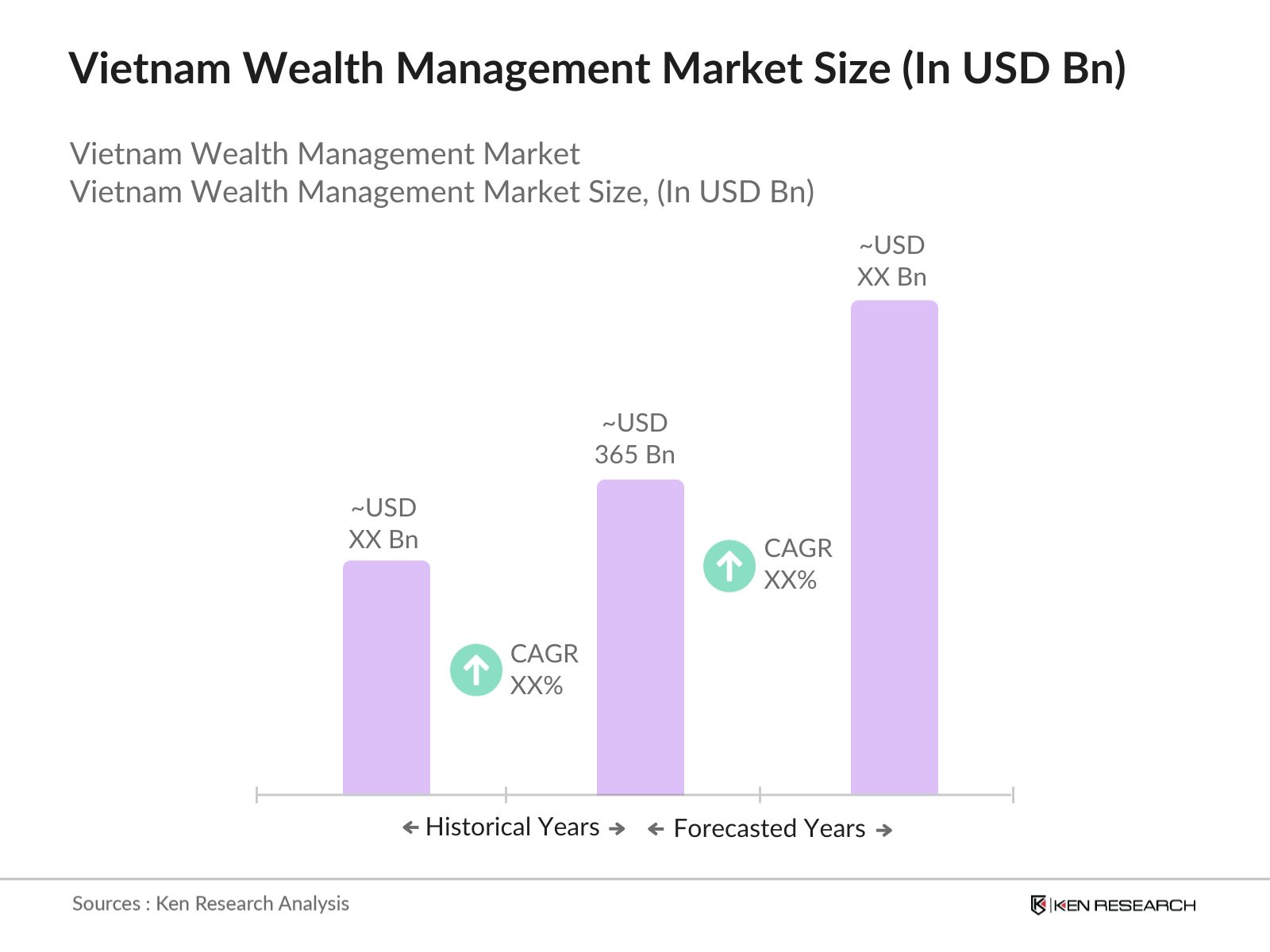

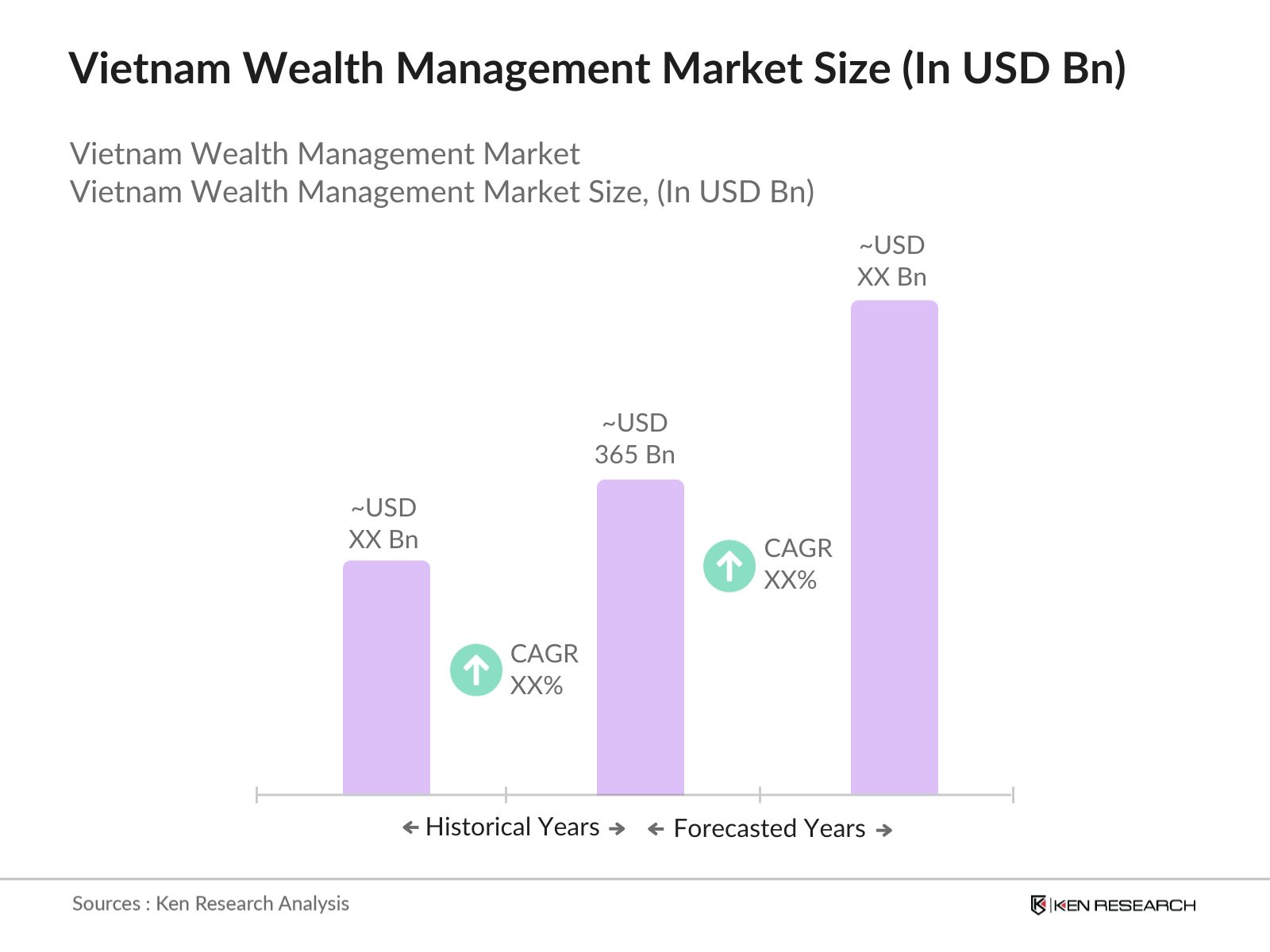

Vietnam Wealth Management Market Overview

- The Vietnam Wealth Management Market was valued at USD 365 billion, based on a five-year historical analysis. This growth is primarily driven by FinTech innovations improving financial access, regulatory reforms modernizing capital markets, and increasing financial literacy among tech-savvy younger generations.

- Ho Chi Minh City and Hanoi dominate the market due to their concentration of 19,500 millionaires and proximity to 85% of Vietnam's high-net-worth individuals. These urban centers attract digital-first wealth management platforms offering mobile trading apps and robo-advisory services tailored to Vietnam's median age of 32.

- Regulatory improvements include draft circulars on digital KYC procedures and proposed sandbox frameworks for blockchain-based asset tokenization. The State Securities Commission has enhanced investor protection through revised disclosure requirements for structured products and mandatory risk-rating systems for investment instruments.

