Vietnam Supermarket Industry Outlook to 2030

Region:Asia

Author(s):Sanjna Verma

Product Code:KROD895

July 2024

100

About the Report

Vietnam Supermarket Industry Overview

- Vietnam Supermarket Industry has experienced notable growth, this is reflected by Global supermarket industry reaching a valuation of USD 950 billion in 2023. This growth is primarily driven by increasing urbanization, rising disposable incomes, and a growing middle class..

- Vietnam Supermarket Market is characterized by the presence of both local and international players. Key players include WinMart (Masan Group), Co.opmart (Saigon Co.op), Lotte Mart (Lotte Group), Big C (Central Group) and AEON. These players are continuously expanding their presence and innovating their offerings to attract more customers and increase their market share.

- Masan Group has been expanding the WinMart/WinMart+ retail network, with the number of stores increasing from 3,020 in December 2019 to more than 3,600 as of early 2023.

Vietnam Supermarket Current Market Analysis

- Vietnam's rapid urbanization and expanding middle class are major growth drivers. By 2022, 37.4 million of the population lived in urban areas, up from 35 million in 2018, fueling demand for modern retail outlets.

- The supermarket market has a significant impact on the Vietnamese economy. It has created numerous employment opportunities, enhanced supply chain efficiencies, and contributed to GDP growth. The market has also encouraged the development of related sectors, such as logistics, packaging, and food processing.

- Ho Chi Minh City is the leading region in the Vietnamese supermarket market, accounting for a substantial share in 2023. The city's large urban population, high income levels, and advanced infrastructure make it a prime location for supermarket chains. Hanoi follows closely, driven by similar factors.

Vietnam Supermarket Industry Segmentation

The Vietnam Supermarket Industry can be segmented based on several factors:

