Vietnam Third-Party Logistics (3PL) Market Outlook to 2030

Region:Asia

Author(s):Vijay Kumar

Product Code:KROD7712

November 2024

92

About the Report

Vietnam Third-Party Logistics Market Overview

- The Vietnam Third-Party Logistics market is valued at USD 6 billion, based on a five-year historical analysis. This market is primarily driven by the booming e-commerce industry, industrial expansion, and increased foreign direct investment (FDI). Logistics outsourcing has become a critical solution for businesses seeking operational efficiency, reduced costs, and improved supply chain management. Additionally, government initiatives to enhance infrastructure, including port and road developments, have supported the logistics sectors rapid growth, enabling more efficient goods movement across the country.

- Key cities such as Ho Chi Minh City, Hanoi, and Da Nang dominate the 3PL market. Ho Chi Minh Citys strategic location near major ports and its role as the economic hub of Vietnam make it a logistics hotspot. Similarly, Hanoi benefits from its proximity to northern industrial zones, while Da Nang serves as a key transportation link between the north and south, thanks to its central location and access to sea routes. These cities act as logistics hubs due to their developed infrastructure, access to skilled labor, and close proximity to major industrial zones.

- The Vietnamese government has significantly invested in infrastructure development, with an allocation of over $10 billion in 2023 for logistics-related infrastructure projects. These projects include road expansions, port upgrades, and the development of new industrial zones. Notably, the North-South Expressway project, costing around $5.8 billion, aims to reduce transportation time, directly benefiting the logistics sector.

