Vietnam Video Game Market Outlook to 2030

Region:Asia

Author(s):Yogita Sahu

Product Code:KROD3936

October 2024

83

About the Report

Vietnam Video Game Market Overview

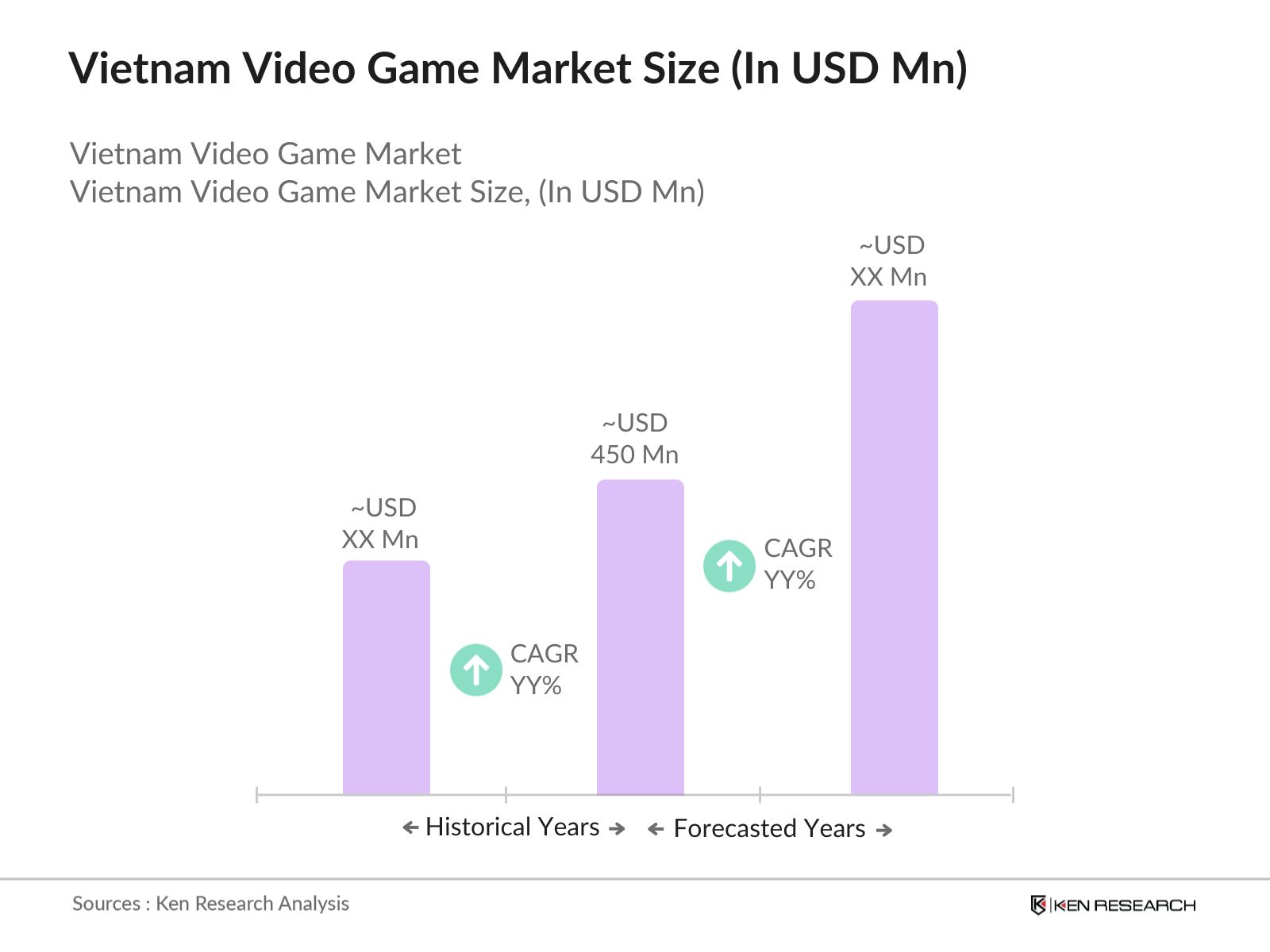

- The Vietnam video game market is valued at USD 450 million. This market size is driven primarily by the increasing adoption of mobile gaming, the surge in internet penetration, and the growing popularity of esports. The rapid rise of smartphones, particularly in urban areas, has made mobile gaming the dominant form of entertainment.