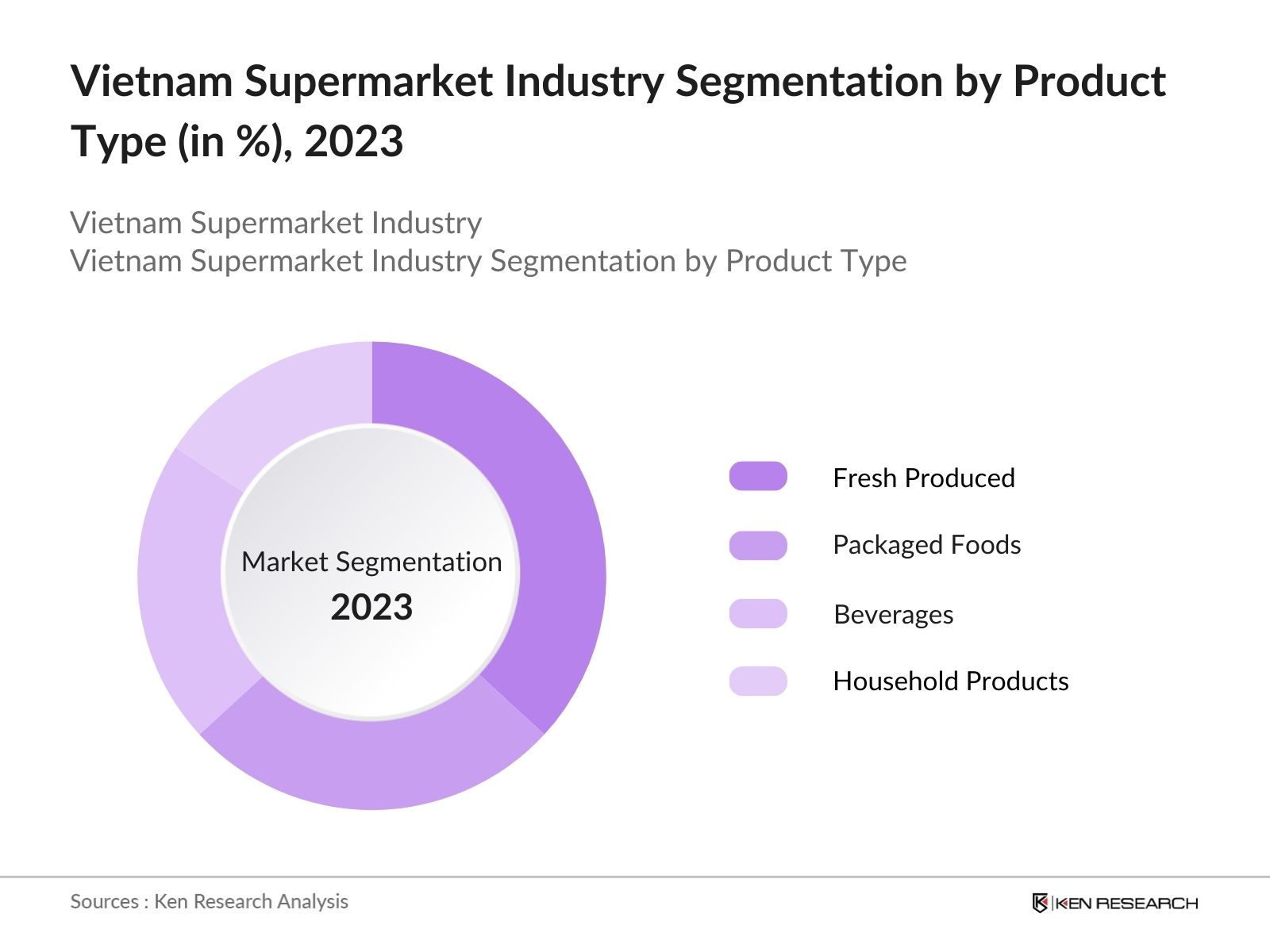

By Product Type: In 2023, the Vietnam Supermarket Industry Segmentation by Product Type is segmented into Fresh Produced, Packaged Foods, Beverages & Household Products. In 2023, Fresh Produce reign as the most dominant sub-segment, holding a substantial market share. Fresh Produce leads due to high consumer demand for quality and freshness.

