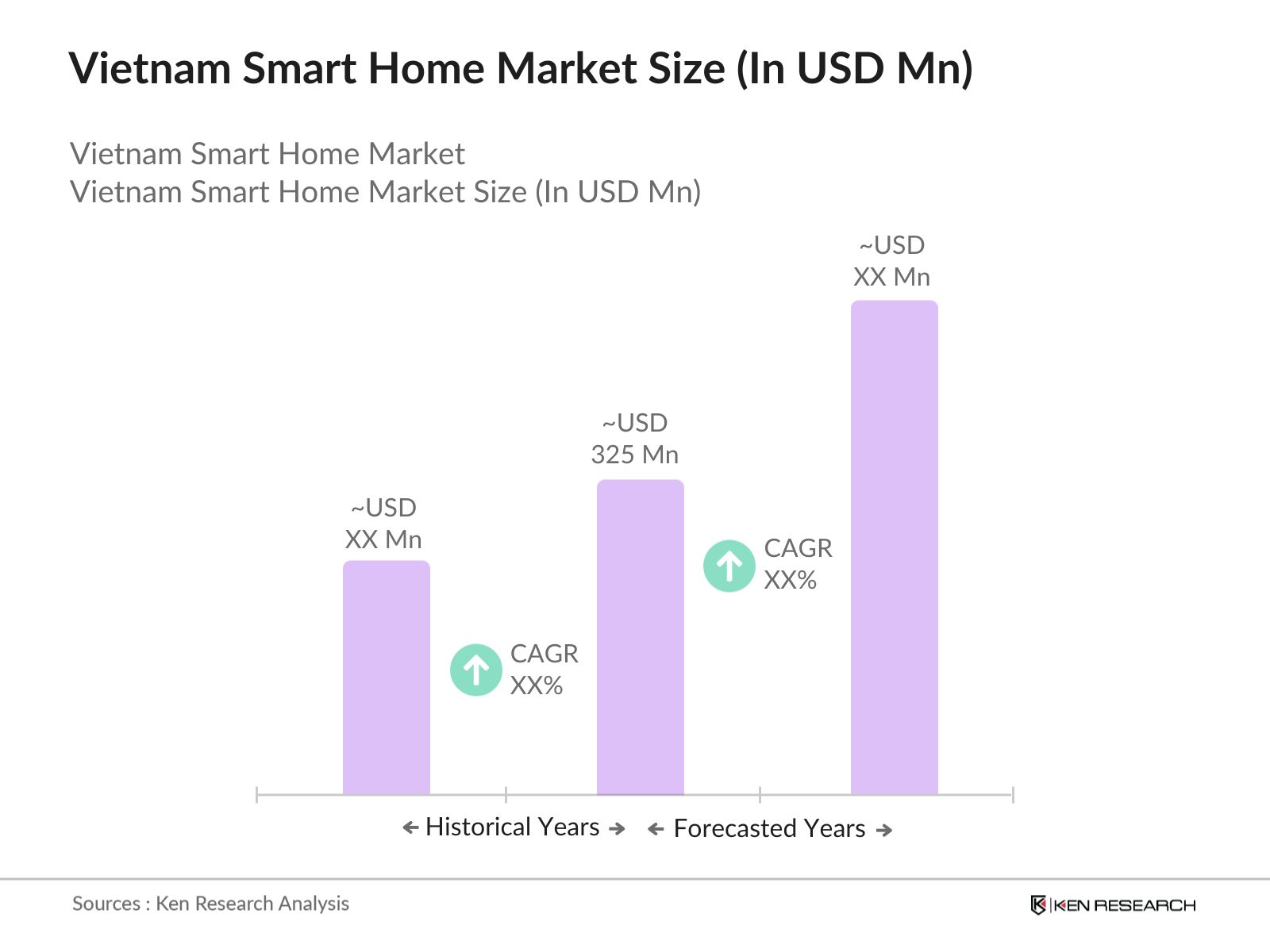

- The Vietnam Smart Home Market has witnessed remarkable growth in recent years, reaching a market size of USD 325 Mn driven by the rapid adoption of smart technologies and the rising urbanization in the country. Vietnam's increasing middle-class population, improving internet infrastructure, and growing awareness of energy efficiency have contributed to the demand for smart home solutions. The market is bolstered by the government's digital transformation policies and increasing consumer inclination towards home automation, smart security systems, and energy-efficient appliances.

