Vietnam Solar Energy Market Outlook 2030

Region:Global

Author(s):Shivani Mehra

Product Code:KROD9227

December 2024

82

About the Report

Vietnam Solar Energy Market Overview

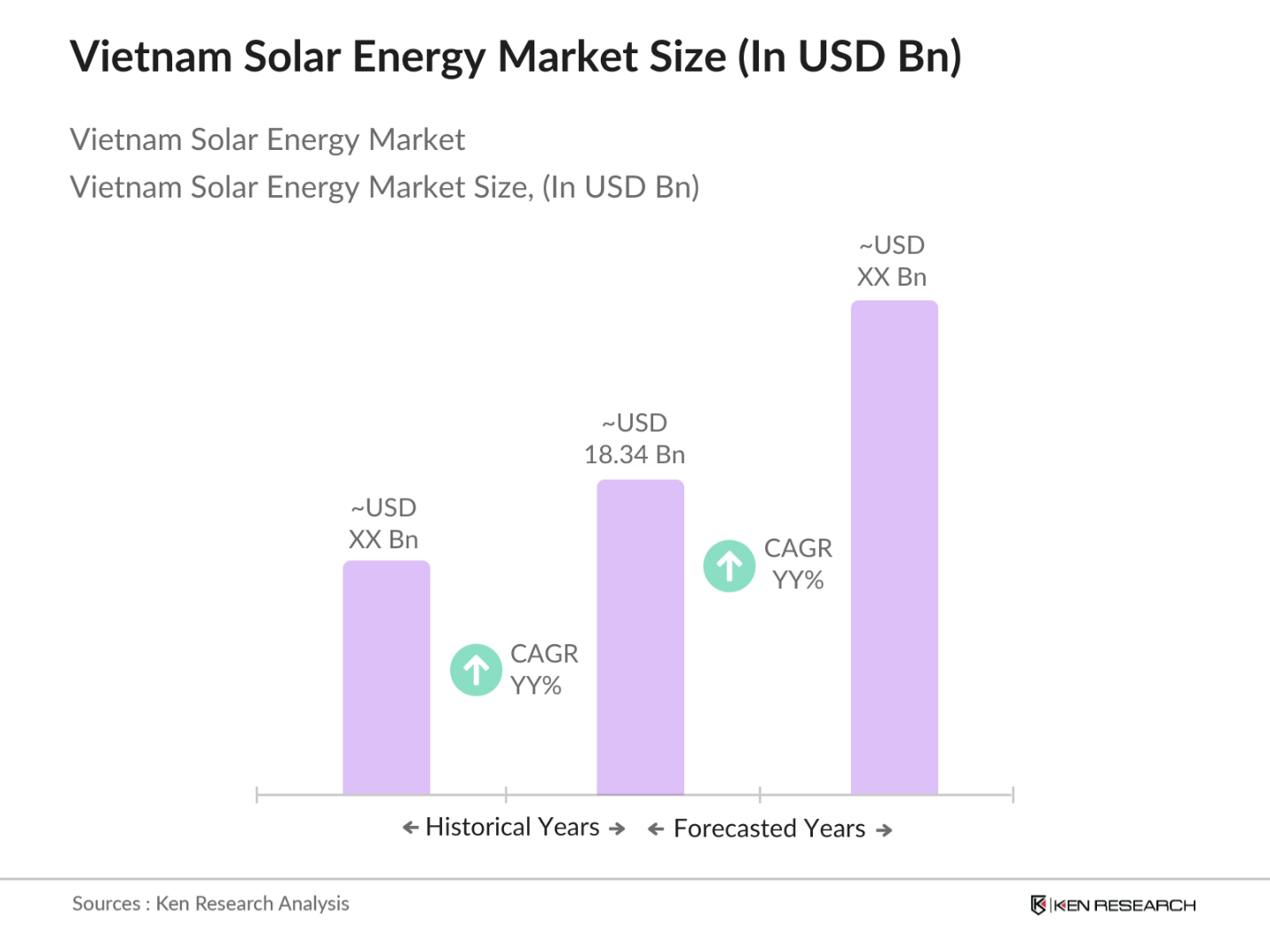

- The Vietnam solar energy market is valued at USD 18.34 billion, driven by a combination of government incentives, increasing energy demand, and a robust investment in renewable energy sources. The country has witnessed a surge in solar energy installations, bolstered by favorable policies like feed-in tariffs (FiTs) and tax exemptions. Additionally, rising concerns over energy security and environmental sustainability have accelerated solar projects, positioning Vietnam as one of the leading solar markets in Southeast Asia.

