Vietnam Textiles Market Outlook to 2030

Region:Asia

Author(s):Vijay Kumar

Product Code:KROD3880

December 2024

88

About the Report

Vietnam Textiles Market Overview

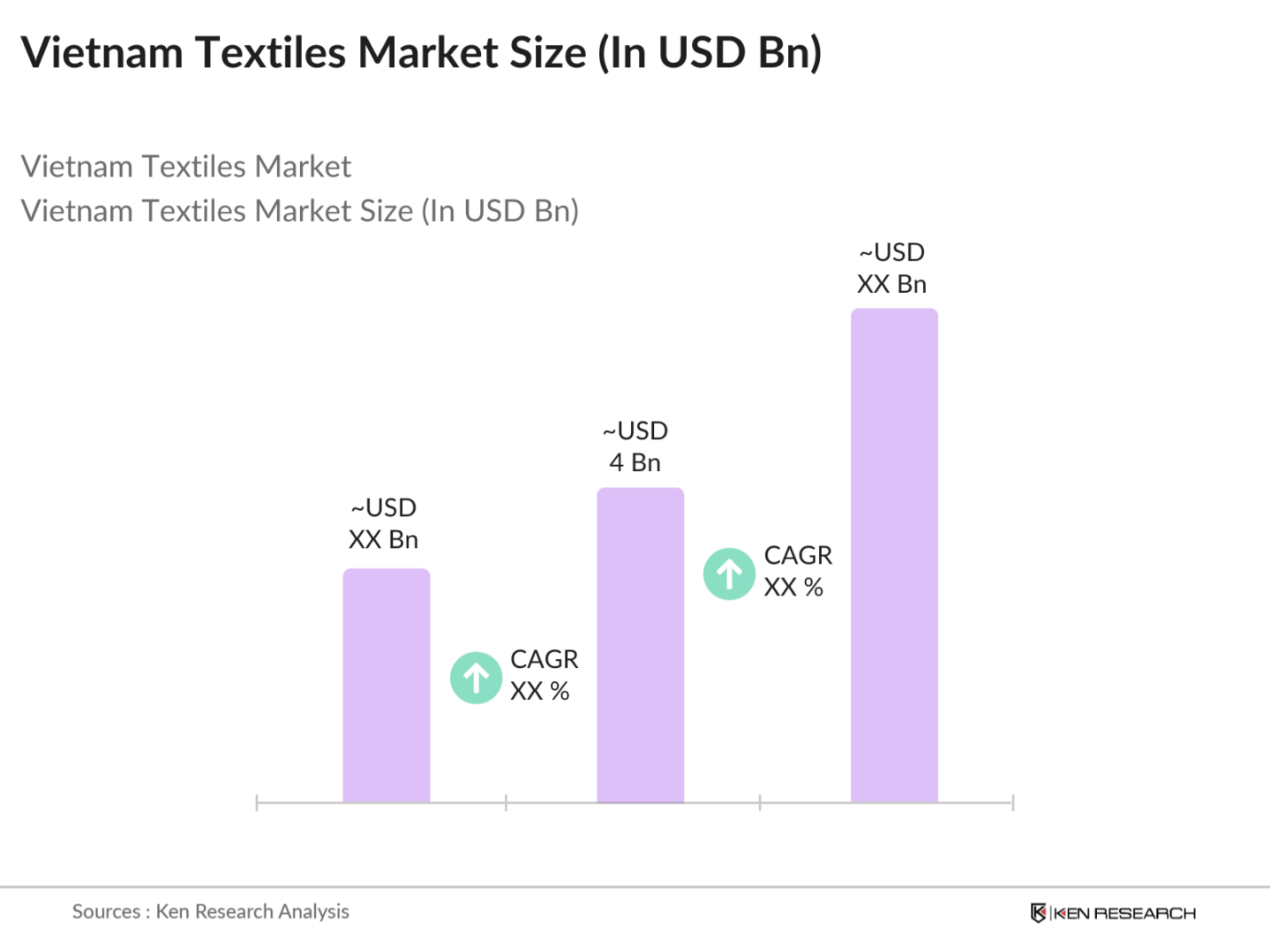

- The Vietnam textile market is valued at USD 4 billion, based on a five-year historical analysis. This market's growth is primarily driven by the countrys participation in international trade agreements, which have bolstered export volumes and facilitated access to major global markets. Additionally, a strong emphasis on sustainable manufacturing and the adoption of eco-friendly materials has propelled the industry forward. The markets evolution is also influenced by the adoption of automation technologies, which are helping companies improve productivity and reduce costs.

- Dominant cities in Vietnam's textile industry include Hanoi and Ho Chi Minh City. These cities serve as major production and export hubs due to their developed infrastructure, availability of skilled labor, and proximity to key seaports, making logistics and supply chain management more efficient. Additionally, these regions host several large-scale textile manufacturers and are well-supported by government initiatives aimed at enhancing industry competitiveness and sustainability.

- In 2023, the Vietnam Textile and Apparel Association (VITAS) introduced updated standards for textile production, emphasizing reduced chemical usage and alignment with international best practices. Over 70 percent of textile companies have implemented these standards, reflecting an industry-wide shift towards sustainable production and enhanced product safety to meet global compliance requirements.

