Region:Asia

Author(s):Dev

Product Code:KRAB0402

Pages:88

Published On:August 2025

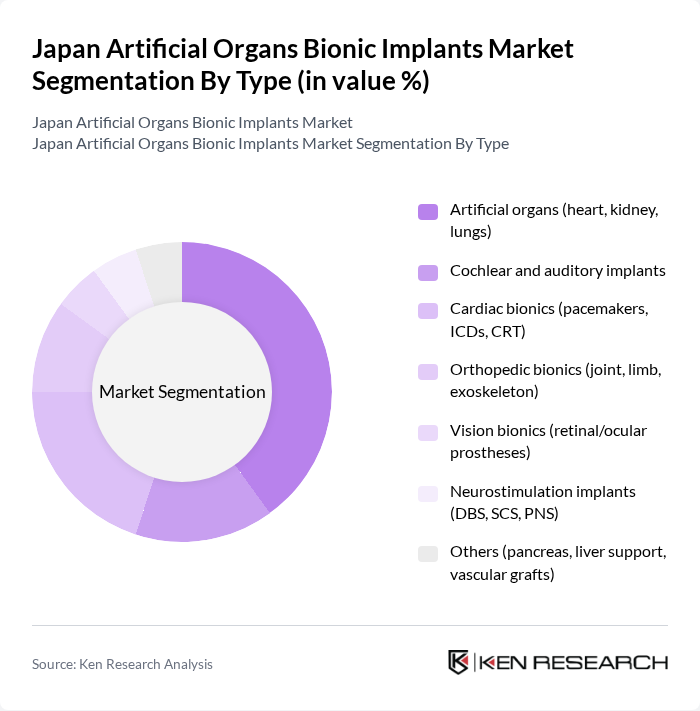

By Type:The market can be segmented into various types of implants, including artificial organs, cochlear and auditory implants, cardiac bionics, orthopedic bionics, vision bionics, neurostimulation implants, and others. Among these, artificial organs, particularly heart and kidney-related technologies (e.g., ventricular assist devices, dialysis-dependent support), are leading the market due to their critical role in life-saving procedures and the increasing number of patients requiring organ replacement or support therapies in Japan’s aging population .

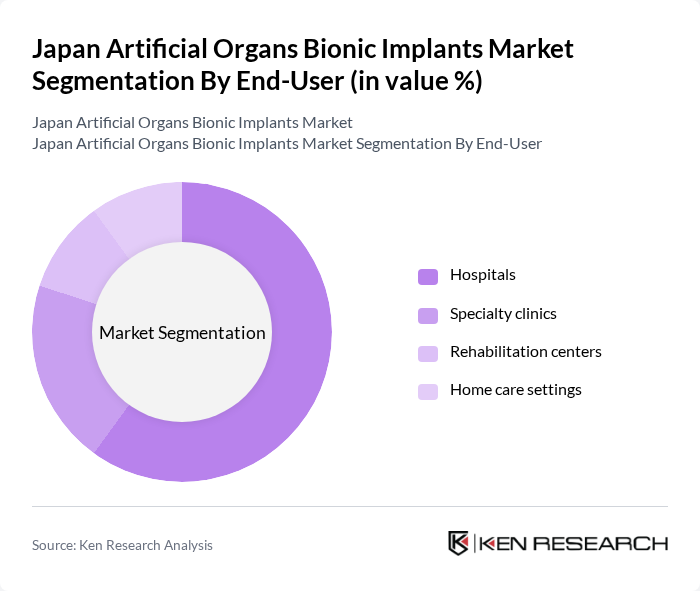

By End-User:The end-user segmentation includes hospitals, specialty clinics, rehabilitation centers, and home care settings. Hospitals are the dominant end-user segment, driven by the high volume of surgical procedures and the need for advanced medical technologies to support patient care, particularly for implantable cardiac devices, cochlear implants, and advanced organ support systems that require tertiary care settings in Japan .

