Vietnam Solar Market Outlook to 2030

Region:Asia

Author(s):Shubham Kashyap

Product Code:KROD2867

October 2024

96

About the Report

Vietnam Solar Market Overview

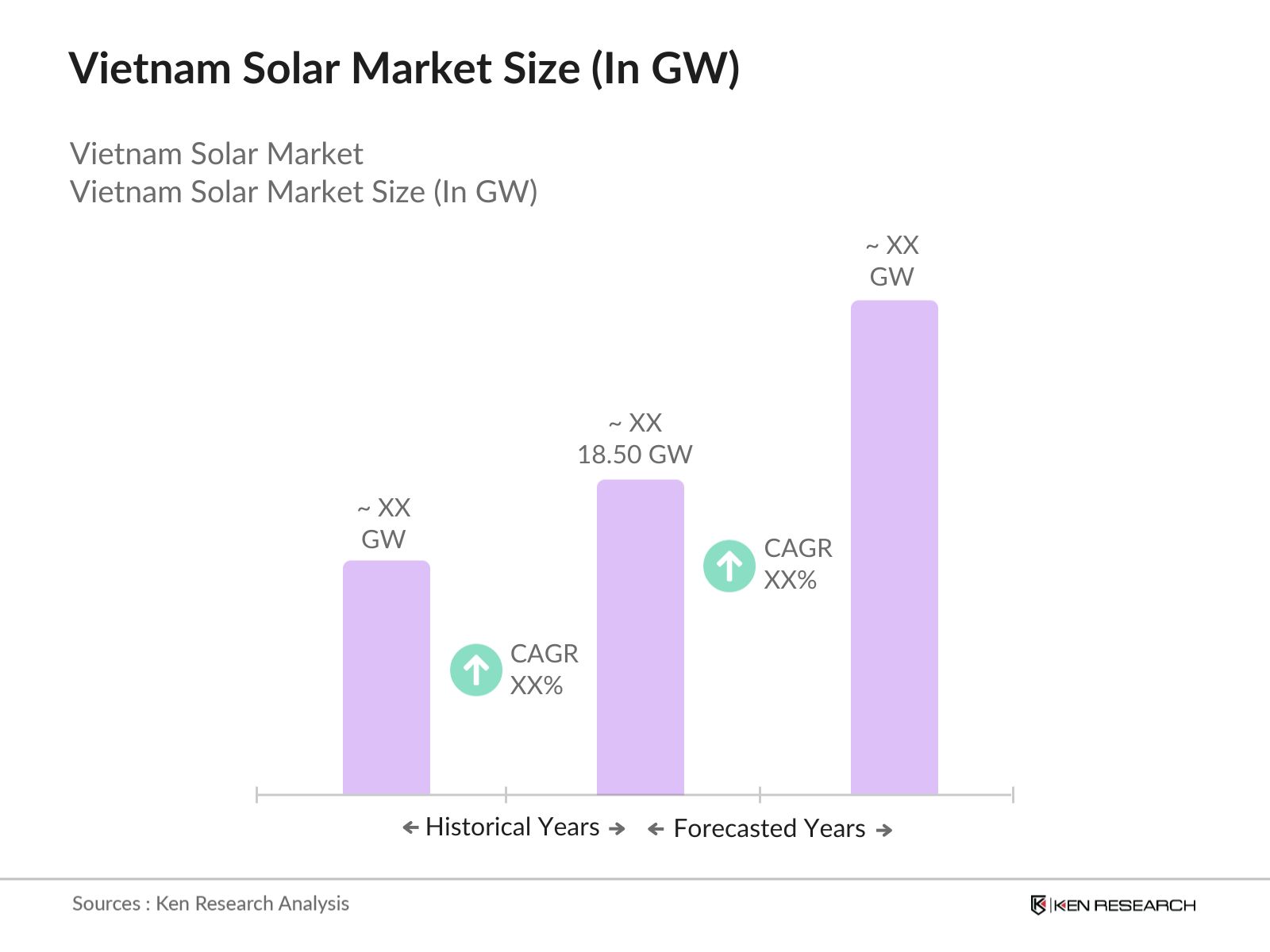

- The Vietnam Solar Market is experiencing robust growth, currently valued at 18.50 gigawatt, based on a five-year historical analysis. This growth is primarily driven by increasing government initiatives to promote renewable energy, favorable policies, and rising awareness about the environmental benefits of solar energy. Vietnam’s rapid economic expansion, along with its ambitious solar capacity targets, has fueled investments in the solar sector, positioning it as one of Southeast Asia’s leading solar energy markets.

