Vietnam Software Defined Perimeter (SDP) Market Outlook to 2030

Region:Global

Author(s):Shivani Mehra

Product Code:KROD3877

December 2024

92

About the Report

Vietnam Software Defined Perimeter (SDP) Market Overview

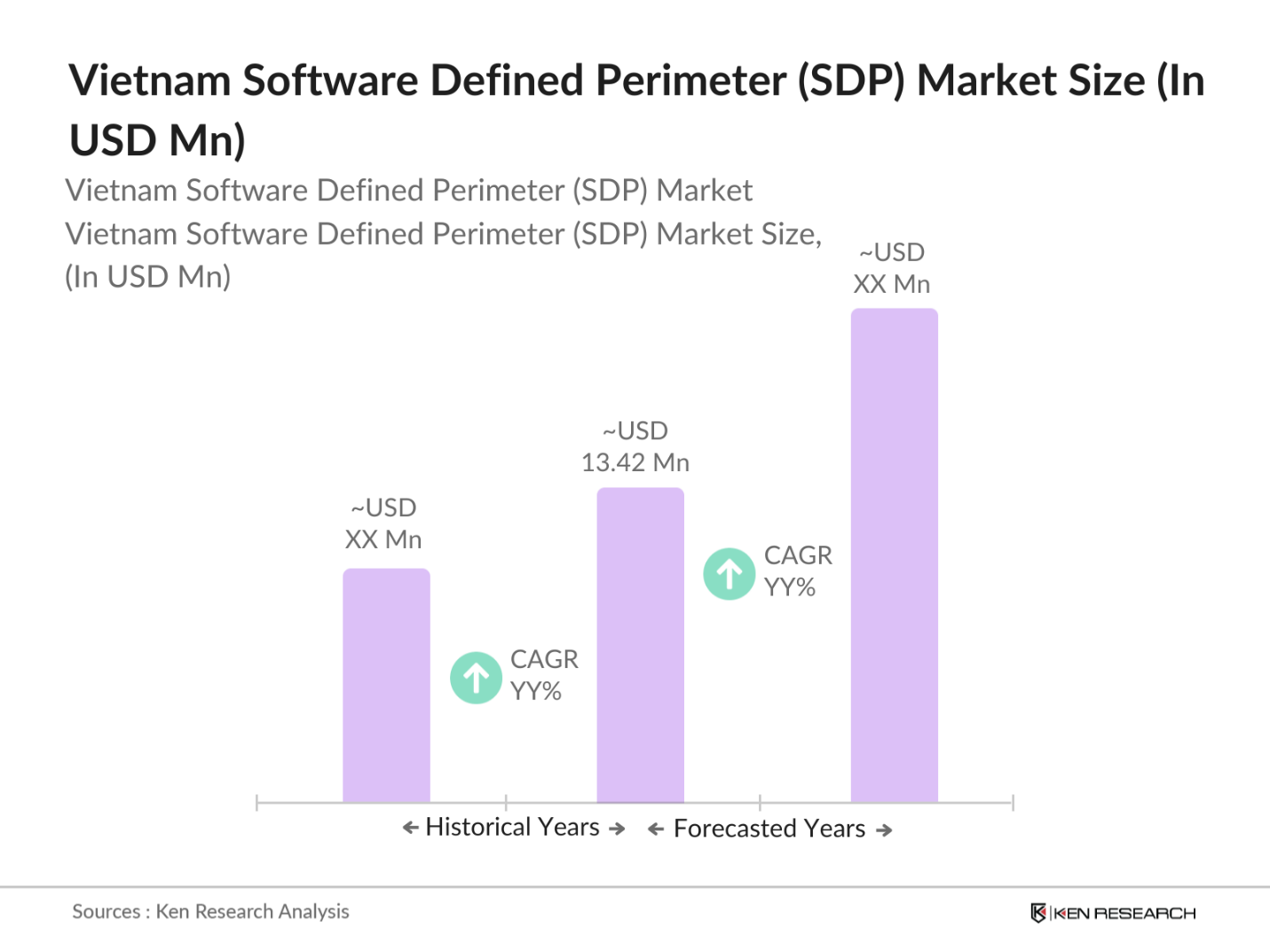

- The Vietnam Software Defined Perimeter (SDP) Market is valued at USD 13.42 million, largely driven by the rise in cybersecurity threats and the push for digital transformation across various sectors. Increasing adoption of cloud services in Vietnam, coupled with growing regulatory requirements on data security, has also propelled the demand for SDP solutions as businesses seek more secure and flexible network access.