Vietnam Textiles Market Segmentation

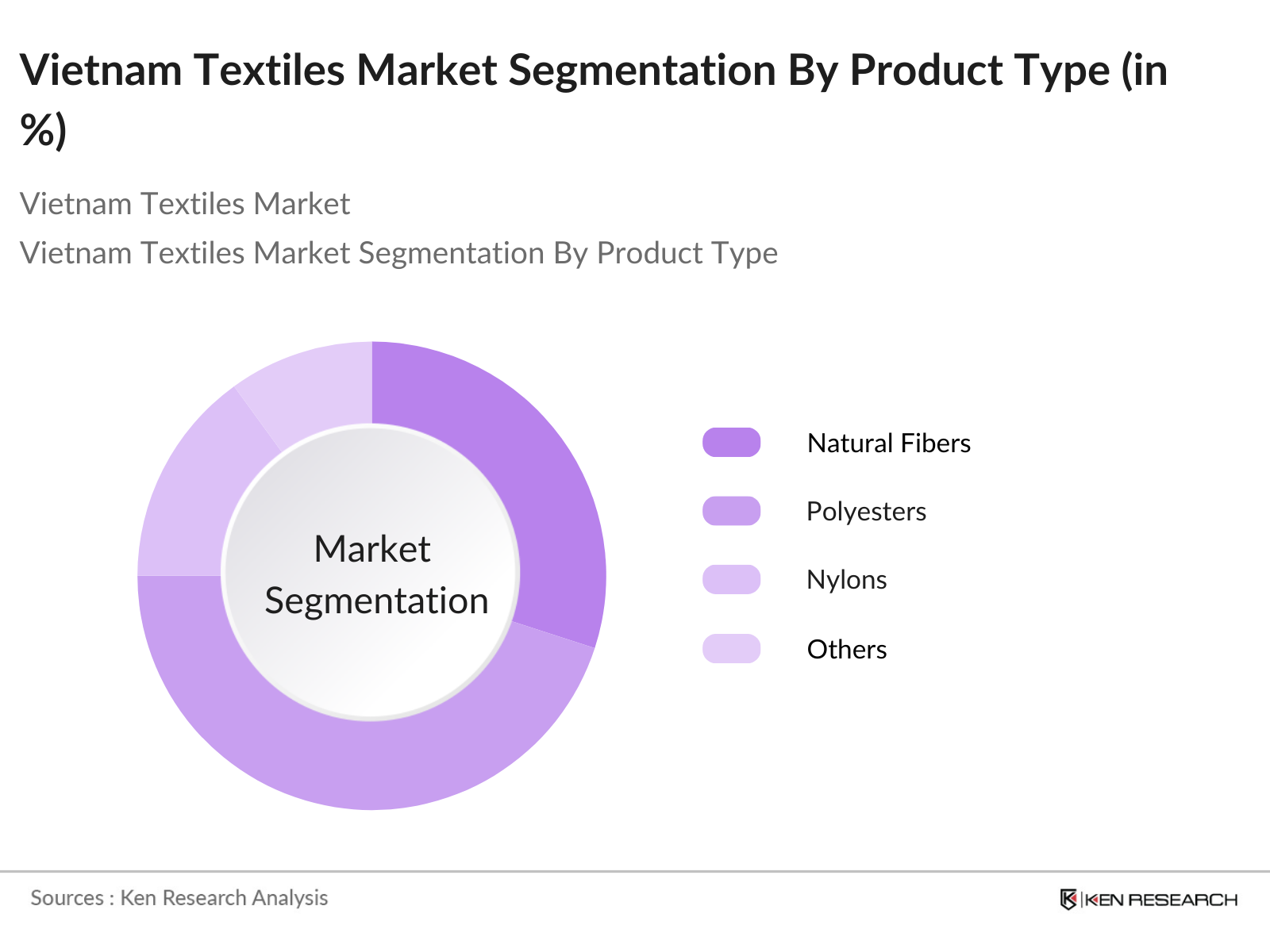

By Product Type: The Vietnam textile market is segmented by product type into natural fibers, polyesters, nylons, and others. Among these, polyesters hold a dominant market share due to their versatility and lower cost of production compared to natural fibers like cotton. The extensive application of polyester in various segments, such as apparel, home textiles, and technical textiles, is also a key contributor to its market dominance. The increased demand for performance textiles and synthetic fibers further boosts the growth of this segment.

