Region:Middle East

Author(s):Rebecca

Product Code:KRAC0315

Pages:99

Published On:August 2025

By Vehicle Type:The vehicle type segmentation includes passenger cars, commercial vehicles, two-wheelers, electric vehicles, hybrid vehicles, luxury vehicles, and specialty & three-wheelers. Passenger cars remain the most popular segment, driven by urban household demand and cultural preferences. Commercial vehicles serve logistics, freight, and public transportation needs. Two-wheelers are favored for affordability and mobility, especially in densely populated urban areas. Electric and hybrid vehicles are experiencing increased adoption due to environmental policies and incentives. Luxury vehicles and specialty & three-wheelers occupy niche segments, catering to specific consumer groups .

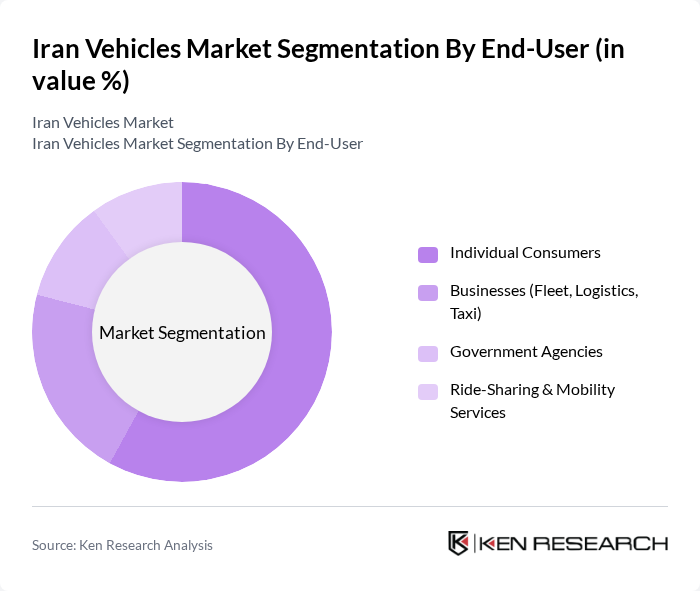

By End-User:The end-user segmentation encompasses individual consumers, businesses (fleet, logistics, taxi), government agencies, and ride-sharing & mobility services. Individual consumers dominate the market, driven by the increasing need for personal transportation and the growing trend of car ownership among the middle class. Businesses utilize vehicles for fleet operations, logistics, and taxi services. Government agencies procure vehicles for official use and public service operations. Ride-sharing and mobility services are expanding, reflecting changing urban mobility patterns .

The Iran Vehicles Market is characterized by a dynamic mix of regional and international players. Leading participants such as Iran Khodro Company (IKCO), SAIPA Group, Pars Khodro, Zamyad Company, Bahman Group, Kerman Motor Company, Modiran Vehicle Manufacturing Company (MVM), Iran Khodro Diesel, Sazeh Gostar Saipa, Aria Diesel, Kaveh Industrial Group, Iran Heavy Diesel Engine Manufacturing Company (DESA), Shahr Khodro, Bonro Company, Rakhsh Khodro Diesel contribute to innovation, geographic expansion, and service delivery in this space.

The Iran vehicles market is poised for significant transformation in the coming years, driven by technological advancements and changing consumer preferences. The shift towards electric vehicles (EVs) is expected to gain momentum, supported by government incentives and a growing awareness of environmental issues. Additionally, the expansion of local manufacturing capabilities will enhance the availability of diverse vehicle options. As urbanization continues, the demand for efficient public transportation systems will also rise, creating opportunities for innovative mobility solutions and partnerships within the automotive sector.

| Segment | Sub-Segments |

|---|---|

| By Vehicle Type | Passenger Cars Commercial Vehicles (Trucks, Buses, Vans) Two-Wheelers (Motorcycles, Scooters) Electric Vehicles (EVs) Hybrid Vehicles Luxury Vehicles Specialty & Three-Wheelers |

| By End-User | Individual Consumers Businesses (Fleet, Logistics, Taxi) Government Agencies Ride-Sharing & Mobility Services |

| By Fuel Type | Petrol Diesel CNG (Compressed Natural Gas) Electric |

| By Price Band | Economy/Budget Vehicles Mid-Range Vehicles Premium Vehicles |

| By Distribution Channel | Direct Sales (OEM) Authorized Dealerships Online Sales Platforms |

| By Vehicle Size | Compact Midsize Full-Size |

| By Application | Personal Use Commercial Use Government & Institutional Use |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Passenger Vehicle Market | 120 | Car Owners, Automotive Enthusiasts |

| Commercial Vehicle Sector | 60 | Fleet Managers, Logistics Coordinators |

| Electric Vehicle Adoption | 50 | Environmental Advocates, Tech-Savvy Consumers |

| Automotive Parts and Accessories | 40 | Retailers, Workshop Owners |

| Market Trends and Consumer Preferences | 80 | General Consumers, Automotive Analysts |

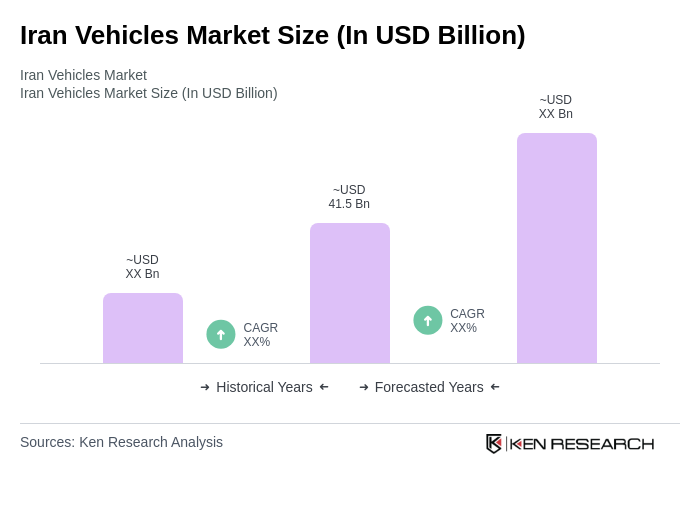

The Iran Vehicles Market is valued at approximately USD 41.5 billion, reflecting growth driven by urbanization, rising disposable incomes, and increased demand for personal and commercial transportation options.