- Major cities like Ho Chi Minh City and Hanoi are leading in SDP adoption due to the concentration of large enterprises and foreign investment, particularly in sectors such as BFSI, government, and IT. These cities are adopting cutting-edge cybersecurity solutions to protect sensitive data and support the governments emphasis on digitalization.

- The Vietnamese government has strengthened its cybersecurity policies to address increasing digital threats. In 2023, the Ministry of Information and Communications introduced a national cybersecurity strategy that focuses on enhancing network security, including the promotion of secure access management technologies such as SDP. This regulatory push for improved cybersecurity practices provides a conducive environment for the growth of the SDP market, as organizations seek solutions to meet regulatory requirements and protect their digital infrastructures.

Vietnam Software Defined Perimeter (SDP) Market Segmentation

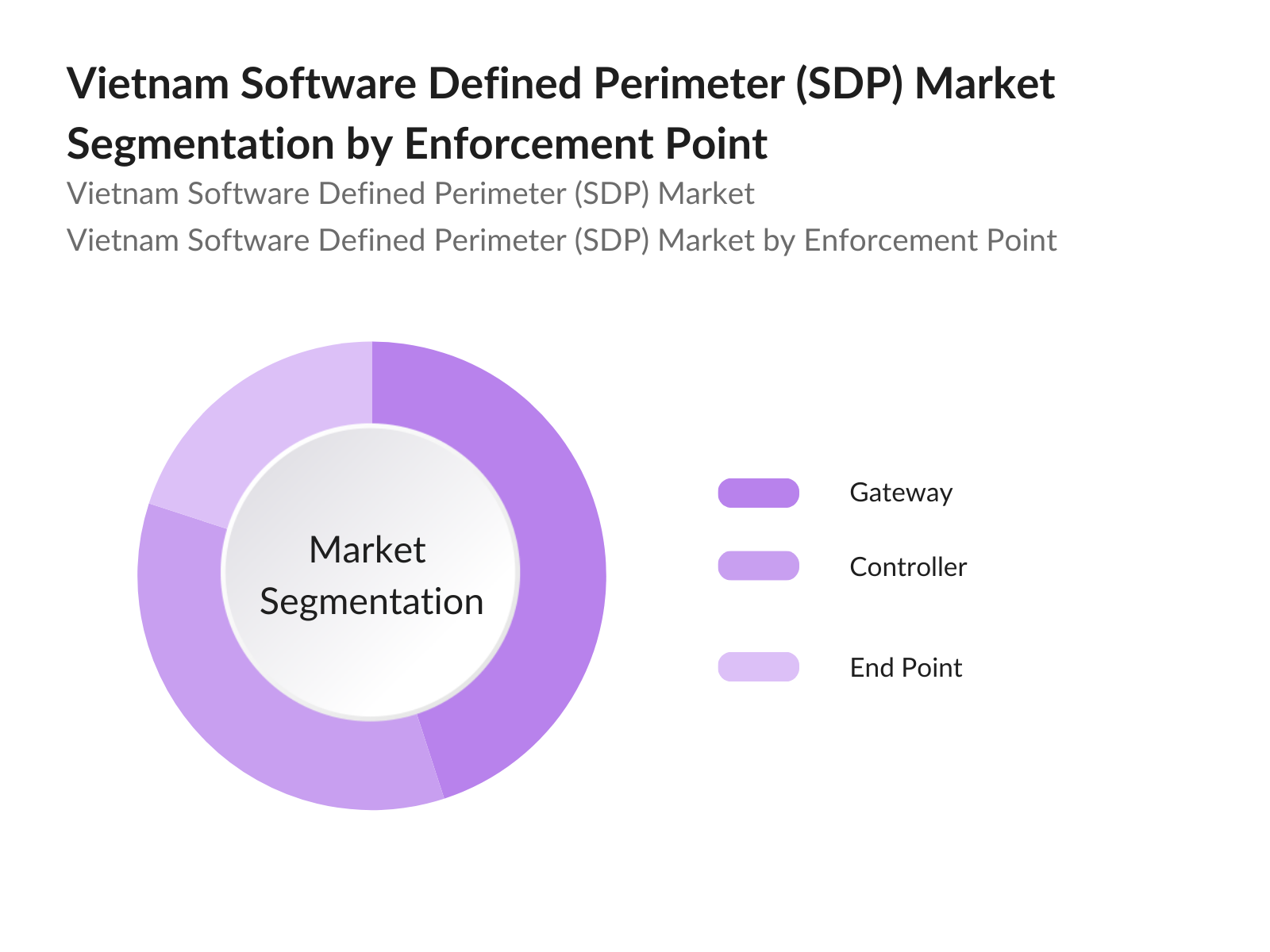

By Enforcement Point: Vietnams SDP market is segmented by enforcement point, including Gateway, Controller, and End Point. Gateways currently hold the largest share due to their crucial role in managing secure access to network resources, particularly for large organizations in sectors like BFSI and IT. They enable centralized control over network policies, which is essential for compliance and security.

