Vietnam Streaming Video Market Outlook to 2030

Region:Asia

Author(s):Shambhavi Awasthi

Product Code:KROD6408

December 2024

99

About the Report

Vietnam Streaming Video Market Overview

- The Vietnam Streaming Video Market, valued at USD 1 billion, is driven by an increase in internet penetration, a shift in consumer preferences towards online content, and the widespread adoption of mobile devices. These factors have provided significant momentum, as internet accessibility and an expanding selection of localized content have spurred demand. Additionally, the growing number of subscription video services offers consumers an array of affordable content options, fueling further market expansion.

- The market is heavily dominated by cities like Ho Chi Minh City and Hanoi, as these areas experience high levels of urbanization, disposable income, and digital literacy. Ho Chi Minh City has seen substantial growth due to its tech-savvy population, while Hanoi benefits from governmental and corporate investment in digital infrastructure. This concentration of tech infrastructure and consumer engagement positions these cities as key hubs for streaming services in Vietnam.

- The Vietnamese government maintains content policies that regulate the type of digital media permissible on streaming platforms. In 2024, compliance requirements led to the removal of 18% of internationally popular titles deemed sensitive or culturally inappropriate. These policies ensure that streaming content aligns with local cultural standards, which shapes the content libraries offered by global and local.

Vietnam Streaming Video Market Segmentation

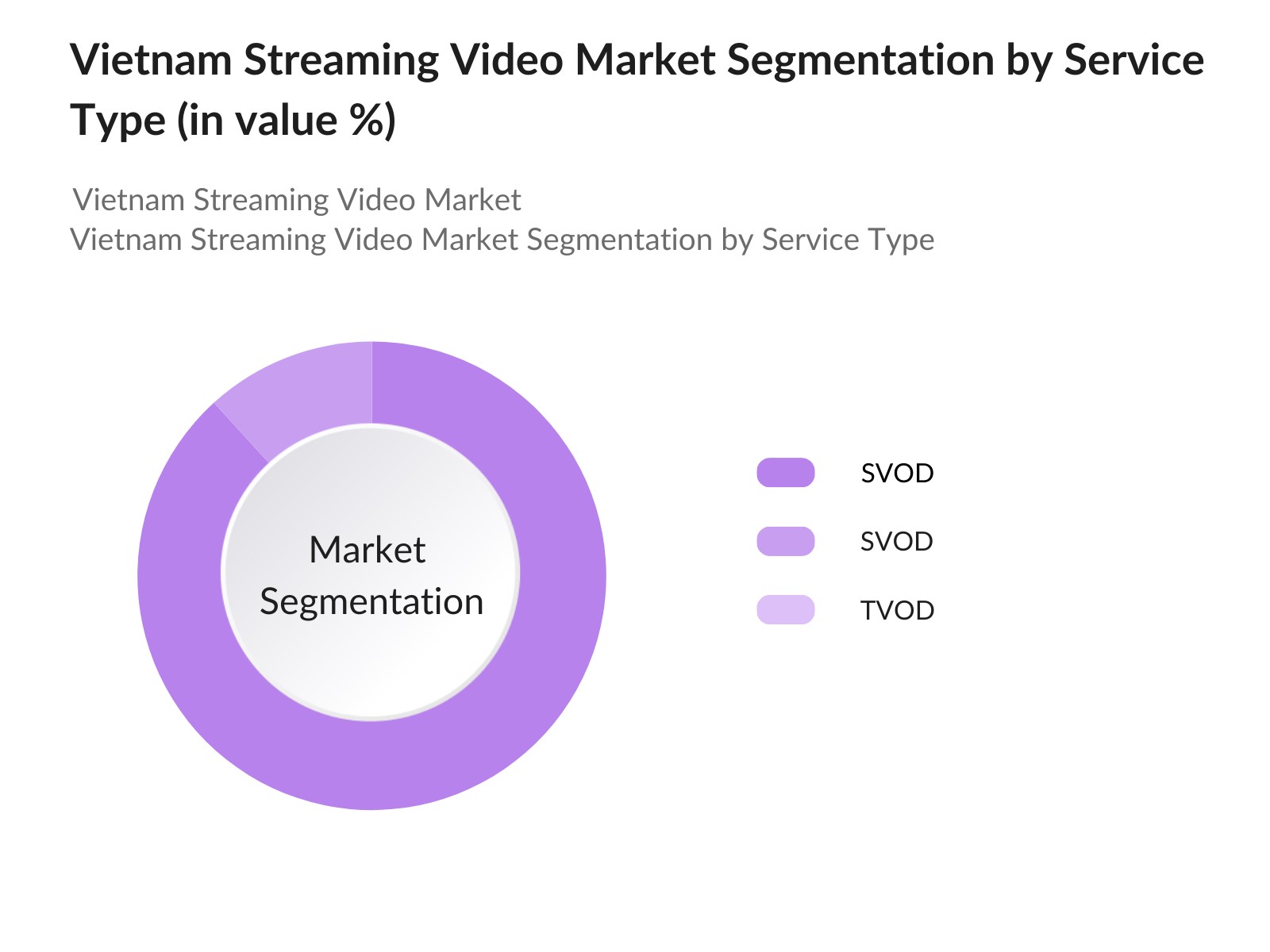

- By Service Type: The Vietnam Streaming Video market is segmented by service type into Subscription Video on Demand (SVOD), Advertising Video on Demand (AVOD), and Transactional Video on Demand (TVOD). Currently, SVOD has a dominant market share within the service type segmentation due to consumer demand for ad-free viewing experiences and exclusive content access. Providers like Netflix and FPT Play capitalize on this preference by offering competitive pricing, high-quality streaming, and a vast library of popular titles.

