Region:Europe

Author(s):Dev

Product Code:KRAB6105

Pages:95

Published On:October 2025

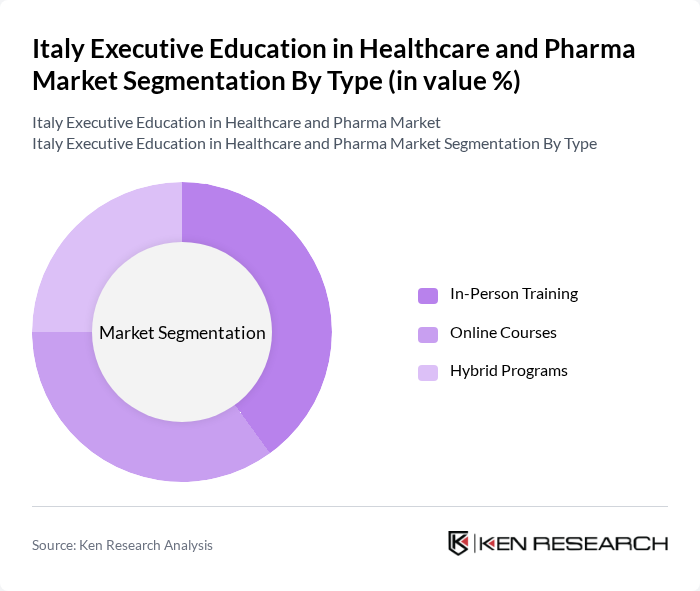

By Type:The market is segmented into three main types: In-Person Training, Online Courses, and Hybrid Programs. In-Person Training is favored for its interactive nature, allowing for networking and hands-on experiences. Online Courses have gained popularity due to their flexibility and accessibility, catering to busy professionals. Hybrid Programs combine the benefits of both formats, appealing to a broader audience.

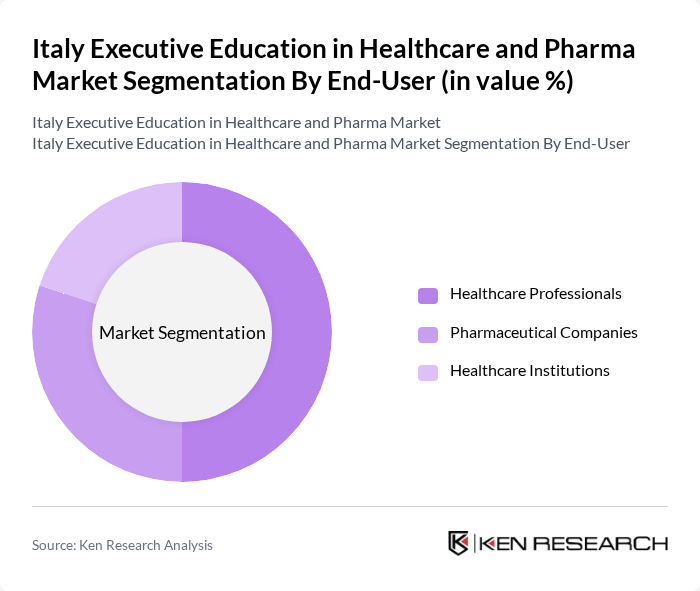

By End-User:The market is segmented by end-users into Healthcare Professionals, Pharmaceutical Companies, and Healthcare Institutions. Healthcare Professionals are the largest segment, driven by the need for ongoing education to meet regulatory requirements. Pharmaceutical Companies invest heavily in training to enhance their workforce's skills, while Healthcare Institutions focus on staff development to improve patient care.

The Italy Executive Education in Healthcare and Pharma Market is characterized by a dynamic mix of regional and international players. Leading participants such as SDA Bocconi School of Management, Università Cattolica del Sacro Cuore, MIP Politecnico di Milano, IESE Business School, Università degli Studi di Roma Tor Vergata, Scuola Superiore Sant'Anna, Università di Bologna, Università di Padova, LUISS Business School, CCLS - Queen Mary University of London, Università degli Studi di Milano, Università di Napoli Federico II, Università di Torino, Università di Firenze, Università di Pavia contribute to innovation, geographic expansion, and service delivery in this space.

The future of executive education in Italy's healthcare and pharma sectors appears promising, driven by technological advancements and a growing emphasis on specialized training. As organizations increasingly recognize the value of upskilling their workforce, the demand for tailored programs is expected to rise. Furthermore, partnerships with healthcare institutions will likely enhance program relevance, ensuring that training aligns with industry needs. This evolving landscape presents opportunities for innovative educational models and collaborative initiatives that can address the sector's challenges effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | In-Person Training Online Courses Hybrid Programs |

| By End-User | Healthcare Professionals Pharmaceutical Companies Healthcare Institutions |

| By Program Duration | Short-Term Courses Long-Term Programs |

| By Certification Type | Professional Certifications Executive MBAs |

| By Delivery Mode | On-Campus Learning Virtual Learning |

| By Industry Focus | Healthcare Management Pharmaceutical Marketing |

| By Price Range | Budget Programs Premium Programs |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Executive Education Programs | 150 | Program Directors, Curriculum Developers |

| Pharmaceutical Industry Training Initiatives | 100 | HR Managers, Training Coordinators |

| Healthcare Management Professionals | 120 | Healthcare Executives, Department Heads |

| Digital Learning Platforms in Healthcare | 80 | IT Managers, E-learning Specialists |

| Regulatory Compliance Training | 70 | Compliance Officers, Quality Assurance Managers |

The Italy Executive Education in Healthcare and Pharma Market is valued at approximately USD 1.2 billion, reflecting a significant demand for specialized training programs among healthcare professionals and pharmaceutical executives, driven by evolving healthcare regulations and technologies.