- Vietnam's southern and central regions dominate the solar energy landscape, owing to their higher solar irradiance levels and extensive land availability for large-scale solar farms. Cities such as Ho Chi Minh and Binh Thuan have become key solar energy hubs, attracting both domestic and international investments. The rapid industrialization and urbanization in these areas, coupled with government-backed renewable projects, have further driven the concentration of solar installations.

- Vietnams government, through collaboration with local banks and international financial institutions, has initiated green credit programs to provide low-interest loans for renewable energy projects. The State Bank of Vietnam (SBV) has encouraged commercial banks to offer preferential lending rates for solar energy developers. In 2022, the Asian Development Bank (ADB) and the World Bank also extended financial support to Vietnams solar sector through green financing schemes. These programs help solar developers secure funding with more favorable terms, accelerating the development of solar projects across the country.

Vietnam Solar Energy Market Segmentation

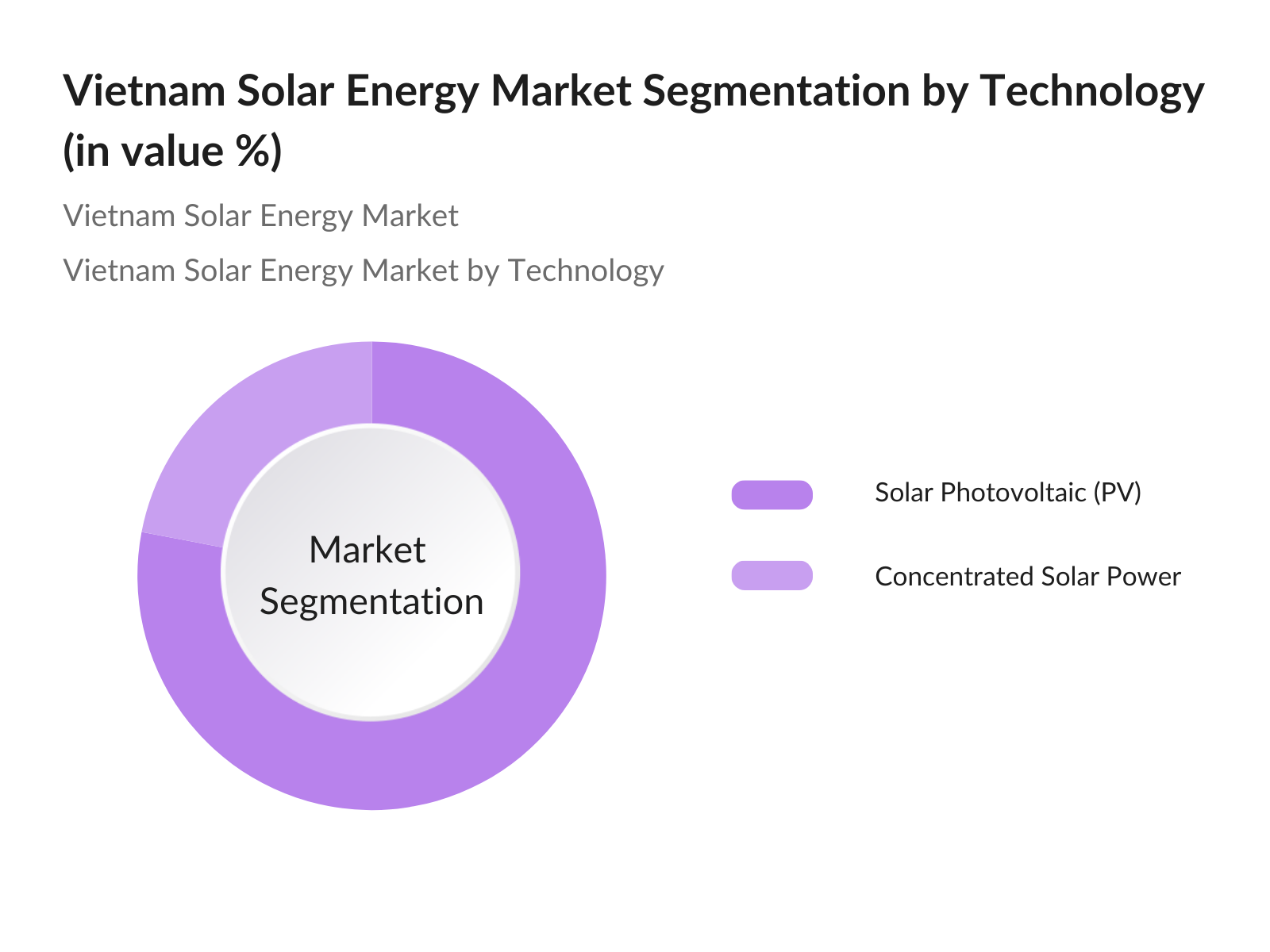

By Technology: The Vietnam solar energy market is segmented by technology into Solar Photovoltaic (PV) and Concentrated Solar Power (CSP). Among these, Solar Photovoltaic holds a dominant market share due to its cost efficiency, ease of installation, and scalability. The increasing deployment of rooftop solar PV systems, driven by government incentives and declining panel costs, makes it the preferred choice across residential, commercial, and industrial sectors. CSP, on the other hand, is less popular due to its higher initial investment costs and limited suitability in Vietnam's geographic conditions.