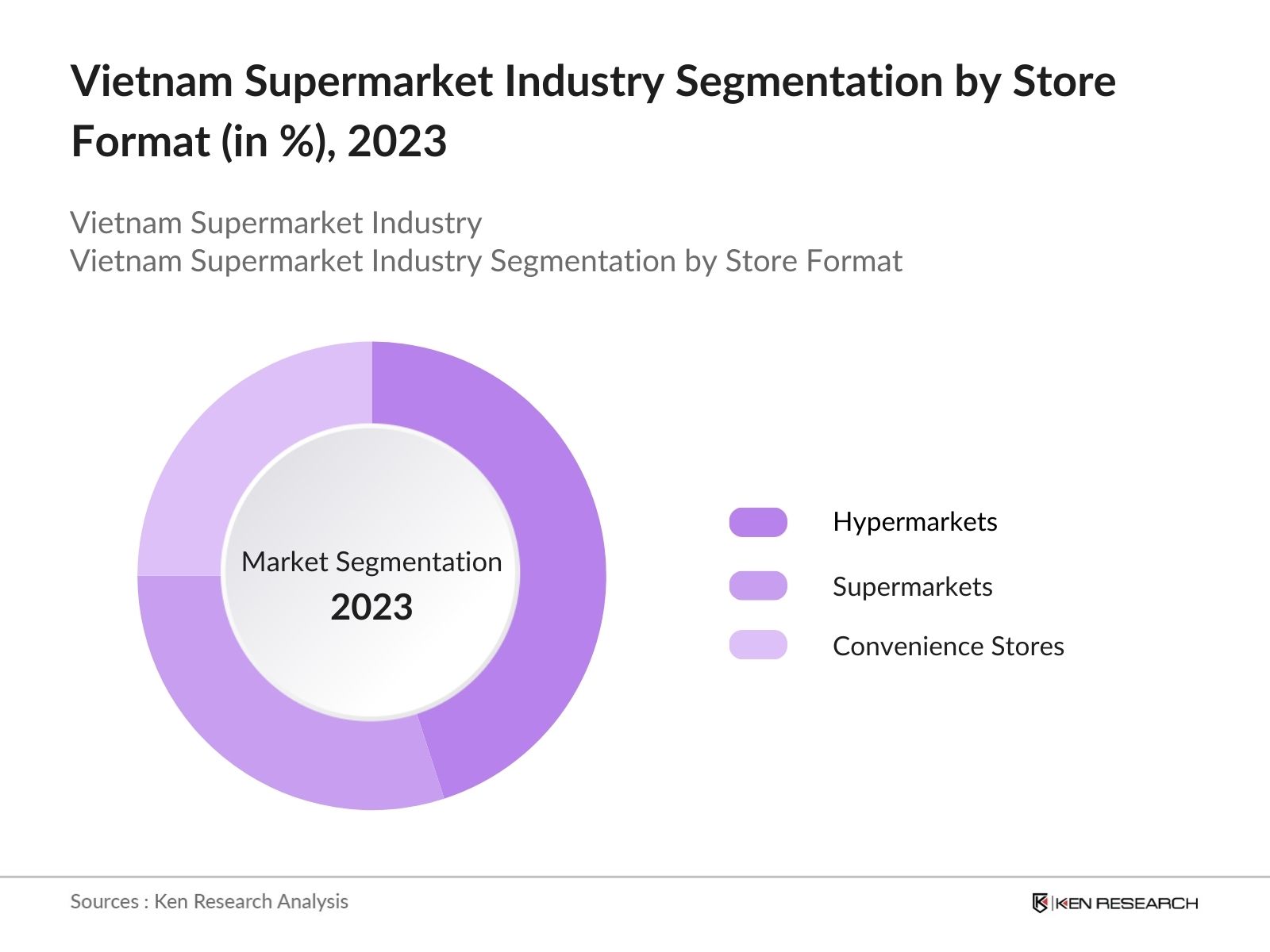

By Store Format: In 2023, the Vietnam Supermarket Industry Segmentation by Store Format is segmented into Hypermarkets, Supermarkets & Convenience Stores. The hypermarkets emerged as the most dominant sub-segment, commanding a significant percentage of the market share. Hypermarkets dominate due to their extensive product ranges and competitive pricing.

By Distribution Channel: In 2023, Vietnam Supermarket Industry is segmented by Distribution Channels into Online & Offline Distribution Channels. In 2023, the offline segment prevails due to concerns regarding product quality and authenticity. A significant portion of Vietnamese consumers prioritize inspecting merchandise before purchase. This is particularly true for fresh produce, where quality assessment is crucial.

Vietnam Supermarket Industry Competitive Landscape

|

Player |

Establishment Year |

Headquarters |

|

VinMart |

2014 |

Hanoi |

|

Co.opmart |

1996 |

Ho Chi Minh City |

|

Lotte Mart |

2008 |

Ho Chi Minh City |

|

Big C |

1998 |

Ho Chi Minh City |

|

AEON |

2011 |

Ho Chi Minh City |

- VinMart: By the end of 2022, WinCommerce (the new name for the retail chain) had 3,268 WinMart+ mini-supermarkets, an increase of 730 new stores compared to the previous year. VinMart has shaped the market by introducing modern retail practices and expanding its reach with over 2,500 stores across the country.

- Lotte Mart: Lotte Mart launched an online shopping platform Lotte On in 2021, capturing the growing e-commerce market. Lotte Mart is leveraging its existing stores to boost e-commerce, instead of building new warehouses like other players. Lotte On has expanded Lotte Mart's reach and convenience.

- AEON: In 2023, AEON has deployed self-service kiosks from Telpo, a China-based self-service kiosk manufacturer. These feature a 21.5-inch touchscreen and accept various payment methods including facial recognition, QR code, and external EFT-POS. This technological advancement aligns with global retail trends and improves customer satisfaction.

Vietnam Supermarket Industry Analysis

Vietnam Supermarket Industry Growth Drivers:

- Rising Disposable Income: The steady increase in disposable incomes among Vietnamese households has fueled consumer spending power, which directly impacts supermarket sales. In 2023, the per capita disposable income of Vietnam was at $3070. Higher disposable income also leads to increased expenditure on groceries and household items, which are primary offerings of supermarkets.

