Vietnam Vaccine Market Outlook to 2030

Region:Asia

Author(s):Samanyu

Product Code:KROD270

June 2024

100

About the Report

Vietnam Vaccine Market Overview

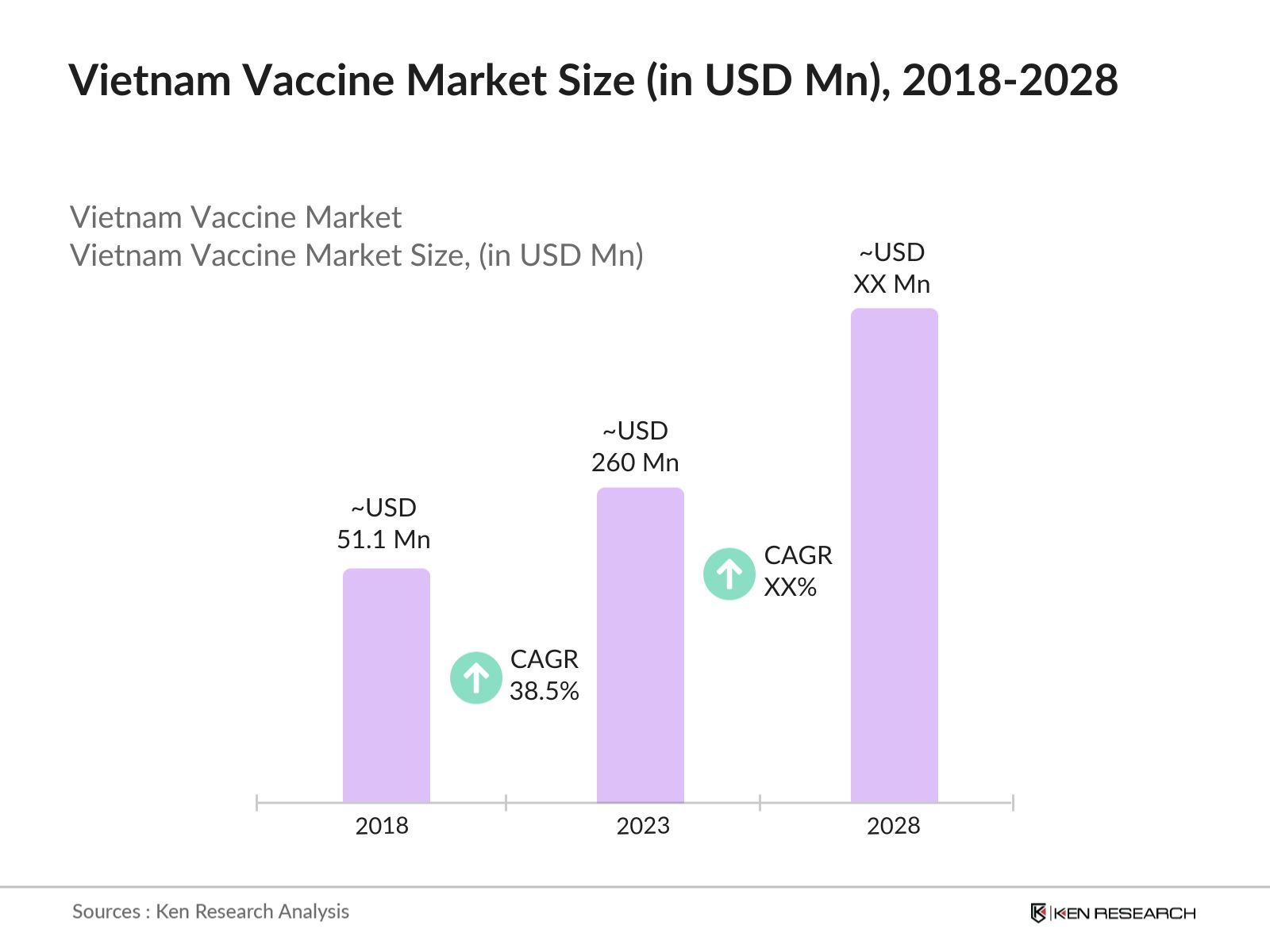

- The Vietnam vaccine market grew from USD 51.1 Mn in 2018 to USD 260 Mn in 2023, driven by increased immunization focus and rising healthcare expenditures.

