Region:Europe

Author(s):Geetanshi

Product Code:KRAA1281

Pages:96

Published On:August 2025

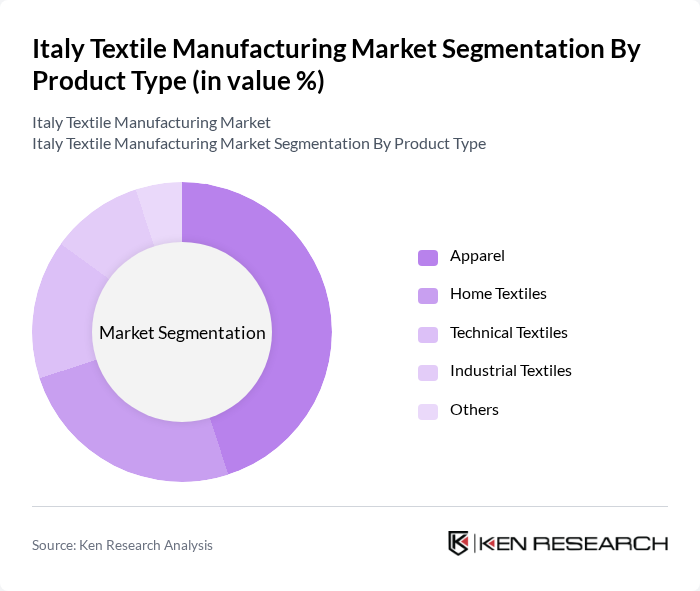

By Product Type:The product type segmentation includes Apparel, Home Textiles, Technical Textiles, Industrial Textiles, and Others. Apparel remains the leading sub-segment, driven by the strong demand for fashion and luxury clothing, supported by Italy’s global reputation for quality and design. Home Textiles are experiencing robust growth due to rising interest in home décor and interior design. Technical and Industrial Textiles are gaining traction, fueled by advancements in textile technology and increased applications in sectors such as automotive, construction, biomedical, and hygiene products.

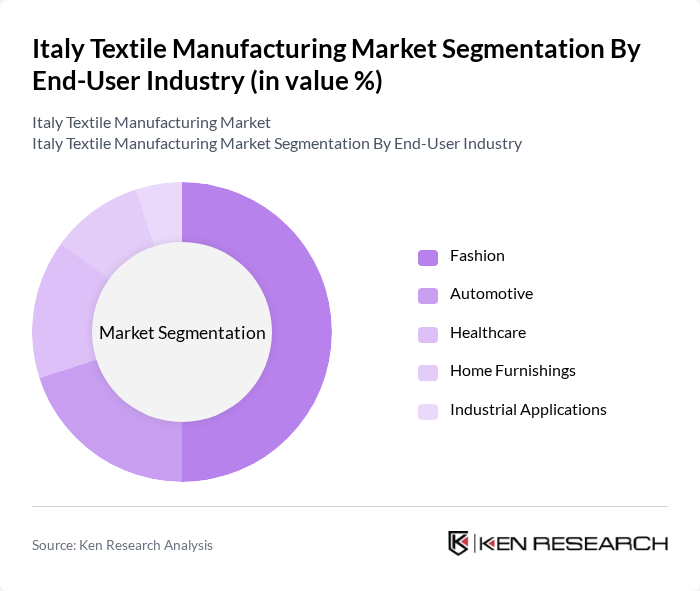

By End-User Industry:This segmentation encompasses Fashion, Automotive, Healthcare, Home Furnishings, Industrial Applications, and Others. The Fashion industry is the dominant segment, supported by Italy's prestigious fashion houses and a strong consumer base that values high-quality textiles. The Automotive sector is significant, utilizing technical textiles for interiors, safety, and performance features. Healthcare textiles are increasingly important due to the rising demand for medical and hygiene products, while Home Furnishings are driven by consumer interest in home aesthetics and comfort.

The Italy Textile Manufacturing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Gucci S.p.A., Loro Piana S.p.A., Ermenegildo Zegna N.V., Marzotto Group, Ratti S.p.A., Aquafil S.p.A., Miroglio Group, Benetton Group S.r.l., Calzedonia S.p.A., Cotonificio Albini S.p.A., Tessitura Monti S.p.A., Zegna Baruffa Lane Borgosesia S.p.A., Carvico S.p.A., Fulgar S.p.A., Vincenzo Zucchi S.p.A. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Italian textile manufacturing market appears promising, driven by a strong emphasis on sustainability and technological innovation. As consumer preferences shift towards eco-friendly products, manufacturers are likely to invest more in sustainable practices and materials. Additionally, the rise of e-commerce will continue to reshape distribution channels, enabling brands to reach consumers directly. With ongoing government support for local manufacturing, the industry is poised for a transformation that aligns with global sustainability goals and technological advancements.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Apparel Home Textiles Technical Textiles Industrial Textiles Others |

| By End-User Industry | Fashion Automotive Healthcare Home Furnishings Industrial Applications Others |

| By Manufacturing Process | Spinning Weaving Knitting Dyeing Printing Others |

| By Material Type | Cotton Wool Silk Synthetic Fabrics Technical Fabrics Others |

| By Application | Clothing Application Industrial Application Household Application Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Apparel Manufacturing Insights | 100 | Production Managers, Quality Control Supervisors |

| Home Textiles Market Analysis | 60 | Product Managers, Marketing Directors |

| Technical Textiles Development | 50 | R&D Managers, Innovation Leads |

| Sustainability Practices in Textiles | 40 | Sustainability Officers, Compliance Managers |

| Consumer Trends in Textile Purchases | 80 | Market Analysts, Retail Buyers |

The Italy Textile Manufacturing Market is valued at approximately USD 27 billion, reflecting a robust growth trajectory driven by high demand for quality textiles, particularly in the fashion and luxury sectors, as well as the rise of sustainable materials.