Vietnam Specialty Fertilizer Market Outlook 2030

Region:Asia

Author(s):Shivani

Product Code:KROD6545

November 2024

97

About the Report

Vietnam Specialty Fertilizer Market Overview

- The Vietnam Specialty Fertilizer Market is valued at approximately USD 3.33 billion based on historical analysis of five years. This market growth is primarily driven by the country's increasing focus on high-efficiency fertilizers, particularly controlled-release and slow-release fertilizers, to combat nutrient deficiencies in crops and improve soil quality.

- The demand for specialty fertilizers is further propelled by government policies aimed at reducing production costs and improving crop yield in key agricultural sectors.The Mekong River Delta and the Red River Delta are the dominant regions in Vietnam's specialty fertilizer market. These regions contribute significantly to rice production, which is a staple crop for Vietnam and a major export. The dominance of these areas is attributed to their fertile soil, expansive irrigation networks, and government support for large-scale cultivation of both rice and other key crops.

- The Vietnamese government has set stringent guidelines on the usage of fertilizers to curb over-application and prevent environmental damage. In 2022, new policies were introduced to reduce the use of chemical fertilizers, encouraging farmers to adopt more efficient specialty fertilizers. Additionally, the government has promoted balanced fertilization programs, which aim to save approximately 4 million tons of chemical fertilizers annually. These efforts are designed to improve the efficiency of fertilizer usage while minimizing the environmental impact on Vietnam's agricultural sector.

