Vietnam Vertical Farming Market Outlook to 2030

Region:Asia

Author(s):Mukul Soni

Product Code:KROD351

July 2024

82

About the Report

Vietnam Vertical Farming Market Overview

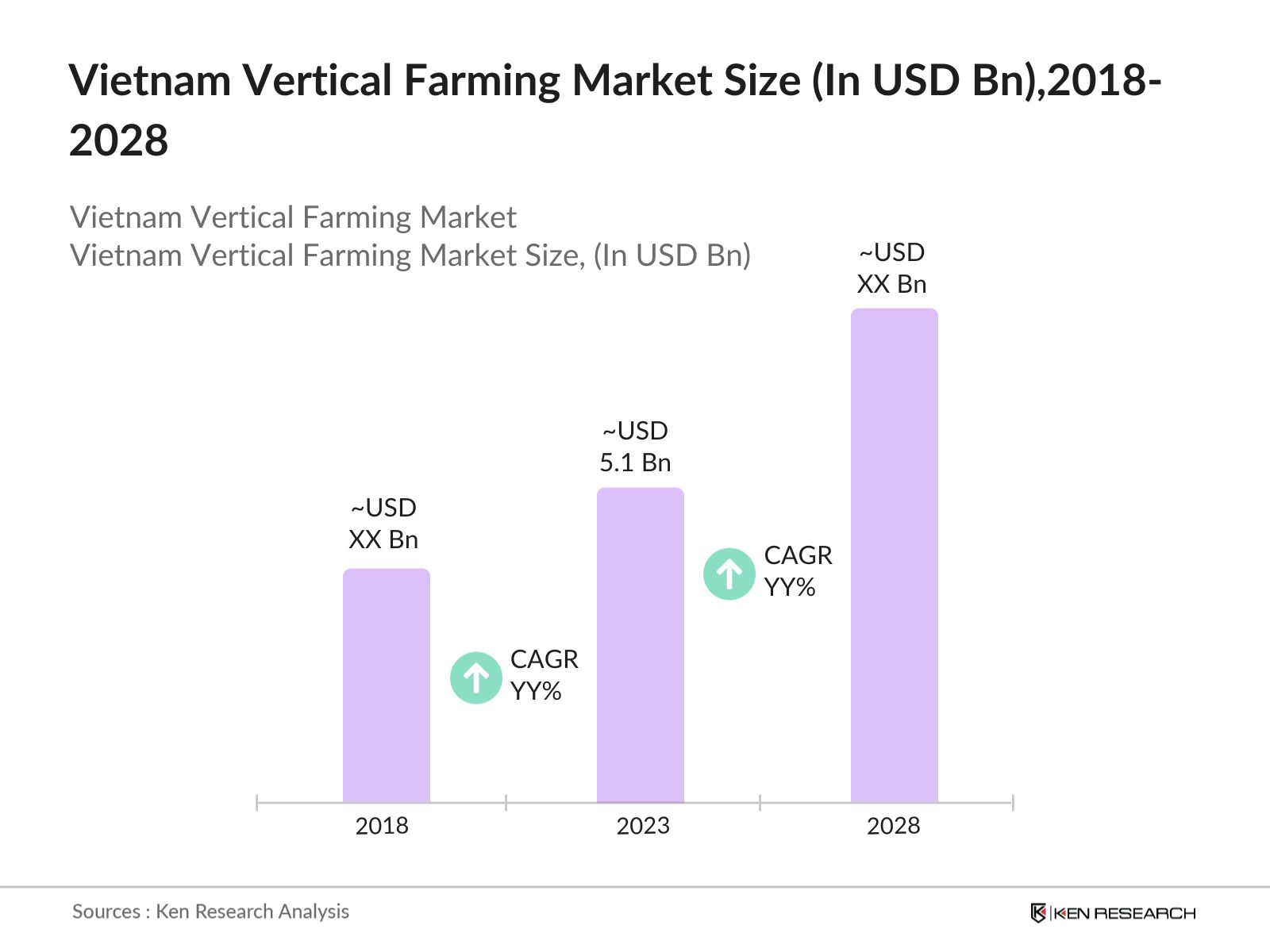

- The Global Vietnam vertical farming market was USD 5.1 billion in 2023 driven by increasing urbanization and the need for sustainable agriculture solutions. The rapid adoption of advanced farming techniques and government support further bolster the market.

