Region:Europe

Author(s):Rebecca

Product Code:KRAB3532

Pages:94

Published On:October 2025

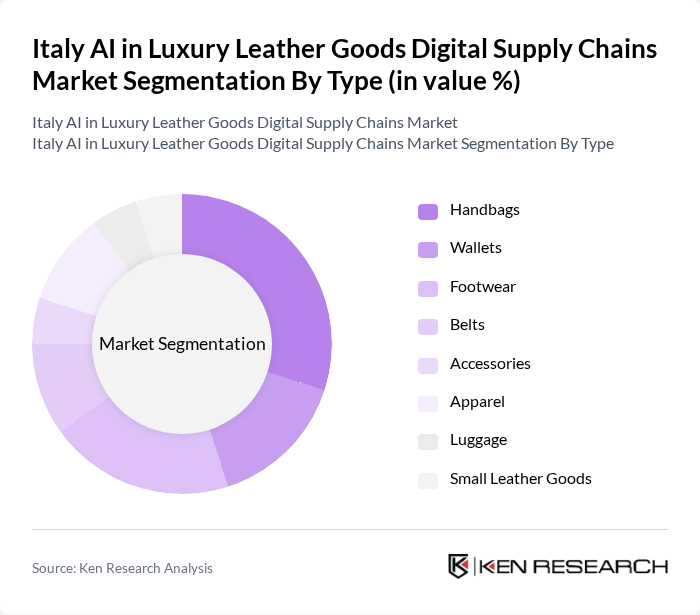

By Type:The market is segmented into various types of luxury leather goods, including handbags, wallets, footwear, belts, accessories, apparel, luggage, and small leather goods. Each of these segments caters to different consumer preferences and trends, with specific sub-segments showing varying levels of demand.

The handbags segment is the leading category in the luxury leather goods market, driven by consumer preferences for stylish and functional designs. The demand for high-quality handbags is fueled by fashion trends and the desire for brand prestige. Additionally, the rise of social media influencers and celebrity endorsements has significantly impacted consumer behavior, leading to increased sales in this segment. The handbags sub-segment is characterized by a diverse range of styles, catering to various demographics and preferences, which further solidifies its market leadership.

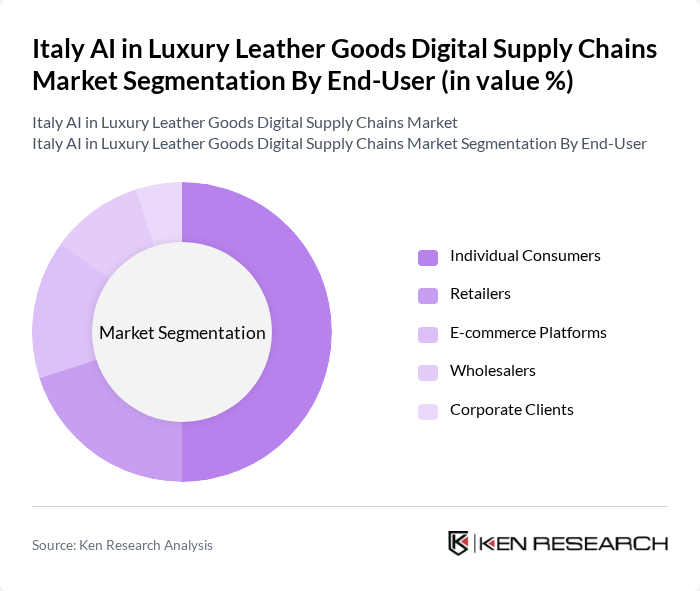

By End-User:The market is segmented based on end-users, including individual consumers, retailers, e-commerce platforms, wholesalers, and corporate clients. Each segment has unique purchasing behaviors and preferences that influence the overall market dynamics.

The individual consumers segment dominates the market, accounting for a significant share due to the growing trend of luxury consumption among affluent individuals. This segment is characterized by a strong preference for personalized and exclusive products, driving brands to innovate and offer unique designs. The rise of online shopping has also facilitated access to luxury goods, further boosting sales in this segment. As consumers increasingly seek high-quality and fashionable items, individual consumers remain the primary drivers of market growth.

The Italy AI in Luxury Leather Goods Digital Supply Chains Market is characterized by a dynamic mix of regional and international players. Leading participants such as Gucci, Prada, Salvatore Ferragamo, Bottega Veneta, Fendi, Valentino, Tod's, Loro Piana, Dolce & Gabbana, Ermenegildo Zegna, Moschino, Max Mara, Celine, Kiton, OTB Group (including Maison Margiela, Marni, and others), Brunello Cucinelli, Versace, Berluti, Serapian, Il Bisonte contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Italy AI in luxury leather goods digital supply chains market appears promising, driven by technological advancements and changing consumer preferences. As brands increasingly adopt AI and analytics, operational efficiencies are expected to improve significantly. Additionally, the focus on sustainability will likely lead to innovative practices that align with consumer values. The integration of digital twins and blockchain technology will further enhance transparency and traceability, fostering trust and loyalty among consumers in the luxury segment.

| Segment | Sub-Segments |

|---|---|

| By Type | Handbags Wallets Footwear Belts Accessories Apparel Luggage Small Leather Goods |

| By End-User | Individual Consumers Retailers E-commerce Platforms Wholesalers Corporate Clients |

| By Sales Channel | Online Sales Offline Retail Direct Sales Distributors Flagship Stores |

| By Material | Genuine Leather Exotic Leather (e.g., crocodile, python) Synthetic Leather Recycled Materials |

| By Price Range | Luxury Segment Mid-Range Segment Budget Segment |

| By Distribution Mode | Direct Distribution Indirect Distribution Franchise Models |

| By Brand Positioning | Premium Brands Mass Market Brands Niche Brands Heritage Brands |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Handbag Supply Chain | 60 | Supply Chain Managers, Product Line Directors |

| Footwear Distribution Networks | 50 | Logistics Coordinators, Retail Operations Managers |

| Accessory Manufacturing Processes | 40 | Production Managers, Quality Assurance Leads |

| Digital Supply Chain Innovations | 45 | IT Managers, Digital Transformation Officers |

| Consumer Insights on Luxury Purchases | 70 | Marketing Managers, Brand Strategists |

The Italy AI in Luxury Leather Goods Digital Supply Chains Market is valued at approximately USD 20 billion, reflecting the significant role of leather goods within the broader Italian luxury goods market, which is projected to generate USD 19.85 billion in revenue by 2025.