- In terms of regional dominance, Ho Chi Minh City and Hanoi lead the market. These cities dominate due to their higher purchasing power, urbanization, and advanced digital infrastructure. The concentration of tech-savvy youth in these cities also contributes to the high demand for gaming content, especially in the mobile and esports segments.

- The government has invested in educational programs and tech incubators focused on game development to enhance local capabilities. By 2025, these initiatives are expected to produce a more skilled workforce, with a goal of increasing the share of locally developed games in the market.

Vietnam Video Game Market Segmentation

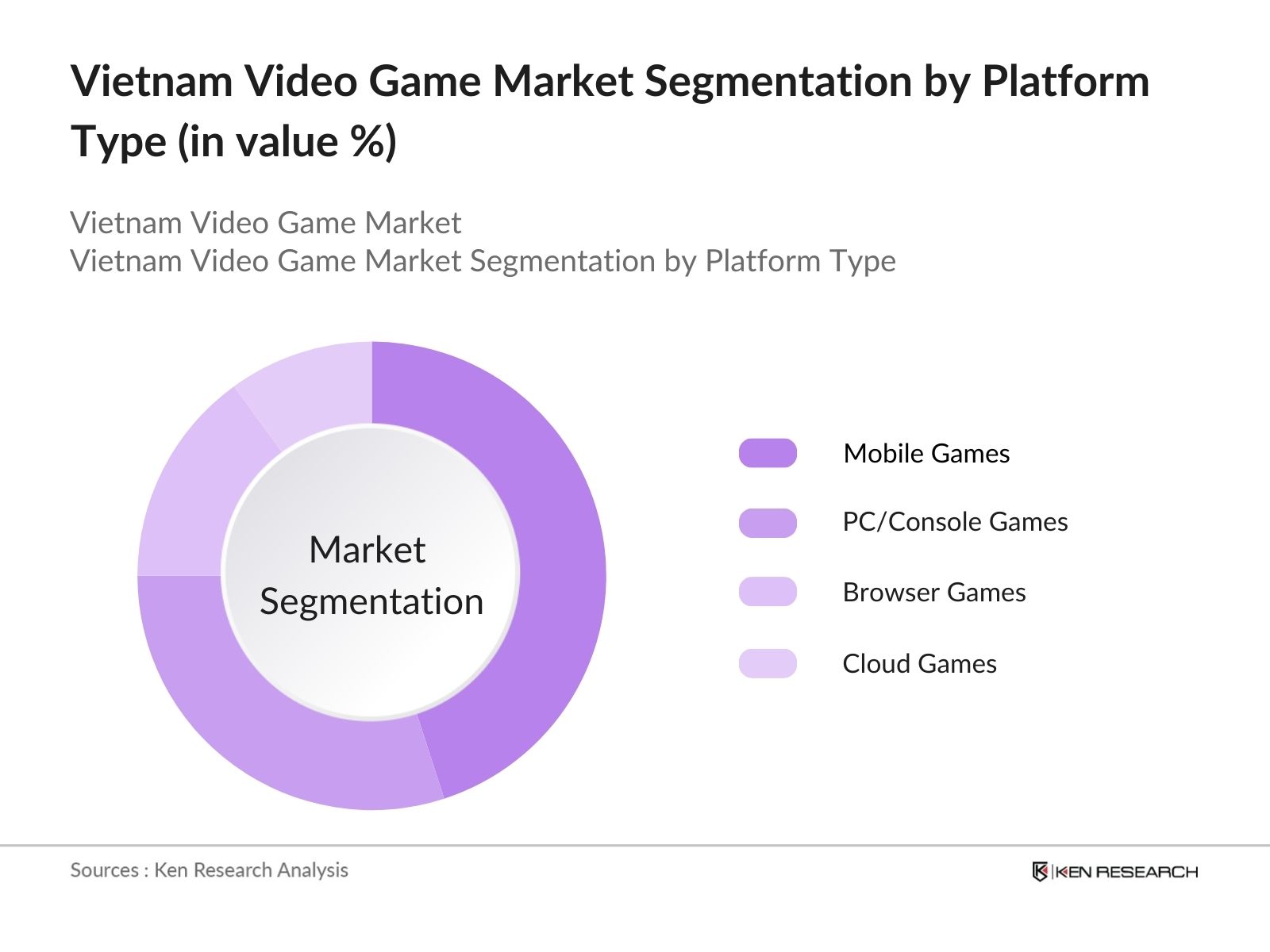

By Platform Type: The market is segmented by platform type into mobile games, PC/console games, browser games, and cloud games. Recently, mobile games have maintained a dominant market share in Vietnam due to the country's high smartphone penetration and affordable mobile data. Mobile games offer convenience, accessibility, and a wide variety of genres that cater to casual and hardcore gamers alike.