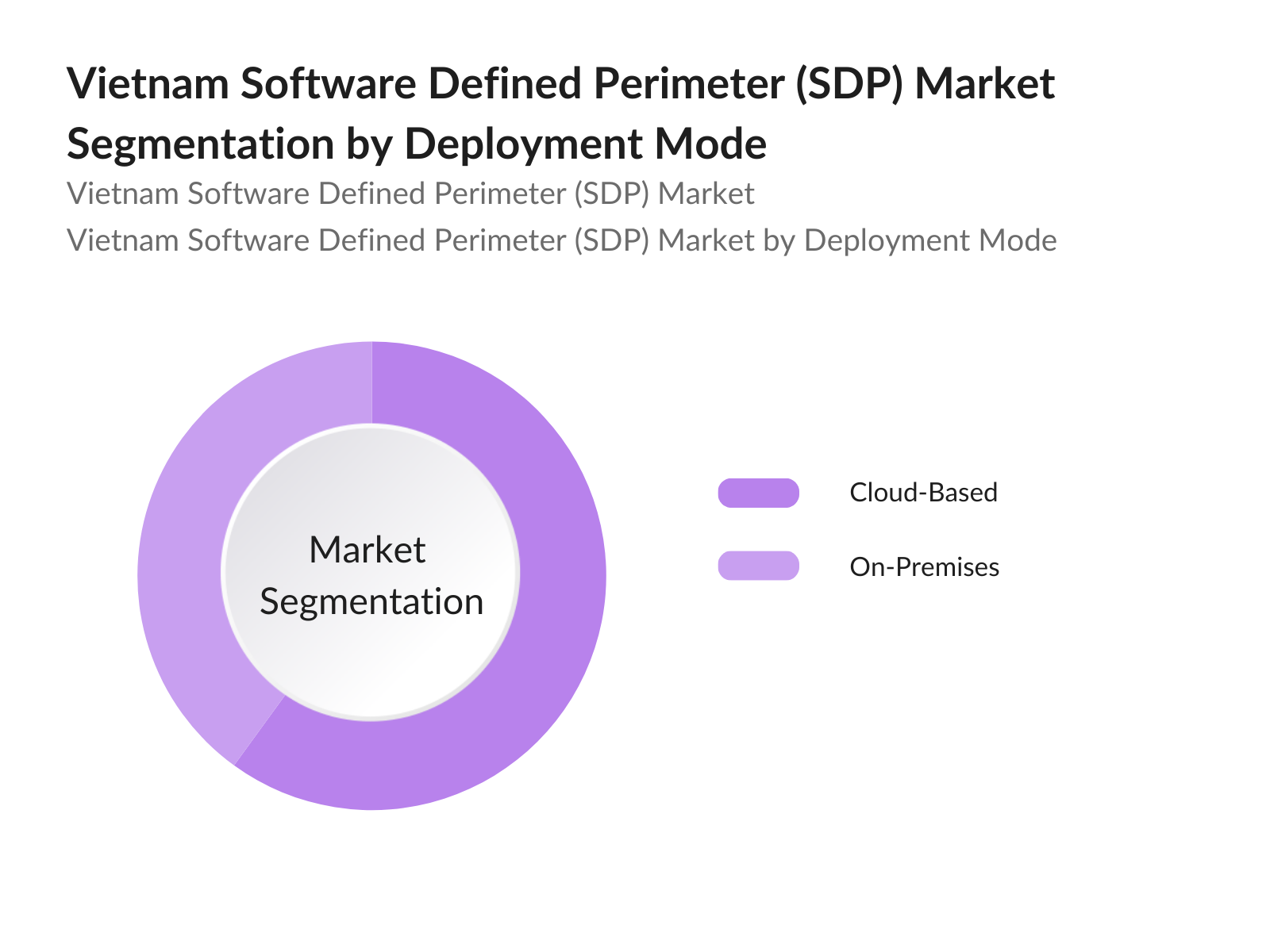

By Deployment Mode: The SDP market is segmented by deployment mode into Cloud-Based and On-Premises solutions. Cloud-Based deployment is gaining popularity as it offers scalability, cost-efficiency, and integration with modern IT infrastructures. SMEs and tech-driven organizations in Vietnam prefer cloud deployment for its ease of setup and lower initial costs.

Vietnam Software Defined Perimeter (SDP) Market Competitive Landscape

The Vietnam SDP market is shaped by a mix of international and regional players, with global firms like Cisco and Fortinet leading due to their extensive product offerings and expertise in network security. Local service providers are also emerging, focusing on managed services tailored to Vietnamese businesses specific needs.

|

Company |

Establishment Year |

Headquarters |

Revenue ($ Mn) |

Employee Strength |

Global Reach |

Cybersecurity Certifications |

Specialized Services |

|

Cisco Systems, Inc. |

1984 |

San Jose, USA |

|||||

|

Palo Alto Networks |

2005 |

Santa Clara, USA |

|||||

|

Fortinet, Inc. |

2000 |

Sunnyvale, USA |

|||||

|

Akamai Technologies, Inc. |

1998 |

Cambridge, USA |

|||||

|

Zscaler, Inc. |

2008 |

San Jose, USA |

Vietnam Software Defined Perimeter (SDP) Market Analysis

Market Growth Drivers

- Digital Transformation Initiatives: Vietnam's digital transformation initiatives are driving the adoption of innovative technologies such as Software Defined Perimeter (SDP). The Vietnamese government has allocated $1 billion to fund digital transformation efforts as part of the "Vietnam Digital Transformation Program 2025." This program promotes the adoption of cloud computing, digital government services, and advanced IT infrastructure, which in turn increases the demand for secure access models such as SDP to protect critical data. These efforts further drive the need for robust cybersecurity frameworks that support both public and private sector digital initiatives.

- Adoption of Cloud Services: The adoption of cloud services in Vietnam is growing rapidly, with the number of cloud users in the country expected to increase by 20% in 2023. Companies in various sectors are migrating to the cloud to enhance scalability, flexibility, and reduce operational costs. However, with the increased use of cloud computing, the need for secure and manageable access control systems has surged. This has led to the growing demand for SDP solutions, which help secure cloud-based infrastructures by defining who and what can access network resources based on identity and context.

- Regulatory Compliance Requirements: Vietnam is tightening its cybersecurity and data protection regulations. In 2023, the Ministry of Information and Communications (MIC) enforced stricter compliance guidelines for businesses, particularly those handling personal data, which now face penalties for non-compliance. These new regulations push organizations to adopt security models like SDP to ensure that their networks meet national and international data protection standards. This drive for compliance is helping the SDP market grow as businesses seek to avoid fines and reputational damage from data breaches and compliance failures.