- Major metropolitan areas like Ho Chi Minh City, Hanoi, and Da Nang are witnessing significant solar energy installations due to high energy consumption, increasing urbanization, and proactive policies by local governments. Additionally, Vietnam's commitment to reducing its carbon emissions and dependence on coal-fired power plants is pushing the demand for solar energy solutions in both commercial and residential sectors.

- Vietnam's government has introduced tariffs and incentives to encourage solar energy development. In 2023, the government offered attractive feed-in tariffs (FiTs) to solar power projects, which have led to a surge in private sector investments. However, challenges such as grid integration and project financing remain, though ongoing improvements in infrastructure are expected to mitigate these issues.

Vietnam Solar Market Segmentation

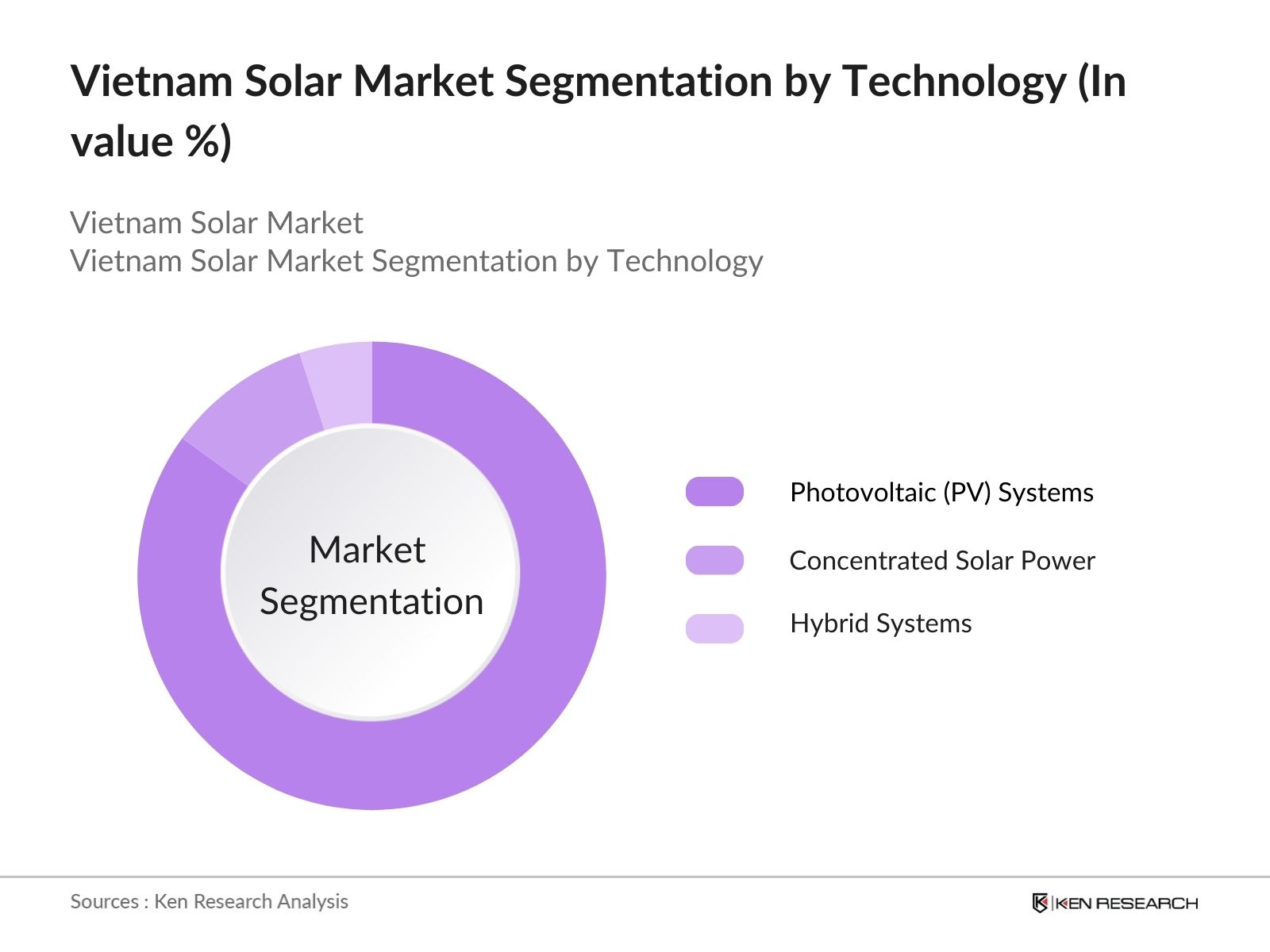

- By Technology: The market is segmented by technology type into photovoltaic (PV) systems, concentrated solar power (CSP), and hybrid systems. Currently, photovoltaic systems dominate the market