Vietnam Software as a Service Market Outlook to 2030

Region:Asia

Author(s):Paribhasha Tiwari

Product Code:KROD9221

November 2024

95

About the Report

Vietnam Software as a Service Market Overview

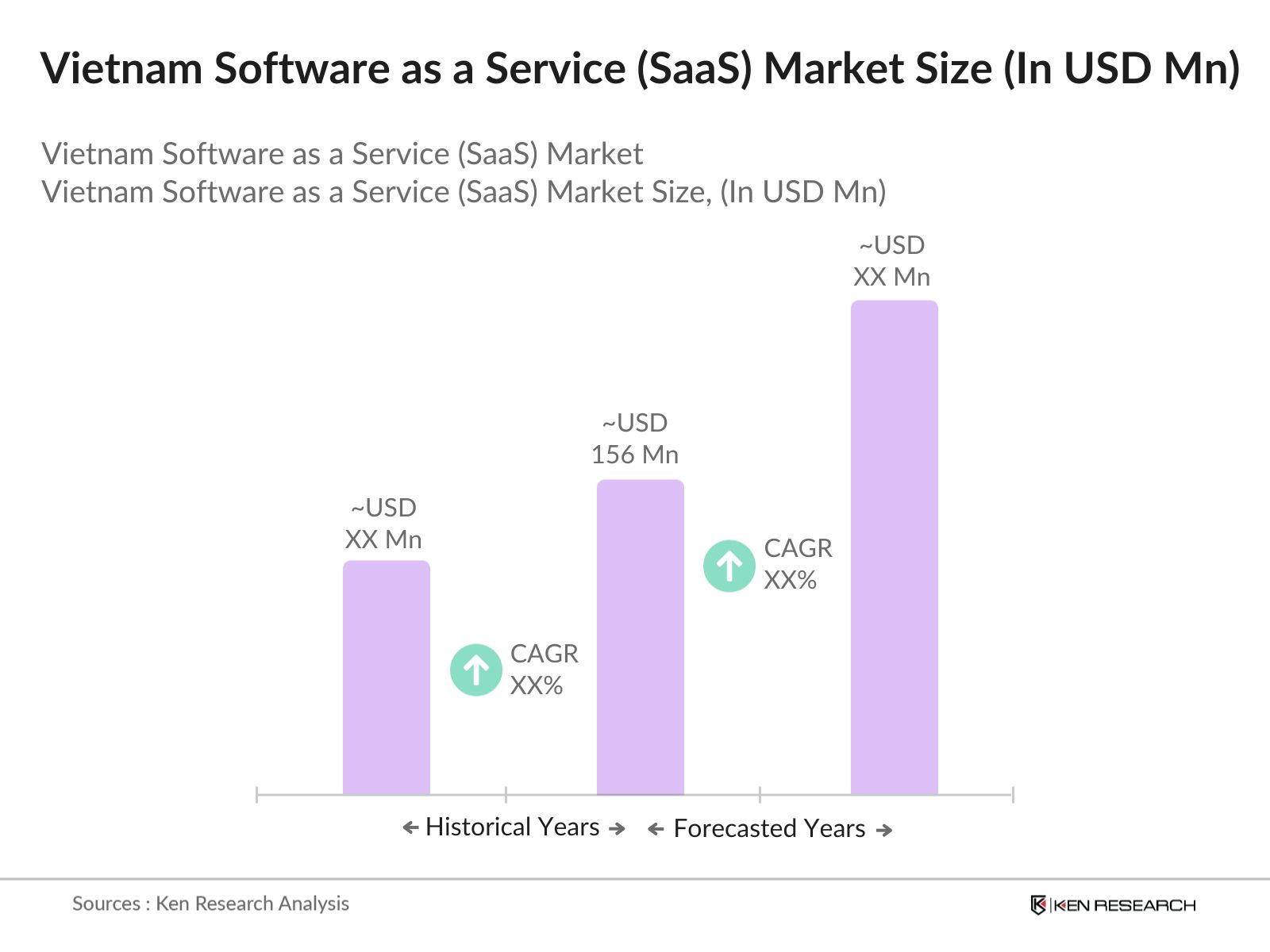

- The Vietnam Software as a Service (SaaS) market is valued at USD 156 million, based on a five-year historical analysis. The market growth is driven by the rapid digital transformation across various industries, coupled with increased investments in cloud infrastructure by both local and international companies. The growth of the SME sector, which is increasingly adopting cloud-based solutions for business management, has also been a major contributor. The introduction of government initiatives aimed at accelerating digital adoption further bolsters market expansion.

