Vietnam Water Purifier Market Outlook to 2030

Region:Asia

Author(s):Shivani

Product Code:KROD7049

October 2024

100

About the Report

Vietnam Water Purifier Market Overview

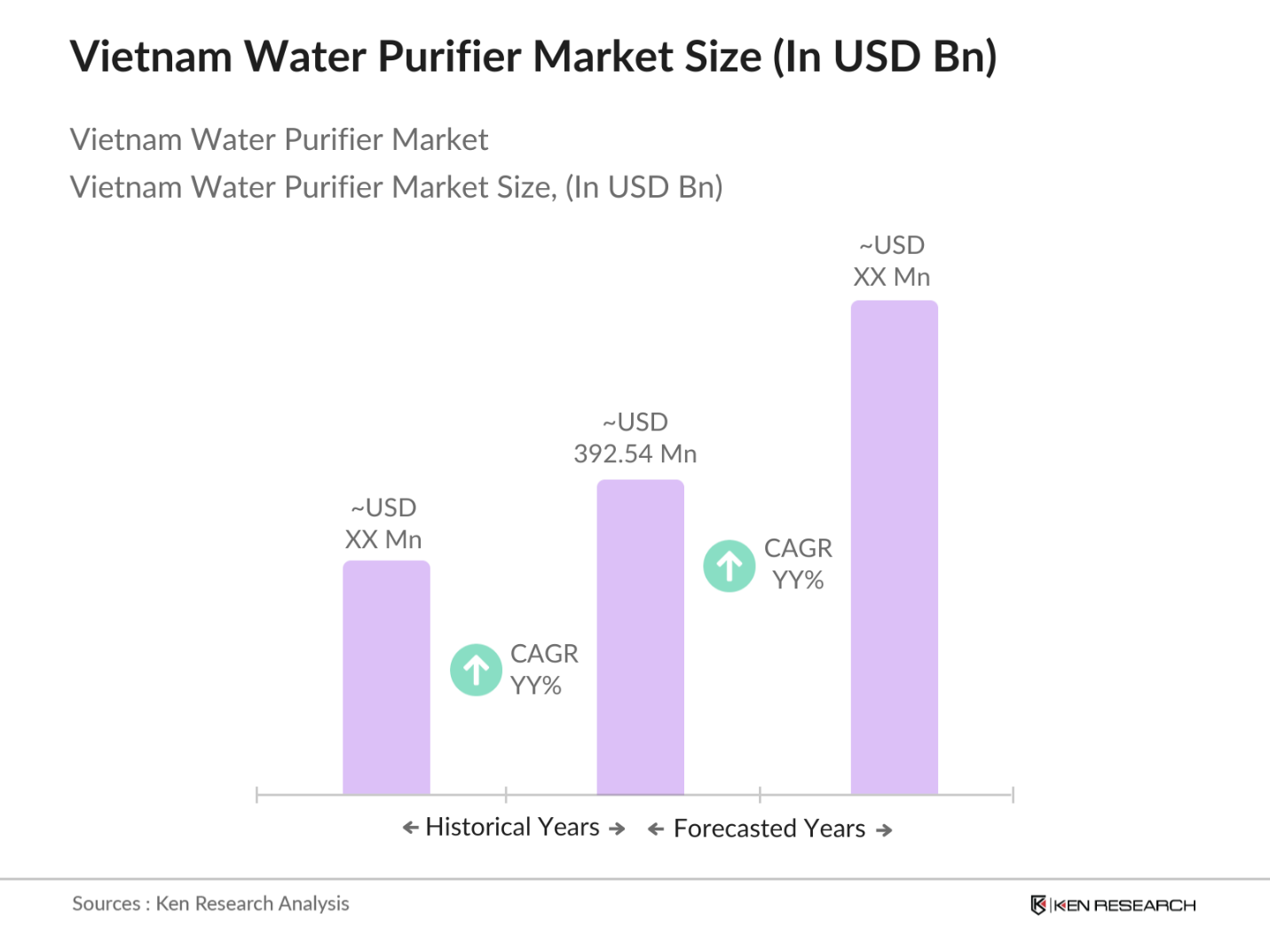

- The Vietnam Water Purifier market is valued at USD 392.54 million, driven by increasing health awareness and concerns about the quality of drinking water, particularly in urban areas. Rapid urbanization, combined with the governments push for clean water initiatives, has fueled demand for water purifiers across the country. Rising disposable incomes and the growing middle-class population are also major factors contributing to the expansion of this market.