- Leading players in the Vietnam vertical farming market include Vifarm, Agrifood Technologies, and CityFarm Vietnam. These companies are at the forefront of adopting cutting-edge technologies and expanding their production capacities.

- In 2023, Vifarm announced a strategic partnership with Agritech Solutions to enhance its technological capabilities and expand its market reach. This partnership aims to integrate advanced automation and AI technologies into Vifarm's vertical farming systems, potentially increasing their efficiency by 20%. This collaboration is expected to set a new standard in the vertical farming industry in Vietnam.

Vietnam Vertical Farming Market Analysis

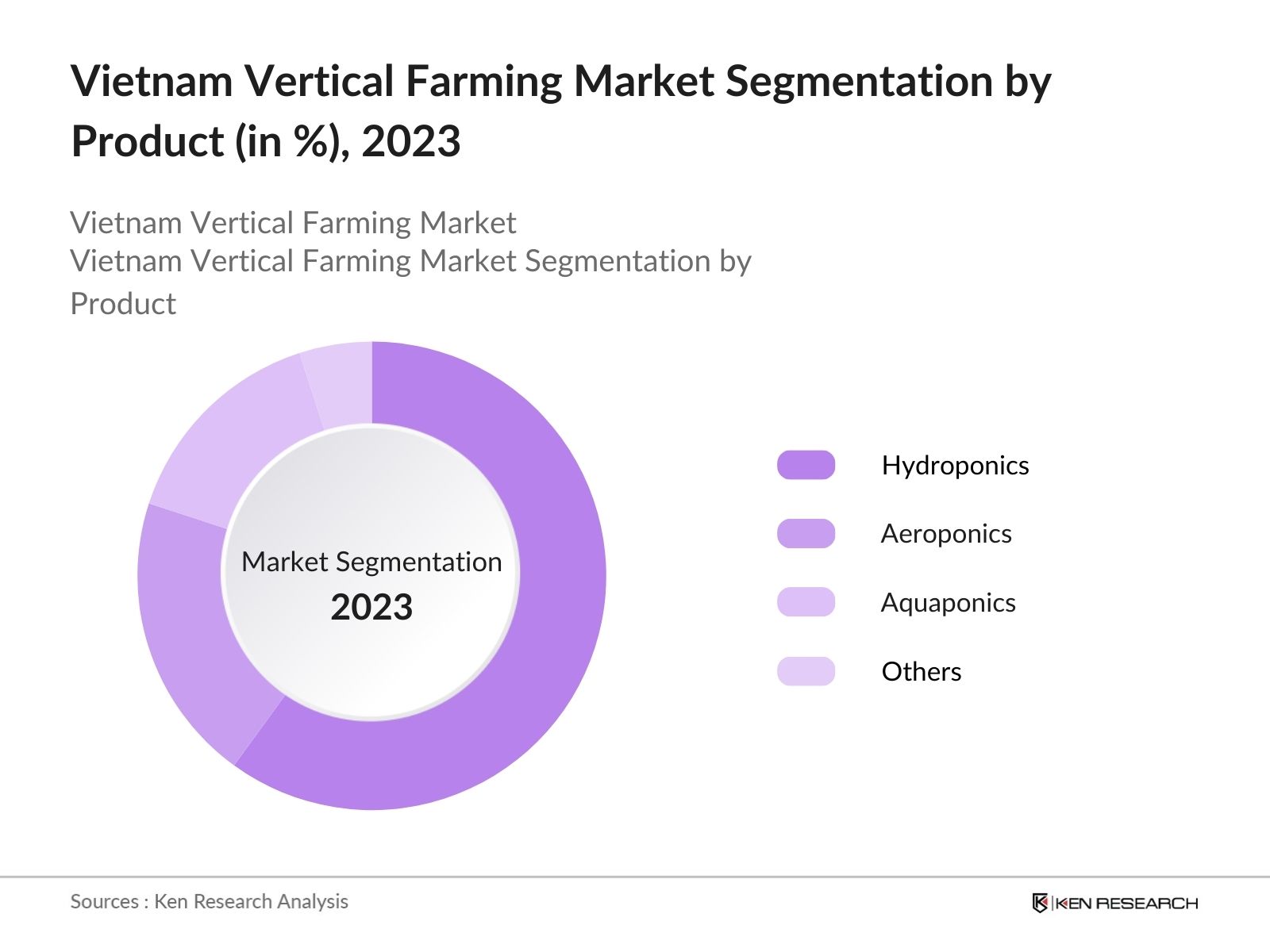

- Current SituationThe vertical farming market in Vietnam is experiencing robust growth, with hydroponics emerging as the leading product segment. This dominance is attributed to the high efficiency of hydroponic systems in utilizing water and nutrients, which makes them particularly suitable for urban farming environments. Hydroponics systems can yield crops faster and with greater efficiency than traditional farming methods, making them an attractive option for urban areas where space and resources are limited