- The SaaS market in Vietnam is primarily dominated by Hanoi and Ho Chi Minh City. These two cities are home to the majority of Vietnam's IT firms and cloud infrastructure, largely due to government support, the concentration of tech startups, and the presence of multinational corporations. The availability of a skilled workforce, coupled with the cities' proximity to global technology hubs in Southeast Asia, makes them the dominant players in the Vietnam SaaS market.

- The Vietnamese governments National Digital Transformation Program, launched in 2020, continues to be a major catalyst for SaaS adoption. With over $2.5 billion allocated for digital infrastructure development in 2024, the program encourages businesses to transition to cloud-based platforms, driving SaaS market growth. The initiative aims to digitize key industries, including healthcare, education, and finance, offering vast opportunities for SaaS providers targeting these sectors.

Vietnam Software as a Service Market Segmentation

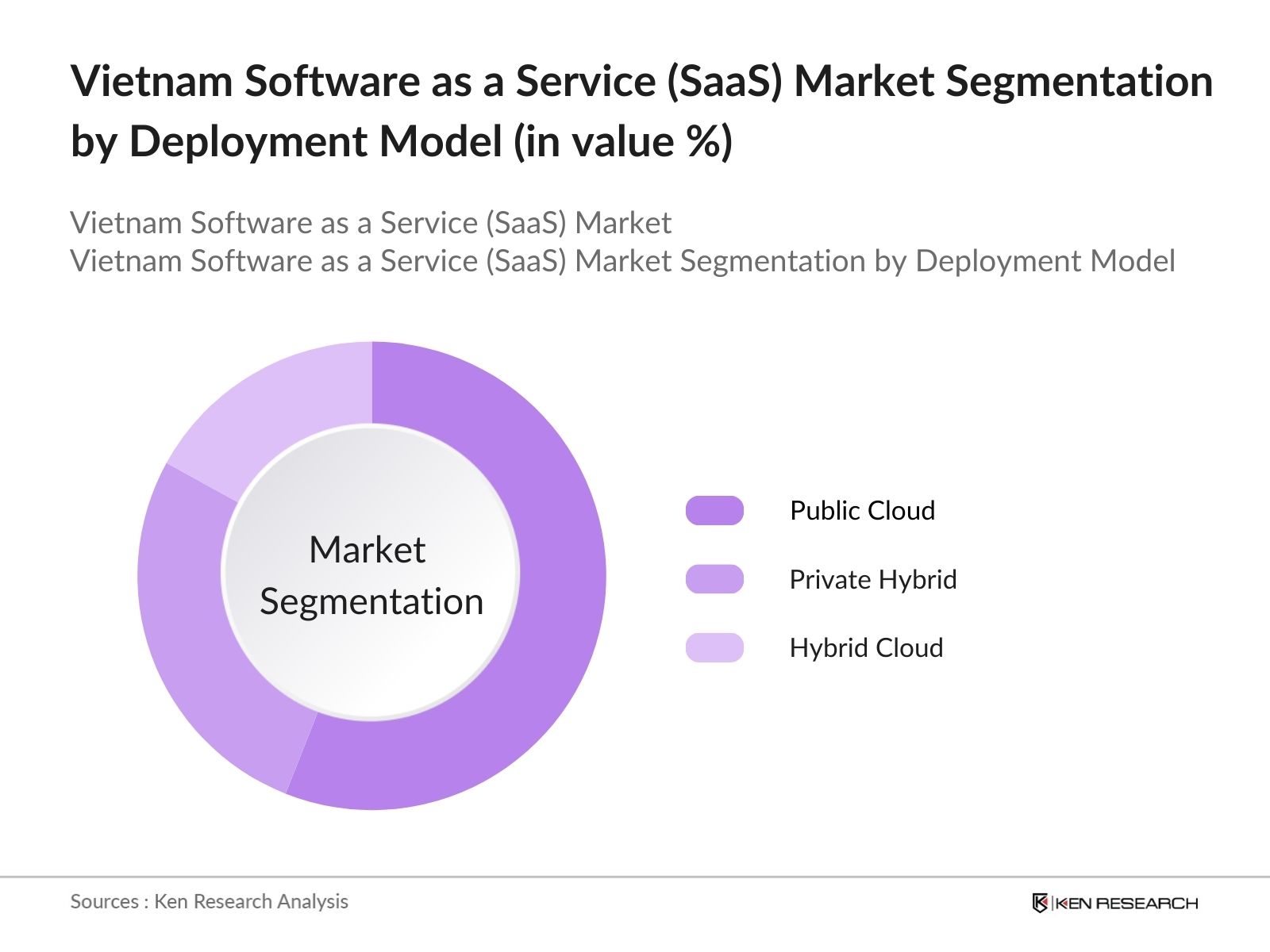

By Deployment Model: Vietnam's SaaS market is segmented by deployment models into public cloud, private cloud, and hybrid cloud. The public cloud segment has recently held the dominant market share due to its cost-effectiveness and ease of scalability. Public cloud solutions are particularly favored by small and medium enterprises (SMEs) due to their lower initial investment requirements. Major cloud providers like AWS and Google Cloud are increasingly offering localized services in Vietnam, further boosting this segment's popularity.

