Region:Europe

Author(s):Geetanshi

Product Code:KRAB4638

Pages:81

Published On:October 2025

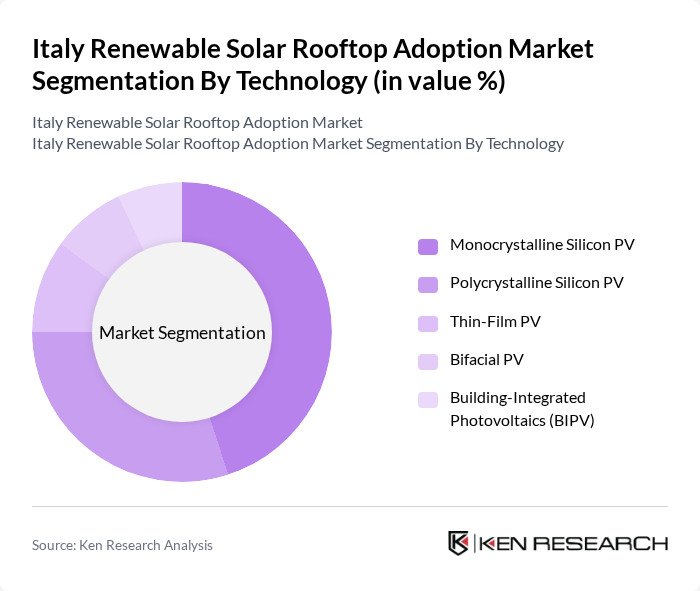

By Technology:The technology segment includes various types of photovoltaic systems utilized in solar rooftop installations. The subsegments are Monocrystalline Silicon PV, Polycrystalline Silicon PV, Thin-Film PV, Bifacial PV, and Building-Integrated Photovoltaics (BIPV). Monocrystalline Silicon PV is currently the leading technology due to its high efficiency and space-saving characteristics, making it a preferred choice for urban installations. Polycrystalline Silicon PV follows closely, offering a cost-effective alternative. Thin-Film PV is gaining traction in specific applications, especially where weight and flexibility are critical, while Bifacial PV and BIPV are emerging as innovative solutions catering to niche markets .

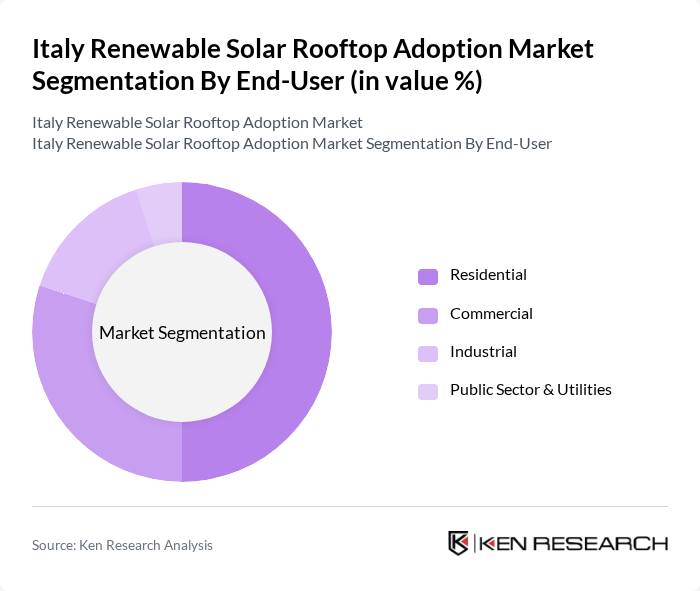

By End-User:The end-user segment encompasses various categories of consumers utilizing solar rooftop systems, including Residential, Commercial, Industrial, and Public Sector & Utilities. The residential sector is the largest end-user, driven by increasing consumer awareness and government incentives such as the Superbonus 110% and regional rebate programs. Commercial installations are also significant, as businesses seek to reduce energy costs and enhance sustainability. The industrial sector is gradually adopting solar solutions, while public sector initiatives are focused on large-scale projects to promote renewable energy usage .

The Italy Renewable Solar Rooftop Adoption Market is characterized by a dynamic mix of regional and international players. Leading participants such as Enel Green Power S.p.A., Eni Plenitude S.p.A., Edison Energia S.p.A., Sorgenia S.p.A., Falck Renewables S.p.A. (now part of Renantis S.p.A.), Gruppo Hera S.p.A., EF Solare Italia S.p.A., Enerpoint S.r.l., SunPower Corporation, Trina Solar Limited, Canadian Solar Inc., JinkoSolar Holding Co., Ltd., First Solar, Inc., SMA Solar Technology AG, Q CELLS contribute to innovation, geographic expansion, and service delivery in this space.

The future of the solar rooftop adoption market in Italy appears promising, driven by increasing energy costs and supportive government policies. As technological advancements continue to lower installation costs and improve efficiency, more homeowners are likely to consider solar energy. Additionally, the integration of solar technology with electric vehicles and energy storage solutions is expected to enhance the appeal of solar rooftops, creating a more sustainable energy ecosystem that aligns with Italy's environmental goals.

| Segment | Sub-Segments |

|---|---|

| By Technology | Monocrystalline Silicon PV Polycrystalline Silicon PV Thin-Film PV Bifacial PV Building-Integrated Photovoltaics (BIPV) |

| By End-User | Residential Commercial Industrial Public Sector & Utilities |

| By Ownership Model | Owner-Occupied Third-Party Owned (Leasing, PPA) Community Solar |

| By Grid Connectivity | On-Grid (Grid-Connected) Off-Grid |

| By Installation Size | <20 kW (Small-scale) –100 kW (Medium-scale) >100 kW (Large-scale) |

| By Region | Northern Italy Central Italy Southern Italy & Islands |

| By Application | Self-Consumption Net Metering Energy Communities Storage-Integrated Systems |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Solar Rooftop Adoption | 120 | Homeowners, Property Managers |

| Commercial Solar Rooftop Projects | 70 | Business Owners, Facility Managers |

| Industrial Solar Installations | 50 | Operations Directors, Energy Managers |

| Solar Technology Providers | 40 | Sales Managers, Technical Experts |

| Energy Policy Makers | 40 | Government Officials, Regulatory Analysts |

The Italy Renewable Solar Rooftop Adoption Market is valued at approximately USD 1.6 billion, driven by increasing energy demand, government incentives, and a strong commitment to sustainability and carbon neutrality.