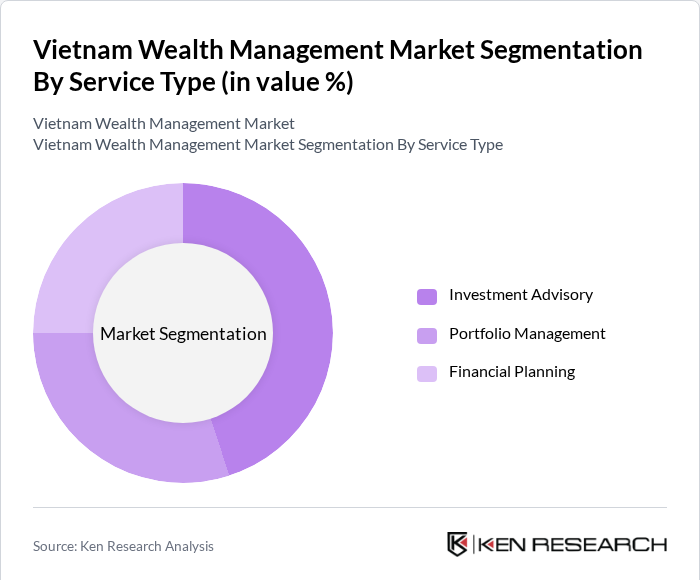

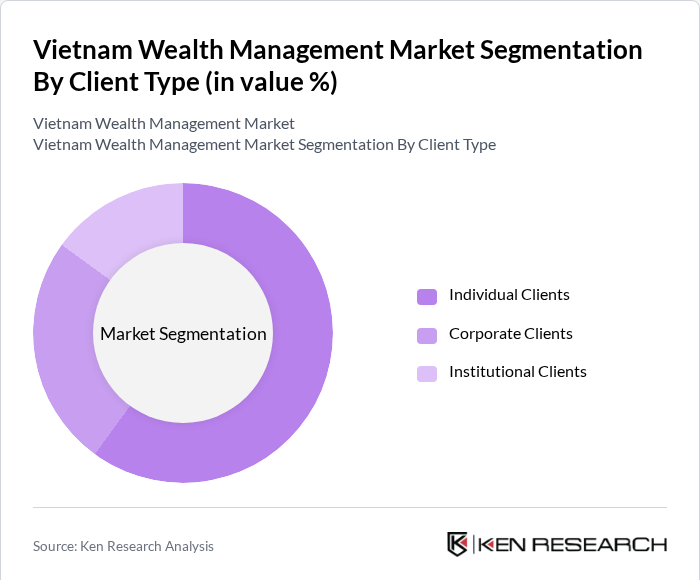

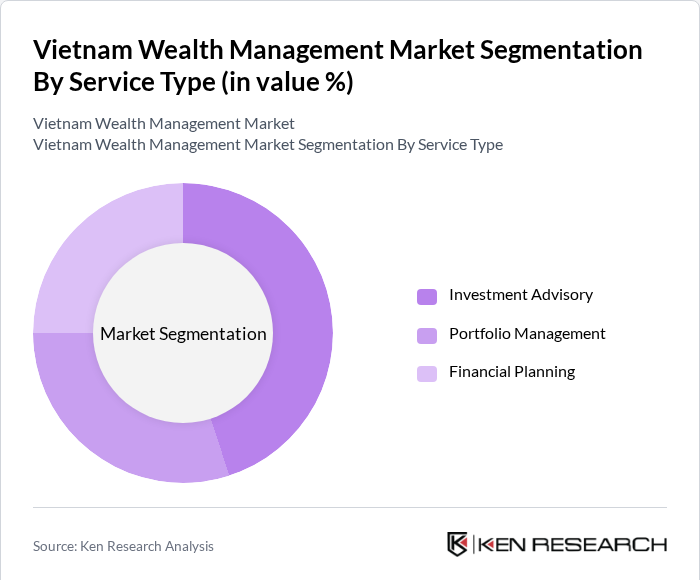

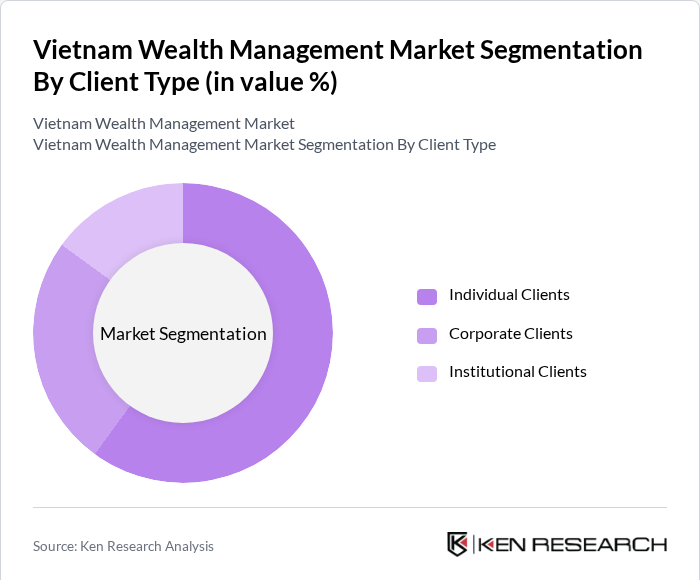

Vietnam Wealth Management Market Segmentation

By Service Type: The market is segmented into investment advisory, portfolio management, and financial planning services. Investment advisory dominates as more Vietnamese investors seek tailored guidance on asset allocation, risk management, and market entry strategies. Local advisory firms and global private banks have expanded their on-the-ground research teams to advise clients on equities, fixed income, and emerging sectors such as fintech and renewable energy. This emphasis on advisory reflects growing financial literacy, the emergence of first-generation affluents, and rising demand for proactive, research-driven recommendations rather than one-size-fits-all investment solutions.

By Client Type: The market is segmented into individual clients, corporate clients, and institutional clients. Individual clients dominate as rising salaries, urbanization, and expanding middle-income cohorts in Ho Chi Minh City, Hanoi, and Da Nang drive demand for wealth management. Retail investors increasingly allocate disposable income to mutual funds, equity portfolios, and managed accounts through local banks and fintech platforms. Enhanced digital onboarding, consumer awareness campaigns about retirement planning, and a proliferation of online research tools have further cemented the individual segment’s leadership over corporate and institutional mandates.