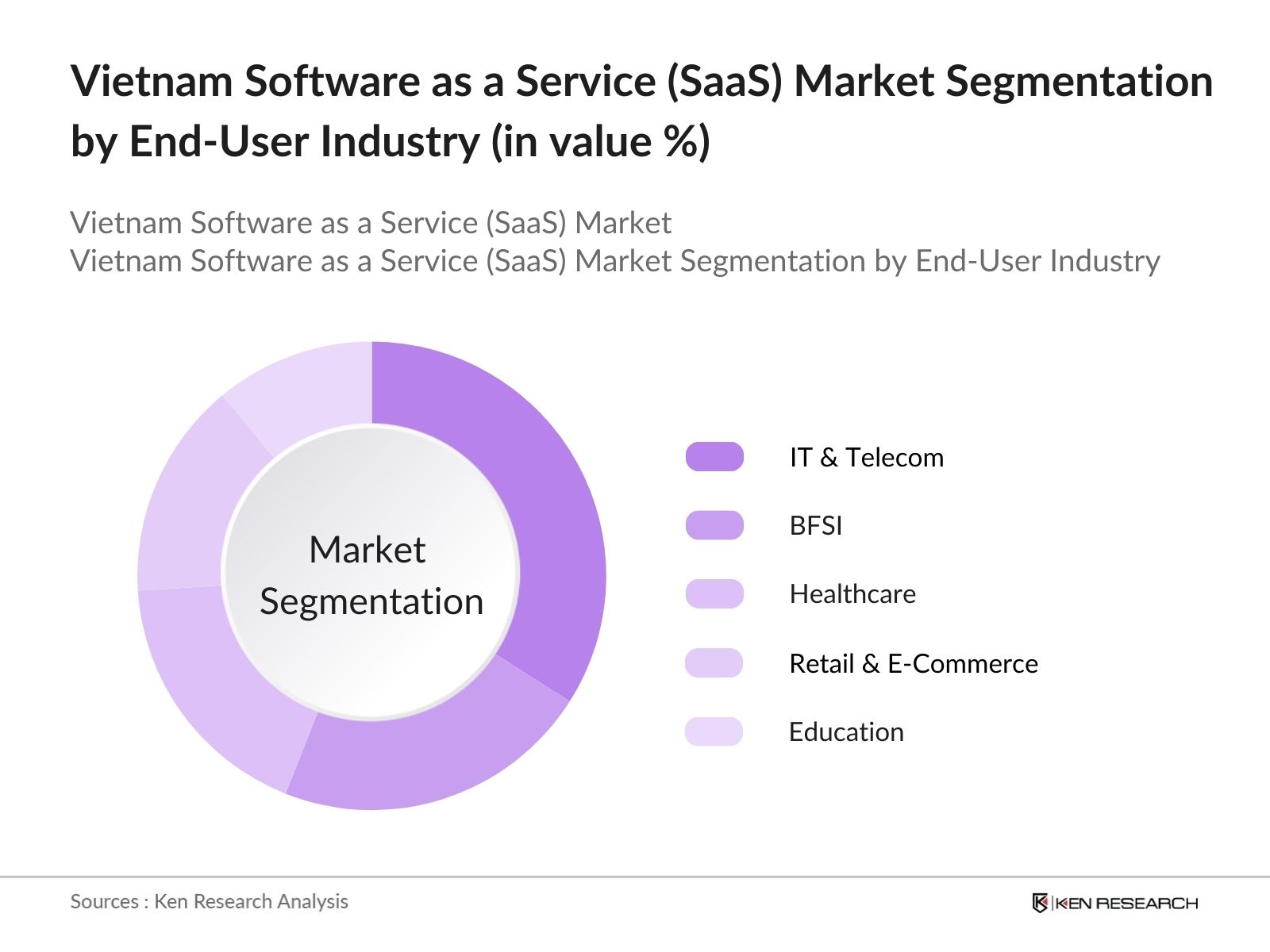

By End-Use Industry: The SaaS market in Vietnam is also segmented by end-use industries, including BFSI, healthcare, IT & telecom, retail & e-commerce, and education. IT & telecom dominate the SaaS market, driven by the industry's demand for scalable, secure, and efficient cloud-based services. The shift toward digitalization and reliance on cloud infrastructure to manage increasing data loads has contributed to this segment's dominance.

Vietnam Software as a Service Market Competitive Landscape

The Vietnam SaaS market is dominated by a mix of international and local players, making it highly competitive. Companies like Microsoft and Oracle lead the market due to their wide range of cloud solutions, while local players like FPT Software are gaining traction with customized offerings.

|

Company Name |

Establishment Year |

Headquarters |

Market Penetration |

No. of Employees |

Product Portfolio |

Cloud Service Provider |

Revenue (USD Mn) |

|

Microsoft Corporation |

1975 |

Redmond, USA |

- | - | - | - | - |

|

Oracle Corporation |

1977 |

Redwood City, USA |

- | - | - | - | - |

|

FPT Software |

1988 |

Hanoi, Vietnam |

- | - | - | - | - |

|

VNG Cloud |

2004 |

Ho Chi Minh City, Vietnam |

- | - | - | - | - |

|

SAP SE |

1972 |

Walldorf, Germany |

- | - | - | - | - |

Vietnam SaaS Market Analysis

Growth Drivers

-

Digital Transformation in SMEs and Large Enterprises: Vietnam is experiencing a significant shift towards digital transformation, particularly among SMEs and large enterprises. In 2024, the governments focus on the National Digital Transformation Program is expected to bring more than 50,000 enterprises online, driving demand for SaaS solutions. With over 97% of the country's businesses classified as SMEs, this segment is actively investing in cloud-based tools to enhance productivity and streamline operations. The Vietnamese government is facilitating this transformation by providing financial incentives and regulatory support to businesses adopting cloud services.