- Major cities such as Ho Chi Minh City and Hanoi are leading the adoption of smart home technologies, where consumers are increasingly embracing smart lighting, thermostats, and surveillance systems to enhance convenience, security, and energy savings. The rising demand for integrated home control systems, coupled with the penetration of smartphones and high-speed internet, is expected to further propel market growth in the coming years.

- Government initiatives, such as the National Digital Transformation Program, aim to promote the application of digital technologies across all sectors, including the home environment, providing opportunities for smart home solutions. However, challenges such as high initial costs and concerns over data privacy and cybersecurity have impacted the market dynamics. Companies are focusing on addressing these concerns while providing innovative, affordable solutions to drive further adoption.

Vietnam Smart Home Market Segmentation

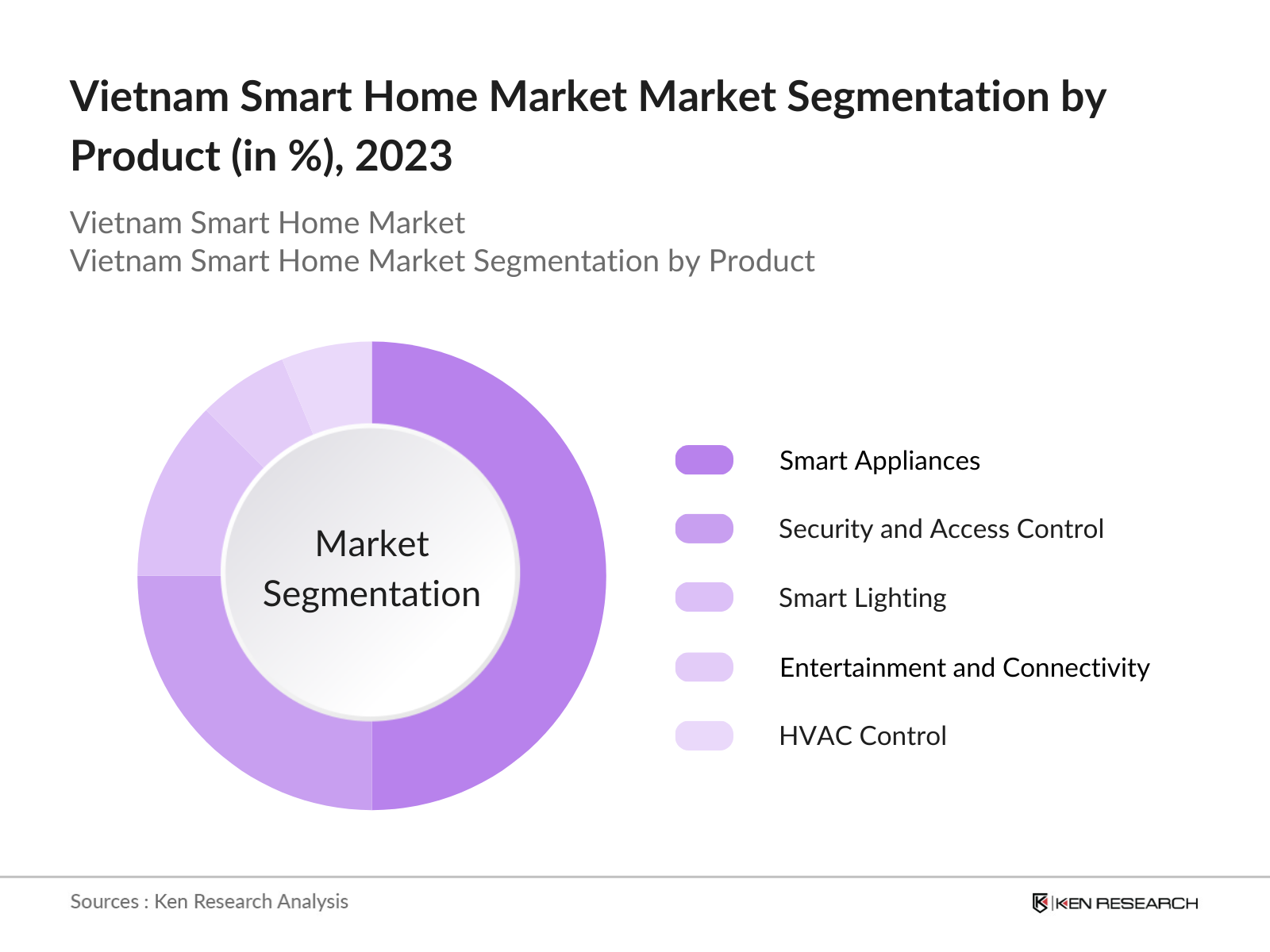

- By Product Type: The market is segmented into smart appliances, security and access control, smart lighting, entertainment and connectivity, and HVAC control. Smart appliances, including refrigerators, washing machines, and air conditioners, dominate the market due to their wide adoption across urban households. The security and access control segment is also growing, with smart doorbells, cameras, and locks gaining traction as more consumers prioritize home safety. The entertainment and connectivity segment, featuring smart speakers and streaming devices, is also expected to see growth as smart homes become more interconnected.

