Region:Asia

Author(s):Rebecca

Product Code:KRAA1460

Pages:96

Published On:August 2025

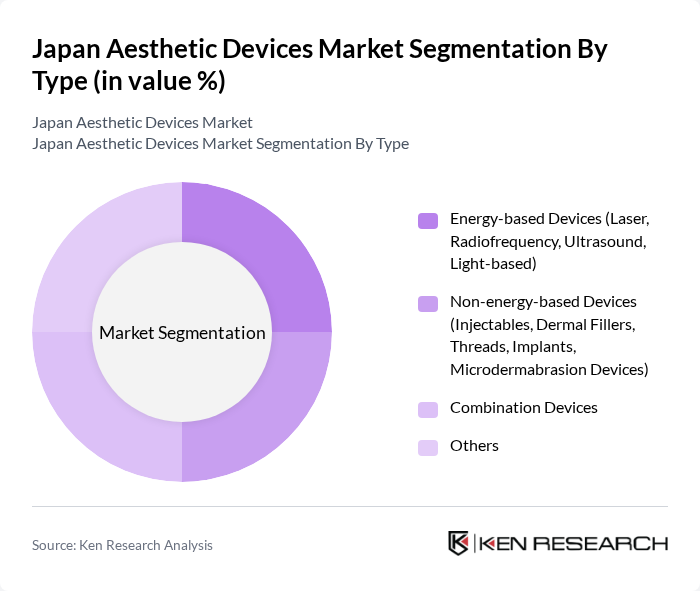

By Type:The market is segmented into various types of aesthetic devices, including energy-based devices, non-energy-based devices, combination devices, and others. Energy-based devices, such as lasers, radiofrequency, ultrasound, and light-based machines, are gaining popularity due to their effectiveness in skin rejuvenation, hair removal, and body contouring. Non-energy-based devices, including injectables, dermal fillers, threads, implants, and microdermabrasion devices, are also widely used for their immediate results and versatility. Combination devices are emerging as a preferred choice for comprehensive, multi-modal treatment options.

By End-User:The aesthetic devices market is utilized across various end-users, including hospitals, aesthetic clinics, dermatology clinics, and home users. Aesthetic clinics are the leading end-users due to their specialized services and high demand for advanced aesthetic treatments. Hospitals are also significant players, offering a range of aesthetic and reconstructive procedures. Dermatology clinics cater to specific skin-related treatments, while home users are increasingly adopting at-home devices for convenience and privacy.

The Japan Aesthetic Devices Market is characterized by a dynamic mix of regional and international players. Leading participants such as Cynosure, LLC, Lumenis Ltd., Cutera, Inc., Syneron Candela (Candela Medical), InMode Ltd., Alma Lasers Ltd., BTL Industries, Sciton, Inc., Venus Concept, Hologic, Inc. (incl. Cynosure), Jeisys Medical Inc., Asclepion Laser Technologies GmbH, Lutronic Corporation, Shiseido Company, Limited, JMEC Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Japan aesthetic devices market appears promising, driven by ongoing technological innovations and a growing consumer base seeking aesthetic enhancements. As the population ages, the demand for non-invasive and personalized treatments is expected to rise. Additionally, the integration of AI and machine learning in aesthetic devices will likely enhance treatment precision and patient satisfaction. The market is also anticipated to see increased collaboration between aesthetic clinics and technology firms, fostering a more dynamic and responsive industry landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Energy-based Devices (Laser, Radiofrequency, Ultrasound, Light-based) Non-energy-based Devices (Injectables, Dermal Fillers, Threads, Implants, Microdermabrasion Devices) Combination Devices Others |

| By End-User | Hospitals Aesthetic Clinics Dermatology Clinics Home Users |

| By Application | Skin Rejuvenation Body Contouring Hair Removal Acne & Scar Treatment Pigmentation Correction |

| By Distribution Channel | Direct Tender Distributors Online Sales |

| By Price Range | Premium Mid-range Budget |

| By Consumer Demographics | Age Group (18-30) Age Group (31-45) Age Group (46 and above) |

| By Brand Loyalty | Brand Loyal Customers Price-sensitive Customers New Customers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Dermatology Clinics | 100 | Dermatologists, Clinic Managers |

| Plastic Surgery Centers | 80 | Plastic Surgeons, Surgical Coordinators |

| Aesthetic Device Distributors | 50 | Sales Managers, Product Specialists |

| Patient Experience Focus Groups | 40 | Recent Patients, Aesthetic Treatment Seekers |

| Regulatory Bodies | 40 | Health Policy Analysts, Regulatory Affairs Managers |

The Japan Aesthetic Devices Market is valued at approximately USD 2.4 billion, driven by increasing consumer demand for non-invasive procedures, advancements in technology, and a growing awareness of personal grooming among the population.