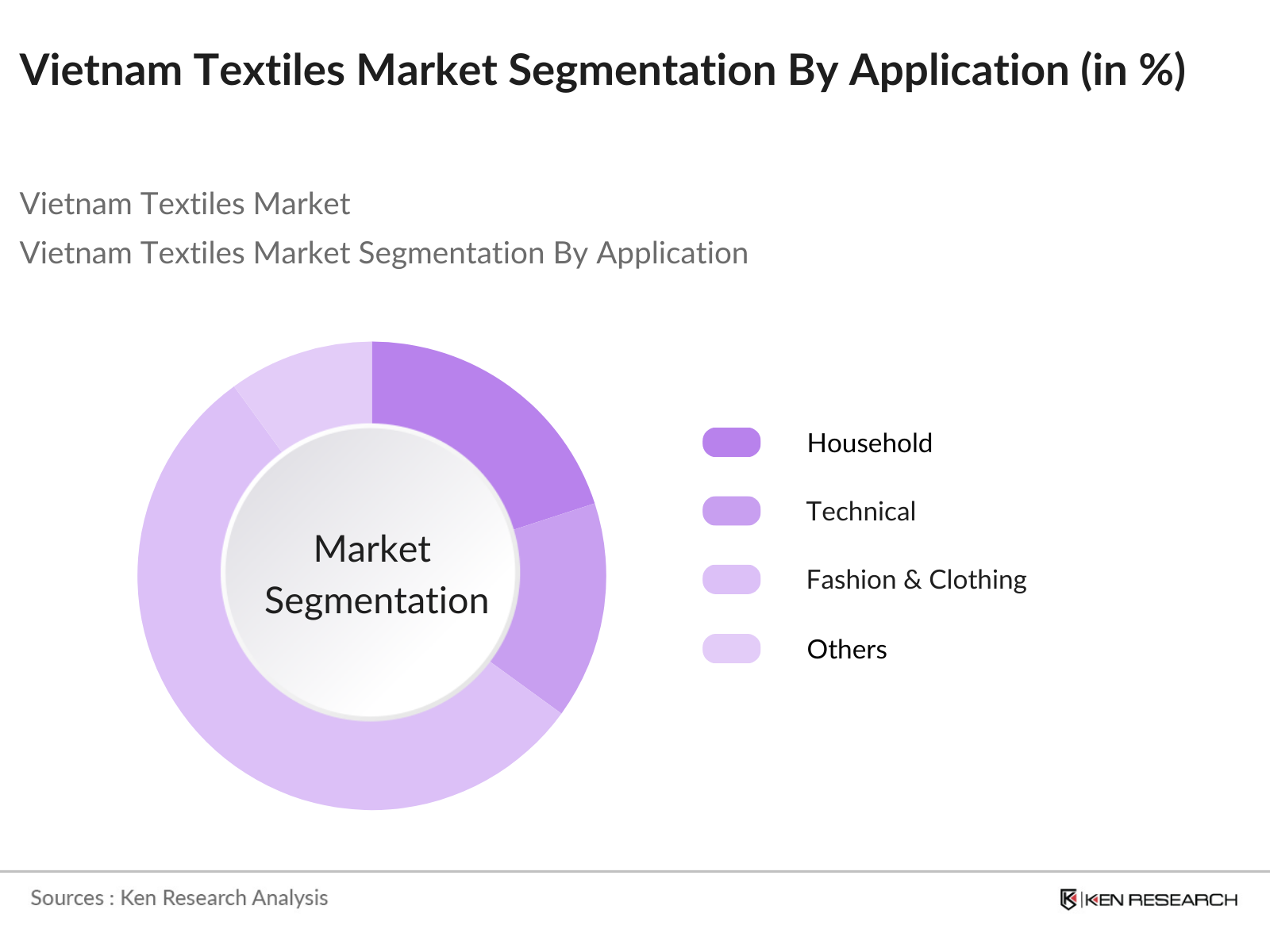

By Application: The Vietnam textile market is categorized by application into household, technical, fashion & clothing, and others. The fashion & clothing segment leads the market share, driven by Vietnams strong export-oriented garment industry. The growth of this segment can be attributed to favorable trade policies, availability of a skilled workforce, and Vietnams reputation as a reliable manufacturing hub for global brands. E-commerce growth and rising domestic consumption are additional factors that bolster this segments position in the market.