- Cities like Ho Chi Minh City and Hanoi dominate the Vietnam water purifier market due to their dense population and better infrastructure for utility services. These cities face issues of water pollution due to industrial activities and urban sprawl, driving residents to adopt water purification technologies. Additionally, these regions have higher disposable incomes, allowing consumers to opt for advanced water purification systems. Rural areas, on the other hand, are gradually adopting basic filtration systems as affordability increases.

- The Vietnamese government requires all imported and locally manufactured water purifiers to undergo rigorous testing and certification processes. The Vietnam Standards and Quality Institute provides certification for purifiers that meet national water quality standards. These certifications help maintain product credibility in the market and ensure consumers have access to safe drinking water.

Vietnam Water Purifier Market Segmentation

By Product Type The Vietnam Water Purifier market is segmented by product type into UV Water Purifiers, RO Water Purifiers, and Gravity-Based Water Purifiers. RO Water Purifiers hold the dominant market share due to their ability to eliminate a wider range of contaminants, including harmful chemicals and heavy metals, which are commonly found in Vietnam's water supply. With the increasing need for better-quality drinking water, especially in urban areas where pollution is prevalent, RO technology has become the preferred choice. Households in major cities opt for RO purifiers, as these systems are effective against complex pollutants and are available in a range of prices, making them accessible to different income segments.

Scope of the Report

|

By Product Type |

UV Water Purifiers RO Water Purifiers Gravity-Based Water Purifiers |

|

By Application |

Residential Commercial Industrial |

|

By Technology |

Reverse Osmosis (RO) Ultraviolet (UV) Purification Gravity-Based Filtration |

|

By Distribution Channel |

Offline Retail Online Retail |

|

By Region |

North-East Midwest West Coast Southern States |

Products

Key Target Audience

Government and Regulatory Bodies (Ministry of Health, Ministry of Natural Resources and Environment)

Water Treatment Companies

Residential Appliance Distributors

Industrial Water Solutions Providers

Retail Chains (Supermarkets and E-commerce Platforms)

Investments and Venture Capitalist Firms

Real Estate Developers (Residential and Commercial Projects)

Non-Governmental Organizations (NGOs) Focused on Water Sanitation

Companies

Major Players

A.O. Smith Corporation

Panasonic Corporation

Karofi Group

Sunhouse Group

Kent RO Systems

Livpure Pvt. Ltd.

Coway Co., Ltd.

Eureka Forbes (Aquasure)

Pureit (Unilever)

BWT Holding GmbH

Culligan International

GE Appliances

Paragon Water Systems

Pentair plc

Midea Group

Table of Contents

1. Vietnam Water Purifier Market Overview

1.1. Definition and Scope

1.2. Market Structure and Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Vietnam Water Purifier Market Size (in USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Vietnam Water Purifier Market Analysis