share, primarily due to their cost-effectiveness and widespread adoption. These systems have become the preferred choice for both utility-scale and rooftop solar installations, as technological advancements in PV cells have led to greater efficiency and lower costs. The country’s policy incentives and relatively short payback period for PV systems have accelerated their growth, making this segment the largest in the market.

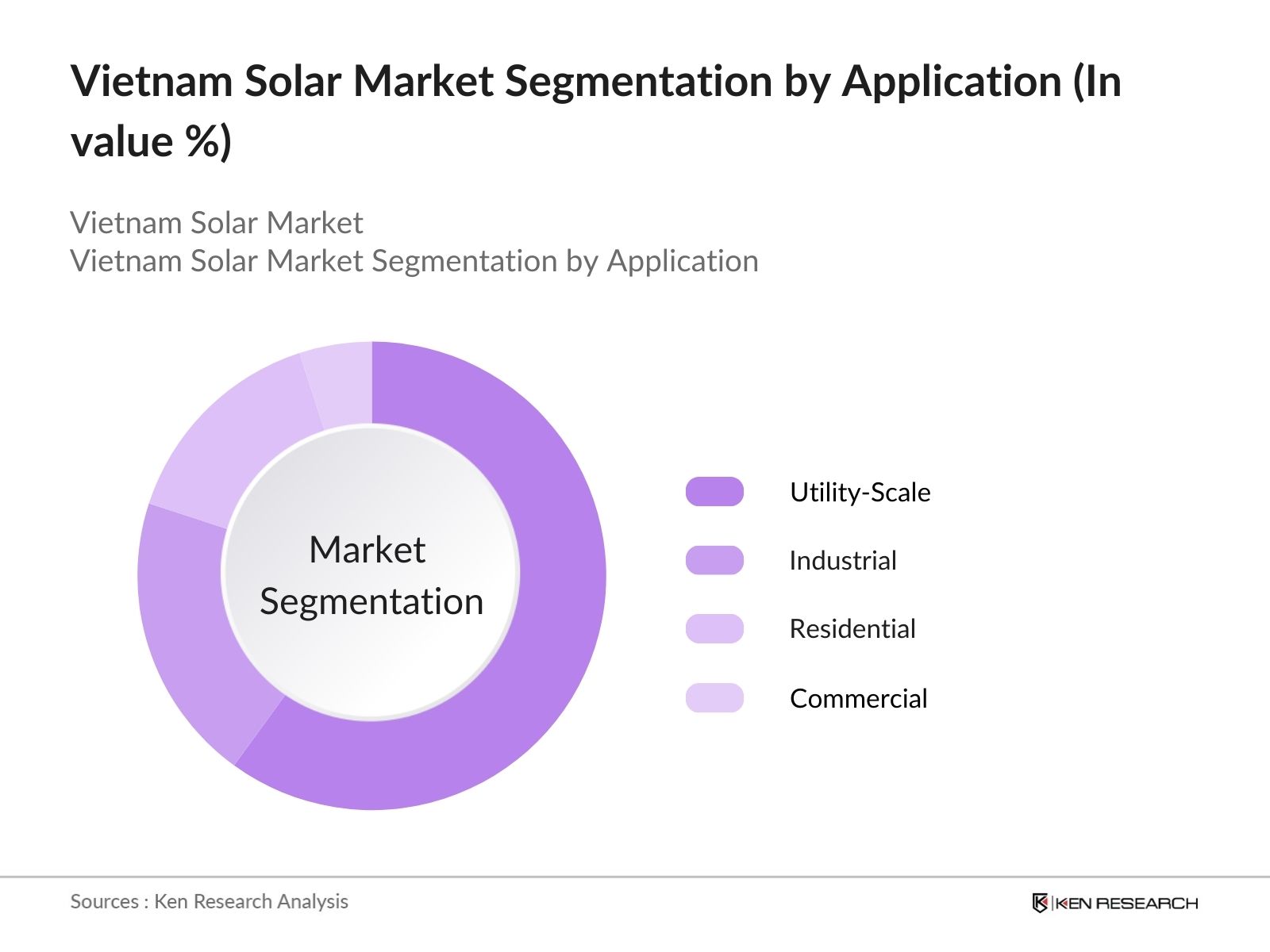

- By Application: The market is also segmented by application into residential, commercial, industrial, and utility-scale installations. Utility-scale projects hold the dominant share of the market, as the government and private investors focus on large-scale solar farms to meet the country’s growing energy demand. These projects are particularly popular in the southern and central regions of Vietnam, where land availability and solar irradiance are optimal for large-scale energy production. Meanwhile, the residential segment is growing rapidly due to declining system costs and increasing consumer interest in reducing electricity expenses.