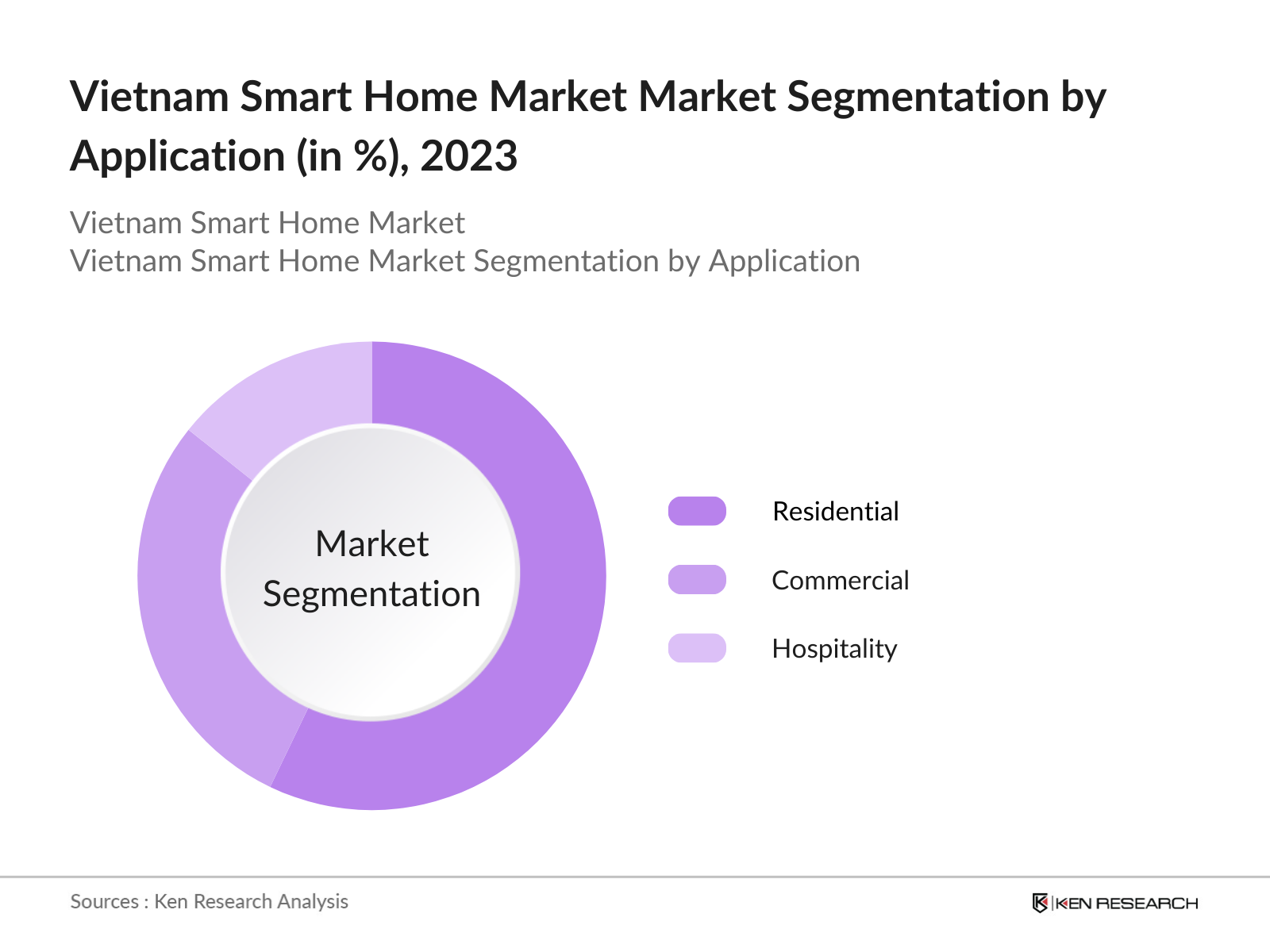

- By Application: The market is further segmented into residential, commercial, and hospitality sectors. The residential sector holds the largest market share due to the increasing adoption of smart home devices among urban households. Commercial applications, such as in office buildings and retail outlets, are also rising, driven by the need for energy efficiency and enhanced security. The hospitality sector is increasingly adopting smart solutions, such as automated room controls and smart locks, to improve customer experience and operational efficiency.

Vietnam Smart Home Market Competitive Landscape

The Vietnam Smart Home Market is competitive, with both domestic and international players vying for market share. Local companies like BKAV and Lumi Vietnam have established a strong presence in providing cost-effective smart home solutions tailored to the local market. These companies are focusing on developing user-friendly devices with localized features, such as Vietnamese language support, to cater to the specific needs of Vietnamese consumers.

International players such as Google, Samsung, and Xiaomi have also entered the market, offering premium smart home solutions. These companies are leveraging their global expertise to provide cutting-edge technologies, such as AI-powered assistants, smart hubs, and integrated ecosystems that appeal to tech-savvy consumers. Strategic partnerships between local and international companies are common, helping to expand distribution networks and increase market penetration.

|

Company Name |

Establishment Year |

Headquarters |

Revenue (2023) |

Key Products |

R&D Expenditure |

No. of Employees |

Distribution Channels |

Strategic Initiatives |

|

BKAV |

1995 |

Hanoi, Vietnam |

||||||

|

Lumi Vietnam |

2010 |

Ho Chi Minh City |

||||||

|

|

1998 |

Mountain View, USA |

||||||

|

Samsung |

1938 |

Seoul, South Korea |

||||||

|

Xiaomi |

2010 |

Beijing, China |

Vietnam Smart Home Market Analysis

Growth Drivers