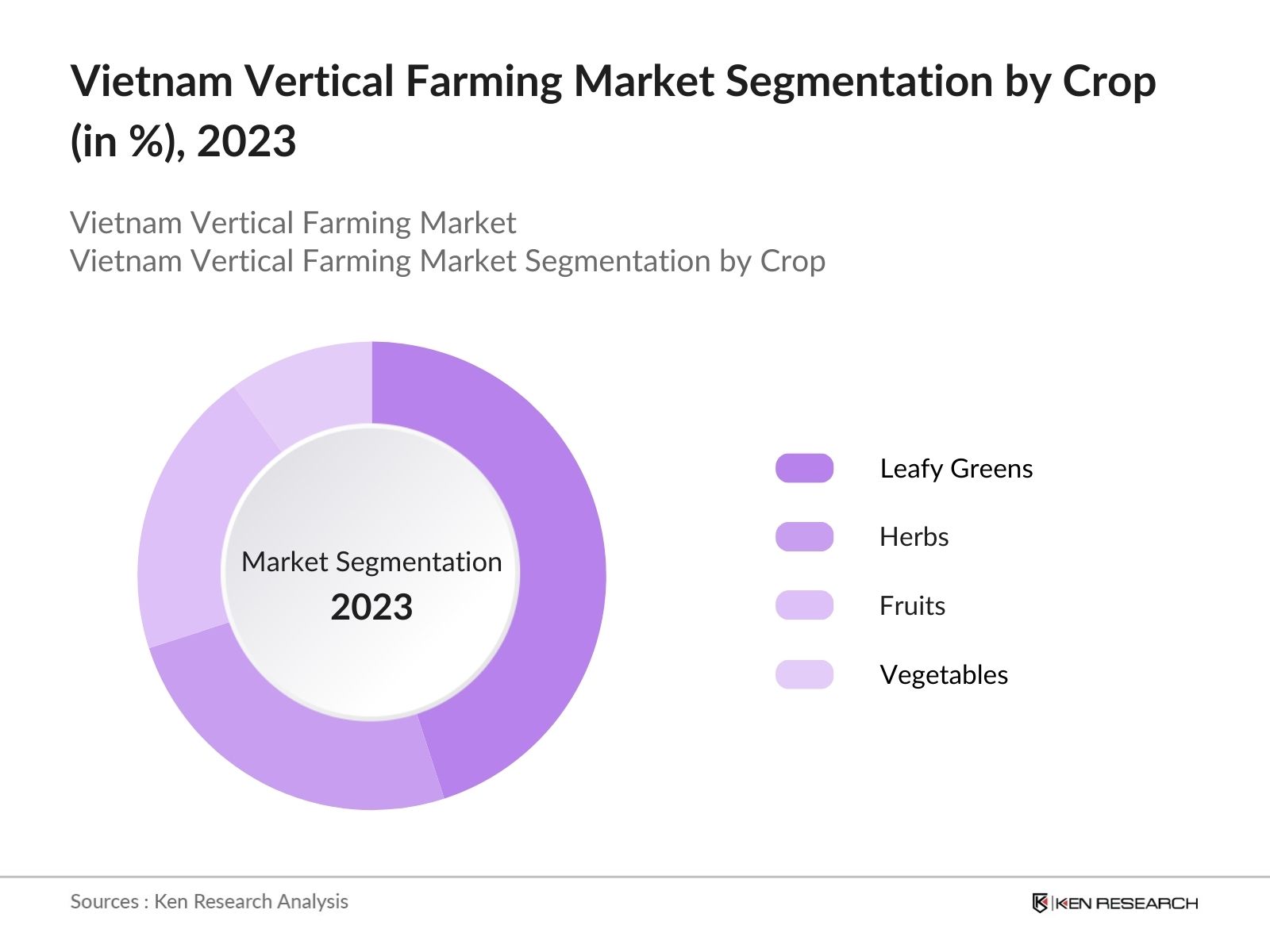

- Best-selling Product: Leafy greens, including lettuce and spinach, are the top-selling products in Vietnam's vertical farming market. These crops are favored due to their short growth cycles and high market demand in urban areas. The ability to produce multiple harvests within a year enhances their appeal. Leafy greens are a staple in many diets and are sought after for their freshness and nutritional value, which vertical farming can consistently provide

- Consumer Preferences: Vietnamese consumers are increasingly favoring pesticide-free, fresh, and locally grown produce. This trend is driving the demand for products from vertical farms, which can offer these qualities more reliably than traditional farming. Urban consumers, in particular, value the assurance of food safety and the environmental benefits associated with reduced pesticide use and shorter supply chains

Vietnam Vertical Farming Market Segmentation

The Vietnam Vertical Farming Market can be segmented by various factors like Product, Crop and Region

- By Product: Hydroponics dominates due to its efficient use of water and nutrients, ideal for urban settings. Aeroponics offers rapid growth and high yields by maximizing root oxygen exposure. Aquaponics integrates fish farming with plant cultivation, creating a sustainable ecosystem. Niche methods like vertical stacking and container farming also contribute to the market, providing flexible and scalable urban farming solutions.

- By Crop: Leafy greens thrive in controlled environments, meeting high consumer demand. Herbs are popular for culinary and medicinal uses. Fruits like strawberries and tomatoes benefit from advanced vertical farming technologies. Vegetables such as peppers and cucumbers also benefit from controlled growing conditions.

- By Region: Northern Vietnam, including Hanoi, benefits from government initiatives and agricultural innovation, with a cooler climate suitable for diverse crops. Southern Vietnam, led by Ho Chi Minh City, dominates the market due to high urbanization, modernization, and strong local demand for fresh produce. Central Vietnam is growing thanks to investments in agricultural technology and a favorable climate that supports diverse crop cultivation. Western Vietnam is emerging in vertical farming, focusing on sustainable practices and government initiatives to improve food security and reduce environmental impact.