- Key players include Sanofi, GlaxoSmithKline, Pfizer, Vietnam Vaccine Company (VNVC), and VABIOTECH, dominating the market with extensive product portfolios and strong distribution networks.

- Challenges include logistical issues in vaccine distribution, vaccine hesitancy among certain populations, high development costs, and stringent regulatory hurdles.

- Major growth drivers are government immunization programs, the growing prevalence of infectious diseases, increasing healthcare spending, and advancements in vaccine research and development.

Vietnam Vaccine Current Market Analysis

- The COVID-19 vaccine is the major product, with high demand and widespread government procurement to combat the pandemic, ensuring mass vaccination.

- Hepatitis B and influenza vaccines are bestselling products, driven by national immunization programs and high public awareness, resulting in widespread adoption.

- Consumers prefer vaccines with proven efficacy and safety profiles, particularly those included in government vaccination schedules, such as MMR vaccines.

- Sanofi leads the market with its extensive product range, strong research and development capabilities, and effective distribution network, meeting diverse vaccination needs.

- Vaccine sales are predominantly driven by public sector procurement for national immunization programs, with private sector contributions steadily increasing, ensuring broader vaccine availability.

Vietnam Vaccine Market Segmentation

The Vietnam Vaccine Market can be segmented based on several factors:

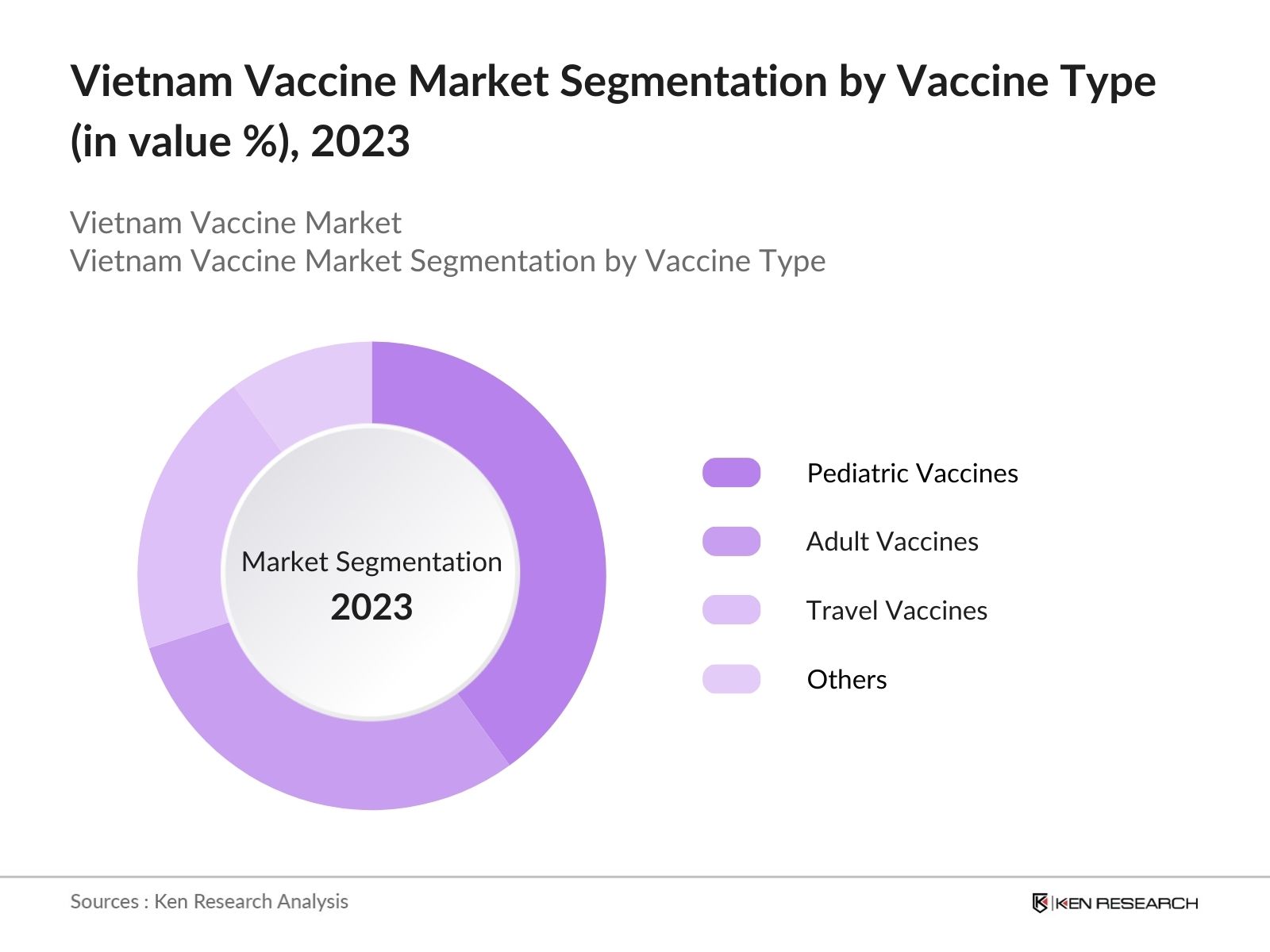

By Vaccine Type: In the Vietnam Vaccine Market segmentation by vaccine type (in value %), 2023, pediatric vaccines dominate due to extensive government support and mandatory vaccination programs.

These initiatives ensure high coverage rates among children, which is crucial for controlling childhood diseases and achieving herd immunity. Adult vaccines, travel vaccines, and other categories follow, catering to specific population needs and health requirements.