- Rising Urbanization and Middle-Class Population: Vietnam's urban population has been expanding rapidly, with over 39% of the population residing in urban areas by 2024 (World Bank). The increasing urbanization is driving the demand for smart home technologies, as more households in cities like Hanoi and Ho Chi Minh City seek to enhance convenience, security, and energy efficiency. Vietnam's growing middle-class population, expected to reach 44 million by 2025, is also a key driver of the smart home market, as these consumers have greater disposable income to invest in smart appliances and home automation systems.

- Government Support for Digital Transformation: The Vietnamese government is actively promoting digital transformation through initiatives such as the National Digital Transformation Program, which encourages the adoption of digital technologies across various sectors, including smart homes. By fostering the development of digital infrastructure and smart city projects, the government is creating a favorable environment for the growth of the smart home market. The Smart City Development Plan, which includes the deployment of smart infrastructure in cities, is expected to further drive the demand for smart home solutions.

- Rising Disposable Income and Middle-Class Growth: Vietnam's gross domestic product (GDP) per capita reached USD 4500 in 2024, indicating a steady rise in disposable income. The country has seen middle-class growth, with more than 13% of the population now categorized within this income bracket. As disposable income rises, consumers are increasingly prioritizing convenience and safety through the adoption of smart home technologies such as security cameras, lighting, and automated appliances. This upward economic trajectory is further fostering the growth of smart home ecosystems, driven by the affordability and accessibility of these solutions.

Market Challenges

- High Initial Costs: Despite the growing demand for smart home devices, the high initial cost of smart home installations remains a barrier for many consumers in Vietnam. The cost of purchasing and setting up smart appliances, security systems, and home automation platforms can be prohibitively expensive for lower-income households, limiting market expansion in rural and less affluent areas. As a result, companies need to develop more affordable solutions to cater to a broader segment of the population.