Vietnam Vertical Farming Market Competitive Landscape

|

Company Name |

Establishment Year |

Headquarters |

|

Vifarm |

2015 |

Ho Chi Minh City |

|

Agrifood Technologies |

2010 |

Hanoi |

|

CityFarm Vietnam |

2013 |

Da Nang |

|

Urban Green Co. |

2016 |

Ho Chi Minh City |

|

Fresh City Farms |

2012 |

Hanoi |

The competitive landscape of Vietnam Vertical Farming Market can be summed up in the following way:

- Vifarm: In 2023, Vifarm reported a 25% increase in production capacity due to the implementation of automated hydroponic systems. This technological advancement has allowed them to produce a significant volume of leafy greens, meeting the growing demand for fresh, pesticide-free produce in urban areas. Vifarm's strategic partnership with Agritech Solutions in 2023 aims to further enhance their technological capabilities and expand their market reach.

- Agrifood Technologies: In 2022, Agrifood Technologies invested USD 5 million in a new research facility dedicated to improving hydroponic and aeroponic systems. This investment has led to innovations that increase crop yields by 30%, positioning Agrifood Technologies as a key player in the market.

- City Farm Vietnam: The company has gained popularity for its smart hydroponic systems designed for urban households. In 2023, CityFarm Vietnam introduced a new line of home hydroponic kits that saw a 40% increase in sales within the first six months of launch. These kits are designed to be user-friendly and efficient, allowing consumers to grow fresh produce at home. CityFarm Vietnam's focus on consumer-centric products and urban farming solutions has made them a prominent player in the Vietnam vertical farming market.

Vietnam Vertical Farming Market Analysis

Vietnam Vertical Farming Market Growth Drivers

- Government Support: The Vietnamese government is boosting the vertical farming market through promotion of sustainable agriculture practices, primarily via subsidies and grants. According to the Ministry of Agriculture and Rural Development, these initiatives have resulted in a 30% increase in the adoption of vertical farming technologies over the past five years.

