Vietnam Wound Care Market Outlook to 2030

Region:Asia

Author(s):Abhinav kumar

Product Code:KROD3498

December 2024

100

About the Report

Vietnam Wound Care Market Overview

- The Vietnam wound care market is valued at USD 8.4 million, based on a five-year historical analysis. It is driven by the growing aging population, increasing cases of chronic wounds, and rising healthcare expenditure. With the increasing incidence of diabetes and obesity, the demand for advanced wound care products such as negative pressure wound therapy (NPWT) and bioactive wound care products is steadily rising. Government support in the form of healthcare reforms further fuels the markets growth by improving access to better treatment options.

- Major cities like Ho Chi Minh City and Hanoi dominate the wound care market due to their advanced healthcare infrastructure and concentration of healthcare facilities. These cities are home to a large population, including the elderly, who often require wound care treatments for chronic wounds and post-surgical care. The healthcare infrastructure in these urban centers is well-developed, allowing for the adoption of advanced wound care technologies and solutions, contributing to the markets growth in these regions.

- Vietnams government has implemented national healthcare policies that are designed to improve healthcare access and quality. In 2024, healthcare expenditure is expected to account for 6% of the country's GDP, according to the World Bank. These policies prioritize expanding healthcare coverage, particularly for vulnerable populations, and improving infrastructure in rural areas. The increased funding and focus on healthcare modernization directly benefit the wound care market, providing better facilities and treatment options for patients with acute and chronic wounds.