Vietnam Specialty Fertilizer Market Segmentation

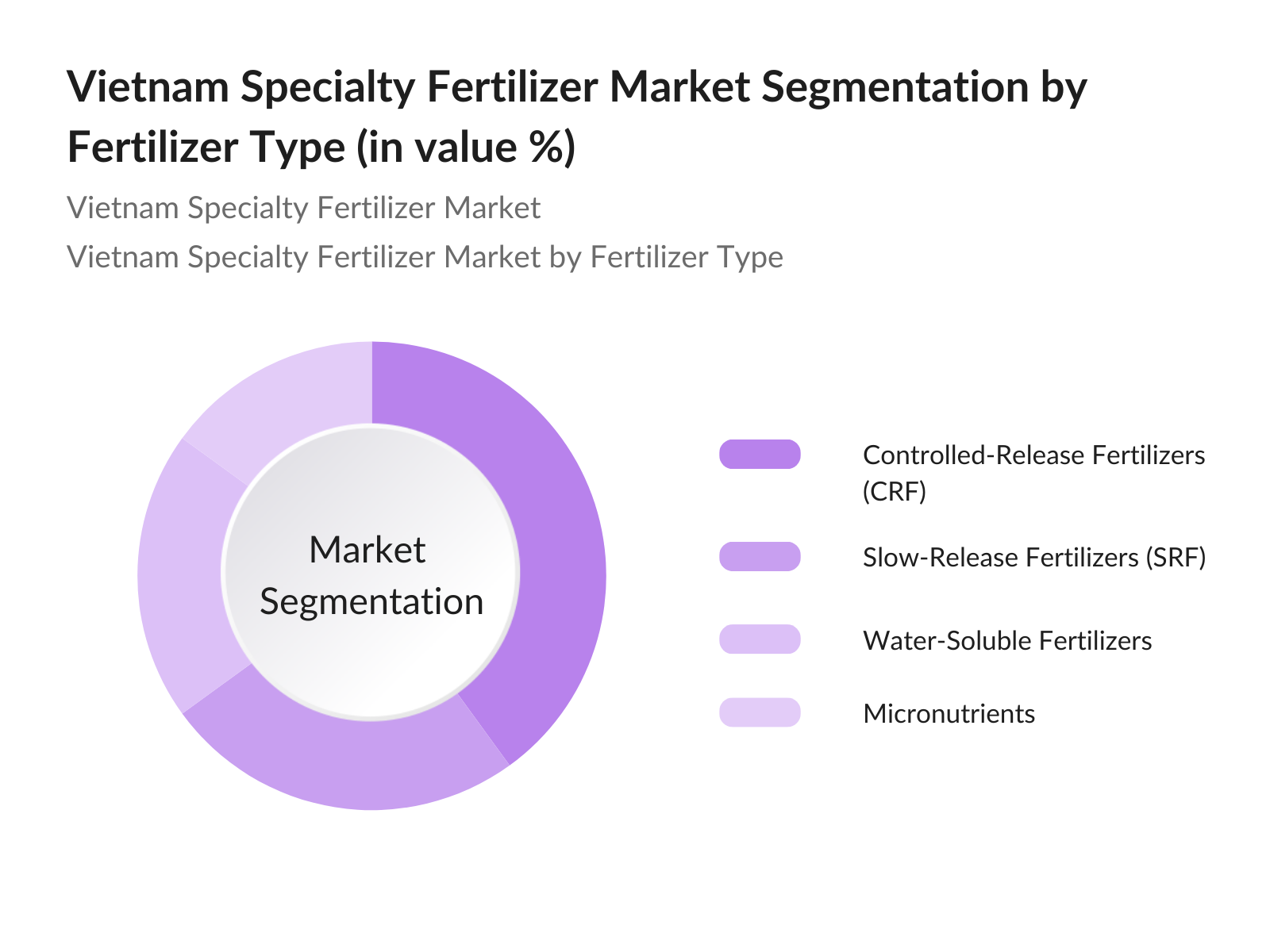

By Fertilizer Type: Vietnams specialty fertilizer market is segmented by fertilizer type into Controlled-Release Fertilizers (CRF), Slow-Release Fertilizers (SRF), Water-Soluble Fertilizers, and Micronutrients. CRF holds the dominant market share due to its role in releasing nutrients at a controlled pace, reducing environmental degradation, and providing economic benefits by optimizing crop growth throughout the season.