3.1. Growth Drivers (Urbanization, Health Awareness, Infrastructure Development)

3.1.1. Rising Health Consciousness

3.1.2. Government Support for Clean Water Access

3.1.3. Expanding Urban Population

3.2. Market Challenges (High Product Costs, Low Awareness in Rural Areas)

3.2.1. Price Sensitivity Among Consumers

3.2.2. Water Quality Variability Across Regions

3.2.3. High Costs of Maintenance and Replacement Filters

3.3. Opportunities (Technological Innovations, Sustainable Water Solutions)

3.3.1. Growth in Smart Water Purification Systems

3.3.2. Adoption of UV & RO Technologies

3.3.3. Expansion into Untapped Rural Markets

3.4. Trends (Eco-Friendly Products, IoT-Enabled Purifiers)

3.4.1. Rise of IoT and Smart Purification Systems

3.4.2. Increasing Demand for Environmentally Sustainable Products

3.4.3. Growing E-Commerce Distribution Channels

3.5. Government Regulations (Water Standards, Import Tariffs, Local Manufacturing)

3.5.1. Water Quality Regulations and Standards

3.5.2. Certification Requirements for Water Purifiers

3.5.3. Import Duties and Incentives for Local Manufacturing

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Landscape

4. Vietnam Water Purifier Market Segmentation

4.1. By Product Type (in Value %)

4.1.1. UV Water Purifiers

4.1.2. RO Water Purifiers

4.1.3. Gravity-Based Water Purifiers

4.2. By Application (in Value %)

4.2.1. Residential

4.2.2. Commercial

4.2.3. Industrial

4.3. By Technology (in Value %)

4.3.1. Reverse Osmosis (RO)

4.3.2. Ultraviolet (UV) Purification

4.3.3. Gravity-Based Filtration

4.4. By Distribution Channel (in Value %)

4.4.1. Offline Retail

4.4.2. Online Retail

4.5. By Region (in Value %)

4.5.1. North Vietnam

4.5.2. Central Vietnam

4.5.3. South Vietnam

5. Vietnam Water Purifier Market Competitive Analysis

5.1. Detailed Profiles of Major Competitors

5.1.1. A. O. Smith Corporation

5.1.2. Kent RO Systems

5.1.3. Coway Co., Ltd.

5.1.4. Pureit (Unilever)

5.1.5. Panasonic Corporation

5.1.6. AquaSure (Eureka Forbes)

5.1.7. Karofi Group

5.1.8. Sunhouse Group

5.1.9. GE Appliances

5.1.10. Paragon Water Systems

5.1.11. Livpure Pvt. Ltd.

5.1.12. BWT Holding GmbH

5.1.13. Culligan International

5.1.14. Midea Group

5.1.15. Pentair plc

5.2. Cross Comparison Parameters (Revenue, Market Share, Regional Presence, Technology Integration, Product Portfolio, Product Innovation, Environmental Sustainability, Customer Satisfaction)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Partnerships, Collaborations, Product Launches)

5.5. Mergers and Acquisitions

5.6. Investment Analysis (Private Equity, Venture Capital)

5.7. Government Grants and Incentives for Local Manufacturing

5.8. R&D Expenditure and Product Development

6. Vietnam Water Purifier Market Regulatory Framework

6.1. Environmental Standards (Water Quality Standards)

6.2. Compliance and Certification Requirements

6.3. Incentives for Local Manufacturing

6.4. Trade Regulations and Tariffs

7. Vietnam Water Purifier Future Market Size (in USD Bn)

7.1. Future Market Growth Projections

7.2. Key Drivers of Future Growth

8. Vietnam Water Purifier Future Market Segmentation

8.1. By Product Type (in Value %)

8.2. By Application (in Value %)

8.3. By Technology (in Value %)

8.4. By Distribution Channel (in Value %)

8.5. By Region (in Value %)

9. Vietnam Water Purifier Market Analysts Recommendations

9.1. Total Addressable Market (TAM) Analysis

9.2. Serviceable Available Market (SAM) Analysis

9.3. Serviceable Obtainable Market (SOM) Analysis

9.4. Product Positioning and Marketing Strategies

9.5. White Space and Growth Opportunities

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map for the Vietnam Water Purifier market. Desk research, utilizing proprietary databases and government reports, is conducted to gather industry-level information. The primary goal is to identify and define key market variables such as consumer behavior, water quality issues, and product types.

Step 2: Market Analysis and Construction

In this phase, historical data is compiled and analyzed to assess market penetration and revenue generation. Further evaluations are made for product performance and distribution channels. This process ensures a deep understanding of consumer preferences and product success in different regions of Vietnam.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses regarding the market are developed and validated through interviews with industry experts. These interviews provide operational and financial insights from companies, which help refine the market data and validate key assumptions about demand and product effectiveness.

Step 4: Research Synthesis and Final Output

The final step involves synthesizing the data and conducting further engagement with manufacturers to gain insights into consumer preferences and market trends. This engagement confirms the accuracy of the revenue estimates and market forecasts, leading to the production of a comprehensive report.

Frequently Asked Questions

1 How big is the Vietnam Water Purifier Market?

The Vietnam Water Purifier market is valued at USD 392.54 million, driven by urbanization, increasing awareness about waterborne diseases, and growing middle-class disposable incomes.

2 What are the challenges in the Vietnam Water Purifier Market?

Challenges in the Vietnam Water Purifier market include high initial product costs, low awareness in rural areas, and the variability of water quality across different regions, which requires different purification technologies.

3 Who are the major players in the Vietnam Water Purifier Market?

Major players in the Vietnam Water Purifier market include A.O. Smith Corporation, Panasonic Corporation, Karofi Group, Sunhouse Group, and Kent RO Systems, among others.

4 What are the growth drivers of the Vietnam Water Purifier Market?

Key growth drivers include rising health awareness, government initiatives to provide clean drinking water, and increasing urbanization, which has led to higher demand for advanced water purification systems.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.