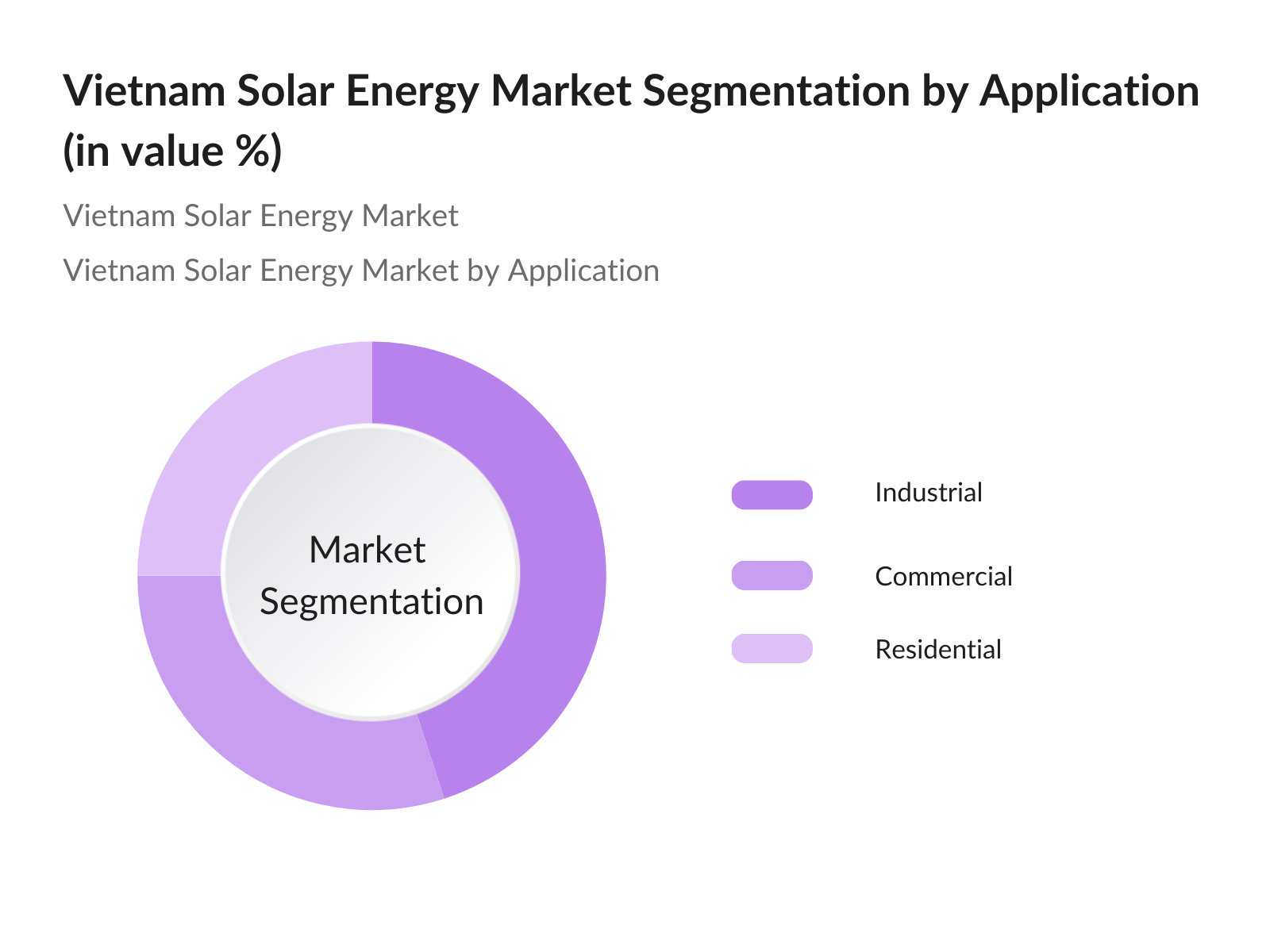

By Application: The market is further segmented by application into Residential, Commercial, and Industrial segments. The Industrial segment dominates the market, accounting for a significant share, primarily due to high energy demand in manufacturing zones and industrial parks across Vietnam. These areas require large-scale solar installations to meet electricity needs, and the governments push towards cleaner energy in industrial sectors has further propelled the growth of solar energy in this segment.

Vietnam Solar Energy Market Competitive Landscape

The Vietnam solar energy market is dominated by a mix of domestic and international players. Leading companies have invested significantly in expanding their solar portfolios, focusing on both utility-scale solar farms and rooftop installations. Key players include Song Giang Solar Power JSC and Sharp Energy Solutions, which have capitalized on government incentives and partnerships with local developers.

|

Company Name |

Establishment Year |

Headquarters |

Key Parameters |

|

Song Giang Solar Power JSC |

2007 |

Vietnam |

- |

|

Sharp Energy Solutions Corporation |

1953 |

Japan |

- |

|

Tata Power Solar Systems Ltd. |

1989 |

India |

- |

|

Berkeley Energy C&I Solutions |

2007 |

Singapore |

- |

|

B.Grimm Power Public Co. Ltd. |

1878 |

Thailand |

- |

Vietnam Solar Energy Market Analysis

Market Growth Drivers

- National Energy Strategy (PDP8): Vietnam's National Power Development Plan 8 (PDP8), approved in 2023, aims to achieve a balanced energy mix, with solar energy playing a pivotal role. According to the Ministry of Industry and Trade (MOIT), PDP8 targets an additional 13 GW of solar power capacity by 2025, focusing heavily on the development of rooftop solar systems and large-scale solar farms. The plan aligns with Vietnams goal to achieve carbon neutrality by 2050 and meet its burgeoning electricity demand, which is expected to exceed 400 TWh by 2025. These initiatives mark a significant push toward renewable energy adoption in the country.