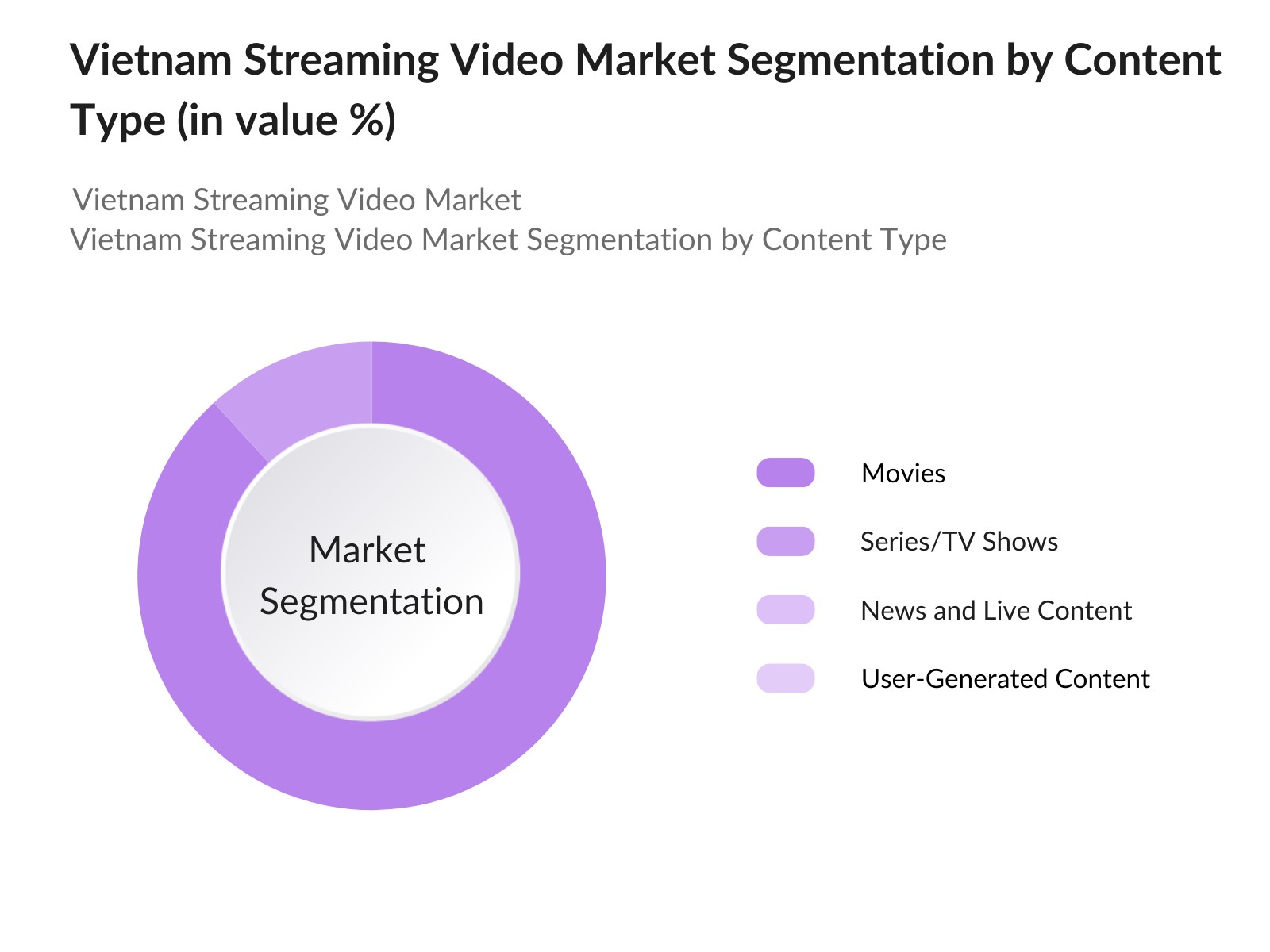

- By Content Type: The Vietnam Streaming Video market is segmented by content type into Movies, Series/TV Shows, News and Live Content, and User-Generated Content. Within this segmentation, Movies dominate due to Vietnamese viewers' strong preference for cinematic content and the availability of regional and international film titles. Services like Pops Worldwide and iQIYI attract users with an expansive movie selection, providing both localized and global films, which bolsters their position in the market.

Vietnam Streaming Video Market Competitive Landscape

The Vietnam Streaming Video Market is dominated by both international and local players. Companies such as Netflix, Disney+, and FPT Play maintain strong positions due to extensive content libraries, diverse revenue models, and innovative marketing strategies. This market structure indicates a competitive environment, where companies leverage their global experience and content partnerships to attract and retain a diverse audience.

Vietnam Streaming Video Market Analysis

Growth Drivers

- Increased Mobile Device Usage: Mobile device usage in Vietnam has surged, with over 90 million active mobile connections as of 2024, up from 85 million in 2023, as reported by the General Statistics Office of Vietnam. This rapid increase in mobile adoption is fueled by the affordability of smartphones and growing mobile internet access, especially in remote and underserved areas. The Vietnamese smartphone penetration rate has surpassed 70%, indicating a significant consumer base for mobile streaming content. Platforms like YouTube and FPT Play report that over 65% of their viewers use mobile devices to stream content, showcasing the central role of mobile usage in driving streaming adoption.

- Shift in Consumer Entertainment Preferences: Vietnamese consumers are increasingly shifting from traditional television to streaming video, with nearly 68% of urban households preferring on-demand digital content in 2024, according to Vietnams General Statistics Office. This shift is driven by a desire for flexibility, ad-free viewing experiences, and exclusive, high-quality content that streaming platforms offer. Young adults, particularly those aged 18 to 34, make up 55% of this consumer segment, illustrating a strong preference among younger generations for personalized digital content. The growing access to affordable, fast internet has reinforced this shift, making streaming services an integral part of everyday entertainment.

- Availability of Local and Global Content: The availability of both local and international content on streaming platforms has been a primary attraction for Vietnamese audiences. Platforms like Netflix and local providers like VieON offer Vietnamese-language options and localized content that resonate well with cultural preferences. In 2024, approximately 43% of Vietnamese consumers preferred local shows and movies, while others showed interest in global content like Korean dramas and U.S.-based series. The governments encouragement of local content production, coupled with partnerships between streaming platforms and Vietnamese studios, has helped expand this catalog.

