Region:Asia

Author(s):Dev

Product Code:KRAA1684

Pages:81

Published On:August 2025

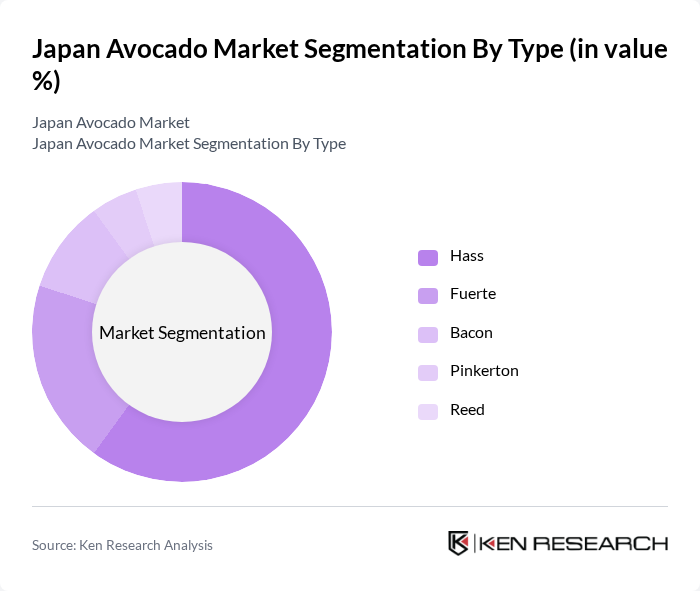

By Type:The market is dominated by thevariety, which leads retail and foodservice due to its creamy texture, rich flavor, and strong global supply continuity. Other varieties such as,,, andare present in smaller shares, reflecting import availability patterns where Hass represents the global standard for trade and ripening programs .

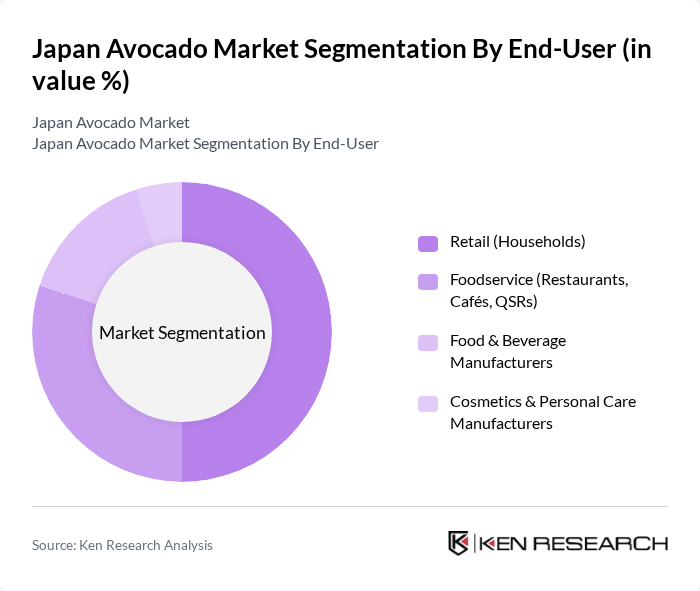

By End-User:Retail (households) is the largest end user given expanding shelf space in supermarkets and convenience channels, while foodservice demand grows with broader menu integration in cafés, casual dining, sushi concepts, and QSRs. Food and beverage manufacturers are increasing usage in ready-to-eat, sandwich spreads, and frozen applications. Cosmetics and personal care manufacturers represent a smaller but rising niche tied to avocado oil applications ; .

The Japan Avocado Market is characterized by a dynamic mix of regional and international players. Leading participants such as Mission Produce Japan GK, Calavo Growers, Inc. (Japan), Westfalia Fruit Japan, Dole Japan, Inc., Fresh Del Monte Japan, Ltd., Tokyo Seika Co., Ltd., Yokohama Reito Co., Ltd., True World Foods Japan, Aeon Retail Co., Ltd. (Private Label), Ito-Yokado Co., Ltd. (Seven & i Group), Seiyu GK (Walmart/KKR), Metro Cash & Carry Japan, Nichirei Fresh Inc., Kagome Co., Ltd. (Avocado-based processed foods), Kato Sangyo Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space ; .

The future of the avocado market in Japan appears promising, driven by increasing health awareness and the growing popularity of plant-based diets. As consumer preferences shift towards healthier options, the demand for avocados is expected to rise significantly. Additionally, the expansion of the food service sector will likely create new opportunities for avocado-based products. With ongoing trends in sustainability and organic offerings, the market is poised for continued growth, despite challenges related to import costs and domestic production limitations.

| Segment | Sub-Segments |

|---|---|

| By Type | Hass Fuerte Bacon Pinkerton Reed |

| By End-User | Retail (Households) Foodservice (Restaurants, Cafés, QSRs) Food & Beverage Manufacturers Cosmetics & Personal Care Manufacturers |

| By Distribution Channel | Supermarkets/Hypermarkets (Aeon, Ito-Yokado, Life, Seiyu) Online Grocery/E-commerce (Rakuten, Amazon, LOHACO) Specialty Produce Stores & Department Stores Wholesale/Cash & Carry (Metro, Regional Wholesalers) |

| By Price Range | Premium Mid-Range Budget |

| By Form/Processing | Fresh (Whole, Ripe-Ready) Processed (Guacamole, Puree, Frozen Diced/Slices) Avocado Oil (Culinary & Cosmetic) |

| By Origin | Domestic (Kyushu, Wakayama, Shikoku small-scale) Imported (Mexico, Peru, USA, New Zealand, Others) |

| By Quality Certification | Organic (JAS Organic) Conventional |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sector Avocado Sales | 120 | Store Managers, Category Buyers |

| Import and Distribution Channels | 100 | Import Managers, Logistics Coordinators |

| Consumer Preferences and Trends | 140 | Health-conscious Consumers, Food Enthusiasts |

| Farm-Level Production Insights | 80 | Farm Owners, Agricultural Technicians |

| Market Regulation and Policy Impact | 50 | Policy Makers, Agricultural Economists |

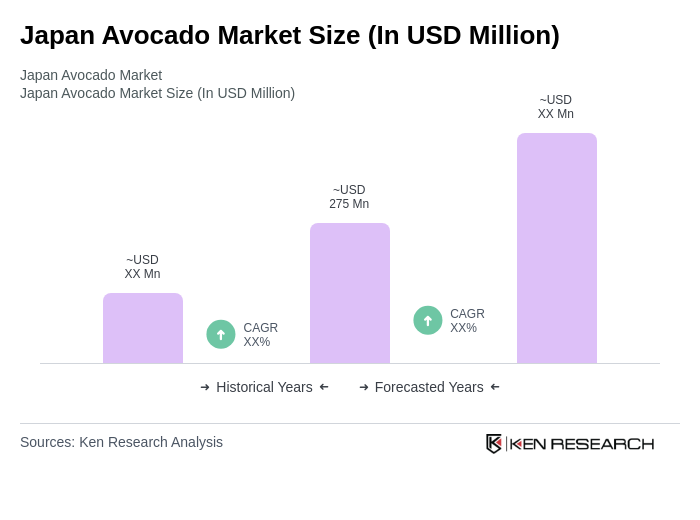

The Japan Avocado Market is valued at approximately USD 275 million, reflecting a growing trend in health consciousness and the increasing popularity of avocados in various cuisines, particularly in metropolitan areas like Tokyo and Osaka.