Vietnam Solar Market Competitive Landscape

The Vietnam Solar Market is highly competitive, with both local and international players focusing on expanding their project portfolios and enhancing technological capabilities. Key international players include First Solar, Trina Solar, and JinkoSolar, which dominate the market with their large-scale solar projects. Local companies such as TTC Group and SolarBK are also prominent in the market, particularly in rooftop installations and smaller-scale projects.

Several companies are investing in research and development to enhance solar efficiency and storage capabilities. Partnerships with local firms and government contracts are common strategies for international players to gain a foothold in the market. Competitive pricing, technological advancements, and after-sales services are key factors for success in this growing market.

|

Company Name |

Establishment Year |

Headquarters |

Key Projects |

Installed Capacity |

Revenue (2023) |

Partnerships |

Product Focus |

Market Segment |

Technology Innovation |

|

First Solar |

1999 |

USA |

- |

- |

- |

- |

- |

- |

- |

|

Trina Solar |

1997 |

China |

- |

- |

- |

- |

- |

- |

- |

|

JinkoSolar |

2006 |

China |

- |

- |

- |

- |

- |

- |

- |

|

SolarBK |

2006 |

Vietnam |

- |

- |

- |

- |

- |

- |

- |

|

TTC Group |

1979 |

Vietnam |

- |

- |

- |

- |

- |

- |

- |

Vietnam Solar Market Analysis

Growth Drivers

- Government Renewable Energy Targets: Vietnam's government has been actively pushing towards renewable energy through the "Vietnam Power Development Plan VIII," aiming to increase solar energy capacity. By 2030, the government targets 18,640 MW of installed solar capacity. The plan also sets a goal for renewables to account for 30.9% of the country's total electricity generation by 2030. Vietnam's National Energy Development Strategy is key to attracting investment, supported by legislation offering favorable terms for renewable projects. This proactive policy support aims to reduce dependency on coal, further accelerating solar market growth.

- Rising Electricity Demand: With Vietnam's rapid industrial growth, electricity consumption per capita reached over 2,400 kWh in 2022. As urbanization continues to drive electricity demand, the Ministry of Industry and Trade projects this to rise above 3,500 kWh by 2025. The Vietnamese economy, growing at 5.05% annually, is significantly energy-intensive, making solar energy a crucial source to meet this expanding electricity demand. Increased consumption is encouraging private and public investments in solar infrastructure to maintain a stable supply of electricity across the country.

- Declining Solar PV Costs: Solar photovoltaic (PV) systems have seen a reduction in cost due to technological advancements and increased production capacity. In Vietnam, the average cost per watt of solar PV systems has declined from USD 0.50 in 2019 to around USD 0.30 in 2023. This drop in costs has been a driving force behind the rapid adoption of solar projects, especially in commercial and industrial sectors. The reduced cost of solar installations encourages businesses to switch to renewable energy sources, creating more investment opportunities in the market.

Market Challenges

- Grid Integration and Capacity Issues: Vietnam's rapid growth in solar energy generation has put significant pressure on its national grid infrastructure. The intermittent nature of solar power, characterized by fluctuating energy output based on sunlight availability, has created challenges in ensuring a stable and reliable energy supply. Grid congestion and transmission bottlenecks have emerged as critical issues, leading to curtailments where excess solar energy cannot be efficiently utilized. To address these concerns, the government is prioritizing efforts to expand and upgrade the grid, aiming to enhance its capacity to better integrate solar energy and maintain overall grid stability.

- Land Acquisition and Regulatory Hurdles: The process of land acquisition for solar projects in Vietnam presents considerable challenges, especially in areas with high population density and agricultural importance. Developers often face prolonged delays due to the complexity of obtaining necessary permits and adhering to environmental regulations. These regulatory hurdles can slow down the pace of project development, as various approvals and assessments are required before construction can begin. Additionally, balancing land use between energy infrastructure and agricultural needs creates further constraints, particularly in rural regions, where concerns about environmental impact can delay or complicate solar farm installations.