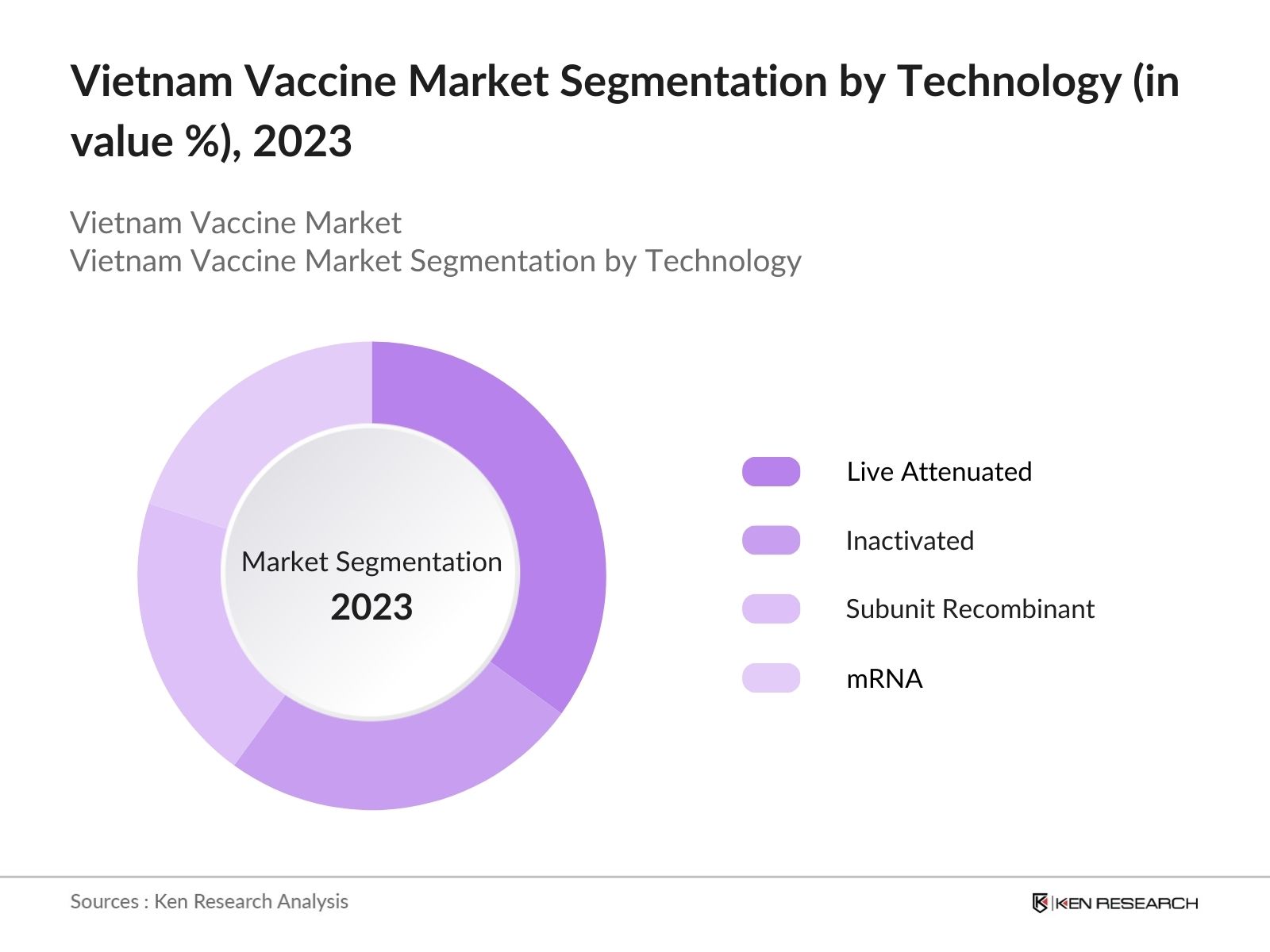

By Technology: In the Vietnam Vaccine Market segmentation by technology (in value %), 2023, live attenuated vaccines dominate due to their strong and long-lasting immune response, which is essential for effective immunization against various infectious diseases.

Inactivated and subunit recombinant vaccines are also significant, while the rising popularity of mRNA vaccines, spurred by their recent success, marks a notable trend in the market.

By Distribution Channel: In the Vietnam Vaccine Market segmentation by distribution channel (in value %), 2023, the public sector remains dominant due to extensive government procurement and distribution through national immunization programs, ensuring widespread coverage and access to vaccines across the population.

The private sector and online pharmacies also play crucial roles, providing additional access points and convenience for vaccine distribution.

Vietnam Vaccine Market Competitive Landscape

- A diverse product portfolio, including vaccines for diseases like hepatitis B, influenza, and COVID-19, enhances market reach and meets varied public health needs. Sanofi, for instance, offers multiple vaccines catering to both public and private healthcare demands in Vietnam.

- Continuous innovation and the development of new vaccines are crucial for maintaining competitiveness. Companies like GlaxoSmithKline and Pfizer invest significantly in R&D, producing advanced vaccines that address emerging health threats and improve efficacy.

- Efficient distribution channels ensure timely delivery and accessibility of vaccines across Vietnam. VNVC operates a nationwide network of vaccination centers, ensuring vaccines reach even remote areas, increasing market penetration and consumer access.