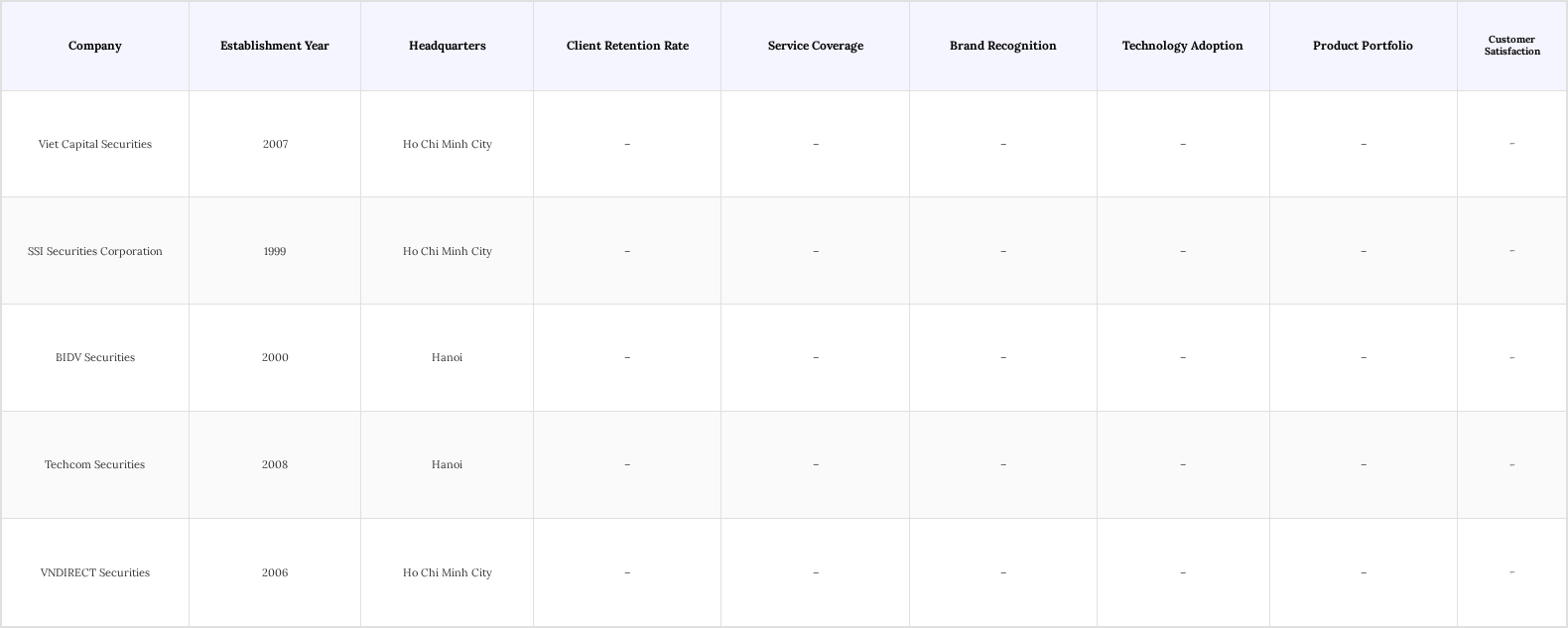

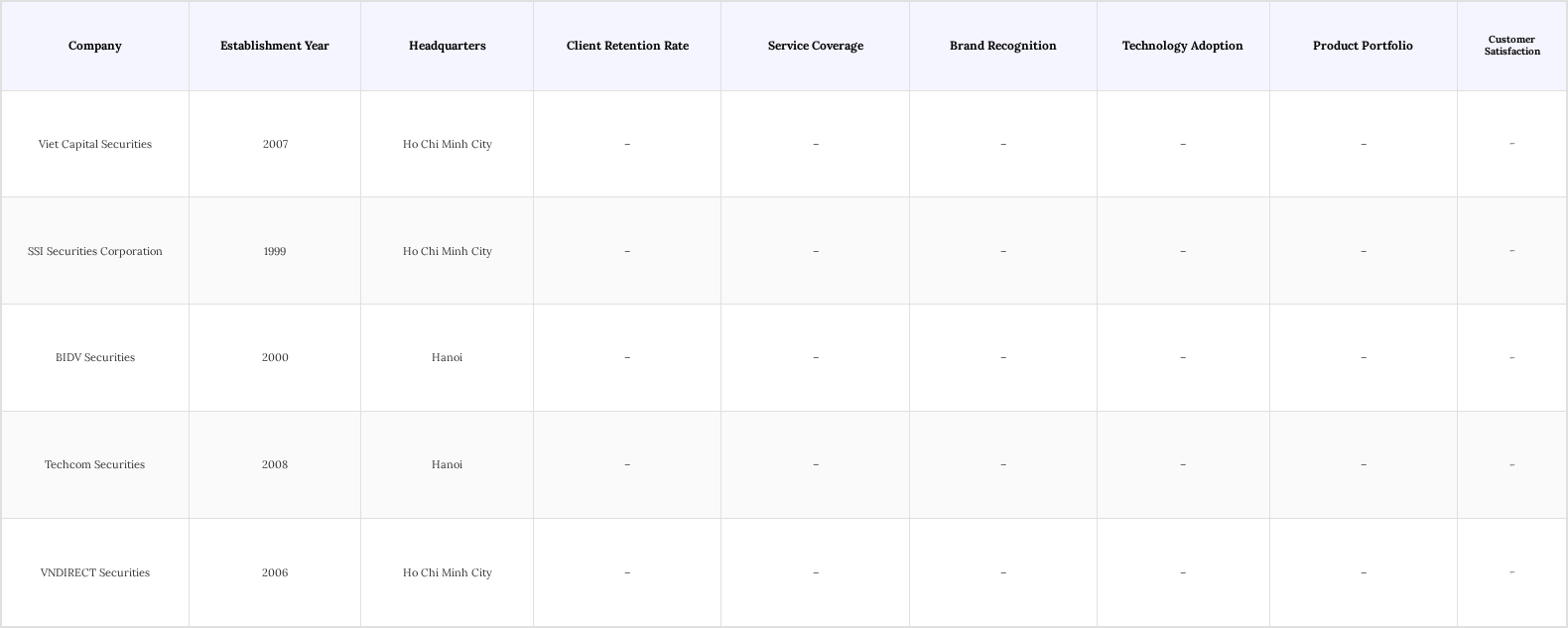

Vietnam Wealth Management Market Competitive Landscape

The Vietnam Wealth Management Market is characterized by a competitive landscape with several key players, including Viet Capital Securities, SSI Securities Corporation, and BIDV Securities. These companies are actively expanding their service offerings and enhancing client engagement through innovative solutions and technology adoption. The market is witnessing a trend towards digitalization, with firms investing in online platforms to cater to the growing demand for accessible wealth management services.