- Increasing Electricity Demand in Urban and Industrial Zones: Vietnams urbanization and rapid industrial growth have led to a sharp increase in electricity consumption, particularly in urban and industrial zones. According to the General Statistics Office of Vietnam, the total electricity consumption in urban areas exceeded 200 TWh in 2023, driven by the expansion of industrial sectors like manufacturing and services. The rise in industrial zones, especially in southern provinces, has heightened the need for reliable energy sources, making solar energy a strategic option for decentralization and energy security.

- Rise in Rooftop Solar Projects: Rooftop solar installations have grown exponentially in Vietnam since 2020, with over 9.3 GW installed by 2023, according to the Electricity Vietnam (EVN). This surge has been propelled by favorable government policies, including incentives for residential and commercial rooftop solar installations. The government's Feed-in-Tariff (FiT) program, alongside initiatives to reduce grid congestion, has significantly boosted rooftop solar capacity. By the end of 2024, the installation base is expected to further grow due to a more streamlined regulatory environment and incentives targeting commercial properties.

Market Challenges

- Grid Infrastructure Limitations: Vietnams rapid expansion of solar energy has exposed significant limitations in its grid infrastructure, which is struggling to accommodate intermittent energy flows from renewable sources. The national grid has experienced multiple bottlenecks, particularly during peak solar production periods. The lack of robust grid infrastructure has led to significant energy losses, affecting the profitability of solar projects. To address this, the government has begun investing in grid modernization projects, but challenges persist in aligning infrastructure development with renewable energy growth, necessitating further reforms and investments in the near future.

- Solar Curtailment and Regulatory Hurdles: Solar curtailment, where excess generated electricity is not utilized due to grid limitations, has become a major issue. According to EVN, curtailment rates for solar power reached nearly 500 GWh in 2023, particularly in provinces like Ninh Thuan and Binh Thuan. Regulatory hurdles, including delays in approving power purchase agreements (PPAs) and inconsistent tariff policies, further exacerbate the challenge. The government's efforts to update regulations have been slow, causing uncertainty for investors in the solar market, delaying the development of new projects.