- Urban Population: Vietnam's rapid urbanization is significantly driving the growth of the vertical farming market. As of 2024, over 37% of the population resides in urban areas, and this number is expected to rise steadily. The increasing urban population has led to higher demand for fresh and locally sourced produce, which is challenging to meet through traditional farming methods due to space constraints.

- Consumer Demand for Fresh and Local Produce: This trend is driven by increasing health consciousness and awareness of the environmental impact of traditional farming methods. Vertical farming addresses these concerns by providing a reliable source of fresh and safe produce year-round. For example, a survey conducted in 2024 indicated that 70% of urban consumers in Vietnam prefer purchasing locally grown vegetables, highlighting the market potential for vertical farming to meet this demand.

Vietnam Vertical Farming Market Challenges

- High Initial Setup Costs: The costs associated with purchasing and installing advanced equipment, such as hydroponic systems and LED lighting, can be prohibitively expensive for small and medium-sized enterprises. For instance, the average cost of setting up a small-scale vertical farm in Vietnam ranges between USD 100,000 to USD 200,000, making it difficult for many farmers to adopt this technology without substantial financial support.

- Energy Consumption: This high energy consumption can lead to increased operational costs and raise concerns about the environmental sustainability of vertical farming. Energy expenses account for approximately 30% of the total operational costs in vertical farming operations in Vietnam, highlighting the need for more energy-efficient solutions and renewable energy sources to mitigate this challenge.

- Skilled Labor Shortage: The adoption of vertical farming technologies requires a workforce with specialized skills and knowledge in advanced agricultural practices and technologies. However, there is a shortage of skilled labor in Vietnam capable of operating and managing these sophisticated systems.

Vietnam Vertical Farming Market Government Initiatives

- Subsidies and Grants (2021): The Vietnamese government introduced a series of subsidies and grants to promote the establishment of vertical farms as part of its sustainable agriculture strategy. These financial incentives are designed to reduce the initial setup costs, which can be prohibitively high for many farmers. By covering up to 50% of the setup costs, these subsidies make it more feasible for farmers to invest in advanced vertical farming systems. these initiatives have resulted in a 20% increase in the number of vertical farms established over the past two years.

- Research Funding (2022): The Ministry of Science and Technology announced a substantial increase in funding for research in advanced farming technologies and sustainable practices. This funding aims to drive innovation in vertical farming systems, focusing on areas such as hydroponics, aeroponics, and energy-efficient LED lighting. The increased research funding is expected to enhance the efficiency and productivity of vertical farming, making it a more viable and attractive option for agricultural production. For instance.

- Public Awareness Campaigns (2021): The government launched comprehensive public awareness campaigns to promote the benefits of vertical farming and encourage its adoption among farmers and the general public. These campaigns are aimed at highlighting the advantages of vertical farming, such as increased crop yields, reduced resource consumption, and the production of fresh, pesticide-free produce.

Vietnam Vertical Farming Market Outlook

The Vietnam Vertical Farming Market is expected to continue its growth in the coming years. The market is also expected to see a shift towards more organized retail, with established players and online platforms expanding their reach.

Future Market Trends

- Integration of IoT and AI: From 2024 to 2028, the use of IoT sensors and AI in vertical farming is expected to increase significantly. These technologies will enhance efficiency and productivity by providing real-time data on plant health, nutrient levels, and environmental conditions. AI algorithms will optimize resource use and predict crop growth patterns, making vertical farming more viable and attractive by reducing costs and improving yields. The continued advancement and affordability of these technologies will drive their adoption in the industry

- Expansion into Urban Areas: Between 2024 and 2028, there will be a growing trend of establishing vertical farms in urban centers to reduce transportation costs and improve the freshness of produce. As urbanization progresses, the demand for local food sources will increase, driving the expansion of urban vertical farms. This trend is supported by city planning initiatives that integrate sustainable practices into urban development. The proximity to consumers will result in fresher produce and a smaller carbon footprint

- Diversification of Crops: Over the next five years, there will be a significant diversification of crops grown in vertical farms, including fruits, herbs, and flowers. Initially focused on leafy greens, vertical farming will broaden its range due to consumer demand and advancements in farming technologies. This diversification will allow farmers to meet a wider range of market needs and reduce dependence on any single crop.