-

Cloud Infrastructure Penetration: The rapid development of Vietnam's cloud infrastructure is another growth driver. According to the Ministry of Information and Communications, Vietnam had more than 40 data centers as of 2023, with major cloud providers expanding their presence. By 2024, these investments are projected to exceed $2 billion, enabling widespread adoption of SaaS platforms. This improved infrastructure will allow businesses across various sectors to leverage cloud-based applications for operational efficiency and cost savings, positioning Vietnam as a key market for SaaS providers.

- Government Initiatives (National Digital Transformation Program): The National Digital Transformation Program, launched by the Vietnamese government, aims to digitize key sectors by 2025, including finance, healthcare, and education. In 2024, the government allocated $2.5 billion to boost digital infrastructure, ensuring businesses have the resources to adopt SaaS solutions. This initiative is pushing enterprises to replace traditional software with scalable cloud solutions, significantly expanding the SaaS market in the country.

Market Challenges

-

Data Security Concerns: As Vietnamese companies increasingly adopt SaaS platforms, data security remains a significant challenge. The Ministry of Information and Communications reported over 8,000 cyberattacks in 2023, prompting heightened concerns among businesses. With many enterprises storing sensitive customer and operational data on cloud platforms, the need for enhanced security measures and compliance is critical. Businesses are cautious about migrating to SaaS solutions without robust cybersecurity protocols, creating hurdles for broader adoption.