Vietnam Wound Care Market Segmentation

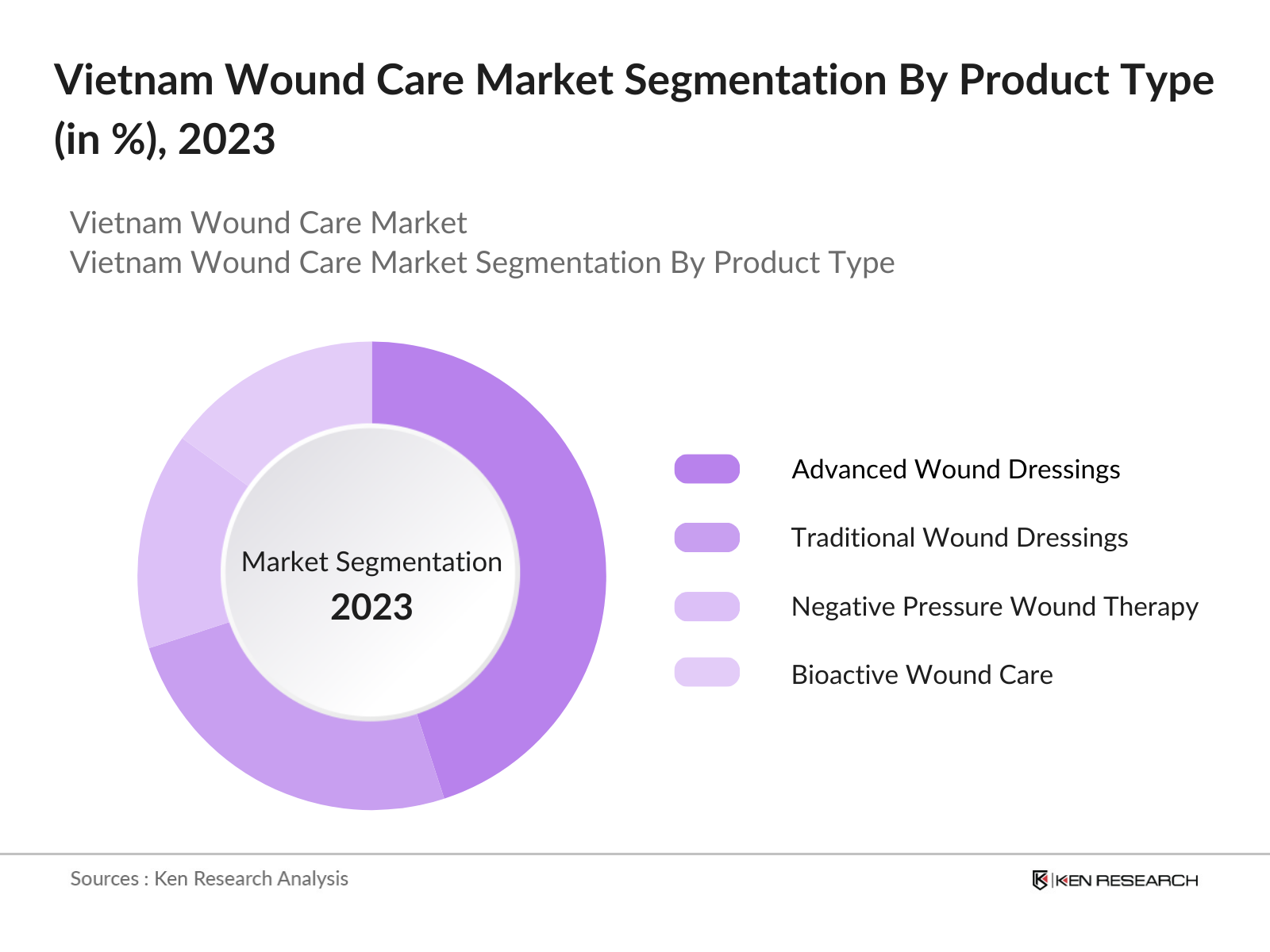

By Product Type: The Vietnam wound care market is segmented by product type into advanced wound dressings, traditional wound dressings, negative pressure wound therapy (NPWT), bioactive wound care, and wound therapy devices. Advanced wound dressings hold a dominant market share due to their efficacy in faster healing and infection prevention. These dressings, including alginate, hydrocolloid, and foam dressings, are widely adopted in hospitals for treating chronic wounds such as diabetic foot ulcers and venous leg ulcers. Additionally, the rising awareness about advanced treatments and the push for improved patient outcomes drive their growth.