- Improvement in Supply Chain and Logistics Enhancements in supply chain and logistics infrastructure have played a crucial role in supporting the growth of the supermarket market in Vietnam. In 2023, the overall GDP of Vietnam was at $429.7 billion with logistics contributing 4.5% of overall GDP. These improvements have facilitated better inventory management and reduced operational costs for supermarkets.

- Strategic Location and Store Formats: Development of smaller-format stores, such as convenience stores and mini-supermarkets, in high-density urban areas has made it easier for consumers to access supermarket products. Additionally, larger supermarkets and hypermarkets located in shopping malls and residential complexes attract family shoppers and offer a comprehensive shopping experience.

Vietnam Supermarket Industry Challenges:

- Competition from Traditional Markets: Despite the growth of supermarkets, traditional wet markets continue to hold a strong presence, especially in rural areas. These markets offer fresh produce at lower prices, making them a tough competitor for supermarkets. The deep-rooted shopping habits and cultural preferences for traditional markets pose a significant challenge to the expansion of supermarkets.

- High Operating Costs: Operating costs for supermarkets in Vietnam are relatively high due to expenses related to real estate, logistics, and labor. Additionally, the cost of maintaining a cold supply chain for fresh produce and perishables is substantial. These high operating costs can affect profitability and hinder expansion plans for supermarket chains.

- Supply Chain Inefficiencies: Supply chain inefficiencies, particularly in the distribution of fresh produce, pose a significant challenge for supermarkets in Vietnam. The lack of a robust cold chain infrastructure leads to frequent spoilage and stock shortages. These inefficiencies not only increase operational costs but also affect the quality and availability of products, impacting customer satisfaction.

Vietnam Supermarket Industry Government Initiatives

- Retail Market Development Plan (2020): The Vietnamese government launched the Retail Market Development Plan in 2020 to modernize the retail sector and promote the growth of supermarkets. This plan includes measures to improve infrastructure, streamline regulations, and attract foreign investment.

- National E-Commerce Development Program (2021): The National E-Commerce Development Program, initiated in 2021, aims to boost the adoption of e-commerce in the retail sector. The program provides incentives for supermarkets to develop online platforms and integrate digital technologies.

- Environmental Protection Policy (2023): In 2023, the government introduced the Environmental Protection Policy to promote sustainable practices in the retail sector. This policy mandates supermarkets to reduce plastic usage, implement recycling programs, and adopt eco-friendly packaging.

Vietnam Supermarket Future Market Outlook

The Vietnam supermarket industry is expected to continue its impressive growth, driven by urbanization, rising incomes, and evolving consumer preferences.

Future Trends

- E-commerce Integration: The integration of e-commerce with traditional retail will be a significant trend in the Vietnamese supermarket market. The convenience of online shopping, coupled with home delivery services, is expected to attract a growing number of consumers to supermarket e-commerce platforms.

- Sustainability Initiatives: Sustainability will become a major focus for supermarkets in Vietnam. In 2023, several major supermarket chains, including AEON and Lotte Mart, introduced eco-friendly packaging and reduced plastic. These initiatives are in response to growing consumer awareness about environmental issues and government regulations promoting sustainability.

- Health and Wellness Products: A growing demand for health and wellness products is expected among Vietnamese consumers. Supermarkets are responding by expanding their range of organic foods, gluten-free products, and dietary supplements. This trend is driven by increased health consciousness and a desire for better nutrition among consumers, especially in urban areas.