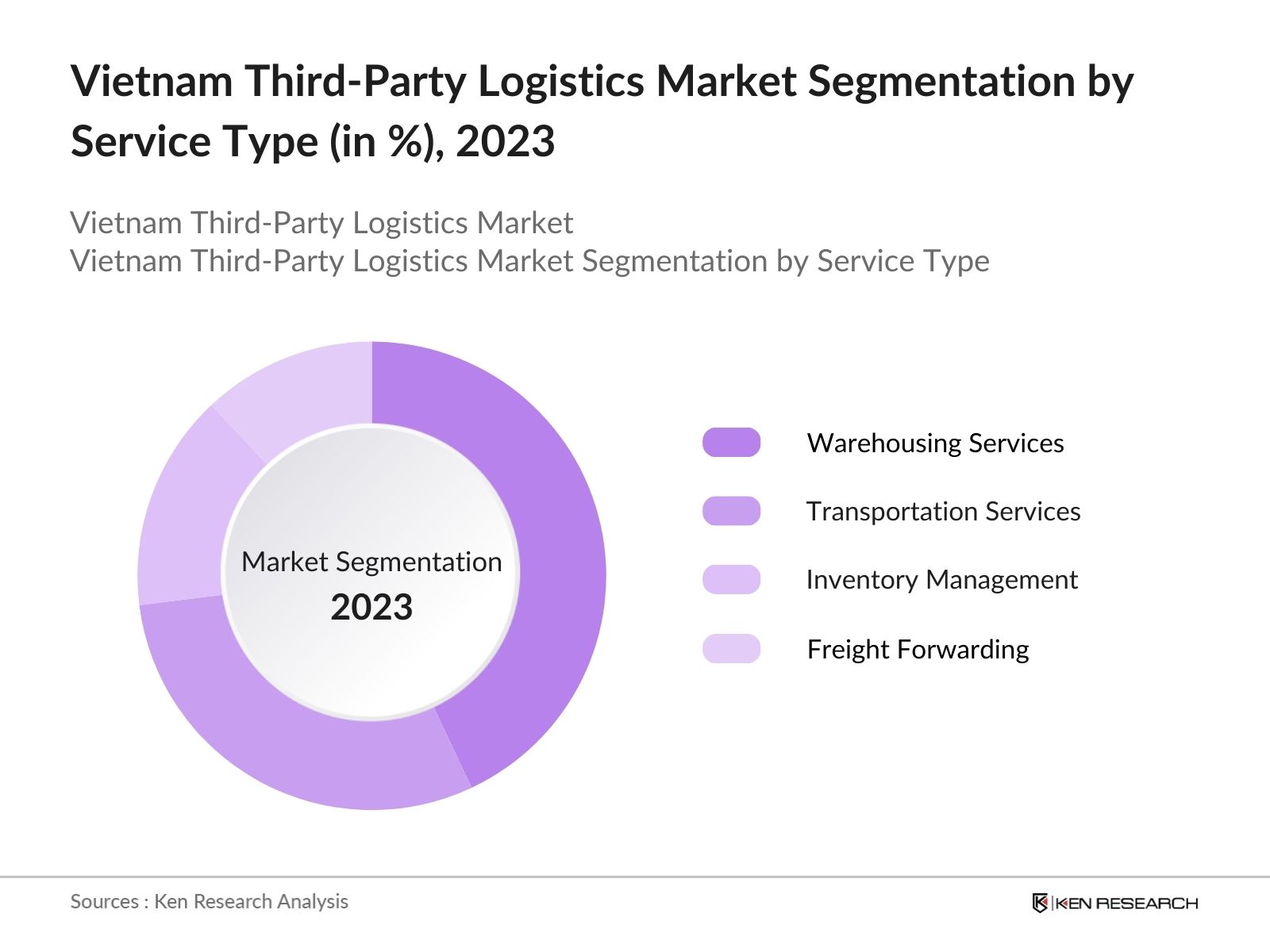

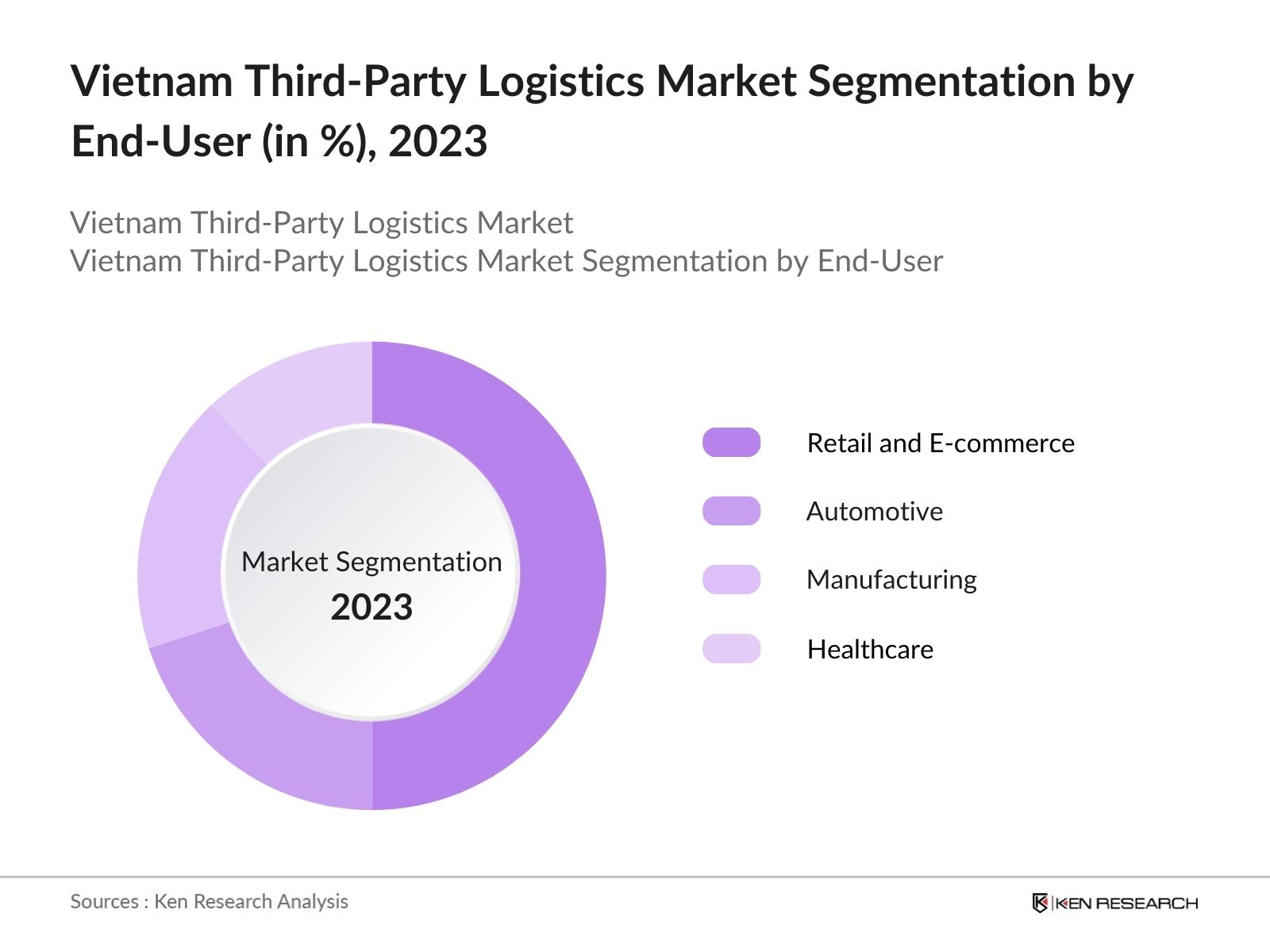

Vietnam Third-Party Logistics Market Segmentation

By Service Type: The Vietnam Third-Party Logistics market is segmented by service type into warehousing services, transportation services, inventory management, freight forwarding, and value-added services. Warehousing services hold the dominant market share within this segmentation due to the countrys booming e-commerce sector and the increasing demand for storage solutions to accommodate fluctuating product volumes.

By End-User Industry: The market is further segmented by end-user industry into retail and e-commerce, automotive, manufacturing, healthcare, and food & beverage. The retail and e-commerce sector dominates the 3PL market due to the exponential rise in online shopping platforms such as Tiki, Shopee, and Lazada. This industry requires efficient logistics services for order fulfillment, inventory management, and last-mile delivery.

Vietnam Third-Party Logistics Market Competitive Landscape

The Vietnam 3PL market is dominated by a few global and regional players who have a strong presence in the country. These companies leverage their extensive logistics networks and technological capabilities to provide end-to-end solutions for businesses. The Vietnam 3PL market is led by major players such as DHL Supply Chain, DB Schenker, and Kuehne + Nagel, which provide comprehensive logistics services, from warehousing to last-mile delivery.

Vietnam Third-Party Logistics Industry Analysis

Growth Drivers

- Expanding E-commerce Industry (E-commerce Penetration, Logistics Integration): The Vietnamese e-commerce market is rapidly expanding, driven by a youthful population, high internet penetration (75.7% as of 2024), and rising incomes. This expansion has led to increased demand for efficient logistics solutions. The integration of 3PL services with e-commerce platforms has become essential to meet the growing consumer demand. Logistics providers now play a crucial role in managing supply chains for online retailers, which handle nearly 10 billion parcels annually, driven by increased online shopping activity.