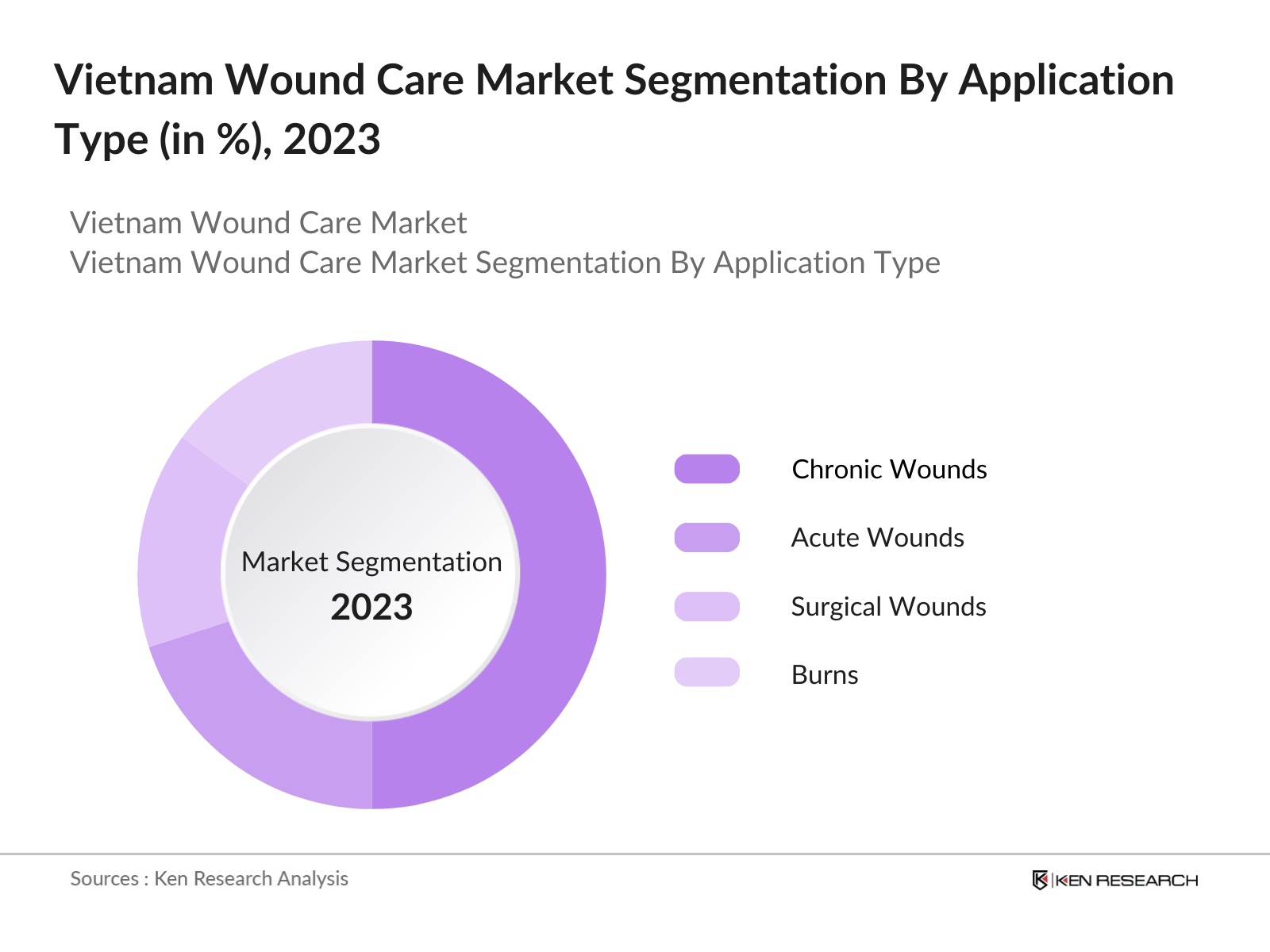

By Application: The Vietnam wound care market is also segmented by application into chronic wounds, acute wounds, surgical wounds, burns, and ulcers (diabetic foot, venous, pressure). Chronic wounds account for the largest share due to the growing prevalence of diabetes and aging population. Diabetic foot ulcers, in particular, contribute significantly to the chronic wound segment, driven by the increasing number of diabetes patients. Healthcare providers are prioritizing chronic wound management to reduce hospital stays and improve quality of life for patients, thus enhancing the demand for advanced wound care solutions.

Vietnam Wound Care Market Competitive Landscape

The Vietnam wound care market is dominated by key players who leverage innovation and technological advancements to maintain their competitive edge. The markets competitive landscape includes local and international companies that focus on research and development to introduce advanced wound care products. Local players like Mediplast are striving to compete with global giants by offering cost-effective wound care solutions. However, global brands continue to dominate through product quality, strong distribution networks, and large-scale operations.

|

Company |

Establishment Year |

Headquarters |

Key Product Segment |

R&D Investment |

Partnerships |

Geographic Presence |

Revenue (USD) |

Employee Strength |

|

Smith & Nephew Plc |

1856 |

London, UK |

_ |

_ |

_ |

_ |

_ |

_ |

|

Mlnlycke Health Care |

1849 |

Gothenburg, Sweden |

_ |

_ |

_ |

_ |

_ |

_ |

|

ConvaTec Group Plc |

1978 |

Reading, UK |

_ |

_ |

_ |

_ |

_ |

_ |

|

3M Healthcare |

1902 |

Minnesota, USA |

_ |

_ |

_ |

_ |

_ |

_ |

|

Mediplast |

1970 |

Ho Chi Minh City, VN |

_ |

_ |

_ |

_ |

_ |

_ |

Vietnam Wound Care Industry Analysis

Growth Drivers

- Rising Diabetic Population: Vietnam is experiencing a notable rise in its diabetic population, which contributes to the increased need for wound care. According to the World Health Organization (WHO), in 2022, Vietnam had over 5 million adults living with diabetes, and this number continues to rise due to factors such as urbanization and lifestyle changes. Diabetes leads to a higher incidence of chronic wounds, particularly diabetic foot ulcers, which require specialized wound care management. This surge directly drives the demand for both traditional and advanced wound care solutions in the country.

- Aging Population: Vietnam is undergoing rapid demographic shifts, with its population aging significantly. As of 2024, the Vietnamese population aged 65 and older is expected to exceed 9.2 million, according to data from the United Nations. The elderly population is more susceptible to chronic wounds such as pressure ulcers and venous leg ulcers, which are common among the aging demographic. This trend is fueling demand for advanced wound care products designed to address the needs of older individuals, particularly in hospitals and home care settings.

- Increased Surgical Procedures: Vietnams healthcare sector is witnessing a steady increase in surgical procedures due to rising healthcare access and improvements in medical infrastructure. The Ministry of Health of Vietnam reported that in 2023, the country performed approximately 2.5 million surgeries annually. These procedures often necessitate post-operative wound care to prevent infections and promote healing. The growing number of surgeries, especially in urban healthcare facilities, is pushing the demand for effective wound care products, including dressings, wound closure devices, and infection control solutions.