- Regulatory Compliance Issues: Navigating Vietnam's regulatory landscape poses challenges for SaaS providers, especially concerning data residency and privacy regulations. In 2023, the government introduced new data localization laws requiring foreign SaaS companies to store Vietnamese users' data within the country. These regulations add operational costs and complexities for global SaaS providers looking to enter or expand in Vietnam, potentially limiting the market's growth.

Vietnam SaaS market Future Outlook

Over the next five years, the Vietnam SaaS market is expected to show significant growth driven by increasing digital adoption across industries, advancements in cloud infrastructure, and government policies promoting digital transformation. Vietnam's rapidly growing startup ecosystem is also contributing to demand for flexible and scalable cloud-based solutions, further propelling the market forward. The rise of artificial intelligence (AI) and machine learning (ML) technologies integrated with SaaS offerings is anticipated to open new avenues for growth.

Market Opportunities

- Growth in AI-Powered SaaS Solutions: Vietnam's AI market is expected to grow substantially in the coming years, providing an opportunity for AI-powered SaaS applications. In 2024, AI technologies are forecasted to generate over $1.2 billion in economic value for Vietnam, with sectors like manufacturing, retail, and finance leading the adoption of AI-powered SaaS solutions. These applications can help automate processes, improve decision-making, and enhance customer experiences, offering SaaS providers a lucrative opportunity to differentiate their offerings in the Vietnamese market.

- Expansion in Non-Metropolitan Areas: While SaaS adoption has been concentrated in major cities like Ho Chi Minh City and Hanoi, there is significant growth potential in non-metropolitan areas. The government's initiatives to improve internet infrastructure in rural regions will enable businesses in these areas to adopt cloud-based software solutions. In 2024, more than 10 million businesses in rural Vietnam are expected to benefit from enhanced digital infrastructure, offering SaaS providers an opportunity to expand their customer base beyond urban centers.

Scope of the Report

|

By Deployment Model |

Public Cloud Private Cloud Hybrid Cloud |

|

By Application |

CRM ERP HCM CMS |

|

By Organization Size |

SMEs Large Enterprises |

|

By End-Use Industry |

BFSI Healthcare IT & Telecom Retail & E-Commerce Education |

|

By Region |

Hanoi Ho Chi Minh City Da Nang Mekong Delta |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (Vietnam Ministry of Information and Communications)

Cloud Service Providers

Software Developers and Tech Firms

SaaS Solution Integrators

SMEs (Small and Medium Enterprises)

Large Enterprises

IT & Telecom Companies

Companies

Players Mentioned in the Report:

Microsoft Corporation

Oracle Corporation

Salesforce.com, Inc.

SAP SE

Adobe Inc.

FPT Software

VNG Cloud

Freshworks Inc.

Base.vn

Amazon Web Services (AWS)

Table of Contents

1. Vietnam SaaS Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Vietnam SaaS Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Growth Analysis

2.3. Key Market Developments and Milestones

3. Vietnam SaaS Market Analysis

3.1. Growth Drivers

3.1.1. Digital Transformation (High adoption in SMEs, large enterprises)

3.1.2. Cloud Infrastructure Penetration

3.1.3. Government Initiatives (National Digital Transformation Program)

3.1.4. Rising Internet Penetration

3.2. Market Challenges

3.2.1. Data Security Concerns

3.2.2. Regulatory Compliance Issues

3.2.3. Cost Barriers for SMEs

3.2.4. Limited Cloud Literacy

3.3. Opportunities

3.3.1. Growth in AI-Powered SaaS Solutions

3.3.2. Expansion in Non-Metropolitan Areas

3.3.3. SaaS Integration with IoT and Blockchain

3.3.4. Global SaaS Export Potential

3.4. Trends

3.4.1. Shift Toward Vertical-Specific SaaS Solutions

3.4.2. Increasing Usage of Low-Code and No-Code SaaS Platforms

3.4.3. Emphasis on SaaS Security Solutions

3.4.4. Adoption of Multi-Tenant SaaS Architecture

3.5. Government Regulation

3.5.1. Data Localization Laws (Vietnam Cybersecurity Law)

3.5.2. Tax Incentives for SaaS Startups

3.5.3. Cloud Infrastructure Development Regulations

3.5.4. Guidelines for SaaS Contracting and Licensing

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Vietnam SaaS Market Segmentation