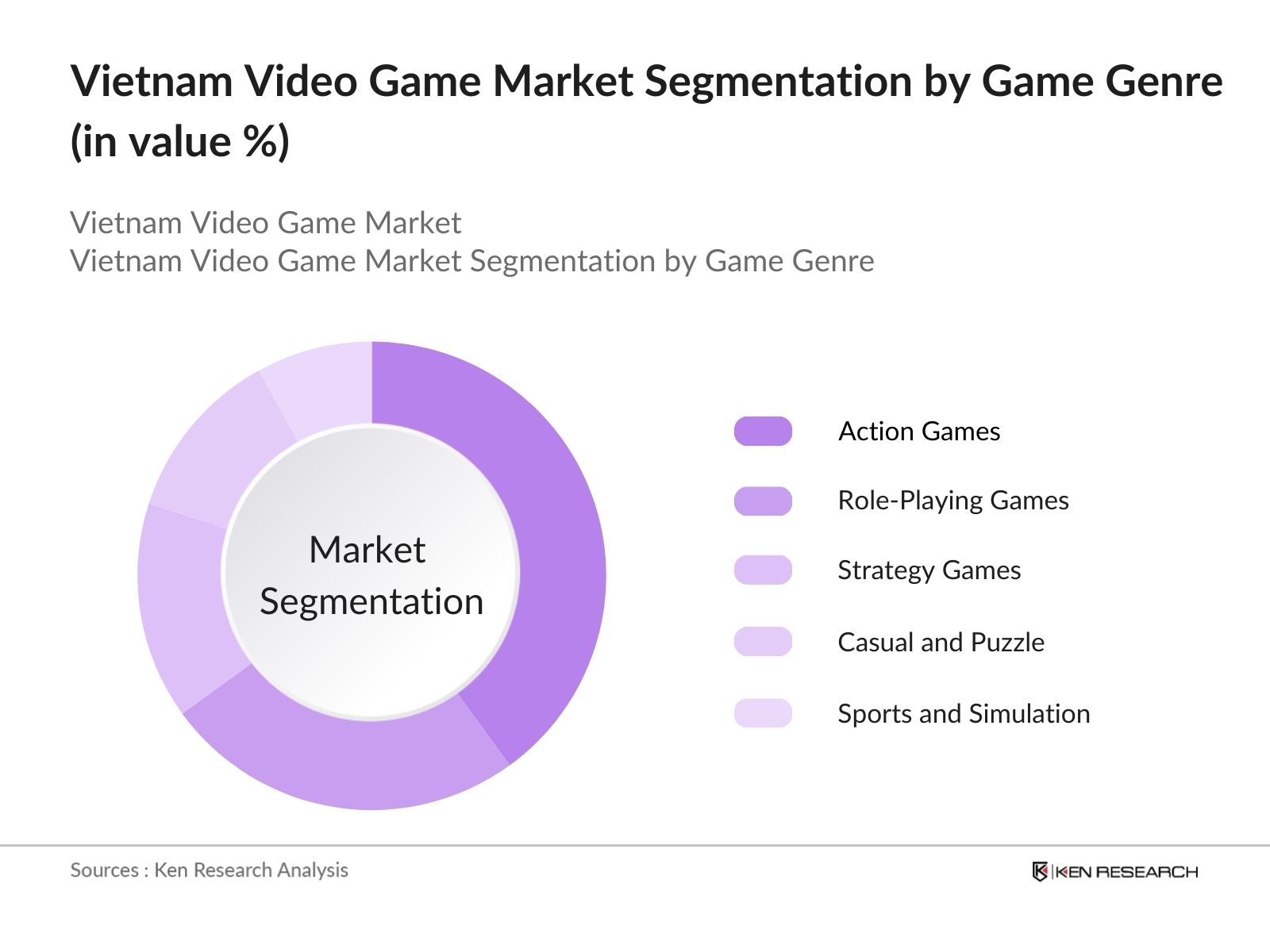

By Game Genre: The market is further segmented by game genre into action games, role-playing games (RPGs), strategy games, casual and puzzle games, and sports and simulation games. Action games currently dominate the market in terms of genre. Their popularity is driven by the high engagement and entertainment value they offer. Titles like Call of Duty Mobile and League of Legends attract a large audience due to their competitive nature, multiplayer features, and vibrant esports ecosystems.

Vietnam Video Game Market Competitive Landscape

The market is dominated by a mix of local and global players, with leading companies like VNG Corporation, Garena, and Appota. The market exhibits strong consolidation, as these key players continue to influence market trends, particularly in the mobile gaming and esports sectors.

|

Company |

Establishment Year |

Headquarters |

Market Reach |

Key Game Titles |

Revenue Generation |

Technology Stack |

Esports Presence |

Localization Strategy |

Mobile Focus |

|

VNG Corporation |

2004 |

Ho Chi Minh City, VN |

|||||||

|

Garena (Sea Group) |

2009 |

Singapore |

|||||||

|

Appota |

2011 |

Hanoi, VN |

|||||||

|

Gamota |

2012 |

Hanoi, VN |

|||||||

|

Funtap |

2013 |

Ho Chi Minh City, VN |

Vietnam Video Game Market Analysis

Market Growth Drivers

- Expanding Mobile Gaming Sector: The number of mobile gamers driven by affordable smartphones and low-cost data plans. The rising availability of mobile phones in both urban and rural areas is expected to push the number of mobile gamers to over 50 million by 2025. With games accounting for over 60% of app downloads on mobile platforms, the sector is experiencing rapid growth, supported by increasing internet penetration of over 73 million users.