Market Challenges

- High Cost of Advanced Wound Care Products: Despite the availability of advanced wound care products, their high cost remains a significant barrier in Vietnam, especially in lower-income regions. According to a report from the Ministry of Health, many hospitals in rural areas rely on basic wound care solutions due to financial constraints. Advanced products like bioengineered skin substitutes and negative pressure wound therapy devices are often priced out of reach for the average healthcare provider, limiting their widespread adoption.

- Limited Awareness in Rural Areas: In rural Vietnam, awareness of advanced wound care solutions remains low, with many healthcare workers and patients relying on traditional methods for wound management. The Vietnam General Department of Preventive Medicine noted that public health campaigns have primarily focused on infectious diseases, leaving wound care education underfunded and underemphasized in rural settings. This lack of awareness hinders the adoption of more effective treatments that could improve outcomes for patients with chronic wounds.

Vietnam Wound Care Market Future Outlook

Over the next five years, the Vietnam wound care market is expected to witness significant growth driven by the aging population, increasing incidences of chronic diseases, and rising healthcare spending. Innovations in wound care technologies, such as biologics and bioactive wound products, are anticipated to further propel market growth. Additionally, the growing trend of home healthcare and telemedicine solutions will play a crucial role in expanding the reach of wound care products to underserved regions and rural areas.

Market Opportunities

- Rising Adoption of Telemedicine: Telemedicine is emerging as a significant opportunity in Vietnams wound care market, particularly in underserved rural areas. According to the World Bank, around 70% of the Vietnamese population now has access to mobile phones, which facilitates telemedicine services for remote wound care consultations. This trend is helping patients in rural areas to access expert medical advice and advanced wound care solutions without traveling long distances, creating new demand for wound care products that can be delivered and used at home.

- Growth in Home Healthcare: Vietnam is seeing a rise in demand for home healthcare services, driven by its aging population and increasing incidence of chronic diseases like diabetes. As of 2023, around 12% of Vietnams healthcare expenditure is directed towards home care services, as reported by the Ministry of Health. This shift toward home-based care is expanding the market for wound care products, as patients prefer to receive treatment at home rather than in hospitals. This trend is particularly noticeable in large cities like Hanoi and Ho Chi Minh City.

Scope of the Report

|

By Product Type |

Advanced Wound Dressings Traditional Wound Dressings NPWT Bioactive Wound Care Wound Therapy Devices |

|

By Application |

Chronic Wounds Acute Wounds Surgical Wounds Burns Ulcers |

|

By End-User |

Hospitals Home Care Settings Clinics Long-Term Care Facilities |

|

By Distribution Channel |

Hospital Pharmacies Retail Pharmacies Online Pharmacies Medical Supply Stores |

|

By Region |

Northern Vietnam Central Vietnam Southern Vietnam |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing to This Report:

Hospitals and Healthcare Companies

Medical Device Manufacturers

Pharmaceutical Companies

Home Healthcare Industries

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (Vietnam Ministry of Health, Vietnam Medical Device Administration)

Wound Care Research and Development Companies

Companies

Players Mentioned in the Report:

Smith & Nephew Plc

Mlnlycke Health Care

ConvaTec Group Plc

3M Healthcare

B. Braun Melsungen AG

Coloplast A/S

Medline Industries, Inc.

Paul Hartmann AG

Advanced Medical Solutions Group Plc

Integra LifeSciences

Derma Sciences, Inc.

Cardinal Health

Acelity L.P. Inc.

Hollister Incorporated

Lohmann & Rauscher GmbH & Co. KG

Table of Contents

1. Vietnam Wound Care Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Vietnam Wound Care Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Vietnam Wound Care Market Analysis

3.1. Growth Drivers

3.1.1. Rising Diabetic Population

3.1.2. Aging Population

3.1.3. Increased Surgical Procedures

3.1.4. Government Healthcare Reforms

3.2. Market Challenges

3.2.1. High Cost of Advanced Wound Care Products

3.2.2. Limited Awareness in Rural Areas

3.2.3. Stringent Regulatory Approvals

3.3. Opportunities

3.3.1. Rising Adoption of Telemedicine

3.3.2. Growth in Home Healthcare

3.3.3. Technological Advancements in Wound Care Devices

3.4. Trends

3.4.1. Use of Biologics in Wound Care

3.4.2. Shift towards Advanced Wound Care Products

3.4.3. Increased Focus on Pain-Free Healing Solutions

3.5. Government Regulations

3.5.1. National Healthcare Policies

3.5.2. Regulatory Approvals for Wound Care Products

3.5.3. Reimbursement Policies

3.6. SWOT Analysis

3.6.1. Strengths

3.6.2. Weaknesses

3.6.3. Opportunities

3.6.4. Threats

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. Vietnam Wound Care Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Advanced Wound Dressings

