Region:Middle East

Author(s):Geetanshi

Product Code:KRAB0026

Pages:87

Published On:August 2025

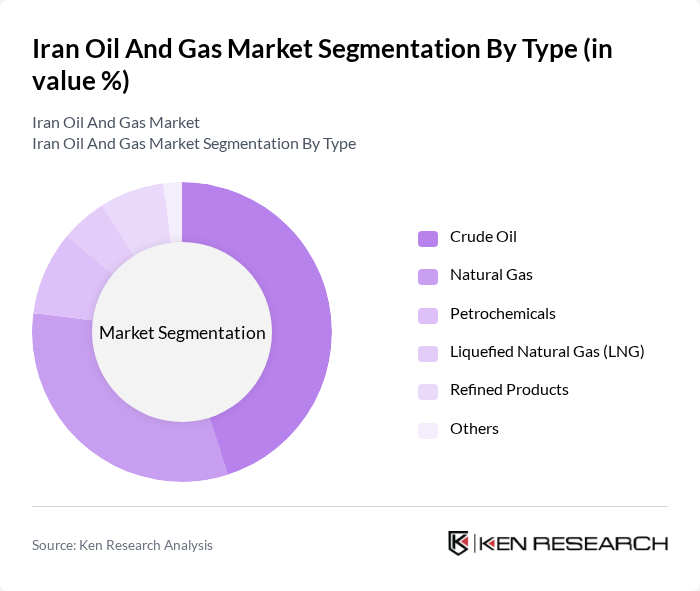

By Type:The market is segmented into crude oil, natural gas, petrochemicals, liquefied natural gas (LNG), refined products, and others. Crude oil and natural gas are the most significant contributors, driven by their extensive use in energy production, electricity generation, and industrial feedstock. Petrochemicals and refined products also play vital roles, supporting Iran’s large domestic market and export activities. LNG remains a smaller but growing segment, reflecting Iran’s efforts to diversify its energy export portfolio .

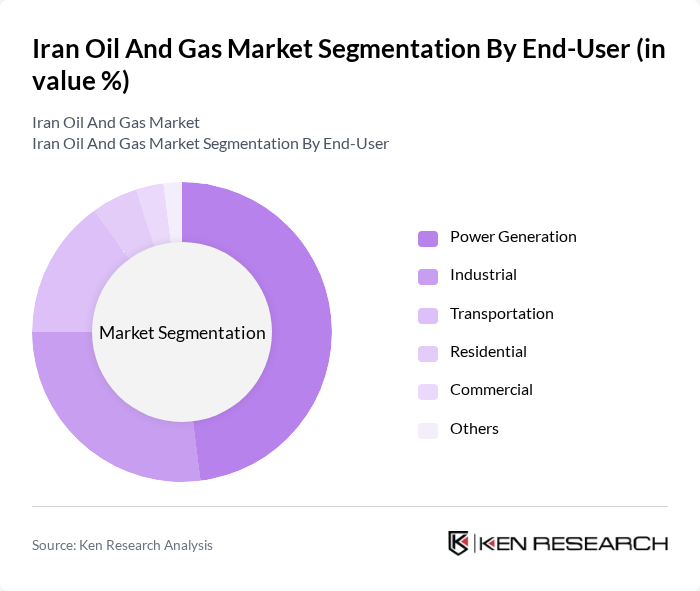

By End-User:The end-user segmentation includes power generation, industrial, transportation, residential, commercial, and others. The power generation sector is the largest consumer of oil and gas, primarily due to the dominance of natural gas in Iran’s energy mix, accounting for nearly three-quarters of primary energy use and generating over 80% of the country’s electricity. Industrial and transportation sectors also represent significant demand, reflecting the country’s large manufacturing base and extensive domestic fuel consumption .

The Iran Oil and Gas Market is characterized by a dynamic mix of regional and national players. Leading participants such as National Iranian Oil Company (NIOC), National Iranian Gas Company (NIGC), Pars Oil and Gas Company (POGC), Iranian Offshore Oil Company (IOOC), Iranian Central Oil Fields Company (ICOFC), Petrochemical Commercial Company (PCC), Iran Oil Pipelines and Telecommunications Company (IOPTC), Persian Gulf Petrochemical Industries Company (PGPIC), Iran LNG Company, Khatam al-Anbia Construction Headquarters, Iran Oil Terminals Company (IOTC), Iranian Offshore Engineering and Construction Company (IOEC), Iran Marine Industrial Company (SADRA), Oil Industries’ Engineering and Construction (OIEC) Group, and Iran National Gas Export Company (INGEC) contribute to innovation, geographic expansion, and service delivery in this space .

The future of Iran's oil and gas market appears cautiously optimistic, driven by potential easing of sanctions and a focus on modernization. The government is likely to prioritize foreign partnerships to revitalize aging infrastructure and enhance production capabilities. Additionally, the integration of renewable energy sources is expected to complement traditional oil and gas operations, aligning with global sustainability trends. As geopolitical dynamics shift, Iran may regain its position as a key player in the regional energy landscape, attracting renewed investment and interest.

| Segment | Sub-Segments |

|---|---|

| By Type | Crude Oil Natural Gas Petrochemicals Liquefied Natural Gas (LNG) Refined Products Others |

| By End-User | Power Generation Industrial Transportation Residential Commercial Others |

| By Application | Exploration Production Refining Distribution Others |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Policy Support | Subsidies Tax Exemptions Regulatory Support Others |

| By Distribution Mode | Direct Sales Distributors Online Sales Others |

| By Price Range | Low Price Mid Price High Price Others |

| By Value Chain Segment | Upstream (Exploration & Production) Midstream (Transportation & Storage) Downstream (Refining & Petrochemicals) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Crude Oil Production Insights | 100 | Production Managers, Field Engineers |

| Natural Gas Market Dynamics | 80 | Gas Plant Operators, Market Analysts |

| Petrochemical Sector Trends | 70 | Product Managers, R&D Directors |

| Export Strategies and Challenges | 60 | Export Managers, Trade Compliance Officers |

| Regulatory Impact Assessments | 50 | Legal Advisors, Policy Makers |

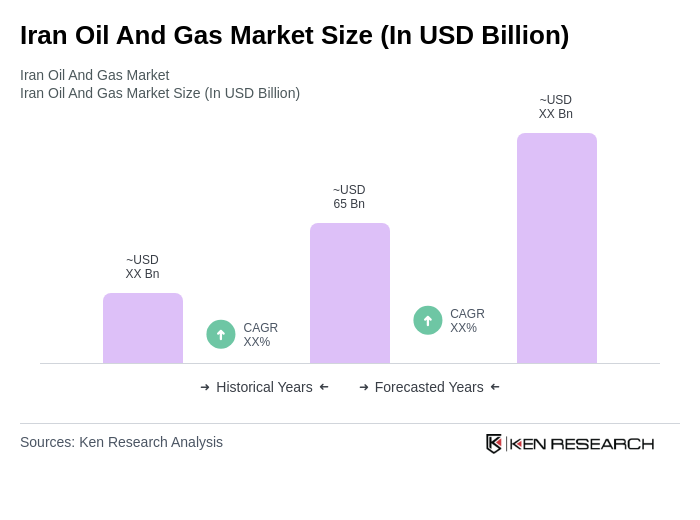

The Iran Oil and Gas Market is valued at approximately USD 65 billion, driven by the country's vast reserves of oil and natural gas, which rank among the largest globally. This valuation reflects a five-year historical analysis of the market.