Vietnam Solar Market Future Outlook

The Vietnam Solar Market is expected to continue its growth trajectory, with total installed capacity projected to grow remalably. This growth will be driven by increasing investments in utility-scale projects, rising residential solar installations, and continued government support. Technological advancements in energy storage and grid management will also play a pivotal role in addressing existing challenges and unlocking the full potential of solar energy in Vietnam.

Future Market Opportunities

- Technological Advancements: Advancements in solar technology, such as bifacial solar panels and energy storage integration, are set to boost the efficiency of solar systems in Vietnam. Bifacial panels, which can generate energy from both sides, have been found to improve energy output by 10-15% compared to traditional panels. Additionally, energy storage solutions are becoming more viable, with battery costs dropping remarkably since 2021. This technology allows excess solar energy to be stored and used during non-peak sunlight hours, enhancing the overall reliability of solar power generation.

- Solar Energy Export Potential: Vietnam’s growing solar capacity has opened doors for cross-border electricity trading, particularly with neighboring countries like Laos and Cambodia. In 2023, Vietnam exported electricity to these nations, with solar energy accounting for a significant share. With expanding solar projects, the government is exploring more opportunities for regional energy trade. Leveraging Vietnam's strategic position in Southeast Asia, the country aims to become a net exporter of solar energy, contributing to regional energy security.

Scope of the Report

|

By Technology |

Photovoltaic (PV) Systems Concentrated Solar Power (CSP) Hybrid Systems |

|

By Application |

Residential Commercial Industrial Utility-Scale |

|

By Installation |

Ground-Mounted Solar Rooftop Solar Floating Solar |

|

By End-User |

Industrial Sector Commercial Buildings Residential Homes |

|

By Price Range |

Premium Mid-Range Economy |

|

By Region |

Northern Vietnam Central Vietnam Southern Vietnam |

Products

- Solar Energy Investors

- Venture Capital Firms

- Renewable Energy Project Developers

- Government and Regulatory Bodies (Ministry of Industry and Trade, Electricity of Vietnam)

- Solar Equipment Manufacturers

- Energy Storage Solution Providers

- Industrial Energy Consumers

- Commercial Real Estate Developers

- Banks and Financial Institutions

Companies

- First Solar

- Trina Solar

- JinkoSolar

- SolarBK

- TTC Group

- LONGi Solar

- Canadian Solar

- Sharp Corporation

- SunPower Corporation

- Sungrow Power Supply Co.

- VinGroup

- JA Solar

- Sunseap Group

- EDF Renewables

- Siemens AG

Table of Contents

1. Vietnam Solar Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Vietnam Solar Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Vietnam Solar Market Analysis

3.1 Growth Drivers

3.1.1 Government Renewable Energy Targets (Vietnam Energy Development Strategy)

3.1.2 Rising Electricity Demand (Energy Consumption per Capita)

3.1.3 Declining Solar PV Costs (Cost Per Watt)

3.1.4 Foreign Investments in Energy Infrastructure (FDI in Solar Sector)

3.2 Market Challenges

3.2.1 Grid Integration and Capacity Issues (Solar Penetration vs Grid Stability)

3.2.2 Land Acquisition and Regulatory Hurdles (Permitting and Environmental Constraints)

3.2.3 Access to Financing and Capital (Project Financing Structures)

3.2.4 Weather Dependence (Annual Solar Irradiance Variability)

3.3 Opportunities

3.3.1 Technological Advancements (Bifacial Panels, Energy Storage Integration)

3.3.2 Solar Energy Export Potential (Cross-Border Electricity Trading)

3.3.3 Rooftop Solar Adoption (Urban and Industrial Sector)

3.3.4 Green Financing Initiatives (ESG Investments in Renewable Energy)

3.4 Trends

3.4.1 Floating Solar Farms (Water-Based Solar Projects)

3.4.2 Hybrid Power Plants (Solar-Wind and Solar-Hydro Hybrid Systems)

3.4.3 Decentralized Solar Energy Systems (Microgrids and Off-grid Solutions)

3.5 Government Regulation

3.5.1 Feed-in Tariffs (FiTs) for Solar Energy (Current Tariff Structure)

3.5.2 Power Purchase Agreements (PPAs) and Policy Incentives

3.5.3 Renewable Energy Development Master Plan (National Energy Plan)

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem (Developers, EPCs, Government Agencies)