Vietnam Solar Energy Market Future Outlook

Over the next few years, the Vietnam solar energy market is expected to witness significant growth, driven by continuous government support, advancements in solar technology, and increasing industrial energy demand. The Vietnamese governments commitment to reducing greenhouse gas emissions and achieving its renewable energy targets will further boost investments in both utility-scale and distributed solar energy projects. Innovations in energy storage solutions, alongside the expansion of smart grids, will also enhance the countrys solar power infrastructure.

Market Opportunities:

- Foreign Direct Investment in Solar Projects: Vietnam continues to attract substantial Foreign Direct Investment (FDI) into its renewable energy sector, with FDI inflows totaling USD 15.8 billion in the first half of 2023, according to the Ministry of Planning and Investment (MPI). Solar energy remains a key area for foreign investors due to Vietnams favorable investment policies, such as tax exemptions and land use incentives for renewable projects. Japan, South Korea, and the EU are among the largest foreign investors in Vietnam's solar industry, contributing to the development of large-scale solar farms and innovative energy storage solutions.

- Expanding Solar Manufacturing Capabilities: Vietnam has rapidly expanded its manufacturing capabilities for solar equipment, with exports of solar panels reaching USD 4.9 billion in 2023, as reported by the General Department of Vietnam Customs. The country is now one of the largest exporters of photovoltaic (PV) panels in Southeast Asia. Investments in solar manufacturing plants, particularly in northern provinces, are expected to create over 20,000 jobs by the end of 2024. This expansion not only supports the domestic solar market but also strengthens Vietnam's position in the global supply chain for renewable energy technologies.

Scope of the Report

|

By Technology |

Solar Photovoltaic (PV) Concentrated Solar Power (CSP) |

|

By Solar Module Type |

Monocrystalline Polycrystalline Thin-Film (Amorphous Silicon, Cadmium Telluride) |

|

By Application |

Residential Commercial Industrial |

|

By End-User |

Electricity Generation Heating and Cooling Lighting and Charging Solutions |

|

By Region |

North-East Midwest West Coast Southern States |

Products

Key Target Audience

Solar Energy Investors

Venture Capitalists and Private Equity Firms

Government and Regulatory Bodies (Ministry of Industry and Trade, EVN)

Solar Technology Providers

Utility Companies

Industrial and Commercial Solar Project Developers

Renewable Energy Consultants

Energy Storage Solution Providers

Companies

Players Mention in the Report

Song Giang Solar Power JSC

Sharp Energy Solutions Corporation

Tata Power Solar Systems Ltd.

Berkeley Energy C&I Solutions

B.Grimm Power Public Co. Ltd.

GE Renewable Energy

Siemens Energy

Wuxi Suntech Power Co., Ltd.

Vivaan Solar Private Limited

ACWA Power

Shapoorji Pallonji Infrastructure

Sunseap Group

Nippon Sheet Glass

Ecoprogetti

German ASEAN Power

Table of Contents

01. Vietnam Solar Energy Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Energy Transition and Decarbonization Strategy