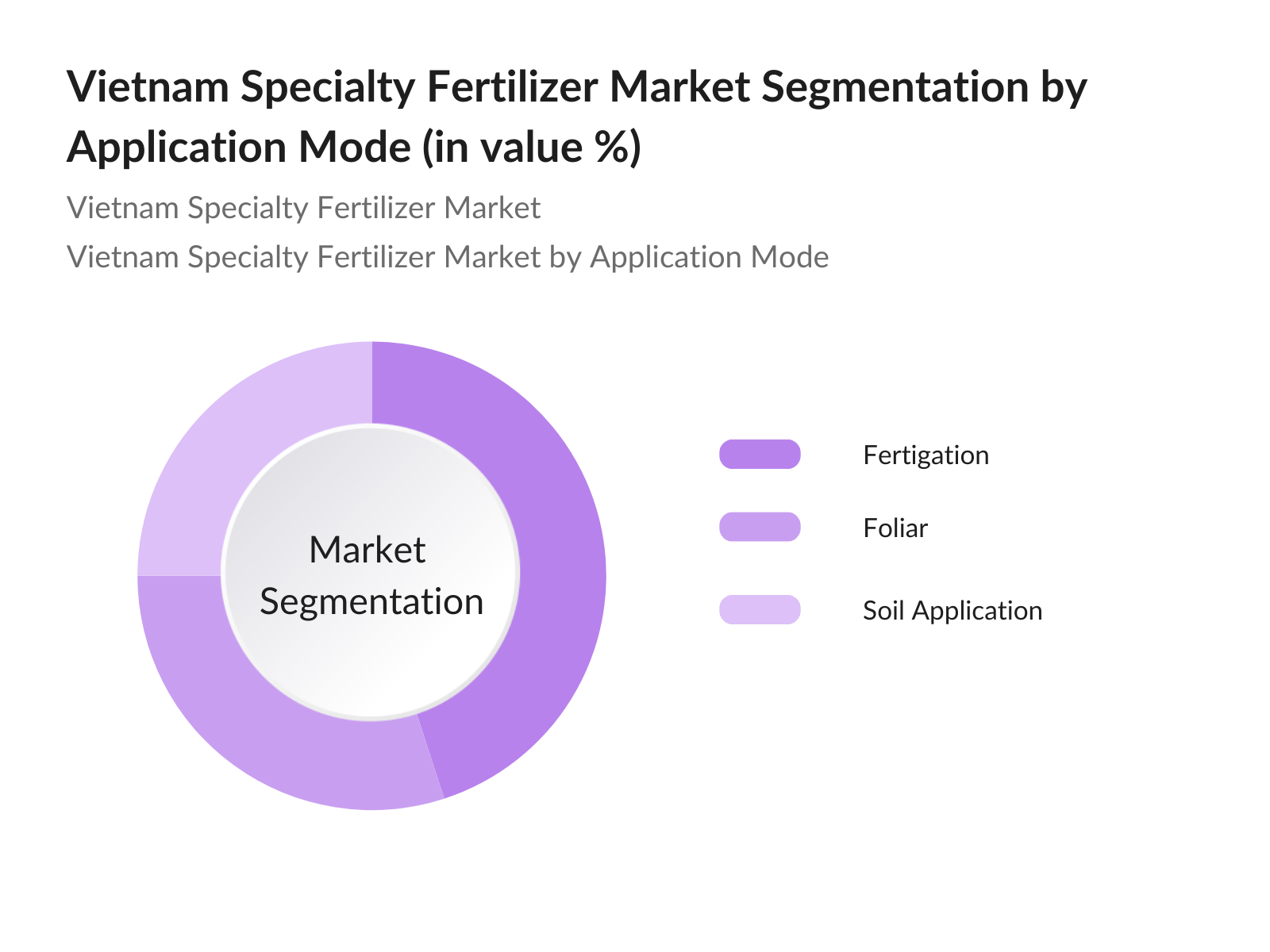

application mode into Fertigation, Foliar, and Soil Application. Fertigation dominates this segment due to its efficiency in delivering nutrients directly to crops through irrigation systems, which conserves water and reduces labor costs.

Vietnam Specialty Fertilizer Market Competitive Landscape

The Vietnam Specialty Fertilizer market is dominated by a few major players. Companies like Yara International ASA, Baconco, and ICL Group Ltd. lead the market due to their strong global presence, technological innovations, and extensive distribution networks

|

Company Name |

Year Established |

Headquarters |

Product Range |

Innovation Focus |

Regional Presence |

Strategic Partnerships |

Certifications (ISO/Local) |

|

Yara International ASA |

1905 |

Norway |

CRF, SRF, Micronutrients |

- |

- |

- |

- |

|

Baconco |

1992 |

Vietnam |

Water-soluble, SRF |

- |

- |

- |

- |

|

ICL Group Ltd. |

1968 |

Israel |

CRF, Liquid Fertilizers |

- |

- |

- |

- |

|

Haifa Group |

1966 |

Israel |

CRF, Micronutrients |

- |

- |

- |

- |

|

Duc Giang Chemicals Group |

1963 |

Vietnam |

Urea, NPK Blends |

- |

- |

- |

- |

Vietnam Specialty Fertilizer Market Analysis

Market Growth Drivers

- Government Support: The Vietnamese government has implemented policies supporting the agricultural sector, which includes incentives for adopting advanced fertilizers. In 2022, the Ministry of Agriculture and Rural Development allocated approximately $320 million to promote the use of controlled-release fertilizers (CRF) and slow-release fertilizers (SRF). This effort aims to improve crop yields and reduce the environmental impact of fertilizer overuse. Additionally, nutrient deficiency solutions are critical, as a significant portion of Vietnam's cultivated land suffers from nutrient deficiencies, driving demand for specialty fertilizers to enhance soil fertility and ensure better productivity across various crops.

- Nutrient Deficiency Solutions: Vietnam's agricultural productivity has been facing challenges due to nutrient-deficient soils. With over 9.3 million hectares of land under cultivation, a large portion faces potassium and phosphorus deficiencies, hindering crop yields. Specialty fertilizers offer a solution by addressing these deficiencies and optimizing nutrient delivery. These fertilizers have demonstrated a significant impact on crop yield, improving rice productivity in experimental fields conducted by the Vietnam Academy of Agricultural Sciences, helping farmers increase output while maintaining soil health.

- Efficiency of CRF/SRF Fertilizers: The efficiency of controlled-release fertilizers (CRF) and slow-release fertilizers (SRF) is a key driver of the Vietnam specialty fertilizer market. CRF and SRF improve nutrient uptake efficiency, significantly reducing nutrient losses through leaching or volatilization. With over 22 million tons of fertilizers used annually, the adoption of CRF and SRF can help cut nutrient losses by approximately 8 million tons, contributing to better resource utilization and increased agricultural productivity across various crop sectors. This transition also supports the country's goals of enhancing sustainable farming practices.

Market Challenges:

- High Production Costs: The cost of producing specialty fertilizers, particularly CRF and SRF, remains significantly higher than conventional fertilizers. For instance, manufacturing these fertilizers can cost up to $120 per ton more than traditional fertilizers. These costs are driven by the need for advanced coating technologies and additional raw materials. With the average income of Vietnamese farmers at around $2,500 annually, the high cost of specialty fertilizers is a considerable barrier to adoption.