- Data Privacy and Security Concerns: With the increasing integration of smart devices into everyday life, concerns over data privacy and cybersecurity have become more pronounced. Vietnamese consumers are wary of the potential risks associated with the collection and storage of personal data by smart home systems, particularly with regards to security breaches and hacking incidents. Addressing these concerns is critical for companies operating in the smart home market, as failure to ensure robust cybersecurity measures could hinder market growth.

Vietnam Smart Home Market Future Outlook

The Vietnam Smart Home Market is poised for continued growth, driven by rising consumer awareness of smart technologies, government support for digital transformation, and increasing urbanization. The integration of advanced technologies, such as AI and IoT, into smart home devices is expected to enhance the functionality and appeal of these solutions, contributing to their wider adoption. As more affordable smart home options become available, and concerns over data security are addressed, the market is likely to witness steady expansion in the coming years.

Future Market Opportunities

- Expansion of AI-Powered Smart Home Solutions: The increasing adoption of artificial intelligence (AI) in smart home devices presents a opportunity for market growth. AI-powered virtual assistants, such as Google Assistant and Amazon Alexa, are gaining popularity in Vietnam, enabling consumers to control smart home systems through voice commands. The integration of AI into smart appliances and security systems offers enhanced personalization, convenience, and automation, making smart homes more attractive to tech-savvy consumers. As AI technology continues to advance, its application in smart home systems is expected to create new growth opportunities in the market.

- Emergence of Affordable Smart Home Devices: The rise of affordable smart home devices is creating substantial growth opportunities in the Vietnam market. As of 2024, smart bulbs, smart plugs, and basic home automation kits can be purchased for under USD 100. The affordability of these devices is driving mass-market adoption, particularly among first-time buyers and younger consumers. This price accessibility allows even households with moderate incomes to invest in smart home technologies, broadening the customer base and accelerating market penetration.

Scope of the Report

|

By Product |

Smart Appliances Security and Access Control Smart Lighting Entertainment and Connectivity HVAC Control |

|

By Application |

Residential Commercial Hospitality |

|

By Connectivity |

Wi-Fi Bluetooth Zigbee Z-Wave |

|

By Distribution Channel |

Online Retail Offline Retail Direct Sales |

|

By Region |

North East West South |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Smart Home Product Manufacturers

Government and Regulatory Bodies (Ministry of Information and Communications, Ministry of Industry and Trade)

Home Automation Service Providers

Real Estate Developers

Energy Management Companies

Telecommunication Service Providers

Retail Chains and E-commerce Platforms

Banks and Financial Institutions

Companies

Major Players Mentioned in the Report

BKAV

Lumi Vietnam

Google

Samsung

Xiaomi

LG Electronics

Apple

Huawei

Panasonic

Sony

Philips

Bosch

Schneider Electric

Amazon

ABB

Table of Contents

01 Vietnam Smart Home Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Key Market Developments and Innovations

1.4 Market Segmentation Overview

02 Vietnam Smart Home Market Size (In USD Mn)

2.1 Historical Market Size (In USD Mn)

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones (Adoption Rate, Connectivity Penetration)