The Japan Artificial Organs Bionic Implants Market is characterized by a dynamic mix of regional and international players. Leading participants such as Medtronic plc, Abbott Laboratories, Boston Scientific Corporation, Johnson & Johnson (including DePuy Synthes), Stryker Corporation, Zimmer Biomet Holdings, Inc., Edwards Lifesciences Corporation, Cochlear Limited, Nipro Corporation, Terumo Corporation, Asahi Kasei Medical Co., Ltd., Olympus Corporation, Canon Medical Systems Corporation, Cyberdyne Inc., Abiomed (a Johnson & Johnson company) contribute to innovation, geographic expansion, and service delivery in this space .

The future of the bionic implants market in Japan appears promising, driven by technological advancements and an increasing focus on personalized healthcare solutions. As the integration of artificial intelligence in medical devices becomes more prevalent, the customization of implants to meet individual patient needs will likely enhance their effectiveness. Additionally, the expansion of telemedicine services is expected to facilitate better post-operative care, improving patient outcomes and driving further adoption of bionic implants in the healthcare system.

| Segment | Sub-Segments |

|---|---|

| By Type | Artificial organs (heart, kidney, lungs) Cochlear and auditory implants Cardiac bionics (pacemakers, ICDs, CRT) Orthopedic bionics (joint, limb, exoskeleton) Vision bionics (retinal/ocular prostheses) Neurostimulation implants (DBS, SCS, PNS) Others (pancreas, liver support, vascular grafts) |

| By End-User | Hospitals Specialty clinics Rehabilitation centers Home care settings |

| By Application | Life-saving procedures (organ support/replacement) Functional restoration (hearing, mobility, vision) Pain management and neuromodulation Cosmetic and reconstructive applications |

| By Distribution Channel | Direct sales Distributors Group purchasing organizations (GPOs) Online procurement portals |

| By Material Type | Metal-based implants Polymer-based implants Ceramic-based implants Composite and bio-hybrid materials |

| By Price Range | Low-cost implants Mid-range implants Premium implants |

| By Regulatory Approval Status | Approved implants (PMDA/MHLW) Under review implants Research and clinical trial phase |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Orthopedic Bionic Implants | 120 | Orthopedic Surgeons, Hospital Administrators |

| Cardiovascular Artificial Organs | 90 | Cardiologists, Cardiac Surgeons |

| Neuroprosthetics | 80 | Neurologists, Rehabilitation Specialists |

| Market Trends in Bionic Technology | 100 | Medical Device Researchers, Healthcare Policy Makers |

| Patient Experience with Bionic Implants | 60 | Patients, Caregivers, Support Groups |

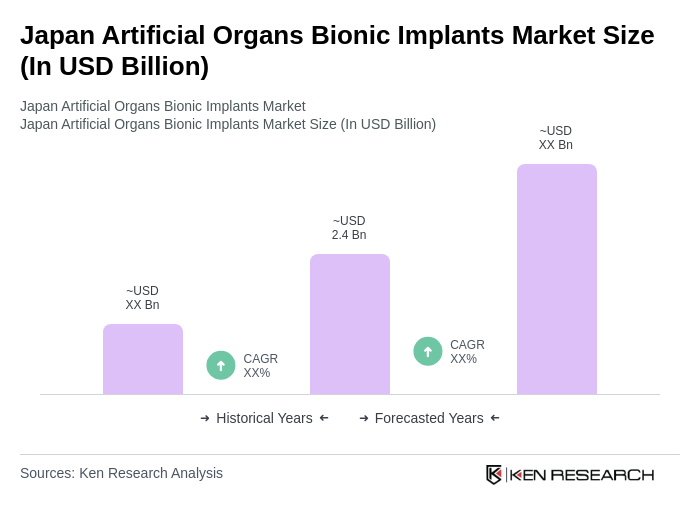

The Japan Artificial Organs Bionic Implants Market is valued at approximately USD 2.4 billion, reflecting a robust growth trajectory driven by advancements in medical technology, an aging population, and increasing healthcare expenditures.