Scope of the Report

|

By Product |

Hydroponics Aeroponics Aquaponics Others |

|

By Crop |

Leafy Greens Herbs Fruits Vegetables |

|

By Region |

North South East West |

Products

Key Target Audience – Organizations and Entities Who Can Benefit by Subscribing This Report:

Urban Farmers

Government Agencies

Investors and Venture Capitalists

Academic and Research Institutions

Supermarkets

Retail Chains

Sustainable Agriculture Advocates

Urban Planners

Local Communities

Environmental NGOs

Agritech Startups

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:Â

Vifarm

Agrifood Technologies

CityFarm Vietnam

Urban Green Co.

Fresh City Farms

Greentech Vietnam

Smart Farms Ltd.

Hydroponic Solutions Inc.

Future Farms

EcoFarm Vietnam

VietAgritech

Green Leaf Agriculture

Advanced Farming Solutions

Urban Farms Co.

Vertical Growth Inc.

Table of Contents

1. Vietnam Vertical Farming Market Overview

1.1 Vietnam Vertical Farming Market Taxonomy

2. Vietnam Vertical Farming Market Size (in USD Million), 2018-2023

3. Vietnam Vertical Farming Market Analysis

3.1 Vietnam Vertical Farming Market Growth Drivers

3.2 Vietnam Vertical Farming Market Challenges and Issues

3.3 Vietnam Vertical Farming Market Trends and Development

3.4 Vietnam Vertical Farming Market Government Regulation

3.5 Vietnam Vertical Farming Market SWOT Analysis

3.6 Vietnam Vertical Farming Market Stake Ecosystem

3.7 Vietnam Vertical Farming Market Competition Ecosystem

4. Vietnam Vertical Farming Market Segmentation, 2023

4.1 Vietnam Vertical Farming Market Segmentation by Product Type (Value in %), 2023

4.2 Vietnam Vertical Farming Market Segmentation by Crop Type (Value In %), 2023

4.3 Vietnam Vertical Farming Market Segmentation by Region (Revenue In %), 2023

5. Vietnam Vertical Farming Market Competition Benchmarking

5.1 Vietnam Vertical Farming Market Cross-Comparison (Company overview, establishment year, headquarters, business strategy, USP, recent development,Â

operational parameters, financial parameters)

6. Vietnam Vertical Farming Future Market Size (in USD Million), 2023-2028

7. Vietnam Vertical Farming Future Market Segmentation, 2028

7.1 Vietnam Vertical Farming Market Segmentation by Product Type (Value in %), 2028

7.2 Vietnam Vertical Farming Market Segmentation by Crop Type (Value In %), 2028

7.3 Vietnam Vertical Farming Market Segmentation by Region (Revenue In %), 2028

8. Vietnam Vertical Farming Market Analysts’ Recommendations

8.1 Vietnam Vertical Farming Market TAM/SAM/SOM Analysis

8.2 Vietnam Vertical Farming Market Customer Cohort Analysis

8.3 Vietnam Vertical Farming Market Marketing Initiatives

8.4 Vietnam Vertical Farming Market White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.Â

Step 2 Market Building:

Collating statistics on Vietnam Vertical Farming Market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for Vietnam Vertical Farming Market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.Â

Step 3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry exerts belonging to different companies to validate statistics and seek operational and financial information from company representatives.Â

Step 4 Research output:

Our team will approach multiple Vertical Farming companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from Vertical Farming companies.Â

Frequently Asked Questions

01 What was the size of the Vietnam vertical farming market in 2023

The Vietnam vertical farming market was valued at USD 5.1 driven by increasing urbanization and the need for sustainable agriculture solutions.

02 Who are the leading players in the Vietnam vertical farming market

The Vietnam Vertical Farming Market Leading players include Vifarm, Agrifood Technologies, and CityFarm Vietnam, which are at the forefront of adopting cutting-edge technologies and expanding their production capacities.

03 What significant development occurred in the Vietnam vertical farming market in 2023

In 2023, Vifarm announced a strategic partnership with Agritech Solutions to enhance its technological capabilities and expand its market reach. This partnership aims to integrate advanced automation and AI technologies into Vifarm's vertical farming systems, potentially increasing their efficiency by 20%.

04 What are the current trends in the Vietnam vertical farming market

Current trends include a surge in demand for hydroponics and aeroponics systems, particularly in urban centers, driven by space constraints and the need for efficient food production.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.