Vietnam Wealth Management Market Industry Analysis

Growth Drivers

- Increasing Affluence of the Middle Class: The growth of Vietnam’s middle class is a key driver for the expanding wealth management market. As of 2024, roughly one-third of the population—around 30 million people—are considered middle class, with average annual incomes above USD 3,000. This rising affluence is increasing disposable income and fueling demand for financial products and wealth management services. While projections estimate Vietnam’s total consumer spending could reach around USD 600 billion by 2027, this figure reflects broader consumption rather than solely disposable income. The expanding middle class is increasingly seeking professional guidance to invest savings, plan for the future, and build wealth, creating significant opportunities for wealth management firms to tailor offerings to this growing segment.

- Rising Demand for Financial Literacy and Advisory Services: The Vietnamese government has recognized financial literacy as vital for economic development. In 2024, initiatives aiming to improve financial education reached millions, focusing on young professionals and entrepreneurs. Programs like the Financial Literacy Program 2024, led by the State Bank of Vietnam in partnership with Visa and fintech firms, delivered extensive online and offline training on financial management, e-commerce, and digital payments, targeting ethnic minorities and underserved regions. Despite progress, many young Vietnamese still face challenges in managing finances and investments, underscoring the need for continued education

- Expansion of Digital Financial Services: The digital transformation in Vietnam is significantly reshaping the wealth management landscape. By 2024, internet penetration in Vietnam reached approximately 79.1%, with around 78.4 million internet users, while mobile connections exceeded the total population at about 169%, reflecting widespread mobile access. This high digital accessibility is fueling the growth of online wealth management platforms, which are increasingly popular among tech-savvy investors. The Vietnam Fintech Report 2024 highlights strong fintech sector growth, with wealth management services playing a key role. Digital platforms offer lower fees and greater convenience, attracting a younger demographic that prefers online transactions and self-directed investment options.

Market Challenges

- Regulatory Compliance and Legal Framework: The wealth management sector in Vietnam faces significant challenges related to regulatory compliance. As of 2024, the Vietnamese government has implemented stricter regulations aimed at enhancing transparency and protecting investors. However, the complexity of these regulations poses a challenge for wealth management firms, particularly smaller players who may lack the resources to ensure compliance. According to the Vietnam Chamber of Commerce and Industry, many financial firms reported difficulties in navigating the regulatory landscape, which can lead to increased operational costs and potential penalties.

- Competition from Traditional Banking Institutions: The wealth management market in Vietnam is highly competitive, with traditional banking institutions dominating the landscape. As of 2024, banks hold majorityu of the market share in wealth management services, leveraging their established customer bases and extensive resources. This competition poses a significant challenge for independent wealth management firms and fintech startups, which may struggle to differentiate themselves in a crowded market.

Vietnam Wealth Management Market Future Outlook

The future of the Vietnam wealth management market appears promising, driven by technological advancements and a growing emphasis on personalized financial services. As digital platforms continue to evolve, they will likely enhance client engagement and service delivery, fostering a more competitive landscape.

Market Opportunities

- Growth of the Digital Economy: The digital economy in Vietnam is projected to reach USD 45 billion by the end of 2025, presenting significant opportunities for wealth management firms to leverage technology in service delivery. With the increasing adoption of digital payment systems and e-commerce, wealth management services can be integrated into these platforms, providing seamless access to financial products. The Vietnam Digital Economy Report 2024 indicates that majority of consumers are willing to use digital financial services, highlighting a growing market for innovative wealth management solutions.

- Increasing Interest in Sustainable and Impact Investing: There is a growing trend among Vietnamese investors towards sustainable and impact investing, driven by a heightened awareness of social and environmental issues. In 2024, it is estimated that many high-net-worth individuals in Vietnam are actively seeking investment opportunities that align with their values. This shift presents a unique opportunity for wealth management firms to develop specialized products that cater to this demand.