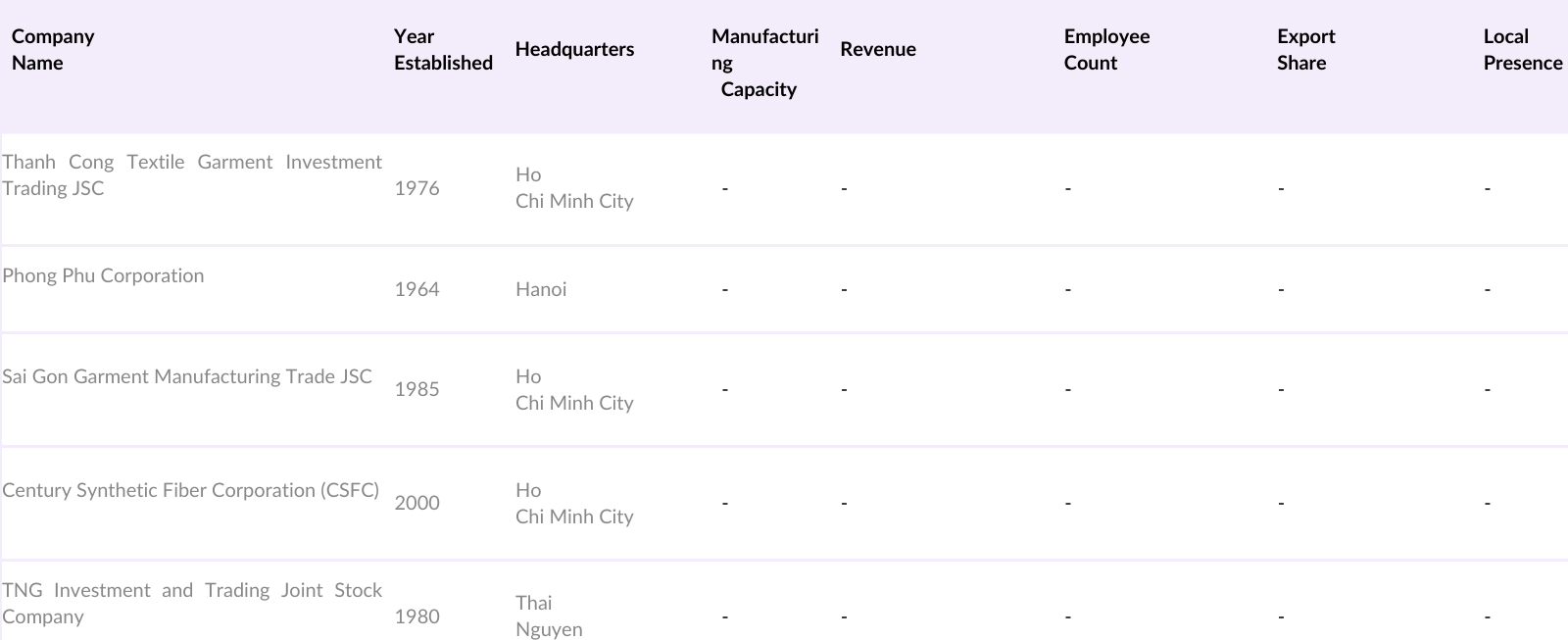

Vietnam Textiles Market Competitive Landscape

The Vietnam textile market is characterized by a mix of local and international players, with a few key companies dominating the market. This consolidation is supported by the presence of a skilled workforce and the government's support through favorable policies and incentives.

Vietnam Textiles Industry Analysis

Growth Drivers

- Favorable Trade Agreements: Vietnam has leveraged multiple free trade agreements (FTAs), such as the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) and the European UnionVietnam Free Trade Agreement (EVFTA). These agreements have boosted Vietnam's textile exports by significantly reducing tariffs and opening up new markets. Between 2013 and 2023, bilateral trade with the United States alone increased from USD 30 billion to over USD 139 billion, reflecting the impact of trade cooperation on textile exports.

- Increasing FDI in Textile Sector: Foreign direct investment (FDI) in Vietnams textile sector has surged, with over 12 new projects announced by international firms in 2023, primarily from Japan and South Korea. The inflow of FDI has strengthened Vietnam's production capacity, contributing to the sector's rapid expansion. This has led to enhanced technological capabilities and increased employment within the textile sector.

- Rising Global Demand for Sustainable Textiles: As the global textile industry shifts towards sustainability, Vietnams textile manufacturers are embracing eco-friendly practices. In 2023, Vietnam exported over USD 1.8 billion worth of sustainable textile products, primarily to Europe and North America. The increasing preference for organic cotton and recycled polyester has positioned Vietnam as a key supplier in the sustainable textiles segment.

Market Challenges

- Dependency on Imported Technology: Vietnams reliance on imported machinery and technology for advanced textile processing has limited its ability to fully capitalize on the high-end textile market. In 2023, the country imported machinery worth over USD 500 million, highlighting the need for increased domestic technological innovation.

- Environmental Regulations: Vietnam has implemented stringent environmental regulations to curb pollution from textile production, especially in dyeing and finishing processes. The governments Green Growth Strategy mandates a reduction in water usage by 30 percent and waste emissions by 50 percent by 2025. Compliance with these regulations has increased operational costs for many firms.

Vietnam Textiles Market Future Outlook

The Vietnam textile market is poised for significant growth in the next five years, supported by continuous investments in technology and sustainability. The industry is likely to benefit from advancements in Industry 4.0 technologies, such as automation and data analytics, which will optimize production processes and enable better resource utilization. Increasing consumer preference for sustainable and eco-friendly textiles is expected to further drive innovation and market expansion. With rising global demand for high-quality textiles and strong government support, Vietnams textile industry is set to maintain its competitive edge in the international market.