Scope of the Report

|

By Product Type |

Fresh Produced Packaged Foods Beverages Household Products |

|

By Store Format |

Hypermarkets Supermarkets Convenience Stores |

|

By Distribution Channel |

Online Offline |

Products

Key Target Audience – Organizations and Entities who can benefit by Subscribing This Report:

Supermarkets and Hypermarkets

Online Grocery Delivery Companies

E-commerce Companies

Food Delivery Companies

Food and Beverage Companies:

Banks & Financial Institutions

Regulatory Bodies (Ministry of Trade, Vietnam Food Administration)

Time Period Captured in the Report:

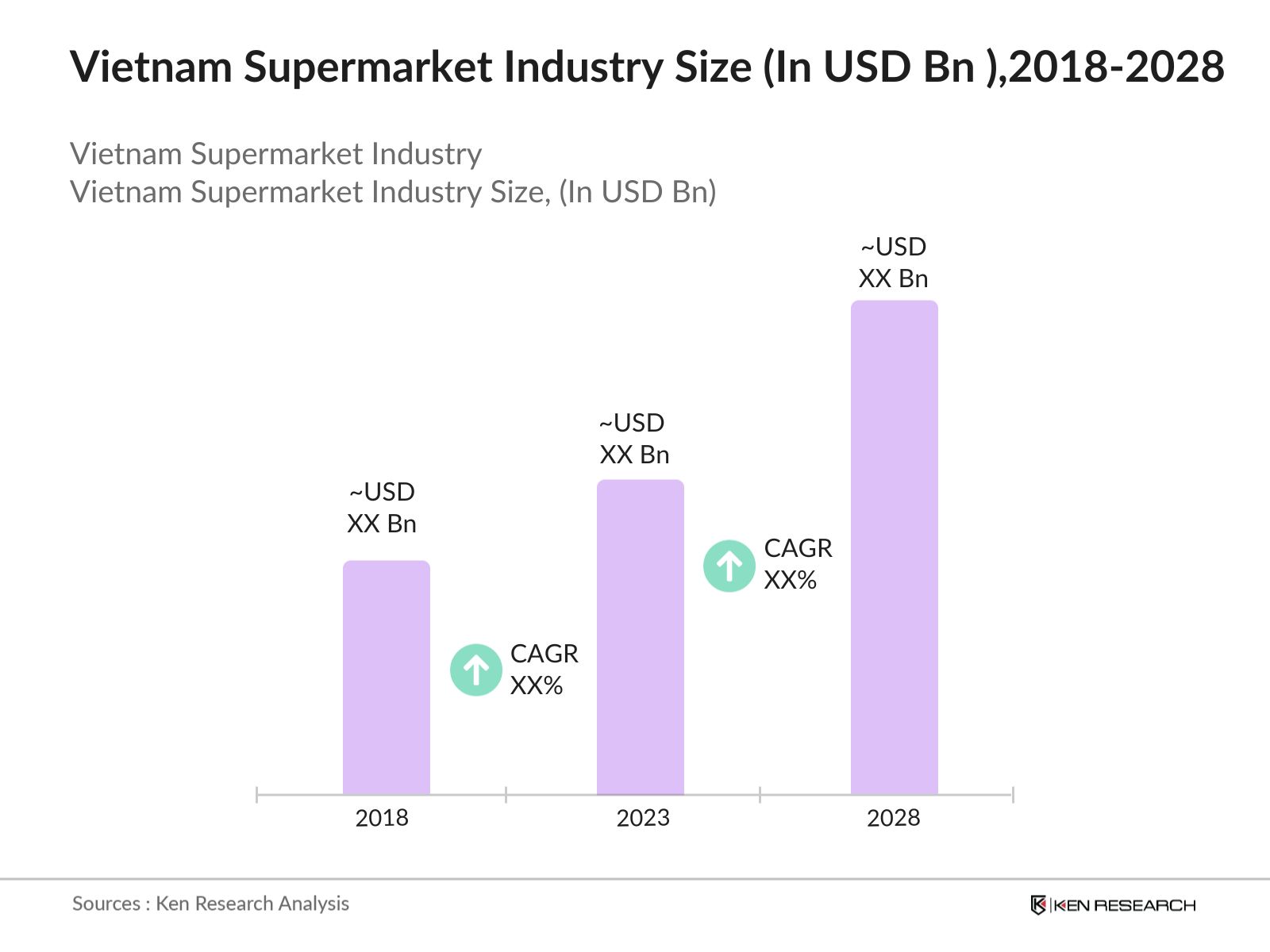

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:Â

VinMart

opmart

Lotte Mart

Big C

AEON

Emart

Bách Hóa Xanh

Mega Market

Satra Mart

Fivimart

Intimex

Citimart

VinMart+

Family Mart

Circle K

7-Eleven

Ministop

Kingfoodmart

Nam An Market

Table of Contents

1. Vietnam Supermarket Industry Overview

1.1 Vietnam Supermarket Industry Taxonomy

2. Vietnam Supermarket Industry Size (in USD Bn), 2018-2023

3. Vietnam Supermarket Industry Analysis

3.1 Vietnam Supermarket Industry Growth Drivers

3.2 Vietnam Supermarket Industry Challenges and Issues

3.3 Vietnam Supermarket Industry Trends and Development

3.4 Vietnam Supermarket Industry Government Regulation

3.5 Vietnam Supermarket Industry SWOT Analysis

3.6 Vietnam Supermarket Industry Stake Ecosystem

3.7 Vietnam Supermarket Industry Competition Ecosystem

4. Vietnam Supermarket Industry Segmentation, 2023

4.1 Vietnam Supermarket Industry Segmentation by Product Type (in value %), 2023

4.2 Vietnam Supermarket Industry Segmentation by Store Format (in value %), 2023

4.3 Vietnam Supermarket Industry Segmentation by Distribution Channel (in value %), 2023

5. Vietnam Supermarket Industry Competition Benchmarking

5.1 Vietnam Supermarket Industry Cross-Comparison (no. of employees, company overview, business strategy, USP, recent development, operational parameters, financial parameters and advanced analytics)

6. Vietnam Supermarket Future Industry Size (in USD Bn), 2023-2028

7. Vietnam Supermarket Future Industry Segmentation, 2028

7.1 Vietnam Supermarket Industry Segmentation by Product Type (in value %), 2028

7.2 Vietnam Supermarket Industry Segmentation by Store Format (in value %), 2028

7.3 Vietnam Supermarket Industry Segmentation by Distribution Channel (in value %), 2028

8. Vietnam Supermarket Industry Analysts’ Recommendations