Market Challenges:

- Limited Awareness and Understanding: Despite the growing cybersecurity threats, awareness and understanding of Software Defined Perimeter solutions in Vietnam remain limited. A 2024 survey indicated that of Vietnamese enterprises lack a clear understanding of how SDP works and its benefits for securing their network. This lack of awareness among small to medium-sized enterprises (SMEs) and decision-makers hinders market growth, as many companies remain reliant on traditional perimeter security measures, delaying the adoption of more advanced cybersecurity technologies like SDP.

- Integration with Existing Systems: Integrating SDP with existing IT and network infrastructures is a significant challenge in Vietnam. Many organizations are still using legacy systems that were not designed to work with modern security models. A report in 2023 highlighted that of companies experienced difficulty integrating SDP solutions with their current infrastructure, including legacy firewalls and VPNs. This integration complexity, along with the need to overhaul older systems, presents a barrier to quick adoption. Organizations need to invest in additional resources and expertise to ensure smooth integration.

Vietnam Software Defined Perimeter (SDP) Market Future Outlook

Over the next five years, the Vietnam SDP market is expected to witness substantial growth as businesses continue to invest in cybersecurity amid increasing digitalization. Key growth drivers include the rising trend of remote work, expanding IoT networks, and stringent data protection regulations. The governments focus on developing a robust digital economy will further create new opportunities for SDP providers, particularly in the cloud-based solutions segment.

Market Opportunities:

- Expansion of IoT Devices: The rapid expansion of the Internet of Things (IoT) in Vietnam presents a major opportunity for SDP technology. By 2024, it is expected that over 300 million IoT devices will be active in the country, ranging from smart home devices to industrial equipment. These devices introduce significant security risks, especially as they create new access points into corporate and personal networks. SDP solutions provide the necessary infrastructure to securely manage and control access to these devices, positioning SDP as a critical security tool for organizations with large IoT ecosystems.

- Development of Local IT Infrastructure: Vietnam is investing heavily in its IT infrastructure as part of its digital economy agenda. In 2023, the government announced plans to develop five new data centers and expand high-speed internet connectivity to underserved regions, facilitating further technological adoption. This improvement in infrastructure creates an opportunity for SDP vendors to expand their offerings to new market segments, particularly in regional markets where digital transformation and secure perimeter solutions are just beginning to gain traction.

Scope of the Report

|

By Enforcement Point |

Gateway |

|

By Components |

Solutions |

|

By Deployment Mode |

Cloud-Based |

|

By End-User |

BFSI |

|

By Region |

North-East Midwest West Coast Southern States |

Products

Key Target Audience

Telecom Providers

IT & Telecom Firms

Healthcare Facilities

Government and Regulatory Bodies(e.g., Vietnam Cybersecurity Emergency Response Team)

Banking and Financial Services

Retail Chains

Industrial Manufacturing

Investments and Venture Capitalist Firms

Companies

Player Mentipon in the Report

Cisco Systems, Inc.

Palo Alto Networks

Fortinet, Inc.

Akamai Technologies, Inc.

Zscaler, Inc.

Cloudflare, Inc.

RSA Security LLC

Symantec Corporation

IBM Corporation

Juniper Networks

Citrix Systems

Forcepoint

Check Point Software Technologies

Intel Corporation

Broadcom Inc.

Table of Contents

01. Vietnam Software Defined Perimeter (SDP) Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

02. Vietnam Software Defined Perimeter (SDP) Market Size (In USD Million)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