4.1. By Deployment Model (In Value %)

4.1.1. Public Cloud

4.1.2. Private Cloud

4.1.3. Hybrid Cloud

4.2. By Application (In Value %)

4.2.1. Customer Relationship Management (CRM)

4.2.2. Enterprise Resource Planning (ERP)

4.2.3. Human Capital Management (HCM)

4.2.4. Content Management Systems (CMS)

4.3. By Organization Size (In Value %)

4.3.1. Small and Medium Enterprises (SMEs)

4.3.2. Large Enterprises

4.4. By End-Use Industry (In Value %)

4.4.1. BFSI

4.4.2. Healthcare

4.4.3. IT & Telecom

4.4.4. Retail & E-Commerce

4.4.5. Education

4.5. By Region (In Value %)

4.5.1. Hanoi

4.5.2. Ho Chi Minh City

4.5.3. Da Nang

4.5.4. Mekong Delta

5. Vietnam SaaS Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Microsoft Corporation

5.1.2. Oracle Corporation

5.1.3. Salesforce.com, Inc.

5.1.4. SAP SE

5.1.5. Adobe Inc.

5.1.6. Zoho Corporation Pvt. Ltd.

5.1.7. Freshworks Inc.

5.1.8. IBM Corporation

5.1.9. VNG Cloud

5.1.10. FPT Software

5.1.11. Base.vn

5.1.12. Amazon Web Services (AWS)

5.1.13. Google Cloud

5.1.14. Twilio Inc.

5.1.15. Dropbox Inc.

5.2. Cross Comparison Parameters

5.2.1 No. of Employees

5.2.2 Headquarters

5.2.3 Inception Year

5.2.4 Revenue

5.2.5 Market Share (in %)

5.2.6 SaaS Product Portfolio

5.2.7 Regional Expansion Strategy

5.2.8 Strategic Partnerships

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Vietnam SaaS Market Regulatory Framework

6.1. Data Protection and Privacy Regulations

6.2. Compliance Requirements for SaaS Providers

6.3. Intellectual Property Laws for SaaS Solutions

6.4. Certification and Licensing Standards

7. Vietnam SaaS Future Market Size (In USD Bn)

7.1. Market Size Projections

7.2. Key Factors Driving Future Growth

8. Vietnam SaaS Future Market Segmentation

8.1. By Deployment Model

8.2. By Application

8.3. By Organization Size

8.4. By End-Use Industry

8.5. By Region

9. Vietnam SaaS Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial step involves mapping the key stakeholders in the Vietnam SaaS market through extensive desk research. This stage is essential for identifying market drivers, challenges, and opportunities.

Step 2: Market Analysis and Construction

In this phase, historical market data is analyzed to identify trends in market growth, SaaS adoption rates, and the influence of cloud infrastructure development. The gathered data is then verified through cross-referencing with proprietary sources.

Step 3: Hypothesis Validation and Expert Consultation

To ensure the validity of the market hypotheses, interviews with industry experts are conducted. These consultations provide insights into operational efficiencies, market strategies, and future trends.

Step 4: Research Synthesis and Final Output

The final step involves synthesizing all collected data to provide a comprehensive overview of the Vietnam SaaS market, ensuring the accuracy of the market size, segmentation, and competitive landscape.

Frequently Asked Questions

01. How big is the Vietnam SaaS Market?

The Vietnam SaaS market, valued at USD 156 million, is primarily driven by the rapid digital transformation and the growing adoption of cloud-based solutions among SMEs and large enterprises.

02. What are the major challenges in the Vietnam SaaS Market?

Major challenges in the Vietnam SaaS market include data security concerns, regulatory compliance issues, and cost barriers for small and medium enterprises (SMEs), which limit the adoption of advanced solutions.

03. Who are the major players in the Vietnam SaaS Market?

Key players in the Vietnam SaaS market include Microsoft Corporation, Oracle Corporation, FPT Software, Salesforce, and SAP SE. These companies dominate due to their established product portfolios and significant cloud investments.

04. What drives the growth of the Vietnam SaaS Market?

The growth of the Vietnam SaaS market is propelled by the increasing adoption of cloud computing across industries, government support for digital transformation, and the rise of AI-driven SaaS applications.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.