3.8 Porter’s Five Forces

3.9 Competition Ecosystem

4. Vietnam Solar Market Segmentation

4.1 By Technology Type (In Value %)

4.1.1 Photovoltaic (PV) Systems

4.1.2 Concentrated Solar Power (CSP)

4.1.3 Hybrid Systems (Solar + Storage Solutions)

4.2 By Application (In Value %)

4.2.1 Residential

4.2.2 Commercial

4.2.3 Industrial

4.2.4 Utility-Scale

4.3 By Installation Type (In Value %)

4.3.1 Ground-Mounted Solar

4.3.2 Rooftop Solar

4.3.3 Floating Solar

4.4 By Region (In Value %)

4.4.1 Northern Vietnam

4.4.2 Central Vietnam

4.4.3 Southern Vietnam

4.5 By End-User (In Value %)

4.5.1 Industrial Sector

4.5.2 Commercial Buildings

4.5.3 Residential Homes

5. Vietnam Solar Market Competitive Analysis

5.1 Detailed Profiles of Major Competitors

5.1.1 First Solar

5.1.2 Trina Solar

5.1.3 JinkoSolar

5.1.4 Canadian Solar

5.1.5 LONGi Solar

5.1.6 Sungrow Power Supply Co.

5.1.7 SolarBK

5.1.8 TTC Group

5.1.9 Sharp Corporation

5.1.10 JA Solar

5.1.11 VinGroup

5.1.12 Sunseap Group

5.1.13 EDF Renewables

5.1.14 Siemens AG

5.1.15 Hanwha Q Cells

5.2 Cross Comparison Parameters (Revenue, Headquarters, Key Solar Projects, Installed Capacity)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers And Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Private Equity Investments

6. Vietnam Solar Market Regulatory Framework

6.1 Energy Policy and Renewable Energy Laws (EVN Policies)

6.2 Compliance Requirements for Solar Projects

6.3 Certification Processes for Solar Installations

7. Vietnam Solar Market Future Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth (Solar Capacity Targets, National Energy Strategy)

8. Vietnam Solar Market Future Segmentation

8.1 By Technology Type (In Value %)

8.2 By Application (In Value %)

8.3 By Installation Type (In Value %)

8.4 By Region (In Value %)

8.5 By End-User (In Value %)

9. Vietnam Solar Market Analyst’s Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Strategic Partnerships and Joint Ventures

9.3 Market Entry Strategies for New Players

9.4 White Space Opportunity Analysis (Niche Solar Applications)

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping out the major stakeholders within the Vietnam solar market, including government bodies, investors, and manufacturers. We rely on comprehensive desk research and secondary databases to gather pertinent information related to market trends, regulatory frameworks, and the competitive landscape.

Step 2: Market Analysis and Construction

In this phase, we collect and analyze historical data pertaining to solar energy installations and investments in Vietnam. We assess market penetration, the ratio of utility-scale versus residential installations, and overall revenue generation. A detailed evaluation of market trends is conducted to provide a comprehensive understanding of the current landscape.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed through in-depth interviews with industry experts, including project developers, manufacturers, and energy regulators. These consultations provide invaluable insights that help validate our assumptions and refine our analysis. This step ensures that our research is grounded in real-world industry perspectives.

Step 4: Research Synthesis and Final Output

In the final stage, we synthesize the collected data, integrating insights from multiple stakeholders to produce a detailed, validated analysis of the Vietnam solar market. This involves direct engagement with solar manufacturers to understand technological advancements and sales performance, ensuring the accuracy of the final report.

Frequently Asked Questions

01. How big is the Vietnam Solar Market?

The Vietnam solar market is valued at 18.50 gigawatts, driven by government incentives and growing private investments in renewable energy infrastructure.

02. What are the challenges in the Vietnam Solar Market?

Challenges in the Vietnam solar market include grid integration issues, difficulties in securing financing for large-scale projects, and land acquisition hurdles that slow down the development of new solar farms.

03. Who are the major players in the Vietnam Solar Market?

Key players in the Vietnam solar market include First Solar, Trina Solar, JinkoSolar, SolarBK, and TTC Group. These companies dominate due to their strong project portfolios and partnerships with local developers.

04. What are the growth drivers of the Vietnam Solar Market?

Vietnam solar market growth is driven by government policies, such as feed-in tariffs (FiTs), declining costs of solar photovoltaic systems, and the increasing demand for renewable energy across industrial sectors.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.