- Established brands with a history of safe and effective vaccines, such as Sanofi and GlaxoSmithKline, gain consumer trust. Their long-standing market presence and proven track record in vaccine safety and efficacy make them preferred choices.

Vietnam Vaccine Industry Analysis

Vietnam Vaccine Market Growth Drivers:

- Government Immunization Programs: Vietnam's government has been proactive in its immunization efforts, with the National Expanded Program on Immunization (EPI) achieving a coverage rate of over 95% for key vaccines. This extensive immunization coverage has driven demand for vaccines, ensuring widespread protection against preventable diseases among the population.

- Increased Healthcare Spending: Vietnam's healthcare expenditure has seen a significant rise, reaching 6.6% of GDP in 2021, up from 5.8% in 2016. This increase in spending reflects the government's commitment to improving healthcare infrastructure and accessibility, leading to higher vaccine procurement and distribution to meet public health needs.

- Partnerships with International Organizations: Vietnam has established partnerships with international health organizations to enhance its vaccine supply and distribution capabilities. Collaborations with entities like UNICEF and WHO have facilitated the procurement of vaccines and technical support, ensuring a steady supply and robust immunization programs.

Vietnam Vaccine Market Challenges:

- Cold Chain Logistics: Maintaining the cold chain for vaccine storage and transportation remains a significant challenge in Vietnam. Approximately 20% of vaccines remains at risk of spoilage due to inadequate cold chain infrastructure, particularly in rural and remote areas. This logistical issue impacts the efficiency and effectiveness of vaccine distribution.