- Soil Degradation: Vietnam's agricultural productivity is under pressure due to ongoing soil degradation. Around 6 million hectares of farmland face soil erosion, which severely impacts the ability of crops to absorb nutrients. As of 2022, this degradation has resulted in a loss of up to 2.2 million tons of rice annually. Specialty fertilizers are needed to restore soil health, but their high cost and lack of awareness among farmers hinder widespread adoption.

Vietnam Specialty Fertilizer Market Future Outlook

Over the next few years, the Vietnam Specialty Fertilizer market is expected to witness significant growth. This growth will be driven by the rising adoption of precision agriculture, increased government subsidies for fertilizer usage, and the need to improve crop yield to meet export demands. The development of sustainable agricultural practices, combined with technological advancements in fertilizer products, will further bolster market expansion.

Market Opportunities:

- Sustainable Agriculture: Vietnam is transitioning towards sustainable agricultural practices, driving an increased demand for specialty fertilizers. In 2022, the government launched a $200 million fund to promote sustainable farming, focusing on reducing the use of chemical fertilizers and encouraging more eco-friendly alternatives. This initiative aligns with global sustainability goals and enhances Vietnam's role in promoting sustainable agriculture within the region. By encouraging the adoption of advanced fertilizers, the government is addressing environmental concerns while improving agricultural productivity.

- Integration with Smart Farming: The Vietnamese government is promoting the adoption of smart farming solutions, which include smart irrigation systems that synchronize with fertilizer applications. As of 2023, over 25,000 hectares of land were utilizing smart farming technologies, contributing to better fertilizer use efficiency and reduced environmental impacts. This integration is expected to boost the demand for specialty fertilizers that can be applied precisely through smart systems.

Scope of the Report

|

By Fertilizer Type |

CRF SRF Water-Soluble Micronutrients |

|

By Technology |

Polymer-coated Sulfur-coated Liquid |

|

By Crop Type |

Field Crops Horticultural Crops Turf |

|

By Application Mode |

Fertigation Foliar Soil |

|

By Region |

North-East Midwest West Coast Southern States |

Products

Key Target Audience

Government and Regulatory Bodies (Ministry of Agriculture and Rural Development of Vietnam)

Fertilizer Manufacturers

Agricultural Cooperatives

Export-Import Firms

Investors and Venture Capitalist Firms

Large-Scale Farmers

Agritech Companies

Distribution and Supply Chain Partners

Companies

Major Players

Baconco

Yara International ASA

ICL Group Ltd.

Haifa Negev Technologies Ltd.

Grupa Azoty S.A.

Hebei Sanyuanjiuqi Fertilizer Co., Ltd.

Duc Giang Chemicals Group

Compo Expert GmbH

Hebei Sanyuanjiuqi Fertilizer Co., Ltd.

Yara Vietnam

Hebei Sanyuanjiuqi Fertilizer Co., Ltd.

Fertiberia

The Mosaic Company

Nutrien Ltd.

Koch Industries

Table of Contents

1. Vietnam Specialty Fertilizer Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Vietnam Specialty Fertilizer Market Size (in USD Mn)