4.1.2. Traditional Wound Dressings

4.1.3. Negative Pressure Wound Therapy (NPWT)

4.1.4. Bioactive Wound Care

4.1.5. Wound Therapy Devices

4.2. By Application (In Value %)

4.2.1. Chronic Wounds

4.2.2. Acute Wounds

4.2.3. Surgical Wounds

4.2.4. Burns

4.2.5. Ulcers (Diabetic Foot, Venous, Pressure)

4.3. By End-User (In Value %)

4.3.1. Hospitals

4.3.2. Home Care Settings

4.3.3. Clinics

4.3.4. Long-Term Care Facilities

4.4. By Distribution Channel (In Value %)

4.4.1. Hospital Pharmacies

4.4.2. Retail Pharmacies

4.4.3. Online Pharmacies

4.4.4. Medical Supply Stores

4.5. By Region (In Value %)

4.5.1. Northern Vietnam

4.5.2. Central Vietnam

4.5.3. Southern Vietnam

5. Vietnam Wound Care Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Smith & Nephew Plc

5.1.2. Mlnlycke Health Care

5.1.3. ConvaTec Group Plc

5.1.4. 3M Healthcare

5.1.5. Coloplast A/S

5.1.6. B. Braun Melsungen AG

5.1.7. Medline Industries, Inc.

5.1.8. Paul Hartmann AG

5.1.9. Advanced Medical Solutions Group Plc

5.1.10. Integra LifeSciences

5.1.11. Derma Sciences, Inc.

5.1.12. Cardinal Health

5.1.13. Acelity L.P. Inc.

5.1.14. Hollister Incorporated

5.1.15. Lohmann & Rauscher GmbH & Co. KG

5.2. Cross Comparison Parameters

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Vietnam Wound Care Market Regulatory Framework

6.1. Vietnamese Medical Device Regulations

6.2. Wound Care Product Certification

6.3. Environmental and Safety Standards

6.4. Compliance Requirements

7. Vietnam Wound Care Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Vietnam Wound Care Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By End-User (In Value %)

8.4. By Distribution Channel (In Value %)

8.5. By Region (In Value %)

9. Vietnam Wound Care Market Analysts' Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Vietnam Wound Care Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, historical data pertaining to the Vietnam Wound Care Market is compiled and analyzed. This includes assessing market penetration, the ratio of medical institutions to product suppliers, and the resultant revenue generation. Furthermore, an evaluation of product usage statistics is conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through consultations with industry experts representing a diverse array of wound care providers and healthcare professionals. These consultations provide valuable operational and financial insights, instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple wound care product manufacturers to acquire detailed insights into product segments, sales performance, and market drivers. This interaction serves to verify and complement the statistics derived from the bottom-up approach, ensuring a comprehensive, accurate, and validated analysis of the Vietnam Wound Care market.

Frequently Asked Questions

01. How big is the Vietnam Wound Care Market?

The Vietnam Wound Care Market is valued at USD 8.4 million, driven by the growing aging population and increasing prevalence of chronic wounds.

02. What are the challenges in the Vietnam Wound Care Market?

Challenges include high costs associated with advanced wound care products, limited awareness in rural areas, and stringent regulatory approvals for new technologies.

03. Who are the major players in the Vietnam Wound Care Market?

Key players include Smith & Nephew Plc, Mlnlycke Health Care, ConvaTec Group Plc, 3M Healthcare, and B. Braun Melsungen AG, which dominate through strong distribution networks and advanced product offerings.

04. What are the growth drivers of the Vietnam Wound Care Market?

The market is driven by an aging population, rising incidence of chronic diseases like diabetes, and growing healthcare expenditure focused on improving patient outcomes.

05. What future trends are expected in the Vietnam Wound Care Market?

Over the next five years, trends such as the adoption of biologics, increasing home healthcare services, and the expansion of telemedicine for wound care management are expected to drive market growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.