1.4. Renewable Energy Integration in Vietnam

02. Vietnam Solar Energy Market Size (In USD Bn)

2.1. Installed Capacity and Electricity Generation (in GW and TWh)

2.2. Growth Drivers and Key Market Developments

2.3. Government Initiatives and Policies (Feed-in-Tariffs, Tax Breaks, and Incentives)

2.4. Supply Chain Analysis

03. Vietnam Solar Energy Market Dynamics

3.1. Growth Drivers

3.1.1. National Energy Strategy (PDP8)

3.1.2. Increasing Electricity Demand in Urban and Industrial Zones

3.1.3. Rise in Rooftop Solar Projects

3.2. Challenges

3.2.1. Grid Infrastructure Limitations

3.2.2. Solar Curtailment and Regulatory Hurdles

3.3. Opportunities

3.3.1. Foreign Direct Investment in Solar Projects

3.3.2. Expanding Solar Manufacturing Capabilities

3.3.3. Innovations in Energy Storage Solutions

3.4. Trends

3.4.1. Adoption of Solar-Plus-Storage Systems

3.4.2. Smart Grid Integration

3.4.3. Floating Solar Plants

04. Vietnam Solar Energy Market Segmentation

4.1. By Technology (In Value %)

4.1.1. Solar Photovoltaic (PV)

4.1.2. Concentrated Solar Power (CSP)

4.2. By Solar Module Type (In Value %)

4.2.1. Monocrystalline

4.2.2. Polycrystalline

4.2.3. Thin-Film (Amorphous Silicon, Cadmium Telluride)

4.3. By Application (In Value %)

4.3.1. Residential

4.3.2. Commercial

4.3.3. Industrial

4.4. By End-Use (In Value %)

4.4.1. Electricity Generation

4.4.2. Heating and Cooling

4.4.3. Lighting and Charging Solutions

4.5. By Region (In Value %)

4.5.1. Northern Vietnam

4.5.2. Central Vietnam

4.5.3. Southern Vietnam

05. Vietnam Solar Energy Market Competitive Landscape

5.1. Detailed Profiles of Major Companies

5.1.1. Song Giang Solar Power JSC

5.1.2. Vietnam Sunergy Joint Stock Company

5.1.3. Sharp Energy Solutions Corporation

5.1.4. Tata Power Solar Systems Ltd.

5.1.5. Berkeley Energy Commercial & Industrial Solutions

5.1.6. Vivaan Solar Private Limited

5.1.7. ACWA Power

5.1.8. Wuxi Suntech Power Co., Ltd

5.1.9. GE Renewable Energy

5.1.10. Siemens Energy

5.1.11. B.Grimm Power Public Co., Ltd.

5.1.12. Shapoorji Pallonji Infrastructure

5.1.13. Sunseap Group

5.1.14. Nippon Sheet Glass

5.1.15. Ecoprogetti

5.2. Cross-Comparison Parameters

- Technology Adoption Rate

- Solar Energy Portfolio Size

- Geographical Presence

- R&D Investments

- Partnership and Joint Ventures

- Government Ties and Subsidy Usage

- Financial Performance

- Environmental, Social, and Governance (ESG) Score

5.3. Market Share Analysis

5.4. Strategic Initiatives and Collaborations

5.5. Mergers and Acquisitions

06. Vietnam Solar Energy Market Regulatory Framework

6.1. National Energy Laws and Policies

6.2. Renewable Energy Targets and Carbon Emission Goals

6.3. Feed-in-Tariffs (FiTs) and Power Purchase Agreements (PPAs)

6.4. Environmental and Safety Standards

6.5. Regional Government Subsidies and Incentives

07. Vietnam Solar Energy Market Future Outlook

7.1. Future Growth Projections (In GW and USD Bn)

7.2. Key Factors Shaping Future Growth

7.3. Innovations and Technological Advancements in Solar Energy

08. Vietnam Solar Energy Market Analysts Recommendations

8.1. TAM/SAM/SOM Analysis

8.2. Investment Opportunities and Risks

8.3. Strategic Expansion Recommendations

Research Methodology

Step 1: Identification of Key Variables

The initial step involved identifying the key variables driving the Vietnam solar energy market, such as government policies, energy demand, and technological advancements. This was achieved through desk research using proprietary databases and industry reports to map the solar energy ecosystem.

Step 2: Market Analysis and Construction

In this phase, historical data on solar energy installations, energy consumption, and industrial demand were compiled and analyzed to project market growth. The analysis focused on both grid-connected and off-grid solar applications, factoring in energy policies and financial incentives.

Step 3: Hypothesis Validation and Expert Consultation

Key industry hypotheses were validated through interviews with energy experts, government representatives, and market players. These consultations provided insights into current market trends and future outlooks, refining the data used in the market model.

Step 4: Research Synthesis and Final Output

The final phase involved synthesizing all gathered data, ensuring the accuracy of market forecasts through engagement with multiple solar energy manufacturers. This allowed for a detailed analysis of solar technology adoption, cost trends, and market penetration across different sectors.

Frequently Asked Questions

01. How big is the Vietnam Solar Energy Market?

The Vietnam solar energy market is valued at USD 18.34 billion, driven by rising energy demand and government-backed renewable energy initiatives.

02. What are the key challenges in the Vietnam Solar Energy Market?

The major challenges include grid infrastructure limitations, solar curtailment, and delays in regulatory approvals for new solar projects, which can hinder the growth potential of large-scale solar farms.

03. Who are the major players in the Vietnam Solar Energy Market?

Key players include Song Giang Solar Power JSC, Sharp Energy Solutions, Tata Power Solar Systems Ltd., Berkeley Energy, and B.Grimm Power Public Co. Ltd., all of which play a significant role in the markets development.

04. What factors are driving the growth of the Vietnam Solar Energy Market?

Growth is primarily driven by increasing industrial energy demand, government incentives, and advancements in solar technology, including lower costs for solar photovoltaic systems.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.