- Esports Popularity and Investments: Vietnam has a substantial esports player base, with 18 million out of 40 million gamers actively participating in esports events. By 2025, this number is forecasted to grow as investment from both domestic and foreign companies intensifies. Esports games are now among the most downloaded in the country, supported by large-scale tournaments and a growing culture of competitive gaming.

- Foreign Game Developers' Interest: Around 80% of games consumed in Vietnam come from international developers, primarily from China and Korea. Due to the country's young population and gaming culture, foreign game publishers are increasingly investing in joint ventures with local developers to expand their presence. By 2025, Vietnam is set to attract even more foreign investment, partly due to relaxed publishing regulations.

Market Challenges

- Piracy and Intellectual Property (IP) Concerns: Vietnam's game industry continues to struggle with piracy and IP violations. Around 30% of games accessed in the country are pirated, which affects both domestic and international developers. Stricter enforcement of IP laws will be crucial in the coming years to attract global developers.

- Regulatory Hurdles for Foreign Investors: Although Vietnam has relaxed some regulations, foreign companies are still required to enter joint ventures, holding no more than 49% ownership in game development businesses. This complex licensing process, particularly for G1 games, remains a challenge, affecting the pace at which new games enter the market.

Vietnam Video Game Market Future Outlook

Over the next five years, the Vietnam video game industry is expected to experience strong growth driven by increasing mobile adoption, the rise of esports, and improved internet infrastructure. The government's push to digitalize rural areas will further expand the reach of mobile gaming.

Future Market Opportunities

- Increased Investment in Cloud Gaming: By 2027, cloud gaming is expected to gain traction in Vietnam due to improved 5G infrastructure and the increasing affordability of cloud services. Major players like Microsoft and Google are likely to invest heavily in cloud gaming platforms targeting Vietnam.