03 Vietnam Smart Home Market Analysis

3.1 Growth Drivers

3.1.1 Increasing Urbanization and Smart City Initiatives

3.1.2 Government Support for Digital Transformation

3.1.3 Rising Disposable Income and Middle-Class Growth

3.1.4 Energy Efficiency and Environmental Concerns

3.2 Market Challenges

3.2.1 High Initial Installation Costs

3.2.2 Data Privacy and Cybersecurity Concerns

3.2.3 Limited Internet Infrastructure in Rural Areas

3.2.4 Low Awareness in Rural Regions

3.3 Opportunities

3.3.1 Increasing Adoption of AI-Powered Solutions

3.3.2 Expansion of Local Smart Home Ecosystems

3.3.3 Emergence of Affordable Smart Home Devices

3.3.4 Growing Investment in Infrastructure and 5G

3.4 Trends

3.4.1 Rising Demand for Voice-Activated Devices

3.4.2 Integration of IoT in Smart Home Systems

3.4.3 Personalized Home Automation Solutions

3.4.4 Cross-Platform Device Compatibility

3.5 Government Regulations

3.5.1 National Digital Transformation Program

3.5.2 Smart City Development Plan

3.5.3 Energy Efficiency Standards for Smart Appliances

3.5.4 Data Privacy and Cybersecurity Regulations

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competition Ecosystem

04 Vietnam Smart Home Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Smart Appliances

4.1.2 Security and Access Control

4.1.3 Smart Lighting

4.1.4 Entertainment and Connectivity

4.1.5 HVAC Control

4.2 By Application (In Value %)

4.2.1 Residential

4.2.2 Commercial

4.2.3 Hospitality

4.3 By Connectivity Type (In Value %)

4.3.1 Wi-Fi

4.3.2 Bluetooth

4.3.3 Zigbee

4.3.4 Z-Wave

4.4 By Distribution Channel (In Value %)

4.4.1 Online Retail

4.4.2 Offline Retail

4.4.3 Direct Sales

4.5 By Region (In Value %)

4.5.1 North

4.5.2 South

4.5.3 East

4.5.4 West

05 Vietnam Smart Home Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 BKAV

5.1.2 Lumi Vietnam

5.1.3 Google

5.1.4 Samsung

5.1.5 Xiaomi

5.1.6 Apple

5.1.7 LG Electronics

5.1.8 Sony

5.1.9 Panasonic

5.1.10 Schneider Electric

5.1.11 Huawei

5.1.12 Amazon

5.1.13 Philips

5.1.14 ABB

5.1.15 Bosch

5.2 Cross Comparison Parameters

No. of Employees, Headquarters, Inception Year, Revenue, Market Share, R&D Expenditure, Strategic Initiatives, Product Offerings

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Private Equity Investments

06 Vietnam Smart Home Market Regulatory Framework

6.1 Energy Efficiency Standards

6.2 Cybersecurity Requirements

6.3 Data Privacy Compliance

6.4 Smart City Regulations

07 Vietnam Smart Home Future Market Size (In USD Mn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

08 Vietnam Smart Home Future Market Segmentation

8.1 By Product Type (In Value %)

8.2 By Application (In Value %)

8.3 By Connectivity Type (In Value %)

8.4 By Distribution Channel (In Value %)

8.5 By Region (In Value %)

09 Vietnam Smart Home Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The first phase involves identifying key variables such as market drivers, challenges, and technological advancements in the Vietnam Smart Home Market. This is achieved through comprehensive desk research, drawing on proprietary databases, government publications, and industry reports. The objective is to map out the entire smart home ecosystem, which includes product manufacturers, service providers, and consumers.

Step 2: Market Analysis and Construction

In this stage, we compile historical data to evaluate market size, penetration rates, and overall market performance in the smart home segment. This data is sourced from industry reports and official publications. We also assess the adoption of smart home technologies across different regions, focusing on both residential and commercial applications to construct an accurate market analysis.

Step 3: Hypothesis Validation and Expert Consultation

To ensure the reliability of the data, our initial hypotheses are tested through consultations with industry experts via surveys and interviews. Experts from leading smart home companies and service providers are engaged in these discussions to validate our findings and provide further insights into market trends and consumer behavior.

Step 4: Research Synthesis and Final Output

The final phase synthesizes the data collected into a comprehensive market report, providing insights into product performance, consumer demand, and future market outlook. This report is designed to support stakeholders such as investors, manufacturers, and policymakers in making informed decisions regarding the Vietnam Smart Home Market.

Frequently Asked Questions

02 How big is the Vietnam Smart Home Market?

The Vietnam Smart Home Market is valued at USD 325 million. This growth is driven by urbanization, increasing disposable income, and the adoption of energy-efficient home automation solutions.

02 What are the challenges in the Vietnam Smart Home Market?

Challenges in the Vietnam Smart Home Market include high initial costs for smart home installations and concerns over data privacy and cybersecurity. Limited internet infrastructure in rural areas also poses a barrier to widespread adoption.

03 Who are the major players in the Vietnam Smart Home Market?

Major players in the Vietnam Smart Home market include both local companies such as BKAV and Lumi Vietnam, and international brands like Google, Samsung, Xiaomi, and Apple. These companies dominate due to their advanced technologies and extensive product portfolios.

04 What are the growth drivers of the Vietnam Smart Home Market?

Key growth drivers in the Vietnam Smart Home Market include government initiatives promoting digital transformation, rising demand for energy-efficient solutions, and the increasing adoption of AI and IoT technologies in smart home systems.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.