- Increasing Foreign Direct Investment (FDI Policies, Industrial Growth): Vietnam's strategic policies have facilitated strong FDI inflows, which reached $22.4 billion in 2022. The governments liberal policies and incentives in the logistics sector have attracted global logistics players to establish operations, leading to industrial growth. This FDI inflow has boosted logistics demand, particularly in transportation, warehousing, and distribution sectors. Additionally, Vietnams participation in free trade agreements has made it an attractive destination for global manufacturers looking to optimize their supply chains.

- Rising Outsourcing Trends in Logistics Operations (Operational Efficiency, Cost Effectiveness): Vietnamese businesses, especially in manufacturing and retail, are increasingly outsourcing logistics operations to third-party providers to enhance operational efficiency and reduce costs. By 2024, it is estimated that over 45% of logistics operations in the country are outsourced. Companies are turning to 3PL providers for warehousing, inventory management, transportation, and distribution services.

Market Challenges

- Regulatory Compliance and Customs Procedures (Customs Efficiency, Regulatory Framework): Vietnam's customs procedures remain a challenge for logistics providers due to lengthy paperwork and complex regulations. In 2022, Vietnam ranked 104th in the World Banks "Trading Across Borders" index due to inefficiencies in customs clearance. While there have been efforts to simplify processes, customs delays remain a significant bottleneck, especially for international logistics.

- Limited Skilled Workforce (Logistics Personnel Training, Labor Market): Despite the growing logistics industry, Vietnam faces a shortage of skilled logistics professionals. The labor market lacks sufficient training programs for logistics personnel, leading to inefficiencies in operations. In 2023, only 30% of Vietnam's logistics workforce had formal training, according to the Ministry of Industry and Trade. This shortage of skilled labor poses a significant challenge to the industry, particularly as logistics processes become more complex and require higher levels of technical expertise.