2.1. Historical Market Size (By Fertilizer Type, Application Mode)

2.2. Year-On-Year Growth Analysis (Volume and Value)

2.3. Key Market Developments and Milestones (Product Innovations, Policy Changes)

3. Vietnam Specialty Fertilizer Market Analysis

3.1. Growth Drivers (Government Support, Nutrient Deficiency Solutions, Efficiency of CRF/SRF Fertilizers)

3.2. Market Challenges (High Production Costs, Soil Degradation, Regulatory Constraints)

3.3. Opportunities (Demand for Organic Fertilizers, Precision Agriculture, Technological Advancements)

3.4. Trends (Sustainable Agriculture, Rising Adoption of Micro-irrigation, Integration with Smart Farming)

3.5. Government Regulation (Fertilizer Usage Policies, Environmental Regulations)

3.6. SWOT Analysis (Strengths, Weaknesses, Opportunities, Threats)

3.7. Stakeholder Ecosystem (Key Farmers, Distributors, Government Programs)

3.8. Porters Five Forces Analysis (Bargaining Power of Suppliers and Buyers, Threats of New Entrants)

4. Vietnam Specialty Fertilizer Market Segmentation

4.1. By Fertilizer Type (CRF, SRF, Water-Soluble, Micronutrients)

4.2. By Technology (Polymer-coated, Sulfur-coated, Liquid Fertilizers)

4.3. By Crop Type (Field Crops, Horticulture, Turf and Ornamentals)

4.4. By Application Mode (Fertigation, Foliar, Soil Application)

4.5. By Region (Southeast, Mekong River Delta, Red River Delta)

5. Vietnam Specialty Fertilizer Competitive Landscape

5.1 Detailed Profiles of Major Companies

Baconco

Yara International ASA

ICL Group Ltd.

Haifa Group

Grupa Azoty S.A.

Hebei Sanyuanjiuqi Fertilizer Co., Ltd.

Duc Giang Chemicals Group

Compo Expert GmbH

Hebei Sanyuanjiuqi Fertilizer Co., Ltd.

Yara Vietnam

Hebei Sanyuanjiuqi Fertilizer Co., Ltd.

and 5 more competitors

5.2 Cross-Comparison Parameters (Revenue, Headquarters, Product Portfolio, Technology Utilization, Fertilizer Type, Target Crops, Regional Presence, Strategic Initiatives)

5.3 Market Share Analysis (Top 5 Companies by Revenue)

5.4 Strategic Initiatives (Partnerships, Mergers, and Acquisitions)

5.5 Investment Analysis (Key Investments in Specialty Fertilizers)

6. Vietnam Specialty Fertilizer Market Regulatory Framework

6.1. National Fertilizer Regulation Policies

6.2. Environmental Compliance Requirements

6.3. Certification Processes (ISO Standards, Local Certifications)

7. Vietnam Specialty Fertilizer Future Market Size (in USD Mn)

7.1. Future Market Size Projections (By Fertilizer Type, Application Mode)

7.2. Key Factors Driving Future Market Growth (Sustainable Farming, Government Support)

8. Vietnam Specialty Fertilizer Future Market Segmentation

8.1. By Fertilizer Type (CRF, SRF, Liquid Fertilizers)

8.2. By Application Mode (Fertigation, Soil, Foliar)

8.3. By Technology (Coated Fertilizers, Water-Soluble Fertilizers)

8.4. By Region (Southeast, Mekong Delta, Red River Delta)

9. Vietnam Specialty Fertilizer Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Marketing Initiatives (Product Positioning, Farmer Education)

9.3. Customer Cohort Analysis (Target Farmers, Distribution Channels)

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The first step involved identifying key variables affecting the Vietnam Specialty Fertilizer Market. This step was driven by secondary research, drawing data from proprietary databases, agricultural reports, and government sources. The key focus was on understanding the demand and supply dynamics of the specialty fertilizer market.

Step 2: Market Analysis and Construction

In this phase, historical data was compiled, including fertilizer consumption trends and their impact on crop yield in Vietnam. The relationship between fertilizer types and soil health was also analyzed to understand market growth potential.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses regarding the growth of specialty fertilizers were validated through interviews with agronomists and fertilizer manufacturers. These consultations provided insight into the operational challenges and emerging trends in the Vietnamese market.

Step 4: Research Synthesis and Final Output

The final step involved synthesizing the data collected from primary and secondary research, cross-validating findings with industry reports, and preparing a comprehensive analysis of the market, which included recommendations for stakeholders and potential growth areas.

Frequently Asked Questions

01. How big is the Vietnam Specialty Fertilizer Market?

The Vietnam Specialty Fertilizer Market was valued at USD 3.33 billion, driven by the demand for high-efficiency fertilizers like controlled-release and water-soluble variants.

02. What are the challenges in the Vietnam Specialty Fertilizer Market?

Key challenges include high production costs, regulatory barriers, and the need to reduce the environmental impact of fertilizers, which has led to a focus on slow-release and organic fertilizers.

03. Who are the major players in the Vietnam Specialty Fertilizer Market?

The market is led by companies such as Baconco, Yara International ASA, and ICL Group Ltd. These companies dominate due to their technological innovations and extensive distribution networks.

04. What are the growth drivers of the Vietnam Specialty Fertilizer Market?

The market is driven by government initiatives aimed at reducing production costs, enhancing crop yield, and promoting sustainable agricultural practices.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.