- Growth of VR and AR Gaming: Vietnam's VR and AR gaming market is projected to grow rapidly over the next five years, driven by technological advancements and the declining cost of VR hardware. By 2026, Vietnamese developers are expected to contribute to this segment, with local studios producing VR content for both domestic and international audiences.

Scope of the Report

|

Platform Type |

Mobile Games PC/Console Games Browser Games Cloud Games |

|

Game Genre |

Action Games RPGs Strategy Games Casual Games Sports Games |

|

Business Model |

Free-to-play (F2P) Subscription-based Premium Games In-game Purchases |

|

Age Group |

Children (Under 12) Teens (13-18) Young Adults (19-35) Adults (36+) |

|

Region |

North East West South |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Investors and venture capital firms

Government and regulatory bodies (Ministry of Information and Communications, Vietnam Esports Association)

Telecommunications companies

Gaming hardware manufacturers

Payment service providers

Banks and Financial Institution

Private Equity Firms

Companies

Players Mentioned in the Report:

VNG Corporation

Garena (Sea Group)

Appota

Gamota

Funtap

VTC Game

SohaGame

Riot Games Vietnam

Ubisoft Vietnam

Studio DIC

G2 Esports Vietnam

Amanotes

Devgame

GamelandVN

Vietnam Esports (Vesco)

Table of Contents

1. Vietnam Video Game Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Vietnam Video Game Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Vietnam Video Game Market Analysis

3.1. Growth Drivers (Market penetration of smartphones, internet infrastructure, localization of game content)

3.1.1. Rising Mobile Gaming Adoption

3.1.2. Internet and 5G Penetration

3.1.3. Growth of Esports

3.1.4. Increased Smartphone Usage

3.2. Market Challenges (High cost of game development, piracy, regulatory constraints)

3.2.1. Piracy Issues

3.2.2. Stringent Government Regulations

3.2.3. High Competition from Global Developers

3.2.4. Infrastructure Challenges in Rural Areas

3.3. Opportunities (Local game development, government support, esports expansion)

3.3.1. Potential in Local Game Studios

3.3.2. Esports Growth and Investment

3.3.3. Foreign Investment Opportunities

3.3.4. Emerging VR and AR Markets

3.4. Trends (Esports, mobile gaming, streaming platforms)

3.4.1. Growing Popularity of Esports

3.4.2. Rise of Streaming and Gaming Content Creators

3.4.3. Growth in Cloud Gaming

3.4.4. Focus on Mobile Gaming

3.5. Government Regulations (Online game approval process, localization policies)

3.5.1. Vietnamese Online Game Regulatory Framework

3.5.2. Content Localization Requirements

3.5.3. Restrictions on Game Violence

3.5.4. Licensing for Online and Foreign Developers

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Local game developers, publishers, distributors, esports organizers)