Vietnam Third-Party Logistics Market Future Outlook

Over the next five years, the Vietnam Third-Party Logistics (3PL) market is expected to grow significantly, driven by the rapid digitalization of logistics operations, the expansion of e-commerce, and government initiatives to enhance the country's infrastructure. The growing emphasis on cold chain logistics for perishable goods and the increasing role of last-mile delivery solutions in urban centers will continue to shape the logistics landscape.

Market Opportunities

- Digitalization and Adoption of Automation (Automation Technologies, Real-time Tracking): The Vietnamese logistics market is seeing increased adoption of automation and digitalization to improve operational efficiency. In 2024, nearly 35% of logistics providers are expected to integrate real-time tracking systems and automation technologies, such as robotics in warehousing operations, to optimize supply chain management. Automation reduces human errors, enhances the speed of operations, and provides transparency across the supply chain.

- Growth of Cold Chain Logistics (Cold Storage Capacity, Perishable Goods Demand): The demand for cold chain logistics is growing rapidly in Vietnam, driven by increasing consumption of perishable goods, including fresh produce, seafood, and pharmaceuticals. As of 2024, Vietnams cold storage capacity is around 1.6 million tons, with the number of cold storage facilities increasing to meet domestic and export demands.

Scope of the Report

|

Service Type |

Warehousing Services Transportation Services Inventory Management Freight Forwarding Value-added Services |

|

End-User Industry |

Retail and E-commerce Automotive Manufacturing Healthcare Food & Beverage |

|

Mode of Transportation |

Road Transportation Rail Transportation Air Transportation Sea Transportation |

|

Logistics Provider Type |

1PL 2PL 3PL 4PL |

|

Region |

North Vietnam Central Vietnam South Vietnam |

Products

Key Target Audience

Retail and E-commerce companies

Automotive manufacturers

Healthcare providers

Manufacturing companies

Food & Beverage companies

Investments and venture capitalist firms

Government and regulatory bodies (Ministry of Industry and Trade, Ministry of Transport)

Cold chain logistics providers

Companies

Players Mentioned in the Report

DHL Supply Chain

DB Schenker

Kuehne + Nagel

Nippon Express

CEVA Logistics

Kerry Logistics

Yusen Logistics

CJ Logistics

Gemadept Corporation

Transimex

Table of Contents

1. Vietnam Third-Party Logistics Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Vietnam Third-Party Logistics Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Vietnam Third-Party Logistics Market Analysis

3.1. Growth Drivers

3.1.1. Expanding E-commerce Industry (E-commerce Penetration, Logistics Integration)

3.1.2. Increasing Foreign Direct Investment (FDI Policies, Industrial Growth)

3.1.3. Government Initiatives for Infrastructure Development (Government Spending, Logistics Infrastructure)

3.1.4. Rising Outsourcing Trends in Logistics Operations (Operational Efficiency, Cost Effectiveness)

3.2. Market Challenges

3.2.1. Regulatory Compliance and Customs Procedures (Customs Efficiency, Regulatory Framework)

3.2.2. Limited Skilled Workforce (Logistics Personnel Training, Labor Market)

3.2.3. High Logistics Costs (Freight Costs, Operational Costs)

3.2.4. Fragmented Supply Chain Networks (Fragmentation of Logistics Providers, Inefficiency in Network Coordination)

3.3. Opportunities

3.3.1. Digitalization and Adoption of Automation (Automation Technologies, Real-time Tracking)

3.3.2. Growth of Cold Chain Logistics (Cold Storage Capacity, Perishable Goods Demand)

3.3.3. Regional Trade Agreements and Expansion of Free Trade Zones (RCEP, Free Trade Zones)

3.3.4. Increasing Demand for Green Logistics Solutions (Sustainability Goals, Carbon Emission Reductions)

3.4. Trends

3.4.1. Integration of Blockchain Technology in Logistics (Transparency, Security)

3.4.2. Rising Usage of Last-Mile Delivery Solutions (Last-Mile Efficiency, Urban Logistics)

3.4.3. Growth of Omni-channel Logistics (Omni-channel Retail, Unified Fulfillment Systems)

3.4.4. Emergence of 4PL Providers (Fourth-Party Logistics, Supply Chain Management)

3.5. Government Regulation

3.5.1. National Logistics Development Plan (Master Plan, Strategic Goals)

3.5.2. Infrastructure and Logistics Policies (Road Development, Port Expansion, Inland Logistics)

3.5.3. Customs Modernization and Trade Facilitation (Simplified Customs Processes, Border Control Systems)

3.5.4. Supportive FDI Policies in Logistics (Investment Incentives, Public-Private Partnerships)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Ecosystem