8.1 Vietnam Supermarket Industry TAM/SAM/SOM Analysis

8.2 Vietnam Supermarket Industry Customer Cohort Analysis

8.3 Vietnam Supermarket Industry Industrying Initiatives

8.4 Vietnam Supermarket Industry White Space Opportunity Analysis

Research Methodology

Step 1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.Â

Step 2 Market Building:

Collating statistics on Vietnam Supermarket Industry over the years, penetration of marketplaces and service providers ratio to compute revenue generated for Vietnam Supermarket Market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.Â

Step 3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.Â

Step 4 Research output:

Our team will approach multiple supermarket suppliers and distributors companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from supermarket suppliers and distributors companies.

Frequently Asked Questions

01 How big is Vietnam Supermarket Industry?

Vietnam Supermarket Industry has experienced notable growth, this is reflected by Global supermarket industry reaching a valuation of USD 950 billion in 2023. This growth is primarily driven by increasing urbanization, rising disposable incomes, and a growing middle class.

02 Who are the major players in Vietnam Supermarket Industry?

Major players include VinMart, Co.opmart, Big C, Lotte Mart, and Aeon, among others. These players are continuously expanding their presence and innovating their offerings to attract more customers and increase their market share.

03 What are the dominant market segments in Vietnam Supermarket Industry?

Grocery items, particularly fresh produce and packaged foods, are the dominant segments due to consistent consumer demand for quality & fresh products.

04 What factors drive Vietnam Supermarket Industry?

Key growth drivers include urbanization, rising disposable incomes, consumer preference for organized retail, and technological advancements. Higher disposable income also leads to increased expenditure on groceries and household items, which are primary offerings of supermarkets.

05 What are the challenges in Vietnam Supermarket Industry?

Major challenges include intense competition, high operational costs, supply chain management issues, and navigating local regulations. Also, the deep-rooted shopping habits and cultural preferences for traditional markets pose a significant challenge to the expansion of supermarkets.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.