03. Vietnam Software Defined Perimeter (SDP) Market Analysis

3.1. Growth Drivers

3.1.1. Rising Cybersecurity Threats

3.1.2. Increased Cloud Adoption

3.1.3. Digital Transformation Initiatives

3.1.4. Government Regulations on Data Protection

3.2. Market Challenges

3.2.1. Limited Awareness Among SMEs

3.2.2. High Deployment Costs

3.2.3. Integration with Legacy Systems

3.3. Opportunities

3.3.1. Growth in Remote Workforce Solutions

3.3.2. Expansion of IoT Devices

3.3.3. Increasing Adoption of Zero Trust Security Models

3.4. Trends

3.4.1. AI Integration in Security

3.4.2. Rise of Managed Security Service Providers (MSSPs)

3.4.3. Demand for Software-Defined Networking (SDN)

3.5. Government Regulations

3.5.1. Cybersecurity Law Compliance

3.5.2. Data Protection Standards

3.5.3. Certification Requirements

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Landscape

04. Vietnam Software Defined Perimeter (SDP) Market Segmentation

4.1. By Enforcement Point (In Value %)

4.1.1. Gateway

4.1.2. Controller

4.1.3. End Point

4.2. By Components (In Value %)

4.2.1. Solutions

4.2.2. Services

4.3. By Deployment Mode (In Value %)

4.3.1. Cloud-Based

4.3.2. On-Premises

4.4. By End User (In Value %)

4.4.1. BFSI

4.4.2. Healthcare

4.4.3. Government

4.4.4. IT & Telecom

4.4.5. Retail

4.5. By Organization Size (In Value %)

4.5.1. Small and Medium Enterprises (SMEs)

4.5.2. Large Enterprises

05. Vietnam Software Defined Perimeter (SDP) Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Cisco Systems, Inc.

5.1.2. Palo Alto Networks

5.1.3. Check Point Software Technologies

5.1.4. Fortinet, Inc.

5.1.5. Akamai Technologies

5.1.6. Cloudflare, Inc.

5.1.7. RSA Security LLC

5.1.8. Intel Corporation

5.1.9. Zscaler, Inc.

5.1.10. Symantec Corporation

5.1.11. IBM Corporation

5.1.12. Juniper Networks

5.1.13. Citrix Systems

5.1.14. Forcepoint

5.1.15. Broadcom Inc.

5.2. Cross Comparison Parameters (Revenue, Headquarters, Inception Year, R&D Investment, Cybersecurity Certifications, Global Reach, Specialized Services, Strategic Partnerships)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

06. Vietnam Software Defined Perimeter (SDP) Regulatory Framework

6.1. Cybersecurity Standards and Compliance

6.2. Data Protection and Privacy Laws

6.3. Certification Requirements

07. Vietnam Software Defined Perimeter (SDP) Future Market Size (In USD Million)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Growth

08. Vietnam Software Defined Perimeter (SDP) Future Market Segmentation

8.1. By Enforcement Point (In Value %)

8.2. By Components (In Value %)

8.3. By Deployment Mode (In Value %)

8.4. By End User (In Value %)

09. A Vietnam Software Defined Perimeter (SDP) Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Market Positioning Strategies

9.3. Investment and Strategic Partnerships

9.4. White Space Analysis for Growth

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

This initial phase includes identifying stakeholders, cybersecurity needs, and market drivers in the Vietnam SDP Market through extensive desk research.

Step 2: Market Analysis and Construction

Market data on adoption rates, infrastructure investment, and security demands is analyzed to create an in-depth view of current market size and growth potential.

Step 3: Hypothesis Validation and Expert Consultation

Discussions with industry experts and cybersecurity professionals validate the findings, providing insights into strategic partnerships, product preferences, and technology adoption.

Step 4: Research Synthesis and Final Output

The final synthesis of research findings, coupled with insights from expert interviews, forms a comprehensive and validated analysis of the Vietnam SDP Market.

Frequently Asked Questions

01. How big is the Vietnam Software Defined Perimeter Market?

The Vietnam Software Defined Perimeter Market is valued at USD 13.42 million, propelled by cybersecurity needs and cloud adoption.

02. What are the challenges in the Vietnam SDP Market?

Challenges include high deployment costs, limited awareness, and difficulties in integrating SDP solutions with legacy systems.

03. Who are the major players in the Vietnam SDP Market?

Key players include Cisco, Fortinet, Palo Alto Networks, Akamai, and Zscaler, each offering specialized cybersecurity solutions.

04. What are the growth drivers of the Vietnam SDP Market?

Growth is driven by rising cyber threats, digital transformation, and stringent government regulations focused on data security.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.