Region:Europe

Author(s):Geetanshi

Product Code:KRAA1980

Pages:81

Published On:August 2025

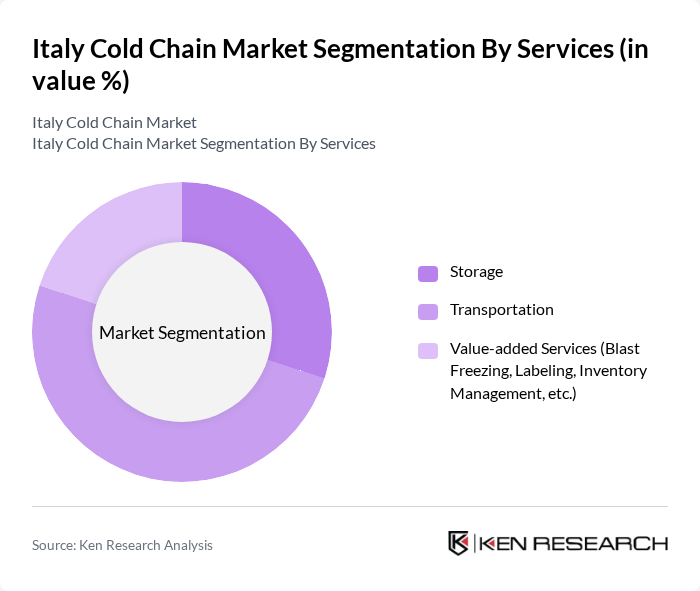

By Services:The services segment includes Storage, Transportation, and Value-added Services such as Blast Freezing, Labeling, and Inventory Management. Among these,Transportationis the leading sub-segment, driven by the increasing demand for efficient logistics solutions in the food and pharmaceutical industries. The need for timely delivery and product integrity has led to significant investments in refrigerated transport and IoT-enabled monitoring, making it a critical component of the cold chain ecosystem.

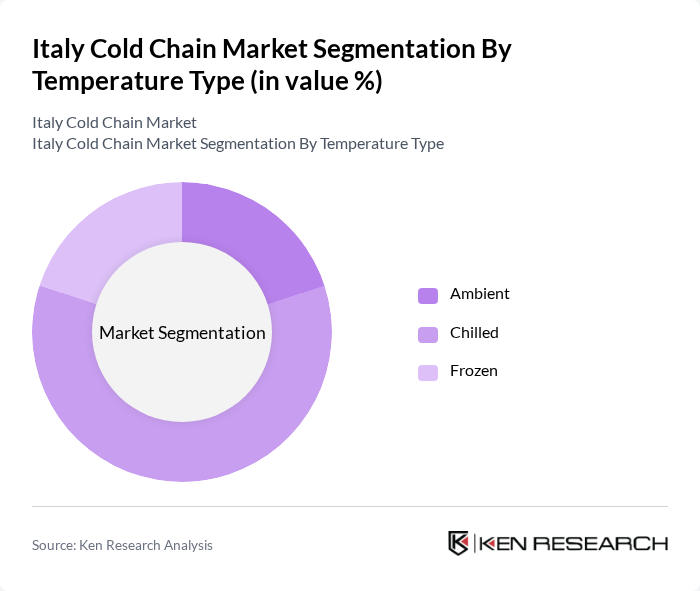

By Temperature Type:The temperature type segment comprises Ambient, Chilled, and Frozen categories. TheChilledsegment is currently the dominant sub-segment, driven by the rising demand for fresh produce and dairy products. Consumer preferences for healthier food options, the growth of the e-commerce sector, and regulatory requirements for food safety have significantly increased the need for chilled storage and transportation solutions, making it a vital part of the cold chain.

The Italy Cold Chain Market is characterized by a dynamic mix of regional and international players. Leading participants such as STEF Italia S.p.A., Number1 Logistics Group S.p.A., DHL Supply Chain, Kuehne + Nagel, Frigoricentro S.r.l., Italtrans S.p.A., LC3 Trasporti S.p.A., Geodis, Fercam S.p.A., XPO Logistics, DB Schenker, Lineage Logistics, CEVA Logistics, Frigo Trasporti S.r.l., Frigoveneta S.r.l. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Italian cold chain market appears promising, driven by increasing consumer demand for fresh and organic products. As e-commerce continues to expand, companies are likely to invest in advanced technologies to enhance efficiency and sustainability. Additionally, the focus on reducing food waste and improving supply chain transparency will shape operational strategies. The integration of automation and IoT solutions will further streamline processes, ensuring that the cold chain remains resilient and responsive to market needs.

| Segment | Sub-Segments |

|---|---|

| By Services | Storage Transportation Value-added Services (Blast Freezing, Labeling, Inventory Management, etc.) |

| By Temperature Type | Ambient Chilled Frozen |

| By Application | Horticulture (Fresh Fruits and Vegetables) Dairy Products (Milk, Ice-cream, Butter, etc.) Meats and Fish Processed Food Products Pharma, Life Sciences, and Chemicals Other Applications |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Distribution Logistics | 100 | Logistics Managers, Supply Chain Coordinators |

| Pharmaceutical Cold Chain Management | 60 | Quality Assurance Managers, Operations Directors |

| Retail Cold Storage Solutions | 50 | Store Managers, Inventory Control Specialists |

| Transport Providers for Perishable Goods | 40 | Fleet Managers, Transport Coordinators |

| Cold Chain Technology Providers | 40 | Product Development Managers, Technical Sales Representatives |

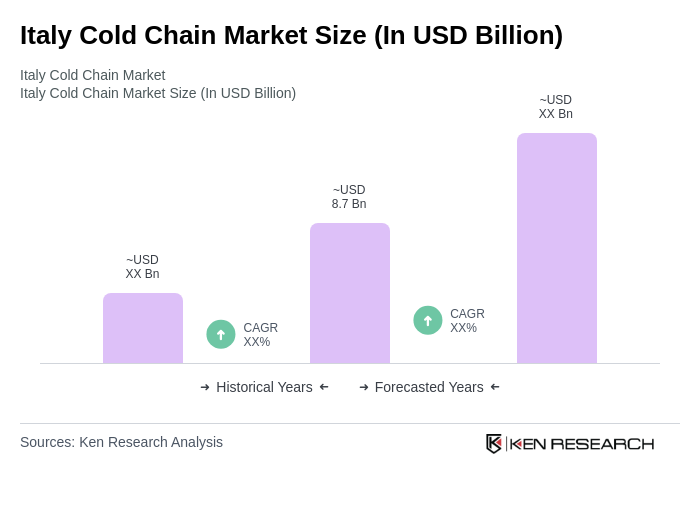

The Italy Cold Chain Market is valued at approximately USD 8.7 billion, driven by the increasing demand for temperature-sensitive products in the food and pharmaceutical sectors, along with advancements in logistics and technology.