Region:Europe

Author(s):Geetanshi

Product Code:KRAB3373

Pages:98

Published On:October 2025

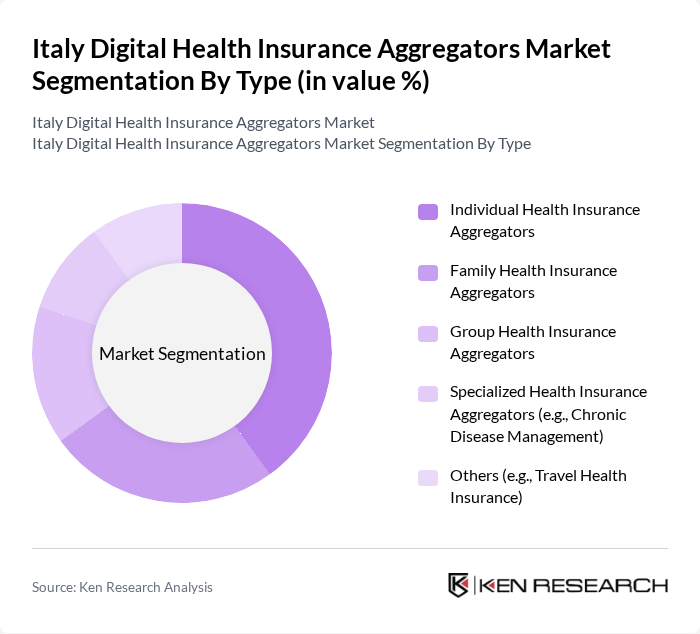

By Type:The market is segmented into various types of health insurance aggregators, including Individual Health Insurance Aggregators, Family Health Insurance Aggregators, Group Health Insurance Aggregators, Specialized Health Insurance Aggregators (e.g., Chronic Disease Management), and Others (e.g., Travel Health Insurance). Among these, Individual Health Insurance Aggregators are currently leading the market due to the increasing number of individuals seeking personalized health insurance solutions. The trend towards individualization in healthcare, coupled with the rise of online platforms, has made it easier for consumers to find tailored insurance products that meet their specific needs .

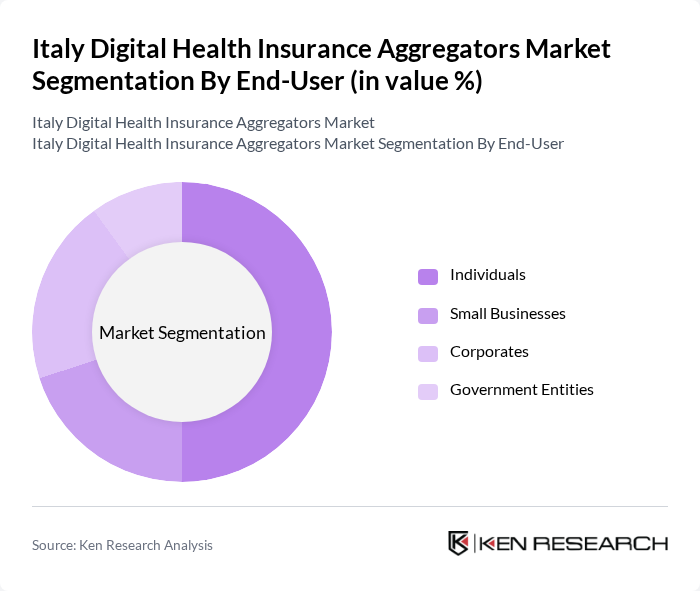

By End-User:The end-user segmentation includes Individuals, Small Businesses, Corporates, and Government Entities. Individuals represent the largest segment, driven by the increasing awareness of health insurance benefits and the growing trend of personal health management. The rise in healthcare costs and the need for financial protection against medical expenses have led to a surge in individual health insurance purchases. Small businesses and corporates are also significant contributors, as they seek to provide health benefits to their employees, enhancing employee satisfaction and retention .

The Italy Digital Health Insurance Aggregators Market is characterized by a dynamic mix of regional and international players. Leading participants such as UnipolSai Assicurazioni S.p.A., Generali Italia S.p.A., Allianz S.p.A., Cattolica Assicurazioni S.p.A., Reale Mutua Assicurazioni S.p.A., AXA Assicurazioni S.p.A., Vittoria Assicurazioni S.p.A., Zurich Italia S.p.A., Poste Italiane S.p.A., Direct Line Insurance S.p.A., Facile.it S.p.A., Segugio.it S.p.A., Prima Assicurazioni S.p.A., Yolo Group S.p.A., Health Insurance Aggregator S.r.l. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Italy digital health insurance aggregator market appears promising, driven by technological innovations and evolving consumer preferences. As telehealth services become more mainstream, the demand for personalized insurance solutions will likely increase. Additionally, partnerships with healthcare providers are expected to enhance service offerings, while government initiatives supporting digital health will further stimulate market growth. The focus on preventive healthcare will also shape product development, aligning with consumer expectations for comprehensive health management solutions.

| Segment | Sub-Segments |

|---|---|

| By Type | Individual Health Insurance Aggregators Family Health Insurance Aggregators Group Health Insurance Aggregators Specialized Health Insurance Aggregators (e.g., Chronic Disease Management) Others (e.g., Travel Health Insurance) |

| By End-User | Individuals Small Businesses Corporates Government Entities |

| By Distribution Channel | Online Platforms Mobile Applications Insurance Brokers Direct Sales |

| By Policy Type | Comprehensive Health Insurance Critical Illness Insurance Short-Term Health Insurance Travel Health Insurance |

| By Customer Demographics | Age Group (18-30, 31-45, 46-60, 60+) Income Level (Low, Middle, High) Employment Status (Employed, Unemployed, Retired) |

| By Geographic Coverage | Urban Areas Rural Areas Regional Coverage (North, South, Central Italy) |

| By Customer Engagement Level | Active Users Occasional Users Inactive Users New Users |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Digital Health Insurance Users | 100 | Policyholders, Health Insurance Customers |

| Healthcare Providers | 60 | Doctors, Clinic Administrators |

| Insurance Brokers | 50 | Insurance Agents, Financial Advisors |

| Regulatory Bodies | 40 | Policy Makers, Health Insurance Regulators |

| Technology Providers in Health Sector | 40 | IT Managers, Digital Health Innovators |

The Italy Digital Health Insurance Aggregators Market is valued at approximately USD 2.1 billion, reflecting significant growth driven by the increasing adoption of digital health solutions and rising healthcare costs among the population.