Market Opportunities

- Growth in E-commerce and Digitalization: Vietnams e-commerce market is expanding rapidly, reaching USD 23 billion in 2023. This has created new distribution channels for local textile manufacturers, enabling them to access international markets directly. The shift towards digital sales has particularly benefited small and medium-sized textile enterprises.

- Expansion into High-Value Textile Segments: Vietnam is increasingly venturing into high-value textile segments like sportswear and technical fabrics. In 2023, exports of high-performance textiles, including moisture-wicking and flame-resistant fabrics, grew by 22 percent. This trend is supported by investments in R&D and partnerships with international brands.

Scope of the Report

|

Product Type |

Apparel Fabrics Home Textiles Industrial Textiles Technical Textiles Eco-Friendly Textiles |

|

By Raw Material Type |

Cotton Polyester Silk Wool Synthetic Fibers |

|

By Application |

Fashion and Apparel Home Dcor and Furnishings Technical Applications Automotive and Aerospace Sportswear and Performance Apparel |

|

By Manufacturing Process |

Weaving Knitting Dyeing and Printing Finishing Yarn Spinning |

|

Region |

Northern Vietnam Central Vietnam Southern Vietnam |

Products

Key Target Audience

Textile Manufacturers

Apparel and Clothing Brands

Government and Regulatory Bodies (Vietnam Textile & Apparel Association - VITAS)

Investment and Venture Capitalist Firms

Exporters and Importers

Retailers and Distributors

Technological Solution Providers for Textiles

E-commerce Platforms

Companies

Players Mentioned in the Report

Thanh Cong Textile Garment Investment Trading JSC

Phong Phu Corporation

Sai Gon Garment Manufacturing Trade JSC

Dong Xuan Knitting Sole Member Company Limited

TNG Investment and Trading Joint Stock Company

Century Synthetic Fiber Corporation (CSFC)

Duc Giang Corporation

Ho Guom Garment Corporation

Viet Tien Garment Corporation

Garment 10 Corporation JSC

Table of Contents

1. Vietnam Textiles Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Vietnam Textiles Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Market Development Trends