3.8. Porters Five Forces (Buyer power, supplier power, threat of new entrants, threat of substitutes, industry rivalry)

3.9. Competitive Ecosystem (Key domestic players, international game studios, and esports platforms)

4. Vietnam Video Game Market Segmentation

4.1. By Platform Type (In Value %)

4.1.1. Mobile Games

4.1.2. PC/Console Games

4.1.3. Browser Games

4.1.4. Cloud Games

4.2. By Game Genre (In Value %)

4.2.1. Action Games

4.2.2. Role-playing Games (RPGs)

4.2.3. Strategy Games

4.2.4. Casual and Puzzle Games

4.2.5. Sports and Simulation Games

4.3. By Business Model (In Value %)

4.3.1. Free-to-play (F2P)

4.3.2. Subscription-based

4.3.3. Premium/Paid Games

4.3.4. In-game Purchases (Microtransactions)

4.4. By Age Group (In Value %)

4.4.1. Children (Under 12)

4.4.2. Teens (13-18)

4.4.3. Young Adults (19-35)

4.4.4. Adults (36 and above)

4.5. By Region (In Value %)

4.5.1. North

4.5.2. East

4.5.3. West

4.5.4. South

5. Vietnam Video Game Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. VNG Corporation

5.1.2. Garena Vietnam

5.1.3. GamelandVN

5.1.4. Gamota

5.1.5. Appota

5.1.6. Funtap

5.1.7. VTC Game

5.1.8. SohaGame

5.1.9. Vietnam Esports (Vesco)

5.1.10. Amanotes

5.1.11. Riot Games Vietnam

5.1.12. Ubisoft Vietnam

5.1.13. Studio DIC

5.1.14. Devgame

5.1.15. G2 Esports Vietnam

5.2. Cross Comparison Parameters (Number of Employees, Headquarters, Inception Year, Revenue, Local/Global Presence, Market Share, Key Products, Technology Expertise)

5.3. Market Share Analysis (Platform-specific market share, Genre-wise dominance)

5.4. Strategic Initiatives (Collaborations, game development deals, esports partnerships)

5.5. Mergers and Acquisitions (Local studio acquisitions, strategic partnerships with international firms)

5.6. Investment Analysis (Venture capital investments, private equity in game development)

5.7. Venture Capital Funding (Key investors in Vietnamese gaming startups)

5.8. Government Grants (Support for local developers, esports initiatives)

5.9. Private Equity Investments (Foreign investments in game development and esports)

6. Vietnam Video Game Market Regulatory Framework

6.1. Game Licensing Requirements (Government game approval, local servers)

6.2. Compliance with Content Regulations (Censorship, age restrictions)

6.3. Certification Processes (Game safety, data privacy, payment systems)

7. Vietnam Video Game Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth (Technological advancements, esports popularity, mobile-first market)

8. Vietnam Video Game Market Future Segmentation

8.1. By Platform Type (In Value %)

8.2. By Game Genre (In Value %)

8.3. By Business Model (In Value %)

8.4. By Age Group (In Value %)

8.5. By Region (In Value %)

9. Vietnam Video Game Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives (Influencer marketing, local game promotions)

9.4. White Space Opportunity Analysis (Untapped market segments, genres, rural penetration)

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The research process begins by mapping out the video game ecosystem in Vietnam, identifying key players, platforms, and genres. This step involves gathering secondary data from proprietary databases, industry reports, and government publications to define the critical variables affecting market dynamics, such as mobile adoption rates and internet infrastructure.

Step 2: Market Analysis and Construction

In this phase, historical market data for the Vietnam video game market is analyzed, including the growth of mobile games, revenue from esports, and in-app purchases. We also assess the competitive landscape, identifying market leaders and potential new entrants to understand the market structure and size.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and validated through interviews with gaming industry experts and professionals, including developers, publishers, and esports organizers. These insights provide a more detailed understanding of the competitive landscape, growth opportunities, and challenges in the Vietnam market.

Step 4: Research Synthesis and Final Output

Finally, the data collected is synthesized into a comprehensive report. This includes direct engagement with leading video game companies and the integration of top-down and bottom-up approaches to ensure that all market size estimates and growth projections are accurate and validated.

Frequently Asked Questions

01 How big is the Vietnam video game market?

The Vietnam video game market, valued at USD 450 million, is primarily driven by mobile gaming and the popularity of esports. The growth is supported by increased internet penetration and a tech-savvy young population.

02 What are the challenges in the Vietnam video game market?

Key challenges in the Vietnam video game market include regulatory restrictions, content localization requirements, and piracy issues. Additionally, the high cost of game development and competition from international companies pose significant hurdles for local developers.

03 Who are the major players in the Vietnam video game market?

Leading players in the Vietnam video game market include VNG Corporation, Garena, Appota, Gamota, and Funtap. These companies dominate through strong local presence, mobile-first strategies, and active involvement in esports.

04 What are the growth drivers of the Vietnam video game market?

The Vietnam video game market is propelled by increasing smartphone penetration, improved internet infrastructure, and the rise of esports. Additionally, government support for the digital economy and the expansion of 5G technology are key drivers.

05 What is the future of mobile gaming in Vietnam?

Mobile gaming is expected to continue dominating the Vietnam video game market, with advancements in cloud gaming and AR/VR technologies further enhancing user experiences. The rural expansion of digital infrastructure will also drive future growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.