Market Challenges

- Piracy and Intellectual Property Issues: Piracy remains a significant challenge in the Vietnamese streaming video market, with up to 55% of online consumers admitting to using unauthorized platforms as of 2024, according to the Ministry of Information and Communications.This high rate of piracy reduces subscription revenues for legitimate streaming services, adversely impacting the market's revenue potential. The Vietnamese government has implemented anti-piracy measures, but enforcement remains difficult. Streaming providers are investing in anti-piracy technology and collaborating with authorities to combat these infringements, but the problem persists as a formidable challenge to market growth

- Regulatory Restrictions on Content: Vietnam enforces strict regulatory controls on digital content, which can restrict the types of shows and movies available on streaming platforms. Content censorship policies require that platforms remove or edit content that contradicts local cultural and political values. In 2024, approximately 18% of the top-rated international content faced restrictions in Vietnam, which led to reduced viewing options for consumers. Streaming providers must comply with these regulations, balancing content offerings that adhere to guidelines while still catering to consumer demand.

Vietnam Streaming Video Market Future Outlook

The Vietnam Streaming Video Market is anticipated to experience steady growth in the coming years due to a rise in mobile internet usage, advancements in 5G connectivity, and increasing digital content consumption. Localized content, along with ad-supported models tailored to price-sensitive consumers, will likely play a critical role in expanding the markets reach. Additionally, strategic partnerships between global streaming services and Vietnamese production houses are expected to further enrich the content landscape and drive growth.

Market Opportunities

- Expansion in Rural Markets: With Vietnams urban streaming market reaching saturation, rural markets present a significant opportunity for expansion. The governments National Digital Transformation Program aims to bring internet access to over 90% of rural households by 2025. In 2024, nearly 30 million people in rural areas had intermittent internet access, up from 25 million in 2022. Streaming companies can capitalize on this growing connectivity by offering localized content that appeals to rural consumers and partnering with telecom providers to bundle data and streaming subscriptions

- Potential for Original Vietnamese Content Production: Original content production focused on Vietnamese culture, history, and contemporary issues is an untapped area with significant growth potential. Vietnamese studios produced over 120 original shows and films in 2024, primarily for local audiences. Streaming platforms have taken note, with companies like VieON and Pops Worldwide increasingly investing in exclusive, locally produced content. This opportunity allows platforms to cater to unique local tastes, strengthening consumer loyalty and attracting new subscribers who seek culturally relevant content.

Scope of the Report

|

Segments |

Sub-Segments |

|

Type |

Subscription Video on Demand (SVOD) |

|

Content Type |

Movies |

|

Platform Type |

Mobile |

|

Age Group |

18-24 |

|

Region |

Ho Chi Minh City |

Products

Key Target Audience for the Vietnam Streaming Video Market

Streaming Service Providers

Telecommunication Companies

Content Producers and Distributors

Advertising Agencies and Marketers

Investor and Venture Capitalist Firms

Government and Regulatory Bodies (Ministry of Information and Communications, Vietnam)

Digital Payment and E-Wallet Providers

End Consumers (Urban and Rural Audiences)

Companies

Players mentioned in the report

Netflix

Disney+

Amazon Prime Video

YouTube

iQIYI

VTV Go

VieON

Zing TV

FPT Play

Pops Worldwide

WeTV

MyTV

TrueID

Apple TV+

HBO Go

Table of Contents

1. Vietnam Streaming Video Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Vietnam Streaming Video Market Size (In USD Billion)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Vietnam Streaming Video Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Internet Penetration