2.4. Key Market Milestones and Developments

3. Vietnam Textiles Market Analysis

3.1. Growth Drivers

3.1.1. Favorable Trade Agreements

3.1.2. Increasing FDI in Textile Sector

3.1.3. Rising Global Demand for Sustainable Textiles

3.1.4. Strong Local Supply Chain Support

3.2. Market Challenges

3.2.1. Environmental Regulations

3.2.2. Fluctuating Raw Material Costs

3.2.3. Competition from Low-Cost Producers

3.2.4. Dependency on Imported Technology

3.3. Opportunities

3.3.1. Growth in E-commerce and Digitalization

3.3.2. Expansion into High-Value Textile Segments

3.3.3. Government Support and Incentives

3.4. Market Trends

3.4.1. Adoption of Sustainable Manufacturing Practices

3.4.2. Investment in R&D for High-Performance Fabrics

3.4.3. Integration of Automation and Smart Technologies

3.5. Government Regulations and Policies

3.5.1. Vietnam Textile & Apparel Association (VITAS) Standards

3.5.2. Environmental and Labor Compliance Policies

3.5.3. National Strategy for Green Growth

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Ecosystem

4. Vietnam Textiles Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Apparel Fabrics

4.1.2. Home Textiles

4.1.3. Industrial Textiles

4.1.4. Technical Textiles

4.1.5. Eco-Friendly Textiles

4.2. By Raw Material Type (In Value %)

4.2.1. Cotton

4.2.2. Polyester

4.2.3. Silk

4.2.4. Wool

4.2.5. Synthetic Fibers

4.3. By Application (In Value %)

4.3.1. Fashion and Apparel

4.3.2. Home Dcor and Furnishings

4.3.3. Technical Applications

4.3.4. Automotive and Aerospace

4.3.5. Sportswear and Performance Apparel

4.4. By Manufacturing Process (In Value %)

4.4.1. Weaving

4.4.2. Knitting

4.4.3. Dyeing and Printing

4.4.4. Finishing

4.4.5. Yarn Spinning

4.5. By Region (In Value %)

4.5.1. Northern Vietnam

4.5.2. Central Vietnam

4.5.3. Southern Vietnam

5. Vietnam Textiles Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Vinatex

5.1.2. Viet Tien Garment Corporation

5.1.3. Garment 10 Corporation JSC

5.1.4. Phong Phu Corporation

5.1.5. Duc Giang Corporation

5.1.6. Nha Be Garment Corporation

5.1.7. TNG Investment and Trading JSC

5.1.8. Garmex Saigon Corporation

5.1.9. Thai Tuan Group Corporation

5.1.10. Nam Dinh Textile & Garment JSC

5.1.11. Thanh Cong Textile Garment Investment Trading JSC

5.1.12. Hoa Tho Textile & Garment JSC

5.1.13. Sai Gon Garment Manufacturing Trading JSC

5.1.14. An Phuoc Garment and Embroidery JSC

5.1.15. Kyungbang Vietnam Co., Ltd.

5.2. Cross Comparison Parameters (Employee Count, Revenue, Manufacturing Capacity, Distribution Network, Export Share, Local vs. Global Production, Production Efficiency, Product Innovation)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital and Private Equity Investments

5.8. Government Subsidies and Grants

6. Vietnam Textiles Market Regulatory Framework

6.1. Compliance Requirements for Textile Manufacturers

6.2. Environmental Standards and Certifications

6.3. Labor Law Compliance and Worker Safety Regulations

6.4. Export and Import Regulations

6.5. Certifications and Licensing Requirements

7. Vietnam Textiles Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Vietnam Textiles Market Future Segmentation

8.1. By Product Type (In Value %)

8.2. By Raw Material Type (In Value %)

8.3. By Application (In Value %)

8.4. By Manufacturing Process (In Value %)

8.5. By Region (In Value %)

9. Vietnam Textiles Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives and Strategies

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

In the initial phase, we create a comprehensive ecosystem map of all major stakeholders in the Vietnam textile market. This involves extensive desk research, leveraging secondary and proprietary databases to collect industry-specific information. The primary objective is to identify and define critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, historical data on the Vietnam textile market is compiled and analyzed. This includes assessing market penetration, the ratio of domestic to international suppliers, and overall revenue generation. A detailed evaluation of industry standards is also conducted to ensure accuracy in revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses are developed and validated through in-depth consultations with industry experts. These interactions provide valuable insights into the operational and financial aspects of the market, refining our understanding of market dynamics.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing research findings to provide actionable insights. We engage directly with key textile manufacturers to verify product segments, sales performance, and other relevant data, ensuring a comprehensive and validated analysis of the Vietnam textile market.

Frequently Asked Questions

1. How big is the Vietnam Textile Market?

The Vietnam textile market is valued at USD 4 billion, based on a five-year historical analysis. This market's growth is primarily driven by the countrys participation in international trade agreements, which have bolstered export volumes and facilitated access to major global markets.

2. What are the main challenges in the Vietnam Textile Market?

The Vietnam textile market primary challenges include rising labor costs, competition from other low-cost manufacturing countries, and compliance with international environmental standards.

3. Who are the major players in the Vietnam Textile Market?

The Vietnam textile market major players include Thanh Cong Textile Garment Investment Trading JSC, Phong Phu Corporation, and Century Synthetic Fiber Corporation.

4. What are the growth drivers of the Vietnam Textile Market?

The Vietnam textile market growth is propelled by favorable trade agreements, a skilled labor force, and increasing adoption of sustainable manufacturing practices.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.