Region:Middle East

Author(s):Shubham

Product Code:KRAB0749

Pages:96

Published On:August 2025

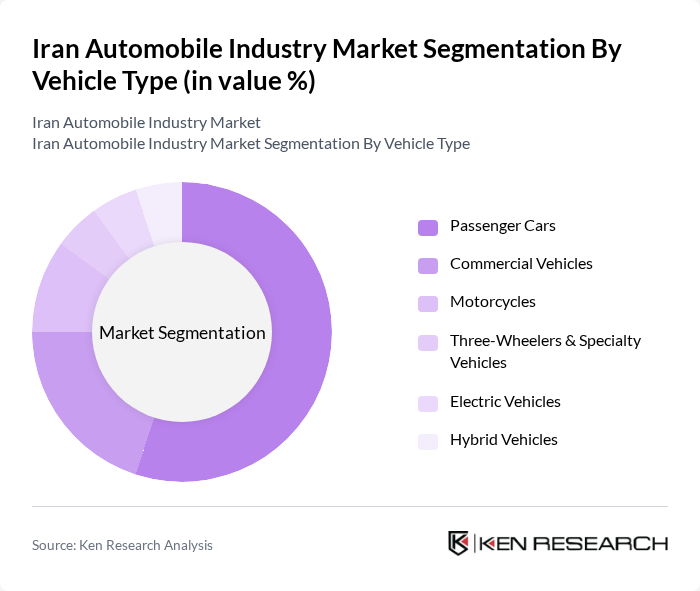

By Vehicle Type:The vehicle type segmentation includes passenger cars, commercial vehicles, motorcycles, three-wheelers and specialty vehicles, electric vehicles, and hybrid vehicles. Among these, passenger cars dominate the market due to their widespread appeal and affordability. The growing middle class, urbanization, and limited public transport capacity have led to increased demand for personal vehicles, making this segment the largest contributor to the overall market .

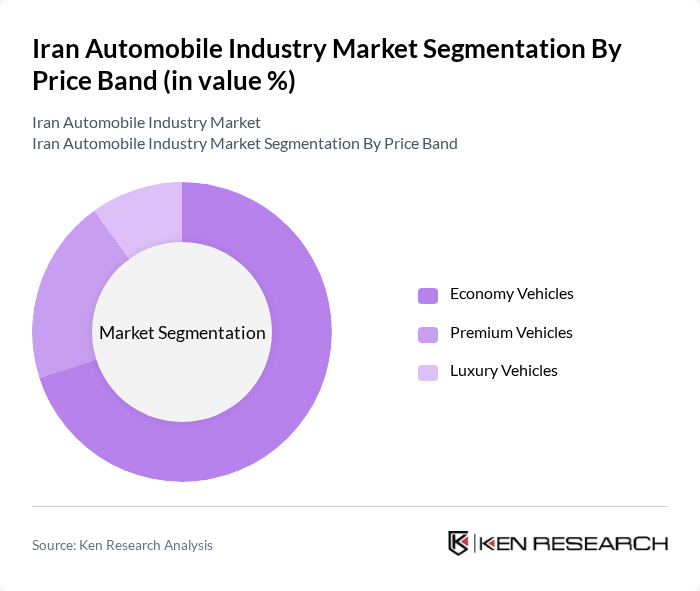

By Price Band:This segmentation includes economy vehicles, premium vehicles, and luxury vehicles. The economy vehicles segment is the most significant, driven by the need for affordable transportation options among the majority of the population. As economic conditions improve, there is a gradual shift towards premium vehicles, but the economy segment remains the backbone of the market due to its accessibility and affordability .

The Iran Automobile Industry Market is characterized by a dynamic mix of regional and international players. Leading participants such as Iran Khodro Company (IKCO), SAIPA Group, Pars Khodro, Zamyad Company, Bahman Group, Kerman Motor Company, Renault Pars, Brilliance Auto Group, Iran Khodro Diesel, Sazeh Gostar Saipa, Sapco (Iran Khodro Spare Parts and Components), Iran Tractor Manufacturing Company (ITMCo), Niroo Research Institute, Aria Motor, and Kaveh Industrial Group contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Iranian automobile industry appears promising, driven by increasing urbanization and rising disposable incomes. As the government continues to support local manufacturing, the industry is likely to see enhanced production capabilities and innovation. Additionally, the shift towards electric vehicles and sustainable mobility solutions is expected to gain momentum, aligning with global trends. However, challenges such as economic sanctions and supply chain disruptions will require strategic management to ensure long-term growth and competitiveness in the market.

| Segment | Sub-Segments |

|---|---|

| By Vehicle Type | Passenger Cars Commercial Vehicles Motorcycles Three-Wheelers & Specialty Vehicles Electric Vehicles Hybrid Vehicles |

| By Price Band | Economy Vehicles Premium Vehicles Luxury Vehicles |

| By Fuel Type | Internal Combustion (Petrol/Diesel) CNG Electric Hybrid |

| By End-User | Individual Consumers Corporates Government Agencies Fleet Operators |

| By Sales Channel | Direct Sales Dealerships Online Sales Auctions |

| By Region | Tehran & Surrounding Urban Areas Northern Iran Southern Iran Eastern Iran Western Iran |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Passenger Vehicle Market Insights | 120 | Sales Managers, Marketing Directors |

| Commercial Vehicle Demand Analysis | 80 | Fleet Managers, Procurement Specialists |

| Automotive Component Supply Chain | 60 | Supply Chain Managers, Quality Control Officers |

| Consumer Preferences in Vehicle Purchases | 100 | End-users, Automotive Enthusiasts |

| Electric Vehicle Adoption Trends | 50 | Environmental Analysts, Policy Makers |

The Iran Automobile Industry Market is valued at approximately USD 41.5 billion, reflecting a significant growth driven by increasing domestic demand, a young population of first-time buyers, and government support for local manufacturers.