3.1.2. Rising Smartphone Adoption

3.1.3. Expansion of 4G and 5G Networks

3.1.4. Shift in Consumer Viewing Habits

3.2. Market Challenges

3.2.1. Content Piracy Issues

3.2.2. Regulatory Constraints

3.2.3. High Competition Among Providers

3.3. Opportunities

3.3.1. Localization of Content

3.3.2. Partnerships with Telecom Operators

3.3.3. Technological Advancements in Streaming

3.4. Trends

3.4.1. Growth of Subscription Video on Demand (SVoD)

3.4.2. Emergence of Local Streaming Platforms

3.4.3. Integration of Artificial Intelligence for Personalized Content

3.5. Government Regulation

3.5.1. Content Censorship Policies

3.5.2. Licensing Requirements for Streaming Services

3.5.3. Data Localization Laws

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Landscape

4. Vietnam Streaming Video Market Segmentation

4.1. By Service Type (In Value %)

4.1.1. Subscription Video on Demand (SVoD)

4.1.2. Advertising-based Video on Demand (AVoD)

4.1.3. Transactional Video on Demand (TVoD)

4.1.4. Live Streaming

4.2. By Content Type (In Value %)

4.2.1. Movies

4.2.2. TV Shows

4.2.3. Sports

4.2.4. News

4.2.5. User-Generated Content

4.3. By Platform (In Value %)

4.3.1. Smartphones

4.3.2. Smart TVs

4.3.3. Tablets

4.3.4. PCs/Laptops

4.4. By Revenue Model (In Value %)

4.4.1. Subscription-Based

4.4.2. Advertisement-Based

4.4.3. Pay-Per-View

4.4.4. Hybrid Models

4.5. By Region (In Value %)

4.5.1. Northern Vietnam

4.5.2. Central Vietnam

4.5.3. Southern Vietnam

5. Vietnam Streaming Video Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. FPT Play

5.1.2. Netflix

5.1.3. YouTube

5.1.4. iFlix

5.1.5. VTVcab ON

5.1.6. K+

5.1.7. Zing TV

5.1.8. VieON

5.1.9. Galaxy Play

5.1.10. Danet

5.1.11. Clip TV

5.1.12. HBO Go

5.1.13. WeTV

5.1.14. iQIYI

5.1.15. SCTV

5.2. Cross Comparison Parameters (Number of Subscribers, Content Library Size, Monthly Active Users, Revenue, Market Share, Subscription Plans, Localization Efforts, Partnerships)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.6.1. Venture Capital Funding

5.6.2. Government Grants

5.6.3. Private Equity Investments

6. Vietnam Streaming Video Market Regulatory Framework

6.1. Content Licensing Regulations

6.2. Compliance Requirements

6.3. Certification Processes

7. Vietnam Streaming Video Future Market Size (In USD Billion)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Vietnam Streaming Video Future Market Segmentation

8.1. By Service Type (In Value %)

8.2. By Content Type (In Value %)

8.3. By Platform (In Value %)

8.4. By Revenue Model (In Value %)

8.5. By Region (In Value %)

9. Vietnam Streaming Video Market Analysts Recommendations

9.1. Total Addressable Market (TAM), Serviceable Available Market (SAM), Serviceable Obtainable Market (SOM) Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

An ecosystem map was constructed encompassing all major stakeholders within the Vietnam Streaming Video Market. Extensive desk research was conducted utilizing both secondary and proprietary databases to gather relevant industry data. This allowed for the identification of critical variables influencing market dynamics.

Step 2: Market Analysis and Construction

Historical data was compiled and analyzed, focusing on streaming service penetration, market reach, and revenue generation across various regions. This analysis also included service quality assessments to ensure reliability in revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were developed and validated through expert interviews with industry professionals from streaming services and content production companies. These insights provided operational and financial data essential to refining and corroborating the gathered market information.

Step 4: Research Synthesis and Final Output

Direct engagement with streaming companies was undertaken to obtain detailed insights into content segmentation, user preferences, and platform performance. This step served to verify and complement data from previous analyses, resulting in a comprehensive and validated report on the Vietnam Streaming Video Market.

Frequently Asked Questions

01. How big is the Vietnam Streaming Video Market?

The Vietnam Streaming Video Market, valued at USD 1 billion, has seen rapid growth driven by internet penetration, expanding mobile use, and local content availability.

02. What are the challenges in the Vietnam Streaming Video Market?

Challenges Vietnam Streaming Video Market include regulatory restrictions on content, high data costs, and the threat of piracy, all of which affect the market's stability and profitability.

03. Who are the major players in the Vietnam Streaming Video Market?

Key players in Vietnam Streaming Video Market include Netflix, FPT Play, Disney+, YouTube, and Pops Worldwide, known for their content variety, subscription models, and market reach.

04. What are the growth drivers of the Vietnam Streaming Video Market?

Key growth drivers in Vietnam Streaming Video market include rising internet penetration, mobile usage, and increasing consumer preference for on-demand digital content, which enhance the market's expansion.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.