4. Vietnam Third-Party Logistics Market Segmentation

4.1. By Service Type (In Value %)

4.1.1. Warehousing Services

4.1.2. Transportation Services

4.1.3. Inventory Management

4.1.4. Freight Forwarding

4.1.5. Value-added Services (e.g., Packaging, Labeling)

4.2. By End-User Industry (In Value %)

4.2.1. Retail and E-commerce

4.2.2. Automotive

4.2.3. Manufacturing

4.2.4. Healthcare

4.2.5. Food & Beverage

4.3. By Mode of Transportation (In Value %)

4.3.1. Road Transportation

4.3.2. Rail Transportation

4.3.3. Air Transportation

4.3.4. Sea Transportation

4.4. By Logistics Provider Type (In Value %)

4.4.1. 1PL

4.4.2. 2PL

4.4.3. 3PL

4.4.4. 4PL

4.5. By Region (In Value %)

4.5.1. North Vietnam

4.5.2. Central Vietnam

4.5.3. South Vietnam

5. Vietnam Third-Party Logistics Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. DB Schenker

5.1.2. Kuehne + Nagel

5.1.3. DHL Supply Chain

5.1.4. Nippon Express

5.1.5. CEVA Logistics

5.1.6. Kerry Logistics

5.1.7. APL Logistics

5.1.8. Yusen Logistics

5.1.9. CJ Logistics

5.1.10. Gemadept Corporation

5.1.11. Transimex

5.1.12. TBS Logistics

5.1.13. Tan Cang-Song Than ICD Co. Ltd.

5.1.14. Vinafco Joint Stock Corporation

5.1.15. Indo Trans Logistics

5.2 Cross Comparison Parameters (Number of Employees, Headquarters, Inception Year, Revenue, Market Share, Logistics Network Size, Sustainability Initiatives, Technological Investments)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers And Acquisitions

5.6. Investment Analysis

5.7 Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Vietnam Third-Party Logistics Market Regulatory Framework

6.1. National Logistics Standards

6.2. Compliance Requirements for Service Providers

6.3. Certification and Licensing Processes

7. Vietnam Third-Party Logistics Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Vietnam Third-Party Logistics Future Market Segmentation

8.1. By Service Type (In Value %)

8.2. By End-User Industry (In Value %)

8.3. By Mode of Transportation (In Value %)

8.4. By Logistics Provider Type (In Value %)

8.5. By Region (In Value %)

9. Vietnam Third-Party Logistics Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Vietnam Third-Party Logistics market. This step is underpinned by extensive desk research, utilizing secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data related to the Vietnam Third-Party Logistics market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of logistics network size and operational quality statistics will be conducted to ensure the reliability of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of logistics companies. These consultations provide valuable operational and financial insights directly from practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with logistics service providers to acquire detailed insights into service offerings, technological investments, and operational efficiency. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, ensuring a comprehensive, accurate, and validated analysis of the Vietnam Third-Party Logistics market.

Frequently Asked Questions

01 How big is the Vietnam Third-Party Logistics Market?

The Vietnam Third-Party Logistics market is valued at USD 6 billion, based on a five-year historical analysis. This market is primarily driven by the booming e-commerce industry, industrial expansion, and increased foreign direct investment (FDI).

02 What are the challenges in the Vietnam Third-Party Logistics Market?

Challenges include high logistics costs, a fragmented supply chain network, and regulatory compliance issues. Furthermore, the lack of a skilled workforce and rising freight costs pose significant obstacles.

03 Who are the major players in the Vietnam Third-Party Logistics Market?

Key players in the market include DHL Supply Chain, DB Schenker, Kuehne + Nagel, Gemadept Corporation, and Transimex, all of whom benefit from established logistics networks and strong technological investments.

04 What are the growth drivers of the Vietnam Third-Party Logistics Market?

The market is driven by the expansion of e-commerce, foreign direct investment in manufacturing, and government support for infrastructure development. Additionally, the growing need for last-mile delivery solutions and the adoption of green logistics practices are propelling market growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.