- Vaccine Hesitancy: Despite high overall vaccination rates, certain communities exhibit vaccine hesitancy, with 10% of the population expressing reluctance to vaccinate due to safety concerns or misinformation. This hesitancy poses a barrier to achieving comprehensive immunization coverage and requires targeted education and communication efforts to address.

- Funding Limitations: Although healthcare spending is increasing, there are still limitations in funding for vaccine programs. Budget constraints can affect the procurement of newer, more expensive vaccines, limiting the ability to offer the latest immunizations to the population. Efficient allocation of resources and international aid are necessary to overcome these financial barriers.

Vietnam Vaccine Market Trends:

- Adoption of Digital Health Solutions: The Vietnamese vaccine market is witnessing the adoption of digital health solutions for better management and tracking of immunization programs. The use of digital registries and mobile health applications has improved vaccine tracking, with over 70% of health facilities using electronic immunization records, enhancing efficiency and data accuracy.

- Local Vaccine Production: There is a growing trend towards local vaccine production in Vietnam, reducing dependency on imports. Domestic production facilities are being upgraded to meet international standards, with Vietnam producing 11 out of 12 vaccines in the EPI schedule locally. This shift supports self-sufficiency and lowers costs.

- Increased Focus on Adult Vaccination: Traditionally, vaccination efforts in Vietnam have focused on children, but there is an increasing emphasis on adult vaccination. The introduction of vaccines for diseases like influenza and HPV for adults has seen higher uptake, with a 15% year-on-year increase in adult vaccination rates, reflecting changing public health priorities.

Vietnam Vaccine Market Government Initiatives:

- National Expanded Program on Immunization (EPI): This program, launched in 1981, provides free vaccines for children against 11 infectious diseases. The EPI has achieved over 95% coverage for key vaccines, significantly reducing the incidence of preventable diseases and demonstrating the government's commitment to public health.

- COVID-19 Vaccination Campaign: Vietnam launched a comprehensive COVID-19 vaccination campaign, aiming to vaccinate 75% of the population by the end of 2021. As of early 2022, over 80 million doses have been administered, showcasing the government's capacity to mobilize resources and achieve large-scale immunization.

- Partnership with COVAX Facility: Vietnam's participation in the COVAX facility has been crucial in securing COVID-19 vaccines. By March 2022, Vietnam had received over 20 million doses through COVAX, enhancing its ability to vaccinate its population rapidly and efficiently, highlighting the importance of global collaboration.

- Introduction of New Vaccines: The government has introduced new vaccines into the national immunization program, such as the HPV vaccine to prevent cervical cancer. This initiative, started in 2020, aims to vaccinate 1.2 million girls annually, addressing a significant public health issue and expanding the scope of immunization efforts.

Vietnam Vaccine Future Market Outlook

The Vietnam Vaccine Market is expected to show a significant growth driven by government immunization programs, the growing prevalence of infectious diseases, increasing healthcare spending, and advancements in vaccine research and development.

Factors Influencing Growth

- Sustainability Focus: Vaccine production is poised to increasingly adopt eco-friendly methods to reduce carbon emissions and environmental impact, aligning with global sustainability goals. This shift includes implementing renewable energy sources and biodegradable packaging to minimize ecological footprint.

- Technological Advancements: Innovations like mRNA vaccines and personalized vaccine development are set to advance disease prevention capabilities. The rapid development and high efficacy of COVID-19 mRNA vaccines, such as Pfizer-BioNTech's, illustrate this progress, paving the way for future vaccines with enhanced effectiveness and safety profiles.

- Government Support: Governments globally, including in Vietnam, will continue to provide substantial funding and initiatives to boost vaccine development and support immunization programs. This ongoing support aims to strengthen local production capacities, exemplified by efforts at VABIOTECH, ensuring a sustainable supply of vaccines to meet public health demands.

- Global Health Collaborations: Collaborations with WHO and UNICEF will bolster vaccine availability and distribution networks, promoting equitable access worldwide. These strategic partnerships will facilitate coordinated responses to health crises, ensuring prompt vaccine deployment in regions in need.

Scope of the Report

|

By Vaccine Type |

Pediatric Vaccines Adult Vaccines Travel Vaccines Others |

|

By Technology |

Live Attenuated Inactivated Subunit, Recombinant mRNA |

|

By Distribution Channel |

Public Sector Private Sector Online Pharmacies |

Products

Key Target Audience – Organizations and Entities Who Can Benefit by Subscribing This Report:

Pharmaceutical Companies

Healthcare Providers

Investors and Financial Institutions

Government Health Agencies

Public Health Advocacy Groups

Healthcare Consultants

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:Â

Sanofi

GlaxoSmithKline

Pfizer

Vietnam Vaccine Company (VNVC)

VABIOTECH

Merck & Co.

Johnson & Johnson

Medigen Vaccine Biologics Corp

Nanogen Pharmaceutical Biotechnology JSC

Institute of Vaccines and Medical Biologicals (IVAC)

AstraZeneca

Moderna

Bharat Biotech

Serum Institute of India

CSL Limited

Table of Contents

1. Vietnam Vaccine Market Overview

1.1 Vietnam Vaccine Market Taxonomy

2. Vietnam Vaccine Market Size (in USD Mn), 2018-2023

3. Vietnam Vaccine Market Analysis

3.1 Vietnam Vaccine Market Growth Drivers

3.2 Vietnam Vaccine Market Challenges and Issues

3.3 Vietnam Vaccine Market Trends and Development

3.4 Vietnam Vaccine Market Government Regulation

3.5 Vietnam Vaccine Market SWOT Analysis

3.6 Vietnam Vaccine Market Stake Ecosystem

3.7 Vietnam Vaccine Market Competition Ecosystem

4. Vietnam Vaccine Market Segmentation, 2023

4.1 Vietnam Vaccine Market Segmentation by Vaccine Type (in value %), 2023

4.2 Vietnam Vaccine Market Segmentation by Technology (in value %), 2023

4.3 Vietnam Vaccine Market Segmentation by Distribution Channel (in value %), 2023

5. Vietnam Vaccine Market Competition Benchmarking

5.1 Vietnam Vaccine Market Cross-Comparison (no. of employees, company overview, business strategy, USP, recent development, operational parameters, financial parameters and advanced analytics)

6. Vietnam Vaccine Future Market Size (in USD Mn), 2023-2028

7. Vietnam Vaccine Future Market Segmentation, 2028

7.1 Vietnam Vaccine Market Segmentation by Vaccine Type (in value %), 2028

7.2 Vietnam Vaccine Market Segmentation by Technology (in value %), 2028

7.3 Vietnam Vaccine Market Segmentation by Distribution Channel (in value %), 2028

8. Vietnam Vaccine Market Analysts’ Recommendations

8.1 Vietnam Vaccine Market TAM/SAM/SOM Analysis

8.2 Vietnam Vaccine Market Customer Cohort Analysis

8.3 Vietnam Vaccine Market Marketing Initiatives

8.4 Vietnam Vaccine Market White Space Opportunity Analysis

Contact Us

Research Methodology

Step: 1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information. Â

Step: 2 Market Building:

Collating statistics on Vietnam vaccine market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for Vietnam vaccine market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared. Â

Step: 3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives. Â

Step: 4 Research Output:

Our team will approach multiple vaccine suppliers and distributors companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from vaccine suppliers and distributors companies.Â

Frequently Asked Questions

01. How big is Vietnam Vaccine Market?

The Vietnam Vaccine Market was valued at USD 260 Mn in 2023 driven by increased immunization focus and rising healthcare expenditures.Â

02. What are the key challenges faced in Vietnam Vaccine Market?

The key challenges faced in Vietnam Vaccine Market are logistical issues in vaccine distribution, vaccine hesitancy among certain populations, high development costs, and stringent regulatory hurdles.Â

03. Who are some of the major players in the Vietnam Vaccine Market?

Some of the major players in the Vietnam Vaccine Market include Sanofi, GlaxoSmithKline, Pfizer, Vietnam Vaccine Company (VNVC), and VABIOTECH.Â

04. What are the key factors driving Vietnam vaccine market?

Major growth drivers are government immunization programs, the growing prevalence of infectious diseases, increasing healthcare spending, and advancements in vaccine research and development.Â

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.